Global Metal Cans Market Size, Share, And Business Benefits By Material (Aluminum, Tin, Others), By Product (2- Piece Drawn and Ironed, 2- Piece Draw Redraw (DRD), 3- Piece), By Closure Type (Easy- Open End (EOE), Peel- off End (POE), Others), By Application (Food and beverages, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155331

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

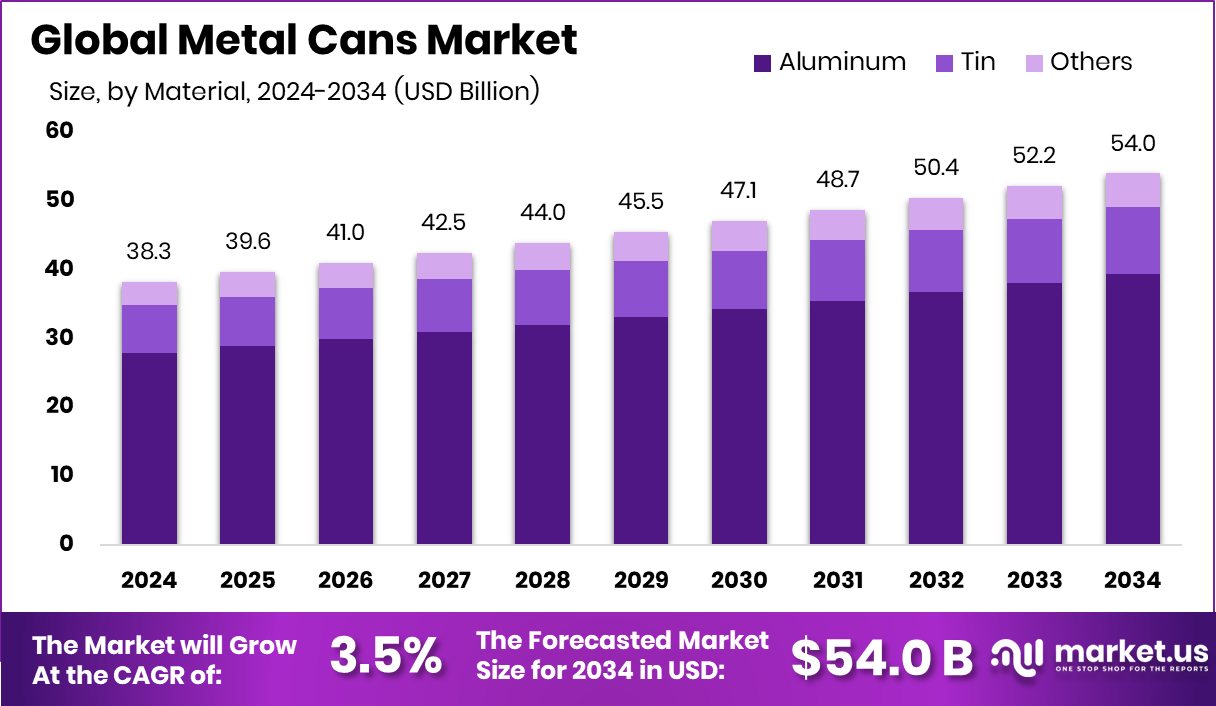

The Global Metal Cans Market is expected to be worth around USD 54.0 billion by 2034, up from USD 38.3 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034. With a 42.80% share, North America is valued at USD 16.3 Bn.

The metal cans market covers the global manufacturing, trade, and consumption of rigid containers made primarily from aluminum or steel, widely used in food, beverages, paints, and chemicals. These cans are valued for their durability, airtight sealing, and recyclability—both aluminum and steel can be reprocessed countless times without losing quality, helping reduce environmental impact.

Rising demand for ready-to-drink beverages, canned foods, and long-lasting packaging solutions continues to fuel market growth, alongside increasing awareness of sustainable packaging. Notably, 31 million aluminum cans are recovered each year through recycling grants, highlighting the sector’s circular economy potential. Major producers are also investing in technology, with Tata Steel UK receiving £7 million to advance AI-driven packaging research, aimed at optimizing production efficiency and sustainability.

Meanwhile, niche beverage brands are innovating, as seen with Liquid Water securing $9 million to boost aluminum-canned water sales, tapping into eco-conscious consumer demand. Urbanization, busy lifestyles, and the beverage industry—especially energy drinks and carbonated sodas—remain key demand drivers, while advancements in lightweight designs and high-quality printing further enhance the appeal of metal cans in competitive markets.

Key Takeaways

- The Global Metal Cans Market is expected to be worth around USD 54.0 billion by 2034, up from USD 38.3 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- In the metal cans market, aluminum dominates with a 72.9% share due to its lightweight and recyclability.

- Two-piece drawn and ironed cans hold 58.1% market share, offering cost efficiency and strong structural integrity.

- Easy-open end (EOE) closures account for 67.6%, enhancing consumer convenience and driving widespread packaging adoption.

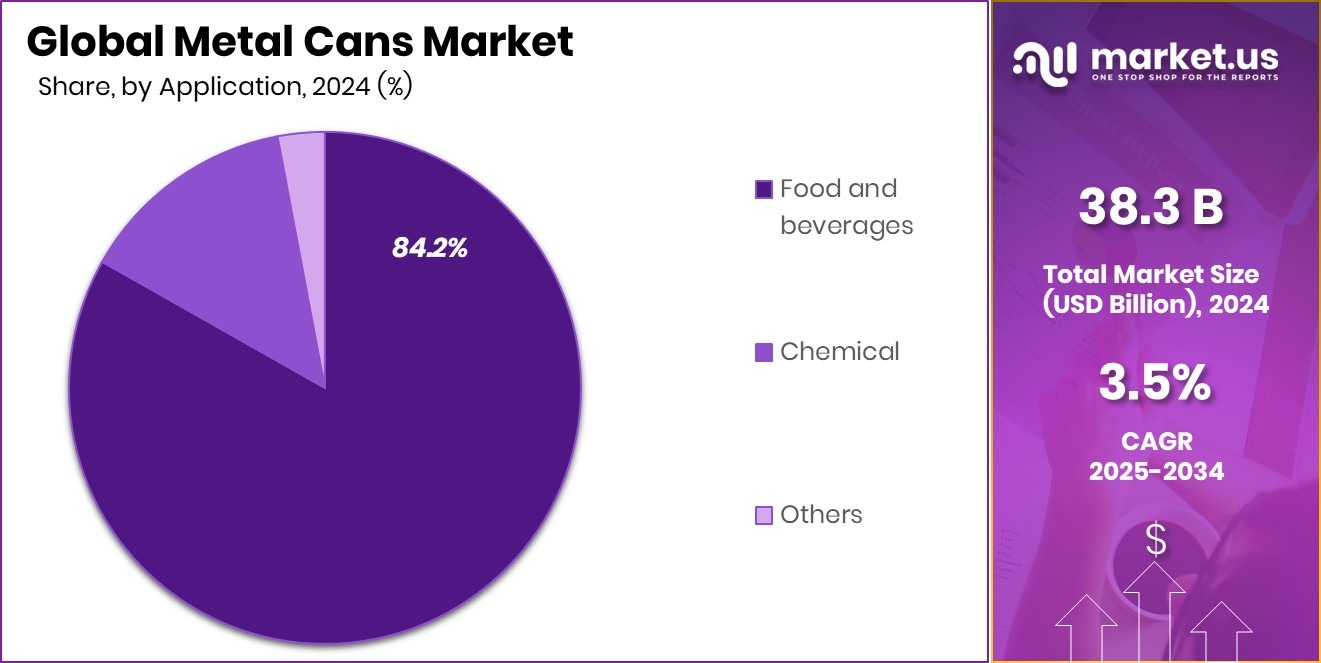

- Food and beverages lead applications with 84.2% share, fueled by growing demand for preserved and portable products.

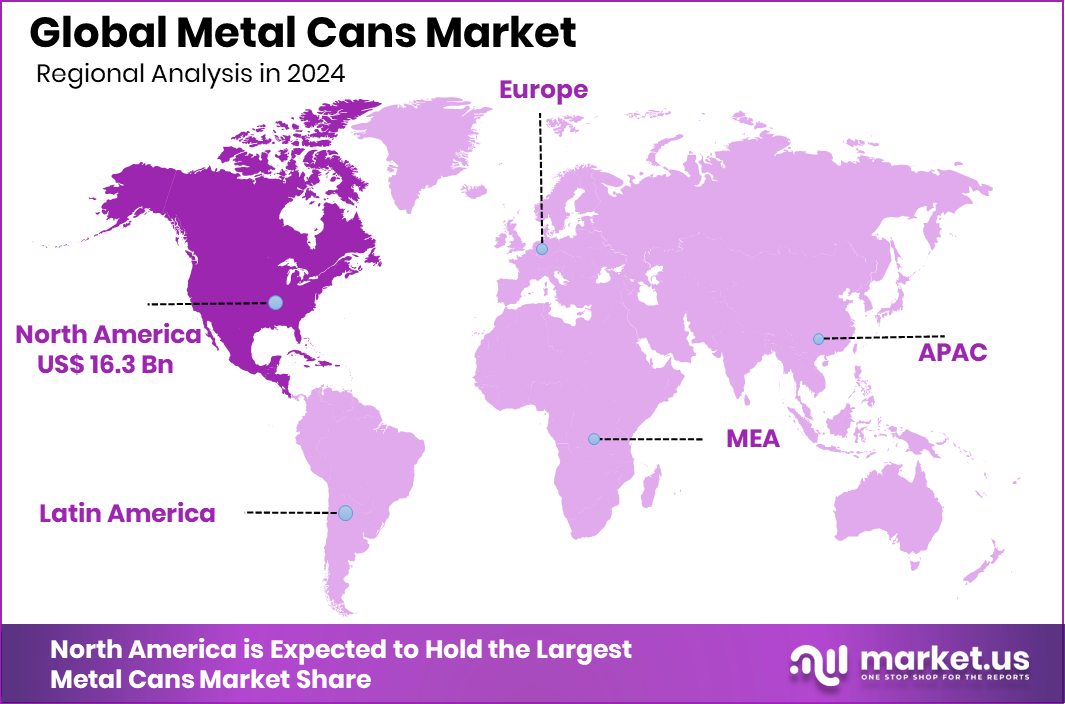

- North America’s metal cans market reached 42.80%, USD 16.3 Bn.

By Material Analysis

Aluminum holds a 72.9% share in the Metal Cans Market.

In 2024, Aluminum held a dominant market position in the By Material segment of the Metal Cans Market, with a 72.9% share. This strong presence is driven by aluminum’s lightweight nature, corrosion resistance, and excellent recyclability, which make it a preferred choice for both food and beverage packaging.

Its ability to preserve product quality by providing an airtight seal has made it indispensable for carbonated drinks, energy beverages, and canned foods, where maintaining taste and freshness is crucial. The high recycling rate of aluminum, often exceeding 65% in many regions, aligns with global sustainability goals, further strengthening its market acceptance.

Aluminum’s versatility also allows for advanced printing and design customization, enabling brands to enhance product appeal and differentiate in competitive retail spaces. The growing shift towards eco-friendly materials, coupled with consumer preference for convenient, portable packaging, continues to favor aluminum over alternatives.

Additionally, advancements in lightweight can manufacturing are helping reduce production costs while maintaining durability, making aluminum cans more cost-effective for large-scale applications. With strong demand from the beverage sector and increasing adoption in premium food products, aluminum is expected to maintain its leadership in the metal cans market, supported by both functional advantages and environmental benefits.

By Product Analysis

Two-piece drawn and ironed design leads Metal Cans Market at 58.1%.

In 2024, 2-Piece Drawn and Ironed held a dominant market position in the By Product segment of the Metal Cans Market, with a 58.1% share. This leadership is largely attributed to its efficient manufacturing process, which produces seamless cans with uniform wall thickness and reduced material usage.

The design enhances structural strength while keeping the cans lightweight, making them ideal for high-volume beverage production. Their smooth, continuous body also allows for high-quality printing and decoration, supporting brand visibility and marketing appeal in competitive retail environments.

The 2-piece drawn and ironed format is particularly favored in the carbonated and energy drink sectors, where pressure resistance and product integrity are critical. The manufacturing process minimizes waste and is compatible with aluminum, enhancing sustainability by facilitating full recyclability without quality loss. Additionally, its cost efficiency in large-scale production has positioned it as a preferred choice for major beverage fillers worldwide.

With growing demand for lightweight, sustainable, and visually appealing packaging, coupled with advancements in high-speed production lines, the 2-piece drawn and ironed segment is expected to sustain its dominance. Its ability to meet both functional requirements and consumer-driven design trends ensures continued growth and market leadership in the coming years.

By Closure Type Analysis

Easy-open end closures dominate 67.6% of the Metal Cans Market.

In 2024, Open End (EOE) held a dominant market position in the By Closure Type segment of the Metal Cans Market, with a 67.6% share. This dominance is supported by the convenience, safety, and ease of use that EOE closures provide, particularly for ready-to-eat food and beverage packaging.

The design allows consumers to open cans without the need for additional tools, catering to the fast-paced lifestyle trends and on-the-go consumption habits that are increasingly prevalent in urban markets. EOE closures also maintain airtight sealing, ensuring product freshness, flavor retention, and extended shelf life.

The popularity of EOE is further driven by its adaptability across various can sizes and its compatibility with both aluminum and steel cans. Its user-friendly nature has made it a preferred choice in sectors such as canned foods, soft drinks, and specialty beverages. Technological improvements in sealing integrity and material efficiency have enhanced the performance of EOE closures while optimizing production costs.

Furthermore, the growing demand for sustainable packaging aligns well with EOE designs, as they can be fully recycled without compromising functionality. With strong consumer acceptance, manufacturing efficiency, and versatility, the EOE segment is set to maintain its leadership in the metal cans market over the forecast period.

By Application Analysis

Food and beverages account for 84.2% of Metal Cans Market.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Metal Cans Market, with an 84.2% share. This overwhelming share is driven by the high consumption of packaged drinks, canned foods, and ready-to-eat meals, which rely heavily on metal cans for preservation, safety, and convenience.

Metal cans provide an airtight seal that protects contents from contamination, light, and oxygen, ensuring extended shelf life without the need for preservatives. This makes them an essential choice for both perishable and non-perishable food products, as well as carbonated and non-carbonated beverages.

The growth of this segment is further supported by changing consumer lifestyles, urbanization, and increasing demand for portable, single-serve, and on-the-go food and drink options. In beverages, metal cans are widely favored for soft drinks, energy drinks, and alcoholic beverages due to their ability to maintain carbonation and product quality.

In the food sector, canned vegetables, fruits, soups, and meats benefit from the durability and stackability of metal cans, making them suitable for global distribution. With rising awareness of recyclability and sustainability, combined with strong demand from both developed and emerging markets, the food and beverages segment is expected to maintain its dominant market presence in the coming years.

Key Market Segments

By Material

- Aluminum

- Tin

- Others

By Product

- 2- Piece Drawn and Ironed

- 2- Piece Draw Redraw (DRD)

- 3- Piece

By Closure Type

- Easy- Open End (EOE)

- Peel- off End (POE)

- Others

By Application

- Food and beverages

- Chemical

- Others

Driving Factors

High Demand for Sustainable and Recyclable Packaging

One of the main driving factors for the metal cans market is the growing demand for sustainable and recyclable packaging. Metal cans, especially those made from aluminum and steel, can be recycled repeatedly without losing quality, making them an eco-friendly choice for manufacturers and consumers. With increasing awareness about plastic pollution and stricter environmental regulations, businesses are shifting toward packaging options that reduce waste and carbon footprint.

Consumers are also more likely to choose products that use recyclable materials, adding to the popularity of metal cans. This trend is further supported by global recycling initiatives, corporate sustainability goals, and the rising preference for packaging that balances durability, safety, and environmental responsibility.

Restraining Factors

Fluctuating Raw Material Prices Impact Production Costs

A key restraining factor for the metal cans market is the fluctuation in raw material prices, particularly aluminum and steel. These metals are the primary components used in can manufacturing, and their prices are influenced by global supply-demand imbalances, mining costs, trade policies, and energy prices. Sudden increases in raw material costs can significantly raise production expenses, putting pressure on manufacturers’ profit margins.

This can also lead to higher prices for end products, which may affect demand in price-sensitive markets. Additionally, unpredictable price trends make it challenging for producers to plan long-term investments and production schedules, forcing them to adopt cost-control measures or explore alternative materials, which can slow market growth.

Growth Opportunity

Rising Demand for Ready-to-Drink Beverages Worldwide

A major growth opportunity for the metal cans market lies in the rising global demand for ready-to-drink (RTD) beverages. Consumers are increasingly opting for convenient, portable, and long-lasting packaging options for soft drinks, energy drinks, iced teas, coffees, and alcoholic beverages. Metal cans are ideal for these products as they preserve taste, maintain carbonation, and offer durability during transport.

The growing popularity of premium and craft beverages also boosts the need for high-quality can designs and customization. In addition, RTD beverages are gaining traction in emerging markets due to urbanization, busy lifestyles, and expanding retail distribution. This shift presents significant opportunities for metal can manufacturers to increase production capacity and innovate with eco-friendly designs to capture a larger market share.

Latest Trends

Increasing Use of Lightweight and Eco-Friendly Cans

One of the latest trends in the metal cans market is the growing use of lightweight and eco-friendly can designs. Manufacturers are focusing on reducing the weight of aluminum and steel cans without compromising strength or durability. This not only lowers material and transportation costs but also reduces the carbon footprint, aligning with global sustainability goals.

Advances in manufacturing technology now allow thinner walls and improved shapes that still maintain product safety and freshness. At the same time, brands are adopting environmentally friendly coatings and inks to make cans fully recyclable. This trend is driven by rising environmental awareness, stricter regulations, and consumer preference for packaging that combines convenience, visual appeal, and minimal environmental impact.

Regional Analysis

In 2024, North America held 42.80%, USD 16.3 Bn.

In 2024, North America emerged as the leading region in the global Metal Cans Market, accounting for 42.80% of the market share, valued at USD 16.3 billion. The region’s dominance is driven by high consumption of packaged beverages, canned foods, and ready-to-drink products, supported by advanced manufacturing infrastructure and strong recycling systems for aluminum and steel.

Consumer preference for sustainable and convenient packaging solutions has further accelerated market growth, with stringent environmental regulations encouraging the use of recyclable materials. Europe follows closely, benefiting from robust environmental policies and increasing demand for eco-friendly packaging, particularly in beverages and processed foods.

The Asia Pacific market is witnessing rapid growth due to urbanization, rising disposable incomes, and expanding retail networks. Meanwhile, the Middle East & Africa and Latin America are gradually adopting metal cans, driven by population growth, changing consumption patterns, and improvements in packaging industries.

Across all regions, sustainability goals, technological innovations in lightweight can production, and increasing demand for long-shelf-life products are shaping market dynamics. However, North America’s combination of strong consumer demand, recycling infrastructure, and brand adoption of premium packaging designs ensures it remains the most influential market for metal cans globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sonoco Products Company continues to focus on sustainable and innovative packaging solutions, leveraging its expertise to enhance recyclability and lightweight designs in metal cans, catering to both food and beverage sectors.

Toyo Seikan Co., Ltd., with its strong manufacturing base in Asia, is expanding its product portfolio through advanced can-forming technologies and aesthetically appealing designs, meeting diverse consumer demands while improving production efficiency.

Ball Corporation remains a global leader in aluminum can manufacturing, prioritizing lightweight, eco-friendly, and customizable packaging to meet growing sustainability targets set by brands and regulators. The company’s emphasis on increasing production capacity in high-demand regions positions it strongly in the beverage packaging segment.

Crown, known for its wide range of metal packaging solutions, continues to strengthen its market presence through technological innovation in can shaping and printing, offering premium branding opportunities to beverage and food manufacturers.

Top Key Players in the Market

- Sonoco Products Company

- Toyo Seikan Co., Ltd.

- Ball Corporation

- Crown

- CANPACK

- Ardagh Group S.A.

- Hindustan Tin Works Ltd

- Trivium Packaging

- Silgan Containers

- Ohio Art Metal Pack, LLC

- Mauser Packaging Solutions

Recent Developments

- In August 2024, Toyo Seikan rolled out the 190 ml “202 SOT” aluminum can, weighing only 6.1 g, making it the lightest beverage can in the world. Produced with CBR technology, it was chosen by Coca-Cola Japan for its Georgia coffee range. The design reduces material use and cuts greenhouse gas emissions by around 8% per can, earning the Appropriate Packaging Award in the Packaging Technology category at the 2024 Japan Packaging Contest.

- In June 2024, Sonoco signed an agreement to acquire Eviosys, Europe’s top producer of metal food and aerosol cans, for $3.9 billion (€3.6 billion). The move aimed to position Sonoco as the global leader in metal food and aerosol packaging. Under the deal, Eviosys CEO Tomas Lopez would continue heading the EMEA metal packaging division post-integration. The transaction was planned to close by the end of 2024, subject to regulatory and works council approvals.

Report Scope

Report Features Description Market Value (2024) USD 38.3 Billion Forecast Revenue (2034) USD 54.0 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Aluminum, Tin, Others), By Product (2- Piece Drawn and Ironed, 2- Piece Draw Redraw (DRD), 3- Piece), By Closure Type (Easy- Open End (EOE), Peel- off End (POE), Others), By Application (Food and beverages, Chemical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sonoco Products Company, Toyo Seikan Co., Ltd., Ball Corporation, Crown, CANPACK, Ardagh Group S.A., Hindustan Tin Works Ltd, Trivium Packaging, Silgan Containers, Ohio Art Metal Pack, LLC, Mauser Packaging Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sonoco Products Company

- Toyo Seikan Co., Ltd.

- Ball Corporation

- Crown

- CANPACK

- Ardagh Group S.A.

- Hindustan Tin Works Ltd

- Trivium Packaging

- Silgan Containers

- Ohio Art Metal Pack, LLC

- Mauser Packaging Solutions