Global Shooting Market Size, Share Analysis Report By Type (Indoor, Outdoor), By Product Type(Fixed Targets, Moving Targets, Virtual Simulators), By Application (Military Training, Self-Defense Training, Recreation, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144653

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Regional Analysis

- Regional Perspectives

- Type Analysis

- Product Type Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

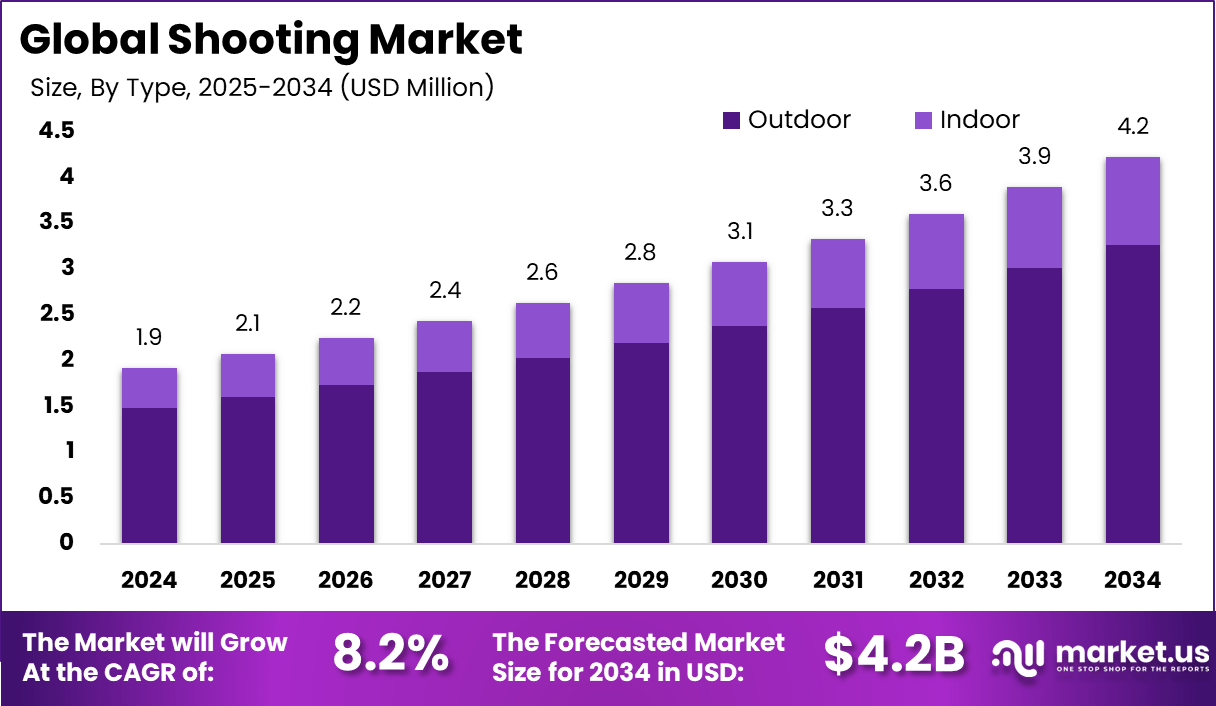

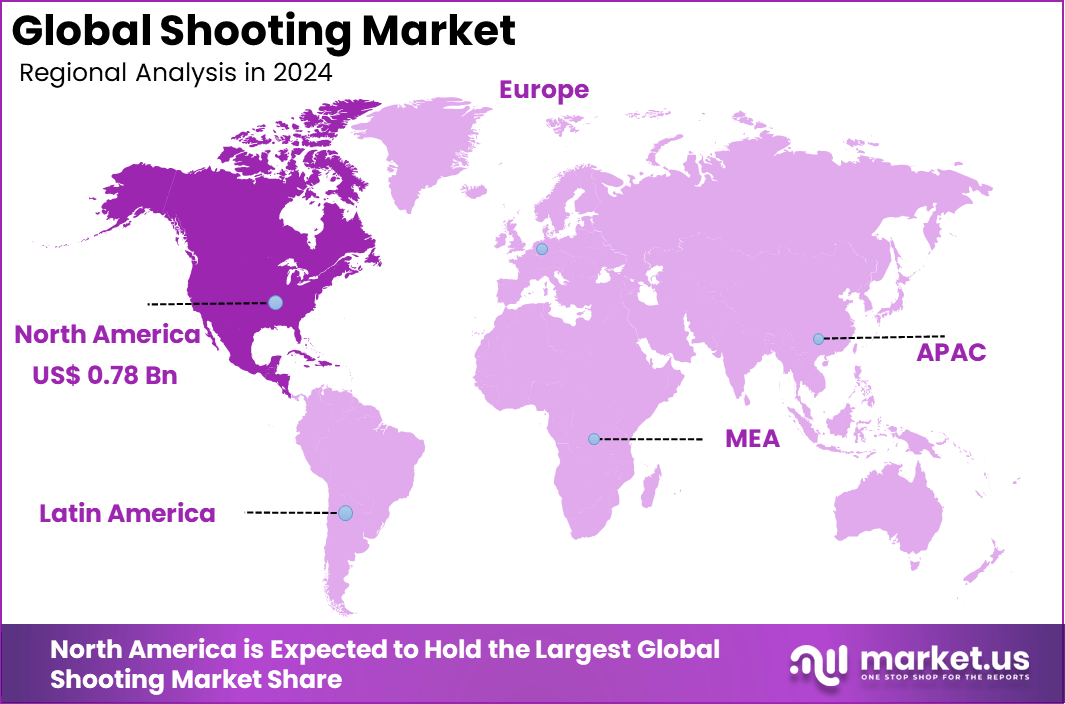

The Global Shooting Market size is expected to be worth around USD 4.2 Billion By 2034, from USD 1.9 billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.2% share, holding USD 0.7 Billion revenue.

The shooting market encompasses a broad range of activities, products, and services related to firearms and shooting sports. This market is segmented by product types such as air rifles and air pistols, with applications in game & clay shooting, hunting, and competitive sports.

The market is characterized by a growing preference for advanced technology and tailored solutions, which enhance the shooting experience through indoor and outdoor ranges, providing controlled environments and innovative technologies for enthusiasts and professionals alike.

The expansion of the shooting market is primarily driven by an increase in urban residents participating in shooting sports and hunting. This trend is supplemented by growing firearm and ammunition sales, and promotional activities by state and federal governments encouraging participation in recreational and competitive shooting sports.

In recent years, there has been a marked preference for cutting-edge technologies within the shooting industry. This includes the integration of smart technology in shooting accessories and the development of advanced firearms that offer higher precision and performance.

The primary reasons for adopting these technologies include enhancing the accuracy and safety of firearms, improving the user experience through customization, and addressing the heightened demand for high-performance sporting and defense firearms. These technologies also help manufacturers meet stringent regulatory standards and cater to a technologically savvy market segment.

The demand in the shooting market is robust, driven by factors such as increased interest in recreational shooting, higher personal security concerns, and the rising popularity of shooting as a competitive sport. The market is further buoyed by an increase in disposable income, which allows consumers to invest in premium shooting equipment and participate in shooting activities.

Key Takeaways

- The shooting market is projected to grow steadily over the forecast period, with its total value expected to reach approximately USD 4.2 billion by 2034, up from an estimated USD 1.9 billion in 2024. This growth represents a CAGR of 8.2% from 2025 to 2034.

- In terms of regional performance, North America led the global market in 2024, accounting for over 41.2% of the total market share. The region generated approximately USD 0.7 billion in revenue, supported largely by robust consumer participation, active sports shooting clubs, and defense training programs.

- The United States, in particular, is anticipated to exhibit notable growth. The U.S. shooting market is forecasted to expand at a CAGR of 7.15% between 2025 and 2034. The market size is expected to rise from approximately USD 0.71 billion in 2024.

- By Shooting Type, In 2024, the Outdoor segment dominated the market landscape, accounting for more than 72.21% of total market share.

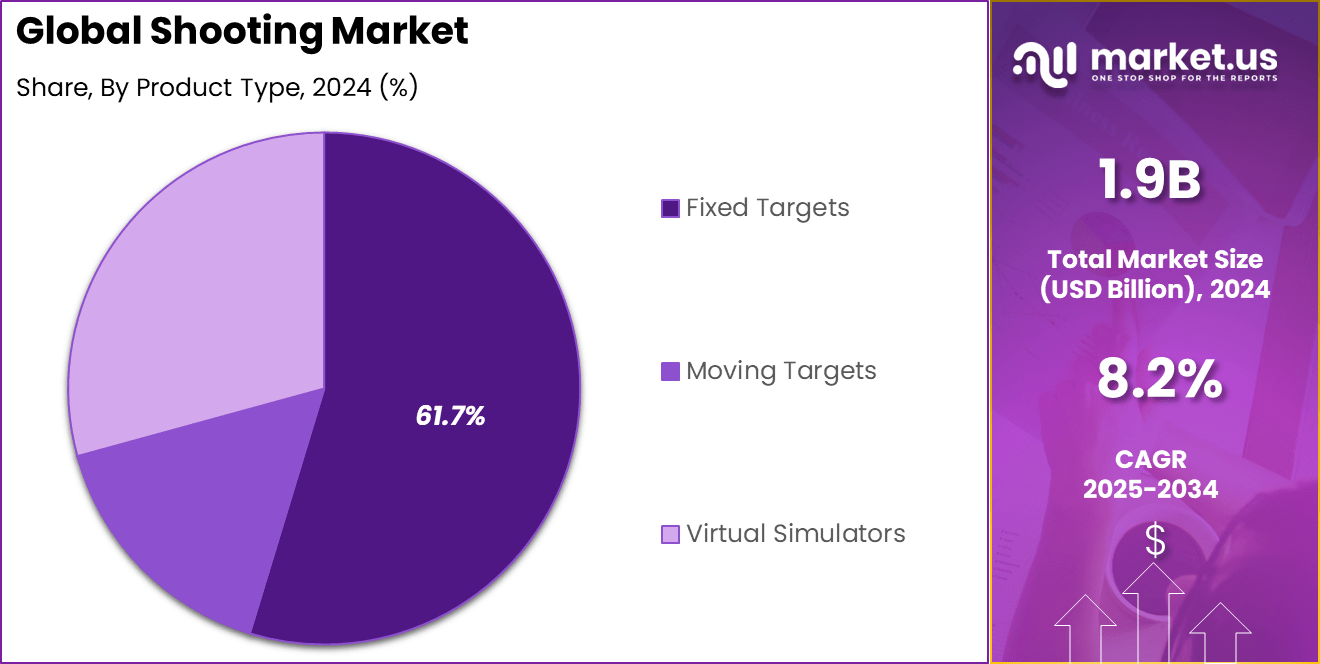

- By Target Type, The Fixed Targets segment held a leading position in 2024, representing over 61.7% of the global market.

- By Application, The Military Training segment emerged as the most prominent application area, capturing more than 56.1% of the total market share in 2024.

Analysts’ Viewpoint

Significant investment opportunities are emerging within the shooting market, particularly in the areas of smart gun technology and eco-friendly shooting range solutions. Investors are also looking at the rising market for female shooters and the continuous innovation in firearm safety and performance technologies as promising areas for growth.

The market trends indicate a growing inclination towards personalized and technologically advanced shooting solutions. There is also a notable rise in eco-conscious practices within the industry, aiming to minimize the environmental impact of shooting ranges and manufacturing processes.

Recent technological advancements in the shooting market include the development of biometric and smart guns, which enhance security and functionality. Innovations in ammunition and accessories that provide greater precision and customization options are also notable advancements that are setting new industry standards.

The regulatory environment for the shooting market is stringent, with numerous laws and regulations that govern the manufacturing, sale, and use of firearms and related accessories. Compliance with these regulations is crucial for market participants to operate successfully and sustainably.

Regional Analysis

U.S. Leadership

The U.S. shooting market is poised for significant growth, forecasted to expand at a compound annual growth rate (CAGR) of 7.15% from 2025 to 2034, with the market size projected to increase from USD 0.71 billion in 2024. This growth is underpinned by several key factors that underscore the U.S.’s dominant position in the global shooting industry.

A crucial driver for the U.S.’s leadership in the shooting market is the country’s substantial defense spending, which significantly influences the market dynamics. The U.S. accounts for more than 60% of the global firearms market, underscoring its dominant position. The local market’s expansion is further fueled by the increasing frequency of mass shooting incidents, which raises personal security concerns among civilians, thereby boosting the demand for firearms.

The U.S. market benefits from advanced technological integration in firearms and shooting accessories. Innovations such as smart guns, biometric safes, and advanced sighting systems not only enhance user safety and performance but also cater to a tech-savvy consumer base that demands modern and efficient solutions.

North America

In 2024, North America held a dominant market position in the shooting market, capturing more than a 41.2% share with revenues amounting to USD 0.78 billion. This substantial market share is primarily driven by the United States, which has a long-standing tradition of firearm ownership coupled with a robust sporting culture that includes shooting sports.

The region’s market dominance is further bolstered by advanced manufacturing capabilities and the presence of major industry players who continually invest in technological innovations and marketing strategies aimed at enhancing product offerings and customer engagement.

The high rate of firearm ownership in North America is supported by a regulatory environment that generally favors the right to bear arms, particularly in the U.S., where the Second Amendment provides a constitutional protection for firearm ownership. This legal backdrop facilitates a large civilian market for firearms and shooting accessories, contributing significantly to the regional shooting market’s size.

Furthermore, the rising concerns over personal security and the increasing participation in shooting sports such as hunting and target shooting have propelled the demand for firearms in North America. Events and competitions organized across the region also play a crucial role in sustaining interest and participation in shooting sports, thereby driving market growth.

Regional Perspectives

Europe: Europe represents a significant segment of the global shooting market, driven by a combination of active sporting communities and stringent regulatory standards that govern firearm ownership and use. Countries such as Germany, the United Kingdom, and France have well-established shooting traditions that support various segments of the shooting market, from sporting rifles to sophisticated shooting accessories.

Asia-Pacific (APAC): The Asia-Pacific region is experiencing rapid growth in the shooting market, fueled by increasing defense spending and a growing interest in shooting sports. Nations like China and India are expanding their military capabilities, which in turn boosts the demand for firearms and related technology.

Latin America: In Latin America, the shooting market is evolving, with growth influenced by security concerns and the legal adoption of firearms for personal protection. Countries like Brazil and Mexico face significant challenges related to crime and security, which drive the civilian demand for firearms and subsequently support the growth of the shooting market.

Middle East and Africa: The shooting market in the Middle East and Africa is primarily driven by security needs and military expenditures. The volatile political landscape and ongoing conflicts necessitate substantial investment in defense and security, which includes the procurement of firearms and shooting equipment.

Type Analysis

In 2024, the Outdoor segment of the shooting market held a dominant position, capturing more than a 72.21% share. This prominence is largely due to its appeal among a wide range of users, from recreational shooters to professional marksmen, including those in military and law enforcement roles.

The Outdoor shooting ranges offer a more authentic and expansive shooting experience, which is highly valued for both training purposes and competitive events. The natural settings not only provide realistic training scenarios but also attract recreational users who prefer a more traditional shooting environment.

The substantial share held by the Outdoor segment is underpinned by its capacity to accommodate a broad spectrum of shooting disciplines and activities. These ranges facilitate a wide variety of firearms and target types, catering to both group events and individual practices.

The flexibility in design and the ability to simulate diverse environmental conditions make Outdoor ranges particularly suited to dynamic shooting practices and professional training programs. Furthermore, the segment’s growth is driven by the increasing demand for more immersive and realistic training environments, which are crucial for effective law enforcement and military preparations.

As safety concerns continue to rise, so does the emphasis on proficient training, which Outdoor ranges are uniquely equipped to provide. The growth is also supported by technological advancements in range design and safety features, enhancing the overall user experience and attracting more participants to outdoor shooting activities.

Product Type Analysis

In 2024, the Fixed Targets segment of the shooting ranges market held a dominant market position, capturing more than a 61.7% share. This segment’s leadership is primarily driven by its foundational role in both recreational and professional shooting disciplines.

Fixed targets are essential for basic marksmanship training, widely utilized in military and law enforcement training programs where precision and accuracy are critical. These targets provide a consistent and reliable means for shooters to measure their skills and track improvements over time.

The widespread preference for fixed targets is also due to their simplicity and cost-effectiveness, making them accessible for a broad range of users, from beginners to experienced shooters. They are integral in various shooting sports and competitions, forming the backbone of many shooting events.

Additionally, fixed targets are easier to maintain and require less technical support compared to moving targets or virtual simulators, which further contributes to their prominence in the market. Technological enhancements in target design and material have also spurred the popularity of this segment.

Modern fixed targets often incorporate features that enable easier scoring and improved durability, which are attractive qualities for shooting range facilities looking to offer value and quality experiences to their customers. These innovations help in maintaining the segment’s leading position by enhancing the overall shooting experience, thus attracting more participants to the sport.

Application Analysis

In 2024, the Military Training segment of the shooting market held a dominant position, capturing more than a 56.1% share. This leading role is largely attributed to the continuous, high-priority demand for comprehensive and advanced training programs essential for military preparedness and effectiveness.

Military shooting ranges are critical for developing the tactical skills of armed forces, encompassing a range of training from basic marksmanship to complex combat scenarios. The segment’s prominence is further reinforced by the substantial investments governments make in defense and security, ensuring that military personnel are equipped with the necessary skills to handle various weaponry in different combat situations.

These investments are not only aimed at improving the precision and safety of military operations but also at adapting to evolving warfare tactics, which require ongoing enhancements in training facilities and methodologies.

Additionally, the integration of cutting-edge technologies in shooting ranges, such as automated target retrieval systems and virtual simulators, has made training more efficient and realistic, thereby enhancing the learning outcomes for military personnel. These technological advancements support a wide range of training needs, from individual skill development to unit-level tactical exercises, making them indispensable for modern military training programs.

Overall, the Military Training segment continues to expand, driven by global security challenges and the need for constant technological upgrades in training to ensure combat readiness. This demand ensures sustained investment and focus on developing and maintaining state-of-the-art shooting facilities tailored for military use, underscoring the segment’s significant share and critical role in the shooting market.

Key Market Segments

By Type

- Indoor

- Outdoor

By Product Type

- Fixed Targets

- Moving Targets

- Virtual Simulators

By Application

- Military Training

- Self-Defense Training

- Recreation

- Others

Driver

Increased Participation in Shooting Sports and Technological Advancements

The shooting industry has witnessed robust growth, largely propelled by the rising popularity of shooting sports and technological advancements in firearms. Enthusiasm for recreational and competitive shooting has surged, drawing a broader demographic interested in both traditional and innovative shooting disciplines.

Technological enhancements in firearm design, such as improved accuracy and safety features, have further stimulated market growth. Innovations include advanced optics, better recoil management, and more reliable firing mechanisms, making firearms appealing to both seasoned shooters and novices.

Moreover, the integration of digital technologies, including virtual reality and simulation-based training systems, has opened new avenues for the industry. These technologies provide realistic and safe environments for training and entertainment, expanding the market to those who may not have access to traditional shooting ranges.

Restraint

Stringent Regulations and Negative Public Perception

One of the primary restraints facing the shooting industry is the stringent regulatory environment in many regions across the globe. Regulations affecting the ownership, sale, and use of firearms are highly variable and can significantly impact market operations.

For example, some countries have enacted strict laws that limit the types of firearms that can be owned and require rigorous background checks and licensing, slowing down market growth and accessibility. Additionally, public perception of firearms and shooting sports can greatly influence the industry.

High-profile incidents involving gun violence tend to heighten public and media scrutiny of the shooting industry. This scrutiny can lead to increased calls for stricter gun control measures, which may result in decreased market activity. Negative media coverage can also erode public trust and deter potential participants from engaging in shooting sports.

Opportunity

Expansion into Emerging Markets and Diversification of Product Offerings

Emerging markets represent a significant opportunity for the shooting industry. Increasing disposable incomes and a growing interest in recreational activities have led to higher demand for shooting sports in regions such as Asia-Pacific and Latin America.

Furthermore, diversifying product offerings to include a range of firearms suited for different user needs – from hunting and sport shooting to personal defense – can help cater to a broader audience. Offering firearms with various calibers and functionalities allows companies to meet specific customer preferences and requirements, thereby enhancing market penetration and growth potential.

Challenge

Adapting to Evolving Technologies and Consumer Preferences

The shooting industry must continually adapt to rapidly evolving technologies and shifting consumer preferences. As digital and smart technologies advance, consumers increasingly expect high-tech features in firearms, such as connectivity for performance tracking and automated safety systems.

Meeting these expectations requires ongoing research and development investments, which can be substantial. Additionally, the industry must navigate changing consumer preferences, such as the rising popularity of eco-friendly and less lethal shooting alternatives.

These trends require manufacturers to innovate continuously while ensuring their products remain relevant and desirable in a competitive market. Balancing innovation with tradition poses a significant challenge but is essential for sustaining long-term growth.

Growth Factors

Technological Innovations and Expanding Market Segments

The shooting industry is experiencing significant growth driven by technological advancements and the diversification of market segments. Innovations in firearm technology, such as enhanced precision, safety features, and the integration of digital technologies like smart gun systems, have bolstered the appeal of shooting sports.

Moreover, the expansion of market segments to include a wider array of shooting disciplines such as tactical shooting, recreational target shooting, and competitive sports has broadened the industry’s consumer base. This diversification has been crucial in attracting new demographics, including younger shooters and women, contributing to the sustained growth of the sector.

Emerging Trends

Shift Towards Personalized and High-Performance Equipment

Emerging trends in the shooting industry indicate a shift towards more personalized and high-performance shooting equipment. Consumers are increasingly seeking firearms and accessories that offer greater customization, which is reflected in the growing popularity of modular designs that allow users to tailor their equipment to specific needs and preferences.

This trend is particularly evident in the rise of customizable handguns and rifles, which are designed to enhance user experience through improved ergonomics and functionality. Additionally, there is a noticeable trend towards the adoption of advanced materials in firearm manufacturing, such as polymers and composites, which provide enhanced durability and performance while reducing weight.

Business Benefits

Increased Consumer Spending and Market Expansion

The shooting industry benefits significantly from increased consumer spending, driven by the rising popularity of shooting sports and the continuous introduction of innovative products. This trend is supported by the expansion into new markets, particularly in regions with growing economic power and changing lifestyles, such as Asia-Pacific and Latin America.

Furthermore, businesses in the shooting industry are reaping benefits from strategic market segmentation and targeted marketing efforts. By understanding and catering to specific consumer segments, companies are able to tailor their products and marketing strategies, enhancing customer engagement and loyalty.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The shooting market is driven by a mix of established companies and new entrants who continue to shape the future of the industry through innovation, partnerships, and expanding their product lines.

Colt CZ Group (CZG) has been actively expanding through strategic acquisitions, notably acquiring Sellier & Bellot as well as swissAA. These acquisitions are part of Colt CZ’s broader strategy to enhance its production capabilities and diversify its product portfolio, particularly in the ammunition sector.

Vista Outdoor has shown a robust approach to market expansion by spinning off its outdoor business, The Kinetic Group, to focus more on its core areas, attracting significant international investment interest. This move is part of a larger strategy to streamline operations and enhance focus on high-growth areas.

Smith & Wesson has recently planned to divest its Thompson/Center Arms brand to concentrate on its core brands and market segments. This strategic refocusing allows Smith & Wesson to enhance its production volumes and efficiency, aiming for increased market share and profitability in its primary business lines.

Top Key Players in the Market

The following are the leading companies in the Shooting market. These companies collectively hold the largest market share and industry trends.

- Royal Range USA

- ACTION TARGET

- Range Systems

- Spire Ranges

- Mobile Range Technologies

- REGUPOL Germany GmbH & Co. KG

- GEBIM S.R.L.

- ARMI PERAZZI S.p.A.

- Phoenix Range

- Other Major Players

Recent Developments

- In March 2025, Action Target announced plans to unveil next-generation shooting range technologies at the SHOT Show 2025. These innovations aim to enhance the safety and efficiency of shooting range operations.

- In November 2024, CSG completed a $2.2 billion acquisition of Kinetic Group, a U.S.-based small-caliber ammunition manufacturer. This acquisition expanded CSG’s portfolio to include prominent brands such as Federal, Remington, Speer, and HEVI-Shot.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 4.2 Bn CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Indoor, Outdoor), By Product Type(Fixed Targets, Moving Targets, Virtual Simulators), By Application (Military Training, Self-Defense Training, Recreation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Royal Range USA, ACTION TARGET, Range Systems, Spire Ranges, Mobile Range Technologies, REGUPOL Germany GmbH & Co. KG, GEBIM S.R.L., ARMI PERAZZI S.p.A., Phoenix Range, Other Major Players” Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Royal Range USA

- ACTION TARGET

- Range Systems

- Spire Ranges

- Mobile Range Technologies

- REGUPOL Germany GmbH & Co. KG

- GEBIM S.R.L.

- ARMI PERAZZI S.p.A.

- Phoenix Range

- Other Major Players