Global Molecular Quality Controls Market Analysis By Product (Independent Controls, Instrument-Specific Controls), By Analyte Type (Single-Analyte Controls, Multi-Analyte Controls), By Application (Infectious Disease Diagnostics, Oncology Testing, Genetic Testing, Other Applications), By End-User (Diagnostic Laboratories, Hospitals, Contract Research Organisations (Cros), Academic & Research Institutes, Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165389

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

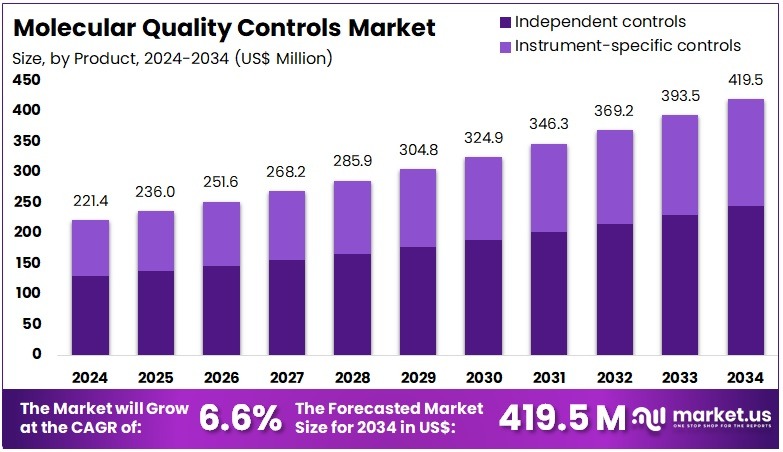

The Global Molecular Quality Controls Market Size is expected to be worth around US$ 419.5 Million by 2034, from US$ 221.4 Million in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.1% share and holds US$ 82.1 Million market value for the year.

The Molecular Quality Controls (MQCs) market plays an essential role in supporting the reliability and precision of molecular diagnostics. These controls are designed to ensure that diagnostic assays such as PCR, next-generation sequencing (NGS), and other nucleic acid-based tests deliver accurate and reproducible results. The market’s development has been supported by the global rise in infectious and genetic diseases, growing laboratory testing volumes, and the increasing demand for compliance with strict regulatory frameworks across healthcare systems.

The regulatory environment has had a direct influence on the market expansion. In the United States, the Clinical Laboratory Improvement Amendments (CLIA) framework requires laboratories to maintain detailed written quality-control procedures. These include verifying test accuracy and consistency across scheduled runs. Because molecular assays are technically complex, they are subject to greater scrutiny. According to CLIA guidelines, laboratories must use validated control materials to confirm precision in daily operations, which has strengthened market growth in molecular quality controls.

In Europe, regulatory oversight under the In Vitro Diagnostic Regulation (IVDR) has similarly boosted adoption. The regulation mandates continuous performance evaluation, clinical evidence, and traceability of diagnostic tests. This has led laboratories to incorporate molecular controls throughout test design, verification, and operational processes. According to the IVDR implementation schedule, laboratories across the European Union are required to maintain traceable control materials to demonstrate compliance, ensuring uniform standards and quality assurance across molecular diagnostic applications.

Regulatory activity in the United States has further intensified with changes related to laboratory-developed tests (LDTs). The U.S. FDA’s actions during 2024 prompted laboratories to strengthen their quality systems. Although a federal court later vacated the May 2024 rule, the ongoing attention to compliance encouraged organizations to formalize documentation and quality measures. For instance, laboratories increasingly adopted third-party molecular controls to support method validation and performance verification, demonstrating a sustained compliance-driven demand across both clinical and research settings.

Public Health Programs and Market Growth

Public health and international standardization programs have played a central role in shaping the molecular quality controls market. The World Health Organization (WHO), through the National Institute for Biological Standards and Control (NIBSC), issues International Standards for nucleic acid amplification tests. These standards ensure that diagnostic assays worldwide are calibrated accurately. For example, WHO reference materials for hepatitis B virus DNA are now used globally as primary standards, prompting the development of secondary controls aligned to international units and improving laboratory comparability across regions.

Global genomic surveillance initiatives have further accelerated demand for molecular controls. The expansion of sequencing infrastructure worldwide has required laboratories to ensure test consistency through validated control systems. According to WHO, 68% of its 194 Member States had in-country sequencing capability by January 2022, up from 54% in March 2021. By December 2022, this figure increased to 84% (163 countries), reflecting a rapid scale-up of genomic testing capacity that depends on reliable molecular quality controls to maintain performance accuracy.

External Quality Assessment (EQA) programs have also strengthened laboratory quality systems. These schemes evaluate inter-laboratory performance and encourage the use of standardized controls. For instance, a study by MDPI found that in Lombardy, Italy, between July 2020 and July 2021, molecular tests detecting SARS-CoV-2 nucleic acid achieved 97.7% concordance from 1,938 tests. In the same assessment, antibody testing reached 93.9% concordance from 1,875 tests. Such findings highlight how EQA programs identify performance gaps and reinforce the adoption of validated molecular controls to improve assay accuracy.

The rising global disease burden has provided another major growth stimulus. WHO and IARC project that global cancer cases will reach nearly 35 million by 2050, representing a 75% increase from 2022. Oncology diagnostics, including liquid biopsy and minimal residual disease assays, rely on highly sensitive controls to detect mutations at low allele frequencies. Similarly, WHO estimates that antimicrobial resistance (AMR) caused 1.27 million deaths in 2019, with rising concern in 2025. Molecular tests for resistance genes require stable, well-characterized controls to ensure accuracy in pathogen identification and stewardship programs.

Investment in laboratory infrastructure, particularly in low- and middle-income countries, continues to expand the market base. For example, the Global Fund invested hundreds of millions of U.S. dollars in 2024 to strengthen laboratory capacity and surveillance systems worldwide. As new molecular platforms are deployed, procurement of external controls has become a standard requirement under donor-funded quality-assurance frameworks. In addition, initiatives such as WHO’s Global Genomic Surveillance Strategy and the U.S. CDC’s Advanced Molecular Detection program have embedded structured quality management systems for sequencing. These initiatives ensure that standardized, traceable molecular controls remain fundamental to clinical accuracy, public health surveillance, and patient safety.

Key Takeaways

- The Global Molecular Quality Controls Market is projected to reach about US$ 419.5 million by 2034, growing steadily at a 6.6% CAGR from 2025 to 2034.

- In 2024, Independent Controls dominated the Product Setting segment, accounting for over 58.2% of total market share in molecular quality controls.

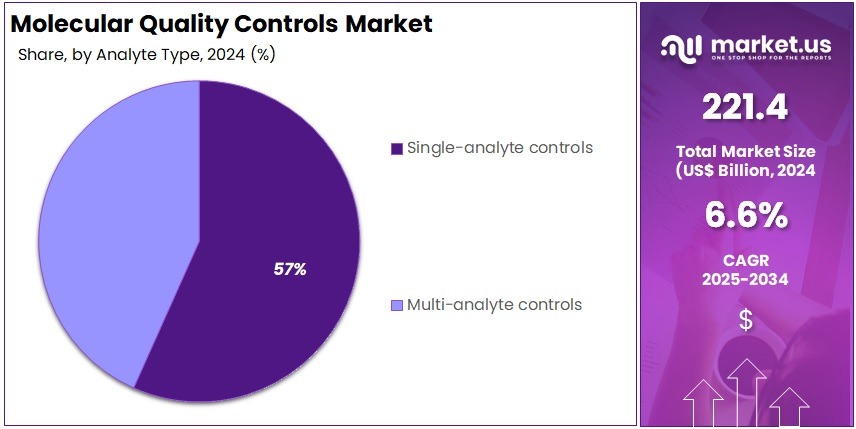

- Single-Analyte Controls led the Analyte Type Setting segment in 2024, securing a substantial 56.7% market share across global molecular control products.

- The Infectious Disease Diagnostics segment maintained leadership within the Application Setting in 2024, capturing over 44.5% share of the total market.

- Diagnostic Laboratories represented the largest End-User group in 2024, holding approximately 34.5% share of the overall molecular quality controls market.

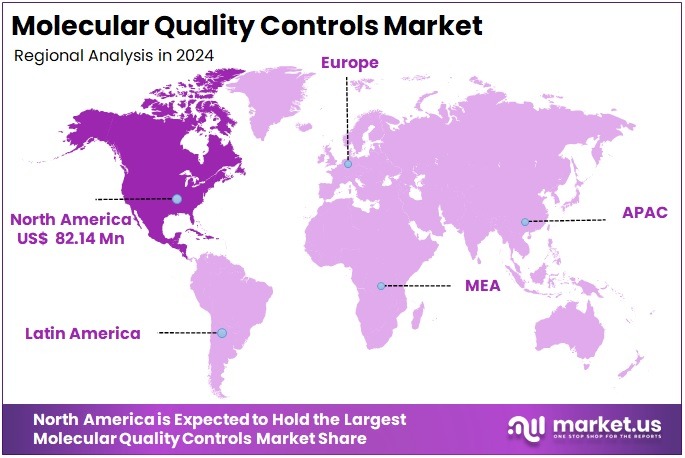

- North America remained the leading regional market in 2024, achieving more than 37.1% market share valued at around US$ 82.1 million.

Product Analysis

In 2024, the Independent Controls section held a dominant market position in the Product Setting segment of the Molecular Quality Controls Market and captured more than a 58.2% share. This segment maintained leadership due to its high adoption rate across molecular diagnostic laboratories. Independent controls offered greater flexibility, as they could be used with multiple instruments and assay types. This adaptability allowed laboratories to achieve standardized quality control, ensuring consistent performance and reliable test validation across platforms.

Experts observed that the independent controls segment continued to gain traction because it enhanced inter-laboratory comparability and supported regulatory compliance. The growing emphasis on accurate molecular testing further accelerated its use. Laboratories preferred these controls to meet external quality assessment requirements and strengthen result reliability. The trend toward standardized diagnostic processes was noted as a key driver supporting the segment’s expanding presence in clinical and research-based applications.

The Instrument-Specific Controls segment represented the remaining market share and showed steady growth during the same period. These controls were primarily used for specific instruments or assay systems, providing precise calibration and optimized assay accuracy. However, their limited cross-platform compatibility restricted broader adoption. Despite this, ongoing technological advancements, coupled with rising automation in molecular diagnostics, were expected to sustain moderate growth in this segment, reinforcing its relevance within the Molecular Quality Controls Market landscape.

Analyte Type Analysis

In 2024, the Single-Analyte Controls section held a dominant market position in the Analyte Type Setting Segment of the Molecular Quality Controls Market, and captured more than a 56.7% share. This leadership was attributed to the rising demand for precise molecular diagnostics. Single-analyte controls were widely used for targeted assays that required high accuracy. Their simple calibration and reliable results made them suitable for clinical testing, especially for detecting specific genetic mutations or viral markers.

Industry experts observed that laboratories preferred single-analyte controls due to their ease of use and cost-effectiveness. These controls offered consistent performance and were compatible with multiple diagnostic platforms. Their reproducibility ensured dependable outcomes in routine molecular assays. Moreover, their adaptability across instruments helped laboratories maintain quality standards without significant operational challenges, making them an essential part of clinical and diagnostic workflows.

However, the multi-analyte controls segment showed gradual growth. Its adoption was rising as laboratories moved toward multiplex testing systems. These controls enabled the simultaneous assessment of several biomarkers, improving testing efficiency. They were particularly valuable in research and high-throughput environments where comprehensive data were required. Although single-analyte controls led the market, multi-analyte systems are expected to gain momentum as molecular diagnostics evolve toward automation and integrated assay solutions.

Application Analysis

In 2024, the Infectious Disease Diagnostics section held a dominant market position in the Application Setting Segment of the Molecular Quality Controls Market, and captured more than a 44.5% share. This leadership was attributed to the growing burden of infectious diseases and the increasing use of molecular diagnostic tests worldwide. Continuous improvements in PCR and molecular assay technologies enhanced test accuracy and reliability. These advancements strengthened the preference for molecular quality controls across infectious disease laboratories.

The Oncology Testing segment accounted for a notable share of the market during the same period. The rise in cancer incidence and the growing use of molecular methods for biomarker testing supported this growth. The integration of molecular quality controls ensured the precision of cancer detection and monitoring processes. The segment’s expansion was further encouraged by ongoing developments in personalized medicine and liquid biopsy testing techniques. These trends reinforced oncology’s steady role in market expansion.

The Genetic Testing and Other Applications segments also demonstrated healthy growth. Genetic Testing benefited from the rising awareness of hereditary disorders and the increasing demand for genomic screening. Molecular quality controls played a key role in maintaining accuracy in carrier screening and prenatal diagnostics. Other Applications, including microbiology and neurology, recorded gradual progress. This growth was driven by the wider adoption of molecular testing in disease detection and the continued evolution of diagnostic technologies.

End-User Analysis

In 2024, the Diagnostic Laboratories section held a dominant market position in the End-User Setting segment of the Molecular Quality Controls Market, and captured more than a 34.5% share. This dominance was due to the extensive use of molecular diagnostic tests for detecting infectious and genetic diseases. Increased demand for accurate and reliable test results further supported the segment’s growth. The need for consistent performance verification in diagnostic assays also encouraged greater adoption of molecular quality control products.

Hospitals followed as another significant end-user category in the market. The segment benefited from the growing application of molecular diagnostics in patient management and disease monitoring. Rising awareness of the benefits of early detection encouraged hospitals to implement strict quality control protocols. This ensured precision in molecular testing outcomes. In addition, the adoption of advanced molecular diagnostic technologies within hospital laboratories contributed to steady market expansion across developed and emerging regions.

Contract Research Organisations (CROs), Academic and Research Institutes, and other end-users also made notable contributions. CROs increased their use of molecular quality controls to improve data accuracy in clinical research and drug trials. Academic and research institutions used these controls to ensure reliable results in genomics and molecular biology studies. Other end-users, including public health laboratories and specialty testing centres, expanded adoption due to growing external quality assessment programs and the need for reliable molecular testing standards.

Key Market Segments

By Product

- Independent Controls

- Instrument-Specific Controls

By Analyte Type

- Single-Analyte Controls

- Multi-Analyte Controls

By Application

- Infectious Disease Diagnostics

- Oncology Testing

- Genetic Testing

- Other Applications

By End-User

- Diagnostic Laboratories

- Hospitals

- Contract Research Organisations (Cros)

- Academic & Research Institutes

- Other End-Users

Drivers

Rising Volume and Complexity of Molecular Testing

The rising volume and complexity of molecular testing are key drivers accelerating the demand for molecular quality controls (QC). As molecular diagnostics expand across infectious disease detection, oncology, and genetic screening, the accuracy and reproducibility of test results have become critical. Laboratories increasingly rely on molecular QC materials to validate every stage of testing—from sample extraction to detection. This ensures that even highly sensitive assays such as PCR, NGS, or multiplex tests deliver consistent and reliable clinical outcomes.

The molecular diagnostics ecosystem is evolving rapidly with more intricate assays and automated workflows. Each added layer of complexity introduces potential error sources that must be mitigated through robust QC systems. For instance, advanced techniques like liquid biopsy or multiplex PCR require precise calibration and standardization to avoid false results. This growing sophistication of molecular workflows directly strengthens the market need for standardized molecular quality control products that safeguard accuracy and reliability across testing platforms.

According to a 2022 commentary by the Association for Diagnostics & Laboratory Medicine (ADLM), global COVID-19 molecular testing capacity still remained around 66 million tests per month, despite declining pandemic-driven demand. This shows the extensive installed base of molecular testing infrastructure that continues to require ongoing quality control and validation. The presence of such large testing capacities has sustained the demand for molecular QC materials across both infectious disease and post-pandemic diagnostic applications.

Moreover, major diagnostics companies are deepening their investment in molecular technologies, reinforcing QC demand. For example, Thermo Fisher Scientific reported total revenue of USD 42.88 billion in 2024, with about 10% derived from Specialty Diagnostics—roughly USD 4.29 billion in related activity. This sustained investment in molecular and specialty diagnostics highlights the growing reliance on QC systems that ensure accuracy in increasingly complex molecular testing environments.

Restraints

High Implementation Costs, Method Variability, and Evolving QA/QC Requirements

Implementation costs, method variability and QA gaps act as a significant restraint on the uptake of molecular quality-control products in diagnostics settings. First, many laboratories face tight budgets and must weigh the expense of acquiring specialised control panels, training personnel and dedicating staff time to additional validation and record-keeping. For smaller or lower-volume labs the reagent/device cost burden and time overhead of rigorous QC/QA can delay adoption of dedicated molecular QC programmes.

Furthermore, method variability poses a barrier. Studies indicate that molecular diagnostic workflows often involve diverse platforms, protocols and target analytes — making standardised control materials harder to apply broadly. For instance, a review of molecular diagnostics noted that “quality assurance and quality control issues have often remained under-developed” in routine labs. The lack of universally suitable reference materials or validated internal controls amplifies this issue and raises the perceived risk of investing in QC tools that may not align with a lab’s specific method.

On the regulatory side, rising demands further constrain uptake of QC products. According to a recent update, the Clinical Laboratory Improvement Amendments (CLIA) proficiency-testing (PT) final rule changes become effective January 1 2025, adding new analytes, stricter acceptable performance limits and broader PT enrolment requirements. These regulatory changes translate into additional compliance obligations for molecular labs. Facing increased staff time and documentation demands, laboratories may postpone purchasing new QC panels until necessary or financially feasible.

Finally, quality assurance and quality control gaps in molecular testing workflows add uncertainty and thus restrain market growth for QC products. For example, a 2022 review focused on molecular testing for SARS‑CoV‑2 highlighted that many labs lacked adequate QA/QC infrastructure despite rapid test expansion. That means labs perceive a risk in switching to or integrating new QC programmes — especially when they must validate those themselves, train staff and maintain records. All these factors combine to slow the uptake of molecular QC-products in the diagnostics market.

Opportunities

Expansion of NGS, Multiplex, and Precision-Medicine Workflows Driving Demand for Tailored Molecular Quality Controls

As molecular testing moves into more advanced workflows, there is a clear opportunity for tailored quality-control (QC) solutions. Laboratories adopting multiplex assays, sequencing-based diagnostics and precision medicine panels require controls that span the entire workflow — from extraction, amplification and detection through library preparation and bioinformatics analysis. Such controls must monitor multiple analytes simultaneously, support next-generation sequencing (NGS) pipeline validation, and provide truth sets for variant calling. This shift creates a growing market need for QC vendors to develop multiplex and NGS-friendly control products.

According to a 2022 consensus guideline by Association for Molecular Pathology (AMP) alongside College of American Pathologists (CAP) and Association for Pathology Informatics (API), laboratories may now use in-silico data to supplement NGS analytical validation — signalling that bioinformatics pipelines in clinical genomics warrant dedicated QC approaches. The guideline underscores the need to validate variant-calling sensitivity, insertion/deletion detection, and other advanced metrics using simulated or manipulated sequence data. PubMed For example, in-silico reference files can simulate low allele-fraction variants and structural variation to test bioinformatics performance.

Furthermore, a 2024 narrative review in the journal Journal of Laboratory and Precision Medicine highlighted that clinical laboratories are playing an ever-expanding role in precision medicine and genomic profiling. The review notes increased implementation of NGS and genomics testing across clinical settings — thereby driving demand for NGS-specific sample mixes, synthetic references and process controls. For instance, labs transitioning to multi-analyte panels require QC solutions that validate extraction through library prep and sequencing in one bundled control set.

In summary, the convergence of multiplex and NGS workflows in clinical diagnostics presents a concrete opportunity for QC vendors. With professional societies endorsing in-silico validation approaches and clinical adoption of advanced molecular testing accelerating, there is a measurable product need for controls that: (a) span extraction through sequencing; (b) support multiplex panel performance; and (c) include bioinformatics truth sets. Vendors who develop high-fidelity, workflow-integrated control materials are well positioned to capture this emerging market.

Trends

Shift Toward Data-Driven, Instrument-Agnostic QC and Integrated Software Connectivity in Molecular Laboratories

The molecular quality control (QC) landscape is shifting toward data-driven and instrument-agnostic strategies in molecular diagnostic laboratories. Laboratories are increasingly seeking QC solutions that span the full workflow—from nucleic-acid extraction through amplification and detection—with software tools that monitor QC performance, detect shifts or trends, and support regulatory compliance. In this environment, QC is no longer just about physical control materials but about connectivity, analytics and full workflow integration.

Historically, by around 2022 the adoption of third-party, instrument-agnostic control materials had become an established practice in molecular infectious-disease testing. For instance, many labs and manufacturers promoted controls that are independent of any single instrument or assay kit, enabling standardised QC across multiple platforms. This standardisation delivers greater comparability, better drift detection and cross-platform traceability.

By 2024 the focus had extended strongly into QC software and connectivity platforms. According to product literature from Thermo Fisher Scientific, their LabLink xL QC software offers web-based QC monitoring with auto-connectivity to instruments/LIS, peer comparison and long-term data storage. In a separate study, a real-life implementation of Unity Real Time (from Bio‑Rad Laboratories) in a molecular virology lab reduced QC review time from 57 minutes to 11 minutes and enabled detection of a reagent-lot-associated shift.

The implication of this trend for suppliers and labs is clear: molecular QC vendors are now selling integrated QC solutions rather than standalone control materials. Labs want combined offers—controls + connectivity + analytics—to simplify QC workflows, detect trends, consolidate multi-instrument workflows and enhance regulatory readiness. Suppliers who deliver this integrated stack gain a broader scope for value creation in the molecular diagnostics market.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 37.1% share and holds US$ 82.1 Million market value for the year. The region’s leadership in the Molecular Quality Controls market is attributed to its strong healthcare infrastructure and advanced diagnostic ecosystem. High test volumes and stringent quality standards have encouraged laboratories to adopt reliable molecular control systems. This consistent adoption ensures accuracy, compliance, and improved reliability across clinical and diagnostic applications.

The region’s dominance is reinforced by the presence of well-equipped laboratories and diagnostic centers. These facilities follow rigorous standards set by regulatory authorities such as the U.S. FDA and CLIA. The implementation of quality assurance guidelines drives laboratories to use molecular quality control products routinely. As a result, the adoption rate in North American facilities remains among the highest globally, creating strong demand for precision-based quality control solutions.

The increasing use of molecular diagnostics for infectious diseases, oncology, and genetic testing is another key factor supporting market growth. Growing cases of chronic and infectious diseases have driven a higher volume of molecular tests. Laboratories now prioritize result accuracy and reproducibility, which has expanded the use of molecular quality control materials. The ongoing shift toward precision medicine has further strengthened the region’s need for standardized testing protocols.

High healthcare spending and continuous R&D investments have also enhanced market strength in the region. The United States and Canada are global centers for biotechnology innovation and molecular research. Significant funding by both public and private sectors has accelerated the adoption of advanced quality control systems. Research institutions and universities actively participate in developing improved molecular testing methods, which continue to expand the scope of the market across research and diagnostic applications.

The presence of leading diagnostic and quality control manufacturers in North America provides a competitive edge. These companies focus on innovation, automation, and integration of digital technologies into laboratory processes. The resulting improvements in efficiency and accuracy further promote the use of molecular control solutions. Continued government initiatives for quality assurance programs and growing awareness of diagnostic accuracy are expected to maintain North America’s dominance in the molecular quality controls market over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The molecular quality controls market is shaped by strong participation from established diagnostic and life science companies. Global firms such as Bio-Rad Laboratories, Thermo Fisher Scientific, and LGC Limited lead through advanced molecular QC solutions and wide product portfolios. Bio-Rad offers comprehensive third-party controls, strengthened by its Exact Diagnostics acquisition. Thermo Fisher’s AcroMetrix line ensures assay consistency across multiple platforms, while LGC, through SeraCare, focuses on NGS-based quality controls. Their leadership positions are supported by innovation, regulatory alignment, and strong customer relationships.

Prominent diagnostics manufacturers, including F. Hoffmann-La Roche Ltd. and Abbott Laboratories, maintain dominance through assay-specific quality control kits. Roche integrates QC materials within its cobas and Liat platforms, ensuring precise and reproducible molecular results. Similarly, Abbott offers Alinity m control kits designed for enhanced reliability in high-throughput laboratories. These strategies strengthen platform integration and ensure compliance with global quality standards. Their closed-system approach enhances customer retention and guarantees performance across molecular diagnostic workflows.

A diverse group of specialized players further enhances market competitiveness. ZeptoMetrix Corporation provides NATtrol-based molecular controls known for stability and cross-platform compatibility. Microbiologics Inc. delivers Helix Elite molecular standards used for assay validation and performance verification. Randox Laboratories and its subsidiary Qnostics Ltd. supply analytical panels and EQA solutions that ensure accuracy in infectious disease testing. These firms contribute to broader accessibility of molecular QC materials, offering cost-effective, vendor-neutral solutions to global laboratories.

Additionally, bioMérieux SA plays an influential role by offering compatible QC solutions that support its BIOFIRE molecular systems. Its collaborations with independent QC providers help ensure high-quality molecular testing. Collectively, these players contribute to the growing emphasis on molecular testing accuracy worldwide. The market’s competitive dynamics are driven by technological innovation, product expansion, and increasing laboratory automation. Continuous advancements in NGS and infectious disease diagnostics are expected to sustain strong demand for molecular quality control solutions globally.

Market Key Players

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- LGC Limited

- ZeptoMetrix Corporation

- Microbiologics Inc.

- Randox Laboratories Ltd.

- bioMérieux SA

- Qnostics Ltd.

- Other key players

Recent Developments

- December 2024: LGC announced the acquisition of DiaMex GmbH, a manufacturer of third-party serology and molecular quality controls used in clinical laboratories and blood banks. The move was framed as enhancing choice of products in the core laboratory and blood-bank spaces and complementing LGC’s molecular quality control portfolio.

- April 2024: Bio-Rad entered into a collaboration agreement with Oncocyte Corporation to co-commercialise the GraftAssure™ assay, which uses ddPCR technology (via Bio-Rad’s QX600 platform) for quantifying donor-derived cell-free DNA (dd-cfDNA) in transplant monitoring. Under the distribution terms, Bio-Rad will hold exclusive global distribution outside the U.S. and Germany, and has an option for IVD commercial rights upon FDA clearance.

- February 2024: Launch of Multiplex Vaginal IVD Controls for point-of-care testing. The company introduced a new control product designed for multiplex molecular panels addressing vaginal infection pathogens (e.g., Atopobium vaginae, BVAB2 surrogate, Candida albicans, Candida glabrata, Trichomonas vaginalis, Lactobacillus acidophilus) in swab format stored at room temperature.

- November 2023: Roche launched the LightCycler® PRO System, a next-generation qPCR platform designed for both clinical diagnostics and research, bridging the gap between translational research and in-vitro diagnostics. The system supports more than 200 LightMix research assays and over 60 CE-IVD assays from subsidiary TIB Molbiol GmbH. It is intended to enable labs to transition seamlessly from discovery research to patient sample testing, supporting molecular diagnostics, including infectious disease, oncology and other areas.

- May 2023: ZeptoMetrix introduced PROtrol™, described as a new line of products designed for antigen-based diagnostic methods (lateral-flow immunoassay market) which are designed to mimic true clinical specimens and monitor antigen assay performance.

Report Scope

Report Features Description Market Value (2024) US$ 221.4 Million Forecast Revenue (2034) US$ 419.5 Million CAGR (2025-2034) 6.6%% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Independent Controls, Instrument-Specific Controls), By Analyte Type (Single-Analyte Controls, Multi-Analyte Controls), By Application (Infectious Disease Diagnostics, Oncology Testing, Genetic Testing, Other Applications), By End-User (Diagnostic Laboratories, Hospitals, Contract Research Organisations (Cros), Academic & Research Institutes, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., Abbott Laboratories, LGC Limited, ZeptoMetrix Corporation, Microbiologics Inc., Randox Laboratories Ltd., bioMérieux SA, Qnostics Ltd., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Molecular Quality Controls MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Molecular Quality Controls MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- LGC Limited

- ZeptoMetrix Corporation

- Microbiologics Inc.

- Randox Laboratories Ltd.

- bioMérieux SA

- Qnostics Ltd.

- Other key players