Global Phosphatic Fertilizer Market Size, Share, Growth Analysis By Type (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Triple Superphosphate (TSP), and Others), By Formulation (Solid and Liquid), By Crop Type (Fruits And Vegetables, Cereal And Grains, Oilseeds And Pulses, Turf And Ornamentals, and Others), By Application Method (Foliar Spray, Soil Treatment, Seed Treatment, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168208

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

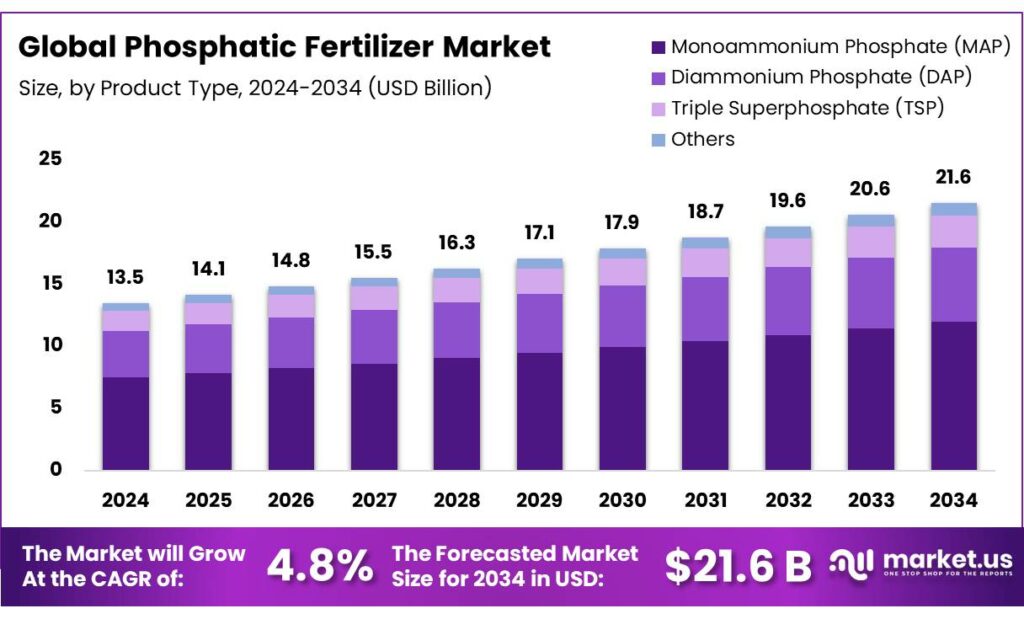

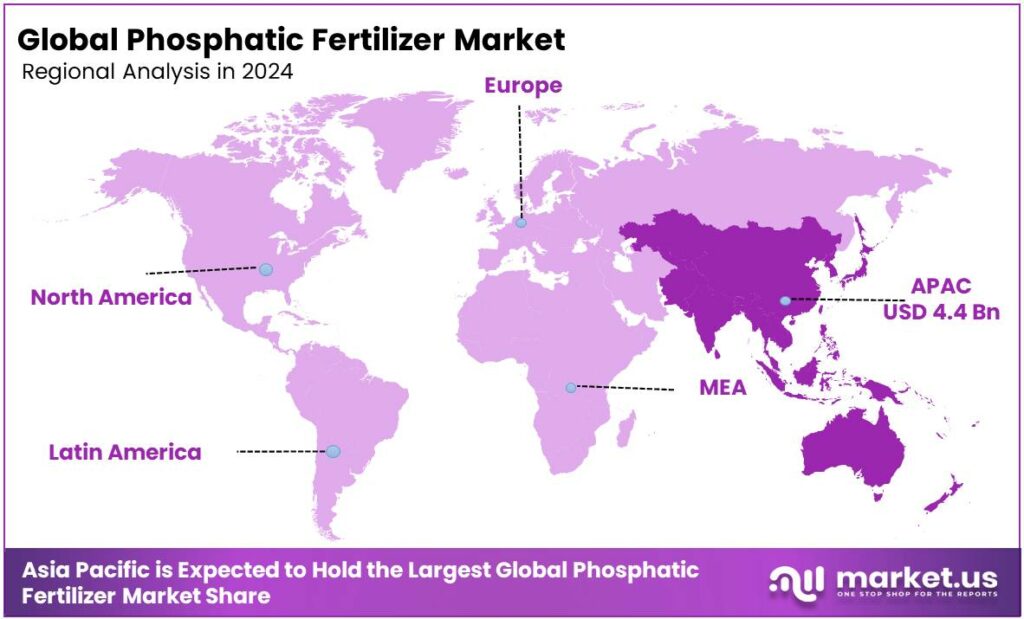

The Global Phosphatic Fertilizer Market size is expected to be worth around USD 21.6 Billion by 2034, from USD 13.5 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominan market position, capturing more than a 32.3% share, holding USD 0.8 Billion revenue.

The phosphatic fertilizers play a crucial role in global agriculture by providing essential nutrients to boost crop yields, particularly for cereals and grains. As the demand for food increases due to population growth, phosphatic fertilizers are essential for maintaining soil fertility and ensuring sustainable crop production.

However, the market faces challenges related to health concerns, such as the potential presence of harmful substances, such as cadmium in phosphate rock, prompting stricter regulatory frameworks globally. To address these issues, companies are focusing on sustainable production practices, offering more efficient and environmentally friendly products.

Additionally, advancements in precision agriculture and the shift toward circular economies, including phosphorus recovery from waste, present growth opportunities. Despite these challenges, the phosphatic fertilizer market remains vital for global food security, driven by innovations and evolving agricultural practices.

- According to the United States Geological Survey (USGS), the world consumption of P2O5 contained in fertilizers was estimated to have been 47.5 million tons in 2024, compared with 45.8 million tons in 2023.

- Global phosphorus (phosphate rock) production was an estimated 240 million metric tons in 2024, with China, the United States, and Russia being the largest producers. China leads production with 90 million metric tons, followed by the US at 20 million metric tons, and Russia at 14 million metric tons.

Key Takeaways

- The global phosphatic fertilizer market was valued at USD 13.5 billion in 2024.

- The global phosphatic fertilizer market is projected to grow at a CAGR of 4.8% and is estimated to reach USD 21.6 billion by 2034.

- Based on the types of phosphatic fertilizer, monoammonium phosphate (MAP) fertilizer dominated the market, with around 55.5% of the total global market.

- On the basis of formulation, the solid phosphatic fertilizers dominated the market, comprising a substantial market share of around 75.8%.

- Based on crop type, grains and cereals held a major share of the phosphatic fertilizer market, around 44.1%.

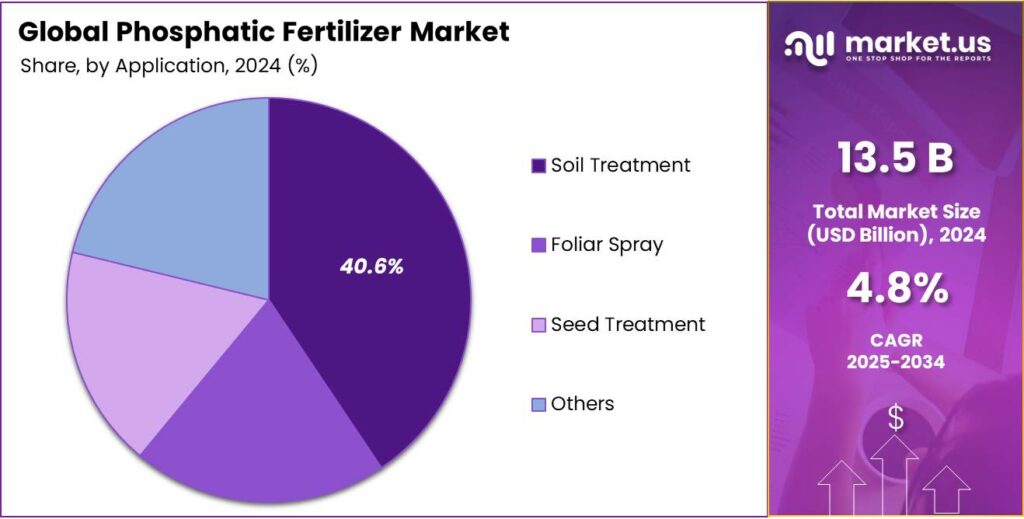

- Among the application methods, soil treatment emerged as a major segment in the phosphatic fertilizer market, with 40.6% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the Phosphatic Fertilizer market, accounting for around 32.3% of the total global consumption.

Type Analysis

Monoammonium Phosphate (MAP) Phosphatic Fertilizer Dominated the Market in 2024.

The phosphatic fertilizer market is segmented based on the types into monoammonium phosphate (MAP), diammonium phosphate (DAP), triple superphosphate (TSP), and others. The monoammonium phosphate (MAP) phosphatic fertilizer dominated the market, comprising around 55.5% of the market share, due to its balanced nutrient profile, ease of application, and versatility in different soil types. MAP contains a higher concentration of phosphorus (11-52-0) and is more soluble in water, making it more readily available to plants.

Its formulation, with an ammonium nitrogen source, provides a stable, slow-release nutrient that helps optimize plant growth without causing nutrient burn, which can be a risk with DAP. Additionally, MAP has a lower pH, making it more suitable for slightly acidic soils, which are common in many agricultural regions. In addition, its relatively lower potential for volatilization compared to DAP makes it a preferred choice, particularly in areas where environmental factors such as high temperatures could increase nitrogen loss.

Formulation Analysis

Solid Phosphatic Fertilizer was a Prominent Segment in the Market.

The phosphatic fertilizer market is segmented on the basis of formulation used into solid and liquid. The solid phosphatic fertilizer led the market, constituting about 75.8% of the market share, due to its ease of handling, storage, and cost-effectiveness. Solid fertilizers, such as granular MAP or DAP, are stable, easy to transport, and have a longer shelf life compared to liquids, which may require special containers and more careful handling.

They can be applied directly to the soil through various methods such as broadcasting, banding, or fertigation, making them versatile for different farming practices. Additionally, solid fertilizers are often less expensive to produce and distribute, contributing to their widespread adoption. While liquid fertilizers offer advantages in specific applications like fertigation, solid phosphatic fertilizers remain the preferred choice for large-scale agricultural operations due to their convenience, lower cost, and efficiency in nutrient delivery.

Crop Type Analysis

The Phosphatic Fertilizer Were Mostly Utilized for Cereal & Grains.

Based on the crop type, the phosphatic fertilizer market is divided into fruits & vegetables, cereal & grains, oilseeds & pulses, turf & ornamentals, and others. The cereals and grains dominated the phosphatic fertilizers market, with a substantial market share of 44.1%. Phosphatic fertilizers are predominantly used for cereals and grains as these crops have a higher demand for phosphorus to support robust root development, flowering, and grain filling.

Cereals and grains such as wheat, rice, and maize are staple crops that form the backbone of global food security and require high phosphorus inputs to maximize yields. These crops are produced in massive volumes across major agricultural economies such as China, India, the U.S., and Brazil. Phosphorus is essential for energy transfer and photosynthesis, both critical processes for the growth and productivity of these crops.

While fruits, vegetables, oilseeds, and pulses need phosphorus, their phosphorus requirements are often met with smaller quantities due to their growth cycles and nutrient uptake patterns. Moreover, cereals and grains are typically grown on larger scales, making them more reliant on efficient and high-yielding fertilizers such as phosphates.

This larger-scale cultivation and the need for consistent, high-volume outputs contribute to the higher use of phosphatic fertilizers in cereals and grains. The scale of industrial farming operations and the need for productivity optimization have positioned cereals and grains as the primary drivers of agrochemical consumption worldwide.

Application Method Analysis

Soil Treatment Emerged as a Leading Segment in the Phosphatic Fertilizer Market.

On the basis of application methods, the phosphatic fertilizer market is segmented into foliar spray, soil treatment, seed treatment, and others. Approximately 40.6% of the phosphatic fertilizers are used in soil treatment, as soil application ensures that phosphorus is directly available to plant roots, where it is most needed for growth and development. Phosphorus is relatively immobile in the soil, so applying it directly to the soil helps establish a localized nutrient supply for the plant.

Soil treatment allows for more precise and controlled delivery, promoting better root development and maximizing phosphorus uptake over time. Foliar spraying, on the other hand, is less efficient for phosphorus as the nutrient is not readily absorbed through the leaves, especially in larger quantities. Furthermore, seed treatment with phosphorus offers limited benefits compared to soil application, as the nutrient needs are often greater than what can be provided by coating seeds. Therefore, soil application is the most effective and practical method for meeting the phosphorus demands of crops.

Key Market Segments

By Type

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Triple Superphosphate (TSP)

- Others

By Formulation

- Solid

- Liquid

By Crop Type

- Fruits & Vegetables

- Cereal & Grains

- Oilseeds & Pulses

- Turf & Ornamentals

- Others

By Application Method

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Others

Drivers

Increasing Food Demand due to Population Growth Propels the Phosphatic Fertilizer Market.

The growing global population is significantly driving up the demand for food, putting pressure on agricultural systems to produce more crops. This increasing population of the world, which raises the demand for food security, is the key driver in the development of phosphatic fertilizers. As the population continues to rise, the need for fertilizers, particularly phosphatic fertilizers, becomes increasingly important to sustain crop yields.

- According to the World Population Prospects report by the United Nations in 2024, the world’s population is expected to continue growing over the coming 50 or 60 years, reaching a peak of around 10.3 billion people in the mid-2080s, up from 8.2 billion in 2024. In an era marked by rapid population growth and escalating environmental concerns, the agricultural sector faces immense pressure to produce more food with fewer resources.

- According to the Food and Agriculture Organization (FAO), the world will need 50% more food by 2050 to feed the increasing global population in the context of natural resource constraints, environmental pollution, ecological degradation, and climate change.

Phosphorus, a key nutrient for plant growth, plays a critical role in improving crop productivity and soil health. In many regions, phosphorus-rich fertilizers are essential for maintaining the fertility of soils that are depleted of natural phosphorus. For instance, countries such as India and China, with large agricultural sectors, have seen a steady increase in the use of phosphatic fertilizers to meet growing food demand. Additionally, as diets shift towards more protein-rich foods, which require more intensive agricultural practices, the demand for fertilizers such as phosphates rises, further fueling the need for more efficient fertilizer use to support global food security.

Restraints

Human Health Concerns Remain a Significant Challenge in the Phosphatic Fertilizer Market.

Human health concerns and regulatory frameworks pose significant challenges in the phosphatic fertilizer market, particularly regarding the presence of harmful substances such as cadmium and heavy metals in phosphate rock, which is a key raw material for phosphatic fertilizers. These contaminants can accumulate in the soil over time, leading to potential health risks through the food chain.

For instance, high levels of cadmium have been linked to kidney damage and cancer, and concerns about its accumulation in crops have prompted stricter regulations in several regions. In the European Union, strict limits, the current limit being 60 mg/kg, have been set on the cadmium content in fertilizers to protect soil health and human well-being.

Similarly, in the U.S., the Environmental Protection Agency (EPA) regulates fertilizer quality to minimize harmful substances from entering the food supply. These health and environmental concerns have led to increasing pressure on manufacturers to find cleaner, more sustainable production methods for phosphatic fertilizers.

The regulatory complexity and the need for compliance with evolving environmental standards can increase production costs, create supply chain disruptions, and limit access to raw materials, thus creating barriers to market growth. Addressing these challenges requires ongoing innovation in fertilizer production processes and stronger global collaboration to safeguard both human health and the environment.

Opportunity

Circular Economy Creates Opportunities in the Phosphatic Fertilizer Market.

The concept of a circular economy is increasingly becoming a focal point in addressing the growing demand for phosphorus in agriculture, particularly through the recovery of phosphorus from wastewater and other by-products. Phosphorus is a non-renewable resource, and its extraction from traditional sources like phosphate rock has environmental and economic challenges, as many reserves are concentrated in just a few countries. Recycling phosphorus from waste streams, such as sewage sludge, agricultural runoff, and food processing waste, offers a sustainable alternative.

For instance, in Sweden, phosphorus recovery technologies such as the Ash Dec process are being used to extract phosphorus from incinerated sewage sludge, which is then turned into a usable fertilizer. In the Netherlands, the phosphorus recovery initiative has enabled the recycling of phosphorus from wastewater treatment plants, which has proven to be both environmentally and economically viable.

This approach helps reduce reliance on mined phosphorus, mitigates the environmental impact of excess phosphorus runoff into water bodies, and supports sustainable agriculture practices. As global awareness grows around resource conservation and environmental sustainability, the recovery and reuse of phosphorus could play a crucial role in reducing the ecological footprint of fertilizers and enhancing food security for future generations.

Trends

Shift Towards Precision Agriculture

The shift towards precision agriculture is transforming how phosphatic fertilizers are applied, making farming practices more efficient and sustainable. By using advanced technologies such as GPS, soil sensors, and satellite imagery, farmers can precisely monitor soil nutrient levels and apply fertilizers only where and when they are needed.

This reduces fertilizer waste, minimizes environmental impact, and improves crop yields. For instance, in the United States, precision agriculture techniques have been used to optimize phosphorus application, resulting in more targeted use of fertilizers that reduce excess runoff into waterways. Similarly, in countries such as Brazil, large-scale farmers are adopting variable-rate technology to apply phosphorus based on soil testing data, improving both yield and resource use efficiency.

This trend is gaining momentum as the need for sustainable farming practices becomes more urgent, allowing farmers to maximize productivity while reducing their environmental footprint. By leveraging data-driven insights, precision agriculture is positioning itself as a key strategy in the future of phosphatic fertilizer use.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Phosphatic Fertilizer Market as Several Countries Rely on Imports for Fertilizers.

As most countries rely on imports to meet domestic fertilizer demand, the geopolitical tensions are having a profound impact on the phosphatic fertilizer market, primarily through disruptions in the supply chain of raw materials, trade flows, and fertilizer pricing. For instance, ongoing conflicts in regions such as Eastern Europe have led to interruptions in the supply of key phosphate-producing countries such as Morocco, which holds some of the largest phosphate reserves in the world.

Similarly, in 2020, Russia accounted for 11% of trade in phosphate, while Russia and Belarus jointly accounted for 41% of global trade in potash. Between 2020 and 2021, fertilizer prices increased substantially when conflicts involving major fertilizer-producing countries (Belarus, Russia, and Ukraine) exacerbated already high fertilizer prices.

However, after the war started, countries that were heavily dependent on fertilizer imports from Russia and Belarus feared an immediate shortfall, and many sought to secure alternative sources. Such disruptions can trigger supply shortages, driving up fertilizer prices and making it more challenging for farmers, particularly in developing countries, to afford essential nutrients for crop production.

In South Asia, countries like India, which are highly dependent on imports for their phosphorus needs, have faced rising costs and logistical delays. Furthermore, the fertilizers used in the United States have raw ingredients that are outsourced worldwide, often from China, Canada, and Mexico.

Reciprocal tariffs imposed recently have driven up fertilizer prices, disrupted supply chains, and reduced cost-effectiveness for farmers, which can lead to higher food costs for customers. USMCA-compliant materials from Canada and Mexico continue to be tariff-free, preserving supply chain stability to some extent.

Several agrochemical companies in the country may invest in domestic production or diversify supply chains to tariff-exempt regions, such as Europe, which would require significant capital and time to achieve. These challenges, compounded by global inflation and rising energy prices, have pushed the price of phosphatic fertilizers to record highs. The geopolitical landscape has intensified the volatility of the phosphatic fertilizer market, making it more difficult to predict supply stability and prices.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Phosphatic Fertilizer Market.

In 2024, the Asia Pacific dominated the global phosphatic fertilizer market, holding about 32.3% of the total global consumption. The region has long been the dominant region in the global phosphatic fertilizer market, driven primarily by its large agricultural base and growing food demand. Countries such as China and India are major consumers of phosphatic fertilizers, as they are the world’s most populous nations and are heavily reliant on agriculture to feed their populations.

- According to the report from FAO, Asia is the region with the largest agricultural land area of around 2.08 billion ha, one-third of which is in China. The Americas follow with 1.1 billion ha, and Europe has around 0.5 billion ha of agricultural land.

For instance, in China, the demand for fertilizers has increased in response to the country’s shift toward more intensive farming practices aimed at boosting crop yields. India, with its vast agricultural land, faces the challenge of maintaining soil fertility, particularly in regions where phosphorus levels are low. The extensive use of phosphatic fertilizers in these countries helps ensure adequate food production to meet both domestic and export needs. Furthermore, the increasing adoption of modern farming practices and government subsidies for fertilizer use in the region contribute to the Asia Pacific’s large market share, making it a critical hub for the global fertilizer industry.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies in the phosphatic fertilizer market often focus on product quality, sustainability, and customer education. Several invest in research and development to improve fertilizer efficiency and reduce environmental impact, offering products that are more precise and eco-friendly. In addition, companies engage in transparency, providing clear information about sourcing, production processes, and the benefits of their fertilizers.

Similarly, they offer tailored solutions for different crop types and soil conditions, helping farmers maximize yields while minimizing waste. By implementing strong after-sales support, offering soil testing services, and engaging in investment initiatives, these companies foster stronger relationships with their customers, reinforcing their reputation for reliability and sustainability.

The Major Players in The Industry

- ADM

- BASF SE

- Bayer AG

- Nutrien

- Syngenta

- Corteva, Inc.

- Sumitomo Chemical Co., Ltd.

- Yara International ASA

- OCP Group

- ICL Group Ltd.

- UPL Limited

- FMC Corporation

- K+S AG

- Nufarm

- Compass Minerals International, Inc.

- Other Key Players

Key Development

- In March 2025, OCP Nutricrops, a subsidiary of the OCP Group and a phosphate-based fertilizer producer, announced a strategic investment to reinforce its production capacity with the creation of two new mining and industrial axes, Mzinda and Meskala, Morocco.

- In August 2024, ICL, a leading global specialty minerals company, announced that it had signed a five-year agreement with AMP Holdings Group Co. Ltd., one of China’s top agricultural distribution companies, valued at approximately US$170 million.

Report Scope

Report Features Description Market Value (2024) USD 13.5 Bn Forecast Revenue (2034) USD 21.6 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Triple Superphosphate (TSP), and Others), By Formulation (Solid and Liquid), By Crop Type (Fruits & Vegetables, Cereal & Grains, Oilseeds & Pulses, Turf & Ornamentals, and Others), By Application Method (Foliar Spray, Soil Treatment, Seed Treatment, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape ADM, BASF SE, Bayer AG, Nutrien, Syngenta, Corteva, Sumitomo Chemical, Yara International ASA, OCP Group, ICL Group, UPL Limited, FMC Corporation, K+S AG, Nufarm, Compass Minerals International, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Phosphatic Fertilizer MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Phosphatic Fertilizer MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- BASF SE

- Bayer AG

- Nutrien

- Syngenta

- Corteva, Inc.

- Sumitomo Chemical Co., Ltd.

- Yara International ASA

- OCP Group

- ICL Group Ltd.

- UPL Limited

- FMC Corporation

- K+S AG

- Nufarm

- Compass Minerals International, Inc.

- Other Key Players