Global Luxury Yacht Market Size, Share, Growth Analysis By Type (Motorized Luxury Yacht, Sailing Luxury Yacht, Others), By Size (100 Meters, 100-150 Meters, Above 150 Meters), By Hull Material (Fiber Reinforced Polymers And Composites, Metals And Alloys, Other Hull Materials), By Application (Private, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148577

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

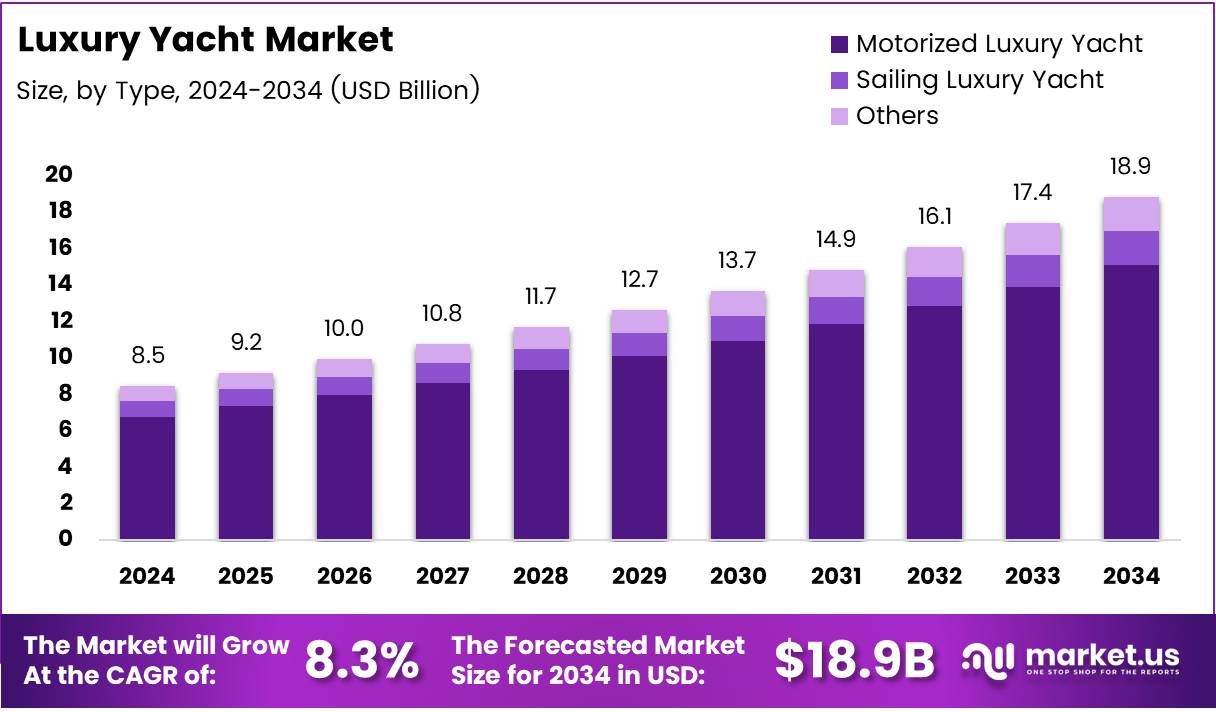

The Global Luxury Yacht Market size is expected to be worth around USD 18.9 Billion by 2034, from USD 8.5 Billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034.

The luxury yacht market refers to the industry involved in designing, manufacturing, selling, and chartering high-end yachts, typically exceeding 30 meters in length. These vessels symbolize exclusivity, comfort, and status, catering to affluent individuals seeking leisure and personalized travel experiences on water. The market encompasses both private ownership and charter services.

Luxury yachts themselves are not just boats but floating estates equipped with premium amenities, advanced technology, and bespoke designs. This segment continuously evolves with innovations in sustainability and smart features, appealing to wealthy buyers looking for customization and comfort. Growth in this market is driven by rising disposable incomes and increasing demand for exclusive leisure experiences globally.

Significant growth opportunities exist, particularly in emerging markets where new wealth is expanding rapidly. Additionally, yacht charter businesses benefit from strong profit margins, with PeekPro reporting healthy margins of approximately 20-30%. This profitability attracts investors and entrepreneurs seeking entry into luxury tourism and recreational services, expanding the market’s reach.

Government investment and regulatory frameworks play a critical role in shaping the luxury yacht market. Coastal infrastructure improvements, such as marinas and ports, enable better access for superyachts. At the same time, regulations focusing on environmental standards and safety are becoming stricter, encouraging manufacturers to innovate in eco-friendly designs while maintaining luxury standards.

According to Super Yacht Times, there are around 5,396 superyachts over 98 feet (30 meters) active worldwide, highlighting the scale and global nature of this market. This active fleet size underscores strong demand and continuous interest from ultra-high-net-worth individuals (UHNWIs) who drive luxury yacht sales and charter activities.

Moreover, industry insights reveal that the average annual revenue for a yacht charter business owner ranges impressively from $300,000 to over $1 million, reflecting lucrative returns for stakeholders. This financial success further incentivizes market growth and diversification, encouraging new entrants and expansion into niche segments.

The luxury yacht market also benefits from strategic partnerships and collaborations across the maritime, tourism, and hospitality sectors. These alliances help expand service offerings, enhance customer experiences, and drive innovation, which collectively fuel market development and resilience.

Key Takeaways

- The Global Luxury Yacht Market is projected to reach US$18.9 billion by 2034, growing from US$8.5 billion in 2024 at a CAGR of 8.3% between 2025 and 2034.

- In 2024, Motorized Luxury Yachts dominated the market by type with an 83.4% share, driven by demand for high-performance and advanced technology.

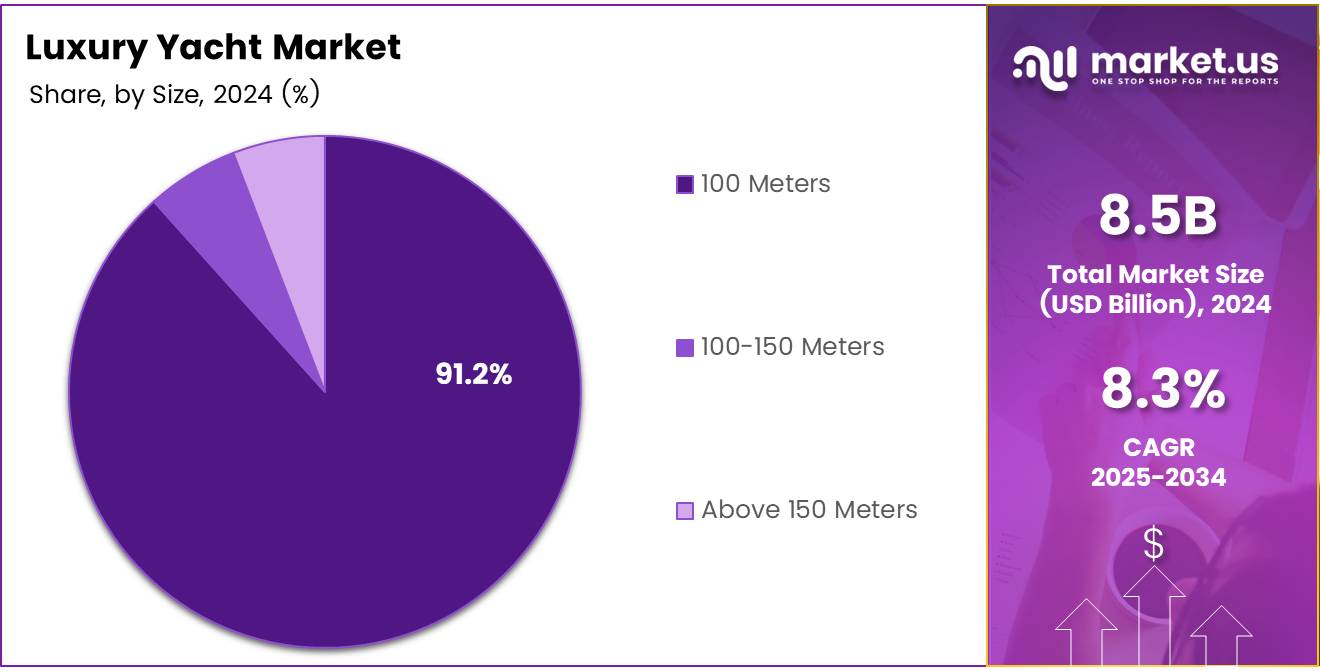

- Yachts sized 100 meters held a dominant 91.2% share in 2024, favored for balancing luxury and manageability.

- Fiber Reinforced Polymers and Composites led hull material preference in 2024 with a 62.8% share due to strength, corrosion resistance, and design flexibility.

- The Private application segment accounted for 76.4% in 2024, reflecting strong demand for exclusive, personalized leisure use.

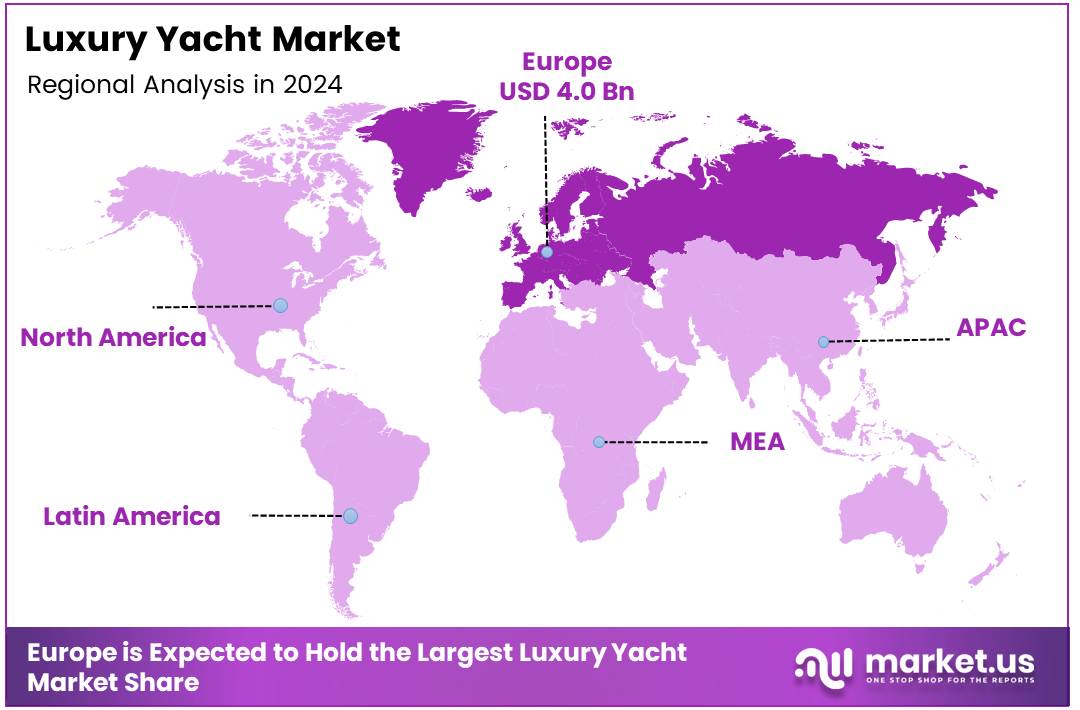

- Europe leads geographically with a 47.6% market share, valued around US$4.0 billion, supported by maritime heritage and luxury tourism investments.

Type Analysis

Motorized Luxury Yacht dominates with a commanding 83.4% share, reflecting its strong preference among consumers in 2024.

In 2024, Motorized Luxury Yacht held a dominant market position in the By Type Analysis segment of the Luxury Yacht Market, capturing a substantial 83.4% share. This dominance is largely driven by the increasing demand for high-performance, technologically advanced yachts that offer superior speed, comfort, and luxury amenities. Motorized yachts provide an ideal combination of power and sophistication, making them highly favored among affluent buyers seeking both leisure and status.

Sailing Luxury Yacht and Others hold smaller shares of the market, with consumers appreciating sailing yachts for their classic appeal and eco-friendly operation. However, the relatively lower market penetration indicates that traditional sailing options are less preferred in comparison to the motorized segment, especially among luxury clientele focused on convenience and modern features.

The Others category remains niche, catering to unique or custom-built vessels that do not fall into the primary categories but appeal to specific customer preferences. Overall, the clear dominance of Motorized Luxury Yachts highlights a market trend toward advanced, motor-driven luxury vessels that combine performance with comfort.

Size Analysis

100 Meters dominates with a substantial 91.2% share, underscoring its popularity in the luxury yacht segment in 2024.

In 2024, 100 Meters held a dominant market position in the By Size Analysis segment of the Luxury Yacht Market, commanding an impressive 91.2% share. This overwhelming preference suggests that yachts of this size hit a sweet spot for luxury consumers who seek grandeur and extensive onboard facilities without venturing into the complexities and costs associated with larger vessels.

Yachts in the 100-150 Meters range and Above 150 Meters categories capture smaller portions of the market, reflecting the niche nature of ultra-large yachts. These larger yachts often require specialized crews, higher maintenance, and substantial operational budgets, limiting their appeal to only the ultra-wealthiest buyers or commercial operators.

The dominance of the 100 Meters segment reveals market trends favoring manageable yet lavish yachts that balance luxury with relative ease of ownership and operation. This size category’s popularity is driven by its ability to accommodate expansive amenities while maintaining practical navigation and docking capabilities.

Hull Material Analysis

Fiber Reinforced Polymers And Composites lead with a commanding 62.8% share due to their advanced material properties and benefits.

In 2024, Fiber Reinforced Polymers And Composites held a dominant market position in the By Hull Material Analysis segment of the Luxury Yacht Market, with a notable 62.8% share. The preference for these materials stems from their exceptional strength-to-weight ratio, corrosion resistance, and flexibility in design, which make them ideal for luxury yachts where performance and aesthetics are critical.

Metals And Alloys and Other Hull Materials maintain smaller shares, as traditional metal hulls often entail heavier weight and higher maintenance costs, making them less attractive for luxury segments focused on innovation and ease of use. Other materials are typically reserved for specialized or custom applications.

The increasing use of fiber reinforced polymers reflects broader industry trends toward lightweight, durable, and customizable construction materials that enhance fuel efficiency and speed without compromising structural integrity or luxury design features.

Application Analysis

Private yachts dominate the market with a substantial 76.4% share, highlighting the preference for personal luxury use in 2024.

In 2024, Private held a dominant market position in the By Application Analysis segment of the Luxury Yacht Market, securing a commanding 76.4% share. This dominance reflects a strong consumer trend toward using luxury yachts primarily for personal recreation and leisure. Private ownership allows for exclusive use, customization, and privacy, which are highly valued by high-net-worth individuals.

Commercial applications, while important, capture a smaller segment of the market, often comprising charter services, event hosting, or luxury hospitality ventures. These uses typically require different operational models and regulatory compliance, making them less prevalent than private ownership in the luxury context.

The significant lead of the private segment underscores how luxury yachts remain status symbols and lifestyle assets, with buyers investing heavily in personalized features and amenities that cater exclusively to their preferences and comfort.

Key Market Segments

By Type

- Motorized Luxury Yacht

- Sailing Luxury Yacht

- Others

By Size

- 100 Meters

- 100-150 Meters

- Above 150 Meters

By Hull Material

- Fiber Reinforced Polymers And Composites

- Metals And Alloys

- Other Hull Materials

By Application

- Private

- Commercial

Drivers

Rising Ultra-High-Net-Worth Individual Population Drives Luxury Yacht Market Growth

The luxury yacht market is growing largely due to the increase in ultra-high-net-worth individuals (UHNWIs) worldwide. As more people accumulate significant wealth, their disposable income rises, allowing them to spend on luxury goods like yachts. This trend supports steady demand in the market.

At the same time, yacht manufacturers are improving their technologies, especially by adopting eco-friendly and hybrid propulsion systems. These advancements make yachts more environmentally responsible and efficient, attracting buyers who value sustainability alongside luxury.

There is also a growing preference for customized yachts equipped with smart features. Buyers want yachts that offer advanced connectivity, entertainment, and convenience, making their experience more personalized and enjoyable.

Furthermore, the expansion of luxury tourism and yacht charter services in emerging markets is boosting demand. New regions are opening up for luxury travel, and more people are opting to charter yachts for vacations, which stimulates market growth by increasing the overall interest in luxury yachting.

Restraints

High Initial Investment and Maintenance Costs Limit Luxury Yacht Market Growth

One of the main challenges for the luxury yacht market is the high cost involved. Buying a yacht requires a large initial investment, which not everyone can afford. Besides the purchase price, maintaining a yacht also involves significant ongoing expenses.

Strict environmental regulations present another hurdle. These rules affect how yachts are designed and operated, often increasing costs and complexity for manufacturers and owners.

Seasonal demand fluctuations also impact the market. In many key regions, yacht use depends heavily on weather conditions, causing periods of low activity that affect revenues for manufacturers and service providers.

Additionally, there is a shortage of skilled workers who can build and maintain luxury yachts. This limited availability of expertise slows down production and raises operational costs, posing a challenge for the market’s consistent growth.

Growth Factors

Integration of AI and Automation Offers Growth Opportunities in Luxury Yacht Market

The luxury yacht market has promising growth opportunities thanks to the integration of AI and automation. These technologies enhance safety and navigation, making yachts easier and safer to operate, which appeals to buyers looking for advanced technology.

Another key opportunity lies in developing sustainable yachts. Using recycled and biodegradable materials in yacht construction helps reduce environmental impact, aligning with the increasing global focus on sustainability.

Yacht sharing and fractional ownership models are gaining popularity as well. These options allow more people to enjoy luxury yachting without the full cost and responsibility of ownership, broadening the customer base.

Moreover, expanding yacht infrastructure such as marinas and repair facilities in untapped markets is creating new avenues for growth. Improved infrastructure supports yacht usage and maintenance, encouraging more investments in luxury yachts.

Emerging Trends

Rising Adoption of Electric and Solar-Powered Yachts Drives Market Trends

One of the key trends shaping the luxury yacht market is the increasing adoption of electric and solar-powered yachts. These environmentally friendly options reduce fuel consumption and emissions, which attracts eco-conscious buyers.

Wellness and spa facilities onboard yachts are also becoming popular. Owners and charterers seek relaxation and health-focused amenities, making these features important selling points.

Social media and celebrity endorsements play a growing role in influencing yacht purchases. Visibility on these platforms helps create desire and prestige around owning luxury yachts.

Finally, there is an increasing demand for multifunctional yachts that combine leisure and business uses. Buyers want versatile yachts that support entertainment as well as work-related activities, reflecting changing lifestyles and work habits.

Regional Analysis

Europe Dominates the Luxury Yacht Market with a Market Share of 47.6%, Valued at USD 4.0 Billion

Europe leads the luxury yacht market, accounting for a commanding 47.6% share, valued at approximately USD 4.0 billion. This dominance is driven by its rich maritime heritage, well-established infrastructure, and a high concentration of affluent consumers. Popular yachting destinations across the Mediterranean and strong investments in luxury tourism continue to fuel demand.

Regional Mentions:

North America holds a significant portion of the market, driven by a wealthy population and a robust culture of recreational boating. The region benefits from advanced yacht manufacturing and an extensive network of marinas and yacht clubs, supporting a luxury yacht market valued in the multi-billion-dollar range.

The Asia Pacific region is rapidly expanding in the luxury yacht segment, with growth supported by rising disposable incomes, coastal infrastructure development, and increased interest in luxury lifestyles. Countries like China and Southeast Asia are driving a surge in demand, contributing substantially to the global market value.

In the Middle East & Africa, the luxury yacht market thrives on the presence of high net worth individuals and favorable weather conditions that support year-round yachting. Significant investments in luxury marinas and waterfront developments position this region as an emerging contributor to the global market’s value.

Latin America offers emerging prospects for luxury yachts, with gradual economic improvements and a growing affluent class. Coastal tourism and new marina projects are expected to bolster the market value, contributing to steady future growth within the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global luxury yacht market continues to be shaped by a handful of dominant players who set high standards in craftsmanship, innovation, and bespoke design. Horizon Yacht USA remains a frontrunner with its strong focus on integrating cutting-edge technology and sustainable practices into its yachts, appealing to an environmentally conscious luxury clientele. Their commitment to customizability ensures they stay relevant in a competitive market.

Feadship Holland B.V. upholds its reputation as a pioneer in superyacht construction, known for its meticulous attention to detail and exceptional quality. Their bespoke vessels combine traditional Dutch craftsmanship with innovative design, catering to ultra-high-net-worth individuals seeking exclusivity and superior performance.

Italy’s Palumbo Group S.P.A leverages its extensive shipbuilding heritage to offer a diversified portfolio that includes both custom superyachts and refitting services. Their strategic investments in expanding shipyard capabilities have enhanced their global footprint, particularly in the Mediterranean luxury market.

Azimut – Benetti S.P.A., another Italian powerhouse, continues to lead through its wide range of luxury yachts, blending elegance with state-of-the-art technology. Their ability to produce yachts at various sizes and price points positions them strongly to capture both emerging and established luxury segments worldwide. Together, these key players define the trends and growth trajectory of the luxury yacht market in 2024.

Top Key Players in the Market

- Horizon Yacht USA

- Feadship Holland B.V.

- Palumbo Group S.P.A

- Azimut – Benetti S.P.A.

- Damen Shipyards Group N.V.

- Brunswick Corporation

- Sanlorenzo S.p.A.

- Heesen Yachts Sales B.V.

- Alexander Marine International

- Princess Yachts Limited

- Sunseeker International (Wanda Group)

- Christensen Shipyards LLC

- Fincantieri S.p.A. (CDP Industria S.p.A.)

Recent Developments

- In April 2025, Dutch entrepreneur and investor Laurens Last completed the full acquisition of Heesen Yachts. This strategic move aims to secure the yacht builder’s future while strengthening its dedication to innovation, craftsmanship, and producing exceptional luxury yachts.

- In November 2024, Russian businessman Medvedev purchased a British-made luxury yacht valued at US$4.4 million, highlighting ongoing demand for high-end vessels among global elite buyers.

- In April 2025, British yacht manufacturer Fairline Yachts was acquired by Bronzewood Capital. This followed the company’s search for a new buyer earlier in February 2025, aiming to boost growth and stability under new ownership.

- In November 2024, Sunseeker Yachts was acquired by a Miami-based investment firm. The acquisition is expected to enhance the brand’s market presence and expand its luxury yacht offerings in the Americas.

Report Scope

Report Features Description Market Value (2024) USD 8.5 Billion Forecast Revenue (2034) USD 18.9 Billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Motorized Luxury Yacht, Sailing Luxury Yacht, Others), By Size (100 Meters, 100-150 Meters, Above 150 Meters), By Hull Material (Fiber Reinforced Polymers And Composites, Metals And Alloys, Other Hull Materials), By Application (Private, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Horizon Yacht USA, Feadship Holland B.V., Palumbo Group S.P.A, Azimut – Benetti S.P.A., Damen Shipyards Group N.V., Brunswick Corporation, Sanlorenzo S.p.A., Heesen Yachts Sales B.V., Alexander Marine International, Princess Yachts Limited, Sunseeker International (Wanda Group), Christensen Shipyards LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Horizon Yacht USA

- Feadship Holland B.V.

- Palumbo Group S.P.A

- Azimut - Benetti S.P.A.

- Damen Shipyards Group N.V.

- Brunswick Corporation

- Sanlorenzo S.p.A.

- Heesen Yachts Sales B.V.

- Alexander Marine International

- Princess Yachts Limited

- Sunseeker International (Wanda Group)

- Christensen Shipyards LLC

- Fincantieri S.p.A. (CDP Industria S.p.A.)