Global Li-ion Battery for Evs Market Size, Share Analysis Report By Battery Type (Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Iron Phosphate (LFP), Lithium Manganese Oxide (LMO), Lithium Titanate Oxide (LTO), Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Others), By Application (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs)) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160207

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

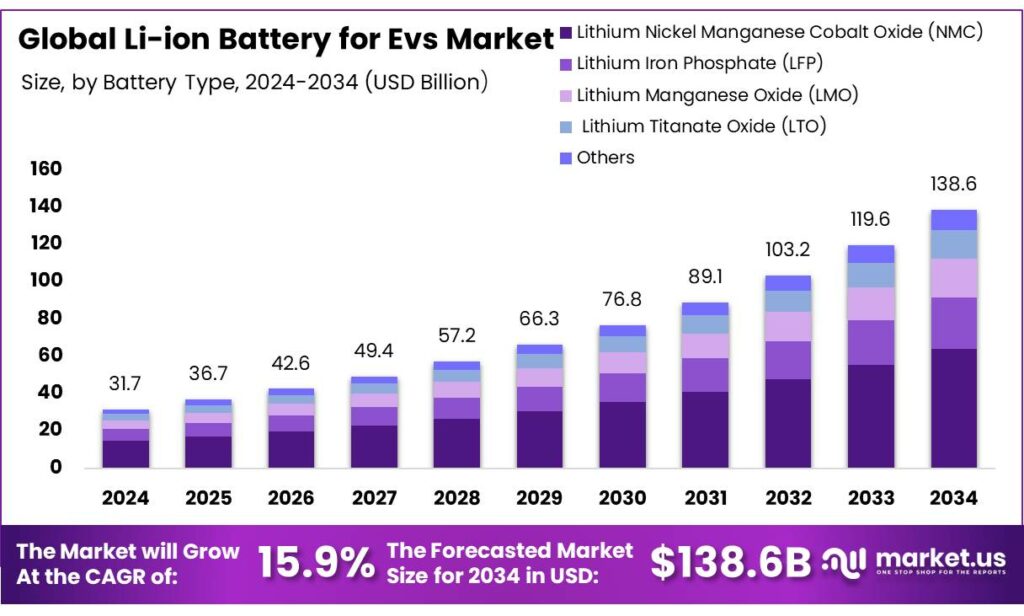

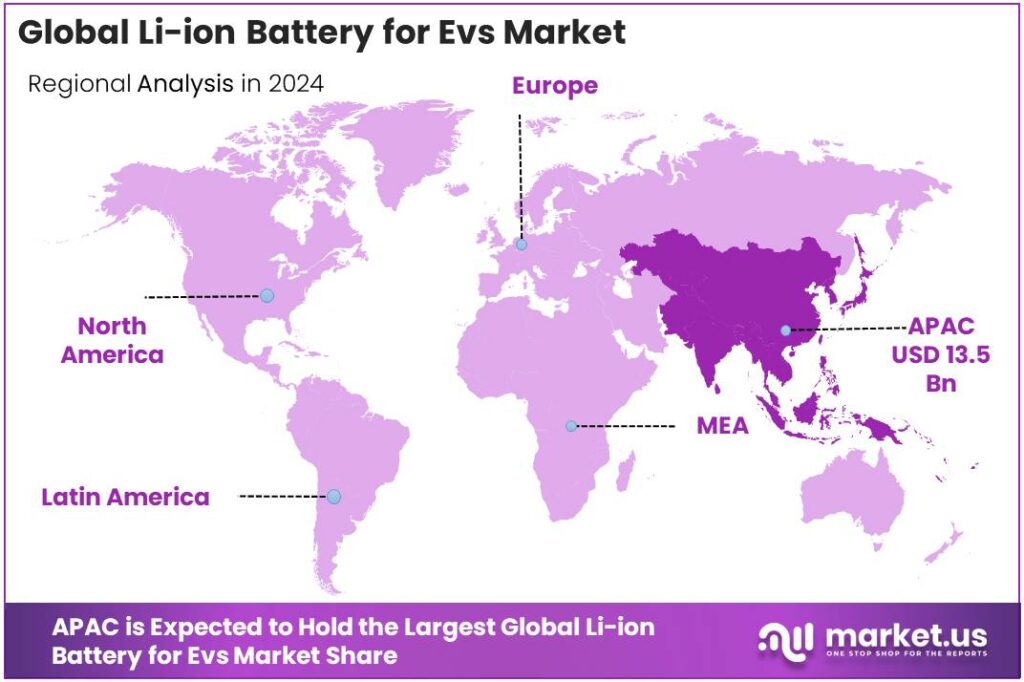

The Global Li-ion Battery for Evs Market size is expected to be worth around USD 138.6 Billion by 2034, from USD 31.7 Billion in 2024, growing at a CAGR of 15.9% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 42.8% share, holding USD 13.5 Billion in revenue.

In 2024, lithium-ion (Li-ion) batteries for electric vehicles (EVs) continued to constitute the principal energy storage technology underpinning the electrification of road transport. The technology was characterised by high energy density, established supply-chain processes, and steep scale-up in cell manufacturing capacity. Demand for EV batteries reached more than 750 GWh in 2023, reflecting a year-on-year increase of approximately 40% relative to 2022, and EV battery demand was projected to grow multiple times by 2030 under stated policy and current trajectory scenarios.

The industrial scenario is characterised by a rapid scale-up of cell manufacturing and an uneven geographic distribution of capacity. Global cell production capacity exceeded 3 terawatt-hours (TWh) in 2024, a level that has outpaced near-term demand and concentrated approximately 80–85% of capacity in China; such centralisation has influenced trade flows, margins and strategic policy responses in importing regions.

Driving factors for Li-ion adoption have been technological improvements, cost declines and regulatory intervention. Energy density gains and manufacturing learning curves have supported reductions in pack-level cost, while government incentives and procurement policies have stimulated fleet renewals.

- For example, the U.S. Bipartisan Infrastructure Law allocated funds to the Department of Energy amounting to more than USD 62 billion for clean energy programs, including battery manufacturing and recycling grants, and additional targeted awards (multi-billion USD rounds) to scale domestic cell production have been announced.

On the government-initiative side, several notable programs illustrate policy support. In the United States, the Bipartisan Infrastructure Law funds a $3 billion Battery Manufacturing and Recycling Grants Program to build local battery supply chain capacity. In January 2025, the U.S. Department of Energy announced intent to allocate approximately $725 million in new awards under the Battery Materials Processing and Battery Manufacturing Grant Program, within an overall $6 billion allocation. The U.S. also runs the Battery Workforce Initiative (BWI) to align training and skills development with the needs of advanced battery manufacturing.

Key Takeaways

- Li-ion Battery for Evs Market size is expected to be worth around USD 138.6 Billion by 2034, from USD 31.7 Billion in 2024, growing at a CAGR of 15.9%.

- Lithium Nickel Manganese Cobalt Oxide (NMC) held a dominant market position, capturing more than a 46.2% share.

- Passenger Cars held a dominant market position, capturing more than a 67.6% share.

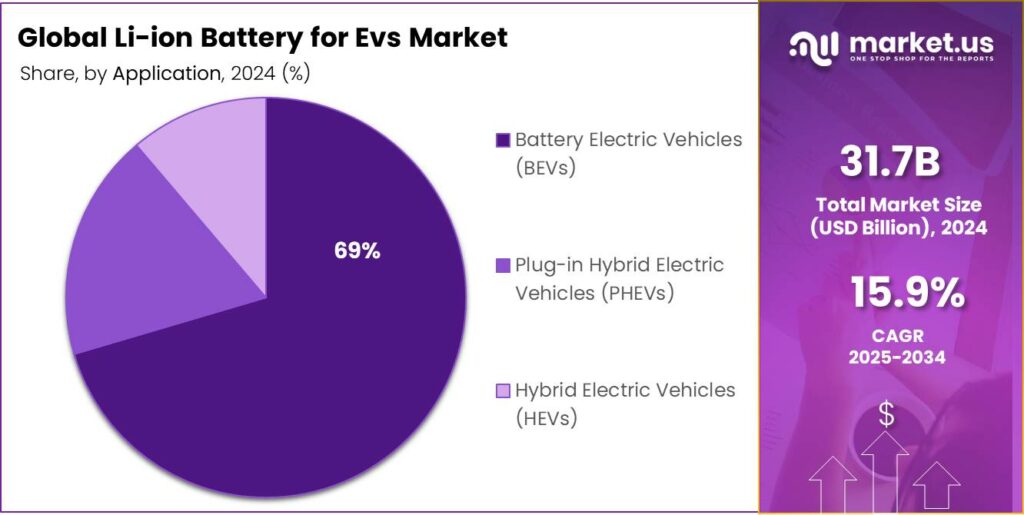

- Battery Electric Vehicles (BEVs) held a dominant market position, capturing more than a 69.1% share.

- Asia Pacific region accounted for a plurality of demand and investment in Li-ion batteries for electric vehicles, representing 42.8% of the regional split and USD 13.5 billion.

By Battery Type Analysis

NMC batteries held 46.2% in 2024 due to their balance of energy density, lifecycle and cost.

In 2024, Lithium Nickel Manganese Cobalt Oxide (NMC) held a dominant market position, capturing more than a 46.2% share. The position can be attributed to NMC’s favourable energy-to-weight ratio and its adaptability across passenger cars and light commercial vehicles. Manufacturing lines were optimised for NMC chemistries, which allowed pack-level cost reductions to be realized without major compromises in range or charging performance. As a result, vehicle makers adopted NMC cells for mid- and long-range models where a compromise between cycle life and energy density was required.

Demand patterns were driven by OEM specifications and procurement for 2024 production ramps, while supply strategies focused on securing precursor materials and scale economies. Manufacturing processes were increasingly automated and downstream integration into module and pack assembly was emphasised to contain costs and improve quality consistency.

By Vehicle Type Analysis

Passenger Cars dominate with 67.6% share in 2024, driven by rising EV adoption and strong consumer demand.

In 2024, Passenger Cars held a dominant market position, capturing more than a 67.6% share. This leadership was driven by the rapid electrification of personal mobility, as households and individuals increasingly chose electric options over conventional vehicles. Passenger cars, being the largest category of road transport, saw strong adoption of Li-ion batteries as automakers expanded their EV portfolios to meet consumer demand for higher range, efficiency, and lower operating costs. The majority of battery demand in 2024 came from this segment, supported by government incentives, stricter emission standards, and growing consumer confidence in EV technologies.

Automakers are launching new models across different price ranges, from affordable compact EVs to luxury sedans and SUVs, all equipped with advanced Li-ion battery packs. Infrastructure growth, particularly in fast-charging networks, is also enhancing adoption rates, ensuring passenger vehicles remain the primary driver of battery consumption.

By Application Analysis

Battery Electric Vehicles (BEVs) lead with 69.1% share in 2024, driven by full electrification trends and strong policy support.

In 2024, Battery Electric Vehicles (BEVs) held a dominant market position, capturing more than a 69.1% share. This strong position reflected the global shift toward complete electrification of mobility, as BEVs operate solely on Li-ion batteries without relying on hybrid systems. The segment’s dominance was supported by rising government incentives, stricter emission reduction targets, and significant investments by automakers in all-electric product lines. Consumers increasingly favored BEVs for their zero tailpipe emissions, lower maintenance costs, and improvements in driving range, which helped strengthen their market leadership.

BEVs are expected to continue expanding their share as technology advancements deliver higher energy density and faster charging solutions. Automakers are accelerating BEV launches across multiple price categories, from entry-level compact cars to premium long-range vehicles, broadening accessibility for different consumer groups. Expanding charging infrastructure, particularly in urban areas and along highways, is further reinforcing consumer confidence in adopting BEVs as a practical everyday mobility solution.

Key Market Segments

By Battery Type

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Manganese Oxide (LMO)

- Lithium Titanate Oxide (LTO)

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Others

By Application

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

Emerging Trends

Falling Battery Pack Costs & Shift in Chemistry Mix

One of the strongest and most visible trends in the Li-ion battery world for EVs is the sharp decline in battery pack costs, which is enabling new vehicle pricing models and pushing shifts in battery chemistry preferences. This cost fall is not just hypothetical — it is happening now, and it’s reshaping how automakers and battery makers plan ahead.

In 2025, the U.S. Department of Energy published a report showing that battery costs for light-duty EVs have dropped to about USD 128–133 per kWh, down from the ~USD 150/kWh level used in prior models. This kind of cost reduction is significant: every USD 1 drop in the cost per kWh translates into tens to hundreds of dollars less in vehicle cost, especially for large battery packs used in SUVs or long-range sedans. The goal for many research programs is to push pack costs below USD 75/kWh by 2030, while still offering a driving range of 300 miles (≈480 km).

This cost pressure is forcing battery makers to rethink design, materials, and scale. For example, in 2024 battery pack prices reportedly dropped 20% — the steepest one-year decline since 2017 — driven by softness in critical mineral prices and intense competition. Lithium itself dropped nearly 20% in 2024 even though battery demand was much higher than years past.

Accompanying cost declines is another key shift: chemistry mix rebalancing, especially toward LFP (lithium iron phosphate) and cobalt-lite variants. Because LFP eliminates cobalt, reduces cost, and has excellent thermal stability, many manufacturers are choosing it for mass market and mid-range models. Reports suggest that LFP share is steadily rising in China and other regions. Meanwhile, higher energy density chemistries (like NMC, NCA) remain in use for premium / long-range segments, but the balance is shifting.

Drivers

Policy and Incentive Support from Governments

Consider the United States: it has committed USD 3 billion through a Battery Manufacturing and Recycling Grants Program to support domestic battery capacity building. This grant is part of the broader Bipartisan Infrastructure Law aiming to secure the battery supply chain within North America. Simultaneously, a twin program—the Battery Materials Processing Grants Program—also plans to deploy USD 3 billion to boost the capacity for refining, processing, and manufacturing battery materials locally. Together, these funds lower entry barriers, spur new plants, and de-risk capital expenditure.

India offers another illustrative case. The government’s Production-Linked Incentive (PLI) scheme includes a dedicated Rs 18,000 crore (≈USD 2.5 billion) “Advanced Chemistry Cell (ACC)” plan focused on battery and energy storage technologies. This is in addition to a Rs 26,000 crore scheme for electric vehicle and hydrogen vehicle manufacturing, and Rs 10,000 crore for its FAME (Faster Adaption and Manufacturing of Electric Vehicles) scheme. By directly subsidizing cell production, these measures push domestic manufacturing growth, attract foreign partnerships, and reduce dependence on imports.

Such policy support is not just about funding — it signals long-term political will. Investors see that a government is serious about clean mobility when it enforces regulatory targets, supports charging infrastructure, and enacts standards. For example, the United States also channels efforts toward workforce development via the Battery Workforce Initiative (BWI), helping ensure trained human capital to support the scaling industry.

Restraints

Raw Material Supply Volatility and Dependence

To begin with, the supply chain is highly concentrated. For example, more than 92% of global anode (graphite) production comes from China, making many countries vulnerable to import risk and trade restrictions. When a dominant supplier country changes policy or imposes export restrictions, the ripple effects are immediate. China has previously limited graphite exports under national security rationales, which can push global prices upward.

Further, prices of raw materials fluctuate, which impacts battery costs. In 2023, global supply of cobalt and nickel exceeded demand by 6.5 % and 8 % respectively, and lithium supply exceeded demand by over 10 %, which helped suppress prices temporarily. But these surpluses are fragile and sensitive to mine disruptions, logistics constraints, or policy shifts.

But these surpluses are fragile and sensitive to mine disruptions, logistics constraints, or policy shifts. If new supply announcements are delayed or falter, the gap could place upward pressure on costs and slow down EV adoption.

Another facet of the raw material challenge is the environmental, regulatory, and community resistance to new mining. Extracting lithium or cobalt often involves water usage, land disturbance, chemical by-products, and potential pollution. Local communities may resist expansion of mines or processing plants, especially where environmental standards are weaker or oversight is weak. This resistance slows permit approvals, increases cost, and adds risk.

Even governments feel this pinch. In the United States, the Li-Bridge initiative documents that >75 % of global battery cell production and >70% of processed battery materials are controlled by China, making the U.S. supply chain vulnerable to geopolitical shifts. Because of that, U.S. policy seeks to invest in domestic critical minerals and processing.

Opportunity

Battery Recycling & Circular Supply Chains

One of the most promising growth levers for the lithium-ion battery industry in EVs lies in the expansion of battery recycling and circular supply chains. As electric vehicles proliferate and more battery packs reach their end of life, the resources embedded inside them—lithium, cobalt, nickel, manganese, graphite—can be reclaimed and fed back into new battery production. This “urban mining” model reduces reliance on fresh mining, lowers long-term cost risk, and enhances sustainability.

In 2023, the United States had domestic battery recycling capacity sufficient to reclaim 35,500 tons of battery materials. That same year, intermediate processing facilities handled about 175,000 tons of battery and manufacturing scrap, with plans to process an additional 198,000 tons in coming years. The scaling is accelerating: battery recycling capacity globally is growing at around 50% year-on-year (as per IEA / related data). The IEA further projects that, if all announced projects are realized, global recycling capacity could exceed 1,500 GWh by 2030, of which about 70% would lie in China.

These numbers hint at a vast untapped opportunity. Today, only a fraction of retired EV batteries get recycled properly; many sit idle, are discarded, or are underutilized. As the volume of grid-deployed and automotive batteries increases, the feedstock for recycling will grow steeply. Capturing even 20–30 % of that flow could supply meaningful portions of raw materials for new battery manufacturing, helping counter supply constraints and reducing exposure to price volatility.

Governments are already backing this push. In the U.S., the Battery Manufacturing and Recycling Grants Program offers USD 3 billion in grants aimed at building manufacturing and recycling capacity. In parallel, a Battery Materials Processing Grants Program also allocates USD 3 billion to expand domestic capabilities in refining and material processing. In 2025, the Department of Energy issued a Notice of Intent to distribute around USD 725 million in the next round of awards under this program. On a smaller scale, the U.S. Battery and Critical Mineral Recycling Program budgets USD 125 million for R&D and demonstration grants to improve recycling technologies.

Regional Insights

Asia Pacific leads with a 42.8% share and USD 13.5 billion in 2024, driven by China’s manufacturing scale and supportive regional policies.

In 2024, the Asia Pacific region accounted for a plurality of demand and investment in Li-ion batteries for electric vehicles, representing 42.8% of the regional split and USD 13.5 billion in market value. This position was supported by exceptionally large cell and materials capacity concentrated in China, which remained the world’s principal battery manufacturing hub, producing well over two-thirds of global EV output and a majority of cell and precursor capacity.

Domestic policy measures across the region have reinforced this industrial lead: India’s central schemes (FAME II and related manufacturing promotion programmes) have mobilised multi-thousand crore rupee allocations to stimulate vehicle electrification and domestic assembly, while Indonesia has used local-content rules and tax incentives to attract upstream battery material and cell investments.

The industrial scenario has been defined by vertically integrated value chains, fast capacity additions, and a focus on localisation of cathode/anode precursor production to secure supply and reduce import dependence. Regional governments have combined demand incentives with production linked schemes and VAT/tax concessions to lower consumer prices and to accelerate plant commissioning, which in turn supported the USD 13.5 billion market footprint recorded in the period.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Panasonic Corporation remains one of the most recognized global leaders in Li-ion batteries for EVs, with long-term partnerships, notably with Tesla, for supplying cylindrical cells. The company has invested heavily in Gigafactory projects in the U.S. and Japan to expand production capacity. In 2024, Panasonic focused on improving energy density and reducing cobalt content in its NCA and NMC chemistries. Its commitment to technological innovation and global collaborations has positioned it as a vital player in the EV battery ecosystem.

BYD Company Limited has grown as both an EV manufacturer and a key battery supplier, leveraging its in-house Blade Battery based on LFP chemistry. By 2024, BYD not only powered its own expanding lineup of passenger cars and buses but also supplied external automakers, reinforcing its dual role in the industry. Its innovation in safer, cost-effective, and long-life batteries has made it a strong competitor globally. BYD’s vertical integration strategy ensures competitive advantage across manufacturing, vehicles, and energy solutions.

A123 Systems LLC, originally founded in the United States and later acquired by Chinese investors, is recognized for its expertise in advanced lithium iron phosphate (LFP) battery technologies. By 2024, the company continued to serve both automotive and commercial applications, focusing on high-power density solutions suitable for hybrid and electric vehicles. While its scale is smaller compared to larger rivals, A123 remains competitive through its innovation in safety, performance, and specialized applications, making it an important niche contributor to the EV battery market.

Top Key Players Outlook

- Panasonic Corporation

- LG Chem Ltd.

- Contemporary Amperex Technology Co. Limited (CATL)

- BYD Company Limited

- SK Innovation Co., Ltd.

- A123 Systems LLC

- GS Yuasa Corporation

- Johnson Controls International plc

- Saft Groupe S.A.

- Toshiba Corporation

Recent Industry Developments

In 2024, BYD Company Limited strengthened its position both as an EV maker and as a major Li-ion battery installer. The company sold 4,272,145 new energy vehicles globally, up about 41.3% from 2023, with 1,764,992 being battery electric vehicles (BEVs) (12% growth YOY) and 2,485,378 plug-in hybrids (PHEVs) (up 72.8%) of its total.

In 2024, CATL sold 475 GWh of lithium-ion batteries, which marks a 21.79% rise from 2023. Of this total, 381 GWh were power battery systems, growing by 18.85%, and 93 GWh were energy storage batteries, which jumped by 34.32% year-on-year.

Report Scope

Report Features Description Market Value (2024) USD 31.7 Bn Forecast Revenue (2034) USD 138.6 Bn CAGR (2025-2034) 15.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Iron Phosphate (LFP), Lithium Manganese Oxide (LMO), Lithium Titanate Oxide (LTO), Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Others), By Application (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Panasonic Corporation, LG Chem Ltd., Contemporary Amperex Technology Co. Limited (CATL), BYD Company Limited, SK Innovation Co., Ltd., A123 Systems LLC, GS Yuasa Corporation, Johnson Controls International plc, Saft Groupe S.A., Toshiba Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Li-ion Battery for Evs MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Li-ion Battery for Evs MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Panasonic Corporation

- LG Chem Ltd.

- Contemporary Amperex Technology Co. Limited (CATL)

- BYD Company Limited

- SK Innovation Co., Ltd.

- A123 Systems LLC

- GS Yuasa Corporation

- Johnson Controls International plc

- Saft Groupe S.A.

- Toshiba Corporation