Global Retinol Market Size, Share, And Enhanced Productivity By Type (Natural, Synthetic), By Application (Personal Care and Cosmetics, Dietary Supplements, Food and Beverage, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172012

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

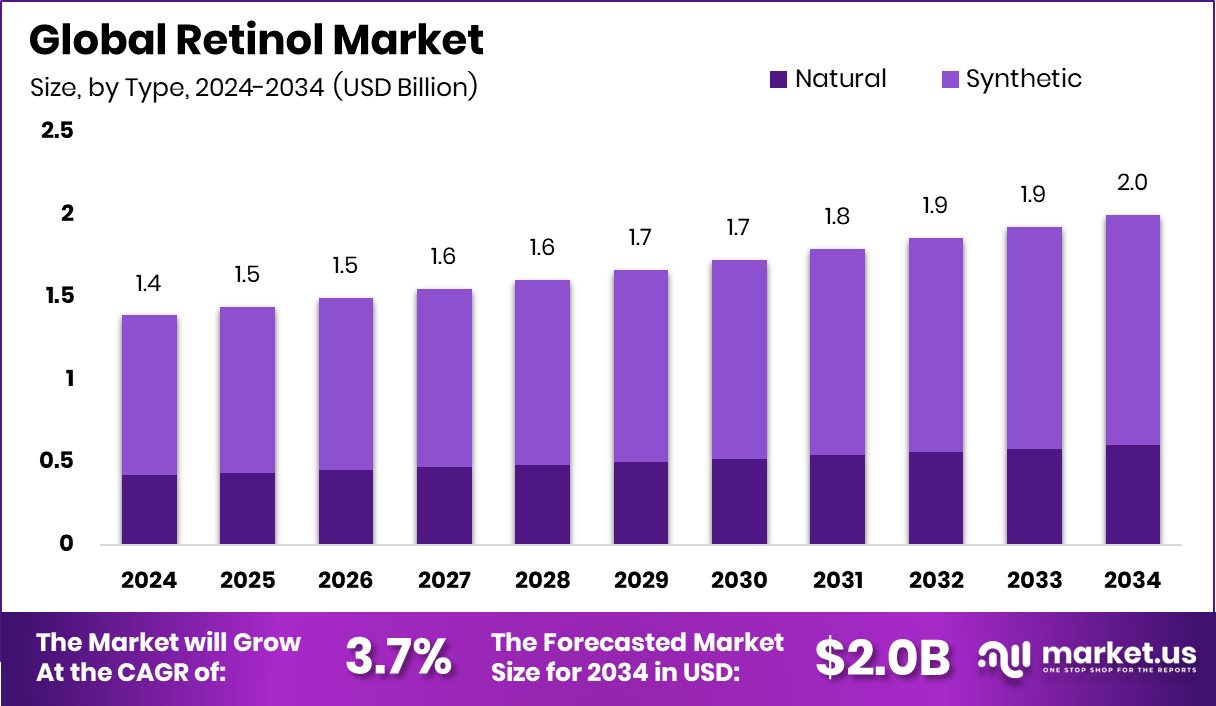

The Global Retinol Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034. Europe accounts for 34.70% of the retinol market, representing USD 0.4 Bn in value regionally.

Retinol is a vitamin A derivative widely used to support skin health, vision, immunity, and cellular renewal. It plays a critical role in regulating cell turnover and supporting epithelial tissues. In skincare and nutrition, retinol is valued for its biological activity and its ability to address deficiency-related health concerns through topical and dietary applications.

The retinol market covers the production, formulation, and distribution of retinol-based ingredients used across personal care, dietary supplements, functional foods, and medical nutrition. Demand is shaped by public health needs, nutrition programs, and rising awareness of micronutrient deficiencies. Regulatory oversight and food safety initiatives also influence how retinol products are developed and distributed globally.

Market growth is supported by public-sector investment in nutrition and safety. The FDA, seeking $7.2 billion to enhance food safety, nutrition, and medical product safety, strengthens regulatory frameworks that encourage compliant vitamin A usage. Grants such as $400K from MDARD and the Michigan Ag Commission further reinforce nutrition-focused product development and agricultural inputs.

Rising investment across nutrition and feed ecosystems boosts retinol demand. ARTAH Nutrition’s £2.85 million funding to expand dietary supplements, Milkfed’s request for a ₹50 crore NDDB grant for cattle feed, and Wastelink’s combined $3 million, ₹27 crore, and additional $3 million funding rounds highlight strong demand for nutrient-enriched formulations.

Opportunities are expanding through biotechnology and sustainable nutrition investments. Full Circle Biotechnology’s funding for a 7,000-ton facility and Provectus Algae’s US$10.1 million raise for feed supplements show growing capacity for bio-based nutrition solutions, indirectly strengthening long-term opportunities for retinol integration across health and food systems.

Key Takeaways

- The Global Retinol Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034.

- The retinol market synthetic type dominates with a 69.3% share, driven by consistency, scalability, and cost efficiency.

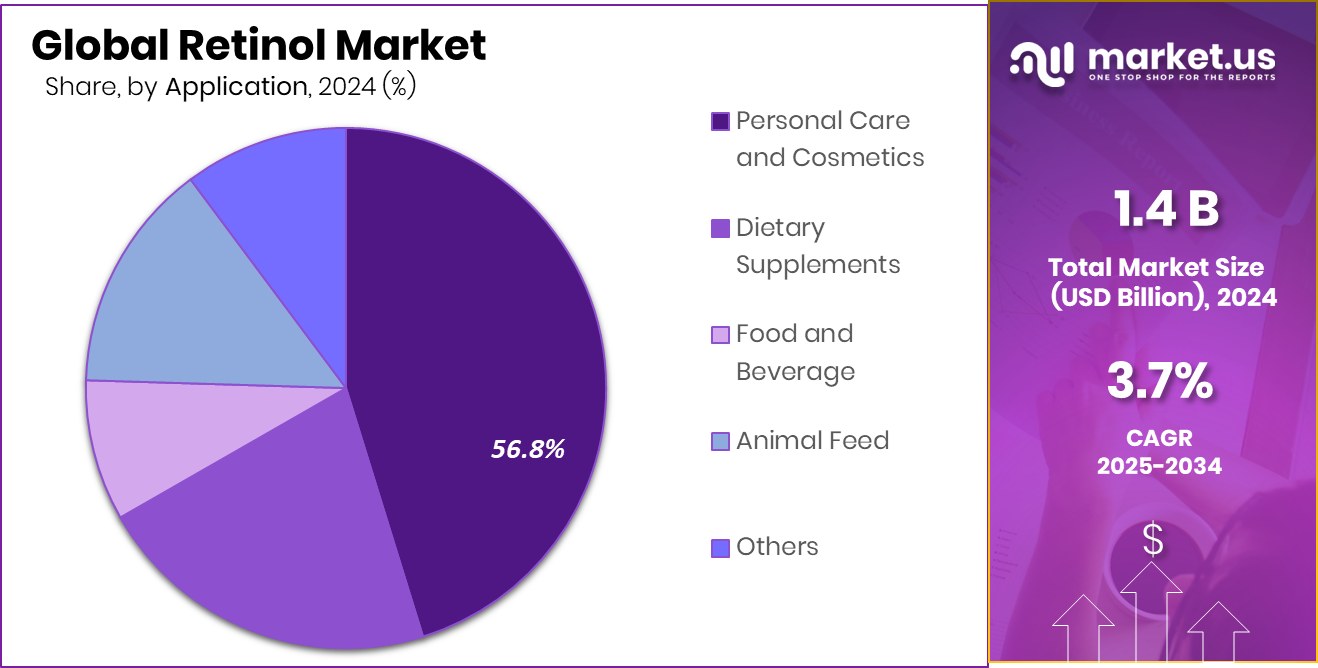

- Personal care and cosmetics lead the retinol market applications with a 56.8% share, supported by anti-aging demand.

- In Europe, the retinol market reached a 34.70% share, generating USD 0.4 Bn in revenue annually.

By Type Analysis

In the retinol market, the synthetic type dominates with a 69.3% share globally across markets.

In 2024, Synthetic held a dominant market position in By Type segment of the Retinol Market, with a 69.3% share. Synthetic retinol continues to be widely preferred due to its consistent molecular structure, predictable performance, and reliable stability across formulations. Manufacturers favor synthetic variants as they allow precise concentration control, which is critical for efficacy and regulatory compliance in finished products. The segment’s strong position also reflects established manufacturing processes and scalable production capabilities that support a steady supply across global markets.

From a market perspective, the 69.3% share highlights the trust of formulators and brand owners in synthetic retinol for delivering uniform results. Its dominance underscores ongoing demand for standardized active ingredients that support product consistency, shelf stability, and controlled bioactivity, reinforcing its leadership within the retinol value chain.

By Application Analysis

Personal Care and Cosmetics application leads the Retinol Market with 56.8% demand worldwide.

In 2024, Personal Care and Cosmetics held a dominant market position in By Application segment of the Retinol Market, with a 56.8% share. This leadership is driven by the extensive use of retinol in skincare formulations targeting visible signs of aging, skin texture improvement, and overall appearance enhancement. Personal care brands continue to integrate retinol as a core functional ingredient due to its proven performance and strong consumer recognition.

The 56.8% share reflects sustained product launches and reformulations within creams, serums, and topical solutions. Market momentum in this segment is supported by consistent consumer demand for high-performance cosmetic actives, positioning personal care and cosmetics as the primary application area shaping retinol market growth and commercial relevance.

Key Market Segments

By Type

- Natural

- Synthetic

By Application

- Personal Care and Cosmetics

- Dietary Supplements

- Food & Beverage

- Animal Feed

- Others

Driving Factors

Rising Nutrition and Agriculture Investment Drives Retinol Demand

Growing public and private investment in agriculture, nutrition, and ingredient innovation is a key driving factor for the retinol market. Funding aimed at strengthening food systems directly supports the availability of vitamin-rich inputs used in supplements, fortified foods, and personal care formulations. Programs such as MDARD award over $1.8 million for projects that create jobs and boost local agriculture businesses, improve raw material supply chains and processing capacity, which are essential for stable retinol production.

At the same time, targeted research funding supports ingredient quality and innovation. MDARD awarding nearly $57,000 in grants for horticulture research in Michigan strengthens crop science and nutrient optimization, indirectly supporting vitamin A–related inputs. On the private side, Cano-ela securing €1.6 million to accelerate seed-based ingredient development highlights rising interest in plant-derived nutrition. Together, these investments improve ingredient reliability, encourage innovation, and create favorable conditions for sustained retinol market growth.

Restraining Factors

Supply Chain Pressures Limit Retinol Market Expansion

Supply chain instability in agriculture and feed production acts as a key restraining factor for the retinol market. When feed availability becomes uncertain, raw material consistency for vitamin A and retinol-related inputs can be disrupted. Programs offering farmers grants of up to £3k to tackle feed shortages indicate ongoing stress within agricultural systems, which can affect livestock nutrition and downstream availability of vitamin-rich ingredients used in supplements and fortified products.

Environmental and alternative protein initiatives also create transitional challenges. The $27.4 million initiative launched by the Bezos Earth Fund and Global Methane Hub to breed low-methane livestock reflects shifting priorities in animal agriculture, requiring adaptation across feed and nutrient strategies. In parallel, Kynda raising €3 million for fungal protein production highlights emerging alternatives that may divert resources and attention. These shifts can temporarily slow retinol supply alignment, limiting short-term market expansion.

Growth Opportunity

Expanding Beauty Brands Create Strong Retinol Opportunities

Growing investment in modern beauty brands is creating a strong growth opportunity for the retinol market. FAE Beauty securing INR 17 Cr in funding led by Spring Marketing Capital reflects rising confidence in science-backed skincare and active ingredients. This capital supports product development, wider distribution, and consumer education, all of which increase the use of retinol-based formulations.

Similarly, Renee Cosmetics raising $30 million to strengthen its offline presence and invest in technology shows how beauty brands are scaling faster across physical retail and digital platforms. As brands expand their reach, demand for proven actives like retinol increases. These investments allow companies to improve formulation quality, enhance product safety, and reach new consumer groups. Together, these funding activities highlight clear opportunities for retinol adoption as beauty brands grow product portfolios and strengthen market visibility.

Latest Trends

K-Beauty Influence Accelerates Retinol Product Innovation

K-beauty–inspired skincare trends are shaping how retinol products are formulated and marketed globally. According to Tracxn, K-beauty startups raising $4.9M in the first four months of 2025 highlight strong interest in innovative, gentle, and results-driven skincare concepts. These startups often focus on combining retinol with skin-friendly routines, encouraging broader consumer acceptance.

In parallel, FAE Beauty is raising ₹17 crore in fresh funding led by Spring Marketing Capital, which supports the trend toward inclusive, active-based skincare adapted to local skin needs. This trend emphasizes improved textures, balanced formulations, and daily-use compatibility. As K-beauty principles spread, retinol is increasingly positioned as effective yet approachable, driving innovation, reformulation, and wider consumer adoption across skincare markets.

Regional Analysis

Europe leads the retinol market with a 34.70% share, valued at USD 0.4 Bn globally.

Europe emerged as the dominating region in the Retinol Market, accounting for 34.70% share and valued at USD 0.4 Bn, supported by its mature personal care and dermatological product landscape. The region benefits from strong consumer awareness of clinically backed skincare ingredients and consistent demand for retinol-based formulations across premium and mass categories.

North America follows closely, driven by well-established cosmetic brands, high adoption of advanced skincare routines, and steady retail penetration of retinol products. Asia Pacific represents a rapidly expanding regional market, supported by rising urban populations, growing skincare awareness, and increasing use of active ingredients in daily personal care.

Meanwhile, the Middle East & Africa region shows gradual market development, backed by improving access to personal care products and rising interest in skin health solutions. Latin America contributes steadily, supported by expanding beauty-conscious consumer bases and wider availability of dermatological products through organized retail channels.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to hold a strong strategic position in the global retinol market due to its deep expertise in chemical synthesis and ingredient standardization. The company benefits from integrated production capabilities, allowing consistent quality and a scalable supply of retinol for downstream formulators. Its focus on formulation stability and regulatory alignment supports long-term partnerships with personal care and pharmaceutical customers. BASF’s structured approach to innovation reinforces its role as a preferred supplier in high-performance retinol applications.

Beauty Solutions LTD operates with a focused portfolio approach, emphasizing specialty cosmetic ingredients tailored for personal care formulations. In the retinol market, the company differentiates itself through customized solutions designed for brand-specific performance requirements. Its agility in responding to formulation trends and customer needs enables steady positioning among niche and mid-sized cosmetic manufacturers. This targeted strategy supports consistent demand within professional and consumer skincare channels.

Biotics Research Corporation brings a health-oriented perspective to the retinol market, leveraging its background in nutritional and wellness formulations. The company emphasizes ingredient purity and controlled dosage formats, aligning retinol usage with broader health and supplementation applications. Its disciplined manufacturing practices and practitioner-focused distribution model strengthen credibility and trust. As a result, Biotics Research maintains a stable presence in retinol applications linked to wellness-driven product development.

Top Key Players in the Market

- BASF SE

- Beauty Solutions LTD

- Biotics Research Corporation

- Divi’s Laboratories Limited

- DRUNK ELEPHANT

- Eluminex Biosciences

- Guangzhou ZIO Chemical Co., Ltd

- DSM

Recent Developments

- In April 2025, Divi’s Nutraceuticals, a subsidiary of Divi’s Laboratories, highlighted its offering of Vitamin A forms suitable for use in dietary supplements and food fortification. These ingredient forms include vitamin A variants that support nutrition and functional product applications, demonstrating the company’s focus on broadening its nutraceutical and vitamin portfolio beyond generic APIs. This development shows Divi is strengthening its range of fat-soluble vitamins relevant to retinol supply chains.

- In January 2025, BASF’s Personal Care business introduced VitaGuard® A, a new encapsulated retinol ingredient that uses solid lipid particles to protect retinol from degradation and reduce skin irritation. This innovation helps formulators include retinol in cosmetic products more easily and improves its stability and skin performance in anti-aging applications.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural, Synthetic), By Application (Personal Care and Cosmetics, Dietary Supplements, Food and Beverage, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Beauty Solutions LTD, Biotics Research Corporation, Divi’s Laboratories Limited, DRUNK ELEPHANT, Eluminex Biosciences, Guangzhou ZIO Chemical Co., Ltd, DSM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Beauty Solutions LTD

- Biotics Research Corporation

- Divi’s Laboratories Limited

- DRUNK ELEPHANT

- Eluminex Biosciences

- Guangzhou ZIO Chemical Co., Ltd

- DSM