Global Rodenticides Market Size, Share Analysis Report By Type (Non-Anticoagulant Rodenticides, Bromethalin, Cholecalciferol, Zinc Phosphide, Strychnine, Anticoagulant Rodenticides), By Form (Pellets, Powders, Sprays, Others), By Application (Agricultural Fields, Warehouse, Pest Control Companies, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155442

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

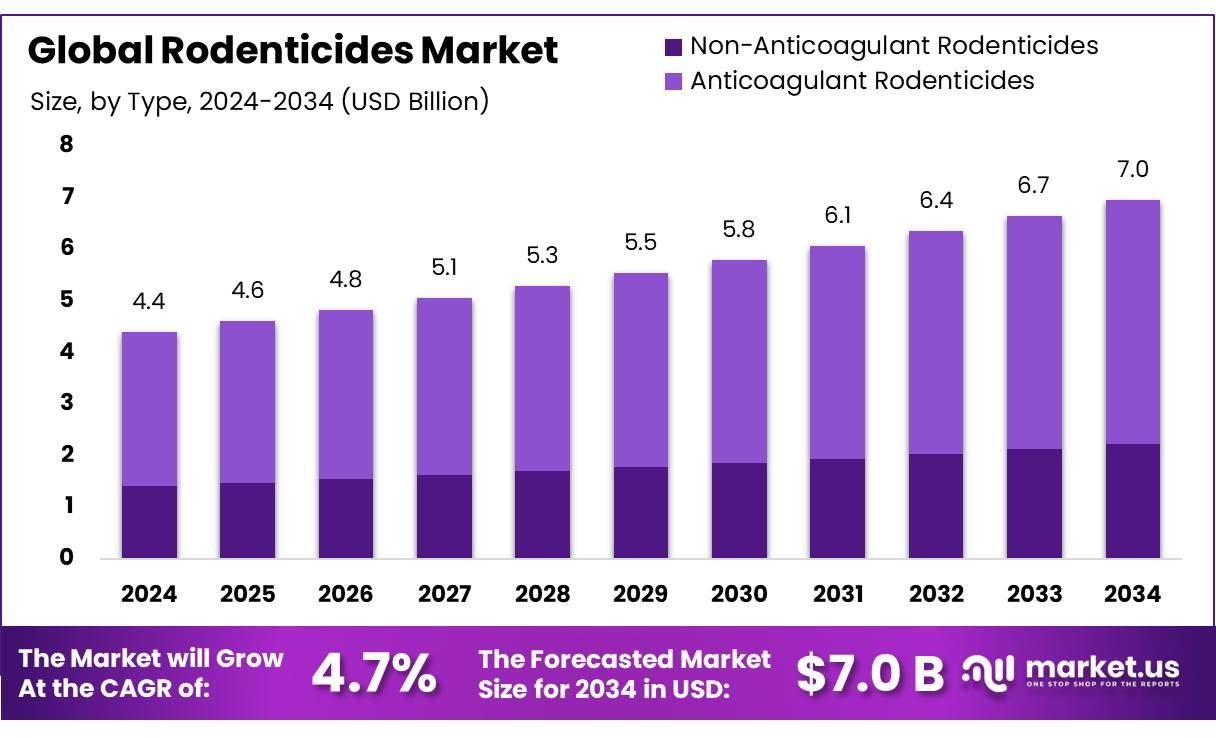

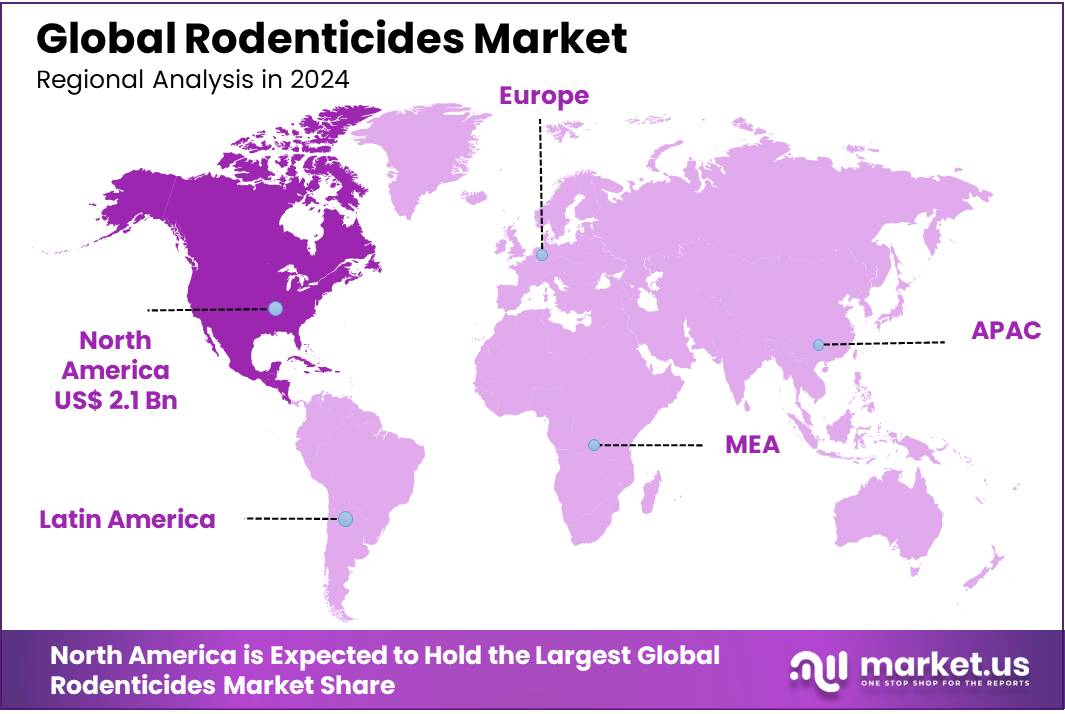

The Global Rodenticides Market size is expected to be worth around USD 7.0 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.80% share, holding USD 2.1 Billion revenue.

The rodenticides industry is a critical segment within the global pest control market, encompassing chemical, mechanical, and biological solutions aimed at managing rodent populations that pose significant threats to agriculture, public health, and infrastructure. Rodenticides are primarily categorized into anticoagulants, which disrupt blood clotting, and non-anticoagulants, which act rapidly to eliminate rodents.

Demand is being sustained by urban sanitation and public-health pressures. The CDC cites ~1 million human leptospirosis cases and ~60,000 deaths annually worldwide, a reminder that rodent-borne disease remains non-trivial; New York City recorded a local high of 24 cases in 2023 with additional cases early in 2024, prompting targeted municipal control.

These figures keep institutional buyers active purchasers of professional concentrates. At the same time, safety signals from wildlife monitoring—e.g., anticoagulants detected in 86% of sampled turkey vultures in Oregon—are accelerating a shift toward integrated pest management (IPM), secured bait stations, and, where feasible, non-anticoagulant modes of action.

The U.S. Environmental Protection Agency (EPA) plays a crucial role in regulating rodenticides to mitigate risks to children, pets, and wildlife. In November 2024, the EPA released a final biological evaluation for 11 rodenticide active ingredients, outlining mitigation measures to reduce risks associated with these products. These regulatory efforts are expected to influence market dynamics, encouraging the development of safer and more effective rodenticide formulations.

Government initiatives play a crucial role in shaping the rodenticides industry. For instance, the U.S. Environmental Protection Agency (EPA) enforces the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), which mandates the registration and regulation of rodenticides to ensure public health and environmental safety. Such regulatory frameworks ensure that only approved and safe rodenticides are available in the market.

Key Takeaways

- Rodenticides Market size is expected to be worth around USD 7.0 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 4.7%.

- Anticoagulant Rodenticides held a dominant market position, capturing more than a 67.9% share of the rodenticides market.

- Pellets held a dominant market position, capturing more than a 48.1% share of the global rodenticides market.

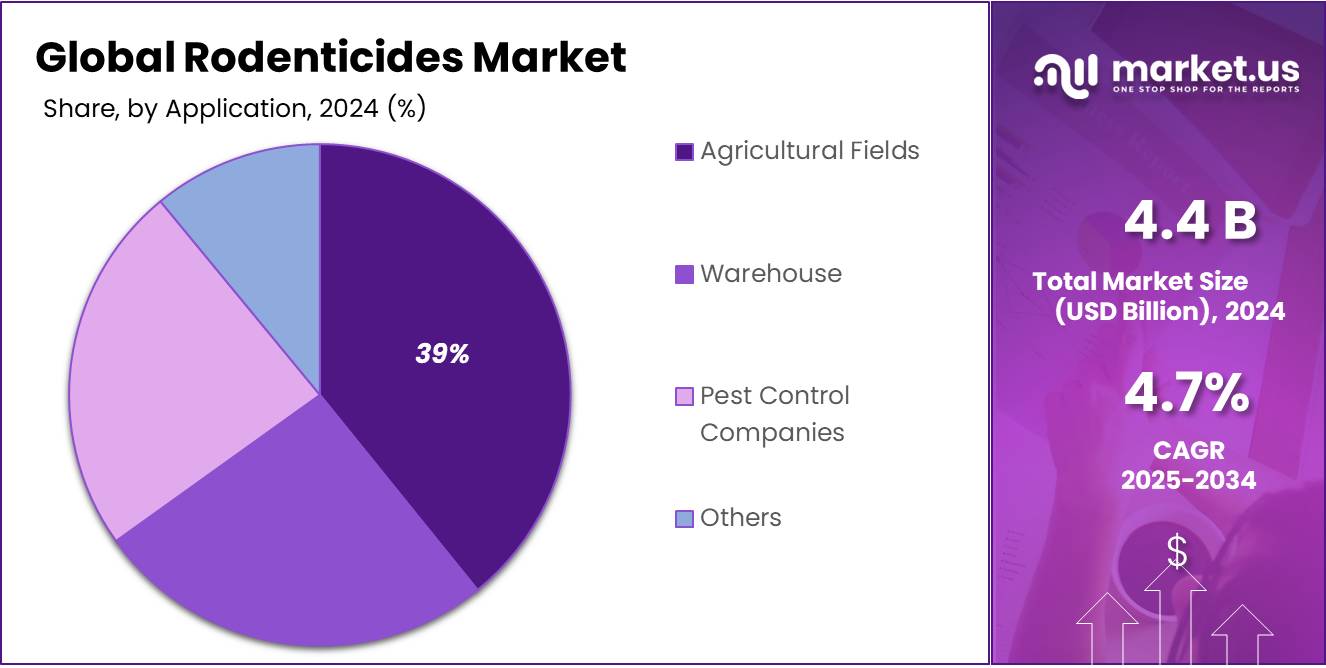

- Agricultural Fields held a dominant market position, capturing more than a 39.3% share of the global rodenticides market.

- North America emerged as the leading region in the global rodenticides market, holding a substantial 47.80% share, valued at around USD 2.1 billion.

By Type Analysis

Anticoagulant Rodenticides dominate with 67.9% share in 2024

In 2024, Anticoagulant Rodenticides held a dominant market position, capturing more than a 67.9% share of the rodenticides market. Their strong position comes from their proven effectiveness in controlling rodent populations in agricultural, urban, and industrial settings. Anticoagulants—particularly second-generation compounds such as brodifacoum, bromadiolone, and difenacoum—remain the preferred choice for pest control professionals due to their high potency and ability to address resistant rodent species.

According to the U.S. Environmental Protection Agency (EPA), these active ingredients are registered for use across multiple sectors, with strict application guidelines to minimize risks to non-target species, and updated label restrictions were implemented in 2024 as part of the agency’s nationwide rodenticide mitigation strategy. The European Chemicals Agency (ECHA) also reinforced their regulated use through the 2024 comparative assessment, highlighting their necessity in situations with high reinvasion pressure, particularly in food storage and processing facilities.

By Form Analysis

Pellets dominate with 48.1% share in 2024

In 2024, Pellets held a dominant market position, capturing more than a 48.1% share of the global rodenticides market. Their popularity comes from the ease of application, longer shelf life, and high attractiveness to rodents, making them effective for both agricultural and urban pest control. Pellets are designed for consistent dosing and can be placed in bait stations or scattered in targeted areas, ensuring controlled exposure and reducing waste. In agricultural settings, they are widely used to protect stored grains and field crops from rodent damage, which the FAO notes can account for up to 20% post-harvest losses in certain regions. Urban pest control programs also favor pellets due to their stability in varying weather conditions, enabling year-round usage.

By Application Analysis

Agricultural Fields dominate with 39.3% share in 2024

In 2024, Agricultural Fields held a dominant market position, capturing more than a 39.3% share of the global rodenticides market. This dominance is largely due to the significant threat rodents pose to crop yields and stored produce in rural and semi-urban farming areas. Rodents damage seeds, gnaw irrigation equipment, and contaminate harvested grain, leading to notable economic losses. According to the Food and Agriculture Organization (FAO), post-harvest grain losses can reach up to 20% in some regions, with rodent activity being a major factor. Farmers rely heavily on rodenticides to protect high-value crops such as cereals, vegetables, and pulses, ensuring both quality and marketable yield.

Key Market Segments

By Type

- Non-Anticoagulant Rodenticides

- Bromethalin

- Cholecalciferol

- Zinc Phosphide

- Strychnine

- Anticoagulant Rodenticides

By Form

- Pellets

- Powders

- Sprays

- Others

By Application

- Agricultural Fields

- Warehouse

- Pest Control Companies

- Others

Emerging Trends

Adoption of Non-Toxic Rodent Control Methods

A significant trend in rodent control is the shift toward non-toxic and eco-friendly alternatives to traditional rodenticides. This movement is driven by growing concerns over the environmental and health impacts of chemical rodenticides, particularly their effects on non-target wildlife and pets.

- For instance, a study by City Wildlife in Washington, D.C., found that 85% of tested animals, including squirrels and crows, had been exposed to rodenticides, leading to severe health issues such as bleeding disorders.

In response, several municipalities have begun exploring and implementing alternative rodent control methods. Fairfield, Connecticut, launched a pilot program using oral contraceptives to manage rodent populations. The program involves distributing herbal-based fertility control pellets to reduce reproduction rates among rodents, thereby decreasing their numbers over time without causing harm to other wildlife or pets.

Similarly, the Food Safety Authority of Ireland (FSAI) has been actively addressing rodent infestations in food establishments. In July 2025, the FSAI issued closure orders to ten businesses, including a Lidl supermarket and a Costa Coffee shop, due to evidence of rat infestations. These actions underscore the importance of maintaining stringent pest control measures to ensure food safety and public health.

Drivers

Rising Urbanization and Increased Rodent Infestation

The rapid urbanization across the globe is one of the primary driving factors behind the growing demand for rodenticides. As cities expand, human habitats increasingly overlap with rodent territories, leading to a rise in rodent infestations.

- According to the National Pest Management Association (NPMA), over 21 million households in the U.S. experience rodent infestations each year, which creates an ongoing need for rodent control solutions.

This increasing rodent population is primarily driven by several factors, including the availability of food and shelter in urban areas. In cities, waste management systems sometimes struggle to keep pace with the growing population, providing ample food sources for rodents. Moreover, the development of new housing and commercial areas without sufficient pest control measures creates ideal environments for rodents to thrive.

Government initiatives are playing an essential role in addressing these rising infestations. In the U.S., for example, the Environmental Protection Agency (EPA) is focused on promoting integrated pest management (IPM) strategies to control rodent populations while ensuring safety and environmental sustainability. The National Institute of Environmental Health Sciences (NIEHS) also funds research to better understand the environmental impact of rodenticides and alternatives.

The growing reliance on urban food markets and restaurants has further increased the need for rodent control. According to the Food and Agriculture Organization (FAO), the food industry faces significant challenges from rodents, as they can contaminate food and damage storage facilities, leading to massive economic losses. In fact, the FAO estimates that rodents damage around 20-25% of global food production annually.

Restraints

Environmental and Health Concerns with Rodenticides

One of the major restraining factors for the growth of the rodenticides market is the growing concern over the environmental and health risks associated with their use. Rodenticides, particularly those containing toxic chemicals like anticoagulants, have been linked to several environmental and health hazards. For instance, the use of certain rodenticides has been shown to cause secondary poisoning in non-target animals, including birds of prey, pets, and other wildlife. According to the U.S. Environmental Protection Agency (EPA), rodenticides like brodifacoum and bromadiolone can accumulate in the food chain, putting wildlife at risk when they consume poisoned rodents.

In addition to environmental concerns, the impact on human health is also a major issue. Accidental poisoning, especially in households with children and pets, has raised alarm. The American Association of Poison Control Centers (AAPCC) reports that each year, thousands of accidental poisonings occur, with children under the age of six being the most vulnerable. While rodenticides are intended to target rodents, their lethal effects can be unintentionally passed on to pets or humans who come into contact with contaminated rodents or bait stations.

Government initiatives have focused on reducing the negative impact of rodenticides. In the U.S., the EPA has introduced regulatory measures to limit the use of certain highly toxic rodenticides. The agency’s Rodenticide Risk Mitigation Decision (2014) outlines strategies to protect non-target wildlife and reduce risks to human health by restricting the sale and use of certain rodenticides. This includes regulations such as restricted packaging, increased warning labels, and the promotion of safer alternatives like mechanical traps and rodent-proofing methods.

The global food industry, which is one of the largest sectors affected by rodent infestations, is also under pressure to adopt safer rodent control solutions. The Food and Agriculture Organization (FAO) has emphasized the importance of balancing effective rodent control with sustainable, non-toxic alternatives. The FAO estimates that rodents cause around 20% of global crop losses annually, but it also advocates for integrated pest management (IPM) solutions that include non-toxic control methods and preventative measures to reduce reliance on chemical rodenticides.

Opportunity

Embracing Integrated Pest Management (IPM) for Sustainable Rodent Control

A promising growth opportunity in rodent control lies in the adoption of Integrated Pest Management (IPM) strategies. IPM focuses on long-term prevention and control of rodent populations through a combination of biological, mechanical, cultural, and chemical practices, with an emphasis on minimizing risks to human health and the environment. This approach aligns with global efforts to reduce reliance on chemical rodenticides and promote more sustainable pest management practices.

In the United States, the Environmental Protection Agency (EPA) has been instrumental in promoting IPM through various initiatives. For instance, the EPA’s Integrated Pest Management Principles highlight the importance of setting action thresholds, monitoring pest populations, and employing preventive measures before resorting to chemical controls. By integrating these practices, communities can achieve effective rodent control while safeguarding public health and the environment.

Moreover, the California Department of Pesticide Regulation has implemented programs to encourage the adoption of IPM. These programs include providing grants for research and development of alternative pest control methods, as well as offering incentives for projects that reduce the use of hazardous pesticides. Between 2013 and 2022, the department funded 31 research projects with a total of $6.8 million, aiming to advance sustainable pest management practices.

Internationally, countries like India have also embraced IPM to address rodent infestations. In Maharashtra, Gujarat, and Telangana, initiatives supported by organizations such as Better Cotton have trained over 214,000 farmers in sustainable pest management techniques, including the use of food sprays to attract natural predators and reduce reliance on chemical pesticides.

Regional Insights

North America leads the rodenticides market with 47.8% share in 2024

In 2024, North America emerged as the leading region in the global rodenticides market, holding a substantial 47.80% share, valued at around USD 2.1 billion. This dominance is supported by the region’s highly urbanized population, advanced agricultural sector, and stringent public health measures to control rodent-borne diseases.

The U.S. Environmental Protection Agency (EPA) continues to implement regulatory updates—such as the 2024 rodenticide mitigation strategy—to balance efficacy with environmental safety, ensuring professional users in agriculture, food processing, and urban pest control maintain access to effective products. In the United States, rodent control is a major municipal expense, with cities like New York, Chicago, and Los Angeles investing millions annually in targeted eradication programs.

Rodent infestations also present significant agricultural challenges, especially in large-scale grain storage and livestock operations across states like Iowa, Nebraska, and Kansas. According to the U.S. Department of Agriculture (USDA), rodents contribute notably to post-harvest grain losses, with contamination and spoilage impacting both domestic supply and exports. Canada’s agricultural hubs in Saskatchewan and Alberta also rely heavily on rodenticides to safeguard grain silos and protect rangeland from burrowing rodents.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE, a global chemical leader, offers a range of rodenticide products tailored for various applications, including agriculture, urban pest control, and public health. Their Selontra® Rodent Bait is designed to control rodents effectively and efficiently, reducing the time spent on servicing bait stations. BASF’s commitment to innovation and sustainability positions them as a key player in the rodenticides market.

UPL Limited, an Indian multinational company, manufactures agrochemicals and specialty chemicals, including rodenticides. Their products are sold in over 150 countries, catering to both agricultural and non-agricultural sectors. UPL’s extensive global presence and diverse product portfolio make them a significant contributor to the rodenticides market.

Rollins, Inc. is a global consumer and commercial services company offering pest control services and protection against rodents through its subsidiaries. They serve over 2.8 million customers worldwide, providing essential pest control services to both residential and commercial clients. Rollins’ extensive reach and established brands position them as a prominent player in the rodenticides market.

Top Key Players Outlook

- BASF SE

- UPL

- Ecolab

- Rollins, Inc.

- PelGar International

- Bayer AG

- Neogen Corporation

- Rentokil Initial plc

- Liphatech, Inc.

- Bell Laboratories Inc.

Recent Industry Developments

In 2024–25, UPL emerged as a powerful force in agrochemicals, posting annual revenue of INR 466.4 billion and a net profit of INR 9 billion, reversing its earlier loss, with EBITDA margin climbing by 460 basis points to 17.4 %.

In 2024, Ecolab reported total revenue of approximately USD 4.0 billion, reflecting a modest 2 % increase over the prior year.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 7.0 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Non-Anticoagulant Rodenticides, Bromethalin, Cholecalciferol, Zinc Phosphide, Strychnine, Anticoagulant Rodenticides), By Form (Pellets, Powders, Sprays, Others), By Application (Agricultural Fields, Warehouse, Pest Control Companies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, UPL, Ecolab, Rollins, Inc., PelGar International, Bayer AG, Neogen Corporation, Rentokil Initial plc, Liphatech, Inc., Bell Laboratories Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- UPL

- Ecolab

- Rollins, Inc.

- PelGar International

- Bayer AG

- Neogen Corporation

- Rentokil Initial plc

- Liphatech, Inc.

- Bell Laboratories Inc.