Global Residential Backup Powers Market Size, Share Analysis Report By Type (Diesel Generators, Gas Generators, Solar Generators, Others), By Application (Standby Power, Prime Power, Peak Shaving), By End-User (Single-Family Homes, Multi-Family Dwellings, Remote Residential Facilities) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169385

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

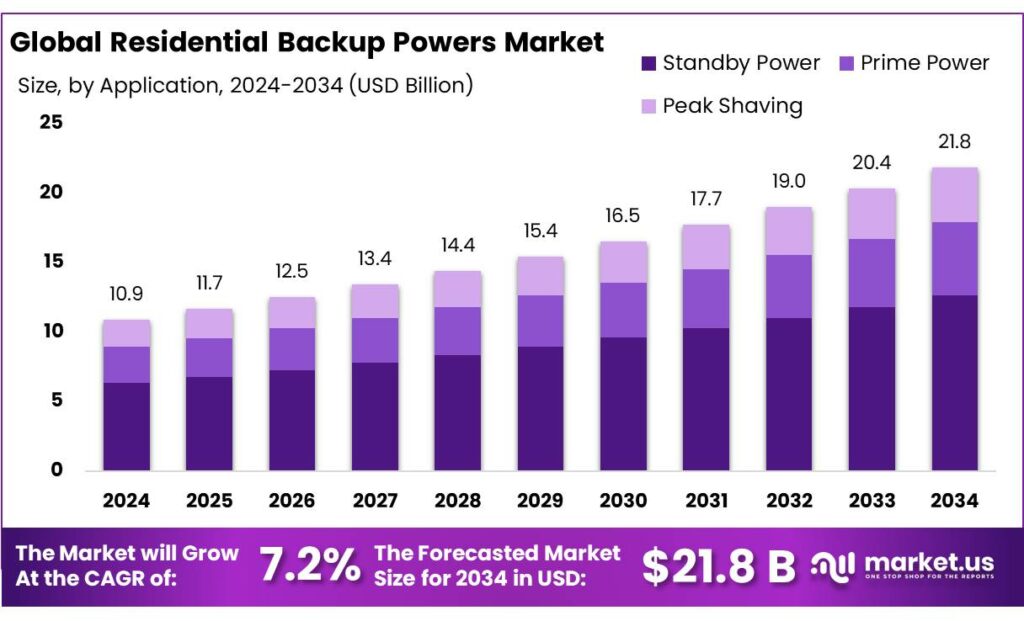

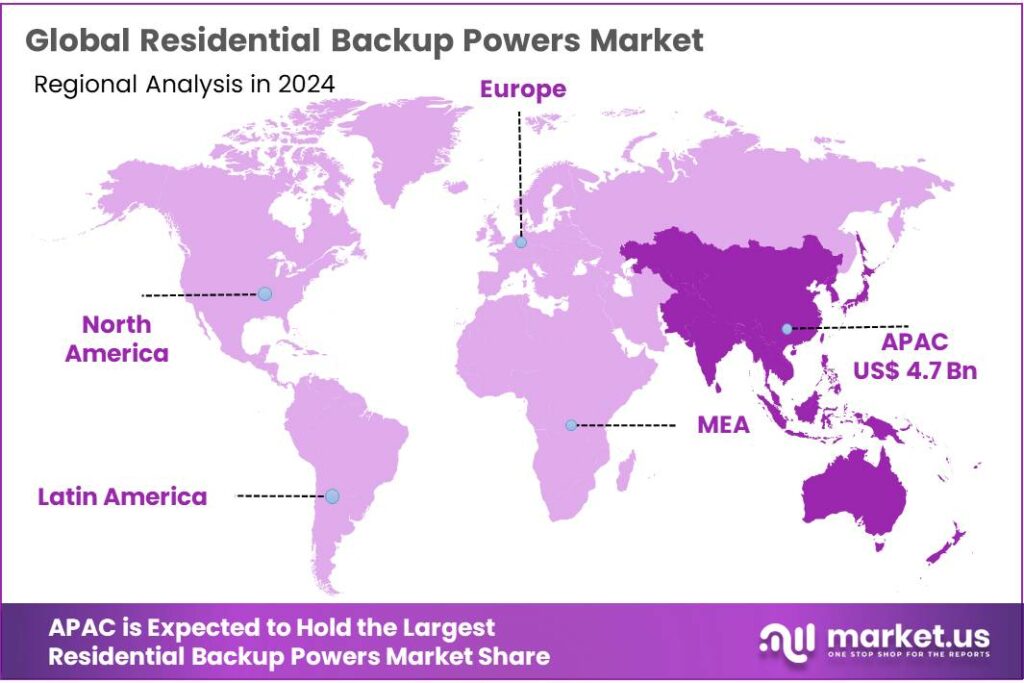

The Global Residential Backup Powers Market size is expected to be worth around USD 21.8 Billion by 2034, from USD 10.9 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 43.20% share, holding USD 4.7 Billion revenue.

Residential backup power refers to small-scale generation and storage used by households to keep lights, refrigeration, connectivity and critical medical or safety equipment running when the grid fails. The growing focus on resilience is not abstract: grid-related technical failures caused outage-driven economic losses of at least USD 100 billion in 2021, about 0.1% of global GDP, according to IEA analysis presented by the Renewable Energy Institute. Such losses, plus increasingly digital lifestyles, are pushing homeowners toward generators, batteries and solar-plus-storage systems as an “insurance policy” against blackouts.

- The IEA estimates that of the first 1 TW of global solar PV installed, about 40% was distributed, with roughly 130 GW deployed by households across around 25 million homes; this could grow four-fold to about 100 million households by 2030 if current installation rates are maintained. In 2022, distributed PV already accounted for 48% of global solar PV additions, underscoring how quickly power supply is shifting to rooftops and behind-the-meter systems that can host backup capability.

Rapid expansion of solar is a primary driver. At least 407 GW of solar PV was added worldwide in 2023, taking total operating capacity to about 1.6 TW, a record increase in both absolute and percentage terms. In the EU, rooftop systems dominate new installations, with residential rooftop PV representing 33% of total installed solar PV capacity in 2023, and around 600,000 roofs equipped in France and 200,000 in the UK in response to high electricity prices. This expanding rooftop base is the natural platform for solar-plus-storage backup solutions.

Battery storage costs and deployment trends are the second major driver. According to the IEA, battery storage in the power sector was the fastest-growing commercial energy technology in 2023, with total storage capacity additions of about 42 GW and cumulative power-sector storage reaching over 85 GW globally. SolarPower Europe reports that Europe’s total battery fleet reached 61.1 GWh in 2024, with installations expected to almost double to around 120 GWh by 2029 under current market outlooks.

- Government initiatives and regulatory frameworks are reinforcing this trajectory. The European Commission notes that total energy-storage capacity in Europe, currently around 89 GW, may need to exceed 200 GW by 2030 and 600 GW by 2050, with an additional 128 GW / 300 GWh of electrochemical storage expected by 2030—much of it in distributed and residential applications.

Key Takeaways

- Residential Backup Powers Market size is expected to be worth around USD 21.8 Billion by 2034, from USD 10.9 Billion in 2024, growing at a CAGR of 7.2%.

- Diesel Generators held a dominant market position, capturing more than a 39.8% share.

- Standby Power held a dominant market position, capturing more than a 58.1% share.

- Single-Family Homes held a dominant market position, capturing more than a 64.4% share.

- Asia-Pacific (APAC) region held a dominant position in the residential backup powers market, capturing 43.20% of global revenue, equal to USD 4.7 billion.

By Type Analysis

Diesel generators dominate with a 39.8% share due to proven reliability and broad fuel availability.

In 2024, Diesel Generators held a dominant market position, capturing more than a 39.8% share. The segment was driven by the technology’s reliability during extended outages, high power density for whole-house backup, and widespread fuel logistics that reduced deployment friction for homeowners and installers. Installation and maintenance ecosystems were well established, which supported rapid response and serviceability in both urban and rural areas. In 2025, diesel generators continued to represent a substantial portion of residential backup demand as households and resellers balanced cost, runtime and familiarity while alternative battery-based solutions progressed through pilot and scale-up phases.

By Application Analysis

Standby power leads with a 58.1% share as the primary residential backup application due to its role in uninterrupted home operations.

In 2024, Standby Power held a dominant market position, capturing more than a 58.1% share. The preference for standby solutions was driven by their ability to provide automatic, near-instantaneous power transfer during outages, which reduced disruption to critical household systems and supported safety and comfort for occupants. Installation of standby systems was enabled by established service networks and standardized installation practices, which lowered deployment risk for homeowners.

In 2025, the standby application continued to command the largest portion of demand as incremental upgrades in controller reliability and fuel-handling routines improved perceived value, while consumer willingness to invest in seamless backup solutions remained strong. The segment’s resilience was underpinned by predictable performance expectations and widespread installer familiarity.

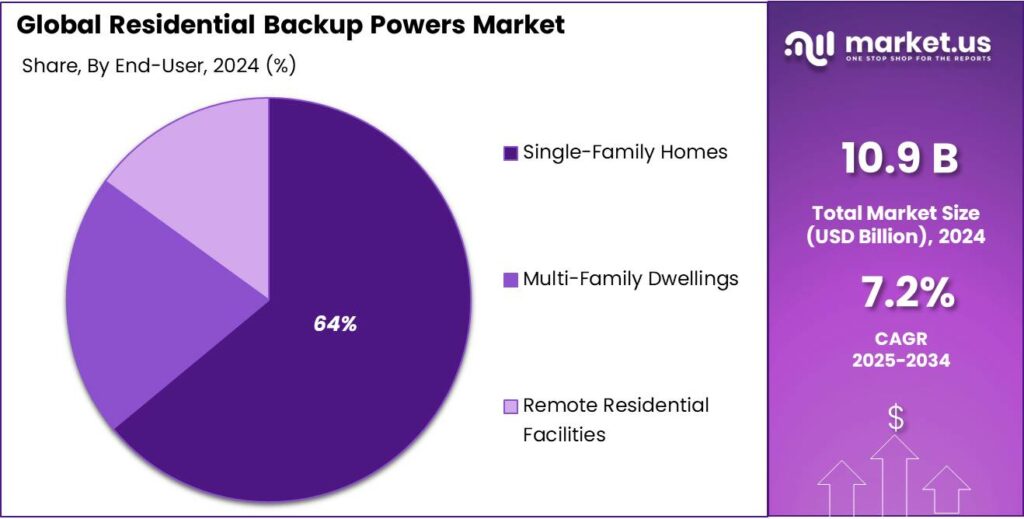

By End-User Analysis

Single-family homes dominate with a 64.4% share as the primary end use for residential backup power.

In 2024, Single-Family Homes held a dominant market position, capturing more than a 64.4% share, as homeowners increasingly prioritized whole-house resilience and convenience during power interruptions. The segment’s leadership was supported by demand for systems sized for full household loads, established installation and service networks, and financing options that spread upfront costs.

Preference for turnkey solutions and clear performance guarantees encouraged adoption among suburban and peri-urban households. By 2025, this end-use continued to shape product design and distribution strategies, with suppliers focusing on ease of installation and dependable runtime to meet homeowner expectations.

Key Market Segments

By Type

- Diesel Generators

- Gas Generators

- Solar Generators

- Others

By Application

- Standby Power

- Prime Power

- Peak Shaving

By End-User

- Single-Family Homes

- Multi-Family Dwellings

- Remote Residential Facilities

Emerging Trends

Electric Vehicles Turning into Everyday Home Backup Batteries

One of the strongest new trends in residential backup power is using electric vehicles as mobile home batteries. Instead of buying a separate stationary battery, households are starting to rely on their EV’s large battery pack to keep lights, fridges and wi-fi running when the grid goes down. This shift is happening at the same time as global EV numbers grow quickly, so the potential impact is huge.

- According to the International Energy Agency’s Global EV Outlook 2024, about 14 million new electric cars were sold in 2023, taking the global electric car fleet to roughly 40 million on the road. By 2024, sales rose again to around 17 million, a more than 25% yearly increase. Each of these vehicles carries a battery that is often 50–100 kWh in size—comparable to, or bigger than, a typical home storage system. This scale makes EVs natural candidates to serve as “batteries on wheels” for households.

Automakers are already building this idea into real products. Ford’s F-150 Lightning, for example, offers a Home Backup Power feature. Ford states that a fully charged F-150 Lightning can provide up to 9.6 kW of power and run an average home for up to three days, or up to 10 days if power use is rationed. This is no longer a lab demonstration; it is a commercial feature that some families are already using during storms and outages.

Governments and energy agencies are starting to formalise this trend in policy. The California Energy Commission’s Vehicle-Grid Integration program explicitly supports bidirectional charging, including vehicle-to-home (V2H) and vehicle-to-grid (V2G), as tools to improve grid resilience while still meeting drivers’ needs. California’s Senate Bill SB-233 goes further by pushing for bidirectional capability to become standard in EVs sold after 2027, framing them as distributed storage assets that can help during peak demand and outages.

Drivers

Rapid Growth and Cost Decline of Battery Storage

One of the biggest drivers pushing residential backup power solutions forward is the dramatic growth in battery storage capacity globally — especially lithium-ion batteries — combined with steep cost reductions. According to a report by the International Energy Agency (IEA), battery storage in the power sector was the fastest-growing commercially available energy technology in 2023. In that year alone, the world added about 42 gigawatts (GW) of new battery storage capacity — more than double the increase seen in 2022.

Cost trends add to the attraction. The price of lithium-ion battery packs has fallen substantially over the past decade. What once cost around USD 1,400 per kilowatt-hour (kWh) in 2010 has dropped to less than USD 140 per kWh by 2023. As battery costs fall, the economics of installing a home backup battery — either standalone or paired with rooftop solar — become increasingly favourable, accelerating adoption.

Global renewable energy generation (particularly from solar PV) is rising — creating a growing need for storage solutions that can deliver clean, stable power even when the sun isn’t shining. The IEA reports that electricity generation from solar PV increased by 320 terawatt-hours (TWh) in 2023 — a 25% jump compared to 2022. As more homes and communities invest in rooftop solar, coupling those systems with batteries becomes a natural choice for resilience and self-reliance.

This driver is also human at its core: imagine a family living in a region with frequent power cuts or unpredictable grid supply. For them, a rooftop solar panel with a battery can mean the difference between living in darkness for hours — or having lights, fans, and refrigeration continue working. As battery systems get cheaper and more widespread, such resiliency becomes accessible not just to the wealthy, but to more ordinary households.

Restraints

High Upfront Cost and Economic Barriers

One of the biggest obstacles slowing down the spread of residential backup power systems is the high upfront cost — especially when battery storage is involved. Even though lithium-ion battery prices have fallen substantially over the years, the total cost of a home-scale system (battery plus installation plus power electronics) remains a gate that many households struggle to cross.

To put it in perspective: according to a 2025 overview of battery-energy storage systems, although lithium-ion battery pack prices have dropped from roughly USD 1,400 per kWh in 2010 to less than USD 140 per kWh in 2023 — a sharp 90% reduction — the overall expense of deploying a residential storage setup is still high once other components are factored in.

Moreover, a study on the adoption of solar-plus-battery systems points out that the total system cost remains the “main barrier” for many potential users. The research highlights that many households postpone or abandon buying storage because they expect a more affordable option later, or because the combined cost of PV panels and storage is too high at once.

Apart from cost, there are other practical and structural restraints. For instance, in regions where the electricity grid is relatively stable or where outages are infrequent and short-lived, paying a premium for backup may not seem worthwhile to people. Many potential users weigh the cost against perceived benefit — if blackouts are rare, investment in backup storage may feel like a luxury rather than a necessity.

Opportunity

Growing Rooftop Solar and Energy-Access Programs Create Huge Backup Power Opportunity

A powerful growth opportunity for residential backup power lies at the meeting point of rooftop solar expansion and the global push to bring reliable electricity to every household. The International Energy Agency (IEA) expects the world to add more than 5,500 GW of renewable power capacity between now and 2030, enough to match today’s entire power capacity of China, the EU, India and the United States combined. This wave of renewables is increasingly happening on rooftops, close to people’s homes, where backup systems naturally fit.

In the IEA’s Net Zero Emissions scenario, the number of residential buildings with solar PV rises from about 25 million in 2020 to 100 million by 2030, and then more than doubles to 240 million by 2050. Each of those homes is a potential customer for storage-based backup systems, either installed from day one or added later as a retrofit. Once a family already has solar on the roof, adding a battery for backup becomes an upgrade decision rather than a complete new investment, which lowers psychological and financial barriers.

Governments and development banks are now designing programs that implicitly create room for residential backup power. Across Africa, the “Mission 300” initiative aims to connect 300 million people to electricity by 2030, backed by at least USD 90 billion in planned finance from the World Bank, the African Development Bank and private partners. Roughly half of these new connections are expected to come from renewable mini-grids and stand-alone systems, where household-level solar and batteries naturally provide both primary supply and backup.

National rooftop-solar schemes are creating similar opportunities in emerging economies. In India, the government’s PM Surya Ghar initiative has already helped about 2.39 million households (23.9 lakh) install rooftop solar, reaching 7 GW of capacity by December 2025, supported by roughly ₹13,464.6 crore in subsidies. The programme’s goal is 10 million solar-powered homes. Each of these rooftops is a future candidate for a home battery or hybrid inverter that can keep lights, fans, fridges and phone chargers running during blackouts.

Regional Insights

APAC leads with a 43.20% share, equivalent to USD 4.7 billion, driven by rising residential resilience needs

In 2024, the Asia-Pacific (APAC) region held a dominant position in the residential backup powers market, capturing 43.20% of global revenue, equal to USD 4.7 billion. This leadership was supported by a mix of structural and cyclical factors: rapid urbanization and expanding home ownership increased the addressable base for whole-house and point-of-use systems; frequent grid interruptions, extreme weather events and planned load-shedding in several markets elevated household willingness to invest in resilient power; and a broad installer and fuel-supply ecosystem enabled deployment of both generator-based and battery-based solutions.

Market adoption in 2024 was strongest in China and India due to sheer market scale and infrastructure constraints, while Japan and Australia showed higher per-household spend driven by premium standby systems and regulatory incentives for resilience. In lower-income APAC markets, diesel and LPG generator sales remained important because of cost and runtime considerations, whereas higher-income markets favoured integrated battery-plus-inverter systems tied to rooftop solar.

Supply-chain investments in 2024 improved availability of batteries and power electronics, shortening lead times for urban installers. By 2025, demand in APAC continued to expand as homeowner awareness of backup benefits increased and financing options became more widely offered, reinforcing the region’s status as the dominating market. The 2024 numeric position (43.20% / USD 4.7 Bn) thus reflected both scale and differentiated adoption patterns across countries, which were expected to shape product mix and channel strategies going forward.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB’s power-protection portfolio is relied upon for residential and small-scale commercial backup through modular UPS and power-conditioning products. The company’s solutions are positioned to address voltage regulation, harmonics and short interruptions, supporting households with sensitive electronics and hybrid installations. Product accreditation and lifecycle performance have been emphasized to reduce total cost of ownership. ABB’s channel and service network enables local deployment and technical support for UPS-based backup systems.

Caterpillar’s generator range includes compact standby units adapted from its broader genset portfolio; these provide diesel and gas options with rapid start and global emissions compliance. The brand’s value proposition rests on robust engines, dealer service networks and emphasis on fuel efficiency for extended outages. Caterpillar’s residential offerings are marketed for reliability where whole-house or critical circuits require uninterrupted power, supported by a global spare-parts and service ecosystem.

Cummins markets whole-house and standby generators with a focus on durability, ease of installation and dealer support. The product range spans small residential models to larger standby sets, and is presented with guidance on sizing and cost (examples: MSRP ranges for 13–20 kW). Cummins’ residential strategy emphasises integrated control, fast transfer and serviceability to meet homeowner expectations for seamless backup.

Top Key Players Outlook

- ABB

- Caterpillar Inc.

- Cummins Inc.

- Exide Industries Ltd.

- Kohler Co.

- Panasonic Corp.

- PRAMAC

- American Honda Motor Company. Inc.

- Schneider Electric

- Tesla

Recent Industry Developments

In 2024 ABB were reported at $32.9 billion, with orders of $33.7 billion and income from operations of $5,071 million, demonstrating broad corporate scale and the financial bandwidth to support product development and channel services for backup solutions.

In 2024, Exide Industries Ltd strengthened its role in residential backup power by supplying lead‑acid batteries, inverter/UPS systems and related products for home‑UPS applications across India. For the full fiscal year ending March 31, 2024, Exide reported revenue from operations of ₹16,029 crore and profit after tax (PAT) of ₹1,053 crore, up from ₹14,592 crore revenue and ₹904 crore PAT in FY2023.

Report Scope

Report Features Description Market Value (2024) USD 10.9 Bn Forecast Revenue (2034) USD 21.8 Bn CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Diesel Generators, Gas Generators, Solar Generators, Others), By Application (Standby Power, Prime Power, Peak Shaving), By End-User (Single-Family Homes, Multi-Family Dwellings, Remote Residential Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Caterpillar Inc., Cummins Inc., Exide Industries Ltd., Kohler Co., Panasonic Corp., PRAMAC, American Honda Motor Company. Inc., Schneider Electric, Tesla Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Residential Backup Powers MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Residential Backup Powers MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Caterpillar Inc.

- Cummins Inc.

- Exide Industries Ltd.

- Kohler Co.

- Panasonic Corp.

- PRAMAC

- American Honda Motor Company. Inc.

- Schneider Electric

- Tesla