Global Natural Food Colorants Market Size, Share, And Business Benefits By Product Type (Anthocyanin, Carotenoid, Curcumin, Carmine, Spirulina, Others), By Color (Red, Blue, Green, Yellow, Others), By Form (Powder, Liquid), By Application (Beverages (Alcoholic Beverages, Non-alcoholic Beverages), Bakery and Confectionery, Dairy-based Products, Nutraceuticals, Snacks and Cereals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153263

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

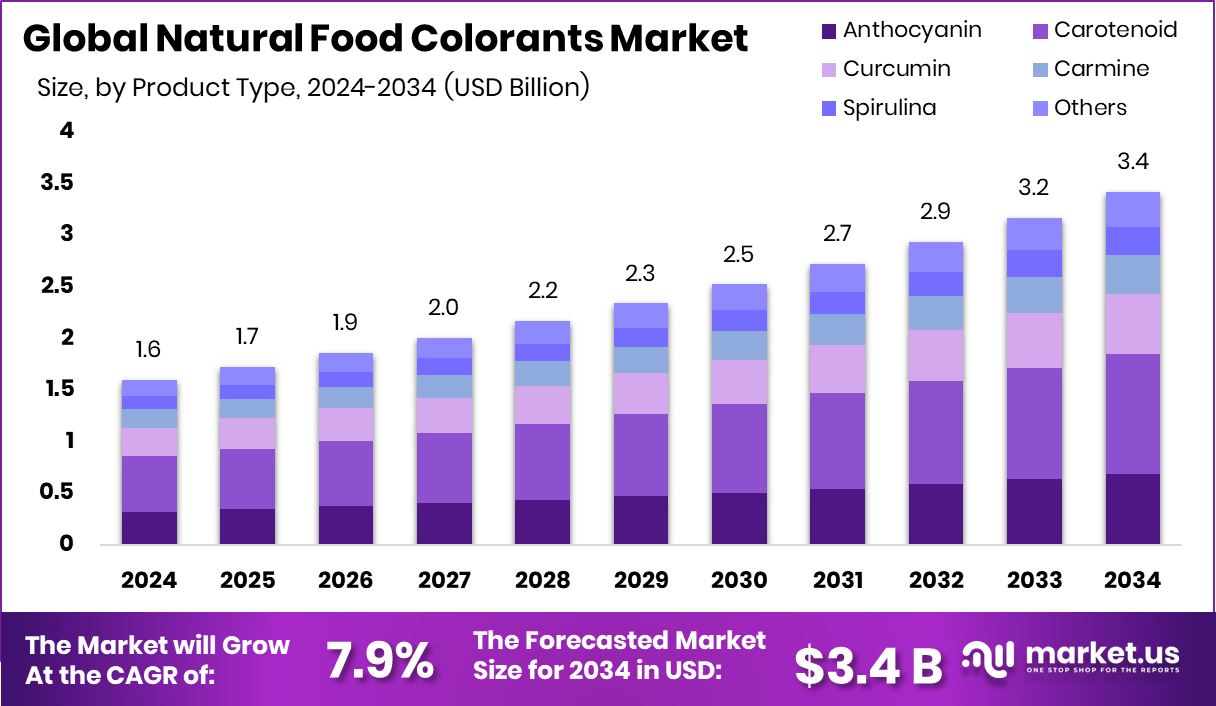

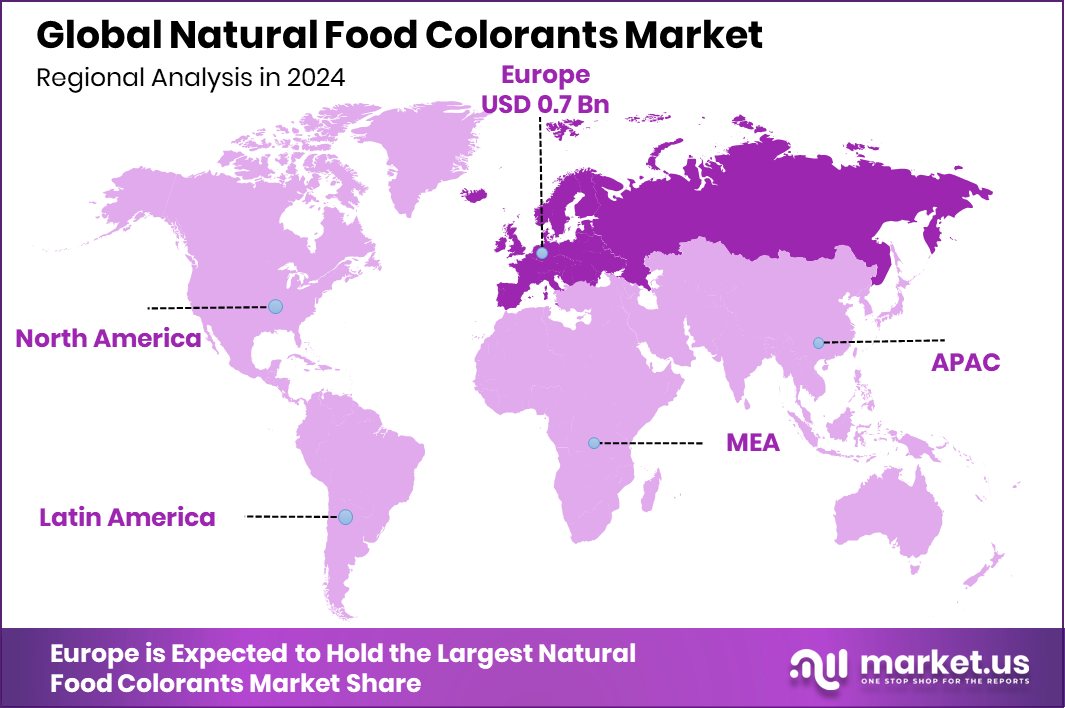

Global Natural Food Colorants Market is expected to be worth around USD 3.4 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 7.9% from 2025 to 2034. High demand for clean-label products supported Europe’s 43.8% share, worth USD 0.7 billion.

Natural food colorants are pigments derived from plant, animal, or mineral sources that are used to enhance the appearance of food and beverages. Unlike synthetic dyes, natural colorants are extracted from ingredients such as fruits, vegetables, flowers, herbs, and spices—like beetroot, turmeric, spirulina, and paprika.

These colorants are often considered safer and healthier alternatives, as they are free from artificial chemicals and align with clean-label and organic product standards. Twenty nutraceutical companies secure a combined funding of $22 million, signaling growing investor confidence in natural and health-focused food innovations.

The natural food colorants market refers to the global trade, production, and consumption of these naturally derived pigments across food, beverages, bakery, confectionery, dairy, and packaged products. As consumers increasingly read ingredient labels and demand chemical-free food, manufacturers are turning to natural alternatives for coloring. Indian startup producing animal-free dairy using bioengineering raises $4 million in funding, further boosting innovation in clean-label dairy products.

Growth in this market is primarily driven by the rising awareness of health and wellness among consumers. There is growing concern around the potential side effects of artificial additives, which has led to a strong preference for natural ingredients. The trend is especially visible in developed markets, where clean-label products are gaining traction across supermarkets and online platforms. Sid’s Farm secures $10 million to support its dairy business expansion, reflecting strong market momentum for naturally positioned dairy offerings.

Demand is also growing due to the expansion of organic and plant-based food sectors. Natural food colorants fit well into these categories, helping brands meet both aesthetic and labeling expectations. Delhi’s dairy startup Doodhvale Farms secures $3 million in fresh funding, supporting growth in naturally sourced dairy applications. Formo, a sustainable protein firm from Germany, receives $36 million from EU Bank, reinforcing investor interest in clean, plant-based protein innovations aligned with natural food systems.

Key Takeaways

- Global Natural Food Colorants Market is expected to be worth around USD 3.4 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 7.9% from 2025 to 2034.

- Carotenoids hold a 34.9% share in the Natural Food Colorants Market due to rising health consciousness.

- Red color dominates with 39.3% market share, driven by strong demand in confectionery and bakery items.

- Powder form leads at 71.2%, as it offers better shelf life and easy blending in beverage applications.

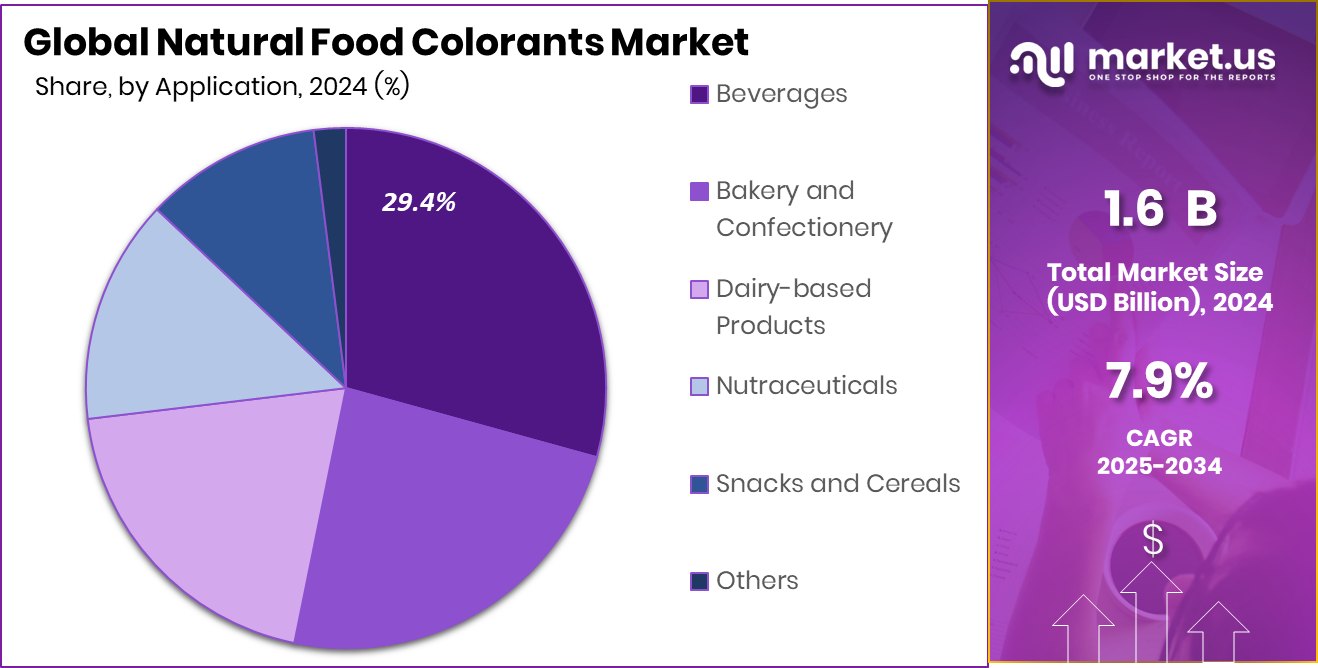

- Beverages remain the top application in the Natural Food Colorants Market, capturing 29.4% global share.

- The regional market value in Europe reached approximately USD 0.7 billion during 2024.

By Product Type Analysis

Carotenoids hold 34.9% share in natural food colorants market.

In 2024, Carotenoid held a dominant market position in the By Product Type segment of the Natural Food Colorants Market, with a 34.9% share. This significant share can be attributed to the widespread use of carotenoids such as beta-carotene, lutein, and lycopene in food and beverage applications due to their strong coloring capabilities and added health benefits.

Their natural origin from sources like carrots, tomatoes, and marigold flowers makes them appealing for clean-label formulations, especially as global consumers continue to avoid artificial additives. Carotenoids are valued not only for their vibrant yellow, orange, and red hues but also for their antioxidant properties, which contribute to product appeal in functional and health-oriented food categories.

The dominance of carotenoids in this segment also reflects their versatility and stability in various food processing environments, including dairy, bakery, and beverage applications. Food manufacturers are increasingly adopting carotenoids to meet consumer expectations for natural ingredients without compromising product appearance.

Moreover, the preference for visually attractive yet health-conscious foods is influencing both premium and mass-market product lines. With growing regulatory support for natural ingredients and expanding demand in emerging markets, carotenoids are expected to maintain a strong presence in the natural food colorants landscape in the near term.

By Color Analysis

Red color dominates with 39.3% in natural colorant market applications.

In 2024, Red held a dominant market position in the By Color segment of the Natural Food Colorants Market, with a 39.3% share. This leading position is largely supported by the high demand for red pigments in a wide range of food and beverage applications, including confectionery, dairy products, sauces, snacks, and ready-to-eat meals. The vibrant visual appeal of red tones plays a crucial role in enhancing product attractiveness and consumer perception, particularly in markets where visual presentation strongly influences purchasing behavior.

Natural red colorants are commonly derived from sources such as beetroot, paprika, and anthocyanin-rich fruits, which are widely accepted for their clean-label compatibility. The dominance of red colorants also reflects evolving consumer preferences toward naturally derived alternatives that offer both safety and visual intensity without the use of synthetic dyes.

As the food industry continues to prioritize transparency in labeling and health-conscious formulations, red natural food colorants remain a preferred choice for manufacturers aiming to align with consumer expectations. Their widespread use and visual impact contribute to red’s strong position in the natural colorant spectrum, driving its market share leadership in 2024.

By Form Analysis

Powder form leads with 71.2% in natural food colorants.

In 2024, Powder held a dominant market position in the By Form segment of the Natural Food Colorants Market, with a 71.2% share. This dominance is primarily due to the superior shelf life, easy storage, and high stability that powdered colorants offer in various food processing environments. Manufacturers widely prefer powdered natural colorants because they can be efficiently blended into dry mixes, bakery ingredients, snack coatings, and beverage powders without affecting texture or moisture content.

The 71.2% market share also reflects the cost-effectiveness and ease of transportation associated with powder form, making it an ideal choice for large-scale production and international trade. Powdered colorants often retain their pigment intensity over time and offer better control over dosage during formulation, which contributes to consistent product quality.

In addition, the wide availability of plant-based raw materials that can be dried and ground into powder adds to the scalability and commercial appeal of this format. As food and beverage manufacturers continue to shift toward clean-label formulations, powdered natural colorants remain the preferred format due to their adaptability and functional benefits.

By Application Analysis

Beverages account for 29.4% market share in 2024.

In 2024, Beverages held a dominant market position in the By Application segment of the Natural Food Colorants Market, with a 29.4% share. This significant share is driven by the rising demand for naturally colored drinks, including juices, carbonated soft drinks, flavored waters, and functional beverages. As consumer preferences continue shifting toward clean-label products, beverage manufacturers are increasingly using natural colorants to replace synthetic dyes without compromising visual appeal.

The strong position of the beverage segment also reflects the growing health awareness among consumers, who are actively seeking products free from artificial ingredients. Natural food colorants are widely used in beverages to provide vibrant and appealing colors derived from fruits, vegetables, and botanicals, which also align with wellness-focused branding. These colorants play a crucial role in enhancing product differentiation and shelf presence in a competitive retail environment.

Moreover, the formulation flexibility and solubility of many natural pigments make them well-suited for liquid applications, encouraging their adoption across a wide range of beverage categories. As brands aim to meet both regulatory standards and evolving consumer expectations, the beverage industry continues to lead in the application of natural food colorants, contributing to its 29.4% market share in 2024.

Key Market Segments

By Product Type

- Anthocyanin

- Carotenoid

- Curcumin

- Carmine

- Spirulina

- Others

By Color

- Red

- Blue

- Green

- Yellow

- Others

By Form

- Powder

- Liquid

By Application

- Beverages

- Alcoholic Beverages

- Non-alcoholic Beverages

- Bakery and Confectionery

- Dairy-based Products

- Nutraceuticals

- Snacks and Cereals

- Others

Driving Factors

Rising Preference for Clean-Label Food Products

One of the main factors driving the growth of the natural food colorants market is the rising consumer preference for clean-label food products. People today are more aware of what goes into their food and often check labels before making a purchase. Consumers are avoiding artificial ingredients and synthetic colors due to health concerns and are choosing products made with natural alternatives.

This shift in consumer behavior has encouraged food and beverage companies to reformulate their products using natural colorants like beetroot, turmeric, and spirulina. Natural food colors not only offer visual appeal but also come from recognizable and safe sources.

Restraining Factors

Limited Stability and Shelf Life of Colorants

A key factor holding back the growth of the natural food colorants market is the limited stability and shorter shelf life of these colorants. Unlike synthetic dyes, natural pigments are more sensitive to factors such as heat, light, pH levels, and oxygen exposure. This means that the color may fade or change during food processing, storage, or even after packaging.

As a result, manufacturers may face difficulties in maintaining consistent color across batches, especially in products that require long shelf lives. This technical challenge increases production complexity and may lead to higher costs. Until more stable natural alternatives are developed, this issue is expected to remain a barrier to wider usage in certain food and beverage applications.

Growth Opportunity

Innovation in Heat-Stable Natural Colorants

A major growth opportunity in the natural food colorants market lies in the innovation of heat-stable natural pigments. Many food and beverage products undergo high-temperature processing, such as baking, pasteurization, or sterilization, which can degrade standard natural dyes.

By developing pigments that can maintain their vibrancy and consistency under heat, manufacturers can use natural colorants in a broader range of products — including baked goods, sauces, soups, and ready-to-eat meals.

This would address a key technical limitation, enhancing reliability and reducing costs linked to color fading or reformulation. As clean-label trends continue to gain momentum, heat-stable natural colorants would enable companies to deliver visually appealing, naturally colored products without compromising quality during processing or storage.

Latest Trends

Growing Use of Superfoods as Natural Colorants

One of the latest trends in the natural food colorants market is the growing use of superfoods like spirulina, beetroot, turmeric, and butterfly pea flower to provide both vibrant color and added health benefits. These ingredients are rich in nutrients and antioxidants, making them appealing not only for their natural coloring properties but also for their wellness associations.

Food and beverage brands are increasingly turning to such superfoods to color products naturally while also promoting them as functional or health-boosting. This dual benefit attracts health-conscious consumers and supports clean-label claims.

The use of superfoods as colorants is becoming popular in smoothies, snacks, dairy, and plant-based products, where both color and nutrition play an important role in consumer choice.

Regional Analysis

In 2024, Europe led the natural food colorants market with 43.8% share.

In 2024, Europe emerged as the dominant region in the global natural food colorants market, accounting for a leading 43.8% share, valued at approximately USD 0.7 billion. The region’s stronghold is supported by growing consumer demand for clean-label and organic food products, along with strict regulatory frameworks that encourage the use of natural over synthetic ingredients.

European food manufacturers have widely adopted natural pigments to align with health-conscious consumer preferences and regional labeling standards. North America also witnessed steady demand, driven by a rising awareness of food safety and a growing interest in plant-based and minimally processed ingredients. In the Asia Pacific region, the market experienced gradual growth, fueled by increasing urbanization and expanding processed food industries in countries like China and India.

Meanwhile, Latin America and the Middle East & Africa recorded moderate growth, supported by changing dietary patterns and growing adoption of natural ingredients in urban centers. However, these regions still hold a relatively smaller market share compared to Europe and North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sensient Technologies Corporation continues to demonstrate its leadership through extensive investment in research and development. By focusing on the optimization of extraction and stabilization techniques, Sensient has enhanced pigment performance under diverse food processing conditions. The company’s agility in adapting natural color solutions across bakery, beverage, and dairy applications has strengthened its market position, enabling it to meet varied client needs with precision.

Archer Daniels Midland (ADM) leverages its robust agricultural supply chain and processing infrastructure to ensure raw material reliability. This integration has allowed ADM to maintain competitive pricing and consistent pigment quality. Through strategic partnerships with food manufacturers, ADM has improved product customization and formulation flexibility, supporting its expanding reach in both developed and emerging markets.

Naturex S.A., with its heritage in botanical sourcing, continues to excel by combining traditional plant extraction methods with modern scaling technologies. The firm has expanded its botanical portfolio, allowing it to offer a wide variety of color spectra. Naturex’s commitment to clean-label and organic certifications has resonated with health-driven consumer segments and premium food brands seeking transparency.

Döhler GmbH has further strengthened its market standing by focusing on co-created solutions that integrate colorants, flavors, and nutritional ingredients into unified systems. This holistic approach has simplified formulation processes for food and beverage manufacturers. Döhler’s global application labs enable rapid onsite technical support, reducing time to market and enabling precise adaptation of color solutions to meet regional preferences.

Top Key Players in the Market

- Sensient Technologies Corporation

- Archer Daniels Midland

- Naturex S.A.

- Döhler GmbH

- Symrise AG

- McCormick & Company

- Kalsec Inc.

- ROHA Dyechem Pvt. Ltd. (JJT Group)

- Aakash Chemicals and Dyestuffs

- AFIS (Australian Food Ingredient Suppliers)

- San-Ei Gen F.FI Inc.

- GNT International BV (EXBERRY)

- Adama Agricultural Solutions Ltd. (LycoRed)

- Novonesis Group

Recent Developments

- In May 2025, McCormick confirmed that it is actively reformulating select products to eliminate synthetic food dyes in response to heightened regulatory and consumer scrutiny, particularly under pressure from initiatives like the “Make America Healthy Again” movement led by HHS Secretary RFK Jr.

- In January 2024, Döhler launched a natural pigment series inspired by Pantone’s “Peach Fuzz 13‑1023.” This velvety peach tone was developed for food and beverage products to deliver warm, positive hues aligned with consumer trends focused on wellness and subtly vibrant colors.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.4 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Anthocyanin, Carotenoid, Curcumin, Carmine, Spirulina, Others), By Color (Red, Blue, Green, Yellow, Others), By Form (Powder, Liquid), By Application (Beverages (Alcoholic Beverages, Non-alcoholic Beverages), Bakery and Confectionery, Dairy-based Products, Nutraceuticals, Snacks and Cereals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sensient Technologies Corporation, Archer Daniels Midland, Naturex S.A., Döhler GmbH, Symrise AG, McCormick & Company, Kalsec Inc., ROHA Dyechem Pvt. Ltd. (JJT Group), Aakash Chemicals and Dyestuffs, AFIS (Australian Food Ingredient Suppliers), San-Ei Gen F.FI Inc., GNT International BV (EXBERRY), Adama Agricultural Solutions Ltd. (LycoRed), Novonesis Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Food Colorants MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Natural Food Colorants MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sensient Technologies Corporation

- Archer Daniels Midland

- Naturex S.A.

- Döhler GmbH

- Symrise AG

- McCormick & Company

- Kalsec Inc.

- ROHA Dyechem Pvt. Ltd. (JJT Group)

- Aakash Chemicals and Dyestuffs

- AFIS (Australian Food Ingredient Suppliers)

- San-Ei Gen F.FI Inc.

- GNT International BV (EXBERRY)

- Adama Agricultural Solutions Ltd. (LycoRed)

- Novonesis Group