Liposome Drug Delivery Market By Product Type (Liposomal Doxorubicin, Liposomal Amphotericin B, Liposomal Paclitaxel, and Others), By Technology (Stealth Liposome Technology, Non-PEGylated Liposome Technology, DepoFoam Liposome Technology), By Application (Fungal Disease, Cancer Therapy, Pain Management, Photodynamic Therapy, and Viral Vaccine), By Liposome Structure (Unilamellar Liposome, Large, Multilamellar Liposome, Small, and Others), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150912

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Application Analysis

- Liposome Structure Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

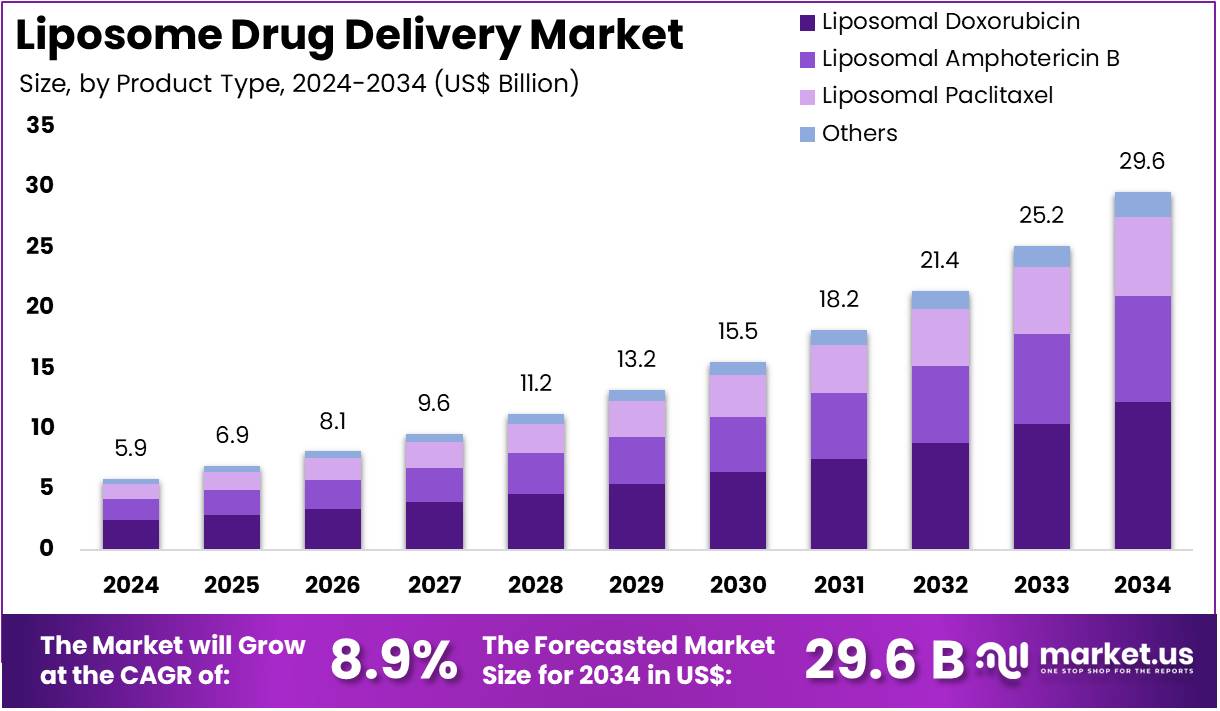

The Liposome Drug Delivery Market Size is expected to be worth around US$ 29.6 billion by 2034 from US$ 5.9 billion in 2024, growing at a CAGR of 8.9% during the forecast period 2025 to 2034.

Increasing demand for targeted and efficient drug delivery systems fuels the growth of the liposome drug delivery market. Liposomes, as advanced drug delivery vehicles, encapsulate therapeutic agents, ensuring their controlled release and enhanced bioavailability. This technology has gained significant attention for its ability to deliver drugs directly to the site of action, improving the efficacy of treatments while minimizing systemic side effects.

Liposomes are increasingly used in the treatment of cancer, infectious diseases, and chronic conditions, providing a promising solution for enhancing the effectiveness of both conventional and biologic therapies. Recent trends show a surge in the development of liposome-based formulations for encapsulating difficult-to-deliver drugs, such as large molecules and poorly soluble compounds.

The announcement by Innocan Pharma Corporation in April 2022 regarding the submission for a Pre-IND meeting with the FDA for its Liposome-Cannabidiol (LPT-CBD) injectable treatment for chronic pain highlights the growing application of liposomes in the cannabinoid drug space. Innovations in liposome formulation, including the integration of nanotechnology and the development of stimuli-responsive liposomes, create significant opportunities for new drug therapies.

As the pharmaceutical industry increasingly focuses on personalized medicine, liposome drug delivery systems offer the potential for more targeted, patient-specific treatments. The growing number of applications in gene therapy and vaccine delivery further contributes to the market’s expansion, positioning liposome drug delivery as a key driver in the evolution of modern medicine.

Key Takeaways

- In 2024, the market for liposome drug delivery generated a revenue of US$ 5.9 billion, with a CAGR of 8.9%, and is expected to reach US$ 29.6 billion by the year 2034.

- The product type segment is divided into liposomal doxorubicin, liposomal amphotericin b, liposomal paclitaxel, and others, with liposomal doxorubicin taking the lead in 2024 with a market share of 41.3%.

- Considering technology, the market is divided into stealth liposome technology, non-pegylated liposome technology, depofoam liposome technology. Among these, stealth liposome technology held a significant share of 53.5%.

- Furthermore, concerning the application segment, the market is segregated into fungal disease, cancer therapy, pain management, photodynamic therapy, and viral vaccine. The cancer therapy sector stands out as the dominant player, holding the largest revenue share of 49.4% in the Liposome Drug Delivery market.

- The liposome structure segment is segregated into unilamellar liposome, large, multilamellar liposome, small, and others, with the unilamellar liposome segment leading the market, holding a revenue share of 45.7%.

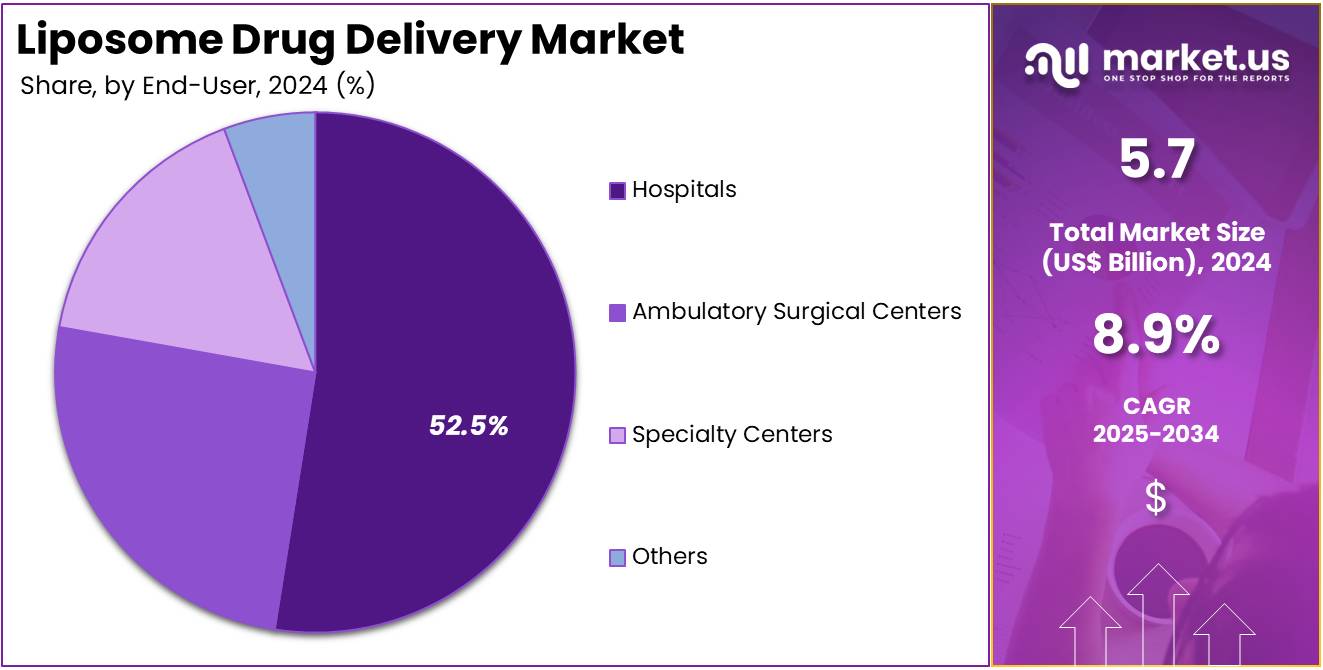

- Considering end-user, the market is divided into hospitals, ambulatory surgical centers, specialty centers, and others. Among these, hospitals held a significant share of 52.5%.

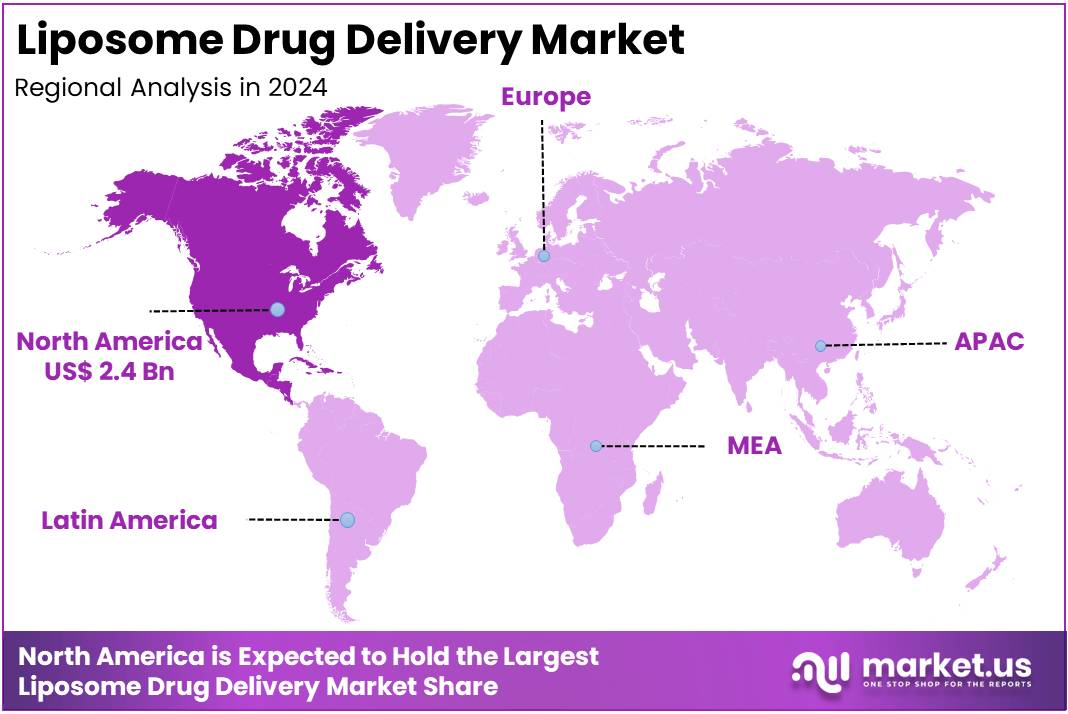

- North America led the market by securing a market share of 39.9% in 2024.

Product Type Analysis

The liposomal doxorubicin segment claimed a market share of 41.3% owing to its strong clinical efficacy in cancer treatment, particularly in treating solid tumors like breast cancer and ovarian cancer. The segment’s growth is anticipated to be fueled by increasing cancer prevalence worldwide and the demand for more effective, less toxic cancer therapies.

Liposomal doxorubicin’s ability to reduce side effects, such as cardiotoxicity, compared to traditional doxorubicin, is projected to continue its adoption among healthcare providers. The segment is likely to benefit from ongoing clinical trials that demonstrate the superiority of liposomal formulations in various cancer indications.

Furthermore, as personalized medicine and targeted drug delivery systems gain traction, liposomal doxorubicin is expected to see an increase in market share. The expansion of oncology care and the adoption of advanced liposomal drug delivery systems will continue to drive the growth of this segment.

Technology Analysis

The stealth liposome technology held a significant share of 53.5% due to its ability to improve the circulation time of liposomal drugs. This technology, often involving PEGylation (attachment of polyethylene glycol), helps the liposomes evade the immune system, allowing them to reach target tissues more effectively. As more therapeutic applications are discovered for stealth liposome technology, it is projected to dominate the liposome market, especially in cancer and fungal treatments.

The increasing demand for targeted drug delivery and the growing emphasis on reducing side effects are expected to further fuel this technology’s market adoption. Furthermore, stealth liposomes have shown promising results in delivering drugs with high molecular weight and poor solubility, which is likely to expand their use in other therapeutic areas. As the technology continues to evolve, stealth liposomes are expected to remain at the forefront of the market.

Application Analysis

The cancer therapy segment had a tremendous growth rate, with a revenue share of 49.4% owing to the rising incidence of cancer globally and the growing demand for targeted therapies. Liposomal drug delivery systems, such as liposomal doxorubicin, are projected to gain more traction in cancer treatment due to their ability to improve drug solubility, enhance drug stability, and reduce side effects. The increasing adoption of liposomal formulations for both chemotherapy and targeted therapy will likely contribute to the growth of the segment.

Cancer therapies that incorporate liposome technology are anticipated to be favored by both healthcare providers and patients due to their improved therapeutic outcomes and reduced adverse effects compared to conventional chemotherapy. As more cancer indications are targeted by liposomal drug delivery systems, the cancer therapy segment is expected to grow significantly in the coming years.

Liposome Structure Analysis

The unilamellar liposome segment grew at a substantial rate, generating a revenue portion of 45.7% due to their simplicity and efficiency in delivering drugs. The uniform size and structure of unilamellar liposomes make them ideal for encapsulating both hydrophilic and hydrophobic drugs, which has led to their widespread use in various therapeutic applications, especially in cancer treatment and vaccine delivery. These liposomes are likely to be more efficient at passing through biological barriers, improving drug bioavailability and stability.

The growing preference for drug delivery systems that can be easily manipulated and tailored for specific drugs will contribute to the continued growth of this segment. As the demand for more effective, targeted drug delivery systems grows, unilamellar liposomes are expected to dominate the market, especially for applications that require high precision in drug delivery.

End-User Analysis

The hospitals held a significant share of 52.5% due to their central role in managing complex drug therapies, particularly for cancer and fungal diseases. The increasing incidence of these diseases is projected to drive the demand for liposomal formulations in hospital settings, where specialized treatment protocols are in place.

Hospitals are likely to see an increase in the adoption of liposomal drug delivery systems, especially as these formulations offer better therapeutic outcomes and reduced side effects. With the growth of oncology care, as well as the rising demand for targeted therapies, hospitals will continue to be key adopters of liposomal drug delivery systems.

Furthermore, hospitals’ infrastructure, combined with access to advanced medical technologies and skilled personnel, makes them the primary healthcare setting for administering liposomal drugs, thus ensuring their dominant market position.

Key Market Segments

By Product Type

- Liposomal Doxorubicin

- Liposomal Amphotericin B

- Liposomal Paclitaxel

- Others

By Technology

- Stealth Liposome Technology

- Non-PEGylated Liposome Technology

- DepoFoam Liposome Technology

By Application

- Fungal Disease

- Cancer Therapy

- Pain Management

- Photodynamic Therapy

- Viral Vaccine

By Liposome Structure

- Unilamellar Liposome

- Large

- Multilamellar Liposome

- Small

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Centers

- Others

Drivers

Increasing Prevalence of Chronic Diseases is Driving the Market

The rising global prevalence of chronic diseases, such as cancer, infectious diseases, and inflammatory conditions, is a significant driver for the liposome drug delivery market. Liposomal formulations offer advantages over traditional drug delivery by enhancing drug solubility, reducing systemic toxicity, and improving targeting to diseased tissues, which is particularly beneficial for potent and toxic drugs used in chronic disease management.

For instance, the International Agency for Research on Cancer (IARC) reported nearly 20 million new cancer cases globally in 2022, highlighting a substantial patient population that could benefit from targeted and less toxic therapies.

Furthermore, the Centers for Disease Control and Prevention (CDC) continuously reports on the high burden of chronic conditions like heart disease and diabetes in the US, affecting millions of individuals who require ongoing and often complex drug regimens. The ability of liposomes to improve drug pharmacokinetics and reduce off-target effects makes them increasingly attractive for managing these long-term illnesses.

Restraints

Challenges in Manufacturing and Scale-Up are Restraining the Market

The liposome drug delivery market faces significant restraint due to the inherent complexities and challenges associated with the manufacturing and large-scale production of liposomal formulations. Achieving consistent particle size, uniform drug encapsulation efficiency, and long-term stability remains a technical hurdle. The scalability of manufacturing processes from laboratory to commercial production often presents difficulties, requiring specialized equipment and strict quality control.

For example, a 2021 publication from the FDA’s “Science and Research” section on “Continuous Manufacturing of Liposomes and Lipid Nanoparticles” highlighted that a major challenge in nanoparticle manufacturing is adequately controlling the process to ensure product quality, which directly impacts safety and efficacy. These manufacturing complexities can lead to higher production costs and limit the widespread adoption of certain liposomal products, thereby slowing market growth.

Opportunities

Development of Targeted and Stimuli-Responsive Liposomes Creates Growth Opportunities

The ongoing development of targeted and stimuli-responsive liposomes presents significant growth opportunities in the liposome drug delivery market. Researchers are designing liposomes that can selectively deliver drugs to specific cells or tissues, reducing systemic exposure and enhancing therapeutic efficacy, particularly in oncology. This includes surface modifications with ligands that bind to receptors overexpressed on cancer cells, or liposomes designed to release their payload in response to specific physiological cues like pH changes, temperature, or enzyme activity in the disease microenvironment.

For instance, a review on advancements in liposome-based delivery of RNA therapeutics for cancer treatment, published in Progress in Molecular Biology and Translational Science in 2024, highlighted the potential of liposomes for precisely targeting cancerous tissues through intrinsic passive and acquired active targeting capabilities. These innovations promise to unlock new therapeutic avenues and improve patient outcomes across various disease areas.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the liposome drug delivery market, primarily through their impact on pharmaceutical research and development (R&D) funding, healthcare infrastructure investment, and patient access to novel therapies. Periods of economic prosperity generally encourage greater private and public investment in biotechnology and nanotechnology research, which are critical for advancing liposomal drug delivery systems.

For instance, the US National Science Foundation reported that total US R&D expenditures reached US$ 892 billion in 2022, with an estimated further increase to US$ 940 billion in 2023, demonstrating robust overall investment in innovation. This substantial R&D landscape supports the high-cost, high-risk development inherent in advanced drug delivery. Conversely, economic downturns or inflationary pressures can lead to tighter R&D budgets for pharmaceutical companies, potentially slowing the pace of innovation and clinical trials for these complex formulations.

Geopolitical factors, such as international scientific collaborations and the stability of global supply chains for specialized lipids and raw materials, are also crucial. For example, recent geopolitical tensions, such as the Red Sea crisis in 2024, significantly impacted global shipping rates and supply chain stability, directly affecting the cost and availability of critical materials for pharmaceutical manufacturing. Despite these broader influences, the transformative potential of liposomal formulations to improve drug efficacy and safety ensures continued scientific and commercial interest, often leading to resilient investment and development even amidst economic and political challenges.

Current U.S. tariff policies may significantly affect the liposome drug delivery market. Tariffs on imported specialized lipids, APIs, and advanced manufacturing equipment can raise production costs. This is especially true for liposomal formulations, which require high-quality inputs. According to the U.S. Census Bureau, the U.S. doubled its medication imports from China between 2020 and 2022. The National Association of Manufacturers reported in October 2023 that around 30% of U.S. pharmaceutical imports were ingredients. Tariffs on these could raise domestic production costs by an estimated 4.1%.

This increase in cost could make liposomal drugs more expensive. That may reduce patient access, especially for new or high-cost therapies. However, tariffs may also drive growth in domestic manufacturing of specialized lipids. This shift could strengthen the U.S. pharmaceutical supply chain in the long term. A more localized production system may lower dependency on foreign sources. While short-term cost pressures are expected, the long-term outlook includes enhanced supply chain security and national pharmaceutical resilience.

Trends

Increased Research and Development in Gene and RNA Therapeutics is a Recent Trend

A prominent recent trend in the liposome drug delivery market is the increasing research and development focus on utilizing liposomes for gene and RNA therapeutics, including mRNA vaccines and gene editing tools. Liposomes, particularly lipid nanoparticles (LNPs), have proven highly effective as non-viral vectors for delivering nucleic acids into cells, protecting the delicate genetic material from degradation and facilitating cellular uptake.

The success of mRNA vaccines for COVID-19, which utilize LNPs for delivery, has significantly accelerated investment and research in this area. A review published in Progress in Molecular Biology and Translational Science in 2024 specifically addressed advances in liposome-based delivery of RNA therapeutics for cancer treatment, emphasizing the revolutionary potential when liposomes are combined with RNA therapies. This growing focus on genetic medicines creates a substantial and expanding application area for liposome technology, pushing the boundaries of targeted therapies.

Regional Analysis

North America is leading the Liposome Drug Delivery Market

North America Dominated the market with the highest revenue share of 39.9% owing to ongoing innovation in drug delivery and a focus on improving patient outcomes through targeted therapies. These formulations are particularly valued for their ability to enhance drug solubility, prolong circulation time, and reduce systemic toxicity, especially in complex diseases like cancer.

While specific new liposomal drug approvals for 2024 from the FDA are still being fully documented for public release, an example of continued regulatory activity is the FDA’s March 2024 approval of Onivyde (irinotecan liposome injection) for metastatic pancreatic ductal adenocarcinoma, demonstrating ongoing support for such specialized delivery systems.

Furthermore, major pharmaceutical companies continue to invest in this space; for instance, Gilead Sciences reported total product sales of US$28.6 billion for the full year 2024, indicating substantial commercial activity in therapeutic areas where advanced formulations are increasingly utilized.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing prevalence of diseases like cancer, coupled with rising healthcare investments and a growing emphasis on advanced therapeutic options across the region. In Japan, the National Cancer Center reported that projected cancer incidence for 2024 is approximately 979,300 new cases, highlighting a significant patient pool that could benefit from advanced drug delivery.

China’s National Medical Products Administration (NMPA) approved a record 104 new drugs in 2023, compared to 77 in 2022, with oncology being the top therapeutic area, signaling a robust regulatory environment that supports the introduction of innovative formulations. Additionally, South Korea’s healthcare spending per capita for 2023 was US$ 3,270, reflecting a 7.21% increase from 2022, which suggests a sustained commitment to improving healthcare access and technology, thereby facilitating the adoption of sophisticated drug delivery methods.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the liposome drug delivery market are adopting multiple strategies to strengthen their positions. These include expanding product portfolios, improving formulation technologies, and pursuing strategic collaborations. A major focus is on long-acting injectable formulations. These help improve patient compliance and reduce the frequency of treatments. Companies are also directing significant resources toward research and development. Their goal is to explore new therapeutic areas and enhance existing liposomal formulations for better safety and efficacy.

Strategic partnerships are another key growth driver in this market. Collaborations with healthcare providers and other pharmaceutical firms are helping expand distribution channels. These efforts improve patient access and ensure a broader reach of advanced drug delivery solutions. In addition, leading firms are actively increasing their presence in emerging markets. These regions present high growth potential due to rising healthcare investments and increasing demand for innovative drug delivery systems.

Gilead Sciences, Inc. is a notable player in this space. Headquartered in Foster City, California, the company focuses on therapeutic areas such as virology, oncology, and inflammation. Its product portfolio includes AmBisome, a liposomal amphotericin B formulation used for fungal infections. Gilead continues to invest in the development of new liposomal therapies. These efforts aim to improve treatment outcomes and meet the growing demand for advanced drug delivery platforms across different regions.

Top Key Players in the Liposome Drug Delivery Market

- Abbott

- CELSION Corporation

- Gencor and Pharmacy Biotechnologies

- Gilead Sciences, Inc.

- Ipsen Pharma

- Novartis AG

- Teva Pharmaceutical Industries Ltd

- Xaira Therapeutics

Recent Developments

- In April 2024: Xaira Therapeutics launched a mission focused on re-engineering drug development and discovery by applying emerging AI technologies across the entire process. Xaira aims to revolutionize medicine creation by utilizing expansive data generation, advanced machine learning, and comprehensive therapeutic product development to drive breakthroughs in the pharmaceutical industry.

- In May 2023: Gencor and Pharmacy Biotechnologies introduced their latest innovation in liposome technology, PlexoZome. This advanced, targeted delivery liposomal technology is designed for liquid formulations, offering fully customizable, stable liposomal ingredients that promise enhanced efficacy and stability in therapeutic applications.

Report Scope

Report Features Description Market Value (2024) US$ 5.9 billion Forecast Revenue (2034) US$ 29.6 billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liposomal Doxorubicin, Liposomal Amphotericin B, Liposomal Paclitaxel, and Others), By Technology (Stealth Liposome Technology, Non-PEGylated Liposome Technology, DepoFoam Liposome Technology), By Application (Fungal Disease, Cancer Therapy, Pain Management, Photodynamic Therapy, and Viral Vaccine), By Liposome Structure (Unilamellar Liposome, Large, Multilamellar Liposome, Small, and Others), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott, CELSION Corporation, Gencor and Pharmacy Biotechnologies, Gilead Sciences, Inc., Ipsen Pharma, Novartis AG, Teva Pharmaceutical Industries Ltd, Xaira Therapeutics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liposome Drug Delivery MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Liposome Drug Delivery MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott

- CELSION Corporation

- Gencor and Pharmacy Biotechnologies

- Gilead Sciences, Inc.

- Ipsen Pharma

- Novartis AG

- Teva Pharmaceutical Industries Ltd

- Xaira Therapeutics