Global Remote Monitoring and Control Market Size, Share, Industry Analysis Report By Type (Solutions, Field Instruments), By Industry (Oil and Gas, Power Generation, Chemicals, Water and Wastewater Treatment, Automotive, Pulp and Paper, Metals and Mining, Food and Beverages, Pharmaceuticals, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158410

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

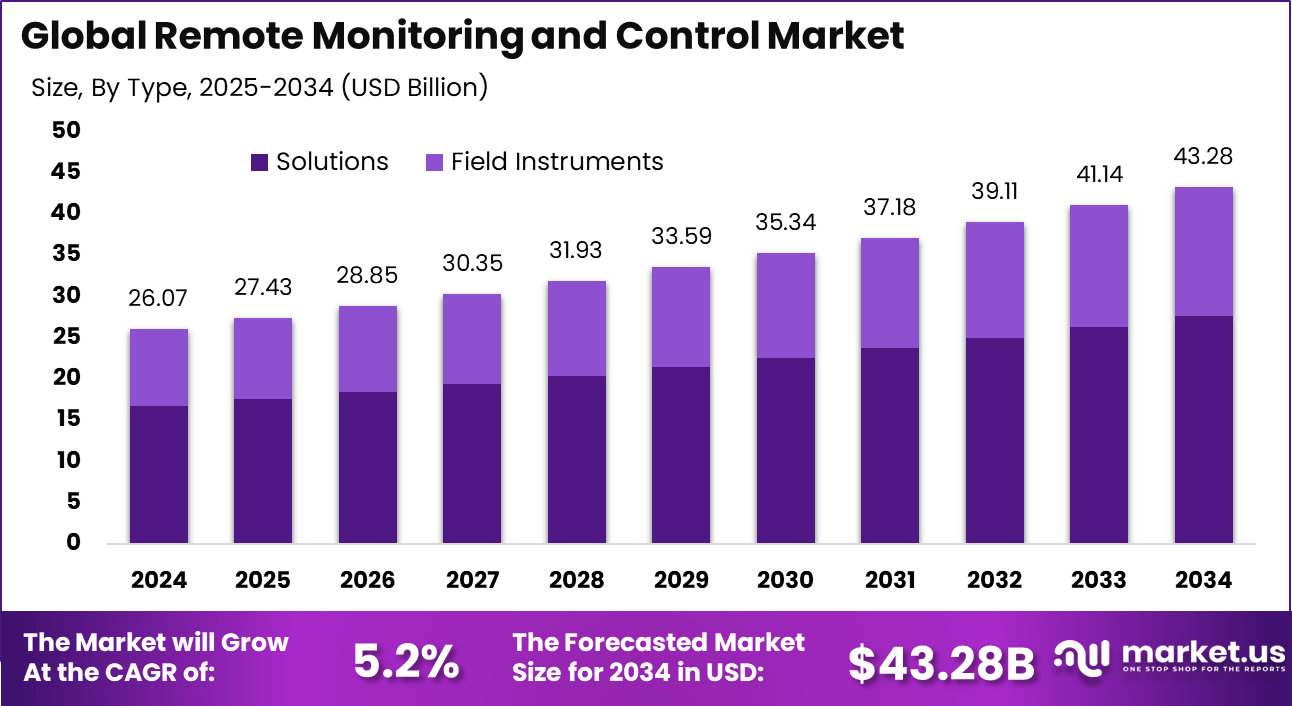

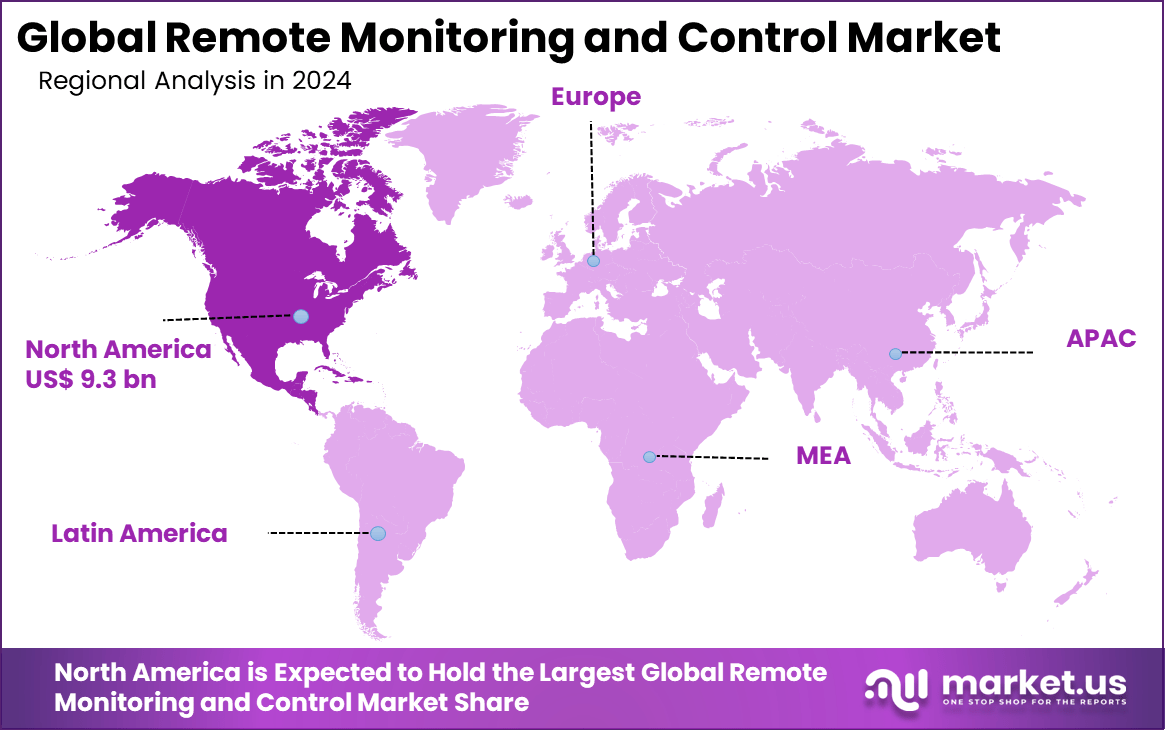

The Global Remote Monitoring and Control Market size is expected to be worth around USD 43.28 billion by 2034, from USD 26.07 billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 9.3 billion in revenue.

The Remote Monitoring and Control Market refers to the industry that provides technologies and systems for supervising and managing equipment, processes, and facilities from remote locations. These systems collect real-time data through sensors, controllers, and communication networks, allowing operators to track performance, identify anomalies, and make adjustments without being physically present.

In September 2025, Honeywell continues to operate its Global Solutions Command and Control Center in India, which offers advanced real-time remote monitoring and control services. This facility supports various industries, including energy, manufacturing, and critical infrastructure, leveraging AI and machine learning to provide continuous operational oversight and actionable insights to optimize performance and ensure sustainability.

One of the top driving factors for market growth is the increasing demand for industrial automation. More than 76% of businesses now rely on automated workflow solutions for both standard operations and data-driven planning, showing a significant move towards digital transformation. Automation reduces reliance on manual labor, boosts reliability, and creates safer environments, all of which align with growing industry standards for safety and compliance.

According to llcbuddy, Cove’s cloud-first architecture provides disaster recovery at up to 60% lower cost compared to proprietary appliances. However, the cost of adopting disruptive technologies remains a concern, with 23% of businesses, particularly small and medium-sized enterprises, citing it as a major barrier to implementation.

Global digital transformation spending is expected to reach USD 2.3 trillion by 2025, reflecting the growing urgency among enterprises to modernize their IT infrastructures. In this context, the Remote Monitoring & Management (RMM) Tools Market is projected to reach USD 1,548.96 million by 2025, expanding at a CAGR of 9.5% during 2025. This growth highlights the increasing reliance on RMM solutions for remote operations, cost optimization, and proactive IT management.

Key Takeaways

- By type, Solutions dominated the Remote Monitoring and Control market in 2024, holding a 64% share, driven by rising demand for integrated monitoring platforms.

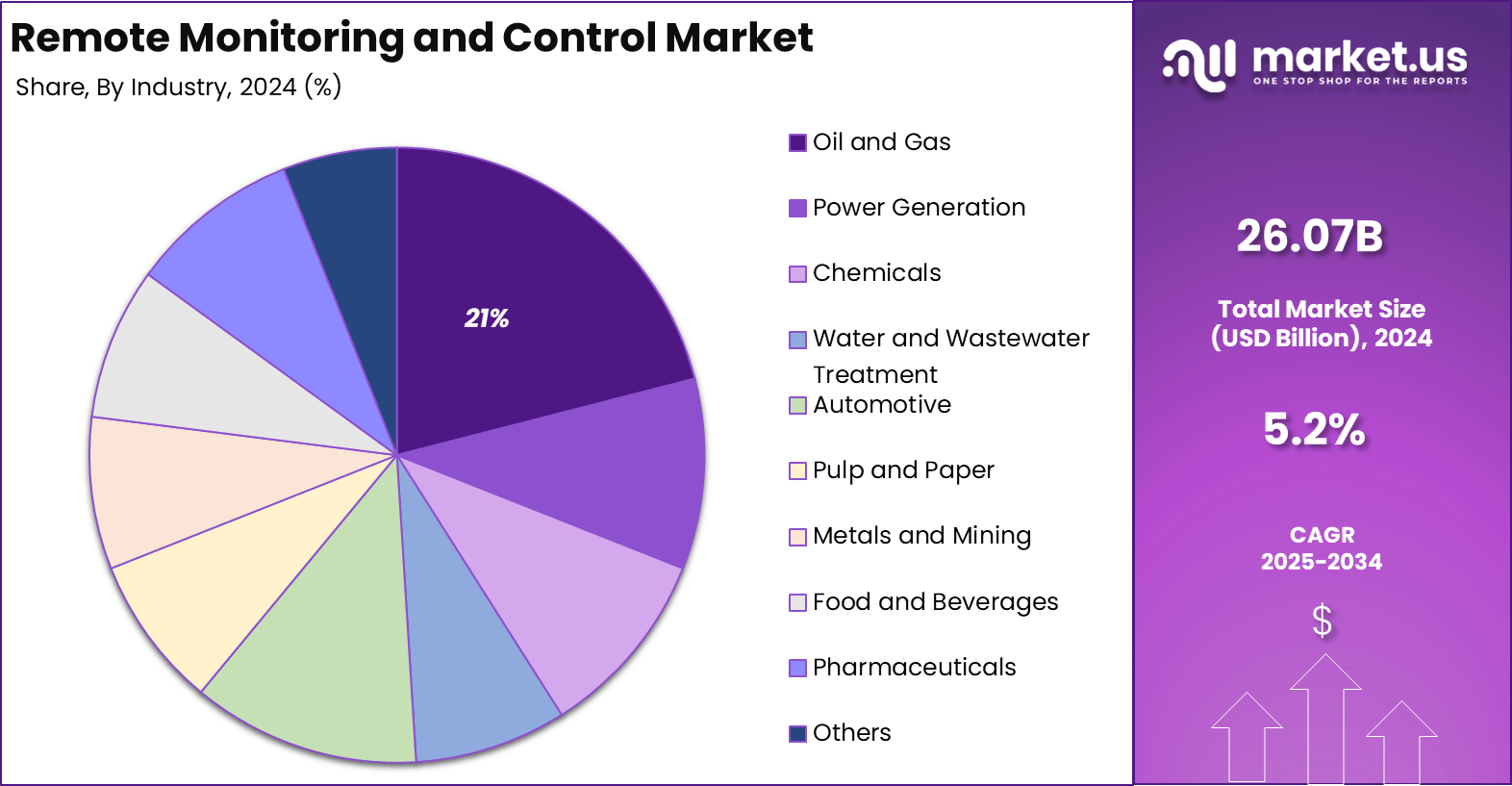

- By industry, the Oil and Gas sector led the market, accounting for 21% share, supported by increasing adoption of remote systems for operational safety and efficiency.

- North America captured a significant 36% share of the global market, highlighting its technological leadership and early adoption of automation.

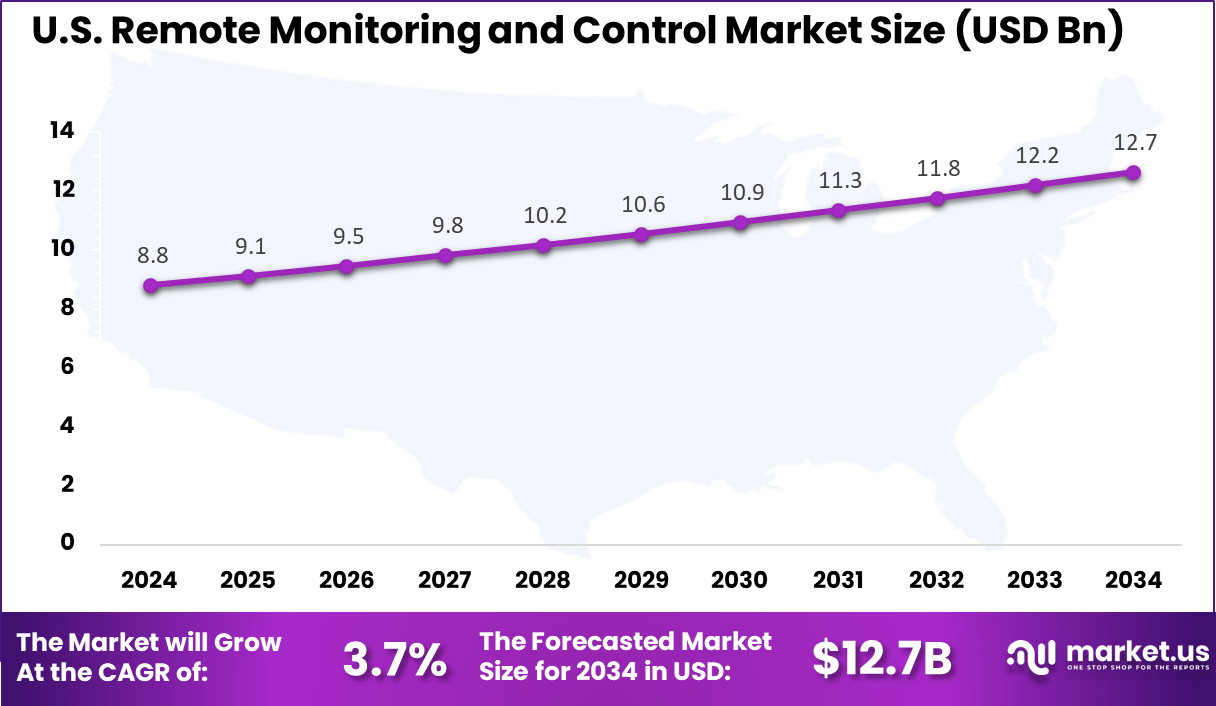

- The U.S. market was valued at USD 8.8 Billion in 2024, with steady growth expected at a CAGR of 3.7%, underpinned by investments in digital oilfield technologies and industrial automation.

Analysts’ Viewpoint

Demand is strong across sectors where continuous monitoring of distributed assets is essential. Utilities use remote monitoring to optimize energy generation and distribution. The oil and gas industry relies on it to monitor pipelines, rigs, and refineries for safety and compliance. Water and wastewater management agencies use remote systems to control treatment plants and reduce leakage.

Healthcare providers are increasingly adopting remote patient monitoring systems to enhance service delivery. Agriculture is also emerging as a growth area, where farmers use these solutions to track irrigation, soil conditions, and crop performance. Increasing adoption of enabling technologies such as IoT, artificial intelligence, edge computing, and private 5G networks plays a critical role in transforming the remote monitoring landscape.

AI-powered predictive maintenance systems and advanced sensors are rapidly gaining popularity for their ability to minimize downtime and enhance asset management. Mixed reality and remote access solutions now account for the majority share of adoption, while private 5G networks are driving ultra-reliable and low-latency communication in large industrial deployments. These technologies improve efficiency, enable remote troubleshooting, and allow businesses to tackle maintenance issues before they escalate.

Investment and Business benefits

Investment opportunities are expanding as companies seek to deploy integrated field instruments and SCADA platforms for greater process control. Investments in new sensor technologies, smart infrastructure upgrades, and digital transformation initiatives are increasing each year.

Sectors like energy, oil and gas, and manufacturing are actively expanding remote monitoring budgets to capture the long-term benefits of reduced downtime and improved regulatory compliance. The Asia Pacific region is experiencing notable growth as governments support large-scale infrastructure modernization.

From a business benefits perspective, remote monitoring and control systems are becoming essential for data-driven decision-making, regulatory compliance, and scaling operations efficiently. Organizations achieve better asset utilization, quicker response times, and sustainable cost savings.

In the energy sector, remote monitoring is helping firms boost uptime and energy management, while manufacturers reduce delays and improve product quality by automating key processes. Overall, these systems help ensure safe, efficient operations and competitive positioning in global markets.

U.S. Market Size

The United States is a significant contributor within North America, with its remote monitoring and control market valued at approximately USD 8.8 billion and growing steadily at a CAGR of around 3.7%. This growth is driven by increasing demand to optimize asset performance, reduce operational costs, and comply with safety regulations.

The U.S. market’s focus on integrating next-generation SCADA systems, predictive analytics, and cybersecurity measures supports this steady expansion. Government initiatives and investments in grid modernization and automation further stimulate market development

For instance, in January 2025, Guident received additional patent protection for its autonomous vehicle (AV) remote monitoring and control systems. The European patent, granted across 20 countries, covers AI and sensor fusion techniques used to enhance AV safety.

In 2024, North America held a dominant market position in the Global Remote Monitoring and Control Market, capturing more than a 36% share, holding USD 9.3 billion in revenue. This dominance is due to its advanced technological infrastructure and high adoption rate of IoT, AI, and 5G technologies.

North America’s leadership in deploying remote monitoring and control systems is fueled by continuous innovation and investment in technologies such as AI, IoT, and edge computing. This trend is particularly visible in key industrial sectors including manufacturing, power generation, and oil and gas.

For instance, in August 2025, Ground Control launched a dual-mode RTU (Remote Terminal Unit) designed for reliable remote monitoring in utility and environmental sectors across North America. This low-power, compact device offers global connectivity through Iridium SBD and NTN NB-IoT, making it ideal for monitoring dispersed assets like water utilities.

Type Analysis

In 2024, the remote monitoring and control market is predominantly led by solutions, accounting for about 64% of the overall market share. Solutions refer to integrated platforms offering comprehensive capabilities for monitoring, controlling, data analysis, and reporting remotely. These platforms are favored because they help companies improve operational efficiency and reduce downtime by providing real-time data visibility and control from distant locations.

The adoption of such solutions is particularly strong in industries that require constant oversight in challenging or hazardous environments. The growing importance of connected technologies like IoT and automation further supports the demand for these solutions, allowing businesses to streamline processes and enhance safety without physical presence.

For Instance, in July 2025, ABB launched a new I/O series to meet the digital demands of the oil and gas industry. The ABB XIO series extends the capabilities of its Remote Module Controllers (RMC), providing enhanced monitoring and control for oil and gas flow applications. This series improves connectivity and data integrity, enabling real-time monitoring and increasing operational efficiency.

Industry Analysis

In 2024, Within the industry segmentation, the oil and gas sector holds a significant share at 21% of the remote monitoring and control market. This reflects the critical need for constant and reliable monitoring of operations in this sector due to the high-risk nature of offshore drilling, pipelines, and extraction processes. Remote monitoring systems help reduce downtime, improve productivity, and ensure compliance with safety regulations.

The technology supports real-time tracking of assets and equipment, allowing timely interventions and preventing costly failures. This has made remote monitoring and control solutions indispensable in oil and gas operations, especially in remote or hazardous locations where physical access can be difficult or dangerous.

For instance, in July 2025, NHS Wales opened an opportunity for self-management and remote monitoring solutions, aiming to enhance patient care and reduce hospital admissions. This initiative encourages the use of digital health technologies to support patients in managing chronic conditions, enabling healthcare professionals to monitor progress remotely.

Emerging Trends

Remote monitoring in 2025 is evolving with greater focus on artificial intelligence, cloud-based platforms, and integrated smart sensors. Systems are becoming more proactive, capable of detecting risks before they escalate, and integrating environmental monitoring beyond security, such as air quality and water leaks.

Temporary and mobile site monitoring are in higher demand as infrastructure projects expand, and predictive maintenance via monitoring platforms is reducing downtime and extending equipment life. Compliance and data protection are now central, with strict protocols addressing privacy and regulatory standards for connected technologies.

Growth Factors

The adoption of remote monitoring and control is being accelerated by the increased reliance on real-time data analytics, automation, and artificial intelligence. These technologies minimize manual intervention, drive predictive maintenance, and enhance operational safety across sectors such as manufacturing, energy, and healthcare.

Cloud deployment is gaining prominence due to scalable access and integration capabilities. The demand for efficiency, reduced costs, and the need for optimized asset management continue to push businesses towards implementing advanced remote control platforms with smart monitoring features.

Key Market Segments

By Type

- Solutions

- SCADA

- Vibration Monitoring

- Field Instruments

- Level Transmitters

- Pressure Transmitters

- Temperature Transmitters

- Humidity Transmitters

- Intelligent Flow Meters

- Vibration-Level Switches

By Industry

- Oil and Gas

- Power Generation

- Chemicals

- Water and Wastewater Treatment

- Automotive

- Pulp and Paper

- Metals and Mining

- Food and Beverages

- Pharmaceuticals

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rise of Industrial Automation

Demand for automation is steadily increasing across industries as organizations seek to optimize performance and reduce operational risks. Remote monitoring and control systems allow companies to supervise processes and equipment from distantly, enabling quick decision-making and minimizing the need for on-site personnel.

For instance, in March 2024, the Bangalore Water Supply and Sewerage Board (BWSSB) demonstrated an AI and IoT-based borewell monitoring technology aimed at improving water resource management. This technology allows remote monitoring and control of borewells, enhancing efficiency by providing real-time data on water usage at specific intervals.

Restraint

Security Concerns

Security concerns remain a significant barrier in the remote monitoring and control market. These systems are prone to cyberattacks, data breaches, and hacking, particularly when connected to critical infrastructure like energy grids, healthcare systems, and industrial processes. With sensitive data being transmitted and stored remotely, ensuring robust cybersecurity measures is essential.

For instance, in August 2024, according to cybersecurity firm Dragos, industrial control systems (ICS) are becoming increasingly vulnerable to cyberattacks, with ransomware targeting the manufacturing sector seeing a 50% increase. The rising interconnectedness of operational technology (OT) with IT systems and the adoption of cloud-based solutions are expanding attack surfaces.

Opportunities

Healthcare Sector Expansion

The healthcare sector presents significant growth opportunities for remote monitoring and control systems. The increasing adoption of telemedicine, telehealth, and remote patient monitoring is reshaping healthcare delivery, especially with an aging population and growing demand for healthcare services.

These systems enable doctors to monitor patients’ conditions in real-time, improving patient care and reducing hospital visits. With advancements in wearable devices and AI-powered analytics, the healthcare sector is poised to expand rapidly, driving the demand for remote monitoring solutions.

For instance, in March 2025, Texas Oncology partnered with Canopy to enhance its remote patient monitoring capabilities. The collaboration builds on a successful pilot project and aims to extend Canopy’s digital platform across Texas Oncology’s extensive network of providers. This partnership focuses on improving symptom response times, reducing ER visits, and minimizing hospitalization by allowing patients to report symptoms during active treatment.

Challenges

Regulatory Compliance

Regulatory compliance presents a significant challenge for the remote monitoring market, as various industries and regions have distinct legal requirements. Particularly in sectors like healthcare, energy, and utilities, strict regulations around data privacy, security, and operational standards must be met.

Navigating these complex regulations can slow down the deployment and adoption of remote monitoring systems. Organizations need to stay informed and adapt to regulatory changes, which can be resource-intensive and time-consuming for businesses looking to scale their solutions globally.

For instance, in August 2025, Tenovi achieved SOC 2 compliance for its remote monitoring ecosystem, ensuring the security, availability, and confidentiality of its healthcare solutions. This certification validates Tenovi’s commitment to data protection and assures healthcare providers and patients regarding the integrity of sensitive health information.

Key Players Analysis

In the remote monitoring and control market, Emerson Electric, Honeywell International, Schneider Electric, General Electric, and ABB Ltd. are the leading players. Their dominance is supported by strong portfolios in automation, control systems, and IoT-enabled solutions. These companies focus on helping industries improve operational efficiency, reduce downtime, and manage assets remotely.

Rockwell Automation, Siemens, Yokogawa Electric, Endress+Hauser, and Hitachi strengthen the market with specialized monitoring technologies. Their offerings include advanced sensors, control systems, and real-time data integration. These companies emphasize predictive maintenance, seamless connectivity, and process optimization, making them key partners for industries adopting Industry 4.0 practices.

Other contributors such as John Wood Group, Ingersoll Rand, Atlas Copco, and Fuji Electric add value with niche solutions and regional expertise. They focus on energy management, process industries, and customized applications for different verticals. These firms play an important role in diversifying the market by offering tailored services and strengthening adoption across small, medium, and large enterprises.

Top Key Players in the Market

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- General Electric Co.

- ABB Ltd.

- Rockwell Automation, Inc.

- Yokogawa Electric Corporation

- Endress+Hauser AG

- Siemens

- Hitachi, Ltd.

- John Wood Group PLC

- Ingersoll Rand Inc.

- Atlas Copco

- Fuji Electric Co., Ltd.

- Other Key Players

Recent Developments

- In April 2025, Medical Guardian expanded its remote monitoring capabilities to enhance chronic disease management and reduce hospital readmissions. The company introduced advanced health monitoring solutions for patients with chronic conditions like heart disease and diabetes.

- In June 2024, the Indian Army unveiled ‘Vidyut Rakshak’, an integrated generator monitoring, protection, and control system created by the Army Design Bureau (ADB). Launched by Vice Chief Lt Gen Upendra Dwivedi, the system reflects a significant step toward modernizing generator management and ensuring reliable power support for critical military operations.

- In January 2024, Rockwell Automation launched its FactoryTalk InnovationSuite, a platform that combines AI and IoT technologies for remote monitoring and predictive maintenance. The suite is aimed at industries such as manufacturing, oil and gas, and utilities, offering real-time data insights to improve efficiency, reduce downtime, and optimize decision-making.

- In February 2024, ABB introduced a new AI-based remote monitoring and control platform targeting the energy and industrial sectors. By focusing on predictive maintenance policies, the system is designed to enhance operational efficiency, cut downtime, and enable proactive asset management across complex infrastructure networks.

- In March 2024, Yokogawa Electric Corporation rolled out an upgrade to its Exaquantum platform, incorporating advanced real-time monitoring and predictive analytics. This solution is tailored for the chemical manufacturing sector, helping users improve plant operations, enhance asset reliability, and achieve more effective production management.

- Also in March 2024, Pelsis Group, in collaboration with Microshare, introduced EverSmart Rodent, a remote monitoring product for pest control. The system provides real-time alerts via smartphones, tablets, or computers when rodent activity is detected, enabling faster response times and more efficient pest management strategies for commercial and residential settings.

Report Scope

Report Features Description Market Value (2024) USD 26.07 Bn Forecast Revenue (2034) USD 43.28 Bn CAGR(2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Solutions, Field Instruments), By Industry (Oil and Gas, Power Generation, Chemicals, Water and Wastewater Treatment, Automotive, Pulp and Paper, Metals and Mining, Food and Beverages, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Emerson Electric Co., Honeywell International Inc., Schneider Electric SE, General Electric Co., ABB Ltd., Rockwell Automation, Inc., Yokogawa Electric Corporation, Endress+Hauser AG, Siemens, Hitachi, Ltd., John Wood Group PLC, Ingersoll Rand Inc., Atlas Copco, Fuji Electric Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Remote Monitoring and Control MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Remote Monitoring and Control MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- General Electric Co.

- ABB Ltd.

- Rockwell Automation, Inc.

- Yokogawa Electric Corporation

- Endress+Hauser AG

- Siemens

- Hitachi, Ltd.

- John Wood Group PLC

- Ingersoll Rand Inc.

- Atlas Copco

- Fuji Electric Co., Ltd.

- Other Key Players