Global Polymer-Coated Urea Market Size, Share, And Business Benefits By Form (Granular, Coated Pellets, Liquid), By Type (Slow Release, Controlled Release, Water Soluble, Immediate Release), By Application (Agriculture, Horticulture, Fertilizer, Others), By End Use (Crop Production, Landscaping, Turf Management, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159634

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

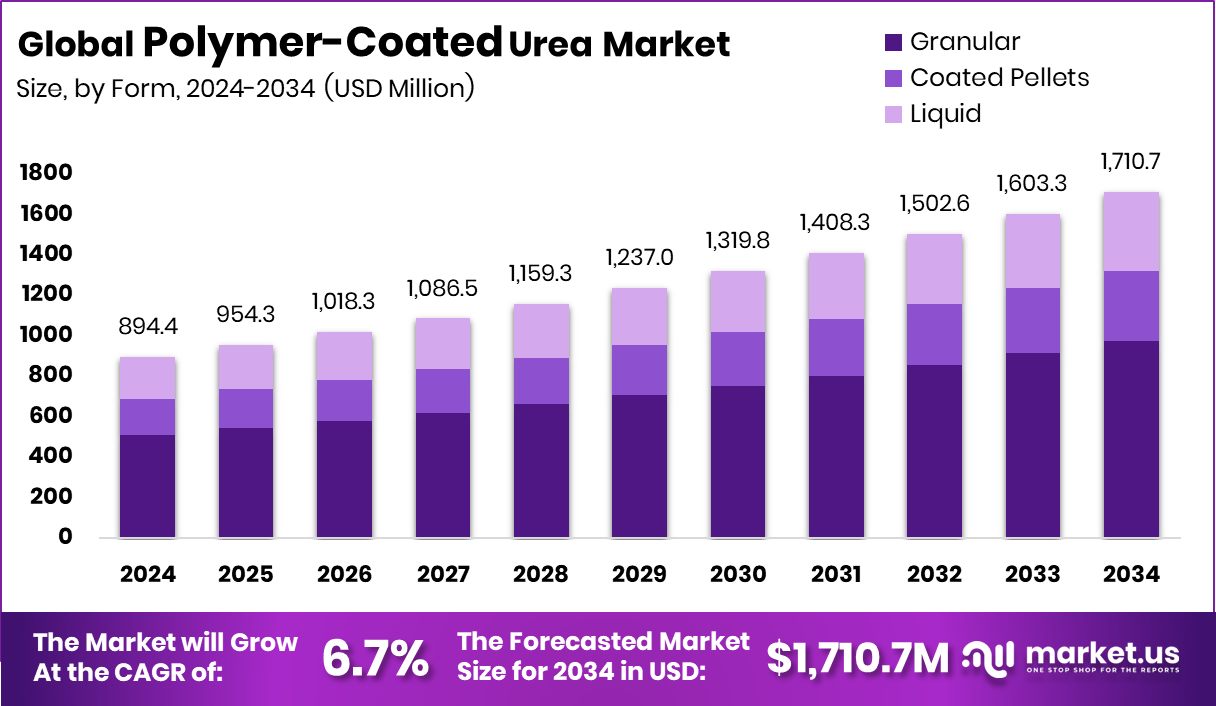

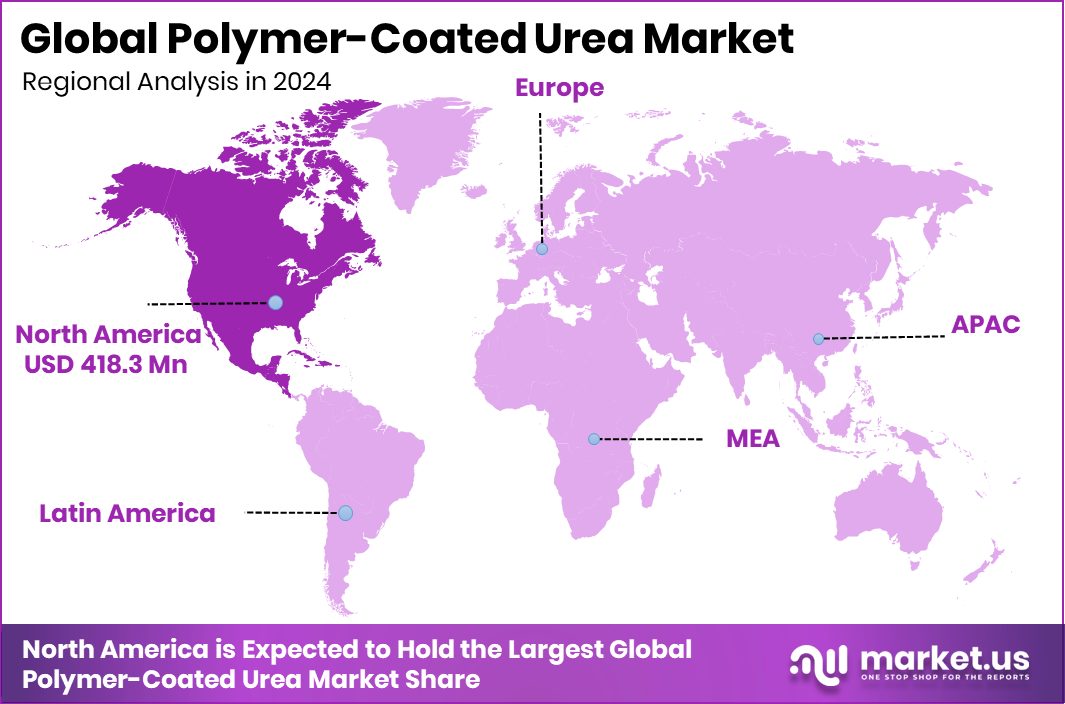

The Global Polymer-Coated Urea Market is expected to be worth around USD 1,710.7 million by 2034, up from USD 894.4 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. With a 46.80% share, North America dominated the Polymer-Coated Urea Market at USD 418.3 Mn.

Polymer-coated urea (PCU) is a type of slow-release fertilizer designed to improve nutrient efficiency. It is created by covering urea granules with a thin layer of polymer, which allows nitrogen to be released gradually into the soil. This controlled release helps reduce nutrient losses from leaching and volatilization, ensuring crops get a steady supply of nitrogen over time while minimizing environmental impact.

The polymer-coated urea market is growing as farmers and agricultural industries look for efficient solutions to improve yields while maintaining sustainability. Rising concerns about greenhouse gas emissions and soil health are pushing adoption. Governments and industries are also supporting new fertilizer technologies, making PCU an important part of modern precision farming practices.

One of the main growth factors is the increasing global demand for sustainable farming solutions. With the world population expected to exceed 9 billion by 2050, demand for efficient fertilizers that reduce waste and enhance productivity is higher than ever. The slow-release nature of PCU directly meets this need by improving nitrogen use efficiency and reducing pollution.

The market also shows strong opportunities due to ongoing investments and projects. Recently, $1.3 million was allocated to improve urea production and reduce carbon dioxide emissions, supporting innovation in eco-friendly fertilizers. Additionally, Perdaman has broken ground on the $6 billion Pilbara Urea Project, which is expected to become one of the world’s largest urea production plants. These initiatives highlight how both funding and infrastructure investments are shaping a robust future for the polymer-coated urea market.

Key Takeaways

- The Global Polymer-Coated Urea Market is expected to be worth around USD 1,710.7 million by 2034, up from USD 894.4 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In the Polymer-Coated Urea Market, the granular form leads with 57.1% preference among users.

- By type, slow-release polymer-coated urea secures 45.8%, highlighting efficiency in controlled nutrient delivery.

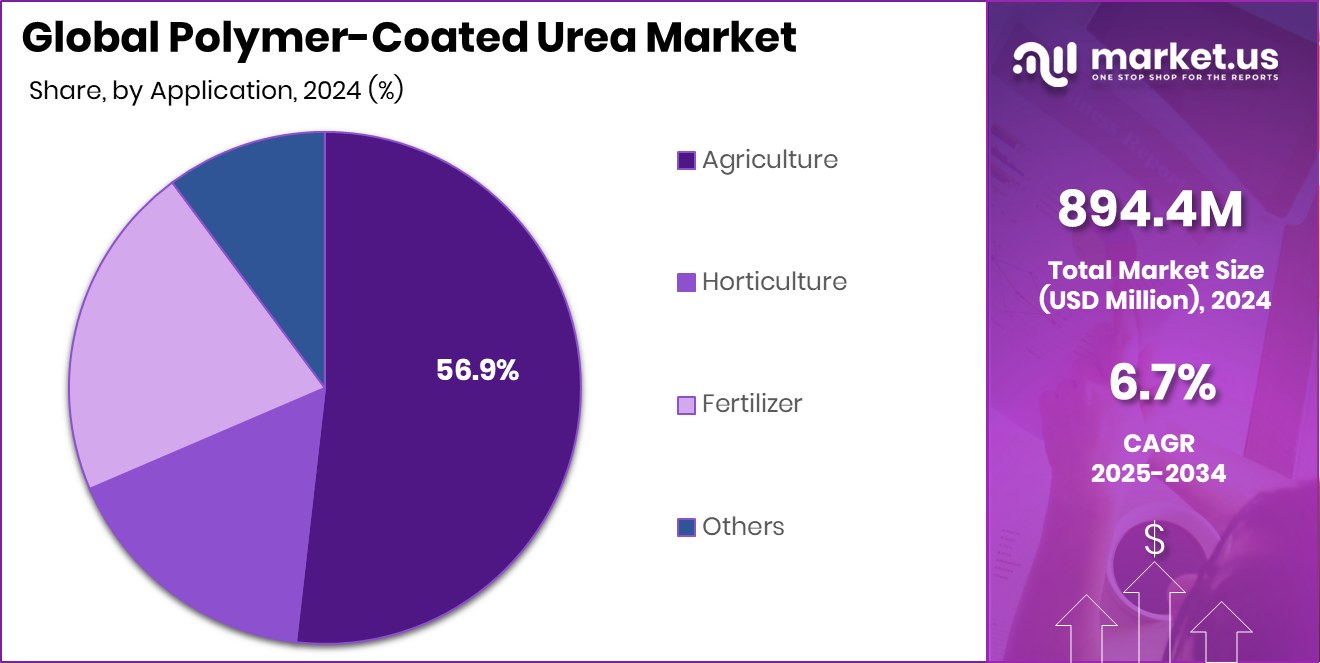

- Agriculture dominates applications of polymer-coated urea, holding a 56.9% share due to rising crop demands.

- Crop production remains the largest end-use sector, accounting for 62.3% of the polymer-coated urea market.

- The Polymer-Coated Urea Market in North America accounted for USD 418.3 Mn.

By Form Analysis

The Polymer-Coated Urea Market sees a 57.1% share in granular form.

In 2024, Granular held a dominant market position in the By Form segment of the Polymer-Coated Urea Market, accounting for a 57.1% share. The dominance of granular form is largely due to its ease of application, better storage stability, and wide suitability across various types of crops and soil conditions.

Farmers prefer granular polymer-coated urea because it ensures uniform distribution in the field and allows for controlled nitrogen release over time, improving crop productivity while reducing nutrient loss. The significant share highlights how granular formulations have become the preferred choice for large-scale farming operations, reflecting both practicality and effectiveness in sustainable fertilizer management practices. This leadership underlines its strong role in shaping the market’s current structure.

By Type Analysis

Slow-release type dominates with 45.8%, ensuring efficient nitrogen utilization worldwide.

In 2024, Slow Release held a dominant market position in the By Type segment of the Polymer-Coated Urea Market, with a 45.8% share. This leadership reflects the rising adoption of slow-release fertilizers, which provide a steady supply of nitrogen to crops while minimizing nutrient losses. The controlled nutrient release reduces the frequency of applications, cutting labor and operational costs for farmers.

Moreover, it supports sustainable farming by lowering environmental risks such as leaching and greenhouse gas emissions. The strong share demonstrates the increasing preference for efficiency-driven fertilizer solutions, especially in regions where productivity and resource management are critical. Slow-release formulations continue to set the benchmark for reliability and effectiveness in modern agricultural practices.

By Application Analysis

Agriculture holds a 56.9% share, reflecting farmers’ preference for sustainable fertilizer solutions.

In 2024, Agriculture held a dominant market position in the By Application segment of the Polymer-Coated Urea Market, with a 56.9% share. This dominance highlights the crucial role of polymer-coated urea in enhancing crop yields and ensuring efficient nutrient management in farming practices. Agriculture’s reliance on slow and controlled nitrogen release directly supports higher productivity, reduced fertilizer loss, and improved soil health.

The significant share reflects the widespread acceptance of this fertilizer among farmers seeking sustainable and cost-effective solutions. By minimizing environmental impact while maximizing crop performance, agriculture continues to drive the largest share of demand, reinforcing its position as the primary application area within the polymer-coated urea market landscape.

By End Use Analysis

Crop production leads with 62.3%, highlighting demand for higher yield efficiency.

In 2024, Crop Production held a dominant market position in the By End Use segment of the Polymer-Coated Urea Market, with a 62.3% share. This leadership underscores the strong reliance of crop producers on polymer-coated urea to achieve higher yields and optimize nitrogen utilization. The controlled-release properties make it particularly effective for large-scale crop farming, where consistent nutrient availability is critical for growth cycles.

The significant share indicates that crop production remains the primary driver of demand, as farmers increasingly adopt sustainable fertilizer solutions to balance productivity with environmental responsibility. This dominance highlights crop production’s central role in shaping the demand dynamics within the polymer-coated urea market.

Key Market Segments

By Form

- Granular

- Coated Pellets

- Liquid

By Type

- Slow Release

- Controlled Release

- Water Soluble

- Immediate Release

By Application

- Agriculture

- Horticulture

- Fertilizer

- Others

By End Use

- Crop Production

- Landscaping

- Turf Management

- Others

Driving Factors

Rising Need for Sustainable Farming Fertilizers

One of the biggest driving factors for the Polymer-Coated Urea Market is the growing demand for sustainable fertilizers that improve crop yields while protecting the environment. Farmers are increasingly turning to polymer-coated urea because it releases nitrogen slowly, ensuring crops get nutrients over a longer time without frequent reapplication. This helps reduce waste, saves costs, and lowers the harmful effects of excess nitrogen on soil and water.

Governments and global organizations are also supporting this shift. For example, the Food and Agriculture Organization (FAO) delivered 36,000 tonnes of USAID-funded TSP fertilizer to Sri Lanka to aid farmers ahead of the cultivation season. Similarly, a Green Urea Mission is projected to bring economic and environmental benefits worth $1 trillion over 25 years.

Restraining Factors

High Production Costs Limit Wider Market Adoption

A key restraining factor for the Polymer-Coated Urea Market is the high cost of production compared to regular urea. The process of coating urea granules with polymers requires advanced technology, quality materials, and additional manufacturing steps, which increases the overall price of the product. For many farmers, especially in developing regions, the higher cost makes it difficult to shift from traditional fertilizers to polymer-coated options, even though they are more efficient.

Limited affordability often slows down adoption, as farmers weigh immediate expenses against long-term benefits. Without stronger subsidies or financial support, the higher price remains a challenge, preventing polymer-coated urea from reaching its full market potential despite its clear agricultural and environmental advantages.

Growth Opportunity

Expanding Investments Create Strong Market Opportunity

One of the major growth opportunities for the Polymer-Coated Urea Market comes from increasing investments and government support to boost fertilizer production. With rising global food demand, there is a stronger push to enhance fertilizer availability and efficiency, making polymer-coated urea a key focus. Supportive funding and policies are expected to encourage large-scale adoption.

For instance, fertilizer stocks are in focus following the anticipation of a budget allocation of ₹1.7 Lakh Cr, aimed at strengthening the agriculture sector. In addition, Matrix Fertilisers has announced plans to invest Rs 7,500 Cr to increase its urea production capacity. Such initiatives not only expand supply but also create opportunities for sustainable growth in the polymer-coated urea market.

Latest Trends

Growing Focus on Sustainable Fertilizer Distribution Programs

A key trend in the Polymer-Coated Urea Market is the rising focus on sustainable fertilizer distribution programs supported by international funding. Farmers are looking for advanced fertilizers that improve productivity while reducing environmental damage, and global organizations are stepping in to make this possible. Recent initiatives show how targeted fertilizer supply is becoming a priority to strengthen food security.

For example, 3,820 tonnes of EU-funded urea fertilizer were distributed to paddy farmers, ensuring timely access for the cultivation season. Such efforts highlight a growing trend where governments and international bodies are actively supporting eco-friendly fertilizer use, creating a pathway for broader adoption of polymer-coated urea as part of modern and sustainable agricultural practices.

Regional Analysis

In 2024, North America held a 46.80% share, valued at USD 418.3 Mn.

The Polymer-Coated Urea Market shows distinct regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

In 2024, North America emerged as the dominating region, accounting for a 46.80% share valued at USD 418.3 million. This strong position is supported by the region’s advanced farming practices, higher adoption of sustainable fertilizers, and increased awareness among growers about controlled-release products.

Europe follows with steady demand, largely driven by regulatory encouragement for environmentally friendly fertilizers and the region’s push to reduce nitrogen losses. Asia Pacific, with its vast agricultural base, continues to show high potential as rising populations and increasing food demand encourage the adoption of efficient fertilizer solutions.

Meanwhile, the Middle East & Africa region relies on improving crop productivity under challenging climatic conditions, offering opportunities for the gradual adoption of polymer-coated urea. Latin America, supported by its strong crop production activities, particularly in countries with large-scale farming, contributes to market growth as well.

Although all regions are contributing, North America’s clear dominance reflects both market maturity and significant investment in modern agricultural inputs, setting the benchmark for adoption trends across other global regions. This regional breakdown highlights the market’s diverse yet interconnected growth pathways.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Agrium has established itself as a critical contributor by focusing on advanced fertilizer solutions that improve crop yields and support long-term soil health. Its expertise in nutrient management allows it to meet the growing demand for eco-friendly farming inputs, positioning it strongly in regions that prioritize sustainable agriculture.

BASF SE, with its deep research capabilities and broad agricultural solutions portfolio, continues to push innovation in polymer technologies that enhance the performance of coated urea. By leveraging its chemical expertise, BASF ensures precision in nutrient release, directly addressing farmers’ concerns of efficiency and environmental safety. This positions the company as a technology-driven leader, shaping the direction of modern fertilizer use.

COMPO EXPERT GmbH contributes significantly with its specialized focus on crop nutrition and tailored fertilizer products. Its role in delivering solutions adapted to diverse soil and climate conditions strengthens its appeal across varied agricultural markets. COMPO EXPERT’s emphasis on targeted plant nutrition aligns well with the rising trend of precision farming.

Top Key Players in the Market

- Agrium

- BASF SE

- COMPO EXPERT GmbH

- Haifa Group

- BASF

- AdvanSix

- Yara International

- Arkema

- Nufarm

- Nutrien

- ICL Group

- Mosaic Company

Recent Developments

- In May 2024, BASF introduced its first biomass-balanced (BMB) ammonia and urea products. These offerings include BMB-certified urea prills and urea solutions, produced using a biomass balance approach to lower carbon footprint

- In April 2024, OCI Global and COMPO EXPERT announced a long-term agreement for supplying lower-carbon ammonia to COMPO EXPERT’s fertilizer production, including NPK and coated fertilizers. OCI’s ammonia has about 60% lower carbon footprint versus industry standard, and COMPO EXPERT plans to replace 25 % of its ammonia usage in 2024 with this lower-carbon version.

Report Scope

Report Features Description Market Value (2024) USD 894.4 Million Forecast Revenue (2034) USD 1,710.7 Million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Granular, Coated Pellets, Liquid), By Type (Slow Release, Controlled Release, Water Soluble, Immediate Release), By Application (Agriculture, Horticulture, Fertilizer, Others), By End Use (Crop Production, Landscaping, Turf Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agrium, BASF SE, COMPO EXPERT GmbH, Haifa Group, BASF, AdvanSix, Yara International, Arkema, Nufarm, Nutrien, ICL Group, Mosaic Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polymer-Coated Urea MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Polymer-Coated Urea MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agrium

- BASF SE

- COMPO EXPERT GmbH

- Haifa Group

- BASF

- AdvanSix

- Yara International

- Arkema

- Nufarm

- Nutrien

- ICL Group

- Mosaic Company