Global Polyethylene Foams Market Size, Share, And Industry Analysis Report By Type (Non- XLPE, XLPE), By Density (LDPE Foam, HDPE Foam), By Size (Sheets, Rolls, Blocks), By Type (Closed-cell Foams, Open-cell Foams), By Processing Method (Extrusion, Molding, Expansion), By End-use (Protective Packaging, Automotive, Building and Construction, Footwear, Sports and Recreational, Medical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175099

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

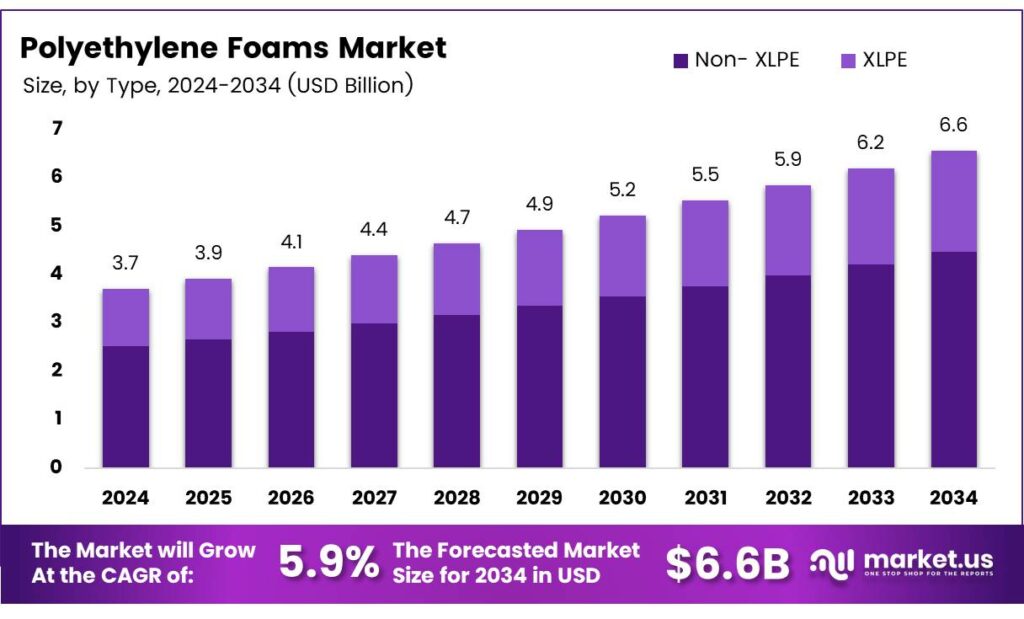

The Global Polyethylene Foams Market size is expected to be worth around USD 6.6 billion by 2034, from USD 3.7 billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Polyethylene foams represent a versatile class of cushioning and insulation materials used across packaging, construction, sports, and consumer goods. The Polyethylene Foams Market includes producers and converters of LDPE, HDPE, XLPE, and non-XLPE foams supplying high-demand sectors where lightweight, durable, and shock-absorbing materials support performance and sustainability needs.

The market grows steadily as manufacturers shift toward recyclable foam solutions and high-thermal-efficiency materials for building insulation. Rising demand from protective packaging, automotive components, and leisure products continues to strengthen industry momentum. Producers increasingly focus on controlled cell structures, customizable densities, and improved thermal properties to meet global regulatory and performance standards.

- Toward performance characteristics, polyethylene offers densities ranging from 1.6 kg/m³ to over 960 kg/m³, delivering wide mechanical and electrical insulating advantages. These foams provide strong cushioning behavior influenced by base resin, blowing system, and processing method. They also demonstrate almost 90% efficiency for a 10 mm, 80-ppi fine-grade sheet.

PE foam can be washed and reused multiple times, increasing longevity in consumer and industrial applications. Adding 5–15% blowing agent in LDPE enabled ideal foam formation at 203°C. Furthermore, experiments at a 22.7 kGy dose ratio, the lowest efficient foaming dose was 30 kGy with 10% azodicarbonamide during a 10-minute foaming cycle.

Expanding e-commerce and logistics activities fuel higher consumption of impact-resistant polyethylene foam sheets and rolls. Packaging converters adopt PE foams due to low weight, moisture resistance, and durability, enhancing total shipment protection. Meanwhile, construction growth in Asia strengthens demand for energy-efficient foam panels and pipe insulation, driving consistent long-term adoption.

Key Takeaways

- The Global Polyethylene Foams Market is projected to reach USD 6.6 billion by 2034, up from USD 3.7 billion in 2024, at a CAGR of 5.9% during 2025–2034.

- Non-XLPE dominated the market in 2025 with a 67.2% share under the By Type segment.

- LDPE Foam led the By Density segment with a 57.6% share in 2025.

- Sheets emerged as the top By Size sub-segment, accounting for 47.1% of the market in 2025.

- Closed-cell Foams dominated the By Type (Structure) segment with a 72.3% market share in 2025.

- Extrusion remained the leading Processing Method, holding 49.9% share in 2025.

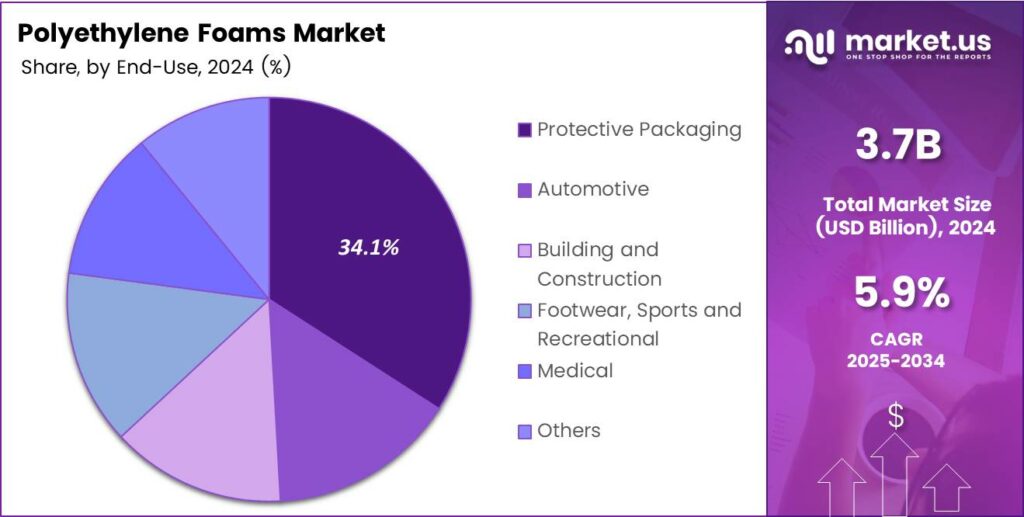

- Protective Packaging led the End-use segment with a 34.1% share in 2025.

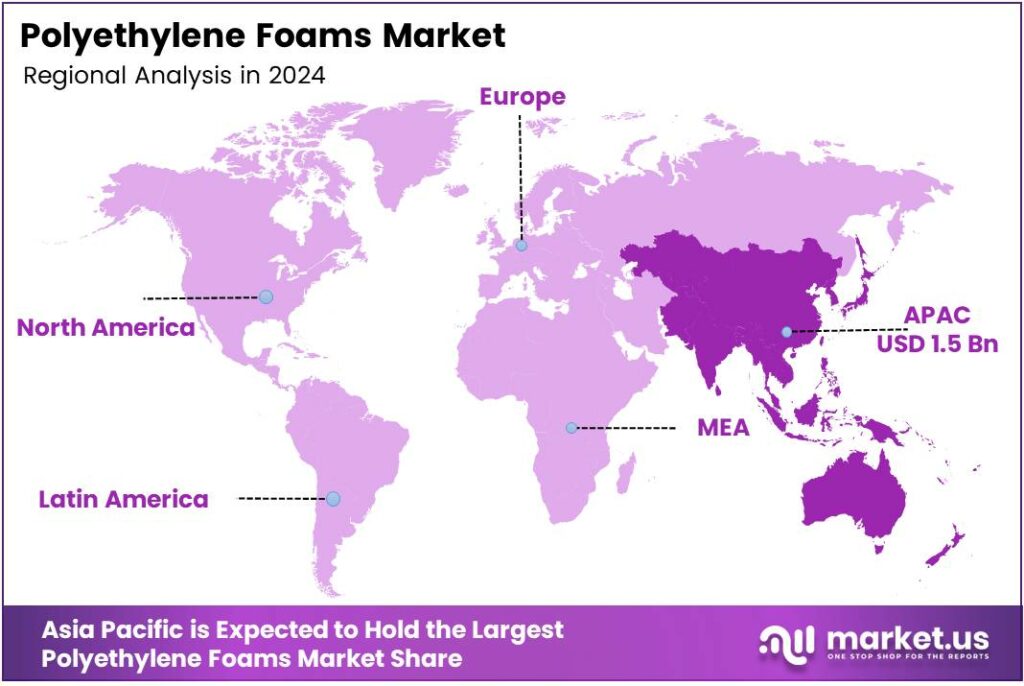

- Asia Pacific dominated the global market with a 42.5% share valued at USD 1.5 billion.

By Type Analysis

Non-XLPE dominates with 67.2% due to its wide industrial applicability and cost efficiency.

In 2025, Non-XLPE held a dominant market position in the “By Type” Analysis segment of the Polyethylene Foams Market, with a 67.2% share. This material is widely preferred for packaging, construction, and insulation due to its softness, flexibility, and low production cost. Its compatibility with diverse applications strengthens demand.

XLPE continued to gain relevance in the Polyethylene Foams Market. Although it did not surpass the dominant segment, XLPE offers enhanced durability, superior thermal resistance, and higher mechanical strength. These attributes make it suitable for automotive, medical, and high-performance industrial uses, driving consistent adoption across specialized applications.

By Density Analysis

LDPE Foam dominates with 57.6% due to its lightweight properties and broad usage.

In 2025, LDPE Foam held a dominant market position in the “By Density” Analysis segment of the Polyethylene Foams Market, with a 57.6% share. LDPE Foam is widely preferred for protective packaging, cushioning, and lightweight insulation. Its softness and cost-effective nature boost its popularity across multiple industries.

HDPE Foam showcased steady market growth within the Polyethylene Foams Market. Despite not leading the segment, HDPE Foam’s high rigidity, strong impact resistance, and ability to withstand heavy-duty applications ensure ongoing adoption. Its use across automotive, construction, and industrial sectors continues to rise gradually.

By Size Analysis

Sheets dominate with 47.1% due to their broad industrial utilization.

In 2025, Sheets held a dominant market position in the “By Size” Analysis segment of the Polyethylene Foams Market, with a 47.1% share. PE foam sheets offer uniform thickness, high flexibility, and protective strength, making them ideal for packaging, construction insulation, and custom industrial applications.

Rolls continued to hold strong relevance in the Polyethylene Foams Market. Rolls are widely used in flooring underlays, laminations, sports padding, and large-surface coverage solutions. Their ease of installation and continuous form give them a competitive edge in fast-paced industrial operations.

Blocks maintained a steady presence in the Polyethylene Foams Market. Blocks are preferred for heavy-duty cushioning, specialized structural support, and precise machining applications. Their high-density configuration and adaptability to complex shapes make them suitable for industrial tooling, protective inserts, and custom fabrication work.

By Type Analysis

Closed-cell Foams dominate with 72.3% due to high insulation efficiency.

In 2025, Closed-cell Foams held a dominant market position in the “By Type” Analysis segment of the Polyethylene Foams Market, with a 72.3% share. These foams are widely valued for moisture resistance, thermal insulation, and structural strength. Their usage spans construction, automotive, and high-performance packaging sectors.

Open-cell Foams experienced growing acceptance in the Polyethylene Foams Market. Although they did not dominate the segment, open-cell foams offer enhanced breathability and shock-absorbing properties. These characteristics make them suitable for cushioning, sound absorption, and flexible protective applications across consumer goods and industrial sectors.

By Processing Method Analysis

Extrusion dominates with 49.9% due to production efficiency.

In 2025, Extrusion held a dominant market position in the “By Processing Method” Analysis segment of the Polyethylene Foams Market, with a 49.9% share. Extrusion allows continuous, cost-effective production of sheets, rolls, and profiles, making it ideal for packaging, construction, and insulation applications.

Molding continued to strengthen its role in the Polyethylene Foams Market. Molded PE foams provide greater dimensional accuracy and tailored shapes, supporting demand in automotive components, medical devices, and specialty packaging. Their ability to meet customized industrial requirements boosts adoption.

Expansion remained an important processing method within the Polyethylene Foams Market. The expansion technique offers lightweight, versatile foam structures used in cushioning, thermal insulation, and sports equipment. Its ability to produce foams with varied densities ensures consistent usage across consumer and industrial applications.

By End-use Analysis

Protective Packaging dominates with 34.1% due to widespread global logistics applications.

In 2025, Protective Packaging held a dominant market position in the “By End-use” Analysis segment of the Polyethylene Foams Market, with a 34.1% share. Its ability to safeguard fragile and high-value products fuels demand across e-commerce, electronics, and industrial logistics.

Automotive remained a strong consumer of polyethylene foams. The sector leverages PE foams for vibration damping, sound insulation, and component protection. Growing vehicle production and the shift toward lightweight interiors continue to support the segment’s adoption.

Building and Construction accounted for steady demand in the Polyethylene Foams Market. PE foams are used for thermal insulation, sealing, piping support, and structural cushioning. Their moisture resistance and longevity enhance usage in residential and commercial construction projects globally.

Footwear and Recreational applications continued gaining attention. PE foams provide comfort, shock absorption, and lightweight cushioning, making them essential in sports gear and footwear manufacturing. Their versatility supports product innovation across global brands.

Medical applications reflected rising demand for sterile, lightweight, and flexible cushioning solutions. PE foams are used in orthotics, medical packaging, and patient-support products. Their non-toxic and hypoallergenic nature ensures safe integration into healthcare environments.

Key Market Segments

By Type

- Non- XLPE

- XLPE

By Density

- LDPE Foam

- HDPE Foam

By Size

- Sheets

- Rolls

- Blocks

By Type

- Closed-cell Foams

- Open-cell Foams

By Processing Method

- Extrusion

- Molding

- Expansion

By End-use

- Protective Packaging

- Automotive

- Building and Construction

- Footwear, Sports, and Recreational

- Medical

- Others

Emerging Trends

Growing Preference for High-Performance and Energy-Efficient Foam Materials Influences Market Trends

One of the most notable trends in the Polyethylene Foams Market is the shift toward high-performance foam materials. Customers want foams that are stronger, more flexible, and more durable. This pushes manufacturers to focus on improved cross-linked PE foams for better insulation and structural support.

- As more consumers shift to online shopping, manufacturers rely heavily on PE foams because they are lightweight, shock-absorbing, and cost-efficient. The U.S. Census Bureau reports that e-commerce sales in 2024 reached USD 1.02 trillion, showing how packaging-intensive the online retail ecosystem has become.

The use of polyethylene foams in green buildings. As energy efficiency becomes a top priority worldwide, construction companies prefer foam materials that reduce heat loss and improve indoor comfort. PE foams are increasingly used for HVAC insulation, flooring underlays, and roofing systems.

Drivers

Growing Demand for Lightweight Protective Packaging Boosts Market Expansion

The Polyethylene Foams Market is growing mainly because industries need lightweight packaging materials that protect products during shipping. Companies in electronics, appliances, automotive, and consumer goods use PE foams to keep items safe from shocks and scratches. This shift toward lighter packaging helps reduce shipping costs and improve handling efficiency.

- The rising use of polyethylene foams in construction. These foams provide strong insulation, moisture resistance, and long-term durability. Builders prefer them for flooring, roofing, and wall applications because they help improve energy efficiency. Sealed Air, one of the world’s largest protective-packaging companies, reported USD 5.4 billion in total sales in 2024, a portion of which now comes from its circular materials portfolio.

The automotive industry is also increasing its use of polyethylene foams. These foams improve comfort inside vehicles by providing cushioning, noise control, and thermal insulation. As vehicle manufacturers focus on weight reduction to improve fuel efficiency, PE foams become even more important.

Restraints

Environmental Regulations on Plastic Materials Limit Market Growth

The biggest restraint for the Polyethylene Foams Market is the increasing pressure from environmental regulations. Many governments are tightening rules against plastic waste, especially single-use materials. Since polyethylene foams take a long time to break down, they often face restrictions or bans in some regions.

- Recycling challenges also affect market growth. PE foam recycling requires specialized processes because the material is lightweight and bulky. In many countries, recycling systems are not advanced enough to handle these materials efficiently. The European Union’s new Packaging & Packaging Waste Regulation (PPWR) requires at least 10% recycled content in plastic packaging by 2030, with higher targets planned for 2040.

Raw material price volatility is another major restraint. Polyethylene is derived from petrochemicals, and when crude oil prices fluctuate, foam production costs rise. Manufacturers often struggle to maintain stable pricing, which affects profitability and market stability.

Growth Factors

Rising Adoption of Sustainable and Recyclable Foam Solutions Creates New Opportunities

Growing interest in sustainable materials offers significant opportunities for the Polyethylene Foams Market. Manufacturers are developing recyclable and eco-friendly foam grades that align with global sustainability goals. These innovations make polyethylene foams more acceptable in regions with strict environmental policies.

- The expansion of e-commerce is another major opportunity. Online shopping requires reliable protective packaging to ensure safe product delivery. Polyethylene foams work well for cushioning electronics, appliances, and fragile items. EU law summaries highlight targets such as 40% reusable transport packaging by 2030, with an aspirational 70% by 2040.

In the medical sector, opportunities are rising due to increased demand for safe and hygienic materials. Polyethylene foams are widely used for medical device packaging, prosthetic padding, and protective healthcare products. This sector’s growing investment in safety-driven materials supports long-term market growth.

Regional Analysis

Asia Pacific Dominates the Polyethylene Foams Market with a Market Share of 42.5%, Valued at USD 1.5 Billion

Asia Pacific leads the global Polyethylene Foams Market, supported by strong construction growth, rising automotive production, and expanding packaging demand across China, India, and Southeast Asia. The region’s dominance is reflected in its substantial 42.5% share, valued at USD 1.5 billion, driven by increasing insulation needs and lightweight material adoption. Government-backed infrastructure development further strengthens the demand outlook.

North America shows steady growth driven by advanced protective packaging applications, higher e-commerce penetration, and strong usage in building thermal insulation. The U.S. market benefits from rising demand for durable, lightweight foams in automotive and healthcare applications. Sustainability push and improved recycling initiatives also support market expansion across the region.

Europe exhibits a mature but innovation-driven market supported by stringent energy efficiency regulations and strong adoption in the construction and transportation sectors. The region focuses heavily on recyclable and low-emission foam products, aligning with EU environmental directives.

The U.S. holds a significant share within North America, supported by high demand from the automotive, medical, electronics, and logistics sectors. Advanced manufacturing capabilities and rapid adoption of sustainable foam solutions drive market momentum. Increased usage in temperature-controlled packaging and building insulation continues to strengthen the country’s growth outlook.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Polyethylene Foams Market in 2025 is shaped strongly by advancements in material engineering, sustainability priorities, and rising demand across packaging, construction, automotive, and consumer goods. Key players continue to strengthen capabilities through product innovation, light-weighting solutions, and performance-enhancing foam technologies tailored for insulation, cushioning, acoustic control, and durability.

Sealed Air remains a central market influence due to its strong focus on protective packaging technologies and advanced PE foam solutions designed for high-performance cushioning. The company’s continuous shift toward recyclable and energy-efficient foam formats strengthens its global positioning in 2025 as sustainability becomes a decisive purchasing factor.

Pregis LLC continues to expand its presence with value-added PE foam offerings optimized for e-commerce, industrial packaging, and automotive components. Its emphasis on protective efficiency and material customization supports steady demand from OEMs seeking reliable and consistent foam performance across supply chains.

Palziv upholds a solid competitive stance with cross-linked and non-cross-linked PE foam grades widely used in sports equipment, medical cushioning, insulation, and construction. Its vertically integrated production and focus on quality consistency help the company maintain long-term partnerships across global markets in 2025.

NMC PRODUCTS (M) SDN. BHD. strengthens market traction with diversified PE foam solutions engineered for insulation, HVAC, construction, and protective applications. Its emphasis on manufacturing flexibility and region-focused supply strategies supports its competitiveness in cost-sensitive and high-growth Asian markets.

Top Key Players in the Market

- Sealed Air

- Pregis LLC

- Palziv

- NMC PRODUCTS (M) SDN. BHD.

- Zotefoams plc.

- TORAY INDUSTRIES, INC.

- FURUKAWA ELECTRIC CO., LTD.

- JSP

- Sekisui Alveo

Recent Developments

- In 2024, Sealed Air continues to offer a range of polyethylene (PE) foam products for protective packaging, including sheets, rolls, and planks designed for cushioning, impact resistance, and sustainability with options for recycled content. High-density PE foams like Ethafoam and Stratocell provide customizable protection against repeated impacts, with features such as moisture resistance and dimensional stability.

- In 2024, Pregis introduced certified-circular PE foam solutions using ExxonMobil’s advanced recycling technology to support plastics circularity goals. This was highlighted sustainability report as a milestone toward zero waste, with the PE foam incorporating certified circular resins.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 6.6 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Non- XLPE, XLPE), By Density (LDPE Foam, HDPE Foam), By Size (Sheets, Rolls, Blocks), By Type (Closed-cell Foams, Open-cell Foams), By Processing Method (Extrusion, Molding, Expansion), By End-use (Protective Packaging, Automotive, Building and Construction, Footwear, Sports and Recreational, Medical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sealed Air, Pregis LLC, Palziv, NMC PRODUCTS (M) SDN. BHD., Zotefoams plc., TORAY INDUSTRIES, INC., FURUKAWA ELECTRIC CO., LTD., JSP, Sekisui Alveo Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polyethylene Foams MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Polyethylene Foams MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sealed Air

- Pregis LLC

- Palziv

- NMC PRODUCTS (M) SDN. BHD.

- Zotefoams plc.

- TORAY INDUSTRIES, INC.

- FURUKAWA ELECTRIC CO., LTD.

- JSP

- Sekisui Alveo