Global Roofing Chemicals Market Size, Share Analysis Report By Material Type (Epoxy Resin, Styrene, Others, Acrylic, Asphalt, Elastomer), By Roofing Type (Membrane Roofing, Elastomeric Roofing, Bituminous Roofing, Metal Roofing, Plastic (PVC) Roofing, Others), By Construction Type (New Construction, Re-Roofing), By End-Use (Residential, Non-Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159869

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

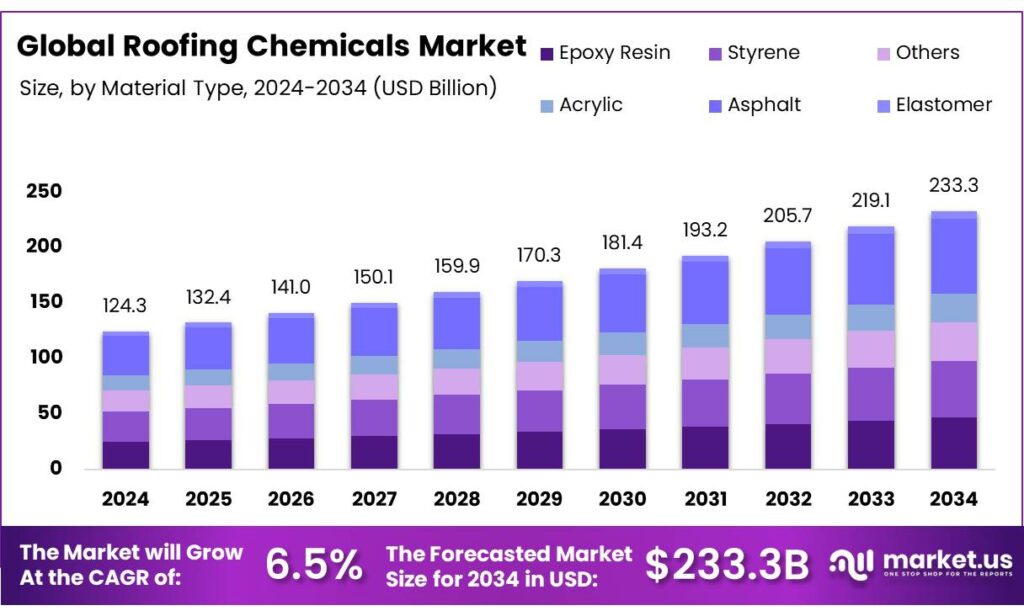

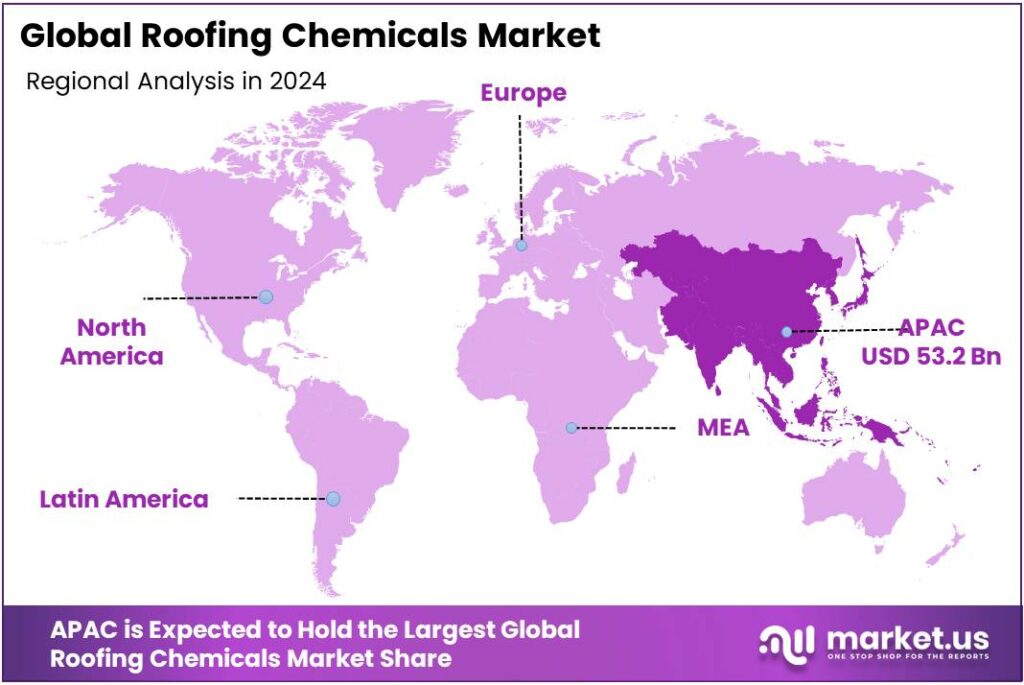

The Global Roofing Chemicals Market size is expected to be worth around USD 233.3 Billion by 2034, from USD 124.3 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 42.8% share, holding USD 53.2 Billion in revenue.

The roofing chemicals industry comprises chemical formulations used in roofing systems to provide waterproofing, sealing, adhesion, UV protection, reflectivity, corrosion resistance, and durability enhancements. These chemistrtries include bituminous compounds, elastomeric coatings, acrylics, polyurethanes, silicones, adhesives and primers specifically tailored for roofing substrates. As climate stresses intensify and building codes push for energy efficiency and durability, roofing chemicals have become a critical sub‑segment of the broader construction / specialty chemicals domain.

This growth is driven by several factors, including rapid urbanization, increased infrastructure development, and government initiatives aimed at enhancing housing and urban infrastructure. For instance, the Indian government’s Pradhan Mantri Awas Yojana (PMAY) program sanctioned the construction of 1 crore houses for urban poor and middle-class families in August 2023, significantly boosting the demand for roofing materials.

- For instance, Deloitte notes the broader chemical sector is reorienting toward resilience, innovation, and decarbonization in 2025. Further, the U.S. Environmental Protection Agency’s Effluent Guidelines for Paving & Roofing Materials impose wastewater discharge limits on roofing and asphalt chemical plants, which constrains process choices and investment burdens. Similarly, EPA’s Chemical Data Reporting (CDR) regime mandates reporting of chemical use and volume when thresholds exceed 25,000 lbs per year at a site, enhancing scrutiny of chemical manufacturing sectors including roofing-related additives.

At the corporate level, major chemical firms with exposure to coatings and dispersion chemistries play a critical role. For instance, BASF’s Coatings division achieved global sales of about USD 4.99 billion in 2024. Within BASF’s “Surface Technologies / Coatings / Dispersions & Resins” segment, “industrial solutions” including dispersions & resins contributed ~EUR 1,240 million in H1 2025 to sales to third parties. Such numbers illustrate how specialty chemical divisions support roofing or coating end‑markets.

Key Takeaways

- Roofing Chemicals Market size is expected to be worth around USD 233.3 Billion by 2034, from USD 124.3 Billion in 2024, growing at a CAGR of 6.5%.

- Asphalt held a dominant market position, capturing more than a 28.9% share in the roofing chemicals market.

- Membrane Roofing held a dominant market position, capturing more than a 29.1% share in the roofing chemicals market.

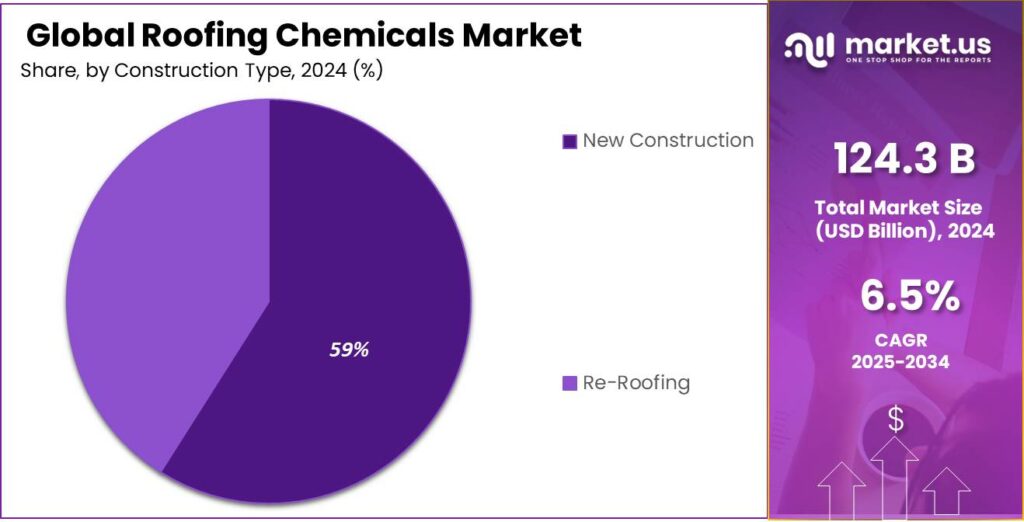

- New Construction held a dominant market position, capturing more than a 59.6% share in the roofing chemicals market.

- Non-Residential held a dominant market position, capturing more than a 52.8% share in the roofing chemicals market.

- Asia Pacific region held a dominant position in the global roofing chemicals market, capturing more than a 42.8% share, translating to an estimated market value of USD 53.2 billion.

By Material Type Analysis

Asphalt leads the Roofing Chemicals market with 28.9% share in 2024

In 2024, Asphalt held a dominant market position, capturing more than a 28.9% share in the roofing chemicals market. The material’s widespread use can be attributed to its proven durability, cost-efficiency, and strong waterproofing properties, which make it a preferred choice across residential, commercial, and industrial roofing applications. The segment witnessed steady adoption in 2024, supported by urban infrastructure expansion and government-backed housing initiatives that emphasized long-lasting and low-maintenance roofing solutions. Asphalt-based roofing chemicals also benefited from technological improvements, including enhanced formulations that offer better resistance to extreme weather conditions and thermal fluctuations.

The demand for Asphalt roofing chemicals is expected to maintain its leading position, driven by continued construction activity and a growing focus on sustainable and energy-efficient roofing solutions. The segment’s resilience is further reinforced by its compatibility with various roofing substrates, ensuring broad applicability across new and renovation projects.

By Roofing Type Analysis

Membrane Roofing leads with 29.1% share in 2024 due to its flexibility and durability

In 2024, Membrane Roofing held a dominant market position, capturing more than a 29.1% share in the roofing chemicals market. The growth of this segment can be attributed to its superior flexibility, water resistance, and ease of installation, making it highly suitable for both commercial and residential flat roofing applications. Membrane roofing chemicals gained traction in 2024 as urban construction projects and infrastructure developments increasingly favored solutions that provide long-term protection against leaks and weather-related damage.

The segment is expected to retain its leading position, driven by the demand for low-maintenance roofing systems and the rising adoption of energy-efficient roofing membranes that help in thermal insulation. Additionally, membrane roofing’s compatibility with diverse building designs and its ability to enhance roof longevity continue to support its prominence in the market.

By Construction Type Analysis

New Construction dominates with 59.6% share in 2024 due to rising infrastructure and housing projects

In 2024, New Construction held a dominant market position, capturing more than a 59.6% share in the roofing chemicals market. This significant share is driven by rapid urbanization, government-backed housing programs, and large-scale infrastructure projects, which have collectively increased the demand for roofing materials and associated chemicals. Roofing chemicals used in new construction are preferred for their ability to provide long-term durability, waterproofing, and resistance to environmental stresses, making them ideal for both residential and commercial projects.

The segment is expected to sustain its leadership, supported by continued investments in urban development and industrial facilities. The focus on energy-efficient and sustainable building practices is also boosting the adoption of advanced roofing chemical solutions in new construction projects, ensuring enhanced roof performance and reduced maintenance costs over time.

By End-Use Analysis

Non-Residential leads with 52.8% share in 2024 driven by commercial and industrial demand

In 2024, Non-Residential held a dominant market position, capturing more than a 52.8% share in the roofing chemicals market. The strong demand from commercial buildings, industrial facilities, and institutional infrastructure contributed to this segment’s leading position. Roofing chemicals in non-residential applications are favored for their durability, waterproofing efficiency, and ability to withstand heavy usage and environmental stress, which is critical for protecting large-scale structures.

The segment is expected to maintain its dominance, fueled by ongoing investments in commercial real estate, industrial parks, and urban development projects. The growing emphasis on energy-efficient and weather-resistant roofing solutions for offices, factories, and warehouses further supports the adoption of advanced roofing chemicals in non-residential construction, ensuring long-term performance and reduced maintenance costs.

Key Market Segments

By Material Type

- Epoxy Resin

- Styrene

- Others

- Acrylic

- Asphalt

- Elastomer

By Roofing Type

- Membrane Roofing

- Elastomeric Roofing

- Bituminous Roofing

- Metal Roofing

- Plastic (PVC) Roofing

- Others

By Construction Type

- New Construction

- Re-Roofing

By End-Use

- Residential

- Non-Residential

Emerging Trends

Rise of “Cool Roof” and Reflective Coatings in Roofing Chemicals

In many regions, buildings are under pressure to be more energy‑efficient. A conventional dark roof can reach temperatures of 150 °F (about 65.6 °C) on a sunny afternoon, but a well‑designed reflective or “cool” roof might remain over 50 °F (around 28 °C) cooler under the same conditions. That temperature drop inside the roof surface directly translates to lower cooling loads for air‑conditioners, especially in hot climates.

- In the U.S., demand for liquid-applied roof coatings (many of which are reflective) is forecast to grow at about 1.1% annually until 2028, reaching 11.91 million square (roof area units). That steady growth underlines how the market is gradually shifting toward coatings (rather than full re-roofing) as a lighter, efficient upgrade.

The U.S. Environmental Protection Agency (EPA) actively promotes the adoption of cool roof technologies as part of its wider efforts to enhance energy efficiency and combat climate change. In line with this, several local governments have introduced specific guidelines that either mandate or incentivize the use of roofing systems with high solar reflectance and thermal emittance values. These measures are designed to ensure that rooftops contribute to lowering heat absorption and energy demand.

Cities like New York have gone a step further by quantifying the environmental impact of such interventions—according to city data, applying cool roof coatings on just 2,500 square feet of roof space can help prevent the emission of approximately one ton of carbon dioxide, highlighting the significant role these coatings play in urban sustainability efforts.

Drivers

Energy Efficiency and Cooling Demand Reduction

One of the strongest and most tangible drivers for the growth of roofing chemicals—especially reflective and cool‑roof coatings—is their ability to reduce energy use by decreasing cooling demand in buildings. In simple terms: when a roof reflects more sunlight and emits heat better, less solar energy penetrates into the building, so the air conditioning system doesn’t have to work as hard. Over time, that energy saving becomes a compelling economic argument for using better roofing chemicals.

Another data point comes from field testing: in a study of 11 homes in Florida, switching to reflective roof materials produced daily air‑conditioning electricity reductions ranging between 2 % and 43 %, and peak demand reductions of 11 % to 30 %. These ranges depend on factors like roof size, insulation, climate, and the reflectance/emittance of the materials. Because cooling typically constitutes a large share of electrical demand in warm regions, shaving off even a modest fraction can lead to significant cost savings over time.

- In monetary terms, the DOE guide for cool roofs suggests that for commercial buildings, installing a white reflective roof can yield annual energy savings worth up to USD 0.20 per square foot, while for residential cool colors the savings might be up to USD 0.05 per square foot per year. When you scale that over large industrial or institutional roof areas, the returns become quite attractive, justifying investment in higher‑performance coating chemistries.

On the policy side, governments and standards bodies are also leveraging this driver via regulation and incentive programs. For example, U.S. building codes and energy standards include “cool roof” credits or requirements, which make installing reflective roofs more favorable in compliance terms. In terms of incentives, utility rebate programs and tax credits tied to energy‑efficient roofing can tip the cost-benefit balance further.

Restraints

Stringent Environmental and Health Regulations on Chemical Emissions

One of the most formidable restraints for the roofing chemicals industry comes from the growing pressure of environmental and health regulations—especially those targeting volatile organic compounds (VOCs), hazardous additives, emissions, and waste discharge. These rules force manufacturers to redesign formulations, invest in cleaner processes, and often absorb higher costs, which can slow growth or limit margins.

Beyond roofing, regulation of chemicals in general is becoming stricter under public health pressure. For instance, in the food industry and food contact materials, regulatory agencies closely monitor additives or contaminants. For example, sodium benzoate, a common preservative, is allowed only when concentration is ≤ 0.1 % by food weight per FDA rules. While this example is from food systems, it demonstrates the growing regulatory insistence on safe chemical limits. The more regulators emphasize controlling chemical exposure even in sensitive domains like food, the likelier stricter standards spill over into industrial coatings and roofing sectors.

- Governments also increasingly promote “green chemistry” or low-emission alternatives by mandating or incentivizing safer materials. For example, California’s Green Chemistry Initiative (AB 1879 / SB 509) aims to reduce exposure to toxins by regulating chemical use and requiring reporting and safer alternatives. In many jurisdictions, incentives or procurement rules favor low-VOC or waterborne systems, putting pressure on conventional solvent-rich roofing chemicals.

All of these regulatory burdens—emission caps, worker safety limits, chemical registration demands, and push for cleaner alternatives—translate into higher compliance cost, slower product development, and constrained flexibility in formulation. Some small or regional roof-chemical firms may find it hard to absorb these burdens, leading to consolidation or exit. Moreover, the requirement to prove safety or environmental acceptability delays time to market for new chemistries or additives.

Opportunity

Biobased And Eco‑Friendly Roofing Coatings

One of the most promising growth opportunities in roofing chemicals lies in the development and adoption of biobased, low‑VOC, and environmentally safer coatings. As people become more conscious of health, sustainability, and regulatory risk, the demand is shifting away from conventional solvent‑heavy formulas toward greener alternatives that perform well but are kinder to people and planet.

- For instance, scientists have created self‑assembled crystalline coatings from saturated fatty acids (which are also found in everyday foods) that offer superhydrophobic and antimicrobial properties while being non‑toxic. These coatings achieved water contact angles of about 165° and hysteresis lower than 6°, demonstrating robust performance.

Governments are also pushing for sustainable chemistry in a big way. In the U.S., the Sustainable Chemistry R&D Act of 2021 established a framework for interagency coordination, research funding, and commercialization incentives to accelerate safer chemical technologies. This emphasis means roofing chemical manufacturers who move early into biobased and low‑impact formulations could benefit from public grants, technical collaboration, or regulatory favor. The federal sustainable chemistry strategic plan further highlights transitioning toward renewable feedstocks, circularity, and lower emissions as national goals.

From the regulatory side, many jurisdictions now prefer or even mandate low‑VOC or “greener” building materials. The U.S. EPA’s Safer Choice program (which certifies products where all intentionally added ingredients pass safety screens) helps buyers identify safer chemical products. In 2024, Safer Choice–certified products accounted for 2.4 billion pounds of production, up 150% from 2021. Imagine extending that to roofing coatings: a manufacturer offering a “Safer Choice” roof coating might gain both a technical edge and market credibility.

Regional Insights

Asia Pacific dominates roofing chemicals market with 42.8% share in 2024, valued at USD 53.2 billion

In 2024, the Asia Pacific region held a dominant position in the global roofing chemicals market, capturing more than a 42.8% share, translating to an estimated market value of USD 53.2 billion. This dominance is attributed to rapid urbanization, robust infrastructure development, and government initiatives aimed at enhancing housing and urban infrastructure. Countries such as China and India are significant contributors to this growth, driven by large-scale construction projects and urban expansion.

- For instance, China’s construction chemicals sector benefits from substantial government investments in infrastructure development and urban renewal projects, commanding approximately 66% of the regional market in 2024.

The region’s growth is further supported by an increasing focus on sustainable and energy-efficient building practices, leading to a higher demand for advanced roofing chemical solutions. The adoption of reflective coatings, cool roofing technologies, and eco-friendly materials is gaining traction as part of the broader trend towards green construction. Additionally, favorable government policies and incentives are encouraging the use of innovative roofing materials that contribute to energy savings and environmental sustainability.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sika AG is a global leader in the roofing chemicals market, providing high-performance solutions for waterproofing, sealing, and roofing applications. In 2024, the company recorded a 7% growth in its roofing chemicals division, generating approximately $1.1 billion in revenue. Sika’s success is driven by its focus on innovative, sustainable solutions and strong presence in Europe, North America, and Asia-Pacific.

BASF SE is a key player in the roofing chemicals market, offering advanced solutions including sealants, coatings, and adhesives. In 2024, BASF reported a 6% increase in revenue from roofing chemicals, reaching around $950 million. The company’s growth is supported by a strong focus on sustainability, innovative formulations, and regulatory compliance.

The Dow Chemical Company is an important contributor to the roofing chemicals sector, providing adhesives, coatings, and waterproofing solutions. In 2024, Dow’s roofing chemicals segment achieved a 5% growth, generating nearly $850 million in revenue. The company emphasizes research-driven innovations, sustainability, and efficiency in its product offerings. Dow’s strong distribution network across North America, Europe, and Asia-Pacific allows it to cater to commercial and residential construction markets, while its commitment to green building initiatives strengthens its position as a leading supplier in the global roofing chemicals industry.

Top Key Players Outlook

- Sika AG

- BASF SE

- The Dow Chemical Company

- GAF Materials Corporation

- Pidilite Industries

- Akzo Nobel N.V.

- Owens Corning

- Johns Manville

- KARNAK Corporation

- Asian Paints Ltd.

Recent Industry Developments

In 2024, BASF’s group sales reached € 65,260 million, down from € 68,902 million in 2023, while its EBITDA before special items stood at about € 7.9 billion for the year.

In 2024 Sika achieved record net sales of CHF 11.76 billion, marking a 4.7% increase from CHF 11.24 billion in 2023.

Report Scope

Report Features Description Market Value (2024) USD 124.3 Bn Forecast Revenue (2034) USD 233.3 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Epoxy Resin, Styrene, Others, Acrylic, Asphalt, Elastomer), By Roofing Type (Membrane Roofing, Elastomeric Roofing, Bituminous Roofing, Metal Roofing, Plastic (PVC) Roofing, Others), By Construction Type (New Construction, Re-Roofing), By End-Use (Residential, Non-Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sika AG, BASF SE, The Dow Chemical Company, GAF Materials Corporation, Pidilite Industries, Akzo Nobel N.V., Owens Corning, Johns Manville, KARNAK Corporation, Asian Paints Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sika AG

- BASF SE

- The Dow Chemical Company

- GAF Materials Corporation

- Pidilite Industries

- Akzo Nobel N.V.

- Owens Corning

- Johns Manville

- KARNAK Corporation

- Asian Paints Ltd.