Global Pentaerythritol Market Size, Share, And Business Benefits By Product (Mono-Pentaerythritol, Di-Pentaerythritol, Tri-Pentaerythritol), By Purity (Upto 97%, Above 97%), By Application (Paints and Coatings, Lubricants, Explosives, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152116

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

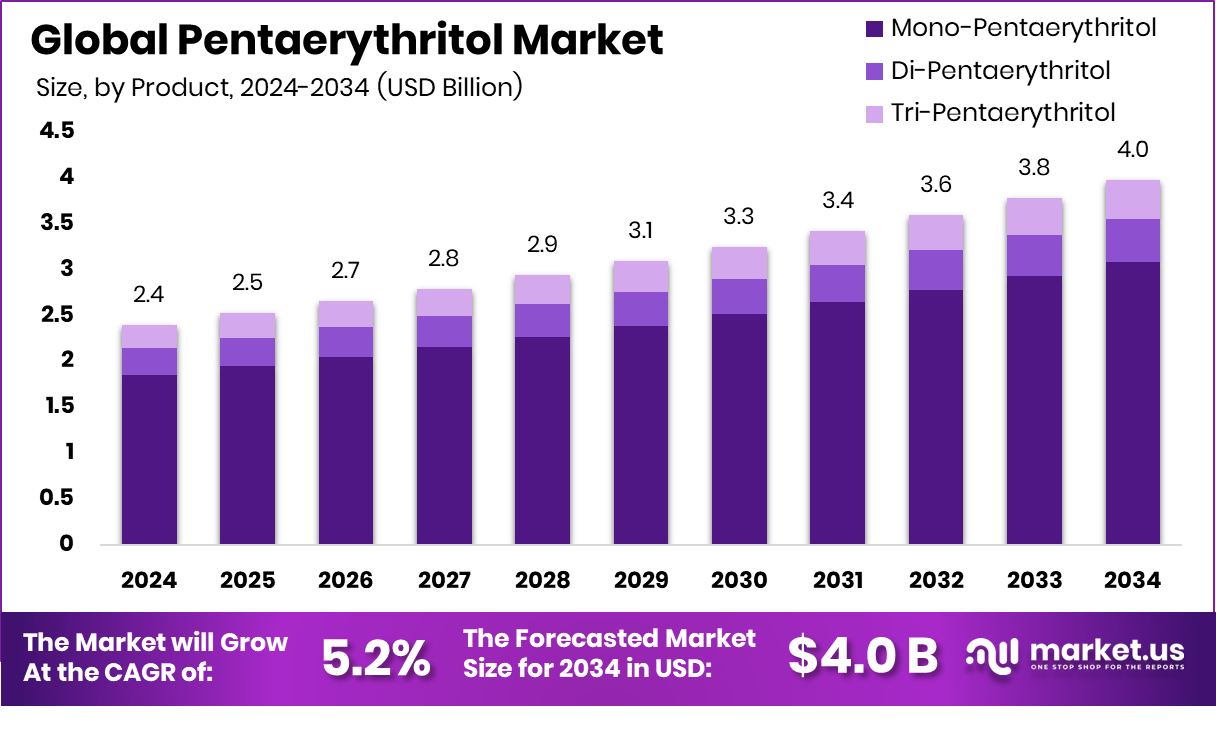

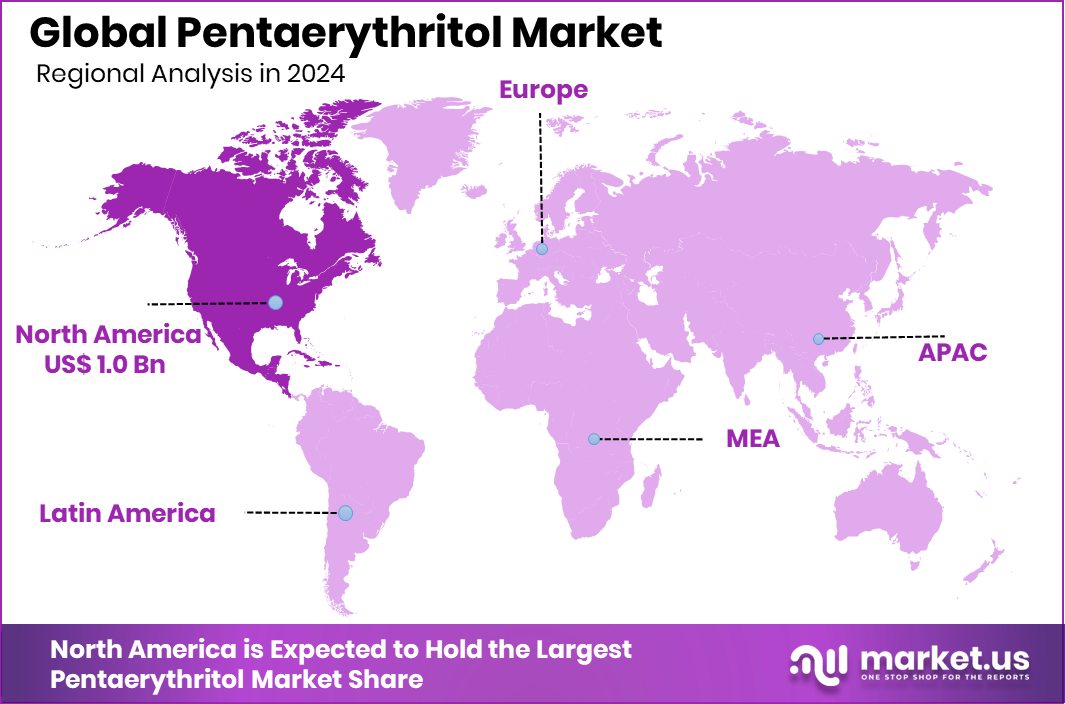

Global Pentaerythritol Market is expected to be worth around USD 4.0 billion by 2034, up from USD 2.4 billion in 2024, and grow at a CAGR of 5.2% from 2025 to 2034. With a 42.9% share, North America leads the global pentaerythritol market.

Pentaerythritol is a white, crystalline, organic compound with the chemical formula C₅H₁₂O₄. It is a polyhydric alcohol containing four hydroxyl groups, making it highly reactive and suitable for multiple industrial applications. Pentaerythritol is primarily synthesized from formaldehyde and acetaldehyde and is known for its stability, non-volatility, and resistance to heat and oxidation.

The Pentaerythritol Market is experiencing consistent growth due to increasing demand across sectors such as automotive, construction, paints and coatings, and energy. Its usage in manufacturing environmentally friendly and high-performance lubricants and coatings has significantly driven market demand. As industries continue to seek materials that enhance durability, weather resistance, and energy efficiency, the demand for pentaerythritol-based formulations is witnessing steady expansion.

The growth of the construction and infrastructure sectors, especially in developing economies, is a major driver of pentaerythritol demand. It is used in the production of alkyd resins for paints and coatings, which are critical in protecting surfaces from moisture, corrosion, and UV exposure. These attributes are particularly valued in large-scale urban development and industrial projects. According to an industry report, Ecoat Raises €21 Million to Advance Low-Carbon Paints and Coatings Solutions

Rising environmental concerns have encouraged the adoption of eco-friendly chemicals, and pentaerythritol, being a low-VOC and biodegradable compound, aligns with regulatory trends promoting green chemistry. It serves as a base for environmentally safer flame retardants and low-toxicity coatings, providing opportunities in sustainable product development.

Key Takeaways

- Global Pentaerythritol Market is expected to be worth around USD 4.0 billion by 2034, up from USD 2.4 billion in 2024, and grow at a CAGR of 5.2% from 2025 to 2034.

- Mono-Pentaerythritol dominates the Pentaerythritol market with a 77.3% share due to widespread industrial use.

- The up to 97% purity segment leads the Pentaerythritol market, accounting for 67.8% of total demand.

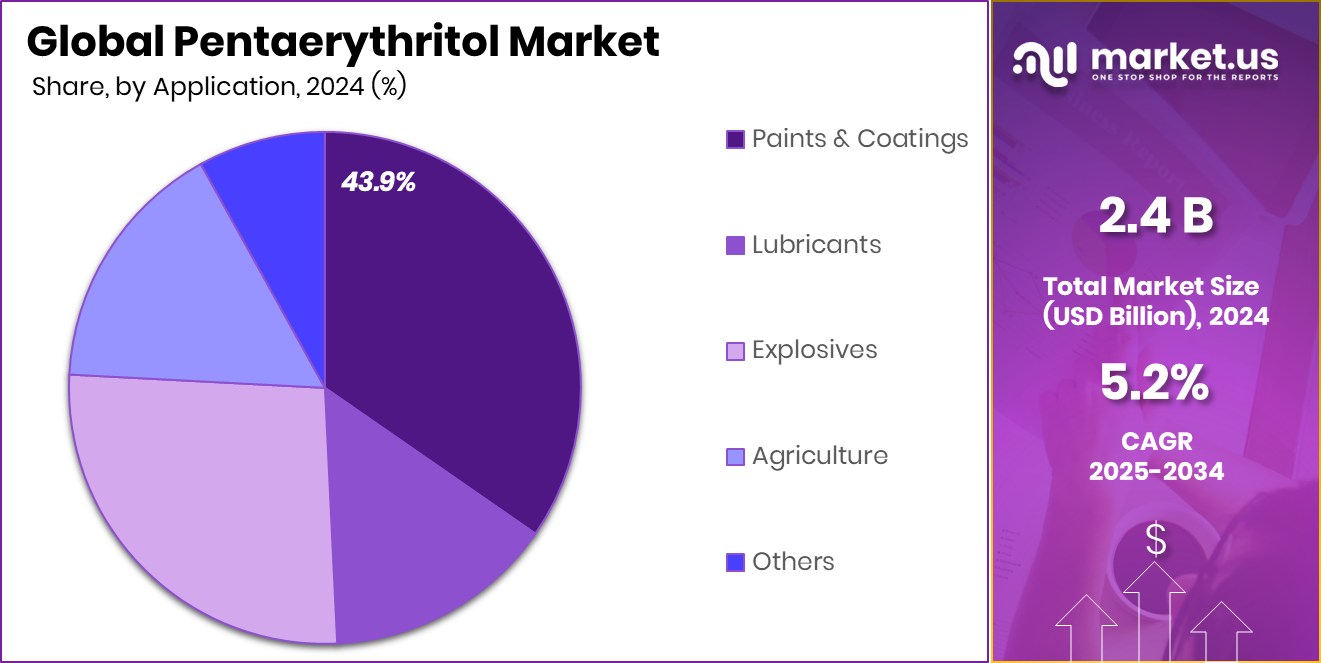

- The paints and coatings segment holds a 43.9% share, driving growth in the global Pentaerythritol market.

- Strong industrial demand in North America drives the USD 1.0 billion market size.

By Product Analysis

Mono-Pentaerythritol leads the market with a 77.3% strong share.

In 2024, Mono-Pentaerythritol held a dominant market position in the By Product segment of the Pentaerythritol Market, with a 77.3% share. This substantial share reflects the wide-ranging industrial applications and consistent demand for mono-pentaerythritol, particularly in the production of alkyd resins, synthetic lubricants, and flame retardants.

Its chemical structure, featuring four hydroxyl groups, makes it highly suitable for creating stable and durable compounds, which are essential in coatings, adhesives, and sealants. Industries favor mono-pentaerythritol for its excellent heat and oxidation resistance, allowing end-use products to withstand harsh environmental conditions.

The dominance of mono-pentaerythritol can also be attributed to its cost-efficiency and ease of synthesis, which supports large-scale manufacturing operations across various sectors. As regulatory frameworks increasingly encourage the use of environmentally safer raw materials, mono-pentaerythritol’s relatively low toxicity and biodegradability further boost its market presence.

The compound’s ability to enhance performance and sustainability in downstream applications has made it a preferred choice among manufacturers, especially in paints, coatings, and lubricants, where product longevity and environmental compliance are critical. With its established utility and strong demand base, mono-pentaerythritol continues to reinforce its leading position in the global pentaerythritol market landscape.

By Purity Analysis

Up to 97% purity dominates with a 67.8% share.

In 2024, Upto 97% held a dominant market position in the By Purity segment of the Pentaerythritol Market, with a 67.8% share. This leading share reflects its widespread adoption across industries that require standard-grade pentaerythritol for general-purpose applications such as paints, coatings, and lubricants.

The 97% purity level offers a reliable balance of performance and cost-effectiveness, making it a preferred choice for manufacturers aiming to maintain product efficiency without incurring the higher costs associated with ultra-pure grades.

The dominance of this segment can be attributed to its suitability for producing alkyd resins, where the required level of purity is adequately met by up to 97% pentaerythritol. This grade also supports ease of formulation and consistent chemical performance, contributing to product stability in industrial processes. As demand continues to rise for protective and decorative coatings across infrastructure and manufacturing sectors, the need for consistent, mid-range purity levels reinforces the growth of this segment.

Furthermore, its wide availability and compatibility with various industrial systems have helped establish up to 97% purity pentaerythritol as the industry standard. The segment’s cost-efficiency, processing convenience, and reliable supply chain have enabled it to maintain a strong foothold in the global market, securing its dominant position in 2024.

By Application Analysis

Paints and coatings hold a 43.9% share of the demand.

In 2024, Paints and Coatings held a dominant market position in the By Application segment of the Pentaerythritol Market, with a 43.9% share. This leading position is driven by the extensive use of pentaerythritol in the formulation of alkyd resins, which serve as key binders in a wide range of industrial and decorative coatings. The compound’s multi-functional alcohol structure enhances the durability, gloss retention, and chemical resistance of coatings, making it ideal for demanding applications in construction, automotive, and general manufacturing sectors.

The dominance of this segment reflects the increasing demand for high-performance and long-lasting protective coatings, especially in environments exposed to moisture, chemicals, and temperature fluctuations. Pentaerythritol-based resins are known for improving film formation and offering superior adhesion properties, which are critical in both protective and aesthetic applications. Additionally, its contribution to reducing volatile organic compound (VOC) emissions in paints aligns with global regulatory trends favoring low-emission, environmentally conscious formulations.

The 43.9% market share underscores the material’s reliability and performance benefits in paint and coating applications. As the need for infrastructure maintenance and industrial finishing continues to grow, the role of pentaerythritol in delivering coating solutions that balance efficiency, quality, and environmental safety remains firmly established.

Key Market Segments

By Product

- Mono-Pentaerythritol

- Di-Pentaerythritol

- Tri-Pentaerythritol

By Purity

- Upto 97%

- Above 97%

By Application

- Paints and Coatings

- Lubricants

- Explosives

- Agriculture

- Others

Driving Factors

Rising Demand for Durable Coatings and Paints

One of the top driving factors for the pentaerythritol market is the increasing demand for long-lasting paints and coatings. Pentaerythritol is widely used to make alkyd resins, which are essential in protective and decorative coatings. These coatings are applied to surfaces like metal, wood, and concrete to protect them from water, chemicals, heat, and sunlight.

As construction and industrial activities grow globally, especially in developing countries, the need for strong and weather-resistant coatings also rises. Pentaerythritol helps improve the hardness, gloss, and durability of the final paint product, making it ideal for both indoor and outdoor use.

Restraining Factors

Raw Material Price Fluctuations Impact Production Stability

A major restraining factor in the pentaerythritol market is the fluctuation in prices of its raw materials, particularly formaldehyde and acetaldehyde. These are petroleum-based chemicals, and their availability and cost are directly affected by changes in global crude oil prices. When oil prices rise, the cost of producing pentaerythritol also increases, which can reduce profit margins for manufacturers.

This instability makes it difficult for companies to plan long-term pricing and production strategies. Additionally, any disruption in the supply of these raw materials—due to geopolitical tensions, trade restrictions, or regulatory changes—can slow down manufacturing processes.

Growth Opportunity

Expanding Eco‑Friendly Formulations with Pentaerythritol

Pentaerythritol presents a significant growth opportunity through its use in eco‑friendly formulations. As regulations and consumer awareness around environmental impacts increase, industries are seeking low‑VOC, biodegradable, and non‑toxic alternatives. Pentaerythritol can serve as a core ingredient in greener alkyd resins, flame retardants, and lubricants that meet the demand for sustainable products.

Its chemical properties support high performance without compromising environmental standards, making it suitable for coatings, plastics, and energy applications. By partnering with regulatory and standards organizations, manufacturers can develop and certify pentaerythritol‑based formulations that appeal to eco‑conscious markets.

Latest Trends

Increasing Use of High‑Performance Pentaerythritol‑Based Coatings

A leading trend in the pentaerythritol market is the growing adoption of high-performance coatings that rely on this compound. Manufacturers are increasingly using pentaerythritol to enhance the strength, shine, and durability of paints and protective layers across many sectors. These advanced coatings offer better resistance to rust, heat, and chemicals, extending the lifespan of treated surfaces.

Additionally, such formulations maintain visual appeal, which is important in industries like automotive, marine, and construction. Easier application processes and compatibility with low-VOC (volatile organic compound) standards further drive their appeal. As industries seek coatings that last longer and perform better in extreme conditions, the use of pentaerythritol-rich formulations is on the rise, reflecting a shift towards smarter material choices in surface protection.

Regional Analysis

In 2024, North America accounted for 42.9% market share, reaching USD 1.0 billion.

In 2024, North America emerged as the leading region in the global pentaerythritol market, capturing a dominant 42.9% share and reaching a value of USD 1.0 billion. This strong market position is driven by the region’s well-established industrial base, especially in coatings, construction, and lubricants, where pentaerythritol is widely utilized due to its chemical stability and performance benefits. The demand in North America is further supported by technological advancements and increased adoption of high-performance materials in sectors such as automotive and building infrastructure.

Europe continues to be a key market, supported by stringent environmental regulations that encourage the use of low-VOC and eco-friendly compounds in paints, resins, and fire retardants.

Asia Pacific shows robust growth potential, fueled by rising industrial output and construction activities, particularly in China and India. The growing demand for industrial coatings and lubricants contributes to regional consumption.

Middle East & Africa and Latin America remain emerging markets, where gradual industrial development and urbanization are beginning to create demand for pentaerythritol-based products. Although these regions currently hold smaller shares, their long-term growth prospects are expected to improve with increased infrastructure investment. North America, however, remains the largest contributor to global market revenues in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Chifeng Ruiyang Chemical Co., Ltd continues to reinforce its position with consistent domestic supply strength and an expanding distribution footprint. The company’s focus on bulk manufacturing and cost-effective processing supports its role in maintaining steady exports to various end-use sectors.

Ercros S.A., a European-based chemical manufacturer, remains a reliable supplier with a well-structured product portfolio. The company’s commitment to integrating sustainable production technologies aligns with the rising demand for eco-friendly chemical solutions in the region, giving it a notable edge in regulated markets.

Henan Pengcheng Group demonstrates a strong foothold in the Asia Pacific region. With its operational efficiency and integrated manufacturing capabilities, the company plays a vital role in fulfilling demand from domestic resin and coating manufacturers, contributing to regional growth.

Chemball, known for its comprehensive chemical offerings, continues to support supply chain continuity across multiple industrial domains. Its ability to offer technical-grade and standard pentaerythritol in bulk positions it as a dependable supplier.

Top Key Players in the Market

- Celanese Corporation

- Chemanol

- Chifeng Ruiyang Chemical Co.,Ltd

- Ercros S.A.

- Henan Pengcheng Group

- Chemball

- Jiangsu Ruiyang Chemical Co., Ltd.

- Kanoria Chemicals & Industries Limited

- KH Chemicals

- MITSUI BU+SAN CHEMICALS Co., Ltd.

- Perstorp Holding AB

- Samyang Chemical Corporation

- U-JIN Chemical Co., Ltd.

- Yuntianhua Group Co., Ltd.

Recent Developments

- In April 2025, Chemanol’s board appointed a third-party forensic auditor to investigate the 2023 acquisitions of ACC and GCI. This step reflects its commitment to transparency and strong governance during the integration of these specialty chemical assets.

- In May 2024, Ercros announced the implementation of its “3D Plan” in Tortosa, which includes capacity expansion for polyols (including pentaerythritol and dipentaerythritol), waste heat recovery units, and plans for a 6 GWh/year photovoltaic park—all aimed at improving efficiency and reducing CO₂ emissions.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 4.0 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Mono-Pentaerythritol, Di-Pentaerythritol, Tri-Pentaerythritol), By Purity (Upto 97%, Above 97%), By Application (Paints and Coatings, Lubricants, Explosives, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Celanese Corporation, Chemanol, Chifeng Ruiyang Chemical Co.,Ltd, Ercros S.A., Henan Pengcheng Group, Chemball, Jiangsu Ruiyang Chemical Co., Ltd., Kanoria Chemicals & Industries Limited, KH Chemicals, MITSUI BU+SAN CHEMICALS Co., Ltd., Perstorp Holding AB, Samyang Chemical Corporation, U-JIN Chemical Co., Ltd., Yuntianhua Group Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Celanese Corporation

- Chemanol

- Chifeng Ruiyang Chemical Co.,Ltd

- Ercros S.A.

- Henan Pengcheng Group

- Chemball

- Jiangsu Ruiyang Chemical Co., Ltd.

- Kanoria Chemicals & Industries Limited

- KH Chemicals

- MITSUI BU+SAN CHEMICALS Co., Ltd.

- Perstorp Holding AB

- Samyang Chemical Corporation

- U-JIN Chemical Co., Ltd.

- Yuntianhua Group Co., Ltd.