Global Neoprene Market By Manufacturing Route (Butadiene Route, Acetylene Route), By Type (Normal Linear Grades, Pre-crosslinked Grades, Sulfur-modified Grades, Slow Crystallizing Grades), By Application (Latex, Elastomers, Adhesives), By End-use (Building and Construction, Automotive, Electrical and Electronics, Medical, Textiles, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150194

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

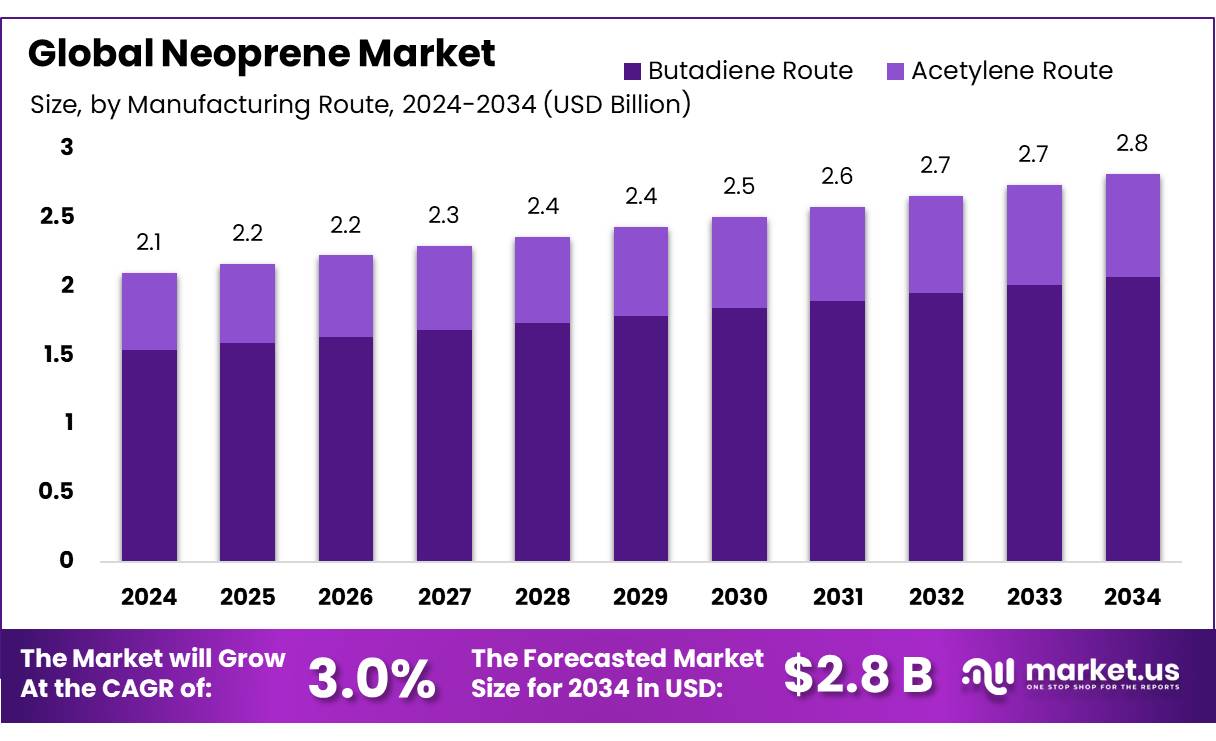

The Global Neoprene Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 3.0% during the forecast period from 2025 to 2034.

Neoprene Cellulose Concentrates represent a niche segment within the broader industrial materials market, combining the properties of neoprene—a synthetic rubber known for its chemical stability and flexibility—with cellulose, a natural polymer derived from plant fibers. This hybrid material finds applications in sectors requiring both durability and biodegradability, such as specialized packaging, automotive components, and certain construction materials.

Government initiatives globally are fostering the development and adoption of sustainable building materials. For instance, the European Union’s Circular Economy Action Plan emphasizes the use of bio-based materials in construction to reduce carbon emissions and promote resource efficiency. Similarly, in India, the “Housing for All” initiative aims to construct 20 million urban homes by 2022, encouraging the use of sustainable and affordable building materials. These policies create a conducive environment for the adoption of neoprene cellulose concentrates in construction projects.

Furthermore, the integration of neoprene in energy-efficient building designs contributes to reduced operational carbon emissions. Studies have shown that incorporating bio-based materials like neoprene can decrease a building’s embodied energy by approximately 20%, highlighting its role in sustainable construction. As buildings become more energy-efficient, the significance of using materials with low embodied carbon, such as neoprene, becomes increasingly critical.

Cellulose fibers, derived from plant-based sources, have been recognized for their reinforcing capabilities in construction materials. Studies have demonstrated that incorporating cellulose nanocrystals into concrete can increase its flexural strength by up to 30%, indicating the potential benefits of cellulose integration in composite materials. Furthermore, cellulose fibers are widely used in construction applications such as dry-mix mortars, tile adhesives, and joint fillers, highlighting their versatility and compatibility with existing building materials.

Key Takeaways

- Neoprene Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 3.0%.

- Butadiene Route held a dominant market position, capturing more than a 73.5% share in the global neoprene.

- Industrial Grade held a dominant market position, capturing more than a 44.1% share in the global neoprene market.

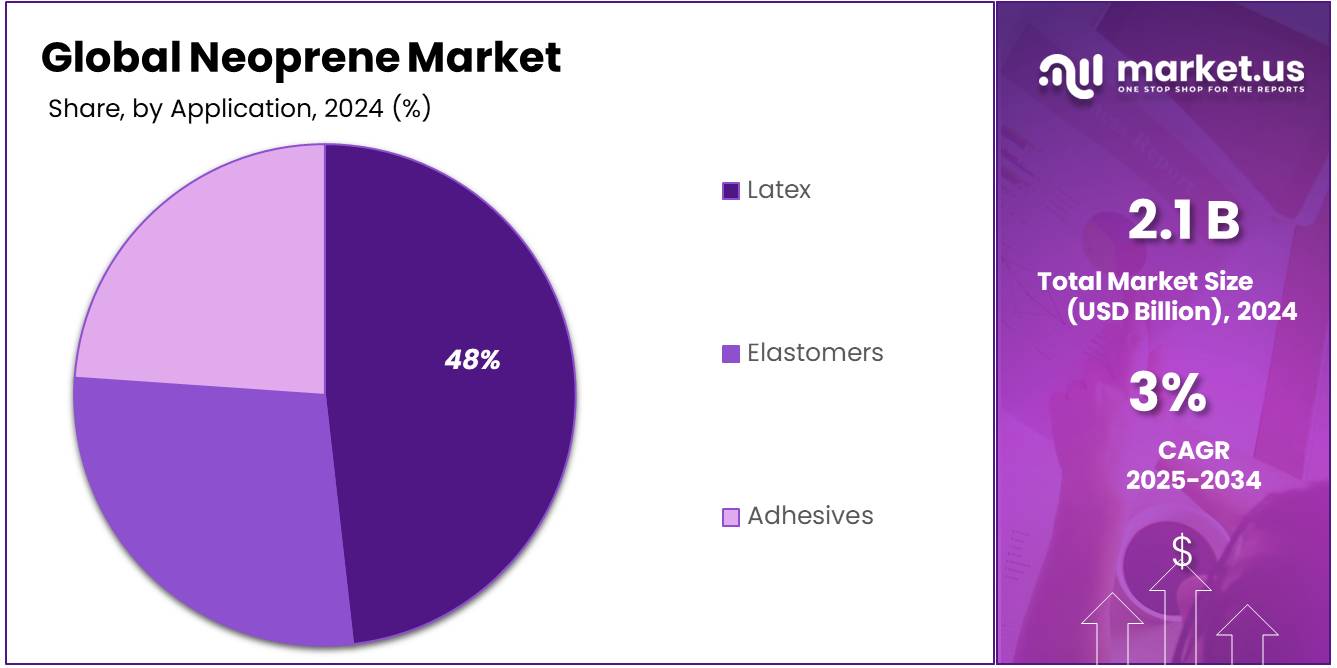

- Latex held a dominant market position, capturing more than a 48.4% share in the global neoprene market.

- Building & Construction held a dominant market position, capturing more than a 33.3% share in the global neoprene market.

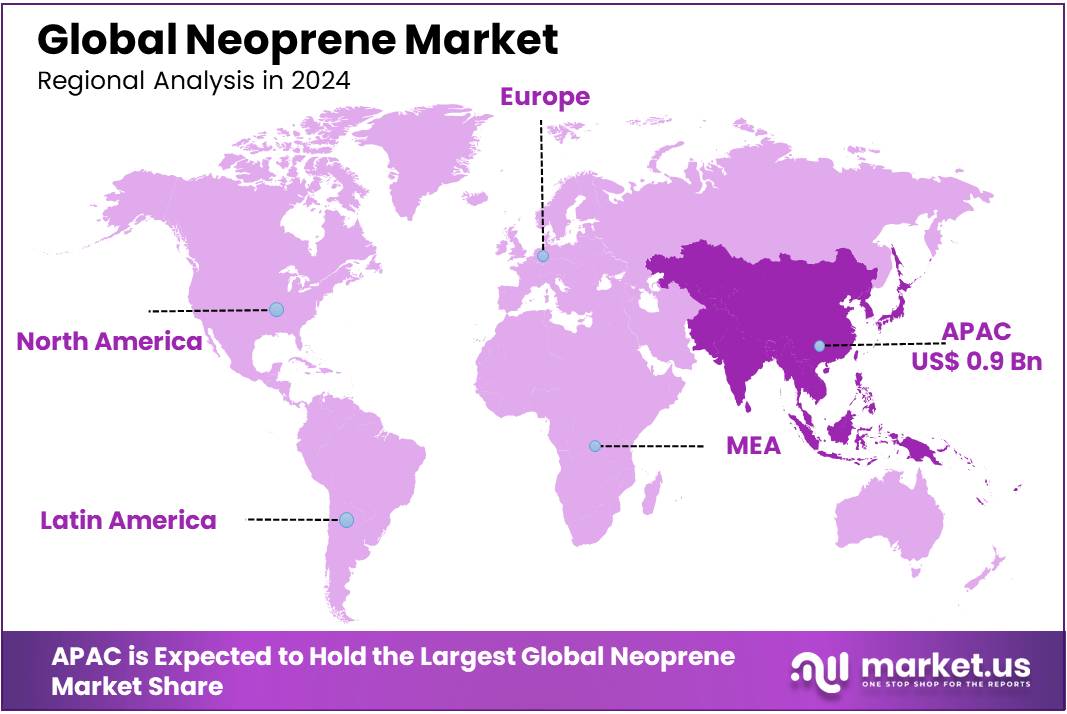

- Asia Pacific (APAC) region solidified its position as the dominant force in the global neoprene market, capturing a substantial 46.6% share, equivalent to USD 0.9 billion.

By Manufacturing Route

Butadiene Route leads with 73.5% share in 2024 owing to its established production efficiency and cost advantages

In 2024, Butadiene Route held a dominant market position, capturing more than a 73.5% share in the global neoprene manufacturing landscape. This route remains the preferred method among producers due to its well-established infrastructure, scalable process efficiency, and comparatively lower raw material costs.

Butadiene, derived primarily from petroleum-based feedstocks, enables a stable and consistent polymerization process, making it ideal for mass production of neoprene across applications in automotive, construction, and industrial goods. While newer and greener alternatives are gradually being explored, Butadiene Route continues to be the backbone of neoprene manufacturing as of 2024, supported by legacy systems and lower transition costs.

By Type

Industrial Grade leads with 44.1% share in 2024, driven by strong demand from automotive and construction sectors

In 2024, Industrial Grade held a dominant market position, capturing more than a 44.1% share in the global neoprene market by type. Its widespread use in heavy-duty applications such as automotive belts, hoses, gaskets, and vibration mounts contributed to this leading position. Industrial-grade neoprene is favored for its excellent resistance to weather, oil, and heat, making it suitable for long-term performance in harsh environments. The ongoing expansion of infrastructure and manufacturing activities globally in 2024 continued to support the steady demand for this grade, particularly in Asia-Pacific and North America.

By Application

Latex dominates with 48.4% share in 2024, fueled by its wide use in adhesives and medical products

In 2024, Latex held a dominant market position, capturing more than a 48.4% share in the global neoprene market by application. This strong position is largely due to the high demand for neoprene latex in water-based adhesives, medical gloves, and protective coatings. Its excellent film-forming ability, elasticity, and chemical resistance make it a preferred choice for manufacturers across packaging, healthcare, and construction sectors. In particular, the rising shift toward solvent-free and environmentally safer adhesive systems in 2024 contributed to higher consumption of neoprene latex in both developed and emerging markets.

By End-use

Building & Construction leads with 33.3% share in 2024, supported by insulation demand and structural durability needs

In 2024, Building & Construction held a dominant market position, capturing more than a 33.3% share in the global neoprene market by end-use. This dominance was mainly driven by the increasing use of neoprene in roofing membranes, expansion joints, window seals, and bridge pads due to its excellent weather resistance, flexibility, and insulation properties.

With global construction activities on the rise—particularly in developing regions like Southeast Asia and the Middle East—demand for long-lasting, moisture-resistant materials such as neoprene saw significant growth. Throughout 2024, building and infrastructure projects continued to favor neoprene for its ability to withstand harsh environmental conditions while ensuring structural performance and safety.

Key Market Segments

By Manufacturing Route

- Butadiene Route

- Acetylene Route

By Type

- Normal Linear Grades

- Pre-crosslinked Grades

- Sulfur-modified Grades

- Slow Crystallizing Grades

By Application

- Latex

- Elastomers

- Adhesives

By End-use

- Building & Construction

- Automotive

- Electrical & Electronics

- Medical

- Textiles

- Others

Drivers

Government-Led Infrastructure Development Drives Neoprene Market Growth

In 2024, the global neoprene market experienced significant growth, largely propelled by increased government investment in infrastructure projects. Neoprene’s durability, weather resistance, and flexibility make it an ideal material for various construction applications, including bridge bearings, expansion joints, and waterproofing membranes. This surge in demand is closely linked to national infrastructure initiatives aimed at enhancing transportation networks and public facilities.

For instance, the United States’ Infrastructure Investment and Jobs Act, enacted in 2021, allocated approximately $1.2 trillion for infrastructure development over a decade. A substantial portion of this funding is directed toward the construction and rehabilitation of roads, bridges, and public transit systems. Such large-scale projects necessitate materials that can withstand environmental stressors, positioning neoprene as a material of choice for ensuring structural integrity and longevity.

Similarly, in the European Union, the Recovery and Resilience Facility has earmarked €723.8 billion to support member states in implementing reforms and investments, with a significant focus on green and digital transitions. This includes the modernization of infrastructure, where neoprene’s properties align with the EU’s sustainability and resilience objectives.

Restraints

Environmental Regulations and Emission Controls Restrain Neoprene Market Growth

In 2024, the neoprene market faced significant challenges due to stringent environmental regulations targeting chloroprene emissions, a key component in neoprene production. The U.S. Environmental Protection Agency (EPA) implemented new rules mandating an 80% reduction in chloroprene emissions within 90 days for facilities producing neoprene, alongside a two-year deadline for other hazardous pollutants. These regulations substantially increased operational costs for manufacturers, compelling them to invest in advanced emission control technologies and compliance measures.

A notable example is Denka Performance Elastomer’s plant in St. John the Baptist Parish, Louisiana. In 2025, Denka announced an indefinite suspension of operations, citing over $109 million in financial losses attributed to the high costs of pollution control equipment and declining global demand for neoprene. The company had invested more than $35 million since 2017 to reduce emissions by 85%, yet levels remained above federal safety guidelines. This situation underscores the financial strain that environmental compliance can impose on neoprene manufacturers.

Beyond the U.S., environmental concerns are influencing the neoprene market globally. In Europe, heightened environmental consciousness and stringent regulatory frameworks are encouraging the development and adoption of sustainable materials, impacting the demand for traditional neoprene. Additionally, the non-biodegradable nature of neoprene and its contribution to pollution have led companies to explore eco-friendly substitutes, further affecting market growth.

Opportunity

Rising Demand in Automotive and Electric Vehicle Sectors Fuels Neoprene Market Growth

In 2024, the global neoprene market experienced significant growth, largely driven by the automotive industry’s increasing demand for durable, heat-resistant, and flexible materials. Neoprene’s unique properties make it an ideal choice for manufacturing automotive components such as hoses, belts, gaskets, and seals. These components are essential for ensuring vehicle performance and safety, particularly as the industry shifts towards more energy-efficient and environmentally friendly solutions.

The rise of electric vehicles (EVs) has further amplified the demand for neoprene. EVs require materials that can withstand higher temperatures and provide effective insulation for battery systems. Neoprene’s thermal stability and resistance to oil and chemicals make it suitable for these applications, contributing to the overall efficiency and safety of electric vehicles.

Government initiatives aimed at promoting sustainable transportation have also played a crucial role in driving the neoprene market. Policies encouraging the production and adoption of electric vehicles have led to increased investments in EV manufacturing, subsequently boosting the demand for neoprene in automotive applications.

Trends

Shift Towards Sustainable Neoprene: A Growing Trend in 2024

In 2024, a notable trend in the neoprene market is the increasing shift towards sustainable and eco-friendly alternatives. This movement is largely driven by heightened environmental awareness and the demand for materials with a reduced ecological footprint.

Traditional neoprene production involves the use of chloroprene, a compound associated with environmental and health concerns. In response, manufacturers are exploring bio-based neoprene options derived from renewable resources. These alternatives aim to maintain the desirable properties of conventional neoprene—such as flexibility, durability, and resistance to various elements—while minimizing environmental impact.

Government initiatives and regulations are also playing a role in this trend. Policies promoting environmental sustainability and the reduction of hazardous substances in manufacturing processes are encouraging companies to innovate and adopt greener alternatives. This regulatory environment supports the transition towards sustainable neoprene production and usage.

Regional Analysis

Asia Pacific Leads Neoprene Market with 46.6% Share in 2024, Valued at USD 0.9 Billion

In 2024, the Asia Pacific (APAC) region solidified its position as the dominant force in the global neoprene market, capturing a substantial 46.6% share, equivalent to USD 0.9 billion. This dominance is underpinned by the region’s robust industrial base, rapid urbanization, and significant investments in infrastructure and automotive sectors.

China, as the largest contributor within APAC, accounted for approximately 45% of the region’s neoprene revenue in 2024. The country’s expansive automotive manufacturing capabilities and ongoing infrastructure projects have been pivotal in driving neoprene demand, particularly for applications requiring materials with high durability and resistance to environmental factors.

India’s National Infrastructure Pipeline (NIP), with an investment outlay of USD 1.4 trillion, has further fueled the demand for neoprene in construction applications such as bridge bearings, expansion joints, and waterproofing membranes. Similarly, Southeast Asian nations like Indonesia and the Philippines are witnessing a surge in infrastructure development, contributing to the increased consumption of neoprene-based products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M is a leading player in the neoprene market, leveraging its global manufacturing and R&D strength to offer high-performance neoprene materials used in industrial safety, personal protective equipment, and automotive applications. The company emphasizes product quality and innovation, particularly in adhesive-backed neoprene and thermal insulation products. In 2024, 3M continued expanding its eco-conscious product line, aligning with sustainability goals across sectors like construction and energy. Its global distribution network ensures consistent availability across North America, Europe, and Asia.

ARLANXEO, a joint venture originally formed by LANXESS and Saudi Aramco, specializes in synthetic rubber production, including chloroprene rubber used in neoprene. The company holds a strong market position due to its technical expertise, cost efficiency, and vertically integrated supply chain. ARLANXEO focuses on neoprene for automotive, cable insulation, and industrial rubber applications. In 2024, it maintained a steady output through its global facilities, particularly in Europe and China, supporting consistent supply to key end-use industries.

BRP Manufacturing is a U.S.-based producer specializing in neoprene rubber sheeting, gaskets, and custom molded parts. With a history dating back over 100 years, the company caters to industrial, marine, and defense sectors. In 2024, BRP reinforced its focus on made-to-order neoprene products with high-performance characteristics, such as flame resistance and chemical stability. Its commitment to quality control, ISO-certified processes, and domestic manufacturing gives it a competitive edge in North America’s engineered rubber solutions space.

Top Key Players in the Market

- 3M

- ARLANXEO

- BGK GmbH Endlosband

- BRP Manufacturing

- China National Bluestar (Group) Co. Ltd

- Covestro

- Denka Company Limited

- Pidilite Industries

- Resonac Holdings Corporation

- SEDO Chemicals Neoprene GmbH

- Shanxi Huojia Changhua Synthetic Rubber Co.,ltd.

- Sundow Polymers

- Zenith Rubber

Recent Developments

In 2024, BGK’s endlosband neoprene belts are renowned for their high chemical stability, flexibility, and durability, making them suitable for high-speed applications up to 100 m/s and operating temperatures ranging from -25°C to +130°C.

In 2024, BRP Manufacturing, a U.S.-based company established in 1914, continued to be a significant player in the neoprene market, specializing in high-quality neoprene rubber products. Operating from a 200,000-square-foot facility in Lima, Ohio, BRP offers a diverse range of neoprene products, including commercial, premium, ultra-strength, and flame-resistant grades.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 2.8 Bn CAGR (2025-2034) 3.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Manufacturing Route (Butadiene Route, Acetylene Route), By Type (Normal Linear Grades, Pre-crosslinked Grades, Sulfur-modified Grades, Slow Crystallizing Grades), By Application (Latex, Elastomers, Adhesives), By End-use (Building and Construction, Automotive, Electrical and Electronics, Medical, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, ARLANXEO, BGK GmbH Endlosband, BRP Manufacturing, China National Bluestar (Group) Co. Ltd, Covestro, Denka Company Limited, Pidilite Industries, Resonac Holdings Corporation, SEDO Chemicals Neoprene GmbH, Shanxi Huojia Changhua Synthetic Rubber Co.,ltd., Sundow Polymers, Zenith Rubber Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- ARLANXEO

- BGK GmbH Endlosband

- BRP Manufacturing

- China National Bluestar (Group) Co. Ltd

- Covestro

- Denka Company Limited

- Pidilite Industries

- Resonac Holdings Corporation

- SEDO Chemicals Neoprene GmbH

- Shanxi Huojia Changhua Synthetic Rubber Co.,ltd.

- Sundow Polymers

- Zenith Rubber