Global Forestry Software Market Size, Share, Statistics Analysis Report By Component (Software, (Services (Professional Services, Managed Services)), By Deployment (On-premises, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Application (Forest Inventory & Monitoring, Harvesting & Logistics Management, Fire & Pest Risk Assessment, GIS & Mapping, Carbon Credit & Sustainability Tracking, Others), By End-User (Government & Conservation Agencies, Forestry Companies & Timberland Owners, Pulp & Paper Industry, Consulting Firms), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144610

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Key Contributions of AI

- U.S. Forestry Software Market

- Component Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

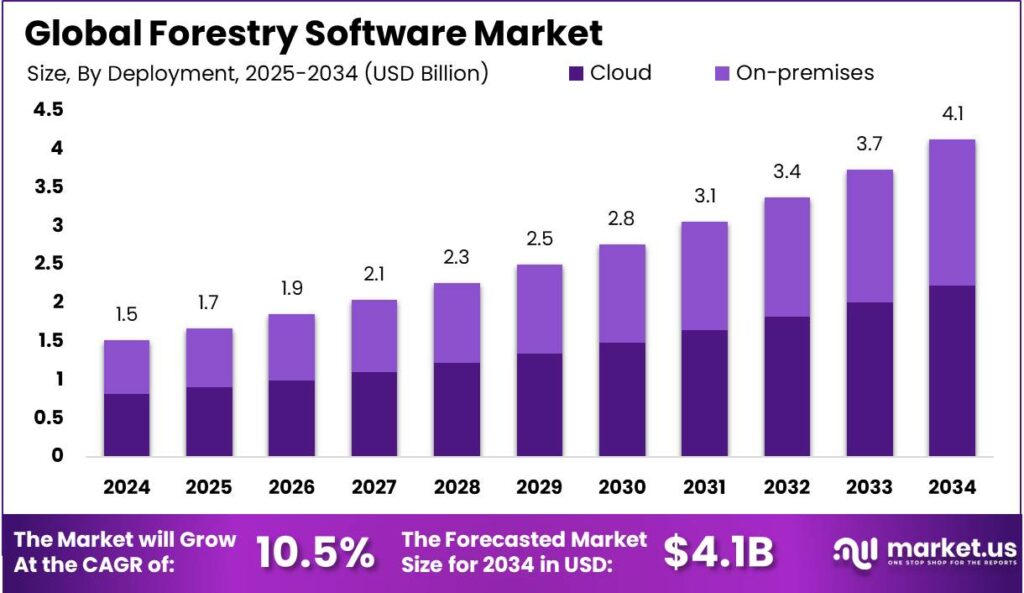

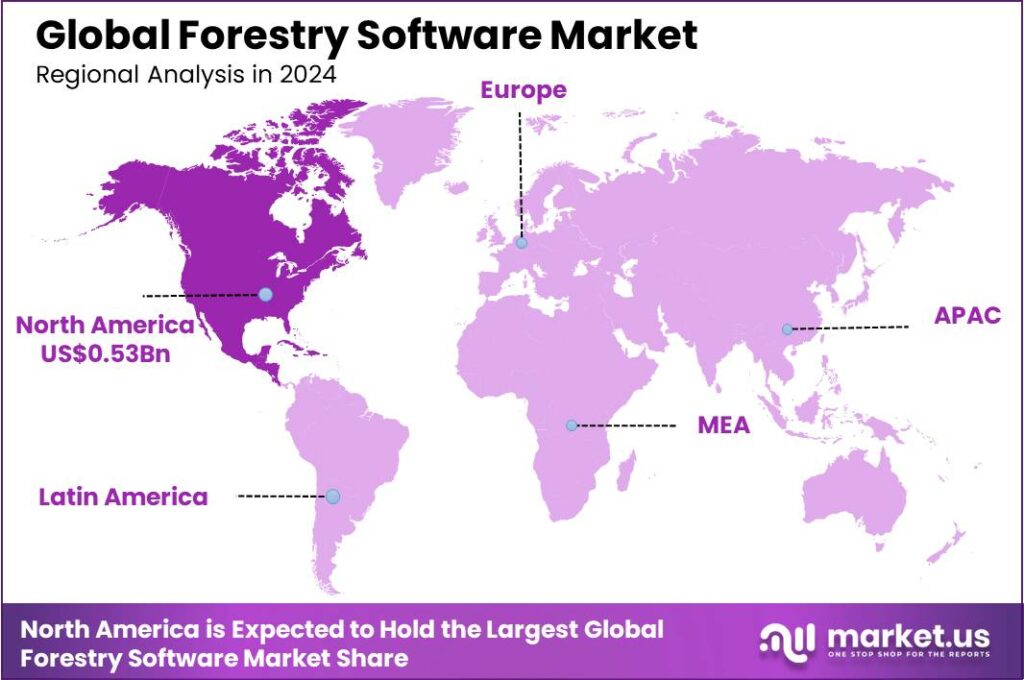

The Global Forestry Software Market size is expected to be worth around USD 4.1 Billion By 2034, from USD 1.52 Billion in 2024, growing at a CAGR of 10.50% during the forecast period from 2025 to 2034. North America dominated the global forestry software market in 2024, holding more than 35% of the market share, with revenues totaling USD 0.53 billion.

Forestry software refers to specialized applications designed to aid in the management, monitoring, and operational control of forests and related resources. Forestry software streamlines operations like inventory management, logging, and planning, ensuring regulatory compliance. It supports sustainability with tools for mapping, data analysis, and reporting, essential for effective forest management and conservation.

Several key factors are fueling the growth of the forestry software market. A growing demand for efficient forest management, driven by sustainability and conservation needs, is one major factor. Technological advancements in GIS, remote sensing, and data analytics are enhancing forestry software, making it more functional, appealing, and accessible to users.

Rising regulatory pressures and environmental compliance requirements are driving forestry businesses to adopt advanced management tools for accurate reporting and legal adherence. The global growth of the forestry industry, focused on optimizing production and maintaining ecological balance, is driving the adoption of advanced forestry software solutions.

Forestry software boosts productivity by automating routine tasks, enabling staff to focus on strategic activities. It enhances data accuracy for regulatory compliance and sustainable management. Additionally, integrating forestry operations streamlines workflows, resulting in cost savings and improved efficiency.

Artificial intelligence (AI) has begun to significantly alter the landscape of forestry management through predictive analytics and machine learning. AI can predict tree growth and optimize harvest schedules, improving yield predictions and resource allocation. AI-powered drones and satellite imagery also enable large-scale monitoring of forest health, detecting pests and diseases earlier and more accurately than traditional methods.

The global push towards sustainability is creating substantial market opportunities for forestry software.As governments and corporations prioritize sustainability, the demand for tools to manage forests sustainably is rising. The growth of reforestation projects worldwide further expands the market for software that can plan, monitor, and report on these efforts.

Market expansion in forestry software is set to grow as environmental awareness rises and technology advances. Emerging markets in Asia and Africa, with increasing forestry activities, require advanced management tools. Additionally, integrating forestry software with agricultural and resource management systems opens up new growth opportunities.

Key Takeaways

- The Global Forestry Software Market is expected to reach USD 4.1 billion by 2034, growing from USD 1.52 billion in 2024, at a CAGR of 10.50% during the forecast period from 2025 to 2034.

- In 2024, the software segment held a dominant position in the forestry software market, capturing more than 63% of the market share.

- The Cloud segment also held a dominant position in 2024, capturing more than 54% of the market share in the forestry software market.

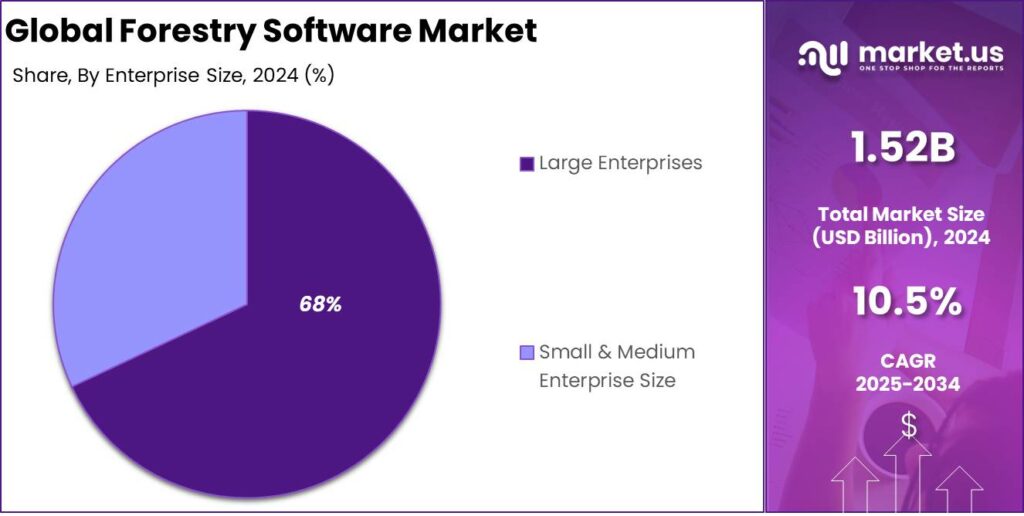

- In 2024, the Large Enterprises segment dominated the forestry software market, capturing more than 68% of the market share.

- The Forest Inventory & Monitoring segment was the dominant segment in 2024, holding more than 25% of the market share in the forestry software market.

- The Forestry Companies & Timberland Owners segment held a dominant position in 2024, capturing more than 40% of the market share within the forestry software market.

- North America dominated the global forestry software market in 2024, holding more than 35% of the market share, with revenues totaling USD 0.53 billion.

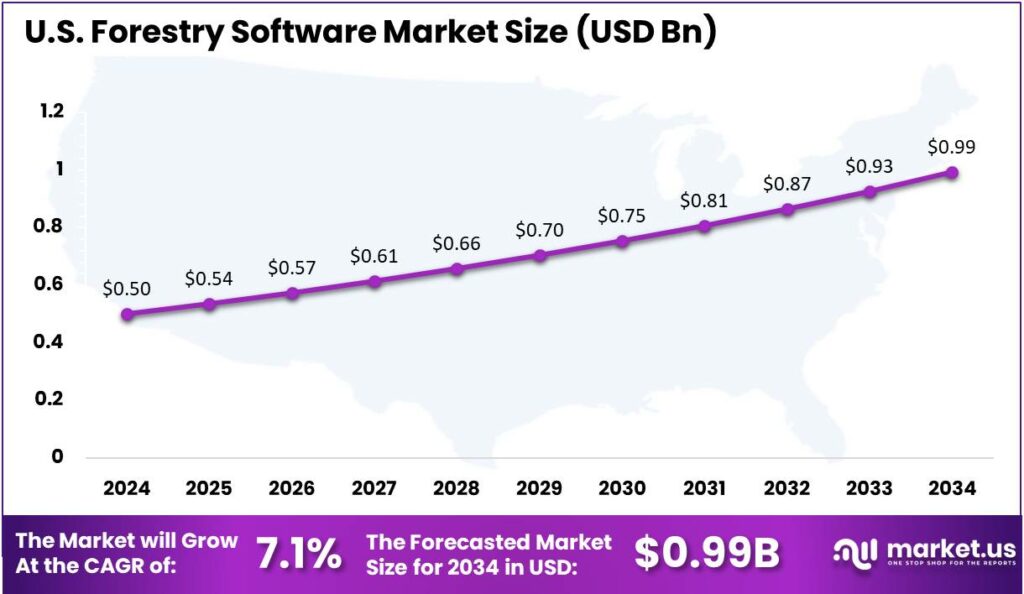

- In 2024, the U.S. forestry software market was valued at USD 0.5 billion and is projected to grow at a CAGR of 7.1%.

Analysts’ Viewpoint

The surging market offers substantial investment opportunities, particularly in cloud-based solutions and innovations that integrate artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) devices. These technologies improve data analysis and operational efficiency, playing a key role in forest management and conservation.

Key drivers include the increased demand for operational efficiency and the integration of advanced technologies like GIS and remote sensing. Additionally, environmental sustainability concerns and regulations are prompting forestry operations to adopt more efficient and compliant software solutions.

The market is also influenced by environmental advocacy and public sentiment towards sustainable practices. Companies in this sector must navigate a complex regulatory landscape that emphasizes conservation and sustainable management, which in turn drives the adoption of sophisticated forestry software solutions.

Key Contributions of AI

- Predicting Forest Growth: AI models like MATRIX are being developed to predict forest growth globally. These models use data from billions of trees, satellite imagery, and geospatial data to map growth rates, carbon dynamics and timber quality. MATRIX is currently trained in Indiana and will expand to cover major forest types worldwide. It aims to assist over 50% of developing countries lacking forest growth models.

- Monitoring Forest Health: AI-powered tools can remotely track forest health using satellite images and sensors. These systems measure moisture, nitrogen levels, and canopy structure to assess tree health. Machine learning algorithms are even used to detect pests like emerald ash borer larvae through vibration signals.

- Fighting Climate Change: AI helps track deforestation and forest degradation caused by wildfires or human activity. Recently, more than hectares of primary forests have been lost globally. By analyzing real-time data, AI can suggest actions to protect forests and reduce emissions.

- Smarter Forest Management: AI improves predictions for timber yield, schedules harvests efficiently, and assesses risks like wildfires. AI systems analyze tree species and dimensions to make better decisions about wood volume and wildfire prevention.

- Forest Tracking: The Global Forest Biodiversity Initiative database includes data from 55 million trees across 1.3 million sample plots worldwide. Satellite-based tools can track deforestation changes with near-perfect accuracy at lower costs than manual methods.

U.S. Forestry Software Market

In 2024, the U.S. forestry software market was valued at USD 0.5 billion. It is projected to grow at a compound annual growth rate (CAGR) of 7.1%.

The growth of the forestry software market is driven by several factors, including the rising demand for streamlined forestry operations and the adoption of advanced technologies for resource monitoring and management. The integration of GIS, remote sensing, and real-time data analysis tools improves operational efficiency and accuracy, further fueling market expansion.

Moreover, the shift towards sustainable forest management practices necessitates sophisticated software solutions that can support decision-making processes. Forestry software enables stakeholders to achieve compliance with environmental regulations and certification standards, while also optimizing the yield and health of forest resources.

Additionally, the ongoing development and enhancement of cloud-based forestry software solutions are expected to further propel the market. These cloud solutions offer scalability, cost-efficiency, and accessibility, making advanced forestry management tools more available to a wider range of users, including small and medium-sized enterprises.

In 2024, North America held a dominant market position in the global forestry software market, capturing more than a 35% share with revenues amounting to USD 0.53 billion. This leadership can be attributed to several key factors that underscore the region’s advanced technological infrastructure and robust forestry practices.

One of the primary drivers for North America’s leading position is the high level of technology adoption among forestry operators in the region. North American forestry companies have been pioneers in integrating advanced technologies such as artificial intelligence, machine learning, and big data analytics into their operations.

The stringent environmental regulations and policies in North America demand precise and sustainable forest management practices. Forestry software plays a crucial role in helping companies comply with these regulations by providing tools for monitoring environmental impact, managing resources sustainably, and ensuring compliance with governmental standards.

The presence of major forestry software developers in North America significantly boosts the region’s market share. These companies serve both local and global markets, setting industry standards and driving innovation. As they refine their offerings, they attract more users domestically and internationally, reinforcing North America’s leading position in the global forestry software market.

Component Analysis

In 2024, the software segment held a dominant position in the forestry software market, capturing more than a 63% share. This leadership is primarily attributed to the essential role that specialized software plays in the daily operations of forest management.

The prominence of the software segment is strengthened by ongoing technological advancements. Innovations in GIS, remote sensing, and data management have greatly improved the functionality and ease of use of forestry software. As these technologies evolve, they integrate more seamlessly with forestry operations, driving greater reliance on software solutions for effective forest management.

Moreover, the increasing regulatory demands for sustainability and environmental compliance in the forestry sector have made software solutions even more critical. Forestry software aids in ensuring compliance with environmental laws and regulations by providing detailed tracking and reporting capabilities.

The shift towards digital transformation in the forestry industry boosts the software segment’s dominance. As forestry operations adopt digital tools for productivity and sustainability, the demand for robust software grows, driving market share and making these tools essential for efficient forest management.

Deployment Analysis

In 2024, the Cloud segment held a dominant position in the forestry software market, capturing more than a 54% share. This significant market share can be attributed to the cloud’s ability to provide scalable and flexible access to forestry software solutions.

The prominence of the Cloud segment is reinforced by its ease of integration and updates. Cloud-based forestry software enables seamless updates, introducing new features without disrupting the user experience. This allows forestry operations to consistently benefit from the latest advancements, ensuring efficiency and compliance with environmental regulations.

The cloud model enhances collaboration, crucial for the dispersed nature of forestry operations. Teams can access real-time data from remote locations, improving decision-making and coordination. This is vital for efficiently managing vast forest areas, where data-driven decisions play a key role in sustainability and productivity.

Cloud platforms’ data security and backup solutions strengthen their market position. With sensitive data requiring robust protection, cloud providers offer advanced security features that ensure data integrity and regulatory compliance, driving the adoption of cloud-based forestry software.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position in the forestry software market, capturing more than a 68% share. This substantial market share is primarily due to several strategic advantages that large enterprises hold over smaller firms in terms of resources and capabilities.

Large enterprises have more financial resources to invest in advanced forestry software, enabling them to integrate AI and IoT technologies. This enhances efficiency and productivity, giving them a competitive edge by deploying comprehensive solutions that cover all aspects of forest management, from planting to harvest and compliance reporting.

The scale of operations in large enterprises demands robust software solutions that can manage extensive data and complex logistics. Large forestry companies often manage vast areas of land across different geographies, necessitating sophisticated tools for spatial analysis, resource tracking and operational planning.

Large enterprises are better positioned to influence market trends and drive technological advancements. Their needs shape software development priorities, leading to innovations tailored for large-scale operations. This cycle ensures that software solutions evolve to meet their demands, further solidifying their dominant position.

Application Analysis

In 2024, the Forest Inventory & Monitoring segment held a dominant market position in the forestry software market, capturing more than a 25% share. This segment’s leadership can be attributed to the increasing necessity for precise and efficient forest management practices.

As the demand for sustainable forestry operations escalates, forestry software plays a pivotal role in inventory management and the monitoring of forest resources. This software aids in tracking tree growth, health, and biodiversity, which are critical for maintaining ecosystem balance and complying with environmental regulations.

The prevalence of the Forest Inventory & Monitoring segment also stems from technological advancements that enhance data accuracy and accessibility. Modern forestry software integrates advanced GIS and remote sensing technologies, which allow for real-time monitoring and detailed data analysis.

Additionally, the economic aspect of forest management significantly influences this segment’s growth. Effective inventory and monitoring help in maximizing the profitability of forest resources by optimizing harvest schedules and reducing waste. This efficiency is vital for forest owners and managers aiming to capitalize on the economic value of their assets while ensuring environmental sustainability.

End-User Analysis

In 2024, the Forestry Companies & Timberland Owners segment held a dominant market position within the forestry software market, capturing more than a 40% share. This leading status can be attributed to several pivotal factors.

Furthermore, regulatory compliance and sustainability goals have necessitated the adoption of robust forestry software by this segment. Governments worldwide are tightening regulations regarding sustainable forest management and traceability of timber products, compelling forestry companies and timberland owners to implement systems that ensure compliance with these regulations.

Technological advancements have been key to the segment’s dominance. The integration of GIS, remote sensing, and drone surveillance in forestry software has transformed forest management by enabling precise mapping, health assessments, and monitoring of changes over time. This significantly enhances decision-making for forestry companies and timberland owners.

Economic factors also support the segment’s leadership. Growing demand for timber and wood products boosts profitability, encouraging forestry companies to invest in high-quality software tools that optimize production and supply chain management, enhancing market position and revenue. This economic incentive drives the adoption of innovative forestry software, reinforcing the segment’s dominance.

Key Market Segments

By Component

- Software

- Services

- Professional Services

- Managed Services

By Deployment

- On-premises

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- Forest Inventory & Monitoring

- Harvesting & Logistics Management

- Fire & Pest Risk Assessment

- GIS & Mapping

- Carbon Credit & Sustainability Tracking

- Others

By End-User

- Government & Conservation Agencies

- Forestry Companies & Timberland Owners

- Pulp & Paper Industry

- Consulting Firms

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Sustainable Forest Management

The escalating global emphasis on environmental sustainability has significantly heightened the demand for sustainable forest management practices. Forestry software plays a pivotal role in this context by providing tools that enable precise monitoring, analysis, and management of forest resources.

These software solutions facilitate the implementation of sustainable practices by offering features such as real-time data collection, geospatial analysis, and resource planning. Consequently, organizations can ensure compliance with environmental regulations and optimize the economic benefits derived from forest resources. This growing need for sustainability is a primary driver propelling the adoption and development of forestry software solutions.

Restraint

High Implementation Costs and Lack of Skilled Professionals

Despite the advantages offered by forestry software, the market faces significant restraints due to high implementation costs and a shortage of skilled professionals. The initial investment required for deploying advanced forestry software solutions can be substantial, encompassing expenses related to software acquisition, hardware infrastructure, and system integration.

This financial burden is particularly challenging for small and medium-sized enterprises (SMEs) and individual landowners, who may find it difficult to allocate the necessary resources. Effective use of these software solutions requires specialized knowledge and technical expertise. The shortage of trained professionals in the forestry sector limits the widespread adoption, as organizations struggle to find skilled personnel to manage and operate the software.

Opportunity

Integration with Remote Sensing and Geographic Information Systems (GIS)

The integration of forestry software with remote sensing technologies and Geographic Information Systems (GIS) presents a significant opportunity for enhancing forest management practices. By incorporating satellite imagery and remote sensor data, forestry software can provide comprehensive insights into forest conditions, enabling more accurate monitoring and assessment.

This integration allows for efficient tracking of changes in forest cover, detection of illegal logging activities, and assessment of biodiversity. Furthermore, GIS capabilities facilitate spatial analysis and mapping, aiding in strategic planning and decision-making processes. The synergy between forestry software, remote sensing, and GIS technologies empowers organizations to implement more effective and sustainable forest management strategies.

Challenge

Data Security and Cybersecurity Concerns

As forestry operations become increasingly digitized, the industry faces mounting challenges related to data security and cybersecurity. The reliance on digital systems for managing sensitive information, such as geospatial data, inventory records, and financial transactions, makes forestry organizations susceptible to cyber threats.

Unauthorized access, data breaches, and cyber-attacks can lead to significant operational disruptions, financial losses, and reputational damage. Ensuring the protection of critical data requires the implementation of robust cybersecurity measures, regular risk assessments, and comprehensive employee training programs. Addressing these cybersecurity challenges is imperative for maintaining the integrity and reliability of forestry software systems.

Emerging Trends

One significant trend is the adoption of Artificial Intelligence (AI) and the Internet of Things (IoT). These technologies enable real-time monitoring and data analysis, enhancing decision-making and promoting sustainable forestry. For example, AI-powered cameras in Tasmania aid in early bushfire detection, ensuring swift responses to threats.

Another emerging trend is the integration of Remote Sensing and Geographic Information Systems (GIS). These tools offer detailed mapping and monitoring, helping forest managers assess health, plan harvests, and track changes. Drones with environmental sensors enhance data collection, supporting conservation efforts.

Predictive Analytics is also gaining traction in forestry software. By analyzing historical data and environmental variables, predictive models can forecast growth patterns, timber yields, and potential disease outbreaks. This proactive approach supports sustainable harvesting and resource allocation, ensuring long-term forest viability.

Business Benefits

Forestry software significantly enhances internal collaboration by providing a unified platform where teams, stakeholders, and contractors can access and share necessary data seamlessly. This comprehensive access ensures all parties are aligned, improving project outcomes and operational efficiency.

Forestry software improves the management of complex supply chains by optimizing delivery routes and load configurations, which reduces transportation costs and delivery times. Additionally, it facilitates compliance with regulatory requirements through automated documentation, enhancing operational reliability and customer satisfaction in the timber and forestry industry.

Forestry software provides tools for detailed inventory management, habitat mapping, and resource allocation. These features help forestry professionals maintain a balance between harvesting and conservation, ensuring efficient, ecologically responsible operations for long-term sustainability.

Key Player Analysis

- Creative Information Systems Inc. stands out as a leading provider in the forestry software space. Known for their ForestPro software, they offer comprehensive solutions for forest management, timber production, and resource planning. The software enables businesses to track inventory, plan harvests, and optimize land usage efficiently.

- Disprax Pty Ltd. is another key player with a unique position in the market. Their Forest Management Software focuses on streamlining operations for forest managers, landowners, and forestry contractors. Disprax stands out for its ability to integrate geographical data, satellite imagery, and mobile technology, giving users real-time insights into forest health and timber management.

- Assisi Software Corp. is a highly regarded software provider in the forestry sector, offering solutions that focus on land management, environmental sustainability, and timber production. Known for their Assisi Forestry Software, they specialize in helping companies manage both small and large-scale forestry operations. Assisi Software distinguishes itself with a strong focus on data accuracy and environmental responsibility.

Top Key Players in the Market

- Creative Information Systems Inc.

- Disprax Pty Ltd.

- Assisi Software Corp.

- Remsoft

- Mason Bruce & Girard Inc.

- Caribou Software Inc.

- Forestry Systems Inc.

- Trimble Inc.

- Environmental Systems Research Institute Inc.

- Enfor Consultants Ltd.

- Other Key Players

Top Opportunities Awaiting for Players

The forestry software market presents several burgeoning opportunities for market players, driven by advances in technology and evolving market demands.

- Adoption of Cloud-Based Solutions: The shift towards cloud-based platforms offers significant benefits, including scalability, cost efficiency, and enhanced accessibility, making it a lucrative opportunity for forestry software providers. This trend is complemented by the increasing inclination of businesses towards sustainable forest management practices.

- Integration of Advanced Technologies: There is a growing trend of incorporating artificial intelligence (AI) and machine learning (ML) into forestry software. These technologies enable more sophisticated data analysis, improve operational efficiencies, and enhance decision-making processes in forest management.

- Expansion in Emerging Markets: The forestry software market is expanding globally, with significant growth opportunities in Asia-Pacific, Latin America, and Africa. These regions are experiencing increased investment in forest management and conservation projects, driven by government initiatives and the rising awareness of sustainable practices.

- Development of Specialized Applications: Opportunities abound for the development of niche applications tailored to specific aspects of forestry, such as inventory management, land use planning, and compliance reporting. These specialized tools can cater to the nuanced needs of different forestry operations, enhancing the precision and effectiveness of forest management.

- Collaborative Ventures and Strategic Partnerships: Engaging in partnerships and collaborative efforts with other tech companies can open new avenues for growth. Such collaborations can lead to the development of integrated solutions that combine GIS, remote sensing, and other technological advancements, offering comprehensive tools that are more attractive to forestry professionals.

Recent Developments

- In April 2024, Holmen, a prominent Swedish forestry company, has chosen Trimble “CONNECTED FOREST” as its all-in-one forest management solution for Holmen Skog. In partnership with ForestX, Trimble’s service partner in Sweden, the digital transformation project marks a key step in modernizing forest management.

- In August 2024, Cambium acquired Forward Forestry, a prominent network of arborists and tree care companies in the U.S. This strategic move aimed to enhance Cambium’s sustainable supply chain and increase the production of Carbon Smart Wood.

Report Scope

Report Features Description Market Value (2024) USD 1.52 Bn Forecast Revenue (2034) USD 4.1 Bn CAGR (2025-2034) 10.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, (Services (Professional Services, Managed Services)), By Deployment (On-premises, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Application (Forest Inventory & Monitoring, Harvesting & Logistics Management, Fire & Pest Risk Assessment, GIS & Mapping, Carbon Credit & Sustainability Tracking, Others), By End-User (Government & Conservation Agencies, Forestry Companies & Timberland Owners, Pulp & Paper Industry, Consulting Firms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Creative Information Systems Inc., Disprax Pty Ltd., Assisi Software Corp., Remsoft, Mason Bruce & Girard Inc., Caribou Software Inc., Forestry Systems Inc., Trimble Inc., Environmental Systems Research Institute Inc., Enfor Consultants Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Creative Information Systems Inc.

- Disprax Pty Ltd.

- Assisi Software Corp.

- Remsoft

- Mason Bruce & Girard Inc.

- Caribou Software Inc.

- Forestry Systems Inc.

- Trimble Inc.

- Environmental Systems Research Institute Inc.

- Enfor Consultants Ltd.

- Other Key Players