Global Rainscreen Cladding Market Size, Share Analysis Report By Raw Material (Fiber Cement, Composite Material, Metal, High Pressure Laminates, Terracotta, Ceramic, Others), By Application (Residential, Commercial, Official, Institutional, Industrial), By Construction Type (New Construction, Renovation) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159845

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

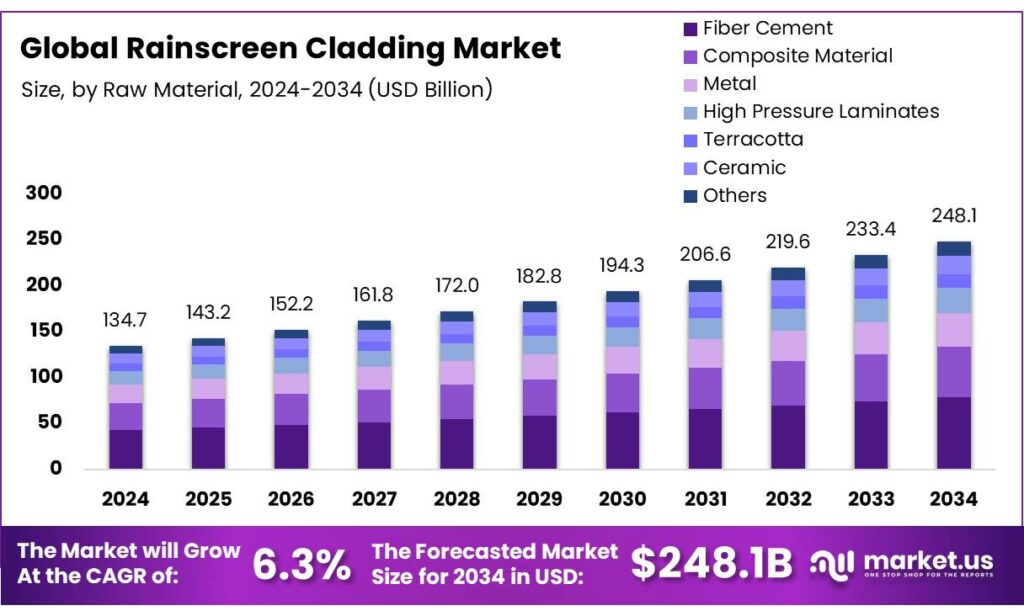

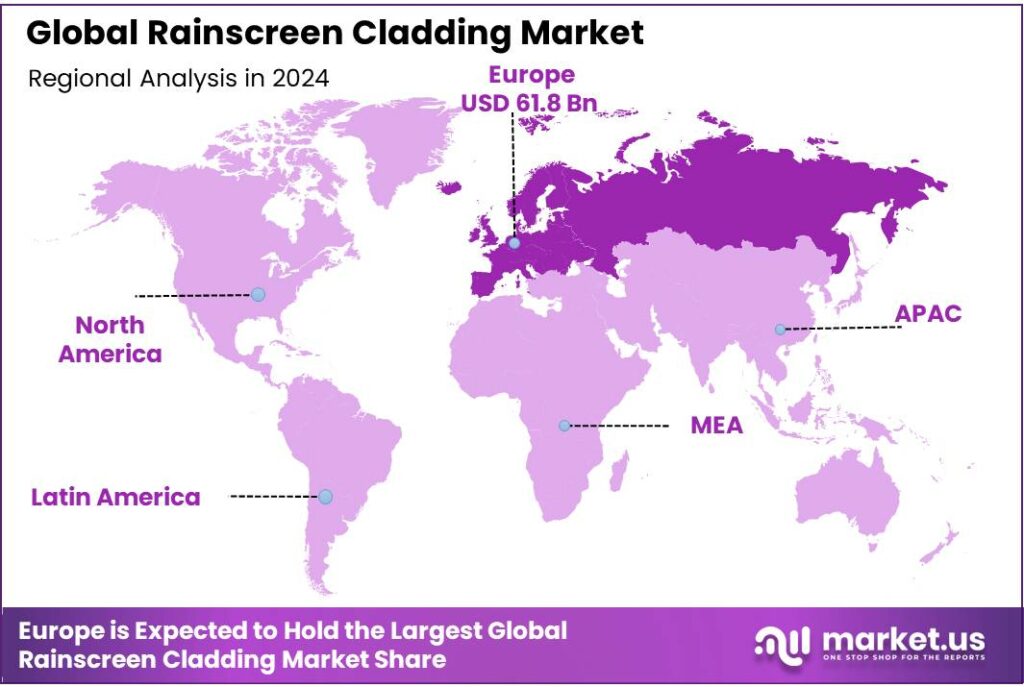

The Global Rainscreen Cladding Market size is expected to be worth around USD 248.1 Billion by 2034, from USD 134.7 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 45.9% share, holding USD 61.8 Billion in revenue.

Rainscreen cladding (also known as ventilated façade cladding) is an exterior façade system comprising an outer weather‐resisting skin, an air cavity, and an inner support wall. Its function is to manage moisture, reduce thermal bridging, and improve building envelope performance by allowing ventilation behind the outer panel. Its adoption is increasing in modern architecture to meet requirements of energy efficiency, moisture control, building durability and aesthetic flexibility.

In India, the government offers incentives to green building projects—these include tax benefits, fast-track approvals, and low interest loans for buildings with LEED/IGBC certification.

- For instance, the Gujarat government offers reimbursement up to INR 3 lakhs or 50% of IGBC certification fee (whichever is lower) for projects obtaining IGBC green building rating. The Indian Green Building Council has set a target of achieving 10 billion sq ft of green buildings by 2035.

Government / Regulatory & Standards Enablers for cladding are relatively rare, standards and policy frameworks act as indirect boosters. In the U.S., federal buildings (new construction or major renovations) are mandated under EISA Section 433 to reduce fossil fuel‑generated energy consumption (e.g. 55% reduction vs. 2003 baseline in initial years) and to meet applicable energy efficiency standards under ASHRAE/IECC. Moreover, the federal government cannot fund a new building unless it meets or exceeds the relevant federal building energy standards.

Key Takeaways

- Rainscreen Cladding Market size is expected to be worth around USD 248.1 Billion by 2034, from USD 134.7 Billion in 2024, growing at a CAGR of 6.3%.

- Fiber cement held a dominant position in the rainscreen cladding market, capturing more than a 31.8% share.

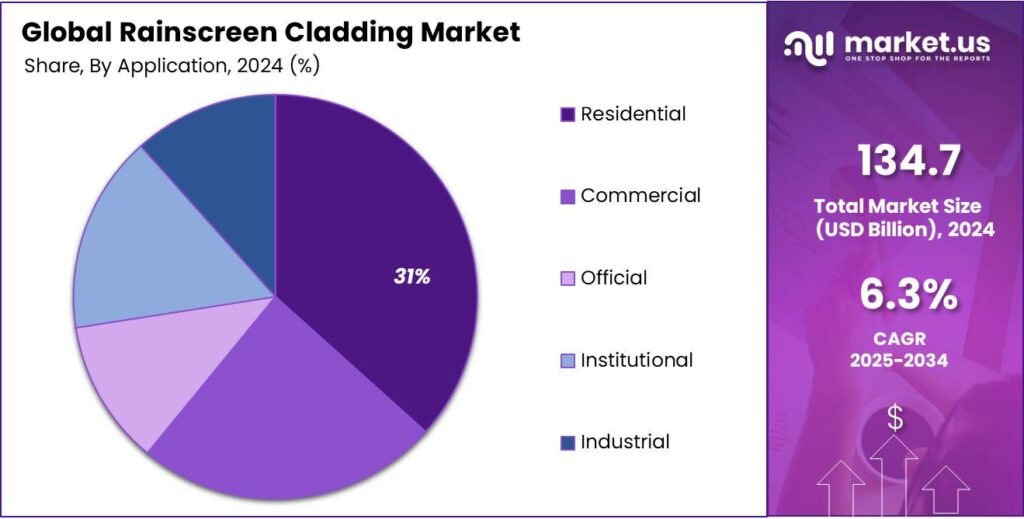

- Residential applications held a dominant market position in the rainscreen cladding industry, capturing more than a 31.6% share.

- New construction held a dominant market position in the rainscreen cladding industry, capturing more than a 67.9% share.

- Europe emerged as the leading regional market for rainscreen cladding, capturing a significant 45.9% share, equivalent to USD 61.8 billion.

By Raw Material Analysis

Fiber Cement Leads Rainscreen Cladding with 31.8% Share in 2024

In 2024, fiber cement held a dominant position in the rainscreen cladding market, capturing more than a 31.8% share. This dominance can be attributed to the material’s exceptional durability, low maintenance requirements, and cost-effectiveness. Manufactured from a blend of cement, cellulose fibers, and mineral fillers, fiber cement panels offer superior resistance to weathering, fire, and pests, making them a preferred choice for both residential and commercial applications.

The fiber cement segment is expected to maintain its leading market share, supported by continuous advancements in manufacturing technologies and the development of new product variants. These innovations aim to enhance the aesthetic appeal and performance characteristics of fiber cement panels, further solidifying their position in the rainscreen cladding market.

By Application Analysis

Residential Application Leads with 31.6% Share in 2024

In 2024, residential applications held a dominant market position in the rainscreen cladding industry, capturing more than a 31.6% share. This growth is largely driven by the increasing focus on energy-efficient and aesthetically appealing homes. Homeowners and developers are prioritizing cladding solutions that provide thermal insulation, weather resistance, and low maintenance, all of which are offered by modern rainscreen systems.

In addition, government initiatives promoting energy-efficient and sustainable housing are supporting the growth of this segment. Incentives for using eco-friendly construction materials and adherence to building codes focused on thermal performance further encourage the integration of rainscreen cladding in residential projects.

By Construction Type Analysis

New Construction Leads with 67.9% Share in 2024

In 2024, new construction held a dominant market position in the rainscreen cladding industry, capturing more than a 67.9% share. This strong presence is primarily driven by the rapid growth of urban infrastructure, commercial complexes, and residential projects worldwide. Builders and developers increasingly prefer rainscreen cladding for new constructions due to its ability to provide thermal insulation, weather protection, and enhanced aesthetic appeal, ensuring long-term building durability.

Additionally, building codes and energy efficiency regulations in regions like North America and Europe are promoting the integration of high-performance cladding systems in new buildings. This further strengthens the adoption of rainscreen cladding in new construction projects, as it helps meet regulatory requirements while improving the overall building envelope performance.

Key Market Segments

By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

By Construction Type

- New Construction

- Renovation

Emerging Trends

Integration of Solar & Photovoltaic Façades (BIPV & Solar Cladding)

A striking and human‑scale shift in rainscreen cladding is the growing integration of solar photovoltaics directly into façade systems, often called Building‑Integrated Photovoltaics (BIPV) or solar cladding. Rather than mounting solar panels separately on roofs or grounds, architects and façade engineers are weaving power generation into the wall itself. This trend not only beautifies buildings but also helps them produce electricity, which makes the façade an active participant in energy generation, not just a passive shell.

Recent studies estimate that façades can capture on average around 68.2% of the rooftop solar potential in many cities. That means for every 1.0 kW that rooftop solar could generate, façades might generate ~0.68 kW, depending on orientation, shading, and climate. In effect, walls become solar collectors. This is particularly valuable in dense urban zones where rooftop area is limited, but vertical surfaces are abundant.

In many countries, policy is nudging buildings to generate their own clean energy. Under India’s ECBC 2017, the code requires buildings to be “ready for installation of renewable energy” for a proportion of electricity demand. The newer ECSBC 2024 (Energy Conservation and Sustainable Building Code) further reinforces this direction, embedding sustainable building norms across residential and commercial domains. These rules help legitimize solar façades as not just optional, but increasingly expected.

Drivers

Regulatory & Policy Push for Energy‑Efficient Building Envelopes

One of the strongest reasons rainscreen cladding is gaining traction is because governments are increasingly mandating higher energy performance in buildings. This regulatory push is turning façades — walls, insulation, windows — into critical parts of energy saving strategies. In plain terms, building owners and architects no longer have the luxury of picking façade materials only by looks or cost — they must also meet stricter rules or face penalties.

In India, the building sector already consumes more than 30 % of the country’s total electricity. Because of rapid urbanisation and growth in commercial construction, energy demand from buildings is forecast to rise. The U.S. Energy Information Administration estimates that in India, delivered energy usage in residential and commercial buildings will grow at about 2.7% per year between 2015 and 2040. That means without regulation, the energy burden would escalate sharply.

- In the U.S., updated building energy codes already deliver significant savings. Modern energy codes now offer more than 30 % energy savings compared to codes from a decade ago, translating into over USD 60 billion in saved energy costs for homes and businesses. This shows what performance codes can do when enforced.

A real-world example helps make it human: Indira Paryavaran Bhawan, a government building in New Delhi, uses many energy-efficient features, including a high-performance envelope. It reduced its electricity use from what would normally be ~2,200,000 kWh in a conventional design to ~1,400,000 kWh — about 40% savings — in part thanks to its façade design.

Restraints

High Initial Costs, Complexity & Compliance Burden

Even though rainscreen cladding offers long‑term benefits, one of its biggest obstacles is the high upfront cost and complexity of design, installation, testing and compliance. Many developers hesitate when the immediate capital outlay and technical risks are significant.

First, the material and installation cost of rainscreen systems is often far higher than simpler cladding or conventional façades. Because rainscreen systems require support frames, ventilated cavities, precise fixings, moisture and air barriers, and high‑quality panels, the cost can run 20 % to even 50 % more than basic cladding systems in many projects (especially smaller ones). While exact numbers for rainscreen systems are seldom publicly disclosed, construction industry cost challenges broadly reflect this pressure: globally, rising input and labour costs are pushing building material costs upward and squeezing margins.

Second, complexity of design is a real barrier. Rainscreen systems must accommodate building movement (due to wind, seismic loads, temperature change), carry in‑plane forces, and avoid binding or stress at joints. Improper detailing can lead to failures or excessive maintenance. As one structural engineering article notes, accumulated drift across multiple floors can exceed 8 inches in tall walls, which must be allowed for in joint design and cladding interfaces.

- Third, regulatory compliance, fire safety tests and approvals impose extra burden. After high‑profile façade disasters (like the Grenfell Tower fire in the UK), authorities have become stricter about cladding fire performance. The cost of full‐scale fire tests (e.g., under NFPA 285 in the U.S.) is high (sometimes over USD 30,000 for a single assembly) and any changes to materials or configuration typically require retesting.

Opportunity

Deep Retrofit & Thermal Upgrade in Existing Building Stock

One of the most compelling growth avenues for rainscreen cladding lies in retrofitting existing buildings with upgraded façade systems. As more cities and nations push to decarbonize and reduce energy consumption, the “retrofit market” is becoming a natural fit for rainscreens that improve insulation, moisture control, and thermal performance — without needing to completely rebuild.

To understand the magnitude: per the International Energy Agency (IEA), renovating about 20 % of existing building stock to a “zero‑carbon ready” state by 2030 is viewed as an ambitious but necessary milestone for global decarbonization. This implies a required annual deep renovation rate of over 2 % per year across many markets. That means a large volume of buildings will need comprehensive façade and envelope upgrades. Rainscreen systems, when integrated with insulation and moisture barriers, are ideal for that upgrade path.

Governments and policy makers are beginning to support such retrofits. In India, the Green Building policy aims to make all new buildings conform to sustainability standards by 2030. Meanwhile, green incentives exist: in Gujarat, for instance, hotels or industrial buildings getting Indian Green Building Council (IGBC) ratings can get reimbursement of up to 50 % of consulting costs (max ₹2.5 lakh) or certification cost support (₹3 lakh or 50 %) from the Climate Change Department. That helps reduce the upfront financial barrier and makes retrofit more attractive.

Regional Insights

Europe Dominates Rainscreen Cladding Market with 45.9% Share in 2024

In 2024, Europe emerged as the leading regional market for rainscreen cladding, capturing a significant 45.9% share, equivalent to USD 61.8 billion. This dominant position is primarily driven by stringent building regulations, increasing urbanization, and growing emphasis on sustainable and energy-efficient construction practices across the region. European countries, particularly Germany, France, and the United Kingdom, are at the forefront of adopting advanced cladding systems that enhance thermal insulation, fire resistance, and overall building aesthetics.

The European market’s strong performance can also be attributed to substantial government initiatives supporting green construction. For instance, the European Union’s Green Deal and Renovation Wave aim to improve energy efficiency in both residential and commercial buildings, promoting the use of high-performance materials such as rainscreen cladding. These programs encourage retrofitting older buildings and integrating modern cladding systems into new construction projects, further driving demand.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kingspan Insulation plc is a global leader in advanced insulation and façade systems, known for high-performance rainscreen cladding solutions. Its Kooltherm and Optim-R product ranges offer ultra-thin insulation with superior thermal conductivity. With a strong sustainability focus, Kingspan aims to achieve Net Zero Carbon manufacturing by 2030. Operating in over 70 countries, it serves commercial, industrial, and residential sectors, supporting green building initiatives globally through energy-efficient façade products and integrated system offerings.

Carea Ltd. specializes in mineral composite rainscreen cladding panels, combining durability with customizable aesthetics. The company’s cladding systems are used in hospitals, schools, offices, and residential buildings, offering impact resistance and easy maintenance. Based in France, Carea exports its products across Europe and the Middle East. Its strength lies in delivering tailored solutions for energy-efficient façades with built-in insulation, aligned with modern architectural demands and environmental building regulations like HQE and BREEAM.

M.F. Murray Companies, Inc., based in the United States, offers rainscreen systems through its architectural metal wall panel solutions. With over 40 years in the industry, the firm provides design, fabrication, and installation of aluminum and composite panels tailored for commercial and institutional buildings. Known for project-specific customization, Murray ensures code-compliant assemblies with superior aesthetics. Their operations focus on curtainwall, metal façades, and integrated rainscreen envelopes, especially for high-rise and public infrastructure projects.

Top Key Players Outlook

- Kingspan Insulation plc

- Carea Ltd.

- M.F. Murray Companies, Inc.

- Celotex Ltd.

- CGL Facades Co.

- Rockwool International A/S

- FunderMax

- Everest Industries Ltd.

- Trespa International B.V.

- Euro Panels Overseas N.V.

Recent Industry Developments

In 2024, Kingspan’s insulation division continued expanding its position by acquiring a 51% stake in Steico, enhancing its product mix (wood‑fibre insulation) relevant to façade upgrades.

In 2024, Rockwool International A/S posted EUR 3,855 million in revenue (up about 6% in local currencies over 2023) and delivered an EBIT margin of 17.5 % (versus ~14.3% in 2023).

Report Scope

Report Features Description Market Value (2024) USD 134.7 Bn Forecast Revenue (2034) USD 248.1 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Fiber Cement, Composite Material, Metal, High Pressure Laminates, Terracotta, Ceramic, Others), By Application (Residential, Commercial, Official, Institutional, Industrial), By Construction Type (New Construction, Renovation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kingspan Insulation plc, Carea Ltd., M.F. Murray Companies, Inc., Celotex Ltd., CGL Facades Co., Rockwool International A/S, FunderMax, Everest Industries Ltd., Trespa International B.V., Euro Panels Overseas N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kingspan Insulation plc

- Carea Ltd.

- M.F. Murray Companies, Inc.

- Celotex Ltd.

- CGL Facades Co.

- Rockwool International A/S

- FunderMax

- Everest Industries Ltd.

- Trespa International B.V.

- Euro Panels Overseas N.V.