Global Palm Oil Derivatives Market By Source (Crude Palm Oil (CPO) and Crude Palm Kernel Oil (CPKO)), By Derivative Type (Fatty Acids, Fatty Alcohols, Fatty Methyl Ester, Fatty Nitrogen Compounds, and Glycerine), By Applications (Food and Beverage, Personal Care and Cosmetics, Industrial, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: August 2025

- Report ID: 153096

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

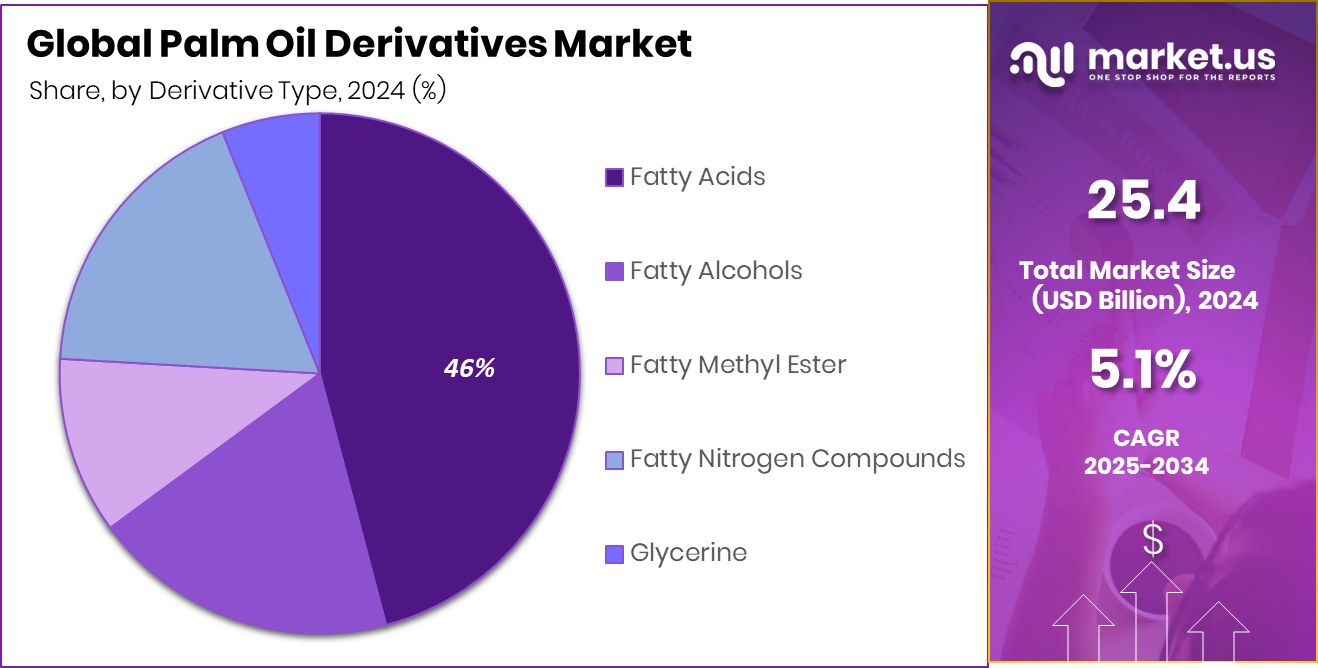

In 2024, the Global Palm Oil Derivatives Market was valued at US$ 25.4 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 5.1%, reaching about US$ 41.8 billion by 2034.

Palm oil, extracted from the fruit of oil palm trees, is a versatile vegetable oil. Through various processes, it’s transformed into different derivatives with specific functionalities, such as fatty acids and alcohols. Palm oil and its derivatives have a wide range of uses due to their unique properties. They act as emulsifiers, thickeners, and stabilizers in various products, and are a relatively inexpensive source of these ingredients.

The major driver of the market is the growing cosmetics industry and the expanding application of palm oil derivatives in cosmetics. They are also extensively used in the food and beverage industry, despite the controversies. Additionally, in recent years, the use of palm-based biodiesel has grown in popularity.

The palm oil industry faces criticism due to deforestation and habitat loss associated with palm oil cultivation. Tracking the origin of palm oil derivatives can be challenging due to the complex nature of the supply chain. There’s a growing focus on sustainable sourcing of palm oil and exploring alternative ingredients.

- According to the United States Department of Agriculture, in 2024, global palm oil production reached 76.02 million metric tons, with the Asia Pacific producing around 90% of the palm oil.

Key Takeaways

- The global palm oil derivatives market was valued at US$ 25.4 billion in 2024.

- The global palm oil derivatives market is projected to grow at a CAGR of 5.1% and is estimated to reach US$ 41.8 billion by 2034.

- On the basis of source, crude palm oil (CPO) dominated the market with a 54.6% share of the total global market in 2024.

- Based on derivative types, in 2024, fatty acids led the palm oil derivatives market with a substantial market share of 45.9%.

- Among the applications, the food and beverage sector was at the forefront of the palm oil derivatives market with a market share of 52.1% in 2024.

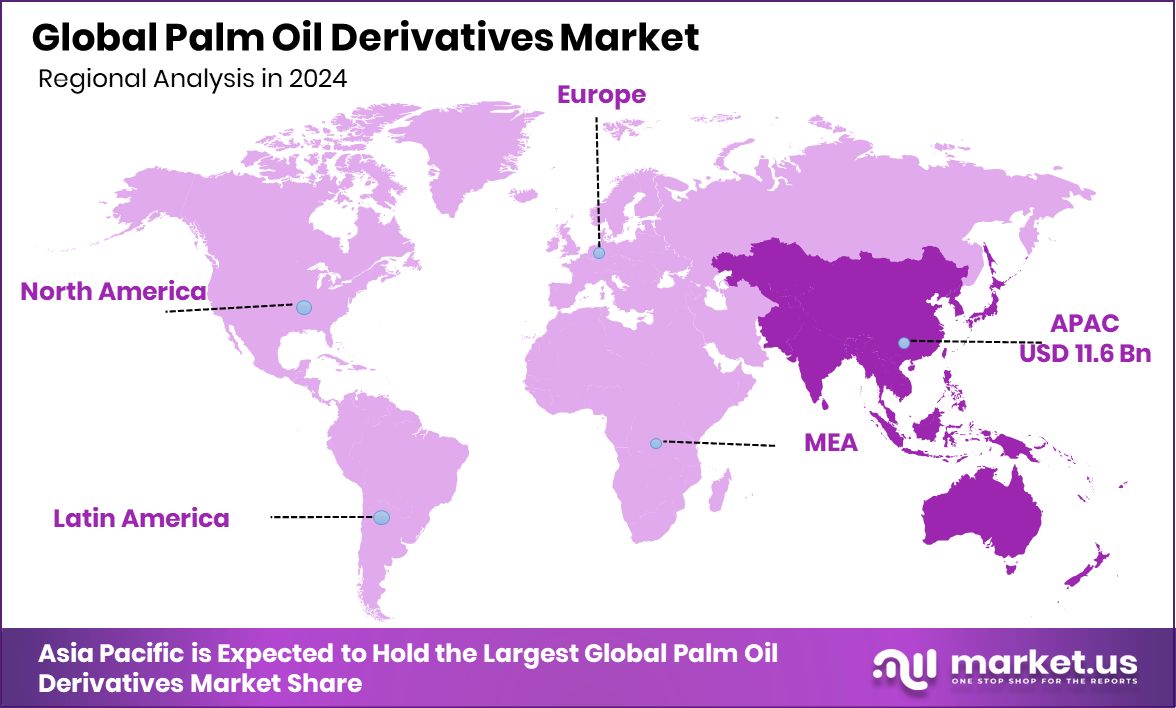

- Asia Pacific was the biggest market for the palm oil derivatives in 2024, with a market share of 43.2%.

Source Analysis

Crude Palm Oil (CPO) Led the Palm Oil Derivatives Market Due to High Production Volume.

Based on the source from which palm oil is produced, it is segmented into crude palm oil (CPO) and crude palm kernel oil (CPKO). In 2024, the market was dominated by crude palm oil with a market share of 54.6%. This dominance of the segment is attributed to several factors, such as production volume and the cost of the oil.

According to the Council of Palm Oil Producing Countries, the total global crude palm oil production reached around 79.2 million tons in 2024, which is a 3.4% growth from 76.6 million tons in 2021. The production of crude palm kernel oil reached around 9 million metric tons in 2024.

As CPKO is produced from nuts inside the palm fruit, which are derived after the production of crude palm oil, it is difficult to produce and the volume is very less. Additionally, due to palm kernel oil’s versatile industry applications, it commands a slightly higher market price than palm oil. Due to being cheaper than kernel oil, CPO has a slightly bigger market than the CPKO.

Derivative Type Analysis

Palm Oil Derivatives that are Fatty Acids Dominated the Market in 2024 with 45.9% Share of the Total Global Market.

Based on the types of derivatives, the palm oil derivatives market is divided into fatty acids, fatty alcohols, fatty methyl esters, fatty nitrogen compounds, and glycerin. Fatty acids led the palm oil derivatives market with 45.9% share of the total global market.

The main fatty acid derivatives of crude palm oil include palmitic acid and oleic acid, and those of crude palm kernel oil include lauric acid. Although all the derivatives of palm oil are currently used commercially, the fatty acid derivatives are most commonly used. For instance, palmitic acid is a key ingredient in soaps, detergents, and personal care products due to its emollient and emulsifying properties.

Similarly, oleic acid, a monounsaturated omega-9 fatty acid, has diverse uses spanning food, pharmaceuticals, and industrial applications. It is used as a surfactant and emulsifier in food production. Similarly, lauric acid is a common ingredient in cocoa butter, coffee creamer, cheese analogs, margarines, and spreads.

Application Analysis

Food and Beverage Dominated the Palm Oil Derivatives Market

The palm oil derivatives market is segmented into food and beverage, personal care and cosmetics, and industrial applications. Among these, food and beverage applications dominated the palm oil derivatives market with around 52.1% of the total market share. Palm oil derivatives, particularly fatty acid derivatives, are mostly used in the food and beverage industry due to their versatility, functional properties, cost-effectiveness, and neutral flavor.

A 2024 USDA report stated that palm oil accounts for 40% of global vegetable oil demand, outpacing alternatives like soybean or canola oil. Its properties, like high heat tolerance and creamy texture, make it ideal for specific applications.

It is used in cookies, cakes, and pastries for their crisp texture and extended shelf life. It provides a creamy texture without needing constant refrigeration for products like peanut butter and margarines. It is also used in chocolate bars, candies, and creamy fillings for structure and smoothness.

Key Market Segments

By Source

- Crude Palm Oil (CPO)

- Crude Palm Kernel Oil (CPKO)

By Derivative Type

- Fatty Acids

- Fatty Alcohols

- Fatty Methyl Ester

- Fatty Nitrogen Compounds

- Glycerin

By Application

- Food and Beverage

- Personal Care and Cosmetics

- Industrial

- Other Applications

Drivers

Cosmetics Industry Drives the Palm Oil Derivatives Market.

Palm oil and its derivatives have become one of the integral elements in the cosmetics industry, accounting for around 70% of personal care and cosmetics products, such as sunscreens, lotions, shampoos, and soaps. The palm oil derivatives, including fatty acids, alcohols, and esters, serve as emollients, moisturizers, emulsifiers, thickeners, and foaming agents in the industry.

For instance, cetyl palmitate, a waxy ester from palm oil, acts as a thickener and emulsifier in creams and lotions, while cetyl alcohol or palmityl alcohol is widely used as an emollient, opacifier, and stabilizer in shampoos and skincare formulations. Derivatives such as glyceryl stearate, cetyl alcohol, and caprylic/capric triglyceride are used in lipsticks to ensure smooth application, color retention, heat stability, and moisturizing properties.

Cosmetic formulators favor palm oil derivatives not only for their functional benefits, but also for their cost‑effectiveness compared to alternatives. This combination of performance, versatility, and affordability makes palm oil derivatives indispensable across nearly all cosmetic lines.

Restraints

Deforestation Linked to Heavy Use of Palm Oil Derivatives Might Pose a Challenge to the Market.

The cosmetics, food and beverage, and other industrial reliance on palm oil derivatives increasingly faces pressure due to the environmental toll of palm cultivation. Between 1990 and 2005, Malaysia converted over 1.1 million hectares of tropical rainforest into oil palm plantations, an expansion that directly contributes to habitat loss and biodiversity decline.

Similarly, between 2001 and 2016, oil palm accounted for approximately 23% of Indonesia’s deforestation, with illegal clearing alone responsible for the loss of up to 840,000 hectares of primary forest annually. Despite the existence of certification systems such as the RSPO, their effectiveness remains limited.

As consumer and regulatory pressure around sustainability mounts, these environmental consequences threaten the dependence of various industries on palm derivatives, making deforestation a strategic and ethical challenge.

Opportunity

Surging Adoption of Palm Oil in the Diesel Industry Propels the Market.

The accelerated adoption of palm oil–derived biodiesel in the energy sector has significantly boosted demand for palm derivatives. Indonesia, the world’s largest palm oil producer, has moved through successive mandates, such as B30 (30 %), then B35 by August 2023, and now implementing B40, requiring diesel fuel to contain up to 40 % palm-based biodiesel.

In 2025, the country allocated approximately 15.6 million kiloliters for its B40 program, compared to 13.2 million kiloliters in 2024. The energy sector has woven palm biodiesel into diverse applications from power generation, such as Thailand’s PTT Group converting cogeneration facilities, to maritime shipping, where palm oil blends, like that of Maersk, offer up to 18 % lower well‑to‑wake emissions compared to conventional marine diesel. This widespread integration signals how the diesel industry’s shift toward biodiesel is a key engine of demand across the palm derivatives supply chain.

Trends

Shift Towards Sustainable Sourcing of Palm Oil and Its Derivatives.

Around the globe, the palm oil industry is increasingly embracing sustainability through certification, partnerships, and innovations that span smallholders, major manufacturers, and traceability systems. The Roundtable on Sustainable Palm Oil (RSPO) has been central to this change, growing from just 125,000 hectares of certified plantations across three countries in 2008 to approximately 5.2 million hectares across 23 countries by 2023, with over 15 million tonnes of Certified Sustainable Palm Oil (CSPO) produced, representing roughly one‑fifth of global palm oil output.

Participation from independent smallholders is also on the rise, with more groups becoming RSPO certified and female participation reaching about 28 %. In 2022, Independent Smallholder (ISH) groups with RSPO membership grew significantly to 166, of which 81% (groups) are now certified. Several companies are trying to align themselves with consumer preferences for sustainable production of palm oil.

Geopolitical Impact Analysis

Impact of Geopolitical Tensions

Geopolitical tensions have had a profound impact on the palm oil derivatives market, influencing everything from supply chains and production to regulatory standards and pricing. For instance, reciprocal tariffs of 32% announced by the United States impacted Indonesian palm oil shipments to the US, as the move undermined the country’s competitiveness in the global market, according to the Indonesian Palm Oil Association, known as Gapki.

Similarly, the conflict in the Middle East is pushing up oil prices and disrupting key shipping lanes, raising transportation and energy costs, leading to rising costs of production of palm oil. Similarly, India-Pakistan tensions could also potentially disrupt vital trade corridors for two major producers of palm oil, Indonesia and Malaysia.

Furthermore, Indonesia’s biodiesel mandate is set to reach B40, 40% palm oil component in diesel, in 2025 and B50, 50% palm oil component in diesel, in 2026, which is expected to boost domestic palm oil demand to 26.1 million tons this year, further tightening export availability. Due to these tensions, prices of palm oil and its derivatives initially shot up in early 2025.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Palm Oil Derivatives Market.

The Asia Pacific was in the vanguard of the global palm oil derivatives market, holding about 43.2%, valued at approximately US$ 11.6 billion. This dominance is largely attributed to the region’s well-established palm oil processing infrastructure and strong demand across various industries.

Palm trees are grown mainly in Southeast Asia, Africa, and parts of Latin America. According to the United States Department of Agriculture, in 2024, Indonesia produced around 58.3% of the total global palm oil production, 46 million metric tons.

Similarly, Malaysia produced approximately 24.6% palm oil, reaching 19.4 million metric tons of palm oil. These countries ensure a consistent supply to countries like China, India, Japan, and South Korea, where most manufacturing of cosmetic and industrial products occurs.

In recent years, the food processing industry has also seen an expansion, further driving the palm oil derivatives market. On the contrary, the palm oil derivatives market in North America as well as Europe has been stagnant for quite a few years, due to controversies related to the use of palm oil derivatives in food and cosmetic products.

Key Regions and Countries Covered in this Report:

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland, Wilmar International, SD Guthrie, IOI Corporation, Cargill, Golden Agri-Resources, Kuala Lumpur Kepong, Asian Agri, United Plantations Berhad, KLK OLEO, and Univanich Palm Oil Public are the global major players in the palm oil derivatives market. As the palm oil derivatives market is very competitive, many players try to gain a competitive edge by engaging in strategic activities, such as product development, mergers, partnerships, and investments.

For instance, in October 2023, KTC Edibles (KTC), the UK’s largest supplier of edible oils, launched Planet Palm, a range of certified, sustainable, traceable, and responsibly sourced palm oil products for bakery and food manufacturers in the UK. Similarly, in July 2025, the Ghanaian government launched US$50 million palm oil project to boost local production with Onesta by Redgold Oil Palm Plantation Project (ROPP).

Top Key Players in the Market

- Archer Daniels Midland Company

- Wilmar International Ltd.

- SD Guthrie Berhad

- IOI Corporation Berhad

- Cargill, Incorporated

- Golden Agri-Resources Ltd.

- Kuala Lumpur Kepong Berhad

- Asian Agri

- United Plantations Berhad

- KLK OLEO

- Univanich Palm Oil Public Co. Ltd.

- Other Key Players

Key Development:

- In October 2023, Cargill announced that the company would no longer offer conventional palm oil in its U.S. portfolio. It was one of the first, large-scale U.S. suppliers to exclusively offer palm oil certified by the Roundtable for Sustainable Palm Oil (RSPO).

- In May 2025, Golden Agri-Resources (GAR), an integrated palm oil producer, announced an agreement with the French Agricultural Research Centre for International Development (CIRAD) to accelerate innovation in sustainable palm oil.

Report Scope

Report Features Description Market Value (2024) US$ 25.4 Bn Forecast Revenue (2034) US$ 41.8 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Crude Palm Oil (CPO), Crude Palm Kernel Oil (CPKO)), By Derivative Type (Fatty Acids, Fatty Alcohols, Fatty Methyl Ester, Fatty Nitrogen Compounds, Glycerine), By Applications (Food and Beverage, Personal Care and Cosmetics, Industrial, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Wilmar International Ltd., SD Guthrie Berhad, IOI Corporation Berhad, Cargill, Incorporated, Golden Agri-Resources Ltd., Kuala Lumpur Kepong Berhad, Asian Agri, United Plantations Berhad, KLK OLEO, Univanich Palm Oil Public Co. Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Palm Oil Derivatives MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Palm Oil Derivatives MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Wilmar International Ltd.

- SD Guthrie Berhad

- IOI Corporation Berhad

- Cargill, Incorporated

- Golden Agri-Resources Ltd.

- Kuala Lumpur Kepong Berhad

- Asian Agri

- United Plantations Berhad

- KLK OLEO

- Univanich Palm Oil Public Co. Ltd.

- Other Key Players