Global Methyl Acetate Market Size, Share, And Business Benefits By Purity (Low Purity (Less Than 99.5%), High Purity (Greater than 99.5%)), By Grade (Technical Grade, Pharmaceutical Grade, Food Grade), By Application (Paints Coatings, Adhesives Sealants, Pharmaceuticals, Cosmetics Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149745

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

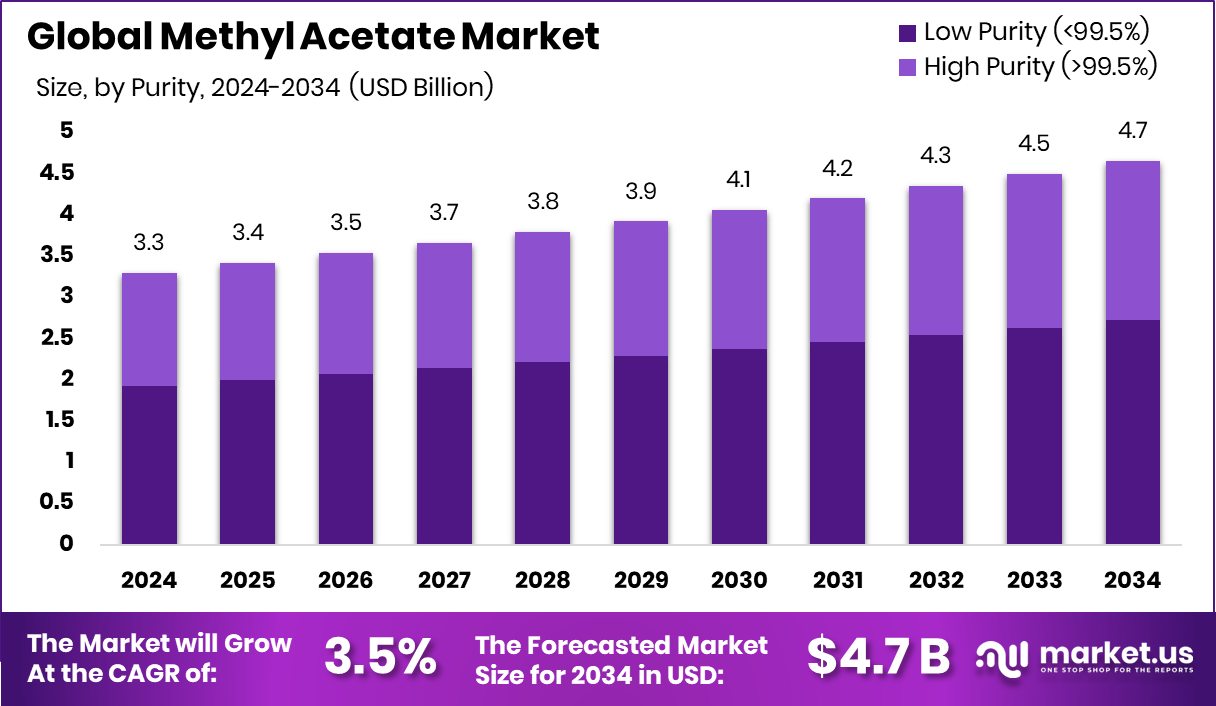

Global Methyl Acetate Market is expected to be worth around USD 4.7 billion by 2034, up from USD 3.3 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034. Strong demand from coatings and adhesives supported North America’s USD 1.2 billion valuation.

Methyl Acetate is a clear, flammable liquid with a pleasant, fruity odor. It is primarily used as a fast-evaporating solvent in paints, coatings, adhesives, and personal care products. Chemically, it is the methyl ester of acetic acid, and it dissolves a wide range of resins and polymers. Due to its low toxicity and biodegradability, it’s considered a safer alternative to more hazardous solvents in industrial and commercial applications.

The Methyl Acetate market is driven by growing demand in the coatings and packaging sectors, especially as industries seek low-VOC (volatile organic compound) alternatives. As regulations around environmental safety tighten, industries are replacing traditional solvents with greener options like methyl acetate. Its compatibility with waterborne and solvent-borne systems gives it an edge in sectors that demand both efficiency and compliance.

Growth in urban development and automotive refinishing has fueled the demand for paints and coatings, thereby boosting methyl acetate consumption. The product’s ability to enhance drying speed and film formation in coatings makes it a preferred choice among manufacturers, especially in developing regions with rising infrastructure activities.

There is a strong opportunity in emerging economies where industrial expansion and urbanization are rapidly progressing. Moreover, methyl acetate’s application in the pharmaceutical and personal care sectors is gaining traction, especially in the formulation of nail polish removers, perfumes, and cleaning products.

Key Takeaways

- Global Methyl Acetate Market is expected to be worth around USD 4.7 billion by 2034, up from USD 3.3 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034.

- In 2024, low-purity methyl acetate accounted for 58.5% due to its widespread industrial solvent usage.

- Technical grade methyl acetate held a 67.4% share, primarily driven by demand in adhesives and manufacturing sectors.

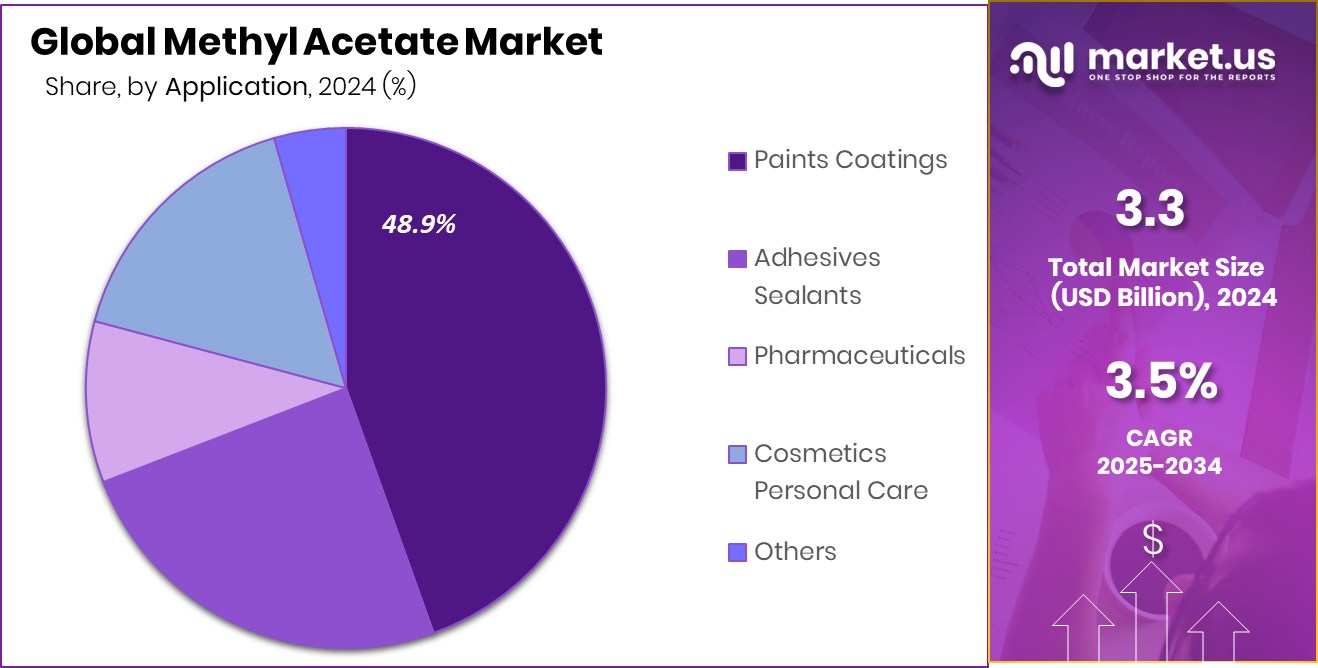

- Paints and coatings dominated applications with 48.9%, supported by rising infrastructure and automotive refinishing activities globally.

- The North American market was valued at USD 1.2 billion during the same year.

By Purity Analysis

Low-purity methyl acetate held a 58.5% share in the global solvent applications market.

In 2024, Low Purity (<99.5%) held a dominant market position in the By Purity segment of the Methyl Acetate Market, with a 58.5% share. This segment’s strong performance is primarily attributed to its wide-scale use in cost-sensitive industrial applications, such as adhesives, paints, coatings, and printing inks. Low-purity methyl acetate is considered sufficient for these uses where ultra-high chemical precision is not critical, allowing manufacturers to benefit from lower input costs without compromising performance.

Industries across construction, packaging, and consumer goods continue to prefer low-purity grades due to their affordability and adequate solvent performance in mass-production environments. The segment also benefits from easy availability and simpler processing requirements, which further reduce manufacturing complexities. Moreover, the ongoing demand for high-volume solvent formulations in rapidly industrializing regions has further reinforced the dominance of this grade.

As environmental regulations drive a shift away from more hazardous solvents, the use of low-purity methyl acetate as a safer, compliant alternative supports its continued market strength. Overall, its balance of cost, functionality, and availability made Low Purity (<99.5%) the preferred option across multiple downstream industries, securing its leading share in 2024.

By Grade Analysis

Technical grade methyl acetate accounted for 67.4% due to widespread industrial formulation uses.

In 2024, Technical Grade held a dominant market position in the By Grade segment of the Methyl Acetate Market, with a 67.4% share. This grade is widely used across several industrial applications, including coatings, adhesives, inks, and process solvents, where ultra-high purity is not required. The high share reflects its strong demand from manufacturers seeking effective and economical solutions for mass-market formulations. Technical grade methyl acetate delivers reliable solvency power and evaporation characteristics, making it suitable for large-scale production environments.

Its extensive use in industrial-scale operations is also driven by growing construction and automotive activity, where solvent-based systems remain prevalent. Additionally, the increasing adoption of quick-drying paints and environmentally friendlier substitutes has supported its uptake, as technical grade methyl acetate balances performance with regulatory compliance in many global markets.

The grade’s commercial availability and relatively low cost further reinforce its preference among end-users looking for cost-effective alternatives to traditional solvents. As industries across emerging economies expand production capacities, the demand for technical-grade methyl acetate is expected to remain steady.

By Application Analysis

The paints and coatings segment led demand, capturing 48.9% of methyl acetate consumption.

In 2024, Paints & Coatings held a dominant market position in the By Application segment of the Methyl Acetate Market, with a 48.9% share. This leading position is largely driven by the solvent’s fast evaporation rate and excellent solvency for resins, making it ideal for use in paint and coating formulations. As demand for quick-drying, smooth-finish coatings rises across automotive, construction, and industrial sectors, methyl acetate continues to be a preferred choice due to its functional advantages and cost efficiency.

Its role in reducing drying time without compromising on coating quality is particularly valuable in fast-paced production lines and renovation projects. The growing focus on low-VOC and environmentally safer solvents has further supported methyl acetate’s presence in modern paint systems, especially in regions with tightening emission norms. The material’s compatibility with waterborne and solventborne systems also adds flexibility in diverse formulations.

Moreover, increasing infrastructure development and housing activities in emerging markets are pushing demand for decorative and protective coatings, contributing to the segment’s strong performance. The 48.9% share held by Paints & Coatings in 2024 underscores methyl acetate’s strategic relevance as a solvent in this high-demand and regulation-sensitive application area.

Key Market Segments

By Purity

- Low Purity (<99.5%)

- High Purity (>99.5%)

By Grade

- Technical Grade

- Pharmaceutical Grade

- Food Grade

By Application

- Paints Coatings

- Adhesives Sealants

- Pharmaceuticals

- Cosmetics Personal Care

- Others

Driving Factors

Rising Demand for Eco-Friendly Solvents Globally

One of the main drivers of the Methyl Acetate market is the growing demand for eco-friendly and safer solvents. Methyl acetate is known for being less toxic and more biodegradable compared to traditional solvents like toluene or acetone. This makes it a popular option among industries such as paints, coatings, adhesives, and cosmetics, especially as governments tighten environmental laws.

Companies are switching to methyl acetate to meet low-VOC (Volatile Organic Compound) standards and avoid harsh chemicals. As industries aim to reduce their environmental footprint, the use of green solvents like methyl acetate is becoming more important. This shift in preference is helping the market grow steadily, especially in countries focused on sustainable manufacturing practices.

Restraining Factors

Health and Safety Concerns Limit Industrial Usage

A key factor holding back the Methyl Acetate market is the concern over its health and safety risks during handling and storage. Although it is less toxic than many other solvents, methyl acetate is still highly flammable and can pose fire hazards in industrial environments if not managed properly. Exposure to high levels of its vapors may also cause dizziness, nausea, or irritation to the eyes and respiratory system.

These risks require companies to invest in special storage facilities, protective gear, and ventilation systems, which increases overall operational costs. Small manufacturers, especially in developing regions, may avoid using methyl acetate due to these safety-related expenses, slowing down its broader adoption across certain industrial sectors.

Growth Opportunity

Bio-Based Methyl Acetate Gains Industry Attention

One major growth opportunity in the Methyl Acetate market lies in the development of bio-based alternatives. As industries move toward greener and more sustainable chemicals, there is growing interest in producing methyl acetate from renewable sources like biomass or plant-based feedstocks.

Bio-based methyl acetate offers the same functional benefits but with a lower carbon footprint, making it attractive for companies aiming to meet strict environmental targets. Governments and organizations are also encouraging the use of bio-chemicals through incentives and eco-labeling, which boosts market potential.

With increasing demand for cleaner production processes, investing in bio-based methyl acetate can open new doors for manufacturers looking to stand out in a competitive and eco-conscious market environment.

Latest Trends

Bio-Based Methyl Acetate Gains Industry Attention

One notable trend in the methyl acetate market is the increasing shift towards bio-based production methods. Manufacturers are exploring renewable sources like sugarcane and corn to produce methyl acetate, aiming to reduce reliance on fossil fuels and minimize environmental impact.

This transition aligns with the global emphasis on sustainability and the demand for eco-friendly solvents. Bio-based methyl acetate offers similar performance characteristics to its conventional counterpart, making it a viable alternative in various applications.

Industries such as paints, coatings, and adhesives are particularly interested in these greener options to meet regulatory standards and consumer preferences for sustainable products. The development and adoption of bio-based methyl acetate not only support environmental goals but also open new market opportunities for producers focusing on sustainable chemical solutions.

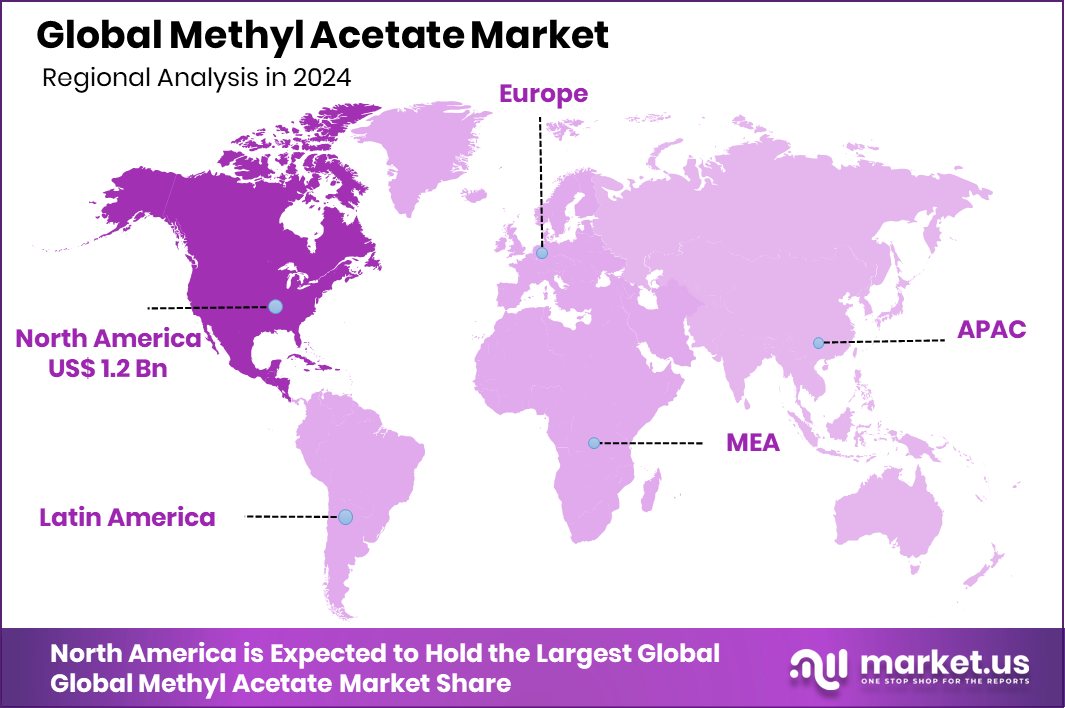

Regional Analysis

In 2024, North America held a 36.8% share in the Methyl Acetate Market.

In 2024, North America dominated the global Methyl Acetate Market, accounting for a significant 36.8% share and reaching a market value of USD 1.2 billion. The region’s leadership is largely attributed to high demand from end-use industries such as paints, coatings, adhesives, and printing inks, particularly in the United States. The presence of a well-established manufacturing sector, along with stringent environmental regulations pushing for low-VOC solvents, continues to support regional growth.

Europe followed with steady demand, driven by rising sustainability standards and the use of methyl acetate in personal care and specialty chemicals. In the Asia Pacific region, industrial development in countries like China, India, and Southeast Asia is gradually increasing usage across multiple sectors, although the region has not surpassed North America in market share.

The Middle East & Africa and Latin America represented smaller shares but are seeing slow and steady growth, supported by emerging construction activities and growing awareness of safer chemical alternatives.

While these regions show future promise, North America retained its lead in 2024 due to mature end-user industries and higher consumption levels, solidifying its position as the dominant region in the global methyl acetate market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Reliance Industries Limited (RIL): As a diversified conglomerate, RIL’s petrochemical segment plays a pivotal role in its operations. The company’s integrated approach, encompassing upstream and downstream activities, ensures a steady supply of raw materials essential for methyl acetate production.

RIL’s commitment to sustainability is evident in its efforts to reduce freshwater consumption, with an average recycled treated effluent of 9,926 m³/day between October 2023 and March 2024, accounting for 17.86% of its water usage. Such initiatives not only align with global environmental standards but also enhance operational efficiency, positioning RIL favorably in the methyl acetate market.

In 2024, SABIC reported a net profit of SAR 1.5 billion (approximately USD 400 million), a significant turnaround from a net loss of SAR 2.8 billion in 2023. This recovery underscores the company’s resilience and strategic agility in a challenging global chemical industry landscape. SABIC’s diversified product portfolio and global manufacturing footprint enable it to cater to various sectors, including those utilizing methyl acetate. However, the company acknowledged challenges such as higher fixed costs and fluctuating sales volumes, emphasizing the need for continuous innovation and cost optimization.

Eastman continues to be a prominent player in the methyl acetate market, offering a product characterized by its fast evaporation rate and mild odor, making it suitable for coatings and ink resins. The company’s focus on producing environmentally friendly solvents aligns with the increasing demand for sustainable chemical solutions. Eastman’s global presence and commitment to innovation position it well to meet the evolving needs of the methyl acetate market.

Top Key Players in the Market

- Reliance Industries Limited

- SABIC

- Eastman Chemical Company

- Formosa Chemicals Fibre Corporation

- Celanese Corporation

- Dow Chemical Company

- Shell Chemicals

- Mitsubishi Gas Chemical Company

- LyondellBasell Industries

- INEOS

- BASF SE

- BPCL

- Asahi Kasei Corporation

- LG Chem

Recent Developments

- In November 2024, Celanese partnered with Henkel to develop adhesives made from captured CO₂ emissions. This collaboration utilizes Celanese’s carbon capture and utilization (CCU) technology to produce methanol, a component in vinyl acetate monomer (VAM), which is related to methyl acetate production. The initiative aims to create more sustainable adhesive products for the packaging and consumer goods industries.

- In January 2025, Dow unveiled targeted actions aimed at delivering $1 billion in cost savings. These measures are designed to enhance the company’s financial foundation and support long-term growth objectives, which may indirectly affect various product lines, including solvents like methyl acetate.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 4.7 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Low Purity (<99.5%), High Purity (>99.5%)), By Grade (Technical Grade, Pharmaceutical Grade, Food Grade), By Application (Paints Coatings, Adhesives Sealants, Pharmaceuticals, Cosmetics Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Reliance Industries Limited, SABIC, Eastman Chemical Company, Formosa Chemicals Fibre Corporation, Celanese Corporation, Dow Chemical Company, Shell Chemicals, Mitsubishi Gas Chemical Company, LyondellBasell Industries, INEOS, BASF SE, BPCL, Asahi Kasei Corporation, LG Chem Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Reliance Industries Limited

- SABIC

- Eastman Chemical Company

- Formosa Chemicals Fibre Corporation

- Celanese Corporation

- Dow Chemical Company

- Shell Chemicals

- Mitsubishi Gas Chemical Company

- LyondellBasell Industries

- INEOS

- BASF SE

- BPCL

- Asahi Kasei Corporation

- LG Chem