Global Potassium Benzoate Market Size, Share, And Business Benefit By Grade (Food Grade, Pharmaceutical Grade), By Application (Food and Beverages, Personal Care, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162585

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

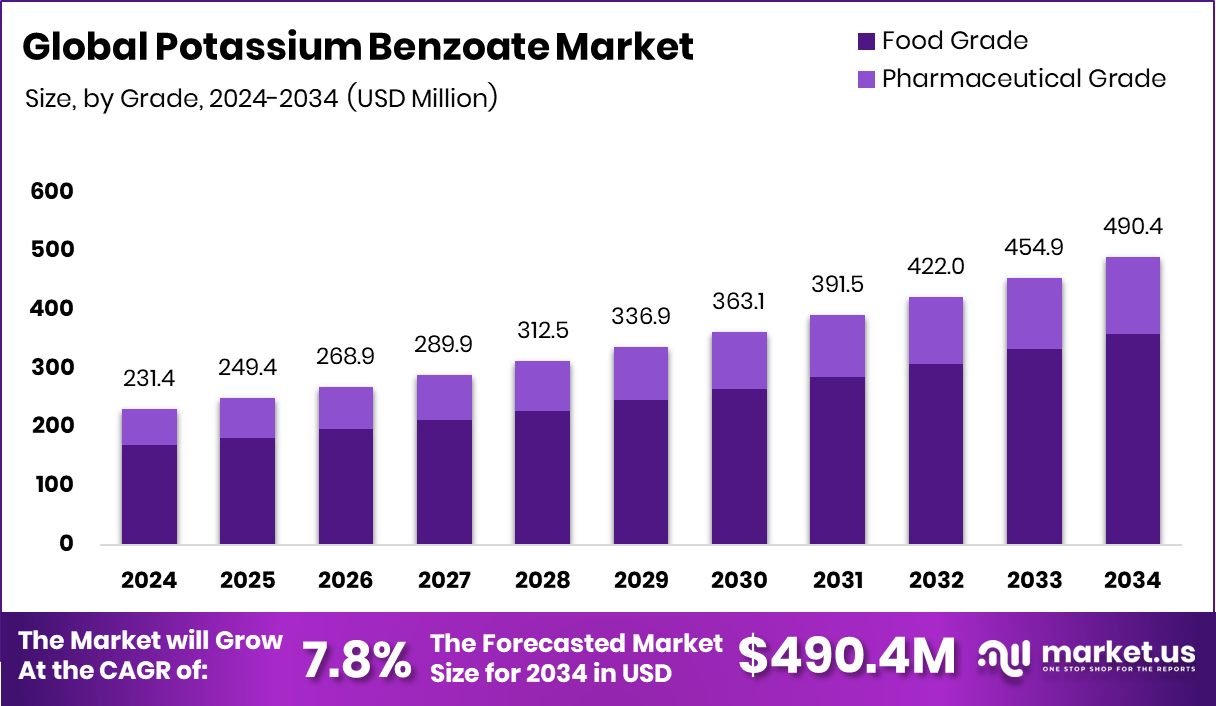

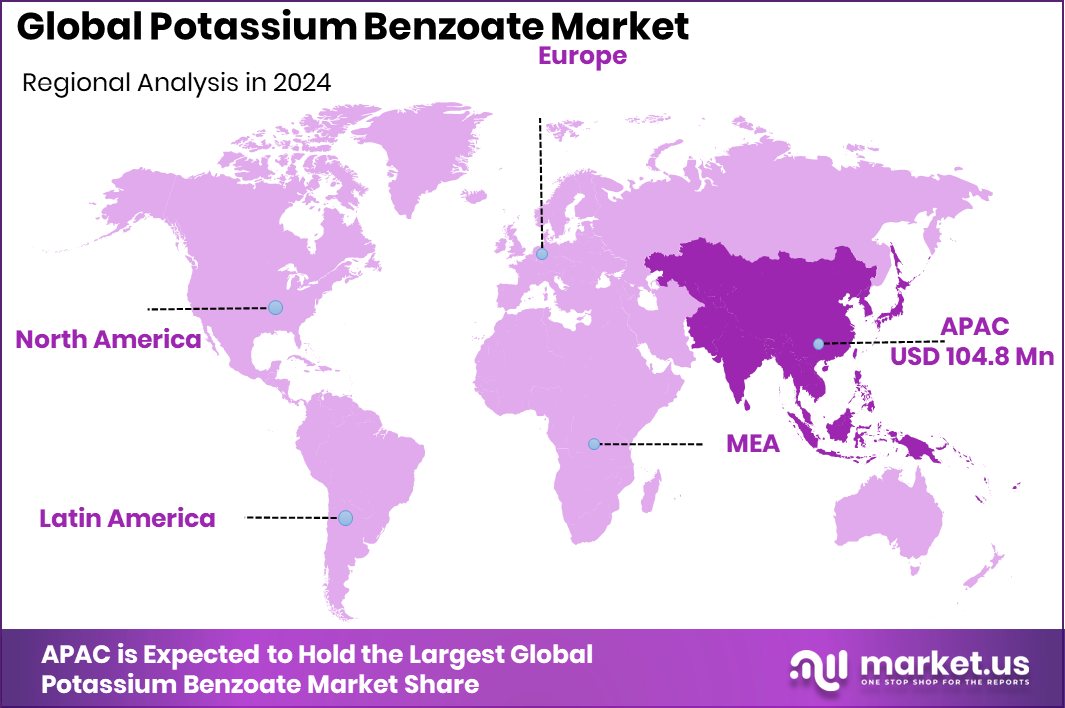

The Global Potassium Benzoate Market is expected to be worth around USD 490.4 million by 2034, up from USD 231.4 million in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034. Expanding beverage industries supported Asia-Pacific’s 45.30% regional dominance in the USD 104.8 million market.

Potassium Benzoate is the potassium salt of benzoic acid, commonly used as a preservative in acidic food and beverage products because it inhibits the growth of mold, yeast, and certain bacteria. It appears as a white crystalline powder and typically works best in products with pH values below about 4.5, where it effectively converts to benzoic acid inside microbial cells. In recent years, its usage has broadened beyond food and beverages into the personal care and cosmetic industries, where demand for safe preservatives has grown.

The growth of potassium benzoate is driven by the increasing demand for convenience foods and packaged beverages globally, which require effective preservation to ensure shelf-life and product safety. Additionally, the shift in personal care and cosmetic formulations toward well-documented preservative systems has expanded its application beyond food. For instance, the funding successes in personal care brands—such as a child personal care brand raising US$4 million, another personal care startup raising ₹40 crore, and a beauty and personal care brand securing ₹200 crore funding—highlight how downstream end-markets (personal care/beauty) are expanding and thereby creating stronger demand for such additives.

The demand for potassium benzoate stems largely from its ability to extend product life without imparting taste or color, making it attractive to manufacturers of acidic beverages, jams, sauces, and dressings. In the personal care arena, as formulations become more complex and consumers become more aware of preservative systems, potassium benzoate finds use in shampoos, cleansers, lotions, and creams. The rise in D2C (direct-to-consumer) personal care brands—one raising Rs 28 crore in pre-Series A—signals that smaller and niche brands are proliferating, further boosting demand for reliable preservative solutions.

Looking ahead, an important opportunity exists in clean-label and low-sodium formulations where manufacturers seek alternatives to sodium-based preservatives; potassium benzoate can serve as a low-sodium preservative alternative. Also, as biotechnology advances and sustainability becomes a premium, formulations emphasizing safe, traceable preservative systems will favour potassium benzoate. The funding of a Danish biotech startup with €8.1 million to eradicate microplastics in personal care products underscores how adjacent sustainability trends can create new value for preservatives aligned with cleaner formulations.

Key Takeaways

- The Global Potassium Benzoate Market is expected to be worth around USD 490.4 million by 2034, up from USD 231.4 million in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

- In 2024, Food Grade dominated the Potassium Benzoate Market with a 73.2% share, ensuring superior preservation stability.

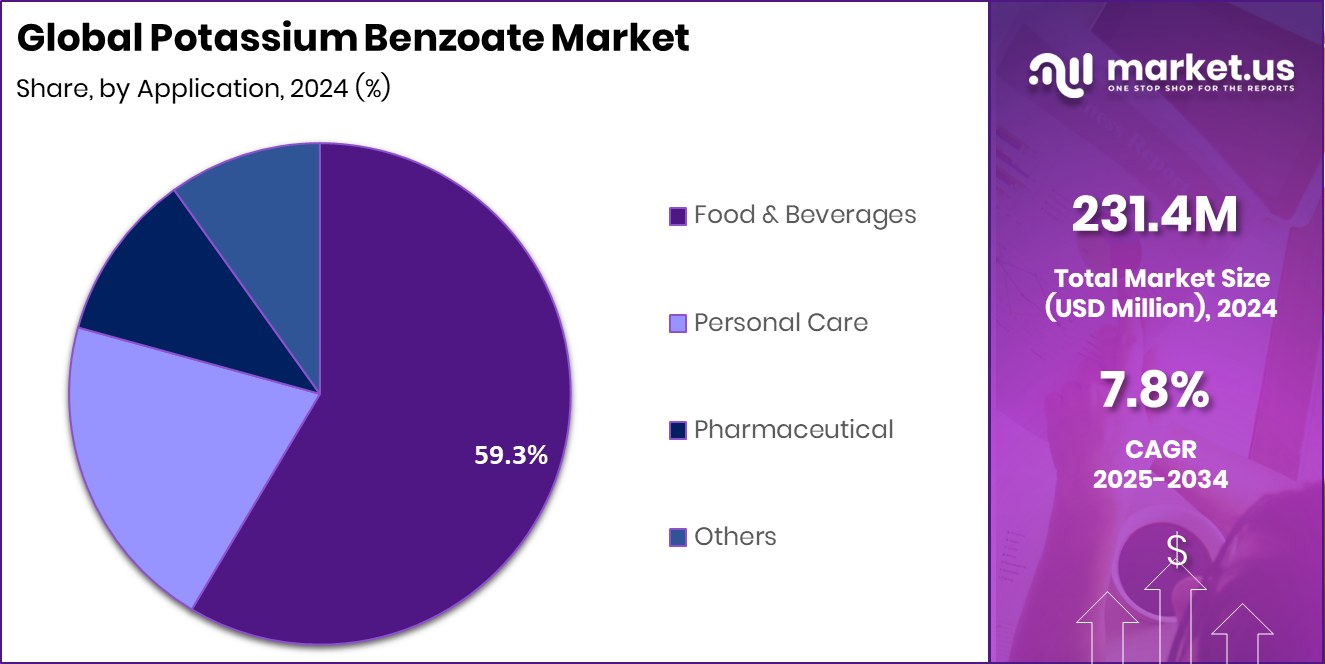

- The Food and Beverages segment led the Potassium Benzoate Market with a 59.3% share in 2024 globally.

- Strong food preservation demand across the Asia-Pacific drove the USD 104.8 million market growth.

By Grade Analysis

Food-grade Potassium Benzoate Market maintains a 73.2% share due to the rising packaged foods.

In 2024, Food Grade held a dominant market position in the By Grade segment of the Potassium Benzoate Market, capturing a 73.2% share. Its wide use in preserving acidic food and beverage products such as soft drinks, jams, and sauces strengthened its dominance. The food-grade type is preferred due to its safety, solubility, and compliance with food safety regulations.

Growing consumption of ready-to-drink beverages and packaged foods across urban regions further boosted its demand. Expanding applications in bakery fillings and salad dressings enhanced its market reach. Moreover, its cost-effectiveness and ability to maintain freshness without altering flavor contributed to sustaining its strong position in the food-grade segment in 2024.

By Application Analysis

Potassium Benzoate Market sees 59.3% share from food and beverage preservation.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Potassium Benzoate Market, accounting for a 59.3% share. Its extensive use as a preservative in acidic foods, carbonated drinks, and fruit-based products strengthened its dominance. The compound’s efficiency in inhibiting mold and yeast growth makes it ideal for extending product shelf life.

Rising global demand for ready-to-drink beverages, packaged foods, and processed sauces further boosted its application. Consumers’ preference for safe and cost-effective preservatives that maintain product quality and flavor stability also contributed to the strong growth of this segment. This consistent demand from the food and beverage industries firmly supported its leading share in 2024.

Key Market Segments

By Grade

- Food Grade

- Pharmaceutical Grade

By Application

- Food and Beverages

- Personal Care

- Pharmaceutical

- Others

Driving Factors

Rising Processed Food Demand Boosts Market Expansion

The key driving factor for the Potassium Benzoate Market is the increasing global demand for processed and packaged food products. Potassium benzoate serves as a highly effective preservative that helps extend shelf life and maintain product freshness, especially in acidic foods and beverages. As urban lifestyles continue to shift toward convenience-based consumption, the use of preservatives in ready-to-eat meals, sauces, and soft drinks is growing rapidly.

Additionally, the expansion of the personal care sector adds further momentum. For instance, Tuco Kids raised $4 million to expand its personal care range, showing strong growth potential for safe and reliable preservative ingredients like potassium benzoate across food and personal care formulations.

Restraining Factors

Health Concerns Limit Widespread Product Utilization

One major restraining factor for the Potassium Benzoate Market is the growing concern among consumers regarding synthetic preservatives and their potential health effects. Excessive intake of potassium benzoate in food and beverages can lead to adverse reactions in sensitive individuals, prompting demand for more natural and organic alternatives. This shift in consumer behavior has led several manufacturers to explore preservative-free or clean-label formulations, limiting the product’s expansion in some regions.

However, innovation in safer formulations and improved regulatory compliance may help balance these concerns. Meanwhile, industry investments continue to shape related markets—for example, new-age personal care brand Plush raised Rs 40 crore to deepen its presence, highlighting ongoing changes in product formulation priorities.

Growth Opportunity

Expanding Personal Care Applications Create New Opportunities

A major growth opportunity for the Potassium Benzoate Market lies in its rising use across the personal care and cosmetics industry. As brands focus on creating safe, stable, and long-lasting formulations, potassium benzoate is gaining importance as a trusted preservative in creams, lotions, shampoos, and cleansing products. Its mild nature and compatibility with natural ingredients make it suitable for clean-label and eco-friendly formulations.

The sector’s expansion is further supported by funding initiatives such as beauty and personal care brand Pilgrim raising Rs 200 crore for further expansion, which highlights the growing scope for preservative ingredients like potassium benzoate in high-performance and sustainable personal care formulations worldwide.

Latest Trends

Shift Toward Safe Preservatives in Personal Care

A key trend in the Potassium Benzoate Market is the increasing adoption of safe and mild preservatives within personal care and cosmetic formulations. Consumers are becoming more aware of ingredient transparency, driving demand for effective yet skin-friendly preservation systems. Potassium benzoate fits well within this trend as it offers antimicrobial protection without harsh effects, making it ideal for shampoos, lotions, and face cleansers.

Growing investments in the personal care sector reflect this momentum — Plush raised INR 40 crore funding from Rahul Garg, Blume Founders Fund, and OTP Ventures, while Kimirica raised $15 million in a round led by Carnelian Asset Management—both signaling expanding opportunities for preservative ingredients like potassium benzoate in modern beauty formulations.

Regional Analysis

In 2024, the Asia-Pacific held a 45.30% share, valued at USD 104.8 million.

In 2024, Asia-Pacific dominated the Potassium Benzoate Market, accounting for a 45.30% share, valued at USD 104.8 million. The region’s strong dominance is supported by the growing consumption of packaged food, carbonated beverages, and ready-to-drink products across developing economies such as China, India, and Indonesia.

Expanding food manufacturing activities, urbanization, and rising disposable incomes continue to drive demand for safe preservatives like potassium benzoate. In North America, consistent adoption in soft drinks and bakery applications maintains steady growth, supported by advanced food processing technologies. Europe follows with increasing regulatory focus on safe food additives and sustainable ingredient formulations.

Meanwhile, the Middle East & Africa and Latin America regions show gradual growth due to emerging packaged food markets and rising awareness regarding product shelf-life stability. Overall, Asia-Pacific’s dominance reflects its robust food and beverage sector, coupled with growing applications in personal care and cosmetic formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Emerald Kalama Chemical played a notable role in shaping the global Potassium Benzoate Market through its expertise in aroma chemicals, benzoates, and performance additives. The company focused on enhancing product purity and consistency to meet growing regulatory and consumer safety standards. Its advanced chemical processing capabilities helped strengthen supply across food preservation and personal care applications.

Tengzhou Aolong Chemical continued to reinforce its regional presence with a strong portfolio in food-grade and industrial-grade benzoates. The company’s efficient manufacturing and competitive pricing strategies supported steady exports, especially across Asia-Pacific markets. Its focus on quality assurance and scalability positioned it as a reliable supplier to beverage and food producers seeking consistent preservative solutions.

A.M Food Chemical emphasized innovation in food-grade preservatives, aligning with clean-label product trends and regulatory compliance. The company’s growing specialization in safe food additives and its commitment to environmental responsibility contributed to market confidence. Together, these players collectively strengthened global supply chains for potassium benzoate, ensuring quality, safety, and application versatility across food, beverage, and personal care industries.

Top Key Players in the Market

- Emerald Kalama Chemical

- Tengzhou Aolong Chemical

- A.M Food Chemical

- Macco Organiques Inc.

- FBC Industries

- Others

Recent Developments

- In May 2025, the company’s parent group announced its portfolio of high-purity preservatives (including potassium benzoate) under the “Kalama Potassium Benzoate FCC (E212)” brand line, demonstrating an increased focus on food & beverage stability applications.

Report Scope

Report Features Description Market Value (2024) USD 231.4 Million Forecast Revenue (2034) USD 490.4 Million CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Food Grade, Pharmaceutical Grade), By Application (Food and Beverages, Personal Care, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Emerald Kalama Chemical, Tengzhou Aolong Chemical, A.M Food Chemical, Macco Organiques Inc., FBC Industries, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Potassium Benzoate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Potassium Benzoate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Emerald Kalama Chemical

- Tengzhou Aolong Chemical

- A.M Food Chemical

- Macco Organiques Inc.

- FBC Industries

- Others