Global Marine Gensets Market, Size, Share, Growth Analysis By Fuel (MDO, MGO, LNG, Hybrid, Others), By Power Rating (Up to 1 MW, 1 MW - 5 MW, 5 MW - 10 MW, 10 MW - 20 MW, > 20 MW), By Application (Merchant, Offshore, Cruise and Ferry, Navy, Others) – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157050

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

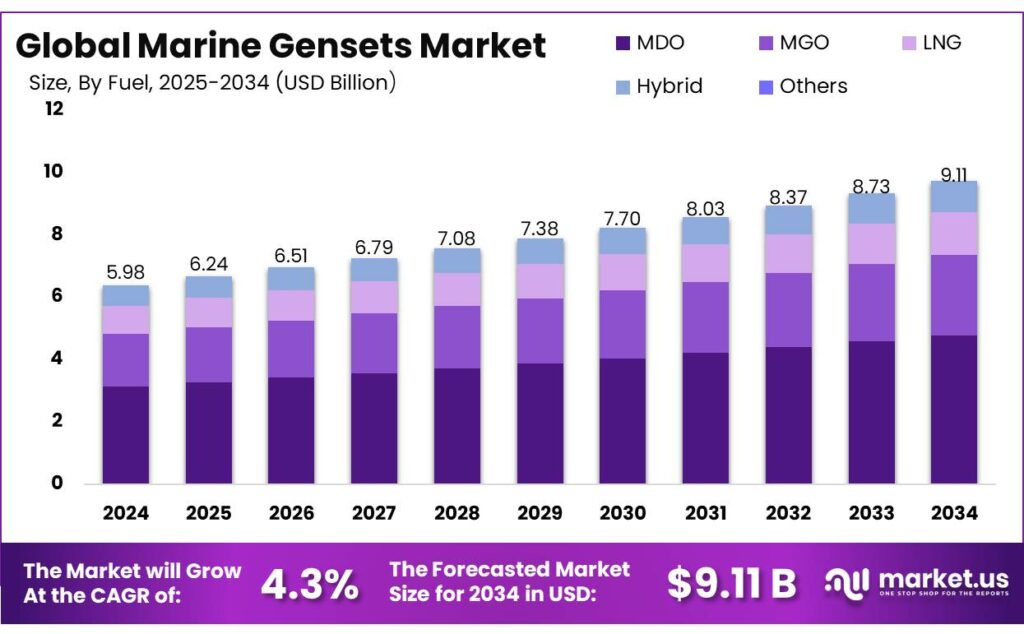

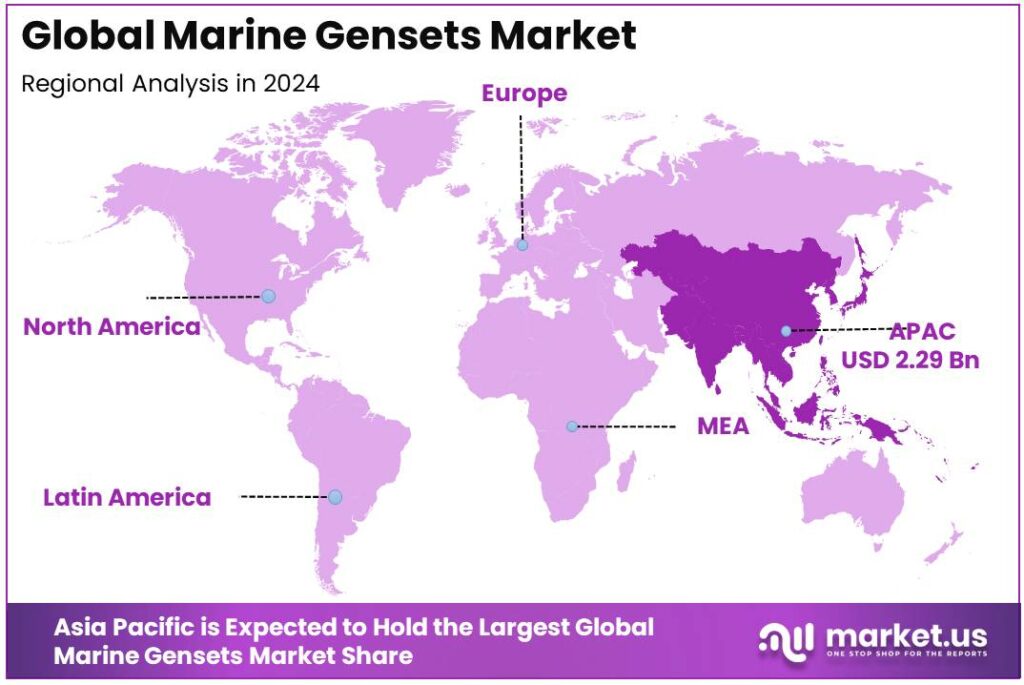

The Global Marine Gensets Market size is expected to be worth around USD 9.11 billion by 2034, from USD 5.98 billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034. Asia Pacific held a dominant market position, capturing more than a 38.4% share, holding USD 2.29 billion in revenue.

The market for marine gensets is driven by the global expansion of maritime trade, rising demand for onboard power reliability, and stringent environmental regulations. As commercial shipping, offshore operations, and naval activities increase, vessels require efficient and compliant power generation systems. Technological advancements, such as hybrid integration, digital monitoring, and fuel flexibility, further accelerate adoption. Additionally, the push for decarbonization is prompting fleet operators to replace legacy systems with low-emission, high-efficiency gensets, reinforcing sustained investment across new builds and retrofits.

- For instance, in September 2022, Rolls-Royce Power Systems showcased key upgrades in its dual-fuel marine engines and variable-speed generator sets as part of a broader propulsion systems roundup. These enhancements were aimed at boosting fuel efficiency, reducing emissions, and increasing operational flexibility across a range of vessel types.

Key Takeaway

- Marine Gensets Market size is expected to be worth around USD 9.11 billion by 2034, from USD 5.98 billion in 2024, growing at a CAGR of 4.3%.

- In 2024, the MDO segment held a dominant market position, capturing a 52.4% share of the Global Marine Gensets Market.

- In 2024, the 1 MW – 5 MW segment held a dominant market position, capturing a 36.2% share of the Global Marine Gensets Market.

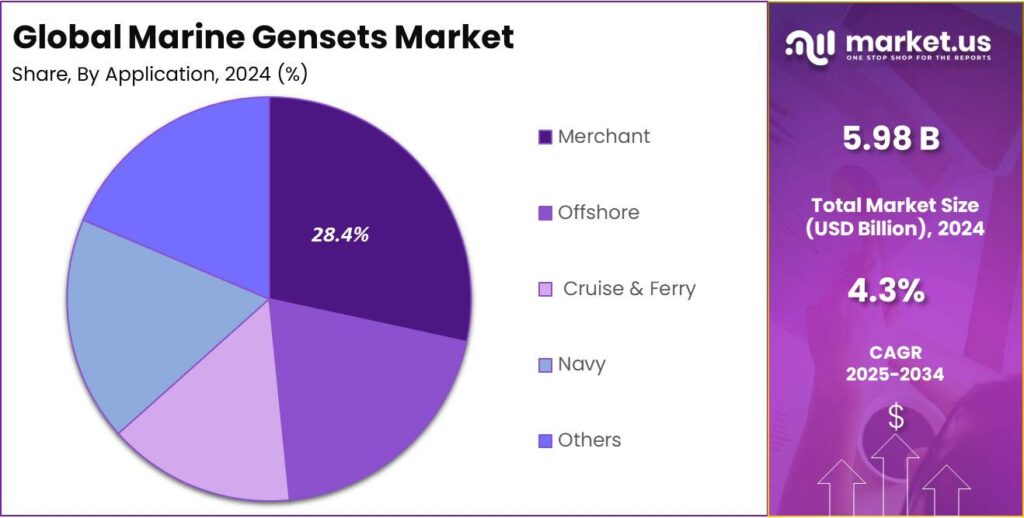

- In 2024, the Merchant segment held a dominant market position, capturing a 28.4% share of the Global Marine Gensets Market.

- The China Marine Gensets Market was valued at USD 0.91 Billion in 2024, with a robust CAGR of 8%.

- In 2024, North America held a dominant market position in the Global Marine Gensets Market, capturing more than a 38.4% share.

China Marine Gensets Market Size

The market for Marine Gensets within China is growing tremendously and is currently valued at USD 0.91 billion. The market is growing tremendously due to the country’s rapid expansion in shipbuilding, port infrastructure, and coastal logistics. As China strengthens its position as a global maritime hub, demand for high-efficiency, low-emission gensets is accelerating across both commercial and naval fleets.

Government-backed green shipping initiatives, stricter emissions regulations, and rising exports of domestically built vessels further support this growth. Additionally, advancements in hybrid and LNG-ready genset technologies are aligning with China’s decarbonization and modernization goals.

For instance, in August 2025, MTU Yuchai Power, a joint venture between Germany’s Rolls-Royce Power Systems and China’s Yuchai Group, launched production of new MTU Series 2000 high-horsepower engines in China. This move reinforces China’s strategic role as a global manufacturing hub for advanced marine propulsion systems.

Fuel Analysis

In 2024, The MDO segment held a dominant market position, capturing a 52.4% share of the Global Marine Gensets Market. This dominance is due to MDO’s widespread availability, cost-efficiency, and compatibility with existing genset technologies. It remains the preferred fuel for a broad range of commercial vessels, offering a balance between performance and regulatory compliance. Additionally, many shipowners continue to rely on MDO as a transitional fuel while gradually integrating alternative energy sources into their fleets.

For Instance, in February 2024, a German operator selected MAN Energy Solutions’ methanol-ready engines for a new series of tankers, highlighting a transitional approach where conventional Marine Diesel Oil (MDO) systems remain in use alongside emerging dual-fuel capabilities. This reflects the market’s continued reliance on MDO for baseline operations, even as shipowners prepare for low-emission alternatives.

Power Rating Analysis

In 2024, the 1 MW – 5 MW segment held a dominant market position, capturing a 36.2% share of the Global Marine Gensets Market. This demand is due to its suitability for mid-sized commercial vessels, including cargo ships, ferries, offshore supply vessels, and tankers. These gensets offer an optimal balance of power output, fuel efficiency, and space utilization. Additionally, the growing trend toward hybrid propulsion and modular genset configurations further supports demand in this power range.

- For instance, in July 2021, Rolls-Royce delivered a 2.5 MW generator designed for hybrid-electric propulsion systems in aviation, demonstrating the company’s capability to scale high-output, compact power solutions. While intended for aerospace, this technology signals a broader trend toward high-efficiency, lightweight gensets in marine applications.

Application Analysis

In 2024, The Merchant segment held a dominant market position, capturing a 28.4% share of the Global Marine Gensets Market. This dominance is due to the vast number of commercial vessels, such as container ships, bulk carriers, and tankers, that rely heavily on gensets for propulsion support and auxiliary power. The segment’s scale, combined with increasing international trade volumes and regulatory demands for energy-efficient systems, continues to drive sustained investment in reliable, high-capacity marine gensets tailored for long-haul operations and global fleet modernization.

For Instance, in November 2022, ABB secured a contract to supply shaft generator systems for ten COSCO Shipping container vessels, enhancing onboard energy efficiency and operational sustainability. These systems enable vessels to generate power directly from the propulsion shaft, reducing dependency on auxiliary gensets during sailing.

Key Market Segments

By Fuel

- MDO

- MGO

- LNG

- Hybrid

- Others

By Power Rating

- Up to 1 MW

- 1 MW – 5 MW

- 5 MW – 10 MW

- 10 MW – 20 MW

- 20 MW

By Application

- Merchant

- Container Vessels

- Bulk Carriers

- RO-RO

- Others

- Offshore

- Drilling RIGS & Ships

- Anchor Handling Vessels

- Offshore Support Vessels

- Floating Production Units

- Platform Supply Vessels

- Cruise & Ferry

- Cruise Vessels

- Passenger Vessels

- Passenger/Cargo Vessels

- Others

- Navy

- Others

Drivers

Global Maritime Trade Expansion

The growth of global maritime trade is significantly boosting demand for reliable marine gensets. As international shipping volumes increase, vessels require more robust onboard power solutions to support navigation, cargo handling, and auxiliary systems. This trend is especially prominent in container shipping, bulk carriers, and oil tankers. As shipping routes expand and vessel sizes increase, power reliability becomes critical, positioning marine gensets as indispensable assets for maintaining operational efficiency and ensuring safety in long-haul maritime transport.

For instance, in March 2025, Arab News reported on Saudi Arabia’s strategic push to enhance its maritime logistics capabilities, including expanded port infrastructure and increased container throughput. This initiative is part of a broader regional effort to position the Middle East as a critical hub for global trade.

Restraint

Fuel Availability and Price Volatility

Marine genset operators remain heavily reliant on conventional fuels such as diesel, exposing them to frequent price fluctuations and regional supply inconsistencies. Volatility in global energy markets, exacerbated by geopolitical tensions and supply chain disruptions, raises operating costs and undermines long-term fuel planning. Furthermore, diesel dependency presents logistical risks during port blackouts or long voyages, highlighting the vulnerability of existing power architectures. These dynamics constrain profitability and deter investment in traditional genset systems, particularly for cost-sensitive operators.

For instance, in June 2025, the Iran–Israel conflict triggered a surge in crude oil prices and raised concerns over the security of key maritime shipping lanes, as reported by Moneycontrol. This volatility has intensified operational uncertainty for ship operators and marine genset users reliant on diesel and other fossil fuels.

Opportunities

Shift Toward Hybrid, LNG, & Alternative Fuels

The marine gensets market is evolving rapidly with the growing adoption of hybrid systems and alternative fuels like LNG, CNG, and methanol. Environmental mandates and decarbonization goals are driving shipowners to integrate battery-assisted gensets and low-emission fuel technologies. These solutions offer enhanced fuel efficiency, lower emissions, and regulatory compliance, while enabling modular upgrades across newbuilds and retrofits. Vendors innovating in flexible, dual-fuel, and hybrid-ready gensets are well-positioned to capture long-term value in a market focused on sustainable marine power.

For instance, in December 2024, X-Press Feeders emphasized in an interview the growing momentum behind hybrid fuel systems and the circular economy as key enablers of sustainable shipping. The integration of LNG, battery storage, and biofuels is accelerating, driven by regulatory mandates and cost-efficiency goals.

Challenges

Intensifying Competitive Landscape

The marine gensets market is witnessing heightened competition as established OEMs and agile new entrants vie for technological supremacy. Legacy players like Caterpillar, Wärtsilä, and MAN Energy Solutions are leveraging scale and global presence, while emerging firms target niche innovations in hybridization, fuel flexibility, and digital monitoring. Price competitiveness, regulatory alignment, and rapid innovation cycles are reshaping industry dynamics. To maintain market relevance, players must invest in R&D, form strategic alliances, and tailor offerings to regional and segment-specific demands.

For instance, in July 2025, Power Equipment secured exclusive distribution rights for the Eniquest marine generator range, strengthening its market position in Australia and New Zealand. This move highlights how established players are enhancing product portfolios through exclusive alignments, responding to rising demand for technologically advanced, locally supported gensets.

Latest Trends

The marine gensets market is experiencing a surge in innovation, driven by advancements in power electronics, automation, and smart load management. Modern gensets now feature integrated remote monitoring and predictive maintenance capabilities, enhancing operational reliability and reducing downtime. Modular, retrofit-ready designs are gaining prominence, enabling easier upgrades for existing fleets and reducing installation complexity. These technologies improve energy efficiency and also align with evolving environmental regulations, positioning innovation as a core differentiator in an increasingly competitive landscape.

For instance, in November 2024, the German Aerospace Center (DLR) unveiled the NAUTILUS genset demonstrator, a low-emission maritime power system integrating fuel cells and hydrogen technologies. This innovation exemplifies the industry’s pivot toward clean, modular, and retrofit-ready genset solutions.

Region Insight

In 2024, Asia Pacific held a dominant market position in the Global Marine Gensets Market, capturing more than a 38.4% share, holding USD 2.29 billion in revenue. This dominance is due to its robust shipbuilding industry, expanding maritime trade routes, and increasing naval investments, particularly in countries like China, South Korea, and Japan. The region’s focus on port modernization, offshore energy projects, and coastal infrastructure further fueled genset demand. Government initiatives promoting low-emission technologies and growing demand for hybrid and LNG-powered vessels further boosted the adoption.

For instance, in April 2024, a new Singapore-based bunker vessel selected the MAN 21/31DF-M dual-fuel genset, reinforcing the Asia Pacific region’s continued leadership in adopting advanced marine power technologies. This decision reflects the region’s commitment to decarbonization, operational efficiency, and compliance with IMO emissions standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

One of the leading players in May 2025, ABB announced the acquisition of BrightLoop, a specialist in high-efficiency power converters and energy management technologies, to strengthen its portfolio in off-highway vehicle and marine electrification. This move supports ABB’s long-term strategy to lead in hybrid and electric marine power systems.

Top Key Players in the Market

- ABB

- GlobalTec Solutions

- Mitsubishi Heavy Industries

- Volvo Penta

- Nidec Industrial Solutions

- Deere & Company

- MAN Energy Solutions

- Rolls-Royce

- Anglo Belgian Corporation

- Kirloskar

- Cummins

- Caterpillar

- Fischer Panda

- Parikh Power

- Northern Lights

- Mase Generators of North America

- Scania

- Sole Diesel

- Kohler

- Other Major Players

Recent Developments

- In October 2024, Enata Marine was appointed as the official distributor of Nanni gensets and engines in the Middle East. This strategic partnership aims to expand Nanni’s regional footprint by leveraging Enata’s local market expertise and distribution network.

- In September 2022, Volvo Penta introduced a new line of marine generator sets tailored for commercial marine applications. These gensets were designed to deliver enhanced fuel efficiency, lower emissions, and operational reliability under varying marine load profiles.

Report Scope

Report Features Description Market Value (2024) USD 5.98 Bn Forecast Revenue (2034) USD 9.11 Bn CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Fuel (MDO, MGO, LNG, Hybrid, Others), By Power Rating (Up to 1 MW, 1 MW – 5 MW, 5 MW – 10 MW, 10 MW – 20 MW, > 20 MW), By Application (Merchant, Offshore, Cruise and Ferry, Navy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, GlobalTec Solutions, Mitsubishi Heavy Industries, Volvo Penta, Nidec Industrial Solutions, Deere & Company, MAN Energy Solutions, Rolls-Royce, Anglo Belgian Corporation, Kirloskar, Cummins, Caterpillar, Fischer Panda, Parikh Power, Northern Lights, Mase Generators of North America, Scania, Sole Diesel, Kohler, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- GlobalTec Solutions

- Mitsubishi Heavy Industries

- Volvo Penta

- Nidec Industrial Solutions

- Deere & Company

- MAN Energy Solutions

- Rolls-Royce

- Anglo Belgian Corporation

- Kirloskar

- Cummins

- Caterpillar

- Fischer Panda

- Parikh Power

- Northern Lights

- Mase Generators of North America

- Scania

- Sole Diesel

- Kohler

- Other Major Players