Global Local Anesthesia Drugs Market By Drug Type (Lidocaine, Bupivacaine, Chloroprocaine, Ropivacaine and Others), By Application (Injectable and Surface Anesthetics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176643

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

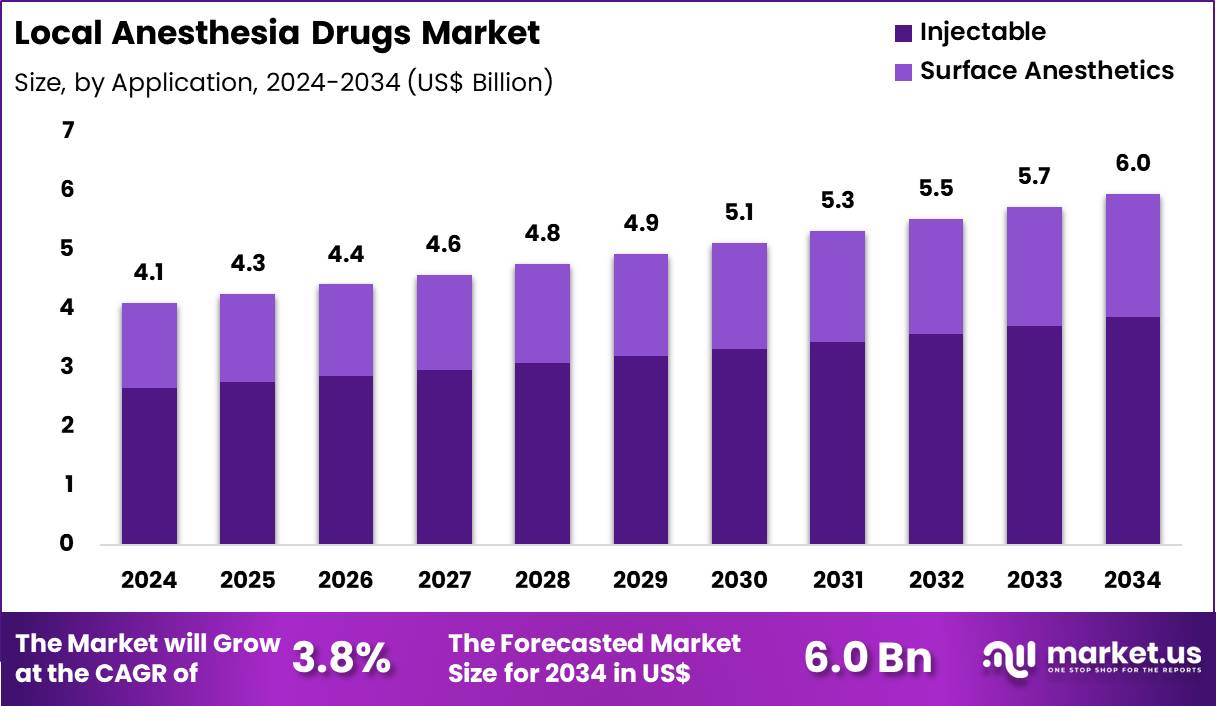

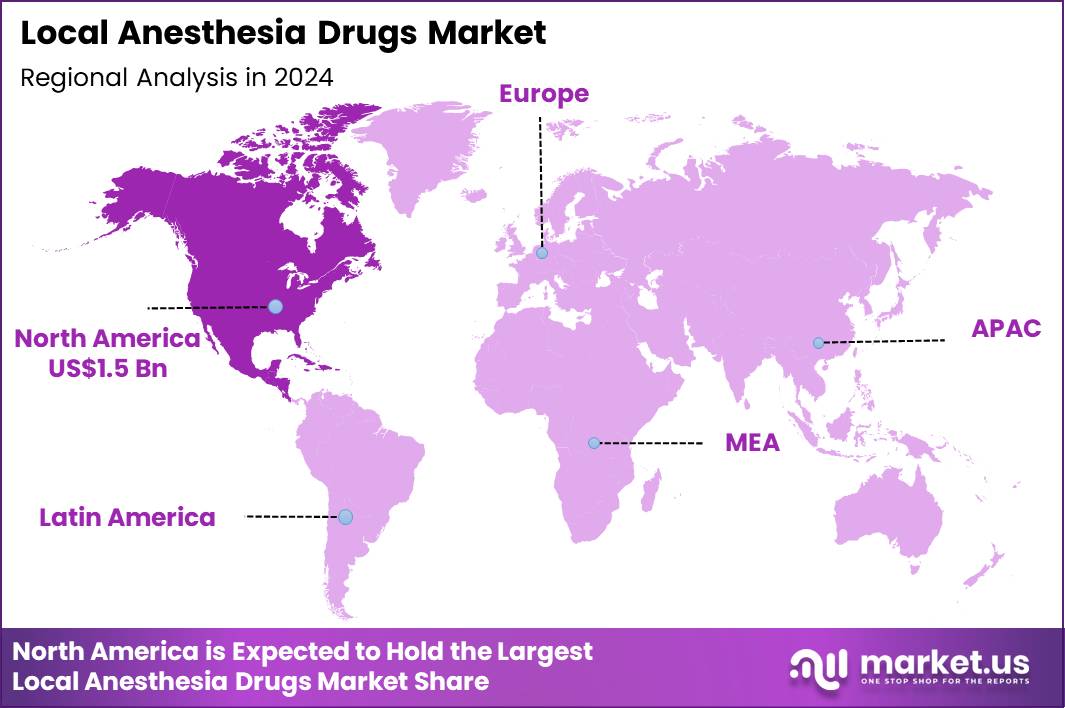

Global Local Anesthesia Drugs Market size is expected to be worth around US$ 6.0 Billion by 2034 from US$ 4.1 Billion in 2024, growing at a CAGR of 3.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.8% share with a revenue of US$ 1.5 Billion.

Rising demand for minimally invasive procedures and effective pain management propels the local anesthesia drugs market as healthcare providers prioritize agents that deliver targeted numbness with rapid onset and predictable duration. Anesthesiologists increasingly administer lidocaine for infiltration anesthesia in dermatologic procedures, enabling painless excision of skin lesions and cosmetic interventions while minimizing systemic absorption.

These drugs support nerve blocks in orthopedic surgeries, where bupivacaine provides prolonged analgesia for joint replacements and fracture repairs, facilitating early mobilization. Clinicians utilize ropivacaine in epidural anesthesia during labor and cesarean sections, offering motor-sparing effects that allow patient participation in delivery.

Local anesthetics also play a critical role in dental practice, where articaine enables deep pulpal anesthesia for endodontic treatments and extractions with reduced injection discomfort. Ophthalmologists apply topical proparacaine for corneal anesthesia during cataract surgery and diagnostic examinations, ensuring patient comfort without compromising intraocular pressure control.

Manufacturers pursue opportunities to develop liposomal formulations that extend duration of action, expanding applications in postoperative pain control for ambulatory procedures and reducing opioid requirements.

Developers advance buffered preparations that improve onset time and reduce injection pain, enhancing patient experience in regional anesthesia for upper and lower extremity surgeries. These innovations facilitate combination products with vasoconstrictors or adjuvants, optimizing hemostasis and analgesia in plastic and reconstructive surgeries.

Opportunities emerge in needle-free delivery systems and microneedle patches that enable precise dermal anesthesia for minor procedures and vaccinations. Companies invest in sustained-release depots for chronic pain conditions, broadening utility beyond perioperative use. Recent trends emphasize safer agents with lower cardiotoxicity profiles, supporting wider adoption in high-risk patients undergoing outpatient and office-based interventions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.1 Billion, with a CAGR of 3.8%, and is expected to reach US$ 6.0 Billion by the year 2034.

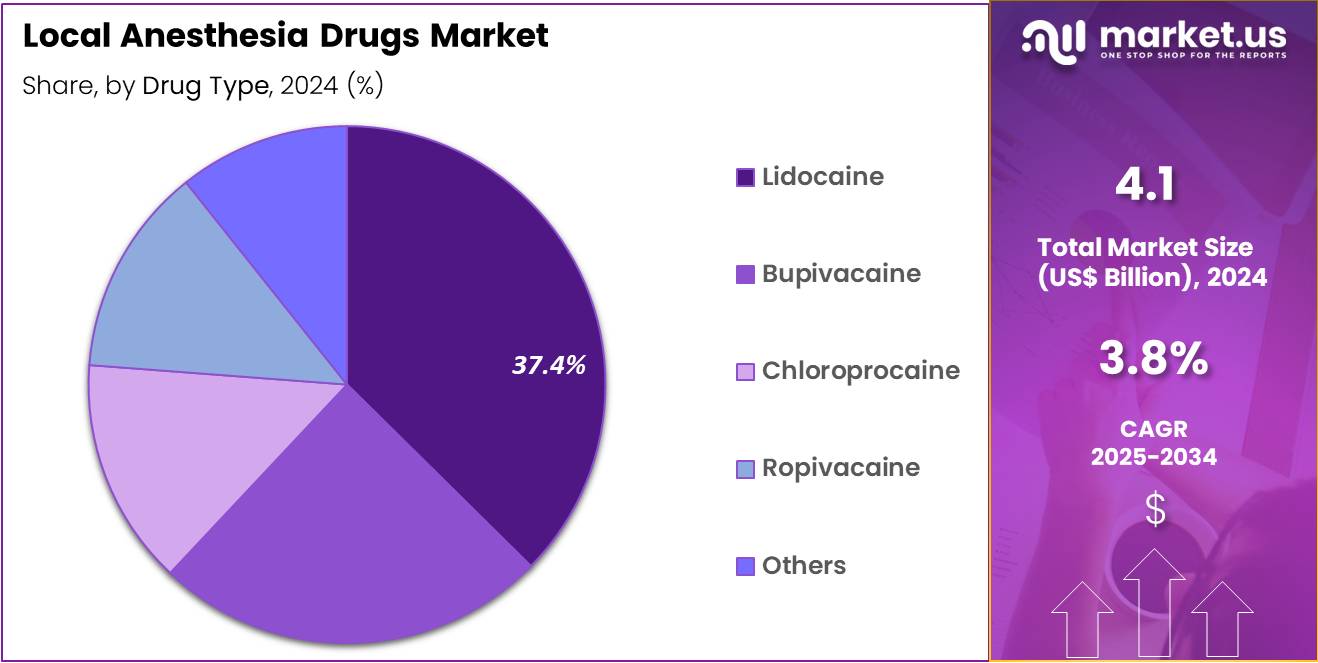

- The drug type segment is divided into lidocaine, bupivacaine, chloroprocaine, ropivacaine and others, with lidocaine taking the lead with a market share of 37.4%.

- Considering application, the market is divided into injectable and surface anesthetics. Among these, injectable held a significant share of 64.8%.

- North America led the market by securing a market share of 36.8%.

Drug Type Analysis

Lidocaine contributed 37.4% of growth within drug type and led the local anesthesia drugs market due to its broad clinical utility, rapid onset of action, and well-established safety profile. Clinicians across dentistry, minor surgery, dermatology, and emergency care prefer lidocaine because it delivers reliable anesthesia for short to moderate procedures. Extensive physician familiarity supports routine use across inpatient and outpatient settings. Its compatibility with multiple formulations and concentrations allows flexible dosing tailored to procedural needs.

Growth strengthens as minimally invasive procedures expand across healthcare systems. Lidocaine supports high patient turnover due to predictable anesthesia duration and recovery. Regulatory acceptance and inclusion in essential medicine lists reinforce widespread availability. Cost effectiveness compared to newer agents also supports sustained demand. The segment is expected to remain dominant as procedural volumes increase and clinicians continue to rely on trusted anesthetic standards.

Application Analysis

Injectable anesthetics generated 64.8% of growth within application and dominated the local anesthesia drugs market due to their effectiveness in achieving deeper and longer-lasting nerve blockade. Surgeons and clinicians favor injectable delivery for procedures requiring precise pain control and localized numbness. The approach supports a wide range of applications, including surgical incisions, biopsies, dental interventions, and regional anesthesia techniques. Growing adoption of day-care surgeries increases reliance on injectable local anesthetics.

Healthcare providers emphasize injectables due to predictable pharmacokinetics and procedural control. Training standards reinforce injectable administration across specialties. Expanding outpatient surgical centers and ambulatory procedures further elevate usage. Injectable formats integrate easily into standardized care pathways. The segment is projected to maintain leadership as healthcare systems prioritize effective pain management with controlled anesthesia delivery.

Key Market Segments

By Drug Type

- Lidocaine

- Bupivacaine

- Chloroprocaine

- Ropivacaine

- Others

By Application

- Injectable

- Surface Anesthetics

Drivers

Increasing prevalence of chronic diseases leading to surgical interventions is driving the market.

The escalating occurrence of chronic illnesses worldwide has substantially elevated the requirement for local anesthesia drugs to facilitate pain management during associated surgical treatments. Greater emphasis on medical interventions for conditions like cardiovascular disorders and orthopedic issues contributes to expanded utilization of these agents in operating rooms.

According to a study published by the National Institutes of Health, in 2022, 15.5% of adults in the United States reported undergoing surgery, representing approximately 39.4 million individuals. This volume illustrates the mounting surgical burden driven by persistent health challenges requiring anesthetic support. Local anesthesia drugs enable safer procedural environments by minimizing general anesthesia risks for chronic patients.

Medical advancements in diagnostics further identify cases necessitating operative care, boosting demand for reliable numbing solutions. Governmental health strategies target chronic disease control through enhanced access to surgical services.

Principal suppliers are augmenting formulations to cater to this heightened procedural frequency. This driver correlates with demographic shifts toward older populations prone to long-term ailments. Altogether, the chronic disease surge propels consistent market advancement in anesthetic pharmaceuticals.

Restraints

Stringent regulatory requirements for drug approval is restraining the market.

The rigorous evaluation processes mandated by health authorities for local anesthesia drugs prolong development timelines and escalate compliance expenditures. Comprehensive clinical trials to demonstrate safety profiles add substantial financial strain on pharmaceutical developers. Smaller enterprises frequently encounter barriers in navigating complex submission protocols for new anesthetic compounds.

Oversight emphasizes minimizing adverse reactions like systemic toxicity, constraining rapid innovation. In controlled healthcare economies, these regulations limit product introductions to verified entities only. Manufacturers allocate significant resources to post-approval monitoring, diverting funds from expansion efforts. This restraint curtails availability in markets with evolving pharmaceutical standards.

Joint industry advocacy seeks streamlined pathways, yet oversight remains firm. Notwithstanding therapeutic progress, approval hurdles restrict timely market entry. Resolving regulatory efficiencies is pivotal to countering this market impediment.

Opportunities

Rising revenues from injectable and anesthesia products is creating growth opportunities.

The upward trajectory in earnings from injectable pharmaceuticals and anesthesia segments signifies potential for local anesthesia drug integration in diversified portfolios. Bolstered financial performance enables investments in specialized anesthetic research for targeted applications. Baxter reported Injectables and Anesthesia net sales of $1,373 million in 2024, a 2% increase from $1,347 million in 2023.

This increment highlights sustained demand that can extend to localized pain control solutions in procedural settings. Cooperative ventures with infusion technology providers facilitate combined offerings for enhanced delivery. The considerable procedural foundation in advanced healthcare systems magnifies prospects for anesthetic upgrades.

Policy progressions in perioperative care reimbursement strengthen facility enhancements. Foremost corporations initiate geographic extensions to harness economic advancements. This opportunity harmonizes with endeavors to heighten benchmarks in outpatient interventions. Concentrated evolutions can produce remarkable strides in niche utilizations.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the local anesthesia drugs market through hospital budgets, outpatient procedure volumes, and purchasing discipline across care settings. Inflation and higher interest rates raise operating costs for providers, which increases scrutiny on drug pricing and formulary choices. Geopolitical tensions disrupt supplies of active pharmaceutical ingredients, excipients, and sterile packaging, creating sourcing risk and inventory pressure.

Current US tariffs on imported APIs and finished injectables increase landed costs for manufacturers and distributors, which tightens margins and complicates contract pricing. These headwinds affect smaller suppliers more sharply and can slow approvals for alternative formulations.

On the positive side, trade pressure encourages API diversification, domestic manufacturing investment, and longer term supply agreements. Steady growth in ambulatory surgeries, dental care, and pain management sustains consistent demand for reliable anesthetics. With resilient supply strategies and focus on high volume indications, the market remains positioned for stable and confident growth.

Latest Trends

Launch of ready-to-use anesthetic formulations is a recent trend in the market.

In 2024, the debut of pre-filled anesthetic preparations has streamlined administration protocols in clinical environments. These innovations feature single-dose containers that mitigate compounding errors and contamination hazards.

In April 2024, Baxter broadened its pharmaceutical offerings with the introduction of Ropivacaine Hydrochloride Injection, USP, supplied in a ready-to-administer, single-dose infusion bag to support local and regional anesthesia needs. This product provides convenient options for local or regional anesthesia in surgical contexts. Producers concentrate on stability enhancements to prolong shelf life without refrigeration needs.

Evaluations in 2024 affirmed improved workflow efficiencies through these user-ready variants. The trend accommodates escalating demands for rapid procedural setups in ambulatory facilities. Supervisory endorsements in 2024 for such formats have hastened their dissemination. Sector alliances hone packaging for superior sterility assurance. These progressions seek to diminish preparation durations while upholding efficacy standards.

Regional Analysis

North America is leading the Local Anesthesia Drugs Market

North America holds a 36.8% share of the global Local Anesthesia Drugs market, evidencing substantial growth in 2024 fueled by increasing outpatient surgical volumes and preferences for minimally invasive techniques that rely on effective pain management without general anesthesia.

Prominent companies such as Pfizer and Fresenius Kabi have introduced improved formulations of bupivacaine and lidocaine, featuring extended-release mechanisms to prolong analgesia and reduce opioid dependency in postoperative care.

The region’s emphasis on patient safety has prompted widespread adoption in dental, dermatological, and orthopedic procedures, where local anesthetics minimize risks associated with systemic effects. Health authorities have supported this trend through guidelines promoting regional blocks for ambulatory surgeries, enhancing recovery times and hospital throughput.

Rising chronic pain conditions, including arthritis and neuropathies, have expanded use in diagnostic injections and therapeutic nerve blocks. Industry-research collaborations have yielded evidence on combination therapies, improving efficacy for complex cases like labor analgesia.

Furthermore, digital tools for precise dosing have optimized administration, lowering adverse events. The FDA approved 4 first generic drugs related to local anesthesia in 2024, facilitating greater affordability and supply chain resilience.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project vigorous advancement in the pain management pharmaceuticals sector across Asia Pacific over the forecast period, as healthcare systems prioritize expanding surgical capabilities to handle rising chronic disease burdens. Firms in India and South Korea develop sustained-release injectables that extend duration for ambulatory operations, while specialists in Indonesia optimize lidocaine variants for tropical climate stability.

Medical centers in Vietnam incorporate advanced ropivacaine solutions into obstetric protocols, improving maternal outcomes during deliveries. Sponsors in Cambodia underwrite programs that supply affordable articaine for dental clinics, targeting underserved rural populations. Bureaucrats in Brunei introduce mandates for stockpile maintenance in emergency departments, ensuring readiness for trauma cases.

Doctors in Bhutan blend traditional practices with modern prilocaine applications, refining approaches for minor interventions. Producers in Fiji customize mepivacaine kits for island-based facilities, aiding remote procedural needs. The NMPA approved 46 innovative drugs in 2024, accelerating access to novel therapeutic agents.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the local anesthesia drugs market expand growth by strengthening their product portfolios with newer formulations that offer longer duration, improved safety profiles, and multi-use indications across surgical, dental, and outpatient procedures. They also deepen engagement with healthcare providers through clinical education programs that highlight best-practice application and outcomes to drive preference at point of care.

Firms strategically align with hospital group purchasing organizations and pharmacy chains to secure preferred supplier status and broader formulary placement. Geographic expansion into emerging regions supports volume growth as surgical procedures and pain management awareness increase.

Pfizer Inc. exemplifies a major diversified pharmaceutical company with a wide range of anesthetic solutions, robust global manufacturing capacity, and an established commercial infrastructure that spans acute care settings. The company fuels performance through disciplined investment in development, strong regulatory strategy, and coordinated marketing that resonates with both clinicians and institutional buyers.

Top Key Players

- Pfizer

- AstraZeneca

- AbbVie

- Baxter International

- Fresenius Kabi

- Teva Pharmaceutical Industries

- Sanofi

- Hikma Pharmaceuticals

- Septodont

- Aspen Pharmacare

Recent Developments

- In April 2025, Johnson & Johnson announced the acquisition of Intra-Cellular Therapies in a USD 14.6 billion all-cash transaction, valuing the company at USD 132 per share. The deal significantly expands Johnson & Johnson’s neuroscience portfolio by adding Caplyta, an approved therapy for schizophrenia and bipolar depression, along with the investigational asset ITI-1284. The transaction is being funded through a combination of existing cash reserves and new debt, with completion subject to regulatory clearances later in the year.

- In April 2024, Baxter International Inc. expanded its US pharmaceutical offerings with the launch of five new products. One of the key introductions was a prefilled, single-dose infusion bag containing ropivacaine hydrochloride, developed to support local and regional anesthesia during surgical interventions as well as short-term postoperative pain management.

Report Scope

Report Features Description Market Value (2024) US$ 4.1 Billion Forecast Revenue (2034) US$ 6.0 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Lidocaine, Bupivacaine, Chloroprocaine, Ropivacaine and Others), By Application (Injectable and Surface Anesthetics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer, AstraZeneca, AbbVie, Baxter International, Fresenius Kabi, Teva Pharmaceutical Industries, Sanofi, Hikma Pharmaceuticals, Septodont, Aspen Pharmacare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Local Anesthesia Drugs MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Local Anesthesia Drugs MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer

- AstraZeneca

- AbbVie

- Baxter International

- Fresenius Kabi

- Teva Pharmaceutical Industries

- Sanofi

- Hikma Pharmaceuticals

- Septodont

- Aspen Pharmacare