Global Safety Needles Market Analysis By Product (Active Safety Needles, Passive Safety Needles), By Application (Drug Delivery, Sample Collection), By End-User (Hospitals & Ambulatory Surgery Centres, Diabetic Patients, Family Practice / Physician Offices , Home Care, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165622

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

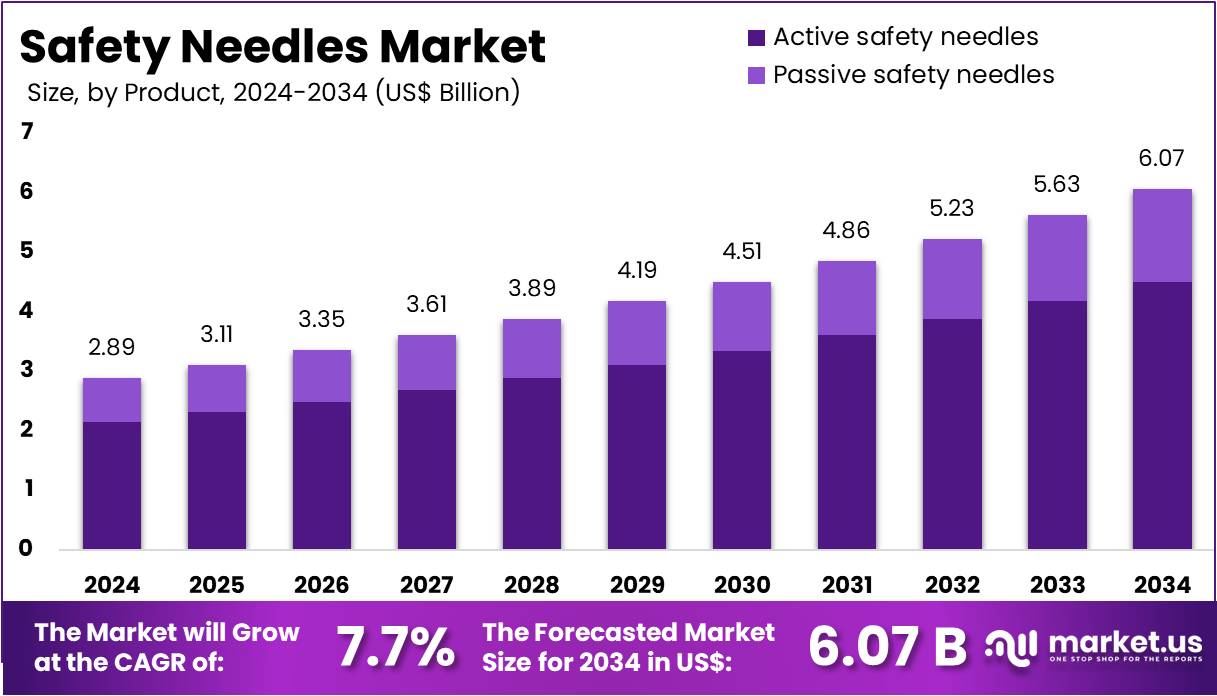

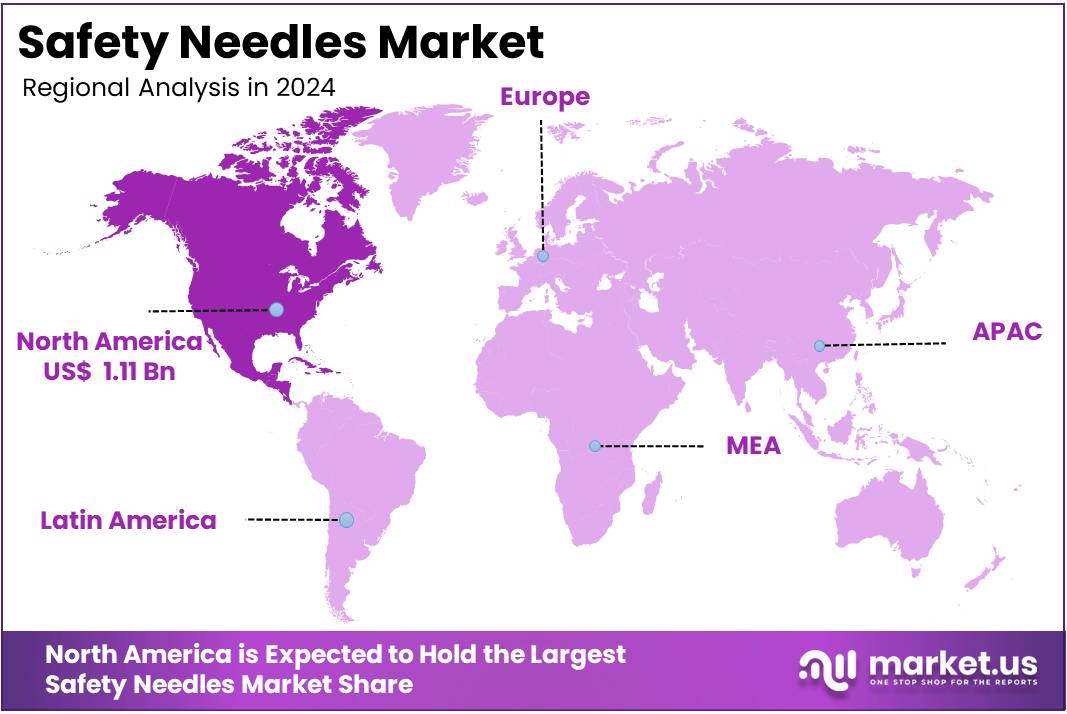

The Global Safety Needles Market Size is expected to be worth around US$ 6.07 Billion by 2034, from US$ 2.89 Billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.5% share and holds US$ 1.11 Billion market value for the year.

Safety needles are designed to reduce accidental injuries during injections and blood collection. They form part of wider efforts to protect healthcare workers and patients from bloodborne infections. Demand is increasing as hospitals seek safer devices that fit existing workflows and lower legal and insurance exposure. According to the World Health Organization (WHO), sharps injuries in health workers lead each year to about 66,000 hepatitis B (HBV), 16,000 hepatitis C (HCV), and 200–5,000 HIV infections worldwide.

The medical and emotional impact of sharps injuries has been widely discussed in global research and hospital safety programs. These events generate fear, require follow-up testing, and add costs for staff monitoring and treatment. Safety needles are regarded as a direct method to interrupt this pathway of transmission in daily practice. WHO data indicate that sharps injuries account for roughly 39% of HCV, 37% of HBV, and 4.4% of HIV infections in health workers, indicating that many cases are preventable.

Policy and regulatory measures have created a strong structural base for safety needle adoption. Health systems now combine legislation, professional standards, and procurement rules rather than rely only on voluntary change. According to WHO guidance, countries are urged to shift from conventional syringes to safety-engineered devices for intramuscular, intradermal, and subcutaneous injections. In the European Union, Council Directive 2010/32/EU requires substitution of traditional needles with safer sharps where there is risk of injury in healthcare settings, and also supports wider use of reuse-prevention designs.

Occupational health initiatives and hospital safety programs further reinforce the move toward safety needles. Facilities aim to protect staff, sustain morale, and reduce compensation claims and absenteeism. For instance, safety needles are now treated as a core element of sharps-injury prevention plans in many hospitals. According to the US Centers for Disease Control and Prevention (CDC), about 385,000 sharps-related injuries occur annually in US hospitals, while study by perioperative experts suggests that 62–88% are preventable when safety-engineered devices and safe work practices are combined.

Global Demand Drivers and Immunization Dynamics

Technological progress has improved the practicality and acceptance of safety needles in daily clinical work. Manufacturers focus on designs that fit standard syringes, require minimal extra steps, and do not slow busy workflows. This approach increases user confidence and supports consistent activation of safety features. For example, many products now provide passive protection, retractable mechanisms, and integrated reuse-prevention functions. According to WHO, effective safety syringes must both prevent reuse and protect staff from sharps injuries to meet modern safety expectations.

Global trends in disease management and vaccination have added new momentum to the safety needles market. Health systems are providing more injections for chronic conditions such as diabetes, cancer, and autoimmune diseases, as well as wider preventive programs. This situation raises the absolute number of opportunities for sharps injuries and strengthens the case for safer devices. According to WHO’s 2024 immunization fact sheet, global DTP3 coverage reached 85% in 2024, while 14.3 million children remained zero-dose, reflecting large ongoing injection needs.

Regional recovery in vaccination coverage shows how quickly injection volumes can rise after disruption and stress supply chains. The WHO African Region experienced setbacks during COVID-19 but is now improving. Coverage there fell from 76% in 2019 to 72% in 2022, then recovered to 76% in 2024. A 2022 PATH auto-disable syringe analysis estimated that over 2 billion syringes were needed in the first quarter of 2022, with a 360 million gap and routine needs 5–25% higher than pre-COVID levels, underlining the scale of demand for safe devices.

Infection prevention and control (IPC) policies and donor-supported initiatives provide further structural support for the safety needles market. IPC strategies now link safe injection practices with reduced antimicrobial resistance, fewer hospital-acquired infections, and better occupational safety results. According to the 2024 RACGP sharps safety guidance and WHO-supported injection safety projects in countries such as India, primary care and public programs are encouraged to adopt auto-disable and safety-engineered devices. For instance, pooled procurement and long-term tenders increasingly favor safety needles, supporting sustained global demand.

Key Takeaways

- The global safety needles market was projected by an independent observer to reach nearly US$ 6.07 Billion by 2034, driven by sustained 7.7% annual growth.

- A third-party review indicated that active safety needles dominated the 2024 product landscape, accounting for over 74.2% of total market share worldwide.

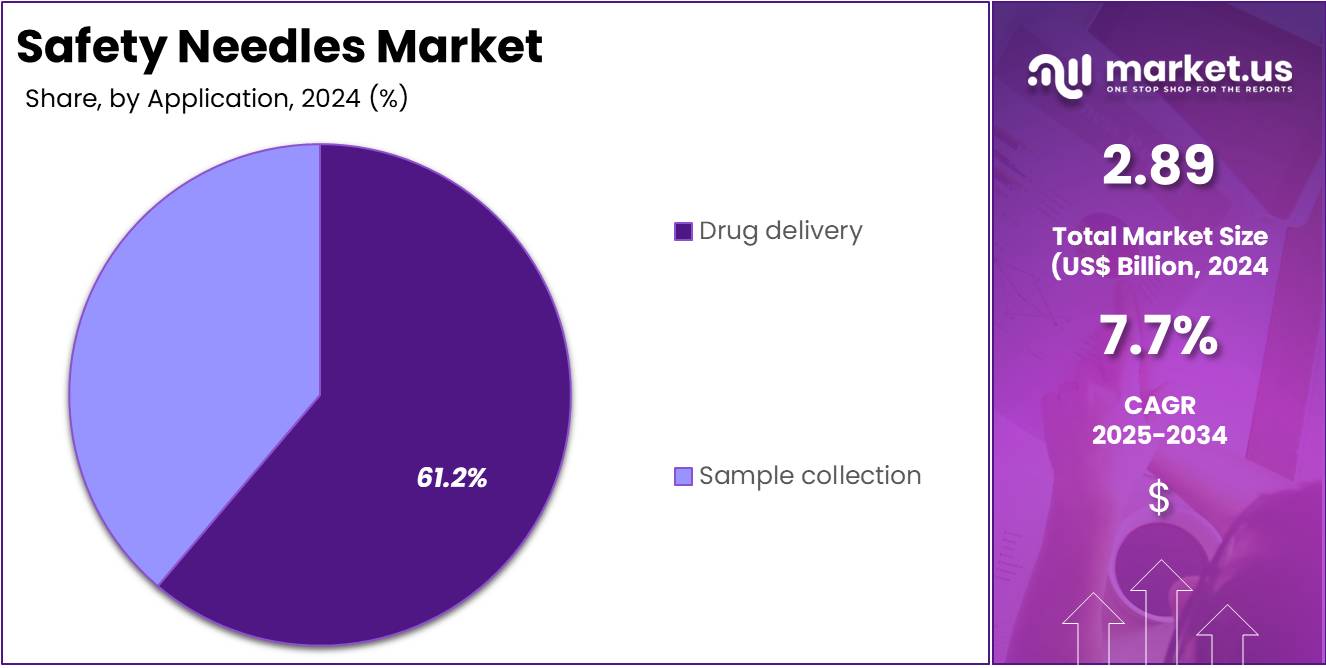

- External assessment showed that drug delivery applications led the 2024 segment distribution, capturing more than 61.2% of the overall demand for safety needles.

- Independent evaluation highlighted that hospitals and ambulatory surgery centres represented over 47.8% of end-user adoption in 2024, reflecting strong institutional preference.

- Market figures reviewed by an outside source confirmed North America’s leading position in 2024 with a 38.5% share, valued at approximately US$ 1.11 Billion.

Product Analysis

In 2024, the Active Safety Needles held a dominant market position in the Product Segment of the Safety Needles Market and captured more than a 74.2% share. This position was viewed as a result of strong acceptance in clinical settings. Their controlled activation process was considered a major advantage. Healthcare staff valued the reduced risk of injuries. The segment further benefited from strict safety rules. Growing awareness of workplace hazards strengthened adoption. Increased use in routine procedures also supported demand expansion.

Industry observers noted that active variants gained traction due to efficient shield-engagement functions. These functions improved safety and supported smoother workflows. Their design allowed clinicians to secure the needle immediately. This lowered error rates. The growing volume of vaccination activities also supported usage. High-volume care centers found these products practical. Their operational simplicity was reported as a key factor. Continuous improvements in product design contributed to their wider acceptance across different medical departments.

Passive safety needles were seen to hold the remaining share of the product segment. Their growth was linked to automatic activation, which reduced dependence on manual steps. This mechanism lowered the chance of user mistakes. Healthcare educators promoted these products during training programs. Their suitability for busy environments encouraged adoption. Passive devices were also recognized for improving compliance with safety protocols. As regulatory expectations increased, more facilities incorporated passive systems. Ongoing innovation continued to support future segment expansion.

Application Analysis

In 2024, the Drug Delivery held a dominant market position in the Application Segment of Safety Needles Market, and captured more than a 61.2% share. This position was supported by strong demand in hospitals and clinics. Increased use of injectable therapies also contributed to the growth. Rising vaccine administration strengthened the adoption of advanced safety needles. Higher focus on reducing needlestick injuries drove compliance. Continuous use of parenteral drugs ensured stable demand. These factors kept the segment in a leading position.

Drug delivery applications were viewed as the primary revenue source for the market. Their growth was driven by a rise in chronic disease treatments. Wider use of insulin pens and prefilled syringes supported segment expansion. Safety regulations influenced the adoption of engineered needle systems. Increased patient volumes in acute care settings further enhanced usage. Broader acceptance of biologic drugs also boosted demand. These conditions created a strong and sustained outlook for this segment in global healthcare environments.

Sample collection formed the second-largest application segment. Its growth was influenced by higher diagnostic testing rates. Increased awareness of bloodborne infection risks encouraged safer devices. Demand for safety-engineered venipuncture products rose in both public and private facilities. Expansion of point-of-care testing added consistent momentum. Although smaller in share, the segment showed steady progress. Improved safety guidelines supported adoption. Together, these elements ensured predictable growth and reinforced the importance of sample collection within the overall market framework.

End-User Analysis

In 2024, the Hospitals & Ambulatory Surgery Centres held a dominant market position in the End-User Segment of the Safety Needles Market, and captured more than a 47.8% share. Their leading role was linked to strict infection-control standards and a high number of procedures. Strong regulatory pressure supported the wider use of safety-engineered devices. Higher patient inflow also increased product demand. Diabetic patients formed another growing group, as frequent injections and home-based glucose care encouraged steady adoption.

Family practice and physician offices were reported to hold a moderate share. Their usage pattern was shaped by routine vaccinations and regular chronic care services. Growing awareness of safe-injection protocols also strengthened adoption. Smaller practices tended to choose cost-efficient options that met regulatory needs. The home-care segment showed a rising uptake as self-administration increased. Safety needles were viewed as essential tools because they reduced accidental injuries and supported confidence among users who managed long-term conditions at home.

The Others category included diagnostic labs, dental clinics, and research facilities. Their use was influenced by the need to protect workers who handled biological materials. Compliance programs encouraged greater integration of safety devices across these settings. Although the share remained smaller, gradual growth was observed. The overall end-user landscape reflected broader awareness of needle-stick risks. Increased regulatory enforcement and the expansion of outpatient and home-care services contributed to consistent demand for safer injection solutions.

Key Market Segments

By Product

- Active Safety Needles

- Passive Safety Needles

By Application

- Drug Delivery

- Sample Collection

By End-User

- Hospitals & Ambulatory Surgery Centres

- Diabetic Patients

- Family Practice / Physician Offices

- Home Care

- Others

Drivers

Rising Burden of Needlestick Injuries and Strengthening Regulatory Pressure

The rising number of needlestick and sharps injuries has been recognized as a major occupational hazard in healthcare settings. This trend has driven strong adoption of safety-engineered needles, as hospitals attempt to reduce accidental exposure risks. The driver is reinforced by mandatory safety protocols and regulatory expectations that promote safer alternatives. As healthcare systems modernize infection-control practices, the substitution of traditional sharps with advanced safety needles has become a priority. This shift indicates a consistent move toward protective technologies across clinical environments.

Demand growth is also supported by the persistent burden of accidental injuries among healthcare workers. The high frequency of exposure events has created operational and legal pressure on institutions to adopt preventive devices. Increasing emphasis on staff protection, along with structured safety compliance programs, has strengthened the market position of safety needles. This environment has created a sustained need for devices that lower occupational risks. The driver is therefore anchored in both clinical necessity and regulatory alignment.

A study by the International Safety Center using 2022 EPINet data, published in the AORN Journal, highlighted that 40.6% of injuries occurred in perioperative settings. For instance, complex procedures performed in operating rooms increase the likelihood of accidental sharps exposure. This pattern points to areas where safety needles and other engineered devices are critically needed. The concentration of injuries in high-risk departments supports market demand, as healthcare providers prioritize technologies that reduce preventable incidents and enhance workplace safety.

Restraints

High Upfront Costs as a Key Restraint in the Safety Needles Market

The market has been restrained by the higher acquisition cost of safety needles when compared with conventional needles. The elevated device price creates financial pressure for healthcare facilities, particularly in low-resource settings. Budget limitations result in the continued use of standard needles even when safer options are available. As a result, full adoption is slowed, and conversion programmes proceed gradually. The market expansion has therefore been limited in the short to medium term despite the recognised long-term value of injury-prevention technologies.

Training and implementation requirements add another financial layer. The need for staff education, procurement adjustments and improved waste-management systems increases programme costs. These added expenditures discourage rapid transition to safety-engineered devices in low- and middle-income countries. The restraint is reinforced when budgets are already stretched and when health systems prioritise immediate affordability over longer-term savings. This situation causes delays in scaling up safety needle initiatives across broader clinical settings.

According to a multi-hospital qualitative study titled Barriers to the Adoption of Safety-Engineered Needles Following a Regulatory Standard, cost was identified as a key barrier to adoption. Stakeholders highlighted that the higher unit price of safety devices affected purchasing decisions even in the presence of regulatory mandates. For example, systematic and economic evaluations have consistently shown that safety-engineered devices require investment not only for procurement but also for training, surveillance and waste-management upgrades, which increases overall programme spending in the early years.

Evidence from India further illustrates this restraint. A study by the national health-technology assessment programme reported that reuse-prevention and sharps-injury-prevention syringes reduced needlestick injury rates by roughly 25–50%. For instance, the disposable syringe NSI rate of 0.00353 per injection fell to about 0.0017–0.0026 with safety syringes. However, the assessment also noted that higher procurement costs and expenditure on training and waste systems raise short-term financial requirements. Although long-term savings arise from avoiding infections, these upfront costs restrict faster market penetration.

Opportunities

Rising Immunization and Diabetes Injection Volumes Driving Safety Needle Demand

The expansion of global immunization activities and chronic disease treatment is creating a clear opportunity for safety needles. Rising vaccination needs and higher injection frequencies in diabetes care are driving sustained demand for safer delivery systems. The market is witnessing consistent growth because safety-engineered needles reduce accidental needlestick injuries. Their use is also being encouraged in both clinical and home-care settings. As injection volumes increase across countries, the adoption of passive-activation and automated-retraction needles is expected to rise at a steady pace.

Immunization efforts are expanding, and this trend is strengthening the long-term outlook for safety devices. According to global health estimates, routine vaccine programmes have been recovering after previous declines. For example, DTP3 coverage reached 84% in 2022, yet millions of children still lacked full protection. These gaps create large catch-up cohorts. Study by UNICEF indicated that 14.3 million infants missed their first DPT dose in 2022, while another 6.2 million were only partially vaccinated. This gap reflects strong future demand for safe injection tools.

The growing number of injections linked to new vaccine introductions is boosting the relevance of safety needles. For instance, additions such as HPV, malaria, and RSV vaccines are increasing the total volume delivered through national programmes. Mass campaigns rely on auto-disable or passive safety syringes to reduce contamination and handling risks. The scale of these injections results in billions of annual doses. Each improvement in vaccine access is therefore expected to support larger procurement of safety-engineered products across high-burden regions.

Diabetes and other chronic conditions are further intensifying this opportunity. According to the IDF Diabetes Atlas, about 540 million people were living with diabetes in 2022. Updated figures show that approximately 589 million adults were affected globally in 2024, and projections indicate 853 million by 2050. For example, many patients require one to four injections per day. Study by IDF shows that this leads to tens of billions of annual injections. This volume strengthens long-term prospects for insulin safety pen needles and safety syringes in clinical and home environments.

Trends

Increasing Adoption of Passive and Integrated Safety Mechanisms in Safety Needles

A clear shift toward automated and passive safety mechanisms has been shaping the safety-needles market. The adoption of devices that secure the needle immediately after use has been rising, as these designs reduce manual steps and enhance compliance. The transition has been driven by the need to lower injury risk and streamline clinical workflows. As a result, the market is moving from basic protective add-ons toward integrated engineering controls that activate automatically and offer consistent protection in varied care settings.

The movement toward comprehensive sharps-safety programmes has further strengthened this trend. Hospitals and clinics have been aligning purchasing decisions with structured safety policies that prioritise passive, ergonomic and user-friendly devices. According to recent observations, healthcare facilities increasingly prefer solutions that minimise technique variability and provide uniform safety performance across procedures. This preference supports steady investment in advanced needle designs and accelerates replacement cycles as organisations upgrade legacy systems.

Evidence supporting the effectiveness of these devices has reinforced the market transition. According to a 2018 study in the Journal of Hospital Infection, safety-engineered needles significantly lower the risk of needlestick injuries. A study by Polish researchers in 2024 also confirmed that the implementation of safety-engineered devices was a major factor in reducing injury incidence. For instance, these findings have encouraged clinical leaders to prioritise devices that demonstrate measurable reductions in occupational exposure.

Guideline updates from 2022 to 2024 have added further momentum. For example, the AST guideline in 2023 highlighted that many perioperative injuries could be prevented through the use of safer engineered devices. In June 2024, RACGP guidance emphasised retractable and shielded needles as preferred controls. CDC resources in 2024 also promoted institution-wide sharps-safety programmes. For example, ongoing studies from 2024–2025 examining passive mechanisms and retractable designs show strong user acceptance, supporting continued innovation and premiumisation within the safety-needles market.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 38.5% share and holding a market value of US$ 1.11 billion for the year. The region’s leadership has been supported by strict occupational safety regulations and sustained demand across hospitals, clinics, and home-care settings. According to the U.S. Needlestick Safety and Prevention Act (NSPA), employers must adopt engineered sharps injury prevention devices, which has accelerated the replacement of conventional needles.

Regulatory alignment in Canada has further strengthened this position. Study by provincial authorities, such as Ontario’s Needle Safety Regulation (O. Reg. 474/07), requires the use of safety-engineered hollow-bore needles. Guidance from national bodies, including CCOHS and PHAC, supports wide adoption across hospitals and community health centers. For instance, mandatory compliance in high-risk clinical settings has increased product penetration and reinforced North America’s lead over other global regions.

High healthcare spending has also contributed to elevated consumption levels. The United States spends over USD 12,000 per capita, making it the highest globally, while Canada remains among the top-spending nations. These expenditures support large hospital networks and significant procedure volumes. For example, millions of injections and blood draws are performed daily. When combined with safety requirements, this high procedural load naturally drives strong uptake of safety-engineered needles compared with lower-spending markets.

The burden of chronic disease adds further momentum. According to the International Diabetes Federation, 15.1% of adults in the North America and Caribbean region live with diabetes, representing 56 million affected individuals. This region also accounts for 43% of global diabetes-related expenditure. For instance, insulin-dependent patients rely on frequent injections, increasing the use of safety-engineered syringes and pen needles. This trend has supported stable long-term demand.

A well-established safety culture and innovation ecosystem continue to reinforce growth. Study by the CDC highlights extensive training tools, reporting systems, and evaluation programs that strengthen injury-prevention practices. For example, hospitals frequently link safety performance with procurement decisions, enabling rapid adoption of improved needle designs. Strong regulatory pathways through the FDA and Health Canada also encourage innovation. As a result, North America is expected to maintain its leading position as safety compliance and chronic disease prevalence remain high.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The safety needles market is shaped by continuous adoption of advanced needlestick-prevention technologies. Growth has been driven by strict safety regulations, rising hospital workloads, and increasing emphasis on occupational risk reduction. Major manufacturers such as Becton Dickinson and Company (BD), Terumo Corporation, and Nipro Corporation have strengthened their portfolios with one-handed activation and passive-shielding features. Their strong clinical presence and global distribution networks have supported faster penetration of safety-engineered needles across hospitals, clinics, and blood collection centers.

Product innovation has become a central differentiator across the competitive landscape. Leading companies such as BD, Terumo, and B. Braun SE have expanded offerings in hypodermic, infusion, and blood collection segments. Their devices are designed to improve user protection, reduce accidental injuries, and comply with regulatory standards. Advanced activation mechanisms, ergonomic designs, and compatibility with existing workflows have increased acceptance. These developments have reinforced confidence among healthcare providers and boosted demand for safer injection and infusion solutions.

Market competition has intensified as firms broaden their geographic footprint and diversify safety features. Companies including Nipro Corporation, Cardinal Health, and B. Braun SE have focused on integrating safety needles into wider infusion systems. Their strategies rely on expanding product ecosystems, strengthening hospital contracts, and improving cost efficiency. This approach has enabled them to compete effectively in tenders and large-scale procurement programs. As adoption rises, these suppliers continue to influence pricing, standardization, and long-term supply agreements across key regions.

A diverse group of additional participants contributes to overall industry growth. Organizations such as AdvaCare Pharma, HMD Healthcare, Unimed S.A., ICU Medical Inc., and Shandong WEGO Group support regional supply and meet cost-sensitive demand. Upstream manufacturers including Gerresheimer AG, SCHOTT Pharma, and West Pharmaceutical Services Inc. provide essential components for prefilled systems, enabling safer drug delivery formats. Their combined efforts strengthen global availability, support local sourcing strategies, and ensure that safety needles continue to gain market traction worldwide.

Market Key Players

- Becton Dickinson and Company (BD)

- Terumo Corporation

- Nipro Corporation

- B. Braun SE

- Cardinal Health

- AdvaCare Pharma

- HMD Healthcare

- Unimed S.A.

- ICU Medical Inc.

- Shandong WEGO Group Medical Polymer Co. Ltd.

- Gerresheimer AG

- SCHOTT Pharma AG & Co. KGaA

- West Pharmaceutical Services Inc.

- Smiths Medical

Recent Developments

- In October 2024: BD announced the launch of its enhanced BD® Intraosseous Vascular Access System, designed for rapid vascular access in critical care and emergency settings. The new system incorporates integrated passive needle tip safety on its IO needles, which is intended to protect clinicians and patients from needlestick injuries during and after insertion. This system is positioned as the only IO device on the market with integrated passive needle-tip safety, and the safety-engineered needle design directly reinforces BD’s presence in the safety needles and sharps-injury prevention segment.

- In November 2023: Terumo India introduced a new insulin syringe (with needle) offering features including a 3-bevel super-sharp needle, high-grade silicone surface, and plunger retention technology to avoid spillage/wastage. This represents an expansion of the Life Care Solutions division’s delivery-device portfolio.

- In June 2023: the U.S. FDA granted 510(k) clearance (K223376) to Cardinal Health 200, LLC for new variants of the Monoject™ Magellan™ Insulin Safety Syringe with a permanently attached 31G x 6 mm needle in 0.3 mL, 0.5 mL and 1.0 mL sizes. These syringes incorporate a safety shield designed to extend, fully cover and permanently lock over the needle to prevent accidental needlestick injuries, reinforcing Cardinal Health’s safety-engineered needle and syringe portfolio.

- In June 2022: Nipro Pharmapackaging (part of Nipro Corporation) announced and hosted a webinar titled “Introduction of New Syringes with Safety System UniSafe™” on 28 June 2022. The session introduced prefilled syringes incorporating an integrated safety system designed to improve usability and reduce needlestick injury risk, positioning UniSafe™ within Nipro’s broader portfolio of safety-engineered injection devices (relevant to the safety needles segment).

Report Scope

Report Features Description Market Value (2024) US$ 2.89 Billion Forecast Revenue (2034) US$ 6.07 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Active Safety Needles, Passive Safety Needles), By Application (Drug Delivery, Sample Collection), By End-User (Hospitals & Ambulatory Surgery Centres, Diabetic Patients, Family Practice / Physician Offices , Home Care, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Becton Dickinson and Company (BD), Terumo Corporation, Nipro Corporation, B. Braun SE, Cardinal Health, AdvaCare Pharma, HMD Healthcare, Unimed S.A., ICU Medical Inc., Shandong WEGO Group Medical Polymer Co. Ltd., Gerresheimer AG, SCHOTT Pharma AG & Co. KGaA, West Pharmaceutical Services Inc., Smiths Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Becton Dickinson and Company (BD)

- Terumo Corporation

- Nipro Corporation

- B. Braun SE

- Cardinal Health

- AdvaCare Pharma

- HMD Healthcare

- Unimed S.A.

- ICU Medical Inc.

- Shandong WEGO Group Medical Polymer Co. Ltd.

- Gerresheimer AG

- SCHOTT Pharma AG & Co. KGaA

- West Pharmaceutical Services Inc.

- Smiths Medical