Global Metal Chelates Market Size, Share Analysis Report By Form (Granules, Liquid, Powder), By Product Type (Macronutrients, Micronutrients), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Application (Foliar, Fertigation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159714

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

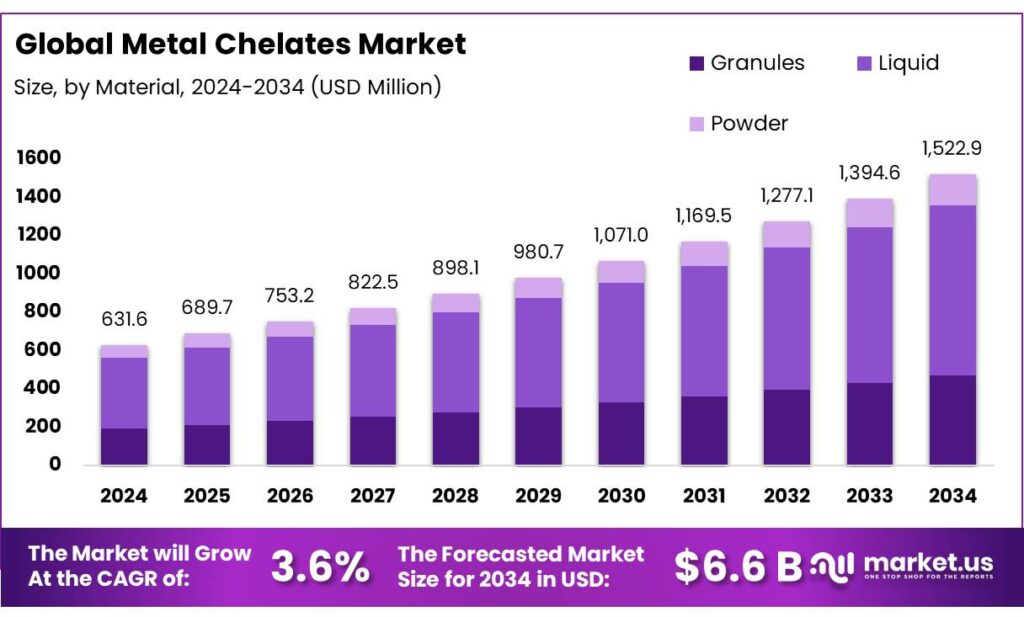

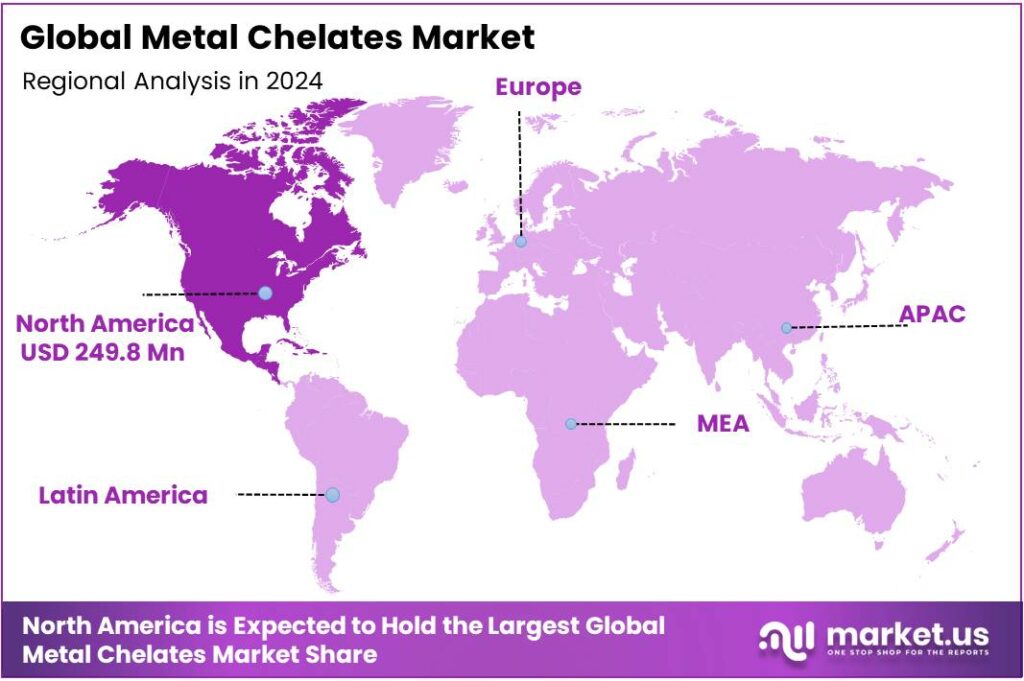

The Global Metal Chelates Market size is expected to be worth around USD 1522.9 Million by 2034, from USD 631.6 Million in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034. In 2024 North American held a dominant market position, capturing more than a 39.6% share, holding USD 249.8 Million in revenue.

Metal chelates—complexes such as Fe-EDDHA, Fe-EDTA, Zn-EDTA, and DTPA salts—are indispensable where metals must stay soluble and bioavailable in challenging pH or hardness conditions. In fertilizers they deliver micronutrients efficiently; in water treatment and cleaning they bind hardness ions and trace metals; and in pharmaceuticals/diagnostics they stabilize actives. Policy attention on nutrient efficiency and safer chemistries is reshaping this landscape: the EU Fertilising Products Regulation (EU) 2019/1009, for example, requires labeling the percentage of each micronutrient chelated by each chelating agent, tightening comparability and quality across the single market.

Regulation is also nudging product design and analytical rigor. Beyond the EU’s labeling rule, European standardization (CEN/TC 260) specifies methods for determining complexed metals in organo-mineral fertilizers, with applicability as low as 0.07% Fe, 0.006% Mn, and 0.035% Zn mass fractions—supporting transparent specification and QC for chelated micronutrient products. Environmental safety benchmarks exist too: ECHA dossiers report a fish early-life NOEC for H₄-EDTA of ≥ 20–25.7 mg/L, while national regulators quantify market scale and emissions; Australia’s chemicals regulator estimated < 3,000 t/year cumulative introduction volume for EDTA salts/complexes across uses, informing exposure assessments.

Water policy adds another growth vector. The U.S. EPA’s Lead and Copper Rule (LCR) historically enforced action levels of 0.015 mg/L for lead and 1.3 mg/L for copper at the 90th percentile; in 2024 EPA finalized improvements that lower the lead action level to 0.010 mg/L, prompting utilities to optimize corrosion control and, in some cases, deploy complexing/chelating strategies alongside orthophosphate to manage metals at the tap. These numeric thresholds drive adoption of chelation in specialty water treatments where appropriate.

Key Takeaways

- Metal Chelates Market size is expected to be worth around USD 1522.9 Million by 2034, from USD 631.6 Million in 2024, growing at a CAGR of 3.6%.

- Liquid form of metal chelates held a dominant market position, capturing more than a 58.2% share of the overall market.

- Macronutrients held a dominant market position, capturing more than an 83.5% share of the global metal chelates market.

- Cereals and grains held a dominant market position, capturing more than a 43.8% share of the global metal chelates market.

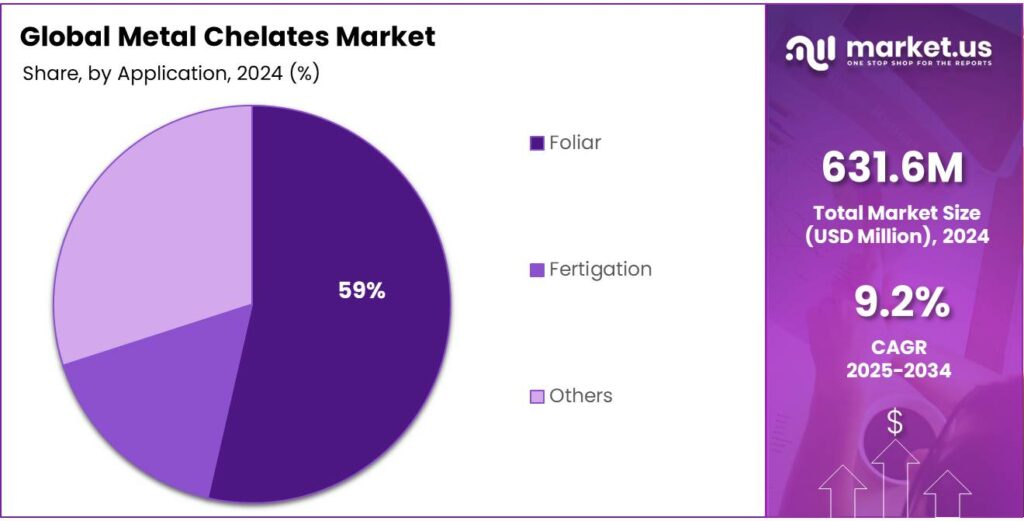

- Foliar application held a dominant market position, capturing more than a 59.4% share of the global metal chelates market.

- North America held a dominant position in the global metal chelates market, capturing 39.60% of the total market share, valued at approximately USD 249.8 million.

By Form Analysis

Liquid Form of Metal Chelates Dominates with 58.2% Market Share in 2024

In 2024, Liquid form of metal chelates held a dominant market position, capturing more than a 58.2% share of the overall market. This significant share can be attributed to the growing demand for liquid fertilizers in the agricultural sector. Liquid metal chelates are particularly favored for their ease of application, quick absorption by plants, and ability to deliver essential micronutrients efficiently. The high solubility and versatility of liquid chelates make them a preferred choice for foliar feeding, fertigation, and soil application.

As farmers and agronomists continue to seek faster and more efficient ways to enhance crop yields, the liquid form remains the go-to option due to its practicality and effectiveness. In the coming years, the dominance of liquid metal chelates is expected to persist, driven by innovations in fertigation systems and the increasing adoption of precision farming techniques. This form’s ability to be mixed with other agrochemicals, such as herbicides and fungicides, further boosts its popularity.

By Product Type Analysis

Macronutrients Dominate the Metal Chelates Market with 83.5% Share in 2024

In 2024, Macronutrients held a dominant market position, capturing more than an 83.5% share of the global metal chelates market. This large share can be attributed to the critical role macronutrients like nitrogen, phosphorus, and potassium play in plant growth. As essential elements for various biological processes, they are widely used in agricultural applications to boost crop yield and enhance plant health. Their demand is particularly high in regions with large-scale agricultural operations that prioritize soil fertility and nutrient management.

The dominance of macronutrients is expected to remain strong throughout 2024 and beyond, as agricultural practices continue to focus on improving productivity while maintaining sustainable practices. The ease of application and cost-effectiveness of macronutrient-based chelates further reinforces their market position. These products are also highly versatile, suitable for both traditional and modern farming techniques, including precision farming, where precise nutrient delivery is essential.

By Crop Type Analysis

Cereals and Grains Lead the Metal Chelates Market with 43.8% Share in 2024

In 2024, cereals and grains held a dominant market position, capturing more than a 43.8% share of the global metal chelates market. This significant share is driven by the extensive use of chelated micronutrients in the cultivation of crops like wheat, maize, and rice, which are essential for global food security. As these crops are staple foods in many regions, the demand for enhanced agricultural productivity is a key factor pushing the use of metal chelates in their cultivation.

Cereals and grains benefit from chelated micronutrients like iron, zinc, and manganese, which help overcome common soil deficiencies and improve overall crop health. The high demand for these crops, coupled with the need to ensure maximum yield and quality, makes them the primary market for metal chelates. As global population growth and the demand for food continue to rise, the importance of optimizing cereal and grain production remains a priority, ensuring the sustained demand for chelated fertilizers.

By Application Analysis

Foliar Application Leads the Metal Chelates Market with 59.4% Share in 2024

In 2024, foliar application held a dominant market position, capturing more than a 59.4% share of the global metal chelates market. This dominance is primarily due to the advantages foliar feeding offers, such as faster absorption of nutrients and direct delivery to plants. Foliar application allows for quick correction of nutrient deficiencies in crops, particularly when soil uptake is insufficient. It is especially effective for correcting micronutrient imbalances in plants, such as iron, zinc, and manganese, which are essential for healthy growth.

The foliar application method is widely preferred in both conventional and organic farming due to its efficiency and effectiveness in improving crop yield and quality. Additionally, the increasing adoption of precision agriculture techniques, where nutrient delivery is customized based on plant needs, further fuels the growth of foliar metal chelates. The demand for foliar feeding is expected to remain strong as agricultural practices continue to evolve toward more targeted and sustainable nutrient management.

Key Market Segments

By Form

- Granules

- Liquid

- Powder

By Product Type

- Macronutrients

- Primary Nutrients

- Secondary Nutrients

- Micronutrients

By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Others

By Application

- Foliar

- Fertigation

- Others

Emerging Trends

Embracing Biodegradable Chelates in Food Safety

In recent years, the food industry has witnessed a significant shift towards sustainability, with a growing emphasis on reducing environmental impact. One notable development is the increasing adoption of biodegradable chelating agents in food safety applications. These agents play a crucial role in enhancing the stability and shelf life of food products by binding metal ions that could otherwise catalyze oxidative degradation.

Chelates are compounds that bind metal ions, preventing them from participating in undesirable reactions. Traditional chelating agents, such as EDTA, have been widely used in the food industry. However, concerns over their persistence in the environment have led to a push for biodegradable alternatives. Biodegradable chelates break down more readily, reducing the long-term environmental burden.

The global market for biodegradable chelates is expanding, driven by both consumer demand for cleaner products and regulatory pressures. According to a report by InsightAce Analytic, the metal chelates market is projected to grow from $627.07 million in 2022 to $1,307.47 million by 2031, at a compound annual growth rate (CAGR) of 8.67%. This growth reflects the increasing incorporation of biodegradable chelates in various food safety applications.

Governments and regulatory bodies are actively supporting the transition to biodegradable chelates. In the United States, the Food and Drug Administration (FDA) has been working on reducing toxic elements in foods, especially those consumed by infants and young children. Their “Closer to Zero” initiative aims to lower exposure to contaminants like lead, arsenic, cadmium, and mercury

Drivers

Enhancing Food Safety and Quality through Metal Chelates

One significant driving factor for the adoption of metal chelates in the food industry is their pivotal role in enhancing food safety and quality. These compounds, such as EDTA (Ethylenediaminetetraacetic acid), potassium tartrate, and potassium citrate, function by binding metal ions that can catalyze oxidative reactions, thereby preventing spoilage and preserving the nutritional integrity of food products.

Metal chelates are instrumental in extending the shelf life of various food items, including processed meats, dairy products, and ready-to-eat meals. By sequestering metal ions like iron and copper, which are known to promote oxidative degradation, chelating agents help maintain the freshness and safety of these products. This application is particularly crucial in reducing food waste, a pressing issue in the global food supply chain. For instance, the use of EDTA in canned foods prevents the development of off-flavors and discoloration, ensuring that products remain appealing to consumers over extended periods.

Another critical application of metal chelates is in mitigating heavy metal contamination in food. Studies have demonstrated that chelating agents can effectively reduce levels of toxic metals such as lead and cadmium in food products. For example, research indicates that soaking and cooking rice with chelating agents like potassium tartrate and potassium citrate can achieve lead reduction rates of up to 99.4% and cadmium reduction rates of up to 95.1%. These findings underscore the potential of chelating agents in enhancing food safety by lowering the risk of heavy metal exposure to consumers.

Restraints

Regulatory Challenges and Safety Concerns in the Use of Metal Chelates

One of the major restraining factors for the widespread use of metal chelates in the food industry is the increasing regulatory scrutiny regarding their safety and potential health risks. Despite their benefits in food preservation and safety, there are concerns over the long-term consumption of chelating agents, especially when they are used in high concentrations. Regulatory agencies, including the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), have set strict guidelines for the permissible levels of these compounds in food products. However, the potential for overuse or misuse, particularly in processed foods, raises concerns about unintended health effects.

In recent years, there has been a tightening of regulations surrounding the use of chelating agents in food. For instance, in 2020, the European Commission revised its regulations on food additives, specifically targeting the use of chelating agents in food products. This revision led to more stringent requirements for manufacturers, including stricter labeling and more detailed safety assessments before approval. As a result, food manufacturers must invest more in compliance with these regulations, which increases the cost of using metal chelates in food products.

For example, the FDA has set specific acceptable daily intake levels for EDTA, which is used in a wide range of food products. The FDA guidelines for EDTA allow up to 75 mg per kg of body weight per day for humans, but exceeding this level could trigger regulatory action. Similarly, in the European Union, the use of EDTA is limited to specific applications such as in canned vegetables and soft drinks, with clearly defined concentration limits. These restrictions, while beneficial for public health, could limit the market for metal chelates in food preservation, particularly for manufacturers looking to use higher concentrations to extend shelf life.

Opportunity

Government Initiatives Supporting Sustainable Agriculture

The global demand for nutrient-rich food is on the rise, driven by increasing health awareness and the need to combat micronutrient deficiencies. Metal chelates, which are compounds that bind essential minerals like iron, zinc, and manganese, play a pivotal role in agriculture by improving the bioavailability of these nutrients to plants. This enhancement leads to healthier crops and, consequently, more nutritious food products.

Advancements in agricultural technologies, such as precision farming, are further driving the demand for metal chelates. These technologies allow for the targeted application of nutrients, ensuring that crops receive the necessary minerals in optimal amounts. This not only improves crop yields but also enhances the nutritional quality of the produce.

Governments worldwide are recognizing the importance of sustainable agriculture and are implementing initiatives to promote the use of metal chelates. For instance, in January 2025, the Chief Minister of Uttar Pradesh, India, launched a 4,000-crore project aimed at enhancing agricultural productivity by up to 35% and supporting the rural enterprise ecosystem. This six-year project is set to run until 2029-30 and is expected to significantly impact the adoption of advanced agricultural technologies, including the use of metal chelates

Regional Insights

North America Holds a Dominant Position in the Metal Chelates Market with 39.60% Share in 2024

In 2024, North America held a dominant position in the global metal chelates market, capturing 39.60% of the total market share, valued at approximately USD 249.8 million. The region’s dominance is primarily driven by the advanced agricultural practices and high adoption of precision farming techniques in countries like the United States and Canada. North American farmers increasingly rely on metal chelates, particularly for foliar application and fertigation, to enhance crop yields and improve soil health. The use of micronutrient-rich chelated fertilizers is integral to boosting the productivity of staple crops, including corn, wheat, and soybeans, which are significant contributors to the agricultural output in the region.

Government initiatives aimed at improving sustainable farming practices have also supported the growth of the metal chelates market. In the United States, for instance, the U.S. Department of Agriculture (USDA) has introduced various programs promoting efficient nutrient management and soil health, which align with the benefits provided by metal chelates. Moreover, the growing trend toward organic farming and the rising demand for high-quality food products further drive the need for chelated micronutrients in North America.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ava Chemicals Private Limited is an ISO 9001:2015 certified company specializing in manufacturing and exporting chelating agents such as EDTA, DTPA, and NTA. Their products find applications in agriculture, water treatment, and various industrial processes. The company’s commitment to quality and customer satisfaction has established it as a reliable supplier in the metal chelates market.

Yara International ASA is a global leader in crop nutrition, offering a comprehensive range of micronutrient fertilizers, including chelated iron products. Their YaraTera™ brand provides fully water-soluble fertilizers, enhancing nutrient uptake in crops. The company’s commitment to sustainability and precision agriculture positions it as a key player in the metal chelates market.

BASF SE is a global chemical company offering a range of chelating agents, including Trilon® G and Neutrol® MGDA, which are used in home care, industrial cleaning, and personal care applications. These products are designed to enhance cleaning efficiency and are partially biobased, meeting the growing demand for sustainable solutions. BASF’s commitment to innovation and sustainability strengthens its position in the metal chelates market.

Top Key Players Outlook

- Yara International ASA

- Nouryon

- BASF SE

- Shandong Iro Chelating Chemical Co. Ltd

- Haifa Negev technologies Ltd

- Ava Chemicals Private Limited

- Protex International

- Mitsubishi Chemical Corporation

- Innospec Inc.

Recent Industry Developments

In 2024 Shandong IRO Chelating Chemical Co., Ltd, reported a production capacity of 50,000 metric tons, including 20,000 metric tons of EDTA series and 22,000 metric tons of organophosphorus chelating chemicals.

In 2024, BASF SE, a global leader in the chemical industry, continued to enhance its position in the metal chelates sector, focusing on sustainability and innovation. The company achieved sales of €65.3 billion in 2024, demonstrating its robust market presence.

Report Scope

Report Features Description Market Value (2024) USD 631.6 Mn Forecast Revenue (2034) USD 1522.9 Mn CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Granules, Liquid, Powder), By Product Type (Macronutrients, Micronutrients), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Application (Foliar, Fertigation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & A1,3-Butanediol (CAS 107-88-0) Marketfrica – GCC, South Africa, Rest of MEA Competitive Landscape Yara International ASA, Nouryon, BASF SE, Shandong Iro Chelating Chemical Co. Ltd, Haifa Negev technologies Ltd, Ava Chemicals Private Limited, Protex International, Mitsubishi Chemical Corporation, Innospec Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Yara International ASA

- Nouryon

- BASF SE

- Shandong Iro Chelating Chemical Co. Ltd

- Haifa Negev technologies Ltd

- Ava Chemicals Private Limited

- Protex International

- Mitsubishi Chemical Corporation

- Innospec Inc.