Global Nanocellulose Market Size, Share, And Business Benefits By Type (CNF (NFC, MFC), Bacterial Cellulose, CNC), By Application (Composites, Pulp and Paperboard, Pharmaceuticals and Biomedical, Electronics, Food and Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149867

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

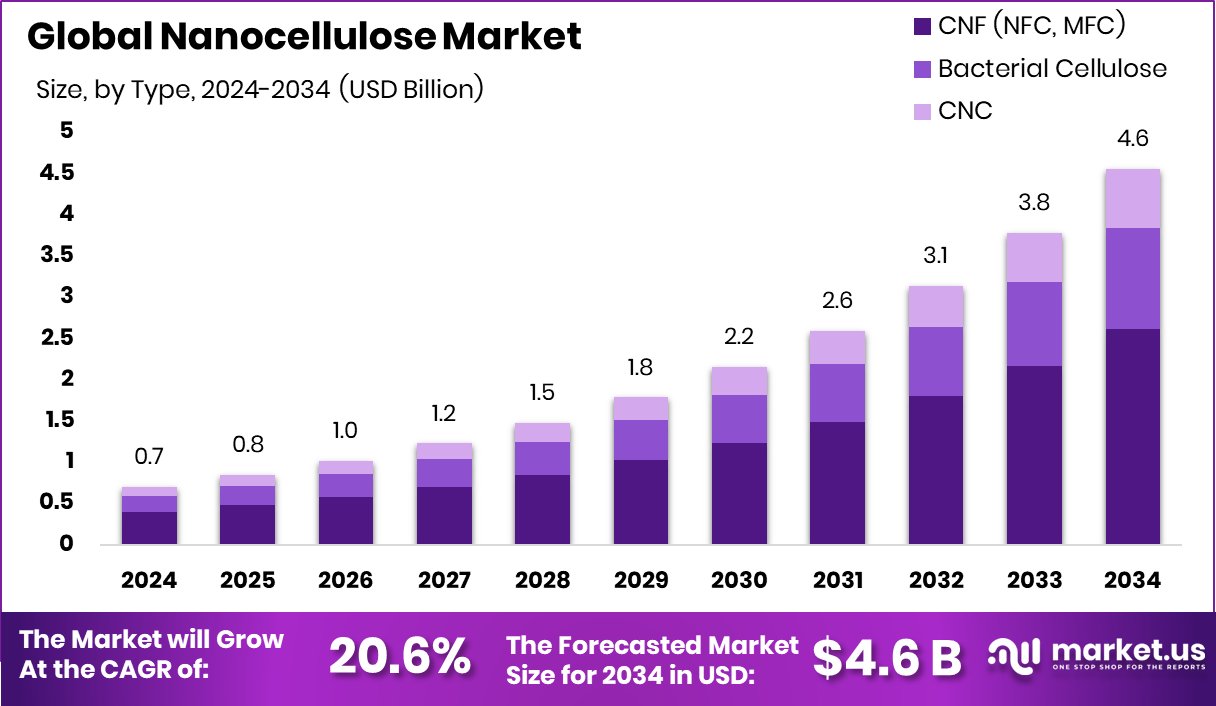

Global Nanocellulose Market is expected to be worth around USD 4.6 billion by 2034, up from USD 0.7 billion in 2024, and grow at a CAGR of 20.6% from 2025 to 2034. Strong sustainability efforts helped Europe dominate with a 45.3% share and growing investments.

Nanocellulose is a lightweight, biodegradable material derived from plant cellulose, typically processed into nano-scale fibers. These fibers have exceptional strength, low density, high surface area, and the ability to form strong networks, making them useful in various applications like packaging, biomedical devices, composites, electronics, and water filtration. There are three main forms: cellulose nanofibers (CNF), cellulose nanocrystals (CNC), and bacterial nanocellulose (BNC), each offering different structural and mechanical properties.

The nanocellulose market refers to the commercial ecosystem surrounding the production, development, and application of nanocellulose-based products across industries. It spans sectors such as paper & packaging, construction, automotive, medical, personal care, and electronics. As industries shift toward greener materials, nanocellulose is being integrated into product design and industrial manufacturing processes.

The market is growing due to rising environmental concerns and demand for sustainable materials. Governments are promoting eco-friendly alternatives to plastics, and nanocellulose fits well into these initiatives. In sectors like packaging and automotive, its lightweight and strength are driving adoption. Furthermore, advancements in nanotechnology are making nanocellulose production more efficient and cost-effective.

Demand is particularly strong in food packaging, where brands are seeking biodegradable, strong barrier materials. Its use in medical applications—like wound dressings and tissue scaffolds—is also increasing due to its non-toxic and biocompatible nature. With the rise of smart materials and functional coatings, demand is extending to electronics and textiles.

Key Takeaways

- Global Nanocellulose Market is expected to be worth around USD 4.6 billion by 2034, up from USD 0.7 billion in 2024, and grow at a CAGR of 20.6% from 2025 to 2034.

- In 2024, CNF (including NFC and MFC) led the Nanocellulose Market with a 57.4% share.

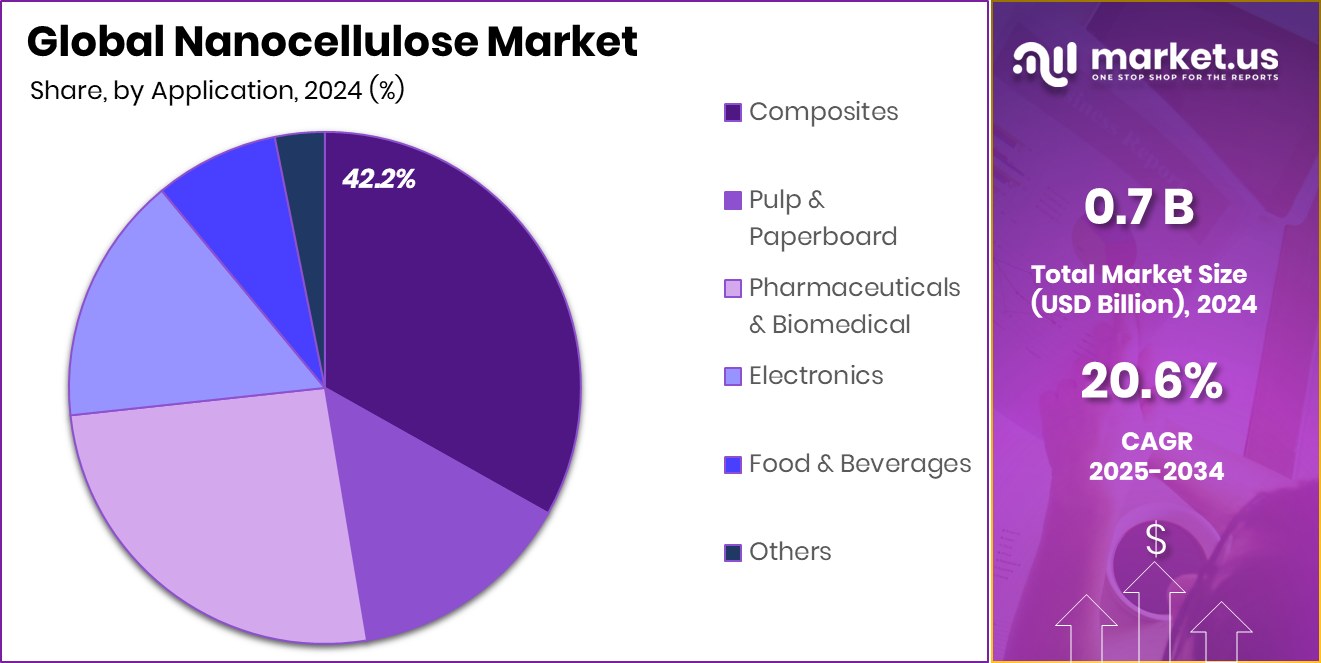

- Composites dominated the application segment of the Nanocellulose Market in 2024, accounting for a 42.2% share.

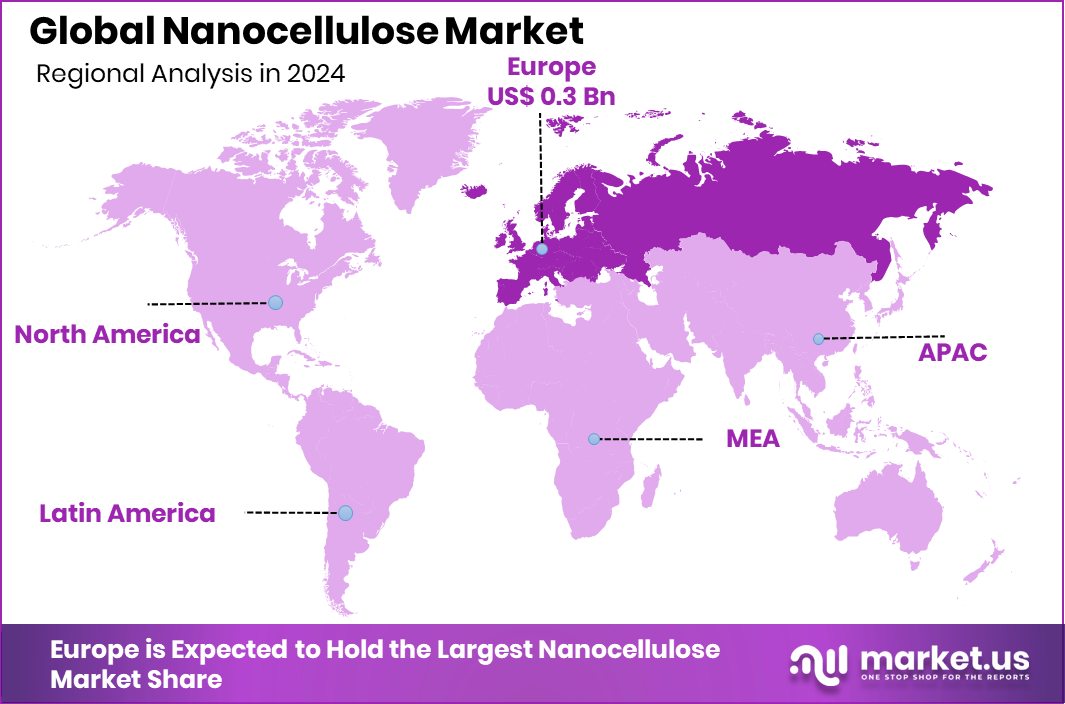

- The Nanocellulose Market in Europe reached USD 0.3 billion in 2024.

By Type Analysis

In 2024, CNF held a 57.4% share in the nanocellulose market by type.

In 2024, CNF (NFC, MFC) held a dominant market position in the By Type segment of the Nanocellulose Market, with a 57.4% share. This leadership can be attributed to its superior mechanical strength, flexibility, and high aspect ratio, which make it highly versatile across multiple end-use applications.

CNF, also known as cellulose nanofibers or microfibrillated cellulose, is particularly favored in packaging, composites, and rheology modifiers due to its excellent film-forming ability and reinforcing properties. The rising demand for sustainable and biodegradable materials has further supported the adoption of CNF, especially in regions where environmental regulations are stringent.

Its dominance is also reinforced by relatively mature processing techniques that allow easier integration into industrial formulations without significant infrastructure changes. Additionally, CNF offers a good balance between performance and cost-effectiveness compared to other types, which contributes to its commercial preference.

Research institutes and pilot-scale production facilities have been focusing significantly on CNF, further pushing its accessibility and industrial relevance. As industries across sectors shift toward green alternatives, CNF’s adaptability and availability make it the primary choice in the nanocellulose ecosystem, sustaining its majority share in the market during 2024.

By Application Analysis

Composites dominated the application segment of the nanocellulose market with a 42.2% share in 2024.

In 2024, Composites held a dominant market position in the By Application segment of the Nanocellulose Market, with a 42.2% share. This significant share is primarily driven by nanocellulose’s excellent reinforcement properties when used in polymer matrices, resulting in stronger, lighter, and more durable composite materials. Industries such as automotive, construction, and aerospace are increasingly adopting nanocellulose-based composites to reduce weight and improve fuel efficiency, while also aligning with global sustainability goals.

Nanocellulose composites also exhibit enhanced thermal stability, barrier properties, and mechanical strength, making them suitable substitutes for traditional fillers and additives. In particular, cellulose nanofiber (CNF)-reinforced composites have gained traction due to their compatibility with both thermoplastics and thermosets. The eco-friendly profile of these composites makes them ideal for manufacturers aiming to reduce carbon emissions and dependency on synthetic reinforcements.

The dominance of composites in the application segment is further supported by ongoing research collaborations and pilot-scale commercial deployments. As the construction and mobility sectors continue to push for sustainable material alternatives, nanocellulose composites offer a promising solution with scalable performance advantages.

Key Market Segments

By Type

- CNF (NFC, MFC)

- Bacterial Cellulose

- CNC

By Application

- Composites

- Pulp and Paperboard

- Pharmaceuticals and Biomedical

- Electronics

- Food and Beverages

- Others

Driving Factors

Rising Need for Sustainable and Eco-Friendly Materials

One of the biggest reasons behind the growing nanocellulose market is the rising demand for sustainable and eco-friendly materials. Many industries are now moving away from plastic and petroleum-based products because of environmental concerns.

Nanocellulose, being made from natural plant fibers, is biodegradable and renewable. This makes it an ideal replacement for synthetic materials in packaging, construction, electronics, and more.

Governments around the world are also making rules to reduce pollution and waste, which is pushing companies to use greener options like nanocellulose. As more brands and manufacturers look for clean alternatives, nanocellulose is getting strong attention due to its low environmental impact and excellent strength, flexibility, and usability in a wide range of products.

Restraining Factors

High Production Cost Limits Large-Scale Market Growth

One of the main challenges in the nanocellulose market is its high production cost. Making nanocellulose involves complex processes, advanced equipment, and high energy use, which makes it expensive. Many small manufacturers and startups find it difficult to invest in this technology due to the upfront costs.

Also, large-scale production is still limited, and that keeps prices high compared to other common materials. Until more efficient and cost-effective production methods are developed, many industries may hesitate to use nanocellulose widely.

This price issue affects its use in cost-sensitive sectors like packaging and consumer goods, where cheaper materials are often preferred. As a result, high production cost remains a key barrier to the market’s faster growth.

Growth Opportunity

Expanding Use in Medical and Healthcare Products

A major growth opportunity for the nanocellulose market lies in its expanding use in medical and healthcare products. Nanocellulose is safe, non-toxic, and biocompatible, which means it can be used inside the human body without causing harm. Because of this, it is being used in wound dressings, drug delivery systems, and tissue engineering. It helps wounds heal faster and can carry medicine directly to where it’s needed.

Researchers are also exploring its use in medical implants and artificial skin. As the healthcare industry continues to look for safer and smarter materials, nanocellulose offers a natural and effective option. This growing interest from the medical field opens new doors for nanocellulose and supports strong market growth in the future.

Latest Trends

Nanocellulose Used in Flexible Electronic Display Materials

One of the latest trends in the nanocellulose market is its growing use in flexible electronic display materials. Because nanocellulose is lightweight, strong, and transparent, it can be used to make flexible screens for devices like foldable phones, tablets, and wearable tech. Unlike glass or plastic, it is biodegradable and safer for the environment.

Researchers and companies are now testing nanocellulose as a base material for display films and touch panels. It also supports high printability, which helps in making detailed electronic circuits. As electronics continue to move toward thinner, lighter, and bendable designs, nanocellulose is becoming a promising material. This trend shows how nanocellulose is moving beyond traditional industries into high-tech and futuristic applications.

Regional Analysis

In 2024, Europe led the Nanocellulose Market with a 45.3% regional share.

In 2024, Europe held a dominant position in the global Nanocellulose Market, accounting for 45.3% of the total market share and reaching a value of USD 0.3 billion. This leadership is largely attributed to the region’s strong focus on sustainability, circular economy practices, and stringent environmental regulations encouraging the adoption of bio-based materials.

Countries such as Germany, France, and the Nordic nations have shown notable advancements in nanocellulose research and commercialization, supported by public-private collaborations and innovation funding.

North America followed with steady demand driven by R&D in advanced materials, particularly in the U.S., which continues to explore nanocellulose for applications in packaging and healthcare. Asia Pacific demonstrated rising interest, especially from technologically progressive countries like Japan and South Korea, focusing on electronics and high-performance composites.

The Middle East & Africa and Latin America represented emerging regions with modest growth, mostly driven by academic research and small-scale industrial applications. However, market maturity in these regions remains comparatively lower.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, American Process Inc. maintained a strategic focus on commercializing sustainable nanocellulose solutions, particularly leveraging its proprietary AVAP® process. This method allows the extraction of high-purity nanocellulose from biomass, making it attractive to packaging and automotive sectors seeking greener materials. The company’s efforts in scaling production and forming industry collaborations supported its consistent presence in the North American nanocellulose landscape.

Borregaard, based in Europe, strengthened its position in the nanocellulose market through its Exilva product line. In 2024, the company focused on applications in adhesives, coatings, and personal care, where rheology modification and film-forming properties are key. Borregaard’s operations benefited from Europe’s regulatory support for bio-based materials, aligning its sustainability goals with market demand.

With full-scale commercial production, Borregaard offered consistent product supply and quality, addressing a critical market need. Its strategic location in Norway also facilitated supply chain access across the European region, supporting its 2024 growth momentum.

Nippon Paper Industries, one of Japan’s largest pulp and paper producers, continued its push into nanocellulose through cellulose nanofiber (CNF) development. In 2024, the company advanced CNF integration into functional coatings and packaging films. Their vertical integration across paper and pulp operations allowed cost management and ensured raw material availability. Nippon Paper’s active research initiatives and government-backed innovation grants enabled the company to sustain product development and commercial deployment in key Asia Pacific markets.

Top Key Players in the Market

- American Process Inc.

- Borregaard

- Nippon Paper Industries

- Sappi

- Stora Enso

- FPInnovations

- Blue Goose Refineries

- Borregaard AS

- Cellu Force

- CelluComp

- Fiber Lean

- GranBio Technologies

- Kruger INC

- Melodea Ltd

- NIPPON PAPER INDUSTRIES CO., LTD.

Recent Developments

- In April 2025, Stora Enso launched Performa Nova, a next-generation folding boxboard designed for consumer packaging. This product aims to meet the growing demand for high-yield, sustainable packaging solutions.

- In October 2024, Borregaard introduced a novel bio-based high-performance dispersant tailored for the coatings industry. This product aims to replace fossil-based dispersants, offering improved pigment dispersion and enhanced scrub resistance. The launch aligns with Borregaard’s commitment to sustainable solutions in industrial applications.

Report Scope

Report Features Description Market Value (2024) USD 0.7 Billion Forecast Revenue (2034) USD 4.6 Billion CAGR (2025-2034) 20.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (CNF (NFC, MFC), Bacterial Cellulose, CNC), By Application (Composites, Pulp and Paperboard, Pharmaceuticals and Biomedical, Electronics, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American Process Inc., Borregaard, Nippon Paper Industries, Sappi, Stora Enso, FPInnovations, Blue Goose Refineries, Borregaard AS, Cellu Force, CelluComp, Fiber Lean, GranBio Technologies, Kruger Inc., Melodea Ltd, NIPPON PAPER INDUSTRIES CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Process Inc.

- Borregaard

- Nippon Paper Industries

- Sappi

- Stora Enso

- FPInnovations

- Blue Goose Refineries

- Borregaard AS

- Cellu Force

- CelluComp

- Fiber Lean

- GranBio Technologies

- Kruger INC

- Melodea Ltd

- NIPPON PAPER INDUSTRIES CO., LTD.