Global Life Insurance Market Size, Share, Industry Analysis Report By Type (Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Others), By Premium Range (Low, Medium, High), By Provider (Insurance Companies, Insurance Agents/Brokers, Insurtech Companies, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161647

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Ownership and Need

- Policy and Market Trends

- Digital and Social Media Influence

- Analyst Viewpoint

- Role of generative AI

- North America Market Size

- Type Analysis

- Premium Range Analysis

- Provider Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Latest Trends

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

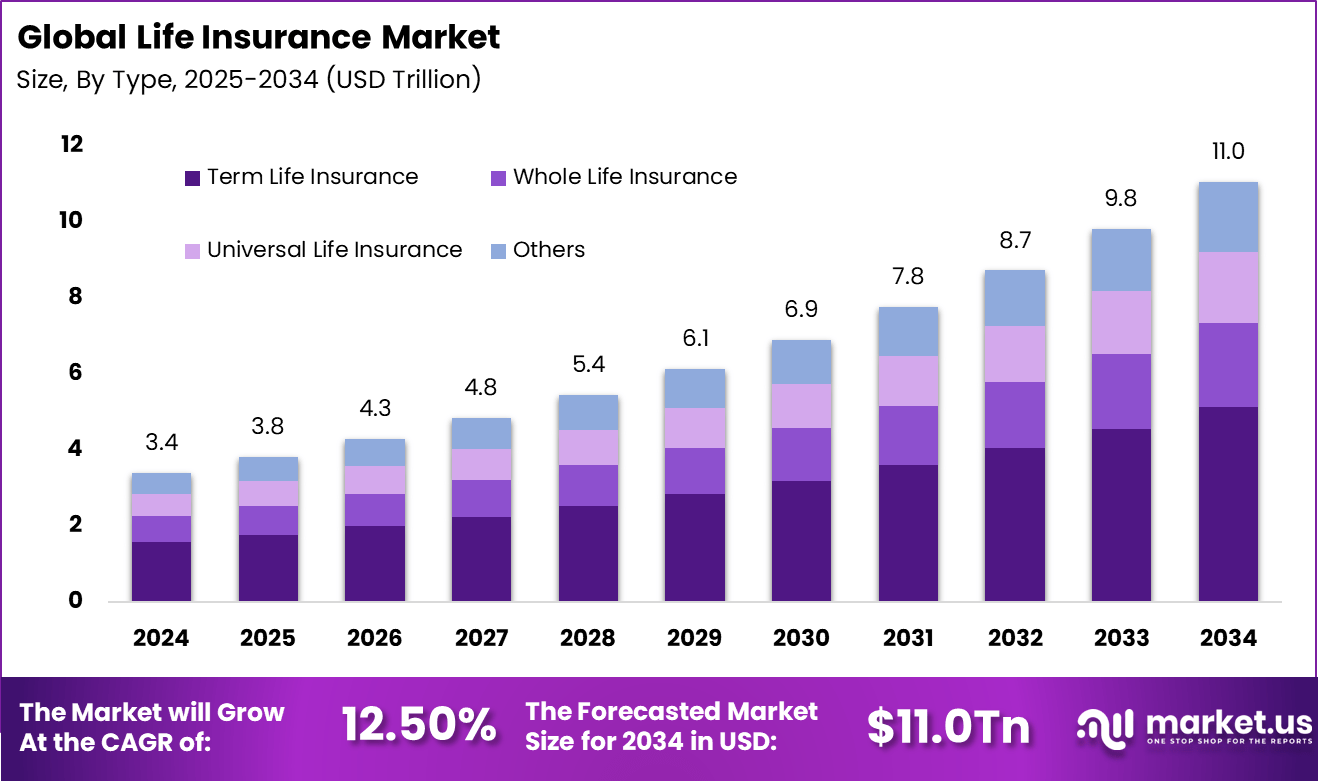

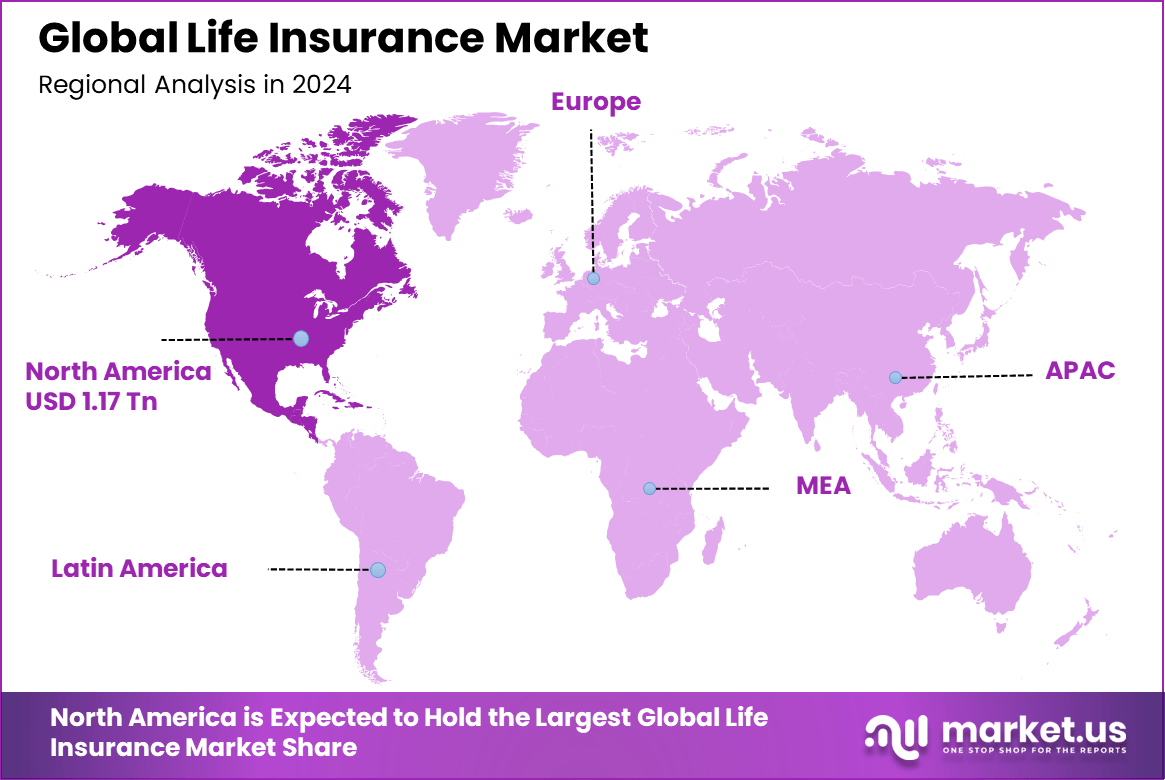

The Global Life Insurance Market size is expected to be worth around USD 11.0 trillion by 2034, from USD 3.4 trillion in 2024, growing at a CAGR of 12.50% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.6% share, holding USD 1.17 trillion in revenue.

The market for Life Insurance is driven by several key factors, including an aging global population, rising awareness of financial protection, and increased disposable incomes, especially in developing regions. The aging population worldwide is also pushing demand for retirement and annuity products, as more people seek financial security for their later years.

Rising disposable incomes and expanding middle-class populations in emerging markets further boost insurance adoption. Advances in technology that enable faster, more personalized service further support this growth trend, making life insurance more accessible and attractive to a broadening customer base.

According to Market.us, The global use of generative AI in life insurance is moving from experimentation to real implementation. The market is projected to reach USD 1,739.9 Million by 2033, rising sharply from USD 138.8 Million in 2023. This growth reflects a strong 28.77% CAGR during 2024 to 2033, driven by insurers using AI to make underwriting faster, reduce fraud, personalise policies, and improve customer interaction.

For instance, in January 2025, Go Digit Life Insurance launched its first individual pure-term life insurance plan called “Digit Glow Term Life Insurance,” specifically designed for India’s self-employed population of over 300 million. This innovative plan addresses challenges like fluctuating incomes and lack of formal income proof through tech-enabled underwriting and alternative credit assessments.

Key Takeaway

- In 2024, the Term Life Insurance segment held a dominant market position, capturing a 46.4% share of the Global Life Insurance Market.

- In 2024, the Medium segment held a dominant market position, capturing a 41.3% share of the Global Life Insurance Market.

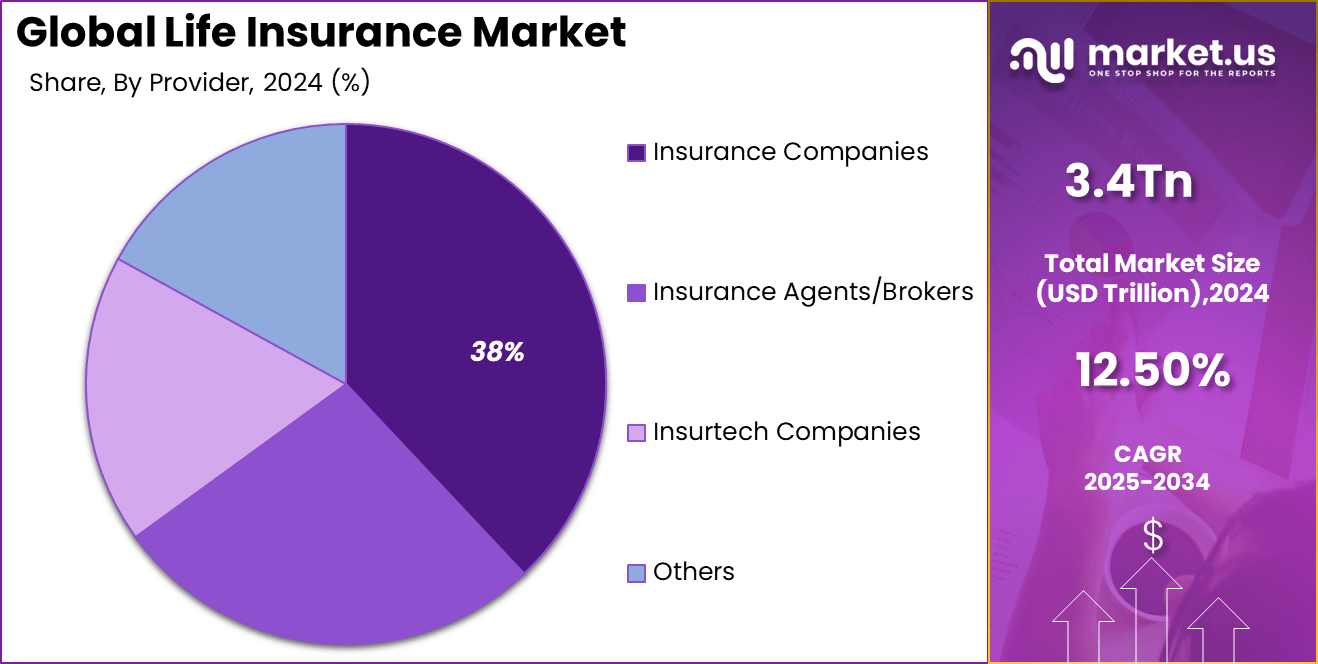

- In 2024, the Insurance Companies segment held a dominant market position, capturing a 38% share of the Global Life Insurance Market.

- The U.S. Life Insurance Market was valued at USD 298.7 Trillion in 2024, with a robust CAGR of 29.6%.

- In 2024, North America held a dominant market position in the Global Life Insurance Market, capturing more than a 34.6% share.

Ownership and Need

- Ownership: About 51% of American adults currently own a life insurance policy.

- Coverage gap: 42% of adults report they either lack life insurance or need more coverage.

- Target demographics: The gap is most evident among single mothers, with 59% indicating they need life insurance.

- Younger generations: Intent to purchase is high, with 44% of Gen Z and 50% of Millennials planning to buy coverage within the next year.

Policy and Market Trends

- Premiums: Total premiums for individual life insurance hit a record $15.9 billion in 2024, up 3% from 2023, marking the fourth consecutive record year.

- Policy sales: The number of new individual policies sold in 2024 remained flat compared to 2023.

- Annuities: The business mix continues to shift, with annuities accounting for 55.8% of life/annuity direct premiums written in 2024.

Digital and Social Media Influence

- Online research: About 25% of Americans say they would research and purchase life insurance online, though Gen Z is least likely to choose this channel.

- Social media trust: Over 60% of younger adults (Gen Z and Millennials) trust social media influencers for insurance information.

- Social media interaction: Around 50% of younger adults follow a financial advisor on social media, and more than one-third follow an insurance company for product insights.

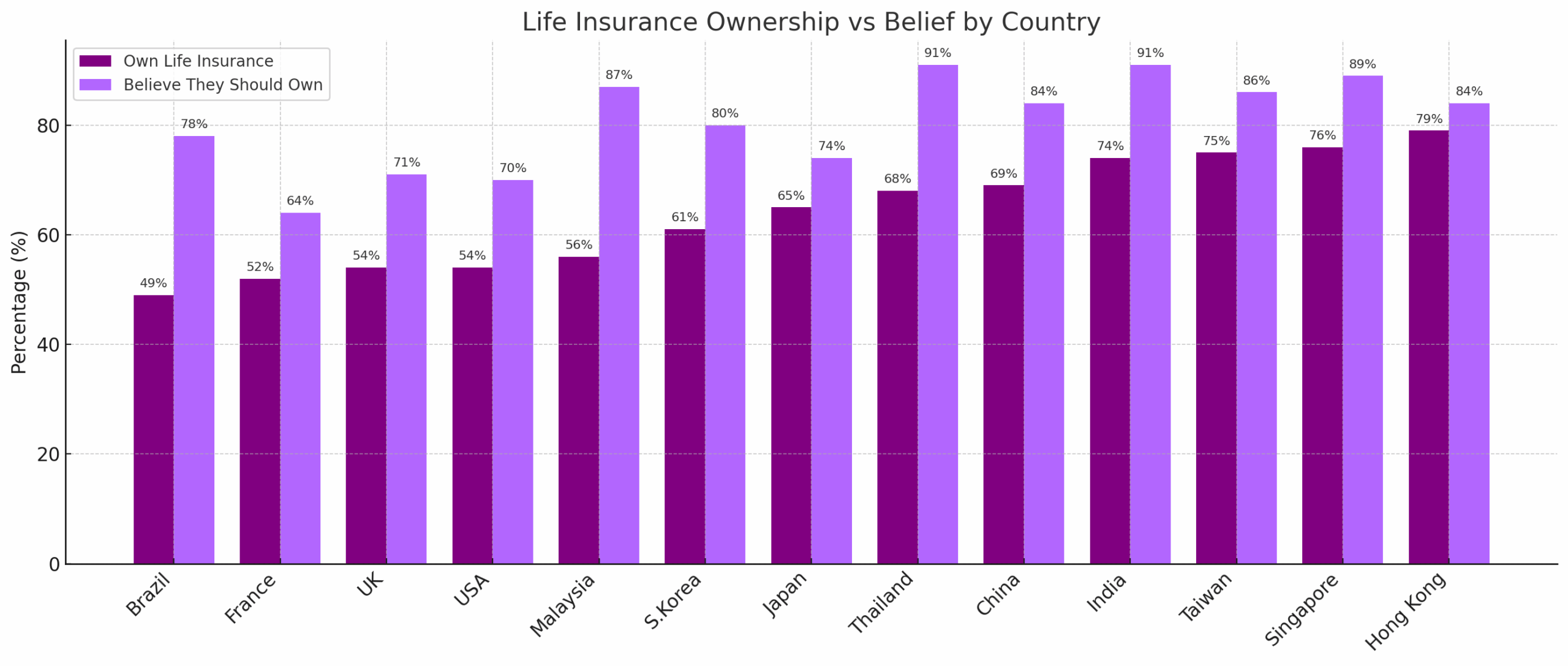

According to Feather Insurance, life insurance awareness and adoption vary widely across countries. Hong Kong ranks highest globally, with 79% of its population holding a policy, and 84% of residents acknowledging the importance of life insurance. In terms of perception, India and Thailand lead with 91% of people in each country considering life insurance essential, even though ownership levels may not be as high.

Analyst Viewpoint

The demand for life insurance is rising steadily, especially in developing markets where penetration remains low. Customers today seek flexible, customized insurance solutions that cater to diverse family structures and changing lifestyles. Innovations in product design and enhancements in distribution channels, particularly online platforms, have made life insurance more accessible and appealing to a broader audience.

Life insurers are leveraging digital technologies like artificial intelligence and data analytics to improve underwriting accuracy, personalize policies, and accelerate claim processing. Automation through chatbots and digital platforms enhances customer service efficiency and reduces operational costs. These technologies enable insurers to better assess risk and tailor products to meet individual customer needs.

The life insurance sector offers substantial investment opportunities in data-driven platforms, insurtech startups, and digital distribution networks. With aging populations, there is increased interest in retirement planning and wealth transfer products. Markets with low insurance penetration are poised for significant growth in demand for life protection and savings products, creating fertile ground for expansion.

Globally, reports from the International Association of Insurance Supervisors (IAIS) offer mid-year and annual updates on macro-financial trends, solvency, liquidity, profitability, and systemic risks across major insurers worldwide. These reports cover over 90% of global gross written premiums, providing a clear view of insurer performance, capital adequacy, and evolving risk exposures in life insurance markets.

Role of generative AI

Generative AI is transforming life insurance by enabling more accurate underwriting and risk assessment. Around 72% of life insurers have adopted generative AI technologies to create synthetic data sets that enhance traditional underwriting models.

This advancement allows insurers to personalize policies more effectively by analyzing a wider range of customer data, leading to better risk prediction and pricing accuracy. Moreover, generative AI is accelerating claims processing efficiency, cutting the average time by up to 73%, which significantly improves customer experience.

It also supports automation in customer service, where AI-powered chatbots handle up to 60% of routine inquiries, reducing operational costs and freeing human agents to focus on complex cases. This AI-driven transformation helps life insurers deliver faster, more personalized services while managing risks effectively.

North America Market Size

In 2024, North America held a dominant market position in the Global Life Insurance Market, capturing more than a 34.6% share, holding USD 1.17 trillion in revenue. This dominance is due to a well-established insurance infrastructure and high consumer awareness. The region benefits from a large aging population that increasingly seeks retirement income products and wealth transfer solutions.

Strong regulatory frameworks and technological advancements in insurance underwriting and claims processing also support market leadership. Furthermore, widespread adoption of digital platforms makes life insurance more accessible, driving steady premium growth and market resilience across North America.

In the United States, slightly more than 51% of people currently hold a life insurance policy, yet a large share believe their coverage is not sufficient. What stands out is that the industry recorded its highest level of individual premium income in 2024, even though the total number of new policies did not significantly change. This signals a shift toward higher-value or more customized plans rather than a rise in policy volume.

For instance, in November 2024, AM Best upgraded the Financial Strength Rating of Investors Life Insurance Company of North America (ILICNA) from B+ to B++, reflecting its strong balance sheet and improved business profile. This upgrade supports ILICNA’s consumer-centric growth strategy focused on technology-enabled distribution and partnerships with insurers and reinsurers.

Type Analysis

In 2024, The Term Life Insurance segment held a dominant market position, capturing a 46.4% share of the Global Life Insurance Market. This dominance is driven by the affordability and simplicity of term policies, which provide coverage for a fixed period at a lower cost compared to whole life insurance.

Many consumers prefer term insurance because it offers straightforward protection without the added investment component, making it particularly attractive to younger and budget-conscious buyers. Additionally, digital transformation plays a crucial role in boosting term life insurance adoption.

Online platforms and streamlined underwriting processes allow for quick, convenient policy purchases, meeting the growing consumer demand for accessible and transparent insurance solutions. This combination of simplicity, affordability, and digital convenience makes term life insurance the preferred choice in many markets.

For Instance, in August 2025, SBI Life Insurance launched a new term insurance product aimed at providing affordable and comprehensive life cover to a broad customer base. This product is designed to meet the rising demand for simple, cost-effective protection solutions, offering flexibility in policy tenure and payout options.

Premium Range Analysis

In 2024, the Medium segment held a dominant market position, capturing a 41.3% share of the Global Life Insurance Market. This segment’s dominance stems from a large portion of middle-income consumers seeking balanced coverage with manageable premium payments. Medium-range premiums offer comprehensive benefits without straining the household budget, making them a popular choice among families and working professionals.

Moreover, insurers are increasingly designing products with added benefits tailored to this segment’s needs. These include features like partial withdrawals, investment-linked benefits, and long-term savings options. The focus on value and personalization, combined with wider distribution channels including digital and agent networks, supports the steady dominance of the medium premium segment.

For instance, in April 2025, ICICI Prudential expressed optimism about outperforming the life insurance industry in terms of Annual Premium Equivalent (APE) growth, particularly in the medium-range term life insurance segment. The company is focusing on enhancing product offerings and leveraging digital channels to reach middle-income customers seeking affordable yet comprehensive life cover.

Provider Analysis

In 2024, The Insurance Companies segment held a dominant market position, capturing a 38% share of the Global Life Insurance Market. This dominance is due to their strong brand reputation and extensive distribution networks. These companies benefit from consumer trust, regulatory compliance expertise, and diversified product portfolios that cater to a wide range of customer needs, from basic protection to complex retirement plans.

Furthermore, leading insurance companies have heavily invested in technology to enhance customer experience and operational efficiency. Digital tools, data analytics, and improved underwriting processes help these providers deliver competitive pricing and faster claims service. Their ability to combine scale, innovation, and reliability sustains their market leadership in a competitive industry.

For Instance, in October 2025, OP Life Assurance became the first life insurance company globally to go live with the Guidewire Jutro Digital Platform. This implementation enhances their term life insurance sales by providing advanced digital capabilities that simplify product updates and improve customer interactions across multiple channels.

Key Market Segments

By Type

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Others

By Premium Range

- Low

- Medium

- High

By Provider

- Insurance Companies

- Insurance Agents/Brokers

- Insurtech Companies

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Aging Population

The aging population around the world is a strong driver for the life insurance market. As more people live longer, especially those over 65, there is an increasing need for products focused on retirement income and protection.

Older individuals seek financial security for themselves and their families, which leads to more demand for life insurance and annuity products. This demographic change boosts the life insurance business as companies create offerings tailored to meet the needs of retirees, including retirement savings and longevity risk coverage.

For instance, in October 2025, the World Health Organization reported that the global population aged 60 years and older is projected to rise from 1.1 billion in 2023 to 1.4 billion by 2030. This rapid growth reflects increased life expectancy, now averaging 73.3 years globally, alongside declining birth rates in many regions.

Restraint

Economic Uncertainty and Slowing Growth

Economic uncertainty poses a major restraint on the life insurance market. With global economic growth slowing down and inflationary pressures rising, consumers typically cut back on expenses, including life insurance premiums. This cautious consumer behavior reduces new sales and may lead to lower policy renewals.

Moreover, geopolitical tensions and volatile financial markets add risk to insurers’ investment portfolios, further impacting profitability. This restraint affects both customer demand and insurers’ ability to maintain competitive pricing. Many households faced with economic challenges delay or avoid buying life insurance, particularly long-term or complex products.

For instance, in September 2025, the life insurance industry experienced a 6.2% growth in new business premiums, primarily driven by the private sector, which saw a 10% increase. However, this growth came with challenges linked to economic uncertainty and slowing overall demand. Despite the premium increase, the number of policies sold fell nearly 9% during the same period, indicating a cautious market.

Opportunities

Rising Demand in Underpenetrated Markets

Emerging markets, especially India, offer a significant opportunity for life insurance growth. Despite rapid recent growth, insurance penetration in India remains low compared to global standards. Growing income levels, increased financial literacy, and regulatory reforms are creating fertile ground for expanding life insurance coverage. Young working adults form a large demographic with rising purchasing power, fueling demand for affordable life and retirement insurance products.

For instance, in September 2025, India’s life insurance industry witnessed rising demand in underpenetrated markets, with penetration at just 2.8% of GDP compared to the global average of 5.6%. This low penetration underscores a long-term growth opportunity fueled by increasing financial literacy, rising incomes, and expanding digital access.

Challenges

Regulatory Complexity and Market Fragmentation

Regulatory complexity is a significant challenge for life insurers operating globally. Different countries impose various rules regarding policy terms, capital requirements, and consumer protections. This patchwork of regulations increases compliance costs and complicates insurers’ ability to offer standardized products internationally. Rapidly changing regulations require frequent adjustments to business models and systems, adding operational stress.

Market fragmentation also reduces efficiency and customer experience. Insurers must invest heavily in technology and agile management to keep pace with these regulatory demands while ensuring seamless customer service across regions. Building strong regulatory relationships and optimizing capital allocation are critical for insurers to maintain profitability and competitiveness in this challenging environment.

For instance, in September 2025, the Indian government implemented a significant regulatory reform by reducing the GST on individual health and life insurance policies from 18% to 0%. This change also highlights ongoing regulatory fragmentation, as group policies continue to attract the previous 18% GST, creating different compliance requirements within the same market.

Latest Trends

Life insurance companies are increasingly adopting advanced technologies like artificial intelligence to transform their operations and customer experience. AI helps improve risk assessment and policy underwriting by analyzing vast amounts of data quickly and accurately. It enables insurers to generate personalized insurance policies tailored to individual needs, increasing efficiency and customer satisfaction.

Additionally, AI-powered chatbots provide 24/7 customer service, answering queries and assisting in claims, which boosts customer engagement and satisfaction. Automation of routine tasks through AI frees employees to focus on higher-value work, raising productivity.

For instance, in September 2025, KB Life Insurance in Korea became the first financial institution in the country to fully implement Microsoft 365 Copilot, leveraging generative AI to transform its operations. This adoption followed regulatory support via the Innovative Financial Services Act in 2024, enabling KB Life to build a smart, AI-enabled workplace that centralizes document management and fosters AI adoption among agents.

Key Players Analysis

The Life Insurance Market is led by major multinational insurers such as American International Group (AIG), Allianz SE, AXA Group, and MetLife, Inc. These companies operate across North America, Europe, and Asia, offering a wide range of life insurance products including term plans, whole life policies, and annuities. Their global presence, diversified portfolios, and strong financial stability position them as preferred providers for individuals and corporations.

Prominent North American and international players such as The Prudential Insurance Company of America, Berkshire Hathaway Life, and AIA Group Limited contribute significantly to market expansion. These insurers focus on retirement planning, wealth protection, and long-term savings products. Their strategies include digital underwriting, bancassurance partnerships, and tailored policies for high-net-worth and mass-market clients.

Asian market leaders such as China Life Insurance (Overseas) Company Limited, Ping An Insurance (Group) Company of China, Ltd., and Assicurazioni Generali S.p.A. strengthen the market through large customer bases, technology-driven distribution, and government-backed initiatives. With rising income levels and increasing financial awareness in emerging economies, these companies continue to shape the future of global life insurance services.

Top Key Players in the Market

- American International Group (AIG)

- Allianz SE

- AXA Group

- The Prudential Insurance Company of America

- MetLife, Inc.

- Berkshire Hathaway Life

- China Life Insurance (Overseas) Company Limited

- Ping An Insurance (Group) Company of China, Ltd.

- China Ping An Insurance (Group) Co., Ltd.

- AIA Group Limited

- Assicurazioni Generali S.p.A.

- Others

Recent Developments

- In July 2025, Canara HSBC Life Insurance launched ‘SecureInvest,’ a new unit-linked individual life insurance savings plan offering life cover up to 100 times the annualized premium. This product is designed to align with customers’ evolving financial goals across different life stages, combining substantial life cover with potential market-linked growth.

- In June 2025, Tata AIA Life Insurance launched two new equity funds aimed at supporting wealth creation and retirement planning. The Top 200 Alpha 30 Index Fund and the Top 200 Alpha 30 Index Pension Fund are tied to the Nifty 200 Alpha 30 Index and include up to 100% equity allocation.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Bn Forecast Revenue (2034) USD 11.0 Bn CAGR(2025-2034) 12.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type- Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Others. By Premium Range- Low, Medium, High. By Provider- Insurance Companies, Insurance Agents/Brokers, Insurtech Companies, Others. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape American International Group (AIG), Allianz SE, AXA Group, The Prudential Insurance Company of America, MetLife, Inc., Berkshire Hathaway Life, China Life Insurance (Overseas) Company Limited, Ping An Insurance (Group) Company of China, Ltd. China Ping An Insurance (Group) Co., Ltd., AIA Group Limited, Assicurazioni Generali S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American International Group (AIG)

- Allianz SE

- AXA Group

- The Prudential Insurance Company of America

- MetLife, Inc.

- Berkshire Hathaway Life

- China Life Insurance (Overseas) Company Limited

- Ping An Insurance (Group) Company of China, Ltd.

- China Ping An Insurance (Group) Co., Ltd.

- AIA Group Limited

- Assicurazioni Generali S.p.A.

- Others