Global Solar PV Glass Market Size, Share Analysis Report By Type (AR Coated, Tempered, TCO-coated), By Technology (Crystalline Solar PV Module, Thin Film Module, Perovskite Module), By Application (Utility, Residential, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154955

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

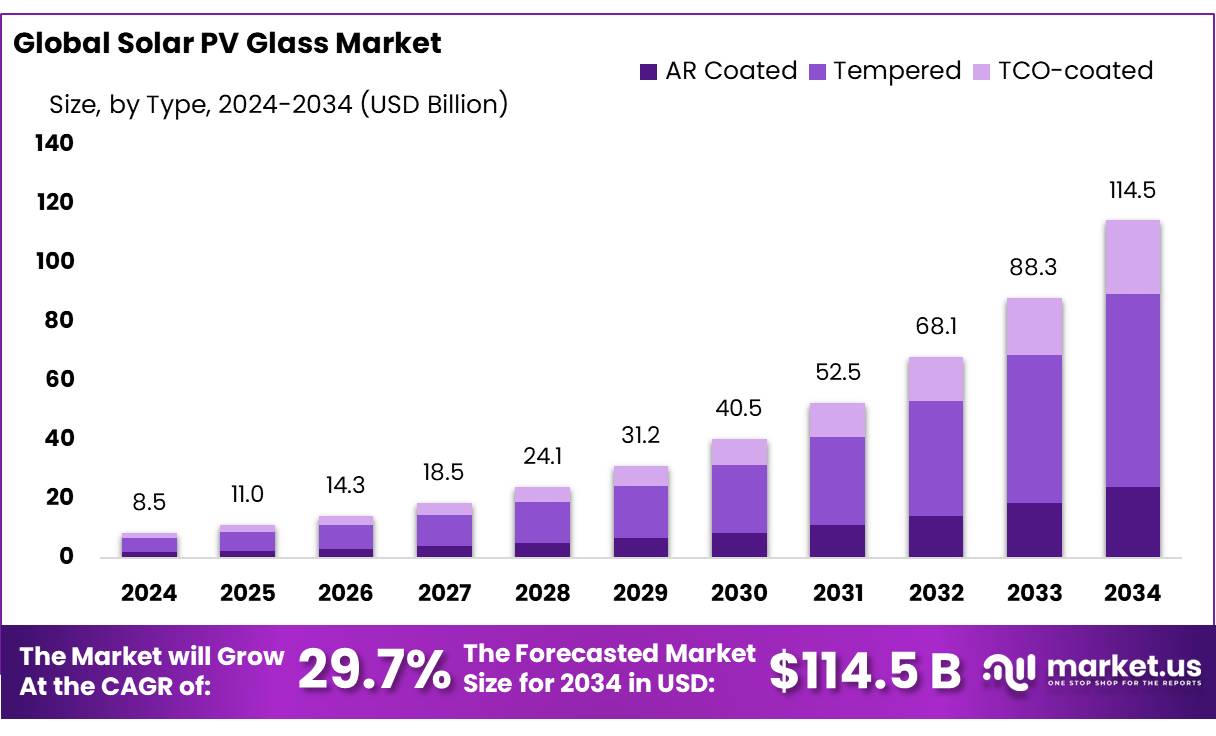

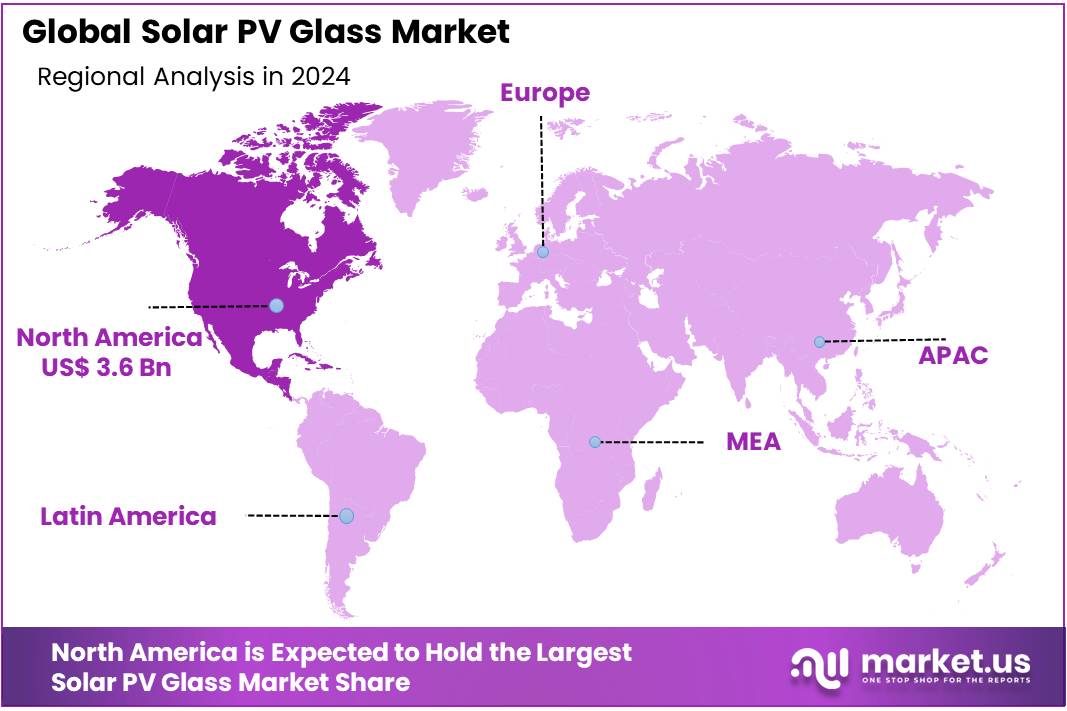

The Global Solar PV Glass Market size is expected to be worth around USD 114.5 Billion by 2034, from USD 8.5 Billion in 2024, growing at a CAGR of 29.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.9% share, holding USD 3.6 Billion revenue.

The Solar PV Glass Concentrates sector pertains to ultra‑low‑iron glass used in photovoltaic (PV) modules—essential for light transmission, durability, and enhanced energy conversion efficiency. These glass concentrates are a critical upstream material in the PV module manufacturing value chain, connecting raw materials (e.g., polysilicon, ingots) to module assembly.

Key driving factors include declining module costs, increased demand for building‑integrated photovoltaics (BIPV), and rising adoption of renewable energy technologies. Global solar installations reached 456 GW in 2023—demonstrating sustained sectoral growth.

Governmental industrial policies—notably in China—have fostered large‑scale manufacturing, cost reductions, and supply‑chain integration. In the United States, the SunShot Initiative (launched in 2011 by the Department of Energy) aimed to reduce residential PV costs to $0.05/kWh and utility‑scale to $0.03/kWh by 2030, achieving 90 percent of its 2020 goal by 2016 and fueling installation growth to 14.8 GW in 2016 (a 97 percent increase over 2015), supported by approximately $30 billion in deployed capital.

In India, national policy has also shaped solar manufacturing growth. The National Solar Mission, initiated in 2010, set a 20 GW solar capacity target by 2022, later increased to 100 GW, with utility solar capacity rising from 2,650 MW in May 2014 to 12,288.8 MW by March 2017, and adding 9,362.7 MW in 2017–18—making it the highest‑growth year.

By December 2023, India’s manufacturing capacity stood at 6 GW of solar cells and 37 GW of modules, with projections to reach 25 GW (cells) and 60 GW (modules) by end‑2025. Further, a regulatory update mandates that from June 2026, solar projects must incorporate locally‑made solar cells, supporting a national non‑fossil fuel capacity goal of 500 GW by 2030 (up from approximately 156 GW), with current module‑making capacity at 80 GW and cell‑making capacity just over 7 GW.

Significant government support underpins industrial expansion. In Australia, the Solar Sunshot program allocates USD 1 billion in incentives and grants to stimulate domestic solar technology production and integrated supply chains. Meanwhile, the U.S. Inflation Reduction Act has directed USD 18.2 billion toward building a domestic solar supply chain, including glass and other critical materials. In Georgia, a private firm backed by the U.S. Department of Energy plans a USD 344 million factory to produce recycled glass for solar panels by 2026, with capacity to support 5 GW of electricity annually.

In the private sector, companies like Borosil Renewables are making substantial investments to enhance domestic production. Borosil announced a ₹900 crore investment to expand its solar glass manufacturing capacity to 10 GW by 2026, aiming to reduce import dependence and strengthen supply chains . This expansion is expected to support the growing demand for solar glass in renewable energy projects across the country.

Key Takeaways

- Solar PV Glass Market size is expected to be worth around USD 114.5 Billion by 2034, from USD 8.5 Billion in 2024, growing at a CAGR of 29.7%.

- Tempered held a dominant market position, capturing more than a 57.1% share of the global solar PV glass market.

- Crystalline Solar PV Module held a dominant market position, capturing more than a 73.4% share of the global solar PV glass market.

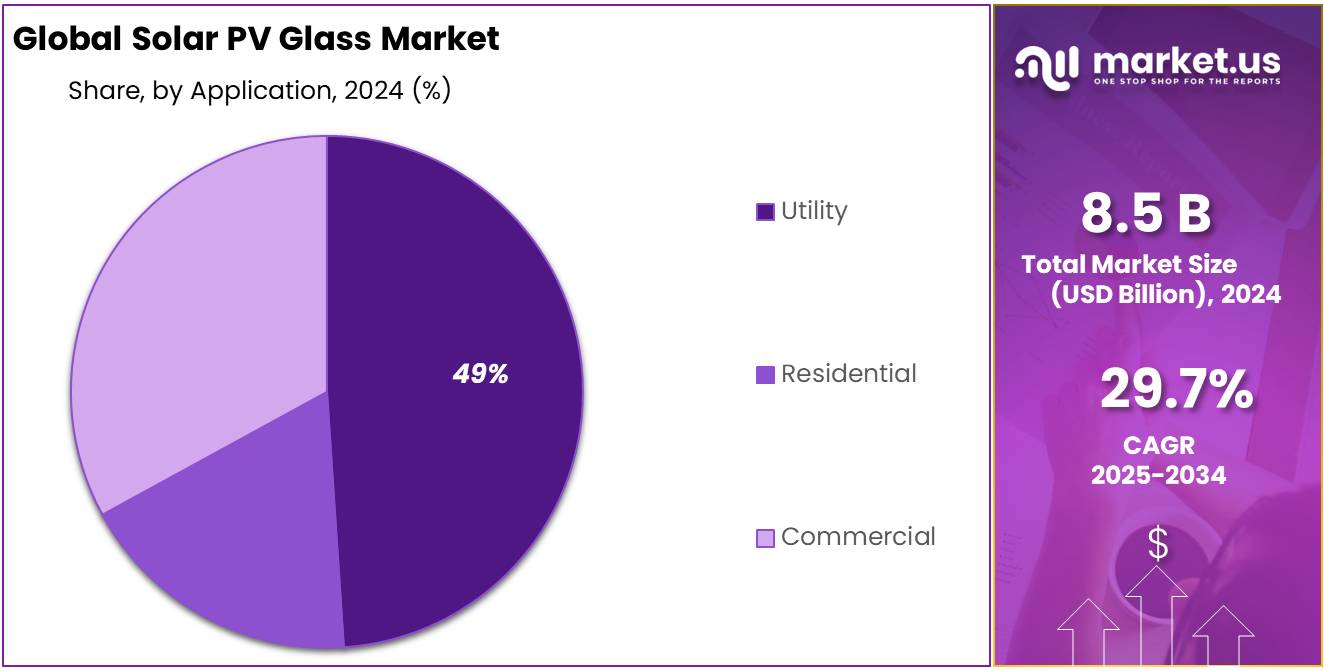

- Utility held a dominant market position, capturing more than a 49.5% share of the global solar PV glass market.

- North America accounting for a substantial 42.9% market share, valued at approximately USD 3.6 billion.

By Type Analysis

Tempered Solar PV Glass dominates with 57.1% due to its strength and wide usage in modules.

In 2024, Tempered held a dominant market position, capturing more than a 57.1% share of the global solar PV glass market. This type of glass is widely preferred in photovoltaic module manufacturing due to its excellent mechanical strength, high impact resistance, and ability to withstand extreme weather conditions.

Its durability makes it ideal for both rooftop and ground-mounted solar systems, where long-term exposure to environmental stress is expected. The tempered glass segment continued to see strong demand through 2025 as more solar installations prioritized safety, reliability, and cost-effective material performance. Its popularity was further supported by its compatibility with anti-reflective coatings and textured surfaces, enhancing solar energy absorption without compromising structural integrity.

By Technology Analysis

Crystalline Solar PV Module dominates with 73.4% due to its high efficiency and proven reliability.

In 2024, Crystalline Solar PV Module held a dominant market position, capturing more than a 73.4% share of the global solar PV glass market. This strong lead can be attributed to the widespread use of crystalline technology in both residential and utility-scale solar projects. Known for its high energy conversion efficiency, long lifespan, and established manufacturing base, crystalline modules remain the preferred choice across major solar markets.

In 2025, demand for these modules continued to rise as governments and private developers pushed for large-scale solar deployments, particularly in Asia and North America. The technology’s compatibility with tempered glass further strengthens its market position, offering better structural support and improved performance under real-world conditions.

By Application Analysis

Utility application dominates with 49.5% due to large-scale solar farm deployments worldwide.

In 2024, Utility held a dominant market position, capturing more than a 49.5% share of the global solar PV glass market. This dominance was largely driven by the rapid expansion of utility-scale solar power plants aimed at meeting growing electricity demands and renewable energy targets. Large solar farms require vast quantities of PV modules, which in turn increases the demand for durable and high-performance PV glass.

In 2025, this trend continued as countries like India, China, and the United States ramped up their investments in grid-connected solar infrastructure. The utility segment’s strong market position reflects the global shift toward centralized clean energy generation, where efficiency, scale, and long-term reliability are critical, and PV glass plays a key role in module protection and energy yield.

Key Market Segments

By Type

- AR Coated

- Tempered

- TCO-coated

By Technology

- Crystalline Solar PV Module

- Thin Film Module

- Perovskite Module

By Application

- Utility

- Residential

- Commercial

Emerging Trends

Advancements in Solar PV Glass Technology

A significant trend shaping the solar photovoltaic (PV) glass industry in India is the continuous advancement in glass technology, particularly in the development of ultra-clear and anti-reflective coatings. These innovations aim to enhance the efficiency and durability of solar panels, making solar energy more accessible and cost-effective.

Ultra-clear photovoltaic glass is designed to allow maximum light transmission, thereby increasing the energy yield of solar panels. This type of glass is particularly beneficial in regions with high solar irradiance, such as parts of India, as it ensures that solar panels capture more sunlight, leading to higher electricity generation. For instance, advancements in ultra-clear glass technology have led to improved efficiency and durability of solar panels, contributing to the overall performance of solar energy systems.

Anti-reflective coatings are another technological advancement gaining traction in the solar PV glass market. These coatings minimize the reflection of sunlight off the glass surface, allowing more light to penetrate the solar cells. This enhancement is particularly useful in environments with varying light conditions, such as early mornings, late afternoons, or cloudy days. By reducing reflection losses, anti-reflective coated glass contributes to consistent energy harvesting, optimizing the overall performance of solar panels.

The Indian government’s initiatives, such as the Production Linked Incentive (PLI) scheme for solar photovoltaic modules, have played a crucial role in promoting these technological advancements. The PLI scheme allocates funds to incentivize the production of high-efficiency solar modules and their components, including PV glass. This policy support has encouraged domestic manufacturers to invest in research and development, leading to innovations in glass technology that enhance the performance of solar panels.

Furthermore, the integration of Building-Integrated Photovoltaics (BIPV) is driving the demand for advanced PV glass. BIPV involves incorporating solar panels into the building’s architecture, such as in windows and facades, which requires specialized glass that combines aesthetic appeal with high energy efficiency. The growing adoption of BIPV solutions is increasing the need for high-quality PV glass, thereby fostering innovation and growth in the sector.

Drivers

Government Initiatives Driving the Solar PV Glass Industry

One of the most significant factors propelling the growth of the solar photovoltaic (PV) glass industry in India is the government’s robust support through various initiatives aimed at boosting domestic manufacturing and reducing reliance on imports. This strategic push not only strengthens the domestic supply chain but also aligns with India’s ambitious renewable energy targets.

A pivotal policy in this regard is the Production Linked Incentive (PLI) scheme for solar photovoltaic modules, introduced in the Union Budget 2022–2023. The scheme allocated approximately USD 2.57 billion to stimulate domestic manufacturing, with a focus on enhancing the production of solar modules and their components, including PV glass. This initiative is expected to significantly reduce India’s dependence on imported solar components, fostering a self-reliant solar manufacturing ecosystem.

Further reinforcing this commitment, the Indian government has mandated that, starting June 2026, all clean energy projects must utilize solar photovoltaic modules made from locally produced cells. This policy aims to curb imports, particularly from China, and promote domestic manufacturing. Currently, India has a solar PV module-making capacity of about 80 gigawatts (GW) and a cell-making capacity slightly over 7 GW, with most relying on imports. The government’s move is expected to accelerate the growth of domestic production capabilities.

In addition to these policies, the Pradhan Mantri Surya Ghar Muft Bijli Yojana, launched in February 2024, aims to empower one crore (10 million) residential households to generate their own electricity through rooftop solar installations. The scheme provides subsidies ranging from ₹30,000 to ₹78,000, depending on the household’s power consumption, thereby making solar energy more accessible to the masses. This initiative is expected to drive significant demand for solar panels and, consequently, for high-quality PV glass.

Restraints

Impact of Import Dependence on India’s Solar PV Glass Industry

One of the primary challenges hindering the growth of the solar photovoltaic (PV) glass industry in India is the nation’s significant reliance on imports for essential components, particularly solar glass. This dependency not only strains the domestic supply chain but also exposes the industry to global market fluctuations and geopolitical tensions.

In the fiscal year 2023–24, India imported solar equipment worth approximately $7 billion, with China accounting for over 60% of these imports. Specifically, imports of solar glass from China and Vietnam surged from 29,980 metric tonnes in 2020–21 to 779,017 metric tonnes during the investigation period, representing a dramatic increase. This influx of low-priced imports has been detrimental to domestic manufacturers, who struggle to compete with the subsidized rates offered by foreign suppliers.

To counteract this imbalance, the Indian government imposed a five-year anti-dumping duty on solar glass imports from China and Vietnam, ranging from $570 to $664 per metric tonne, effective from December 4, 2024. While this measure aims to protect domestic manufacturers and promote local production, it has inadvertently led to an increase in the cost of solar modules by approximately 3–5%. This price hike poses a challenge to the affordability of solar energy systems for consumers and could potentially slow down the adoption of solar technology.

Furthermore, India’s solar PV module-making capacity stands at about 80 gigawatts (GW), whereas the cell-making capacity is slightly over 7 GW, with a substantial portion of cells being imported. The government’s mandate, effective from June 2026, requires clean energy projects to utilize locally produced solar cells, aiming to reduce reliance on imports. However, this transition presents a significant challenge, as domestic production is currently insufficient to meet the demand, potentially leading to supply shortages and project delays.

Opportunity

Government Initiatives Fueling Growth in Solar PV Glass Sector

The Indian solar photovoltaic (PV) glass industry is experiencing significant growth, driven by robust government initiatives aimed at enhancing renewable energy capacity and reducing dependence on imported components. One of the most impactful policies is the Pradhan Mantri Surya Ghar Muft Bijli Yojana (PMSG), launched in February 2024. This scheme allocates over ₹75,000 crore to empower 1 crore households to generate their own electricity through rooftop solar installations. Beneficiaries receive a one-time subsidy and access to concessional bank loans, facilitating the adoption of solar technology at the grassroots level .

In tandem with PMSG, the Indian government has implemented measures to bolster domestic manufacturing capabilities. Notably, an anti-dumping duty of up to USD 664 per tonne has been imposed on certain types of solar glass imported from China and Vietnam. This policy aims to protect local manufacturers from unfair trade practices and encourages the growth of the domestic solar glass industry .

These initiatives are contributing to a surge in demand for solar PV glass. For instance, India’s solar panel glass market size reached 512.30 thousand tons in 2024 and is projected to reach 990.46 thousand tons by 2033, exhibiting a CAGR of 7.60% during 2025-2033 . This growth is further supported by advancements in solar technology, such as the development of high-efficiency, low-cost Silicon-Perovskite Tandem solar cells at IIT-Bombay, which are expected to enhance the performance and affordability of solar panels.

Regional Insights

North America Commands 42.9% Share (USD 3.6 Bn) in the Global Solar PV Glass Market

The global Solar Photovoltaic (PV) Glass market shows strong regional segmentation, with North America accounting for a substantial 42.9% market share, valued at approximately USD 3.6 billion as of 2025. This makes North America the second-largest regional market, driven by robust solar energy adoption, favorable federal incentives under policies like the U.S. Inflation Reduction Act, and growing demand for building-integrated photovoltaics (BIPV) in both commercial and residential sectors.

In comparison, Asia-Pacific (APAC) dominates the global landscape with a commanding 59.3% market share, led by major solar energy initiatives in China, India, and Japan. The region’s strong manufacturing capabilities and cost-effective production give it a competitive edge in both domestic deployment and exports.

Europe follows with a steadily growing market, supported by environmental regulations, sustainability goals, and widespread adoption of BIPV technologies. Countries like Germany, France, and Spain remain central to regional growth, benefiting from EU-backed clean energy programs.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

First Solar Inc. is a U.S.-based industry leader in advanced thin-film photovoltaic (PV) modules, specializing in cadmium telluride (CdTe) technology. The company is known for high-efficiency solar panels with low carbon footprints and strong durability. It operates globally, with manufacturing facilities in the U.S., Malaysia, and Vietnam. First Solar is heavily focused on utility-scale solar projects and has a strong presence in North America, contributing significantly to the solar PV glass segment through innovation and scale.

Xinyi Solar Holdings Ltd., headquartered in China, is one of the world’s largest manufacturers of solar PV glass. The company dominates the industry with vertically integrated operations and large-scale production facilities. It supplies ultra-clear PV glass to top solar module manufacturers globally. Xinyi benefits from China’s booming solar sector and cost-competitive advantages. With continuous R&D and expansion, Xinyi plays a pivotal role in shaping global solar trends, particularly in Asia-Pacific, which is the fastest-growing region in the PV glass market.

Yingli Green Energy, headquartered in China, was once one of the largest global solar panel manufacturers. The company designs, manufactures, and sells PV modules that integrate solar PV glass, serving residential, commercial, and utility-scale markets. Though its market share has declined in recent years due to financial restructuring, Yingli continues to focus on innovation and efficiency. It remains an important player in the PV value chain and contributes to the solar PV glass market through its integrated module production.

Top Key Players Outlook

- First Solar Inc.

- Xinyi Solar Holding Ltd.

- Nippon Sheet Glass Co. Ltd.

- Yingli Green Energy Holding Company Ltd.

- Sun Power Corporation

- ReneSola Ltd.

- Hanwha Q CELLS Co.

- Saint-Gobain S.A

- Guardian Industries

- Borosil Glass Works Limited

Recent Industry Developments

In 2024, Xinyi Solar Holdings Ltd.—the world’s largest solar PV glass maker—saw its total revenue at RMB 21,921 million, down 9.3 % from the previous year, while net profit tumbled to RMB 1,008 million, a sharp 73.8 % decline.

In 2024, Yingli Green Energy Holding Co. Ltd. quietly turned a corner—transforming its losses into profit with revenue growing by around 24 %, as reported in late March 2025.

Report Scope

Report Features Description Market Value (2024) USD 8.5 Bn Forecast Revenue (2034) USD 114.5 Bn CAGR (2025-2034) 29.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (AR Coated, Tempered, TCO-coated), By Technology (Crystalline Solar PV Module, Thin Film Module, Perovskite Module), By Application (Utility, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape First Solar Inc, Xinyi Solar Holding Ltd, Nippon Sheet Glass Co. Ltd, Yingli Green Energy Holding Company Ltd, Sun Power Corporation

ReneSola Ltd, Hanwha Q CELLS Co, Saint-Gobain S.A, Guardian Industries, Borosil Glass Works LimitedCustomization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- First Solar Inc.

- Xinyi Solar Holding Ltd.

- Nippon Sheet Glass Co. Ltd.

- Yingli Green Energy Holding Company Ltd.

- Sun Power Corporation

- ReneSola Ltd.

- Hanwha Q CELLS Co.

- Saint-Gobain S.A

- Guardian Industries

- Borosil Glass Works Limited