Global PVC Paste Resin Market By Process (Micro-Suspension Process and Emulsion Process), By Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, and Others), By End-Use Industry (Construction, Automotive, Electronics, Packaging, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: September 2025

- Report ID: 157677

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

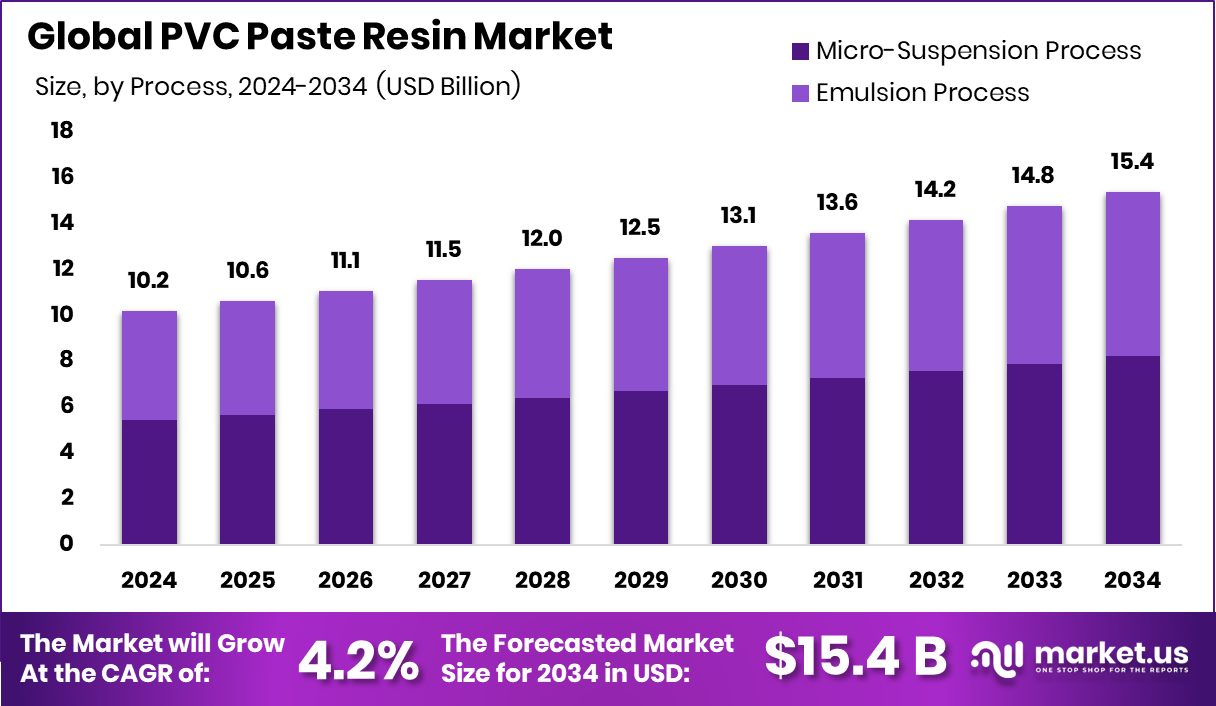

In 2024, the Global PVC Paste Resin Market was valued at US$10.2 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 4.2%, reaching about US$15.4 billion by 2034.

PVC paste resin is a fine particle-sized polyvinyl chloride powder, which, when mixed with plasticizers, forms a stable, non-fluid paste called a plastisol. It is highly versatile due to its chemical stability, durability, and electrical insulating properties, which remain even after being mixed with additives.

This paste is used in processing techniques, such as coating, dipping, and spraying, to create a wide range of flexible PVC products, including artificial leather, gloves, floorings, and wallpapers.

Some of the major drivers of the market are the demand for PVC resins from the construction industry and the automotive industry. In recent years, as there has been a global shift towards sustainable practices, the PVC paste resin market is experiencing the development of phthalate-free plasticizers and bio-based PVC alternatives.

Despite the advantages of PVC and the technological advancements in the market, the market may face challenges due to environmental concerns regarding the manufacturing and disposal of PVC products, due to high chlorine content.

- Polyvinyl chloride (PVC) is one of the most used plastics in the world, as global use of PVC resin exceeds 40 million tons per year.

Key Takeaways

- The global PVC paste resin market was valued at US$10.2 billion in 2024.

- The global PVC paste resin market is projected to grow at a CAGR of 4.2% and is estimated to reach US$15.4 billion by 2034.

- Based on the process, PVC paste resin that is produced through the micro-suspension process dominated the market in 2024, comprising about 53.4% share of the total global market.

- Based on the grade of PVC paste resins, high K-value grade resins led the market with approximately 42.9% of the market share.

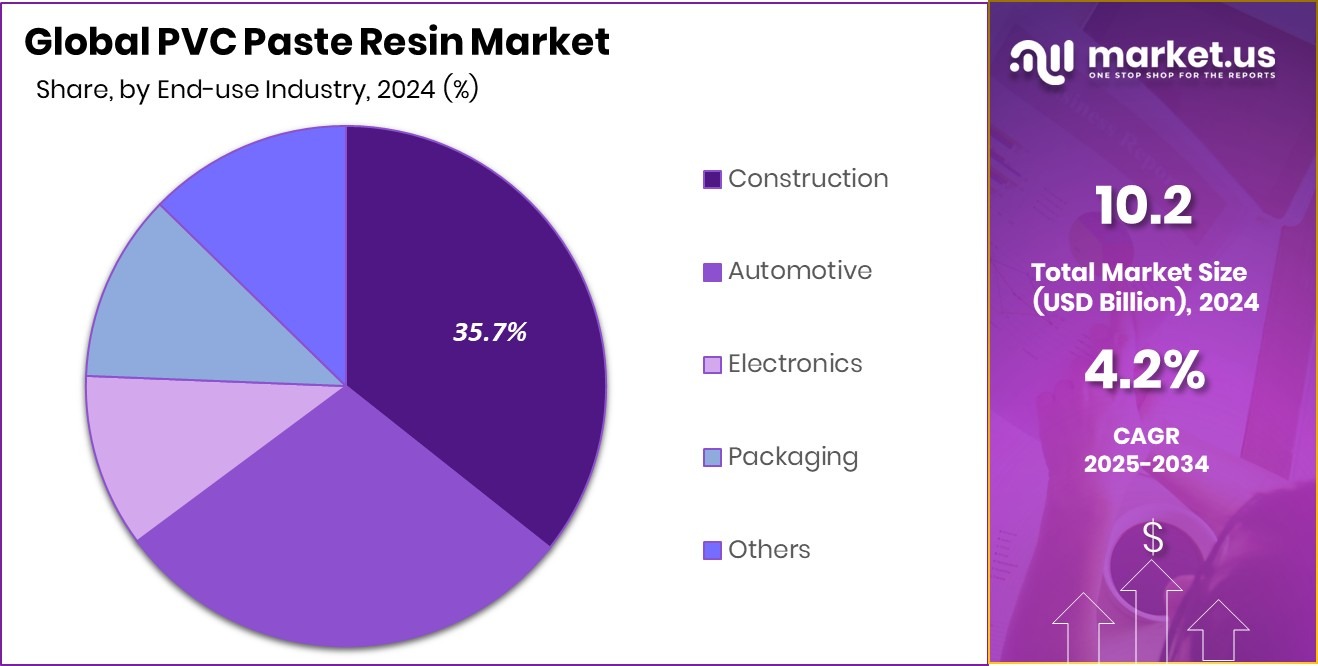

- Among the end-use industries, PVC paste resins are used in the construction sector, and hence, they dominated the market in 2024, accounting for around 35.7% of the market share.

- Asia Pacific was the largest market for PVC paste resin in 2024 due to its rapidly expanding construction industry, comprising around 42.5% of the total global market share.

Process Analysis

PVC Paste Resin, Produced Through a Micro-Suspension Process, Dominated the Market.

On the basis of the process through which PVC paste resins are produced, the market is segmented into the micro-suspension process and the emulsion process. PVC paste resin manufactured by the micro-suspension process dominated the market in 2024 with a market share of 53.4%.

PVC paste resins are predominantly produced via the micro-suspension process because it yields paste resins with better flow, lower viscosity, and improved thermal and water resistance compared to the emulsion process.

Additionally, the micro-suspension process allows for better control over particle size (around 1 μm), leading to more consistent and desirable properties in the final product. Similarly, the process requires fewer emulsifiers, which contributes to higher purity and better overall resin properties.

Grade Analysis

PVC Paste Resin of High K-Value Grade Dominated the Market Due to Its Chemical Properties.

Based on the grade of the PVC paste resins, the market is segmented into high K-value grade, mid K-value grade, low K-value grade, and others. PVC paste resin of high K-value dominated the market in 2024 with a market share of 42.9%.

Higher K-values indicate a higher molecular weight, which results in increased tensile strength, modulus, and impact properties. This makes high K-value PVC ideal for products that need to withstand significant stress and strain. With increased molecular weight, high K-value PVC offers better resistance to creep, deformation, and flex fatigue, leading to longer-lasting products.

Applications that require stiffness and structural integrity, such as rigid pipes, window frames, and building profiles, benefit from the inherent strength of high K-value resins. While lower K-values are easier to process and suitable for flexible films or packaging, high K-values are used for high-performance cable insulations, tough coatings, and other demanding industrial uses.

End-Use Industry Analysis

The construction industry dominated the PVC paste resin market in 2024.

Based on the applications of the PVC paste resin, the market is segmented into construction, automotive, electronics, packaging, and others. The construction industry led the PVC paste resin market in 2024 with 35.7% of the total market share.

PVC is a dominant material in construction due to its high durability, low cost, versatility, and resistance to water, corrosion, and weather, offering advantages over traditional materials, such as wood and metal.

In addition, its inherent flame-retardant properties, ease of installation, lightweight nature, and long service life further make it an attractive and sustainable choice for various applications, such as pipes, electrical wiring, flooring, and window profiles.

Key Market Segments

By Process

- Micro-Suspension Process

- Emulsion Process

By Grade

- High K-Value Grade

- Mid K-Value Grade

- Low K-Value Grade

- Others

By End-Use Industry

- Construction

- Automotive

- Electronics

- Packaging

- Others

Drivers

Demand for PVC Paste Resin for the Construction Industry Drives the Market.

The construction industry is a major driver of demand for PVC paste resin, owing to its versatility, durability, and cost-effectiveness in producing materials, such as flooring, wall coverings, window profiles, pipes, and roofing membranes. PVC paste resins offer resistance to moisture, chemicals, and UV exposure, making them ideal for both residential and commercial applications.

In rapidly urbanizing countries such as India and China, infrastructure development, including affordable housing, smart cities, and transportation projects, has significantly increased the use of PVC-based products.

For instance, in Europe, sustainable building practices have favored PVC due to its recyclability and energy efficiency in applications, such as insulated window frames. The construction sector’s ongoing need for durable, low-maintenance, and adaptable materials ensures a steady demand for PVC paste resin globally.

Restraints

Environmental Concerns Might Restrain the PVC Paste Resin Market from Growing.

Environmental concerns are increasingly posing significant restraints on the growth of the PVC paste resin market. One of the primary issues lies in the production and disposal of PVC, which generates toxic by-products such as dioxins, classified as persistent organic pollutants (POPs) by the WHO.

These compounds can accumulate in the food chain and pose serious health risks, including cancer, impairment of the immune system, and reproductive issues. Moreover, PVC paste resins commonly use plasticizers such as phthalates, several of which have been linked to endocrine disruption and developmental toxicity. As a result, the EU has restricted the use of several phthalates under REACH regulations, while California’s Proposition 65 lists multiple phthalates as hazardous.

Moreover, PVC is non-biodegradable and challenging to recycle due to its chlorine content, contributing to long-term environmental pollution. These environmental and regulatory pressures are compelling manufacturers to seek alternative materials and greener formulations, potentially limiting the market’s expansion unless sustainable innovations are adopted widely.

Opportunity

Applications of PVC Paste Resin in the Automotive Industry Create Opportunities in the Market.

The automotive industry presents significant opportunities for the PVC paste resin market due to its demand for lightweight, durable, and cost-effective materials. PVC paste resin is widely used in automotive interiors, including seat coverings, dashboards, door trims, and floor mats, owing to its flexibility, abrasion resistance, and ability to be easily molded into complex shapes.

For instance, over 60% of car interiors in modern vehicles incorporate some form of PVC-based component, as it helps reduce overall vehicle weight and enhances fuel efficiency, a crucial factor given increasingly stringent emissions regulations worldwide.

Furthermore, PVC paste resin provides insulation and flame-retardant properties, making it suitable for wire harness coatings and protective sheaths. With the global shift toward electric vehicles, which rely heavily on lightweight materials to extend battery range, the demand for advanced PVC applications is expected to rise further.

Trends

Shift Towards Sustainable Practices.

The shift towards sustainable practices is becoming a defining trend in the PVC paste resin market, driven by increasing environmental awareness and tightening global regulations. Manufacturers are focusing on developing phthalate-free plasticizers and bio-based PVC alternatives to reduce toxicity and carbon footprints.

For instance, DEHP plasticizers have been linked to health risks, prompting several regions, such as the EU and parts of Asia, to restrict their use. In response, companies are adopting alternative plasticizers such as DOTP and DINCH, which are considered safer and eco-friendly. Also, there is a focus on innovations in recycling technologies of PVC materials.

There is a demand from the automotive and medical sectors for greener materials to meet regulatory and consumer expectations. This growing push for sustainability is reshaping production processes and encouraging long-term investment in R&D for environmentally responsible PVC formulations.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the PVC Paste Resin Market.

Geopolitical tensions have a considerable impact on the global PVC paste resin market, particularly by disrupting supply chains, increasing raw material costs, and creating trade uncertainties. PVC production heavily relies on feedstock such as ethylene and chlorine, which are derived from oil and natural gas, commodities that are highly sensitive to geopolitical instability.

For instance, the Russia-Ukraine conflict led to volatility in energy prices, directly affecting the cost of vinyl chloride monomer (VCM), a key precursor in PVC manufacturing. Furthermore, export restrictions and sanctions imposed on petrochemical-producing nations can limit global resin availability, causing price spikes and supply shortages. Similarly, trade tensions between major economies, such as the U.S. and China, have resulted in increased tariffs on chemical imports and exports, further impacting the PVC value chain.

These uncertainties force manufacturers to diversify supply sources and invest in local production capacity, increasing operational costs. Furthermore, tariffs, such as the Indian government’s additional anti-dumping duties (ADDs) on imports of paste polyvinyl chloride (e-PVC) from China, South Korea, Malaysia, Norway, Taiwan, and Thailand, create price fluctuation, further deteriorating investments.

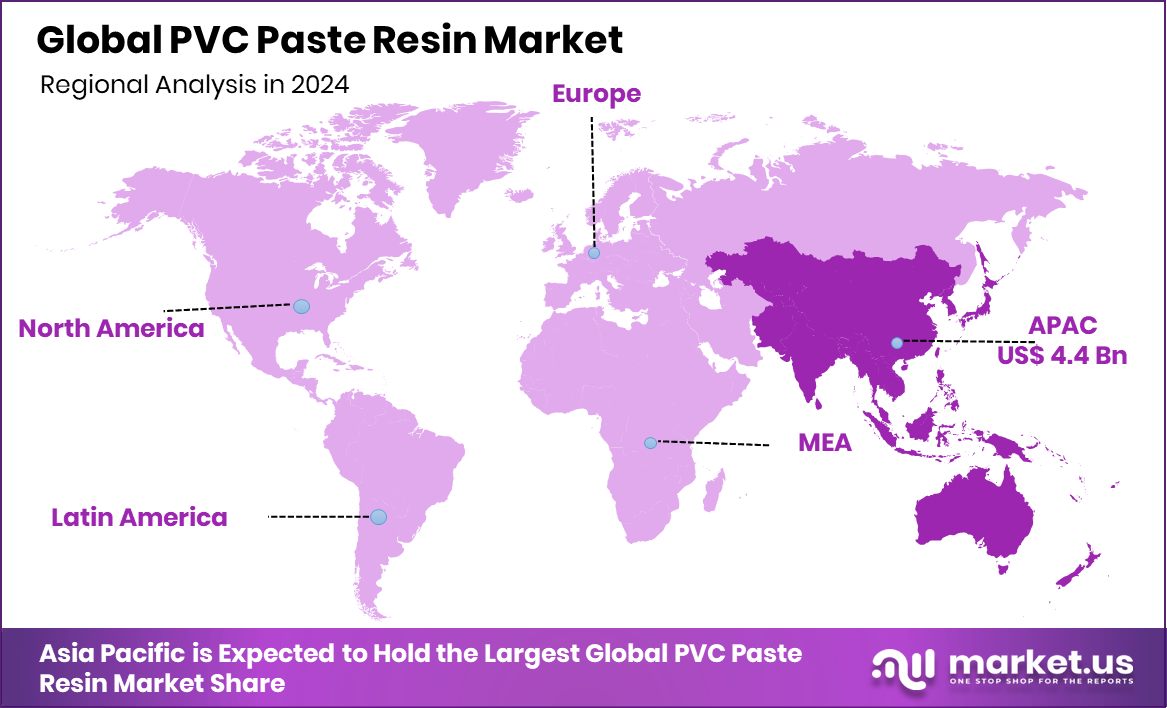

Regional Analysis

Asia Pacific was the Largest Market for PVC Paste Resin in 2024.

Asia Pacific held the major share of the global PVC paste resin market with 42.5% of the market share, valued at around US$4.4 billion. The region emerged as the largest market for PVC paste resin, primarily driven by rapid industrialization, urbanization, and a booming manufacturing sector across countries, such as China, India, South Korea, and Southeast Asian nations.

China alone accounts for almost 38% of global PVC consumption, owing to its extensive infrastructure projects and massive production base for consumer goods, automotive components, and construction materials. Similarly, in India, rising demand for affordable housing and government-backed infrastructure schemes such as smart cities have boosted the need for PVC-based products such as wall coverings, flooring, and pipes.

Additionally, the Asia Pacific is a major hub for automotive production, with Japan, China, and South Korea ranking among the top global vehicle producers, further fueling demand for PVC paste resins in car interiors and wiring.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Player Analysis

Several leading companies in the PVC paste resin market are actively pursuing strategic initiatives, such as product innovation, investments, mergers, and partnerships, to strengthen their market position. For instance, in February 2024, Chemplast Sanmar commenced commercial production of its specialty paste PVC resin facility in Cuddalore, India, at an investment of INR360 crores. Prominent players in this industry include INEOS Group, LG Chem, Westlake Corporation, Hanwha Solutions Corporation, Orbia, Tosoh Corporation, Formosa Plastics Corporation, SCG Chemicals Public Company, Kaneka Corporation, and Chemplast Sanmar.

INEOS produces PVC paste resin as a component for its compounds, which are used to formulate a wide range of products. The company produces specialty PVC resins using emulsion polymerization.

LG Chem is a global leader in advanced materials, petrochemicals, life sciences, and energy solutions, with PVC paste resin being a product within its petrochemical portfolio. However, the company is actively transforming itself from a petrochemical-focused business to a science company.

Westlake Corporation is a global manufacturer of petrochemicals, polymers, and building products, including a wide range of PVC resins. The company is a major producer of PVC, with significant production capacity across its facilities in the US, Germany, and China. The company is known to emphasize environmental stewardship and sustainability in its manufacturing practices.

Top Key Players in the Market

- INEOS Group Limited

- LG Chem

- Westlake Corporation

- Hanwha Solutions Corporation

- Orbia

- Tosoh Corporation

- Formosa Plastics Corporation

- SCG Chemicals Public Company Limited

- Kaneka Corporation

- Chemplast Sanmar

- Other Key Players

Recent Developments

- In January 2025, Kaneka Corporation announced that terminate its contract with Toagosei Co., Ltd. for the consignment of the production of polyvinyl chloride at the end of December 2025 to restructure its system for production in-house.

- In May 2024, INEOS Innovyn launched pilot plants to advance the recycling of PVC, including paste PVC, as part of its Project Circle initiative.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 15.4 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Micro-Suspension Process, Emulsion Process), By Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Others), By End-Use Industry (Construction, Automotive, Electronics, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape INEOS Group Limited, LG Chem, Westlake Corporation, Hanwha Solutions Corporation, Orbia, Tosoh Corporation, Formosa Plastics Corporation, SCG Chemicals Public Company Limited, Kaneka Corporation, Chemplast Sanmar, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  PVC Paste Resin MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

PVC Paste Resin MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- INEOS Group Limited

- LG Chem

- Westlake Corporation

- Hanwha Solutions Corporation

- Orbia

- Tosoh Corporation

- Formosa Plastics Corporation

- SCG Chemicals Public Company Limited

- Kaneka Corporation

- Chemplast Sanmar

- Other Key Players