Global Quinoa Starch Market Size, Share, And Enhanced Productivity By Source (White Quinoa, Red Quinoa, Black Quinoa, Mixed/Tricolor Quinoa), By Product Format (Powder, Granules, Gel), By Purity Level (Native Quinoa Starch, Purified/Isolated Quinoa Starch), By Functionality (Thickening Agent, Stabilizer, Binder, Texturizer, Fat Replacer), By Distribution Channel (B2B, B2C), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172730

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Source Analysis

- By Product Format Analysis

- By Purity Level Analysis

- By Functionality Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

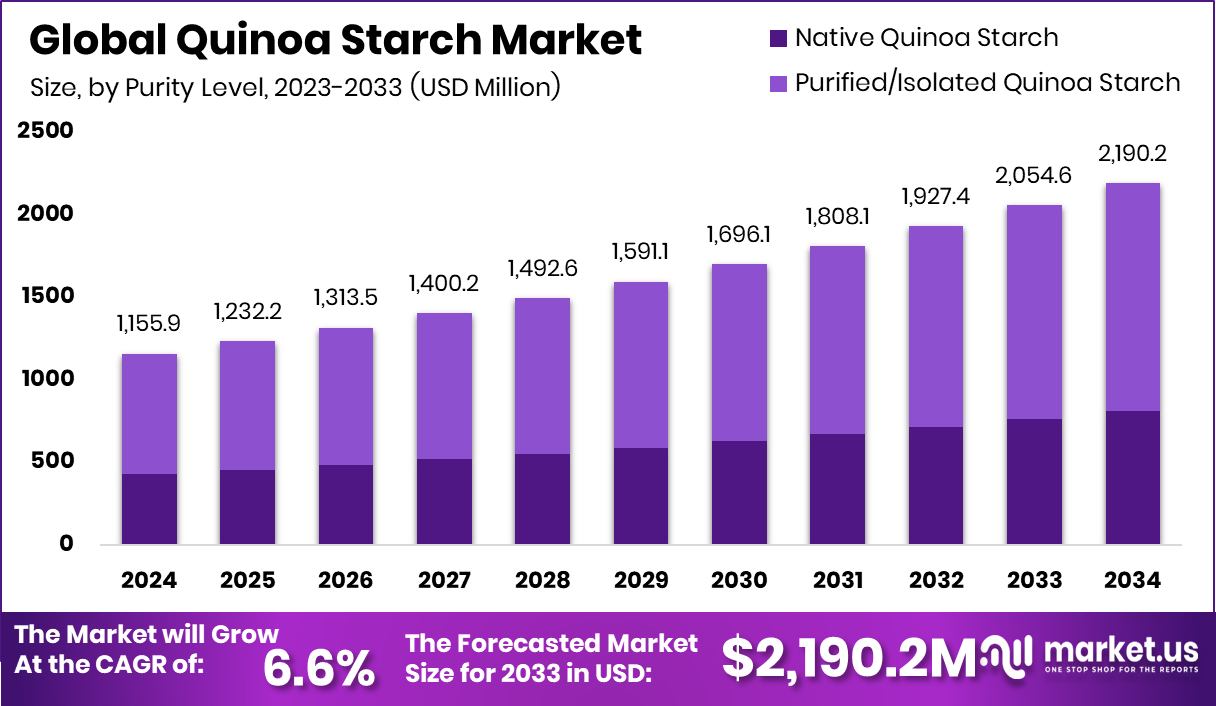

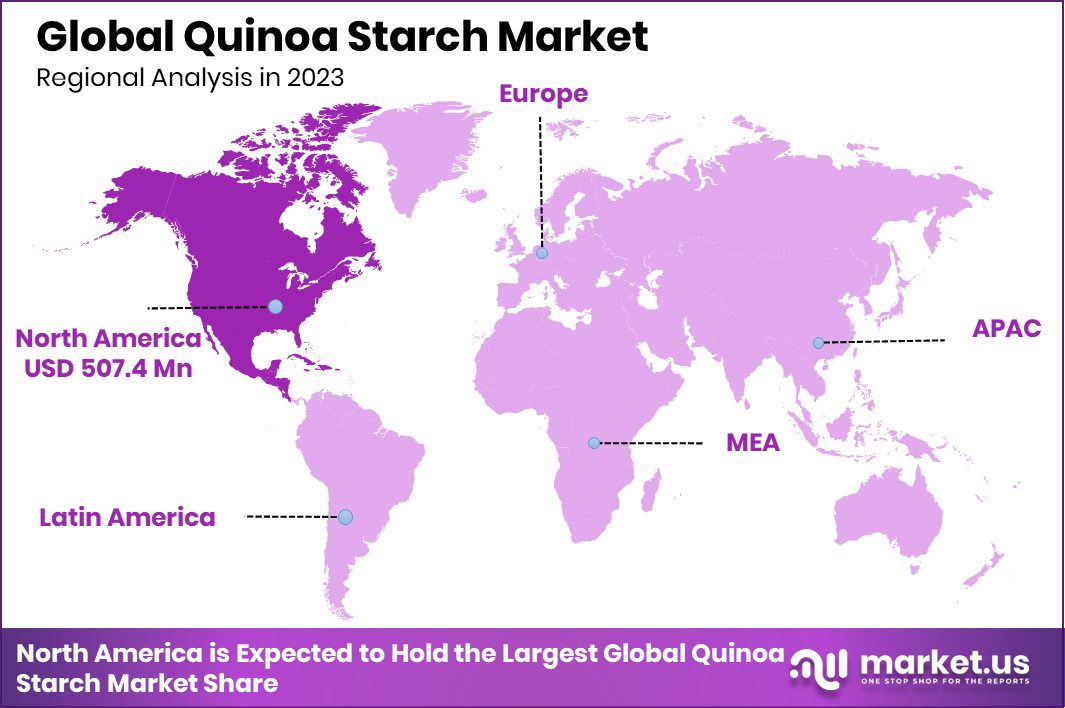

The Global Quinoa Starch Market is expected to be worth around USD 2,190.2 million by 2034, up from USD 1155.9 million in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034. North America dominates the quinoa starch market, accounting for 43.90% share and USD 507.4 Mn.

Quinoa starch is a fine, white carbohydrate extracted from the seeds of the quinoa plant. It acts as a natural thickener, binder, and texture enhancer in food products like sauces, soups, gluten-free baked goods, and dairy alternatives. Unlike many conventional starches, quinoa starch is naturally gluten-free and has a neutral taste, making it attractive for clean-label and health-focused formulations. Its ability to improve mouthfeel and stability under heat also makes it useful in industrial applications beyond food.

The Quinoa Starch Market refers to the global commercial ecosystem where this ingredient is produced, sold, and used by food manufacturers, nutraceutical brands, and ingredient suppliers. This market includes the growth, processing, distribution, and demand for quinoa starch across regions. Increasing consumer interest in plant-based, gluten-free, and functional foods has expanded this market’s relevance, encouraging more investment into quinoa value chains.

Growth factors for quinoa starch include broader consumer demand for natural and healthy ingredients, supportive agricultural initiatives, and innovations in crop technology. Funding momentum, such as Nourish You securing INR 16 Cr in Series A funding led by SIDBI Venture Capital and the Superfood Brand Nourish You raising $2 million in seed funding, indicates investor confidence in plant-based food ingredient ecosystems.

Demand for quinoa starch grows as more food producers reformulate products to meet health trends. Additionally, grassroots agricultural developments, like a student bringing quinoa to Ladakh that can help farmers earn up to Rs 1000 per kg, support local supply, and diversify raw material sources. These shifts strengthen regional participation in quinoa ingredient markets.

Opportunity lies in technological and agro innovations. With agtech receiving attention — for example, Singapore State Fund Temasek investing in seed tech companies and ClearPath Robotics raising $30m — there is room to enhance crop yields and processing efficiency, which could lower costs and broaden quinoa starch adoption across emerging food segments.

Key Takeaways

- The Global Quinoa Starch Market is expected to be worth around USD 2,190.2 million by 2034, up from USD 1155.9 million in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

- In the Quinoa Starch Market, white quinoa sources dominated with 49.7% share globally overall.

- Powder format led the Quinoa Starch Market, capturing 56.3% demand across food applications globally.

- Purified or isolated quinoa starch held 63.2% share, driven by clean-label requirements worldwide.

- Thickening agent functionality accounted for 31.6% usage within the evolving Quinoa Starch Market landscape.

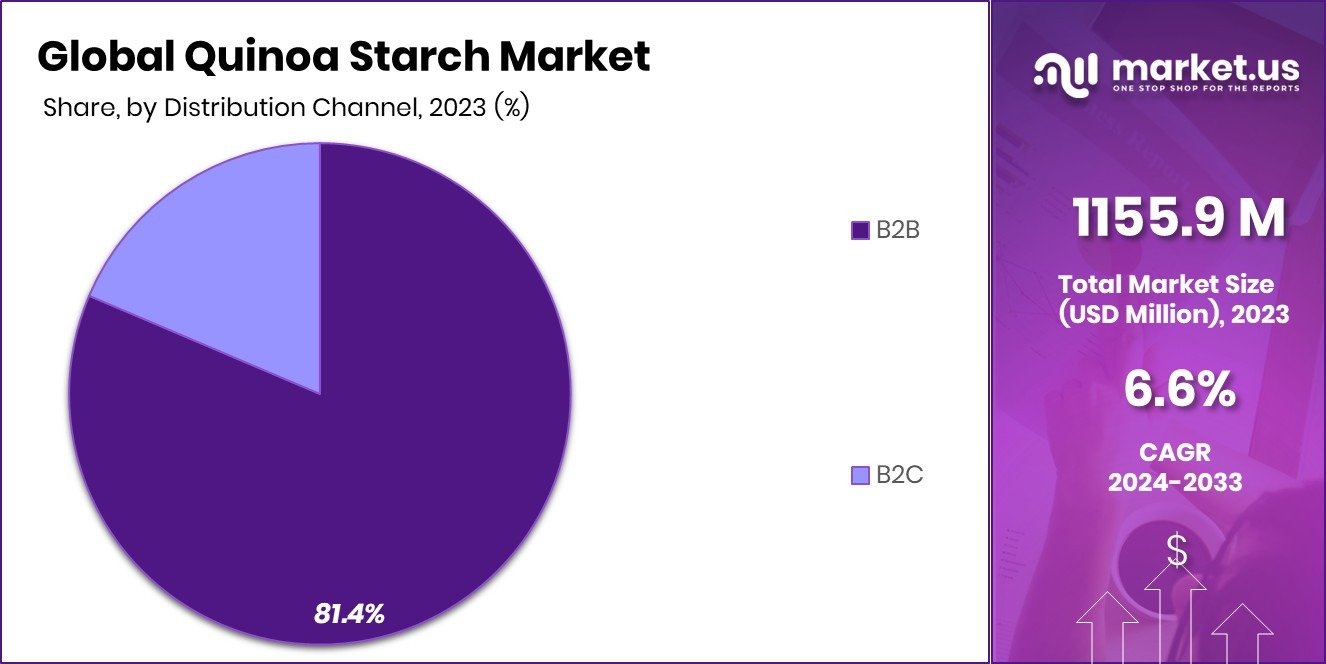

- B2B distribution channels dominated with 81.4% share, reflecting strong industrial and ingredient demand growth.

- In North America, the quinoa starch market reaches a 43.90% share, totaling USD 507.4 Mn.

By Source Analysis

White quinoa dominates the quinoa starch market with 49.7% source share globally.

In 2024, the White Quinoa segment held a dominant 49.7% share in the global Quinoa Starch Market, driven by its consistent starch yield and neutral sensory profile. White quinoa is widely preferred by processors because it delivers stable viscosity, clean color, and predictable performance across food and industrial formulations. Its wider cultivation base also ensures reliable raw material availability, reducing supply risks for manufacturers.

Food brands increasingly choose white quinoa starch for gluten-free bakery, sauces, and ready meals, where product appearance and texture consistency matter. In addition, white quinoa aligns well with clean-label positioning, as it requires fewer processing adjustments. This balance of performance, availability, and consumer acceptance makes white quinoa the primary source supporting large-scale starch extraction and commercial adoption.

By Product Format Analysis

Powder format leads the Quinoa Starch Market, holding 56.3% demand worldwide.

In 2024, the Powder format accounted for a leading 56.3% share of the Quinoa Starch Market, reflecting strong demand for easy-to-handle and versatile ingredient forms. Powdered quinoa starch offers advantages in storage stability, transportation efficiency, and precise dosing during formulation.

Manufacturers prefer powder formats because they blend uniformly into dry mixes, instant foods, and nutraceutical products without additional processing steps. This format is also compatible with automated production lines, helping reduce labor costs and formulation variability.

In foodservice and packaged food applications, powdered quinoa starch supports faster dispersion and consistent thickening results. Its longer shelf life compared to liquid alternatives further strengthens its role, making powder the most commercially viable and scalable product format in global markets.

By Purity Level Analysis

Purified quinoa starch strengthens the quinoa starch market, capturing 63.2% purity demand.

In 2024, Purified/Isolated Quinoa Starch dominated the market with a 63.2% share, highlighting strong demand for high-performance and application-specific ingredients. Purified starch offers superior functional consistency, reduced impurities, and better control over texture and viscosity. These qualities are especially valuable in premium food products, infant nutrition, and pharmaceutical formulations, where quality standards are strict.

Manufacturers favor isolated quinoa starch for its predictable behavior under heat, shear, and varying pH conditions. Its gluten-free and allergen-friendly profile further supports adoption in specialized diets. Although purification adds processing cost, the resulting performance benefits justify the investment. As a result, purified quinoa starch continues to be the preferred choice for value-added and high-margin applications.

By Functionality Analysis

Thickening functionality supports the quinoa starch market, accounting for 31.6% applications globally.

In 2024, the Thickening Agent functionality led the Quinoa Starch Market with a 31.6% share, driven by its effectiveness in improving texture and mouthfeel. Quinoa starch delivers smooth, stable viscosity without overpowering flavor, making it suitable for soups, sauces, dairy alternatives, and plant-based products. Its natural origin appeals to clean-label and health-focused brands seeking alternatives to modified starches.

Compared to conventional starches, quinoa starch performs well at lower usage levels, helping formulators optimize costs. It also maintains stability during freezing and reheating cycles, which is critical for ready-to-eat foods. These functional advantages reinforce its strong position as a preferred thickening solution across multiple food and beverage categories.

By Distribution Channel Analysis

B2B channels dominate the quinoa starch market, representing 81.4% distribution share worldwide

In 2024, B2B distribution channels dominated the quinoa starch market with a substantial 81.4% share, reflecting the ingredient’s strong industrial orientation. Most quinoa starch volumes are sold directly to food manufacturers, nutraceutical producers, and pharmaceutical companies through long-term supply contracts.

B2B buyers prioritize consistent quality, bulk pricing, and technical support, which favors direct supplier relationships. This channel structure also enables customization of starch purity and functionality to meet specific formulation needs.

Compared to retail sales, B2B distribution offers higher volume stability and predictable demand patterns. As industrial applications expand, especially in clean-label and gluten-free products, B2B channels remain the backbone supporting market growth and scale.

Key Market Segments

By Source

- White Quinoa

- Red Quinoa

- Black Quinoa

- Mixed/Tricolor Quinoa

By Product Format

- Powder

- Granules

- Gel

By Purity Level

- Native Quinoa Starch

- Purified/Isolated Quinoa Starch

By Functionality

- Thickening Agent

- Stabilizer

- Binder

- Texturizer

- Fat Replacer

By Distribution Channel

- B2B

- B2C

Driving Factors

Growing Demand for Healthier, Natural Ingredient Choices

Consumers are increasingly choosing healthier foods, which is a major driving factor for the Quinoa Starch Market. People are more aware of how ingredients affect their health, pushing food makers to replace artificial additives with natural alternatives like quinoa starch. This starch is gluten-free, mild in taste, and works well as a thickener and binder in sauces, soups, gluten-free baked goods, and plant-based foods.

As customers avoid ultra-processed foods (UPFs), startups and brands focusing on real, plant-based ingredients are gaining investor attention — for example, With UPFs Under Fire, Investors Bet $7M on Actual Veggies After Revenues Double shows how money is shifting into healthier food solutions. This funding highlights that the market is moving toward simple, clean ingredients. With this growing interest, quinoa starch is becoming an important natural ingredient choice for food companies aiming to meet modern consumer expectations for transparency, nutrition, and simplicity.

Restraining Factors

High Production Costs and Supply Constraints Affect Growth

One key restraining factor for the Quinoa Starch Market is the high cost and limited availability of quinoa raw materials, which makes production of quinoa starch expensive compared to common starches like corn or potato starch. Quinoa requires specific growing conditions, and yields can vary widely by region. This leads to supply uncertainty and higher prices for manufacturers who want to use quinoa starch in food products.

At the same time, investor funding trends such as With UPFs Under Fire, Investors Bet $7M on Actual Veggies After Revenues Double and Kelp burger startup raises $3.2 million seed funding show that money is flowing into plant-based innovation broadly, but many of these investments focus on novel foods rather than improving quinoa supply chains. Without targeted investment to expand quinoa cultivation and processing infrastructure, the Quinoa Starch Market may struggle with cost pressures and limited scalability. This can slow adoption by larger food producers still focused on price competitiveness.

Growth Opportunity

Rising Plant-Based Alternative Products Create Opportunities

A key growth opportunity for the Quinoa Starch Market lies in the rising demand for plant-based and clean-label food products, where quinoa starch can play a valuable role. As more consumers choose alternatives to dairy and animal-derived ingredients, food developers are looking for natural plant ingredients that deliver functionality without compromising taste or texture.

Quinoa starch fits this need well, acting as a thickener, stabilizer, and texture enhancer in plant-based alternatives like dairy-free yogurts and sauces. This trend is gaining backing from investors, as seen in Time-Travelling Milkman Gears Up to Launch Dairy Fat Alternative with $2.3M Funding, where new plant-focused food technologies attract capital to innovate beyond traditional products.

Such funding highlights strong market interest in developing new alternatives and creating room for ingredients like quinoa starch to expand. With growing plant-based product launches and supportive investment flows, quinoa starch has the opportunity to become a go-to ingredient in emerging alternative food formulations.

Latest Trends

Fat Replacement and Texture Innovation Drives Ingredient Trend

A major trend in the Quinoa Starch Market is the growing use of quinoa starch in fat-reduced and texture-enhanced food products. As consumers become more health-conscious, food companies are reformulating products to lower fat content while keeping a pleasing mouthfeel.

Quinoa starch works well as a natural ingredient that can help replace fat and improve texture in sauces, dressings, and plant-based foods. This trend is supported by recent investments in fat-replacement technology, such as MicroLub closes £3.5m investment round to commercialise fat replacement tech, which shows that capital is flowing into solutions making foods healthier without taste compromise.

With such technological advances gaining financial backing, quinoa starch stands to benefit as a functional, clean-label ingredient. This trend aligns with broader consumer demands for foods that are both healthier and enjoyable, positioning quinoa starch as a rising choice for formulators looking to innovate in fat-reduced and texture-focused products.

Regional Analysis

North America leads Quinoa Starch Market with 43.90% share at USD 507.4 Mn.

In the Quinoa Starch Market, North America emerged as the dominating region in 2024, holding a 43.90% market share valued at USD 507.4 Mn. This leadership is supported by strong demand from food manufacturers focusing on gluten-free, clean-label, and plant-based formulations, where quinoa starch is widely used as a functional ingredient. The region benefits from well-established ingredient processing infrastructure and high adoption of alternative starches in packaged foods and nutrition products.

Europe follows with steady growth driven by clean-label regulations and rising use of quinoa-based ingredients in bakery, dairy alternatives, and infant nutrition applications. Asia Pacific represents an emerging growth region, supported by expanding food processing capacity and increasing awareness of functional plant ingredients across urban markets.

In the Middle East & Africa, demand remains niche but is gradually improving due to premium food imports and growing health-focused consumer segments. Latin America, as a quinoa-producing region, plays a strategic role in raw material supply while steadily increasing regional consumption of value-added quinoa starch products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Inka Crops continues to strengthen its position in the global Quinoa Starch Market through vertical integration and origin-based sourcing. The company benefits from close ties with quinoa-growing regions, allowing better control over raw material quality and traceability. Its operational focus on value-added quinoa derivatives supports consistent starch characteristics, which are important for food manufacturers targeting clean-label formulations. From an analyst perspective, Inka Crops’ ability to align agricultural sourcing with ingredient processing enhances supply reliability and long-term competitiveness. This structure also allows flexibility in meeting customized starch specifications for industrial buyers.

Northern Quinoa Production Corporation plays a strategic role by focusing on standardized quinoa processing and ingredient consistency. In 2024, the company’s emphasis on controlled processing environments supports uniform starch performance across applications such as thickening and texture improvement. Analysts note that its operational discipline and process optimization help reduce variability, which is a critical requirement for B2B customers. By prioritizing quality control over volume-driven expansion, the company positions itself as a dependable supplier for manufacturers seeking functional reliability rather than commodity pricing.

Andean Naturals brings a differentiated approach to the Quinoa Starch Market through its strong clean-label and natural ingredient positioning. In 2024, the company’s brand equity supports growing interest in quinoa starch derived from responsibly sourced quinoa. Analysts view Andean Naturals as well-aligned with premium food and nutrition segments, where ingredient transparency and origin matter. Its focus on natural processing supports demand from manufacturers targeting health-conscious consumers.

Top Key Players in the Market

- Inka Crops

- Northern Quinoa Production Corporation

- Andean Naturals

- Barentz

- Oegema Grains

- Quessentials Pvt Ltd.

- Ardent Mills

- The British Quinoa Company

Recent Developments

- In 2024, Ardent Mills introduced two new plant-based ingredient solutions as part of its product portfolio to help food developers with functional needs for cost, supply stability, and consumer trends. This included items like Egg Replace (a plant-based egg alternative) and a baking flour blend with ancient grains and chickpeas that supports protein enrichment and gluten-free needs — positioning the company for broader ingredient demand.

Report Scope

Report Features Description Market Value (2024) USD 1155.9 Million Forecast Revenue (2034) USD 2,190.2 Million CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (White Quinoa, Red Quinoa, Black Quinoa, Mixed/Tricolor Quinoa), By Product Format (Powder, Granules, Gel), By Purity Level (Native Quinoa Starch, Purified/Isolated Quinoa Starch), By Functionality (Thickening Agent, Stabilizer, Binder, Texturizer, Fat Replacer), By Distribution Channel (B2B, B2C) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Inka Crops, Northern Quinoa Production Corporation, Andean Naturals, Barentz, Oegema Grains, Quessentials Pvt Ltd., Ardent Mills, The British Quinoa Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Inka Crops

- Northern Quinoa Production Corporation

- Andean Naturals

- Barentz

- Oegema Grains

- Quessentials Pvt Ltd.

- Ardent Mills

- The British Quinoa Company