Global Lead Carbon Battery Market Size, Share, And Enhanced Productivity By Type (Pure Lead Carbon Batteries, Modified Lead Carbon Batteries), By Technologyn(Flooded Lead Carbon Batteries, Valve-Regulated Lead Carbon Batteries (VRLA)), By Application (Renewable Energy Storage, Telecommunication, Uninterruptible Power Supply (UPS), Electric Vehicles and Hybrid Vehicles, Grid Stabilization, Others), By End-User (Energy and Utilities, Transportation, IT and Telecom, Industrial and Commercial Sectors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167325

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

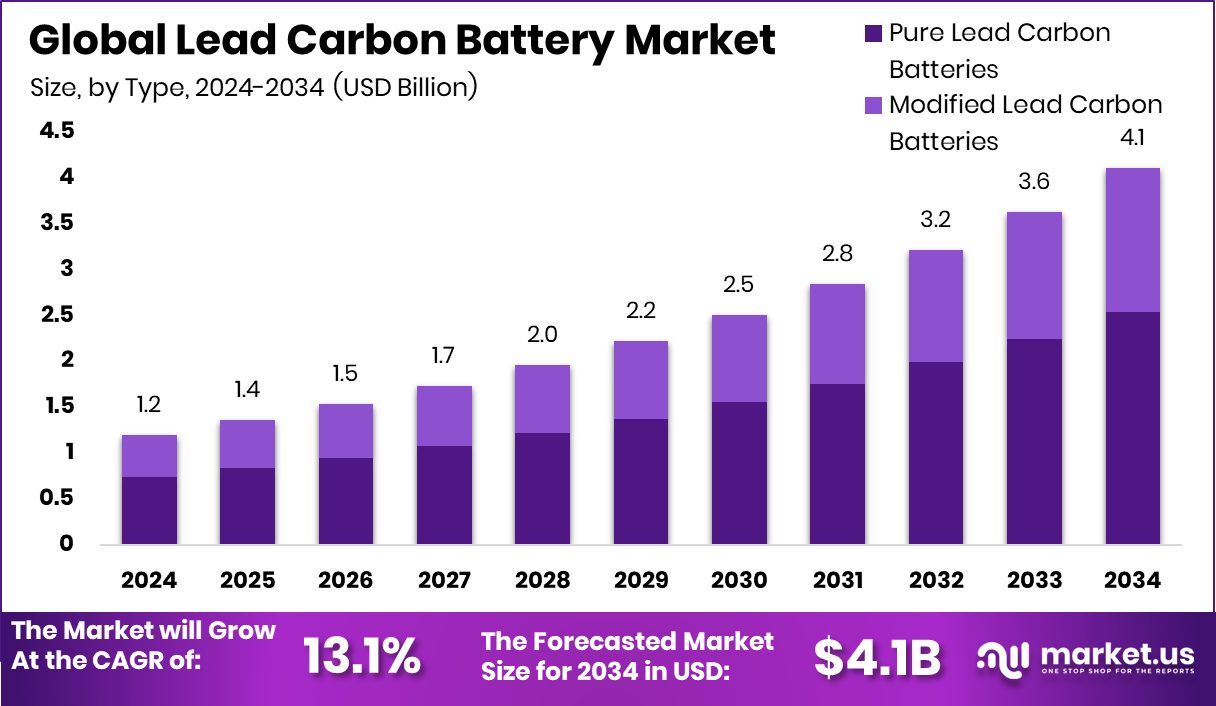

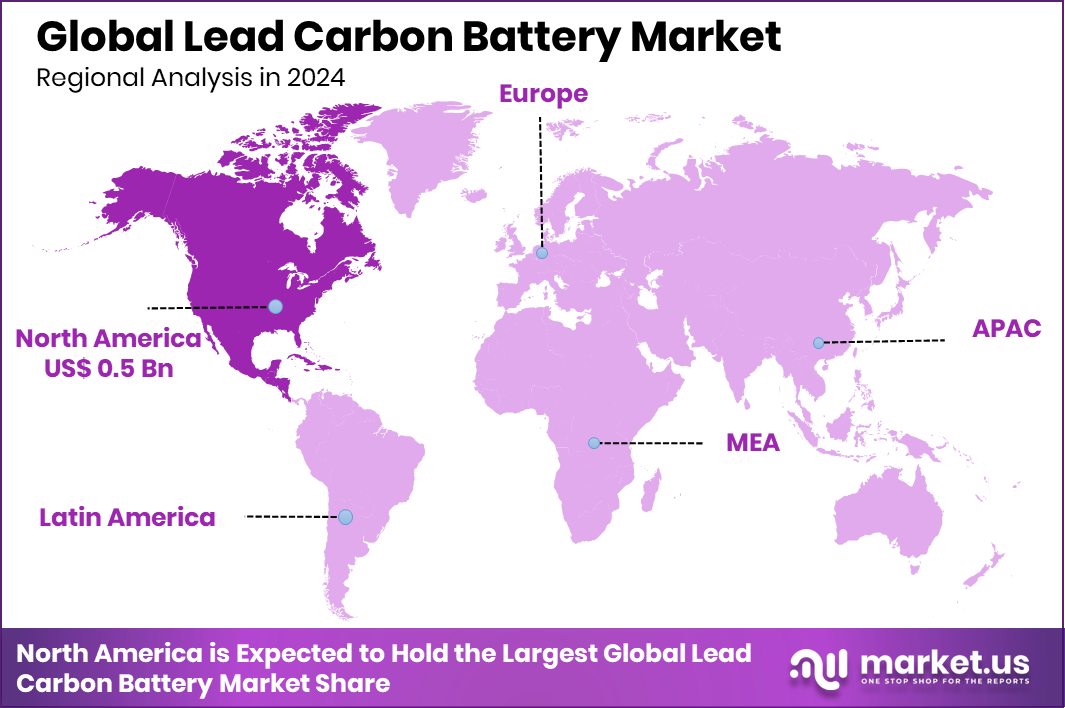

The Global Lead Carbon Battery Market is expected to be worth around USD 4.1 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 13.1% from 2025 to 2034. Funding and renewable demand support North America’s USD 0.5 Bn market value.

A Lead Carbon Battery is a modified form of lead-acid technology where carbon is added to the negative electrode to reduce sulfation, improve charge acceptance, and extend cycle life. This makes it suitable for renewable energy storage, backup systems, and microgrids where batteries face frequent charge–discharge cycles. The battery offers longer durability, better performance at partial state of charge, and greater reliability than conventional flooded or VRLA systems.

The Lead Carbon Battery Market is growing as industries shift toward energy storage solutions supporting solar, wind, telecom backup power, and grid-support applications. The demand is increasing because these batteries offer a balance between cost, safety, and lifecycle, especially in regions with rising renewable installations and unstable grid infrastructure.

Growth is further shaped by strong innovation and investments in battery technology. Projects such as UT Dallas leading a $30 million battery initiative and Porsche participating in Group14’s $400M Series C round strengthen global interest in advanced energy storage.

Demand also benefits from clean-energy deployment, where funding flows continue. Sicona Battery Technologies securing AUD22 million and Verkor raising €2B for a low-carbon battery gigafactory reflect rising production momentum.

Opportunities expand as governments push for decarbonization. Programs like the DOE’s $1.8B carbon initiative and the U.S. awarding $1.2B to carbon air-capture hubs show supportive policy frameworks that will indirectly boost storage ecosystems where lead carbon batteries remain competitive.

Key Takeaways

- The Global Lead Carbon Battery Market is expected to be worth around USD 4.1 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 13.1% from 2025 to 2034.

- Pure Lead Carbon Batteries hold a 61.9% share, driving efficiency and long-cycle performance in the Lead Carbon Battery Market.

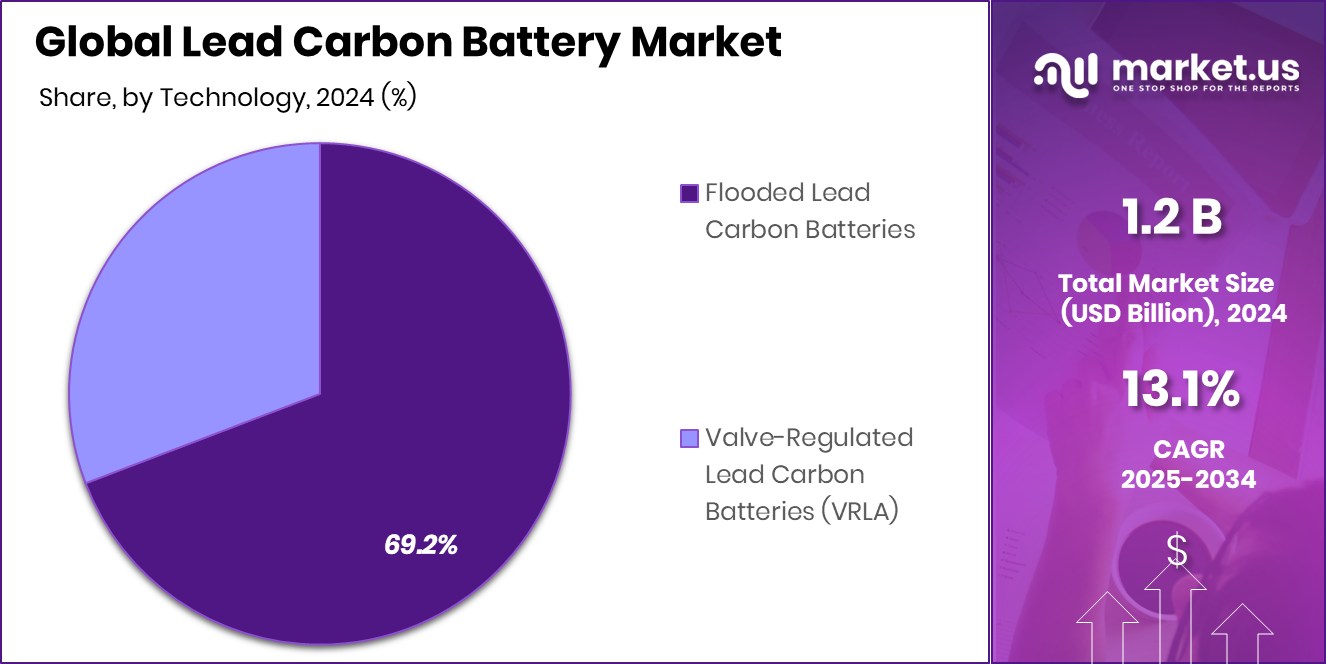

- Flooded Lead Carbon Batteries lead with 69.2%, supporting rugged storage needs across industrial and off-grid environments.

- Renewable Energy Storage captures 35.7%, as the Lead Carbon Battery Market benefits from growing solar and wind systems.

- Energy and Utilities dominate with 38.8%, boosting long-duration storage adoption in the Lead Carbon Battery Market.

- The 43.80% market share shows strong Lead Carbon Battery adoption across North America.

By Type Analysis

In 2024, Pure Lead Carbon Batteries held 61.9%, dominating the Lead Carbon Battery Market.

In 2024, Pure Lead Carbon Batteries held a dominant market position in the By Type segment of the Lead Carbon Battery Market, with a 61.9% share. This strong preference reflects their longer cycle life, better charge efficiency, and improved performance under partial-state-of-charge conditions, making them suitable for renewable storage, telecom backup, and grid applications.

The higher share also signals rising demand from solar-linked microgrids and energy storage systems, where consistent cycling and reliability matter. Their durability and reduced sulfation benefit end-users seeking stable long-term storage solutions without frequent replacements. As energy systems continue shifting toward cleaner and more distributed setups, Pure Lead Carbon Batteries maintain traction due to their balance of cost, lifespan, and operational stability.

By Technology Analysis

Flooded Lead Carbon Battery technology led the market with a strong 69.2% share.

In 2024, Flooded Lead Carbon Batteries held a dominant market position in the By Technology segment of the Lead Carbon Battery Market, with a 69.2% share. This leadership reflects their suitability for applications requiring deep cycling, stable backup performance, and cost-efficient storage. Their design allows easier maintenance and longer operational life in environments where batteries undergo frequent charge–discharge patterns, especially in renewable storage and off-grid installations.

The higher adoption also indicates user preference for proven technology that balances performance and affordability. With growing interest in energy storage for industrial and utility support, Flooded Lead Carbon Batteries continue to hold traction due to their reliability, operational endurance, and suitability for large-scale deployments.

By Application Analysis

Renewable energy storage accounted for 35.7%, supporting cleaner Lead Carbon Battery Market growth.

In 2024, Renewable Energy Storage held a dominant market position in the By Application segment of the Lead Carbon Battery Market, with a 35.7% share. This leadership reflects the growing shift toward cleaner power systems and the need for dependable storage to manage solar and wind fluctuations. Lead carbon technology supports frequent cycling and partial-state-of-charge operation, making it a practical fit for microgrids, hybrid power solutions, and off-grid renewable projects.

The higher share also indicates increasing adoption in community-scale energy systems and rural electrification efforts where dependable backup and cost stability matter. As renewable capacity expands across global markets, the use of lead-carbon batteries in storage roles continues to strengthen due to performance stability and lifecycle advantages.

By End-User Analysis

Energy and utilities remained the top end-user with 38.8% market share.

In 2024, Energy and Utilities held a dominant market position in the By End-User segment of the Lead Carbon Battery Market, with a 38.8% share. This leading position reflects the increasing demand for reliable storage solutions to support grid stability, renewable integration, and peak-load management. Lead carbon technology offers long cycling capability and stable performance in partial-state-of-charge environments, making it a suitable option for power networks and distributed energy systems.

The higher share also signals growing adoption in substation backup, frequency regulation, and long-duration storage setups. As utilities continue to modernise infrastructure and expand renewable-linked storage, Lead Carbon Batteries remain a preferred choice due to lifecycle stability and operational resilience.

Key Market Segments

By Type

- Pure Lead Carbon Batteries

- Modified Lead Carbon Batteries

By Technology

- Flooded Lead Carbon Batteries

- Valve-Regulated Lead Carbon Batteries (VRLA)

By Application

- Renewable Energy Storage

- Telecommunication

- Uninterruptible Power Supply (UPS)

- Electric Vehicles and Hybrid Vehicles

- Grid Stabilization

- Others

By End-User

- Energy and Utilities

- Transportation

- IT and Telecom

- Industrial and Commercial Sectors

- Others

Driving Factors

Rising Renewable Energy Projects Boost Demand

The key driving factor for the Lead Carbon Battery Market is the growing need for reliable energy storage to support renewable power systems. As solar and wind capacity expands, storage solutions that handle frequent charge and discharge cycles become essential, and lead-carbon technology fits well due to its longer life and stability. Government initiatives are also supporting this growth.

For example, India announced a Rs 5,400 crore funding scheme to build 30 GWh battery energy storage, which encourages large-scale deployment. Additionally, India introduced a new $631 million funding plan for battery storage and waived inter-state transmission charges, helping reduce project costs. These steps create a strong push for storage systems where lead-carbon batteries can play an important role.

Restraining Factors

High Competition From New Battery Technologies

One major restraining factor for the Lead Carbon Battery Market is the rising competition from newer battery technologies that offer higher energy density, lighter weight, and reduced maintenance needs. As industries adopt advanced storage systems, lead-carbon batteries face pressure to justify their value in long-term applications. Some users prefer alternatives that support faster charging and require less maintenance, especially in mobile and high-performance environments.

Shifting demand patterns are also influenced by digital connectivity and expanding telecom networks. For example, Telecom startup Wiom raised $35 million to provide affordable internet across India, which reflects rising demand for modern and scalable power backup systems. As these sectors grow, competition from more advanced chemistries may slow the adoption pace of lead-carbon batteries.

Growth Opportunity

Expanding Energy Storage Projects Create New Opportunities

A key growth opportunity for the Lead Carbon Battery Market comes from the increasing focus on large-scale energy storage systems used in renewable power and grid support. As more countries invest in solar and wind capacity, the need for stable and long-life storage solutions grows. Lead carbon batteries offer good performance for frequent cycling, making them suitable for microgrids, hybrid systems, and rural electrification. Recent financial support programs are helping accelerate this shift.

For example, ACME Hybrid Urja secured ₹3,184 crore in funding from REC, reinforcing investment in hybrid clean energy projects. Similarly, Spain announced a €700 million initiative to boost energy storage and renewable power, which opens more opportunities for battery deployment. These funding moves create strong market potential for leading carbon storage solutions in the coming years.

Latest Trends

Growing Adoption of Smart and AI-Enabled Storage

One of the latest trends in the Lead Carbon Battery Market is the shift toward smarter and AI-enabled energy storage systems. As renewable power grows, energy storage is not just about holding electricity but also managing when and how it is used. Lead carbon batteries are increasingly integrated with digital platforms to support peak shaving, grid balancing, and automated energy trading. This trend is supported by new funding in digital energy solutions.

For example, Suena Energy raised €8 million to automate renewable storage trading using AI, showing how software and storage are becoming linked. In addition, Celero Communications’ securing $140 million strengthens AI-driven connectivity infrastructure, which indirectly supports smarter grid ecosystems where advanced battery systems can be optimised.

Regional Analysis

North America holds a 43.80% share worth USD 0.5 Bn in 2024.

North America leads the Lead Carbon Battery Market with a strong 43.80% share valued at USD 0.5 Bn, driven by increasing renewable storage use and the need for reliable backup power systems across utilities and commercial applications. The high adoption also reflects growing investment in grid modernisation and energy storage deployment, where cycling performance and stable operation matter.

Europe shows steady uptake as countries expand renewable infrastructure and focus on long-duration storage to support solar and wind variability. The region’s interest in storage-ready energy systems supports consistent deployment across utility, industrial, and commercial segments.

Asia Pacific continues to move forward as renewable deployment accelerates in developing markets seeking cost-efficient storage solutions. The growing push toward solar-linked storage and off-grid electrification boosts interest in batteries suitable for frequent cycling.

The Middle East & Africa reflect emerging demand linked to hybrid power solutions in remote and high-temperature environments where durable backup is required. Latin America shows gradual progress as energy storage becomes part of regional clean-energy and electrification planning.

Overall, interest continues to expand as regions strengthen renewable capacity, backup reliability, and distributed power architecture, with North America remaining the strongest contributor based on the provided values.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the 2024 Lead Carbon Battery Market, ShuangDeng plays a noticeable role as the technology continues gaining traction in renewable storage, telecom backup, and grid-support systems. The company benefits from rising interest in long-cycle energy storage, where durability and operational stability matter. Its focus on improving lifecycle performance and charge acceptance positions it well as storage requirements grow across microgrids and utility-linked installations.

China Tianneng remains active in the evolving energy storage landscape as demand increases for solutions supporting solar and distributed power. With growing attention on partial-state-of-charge performance and cycling efficiency, the company stands aligned with market needs driven by clean-energy deployment and expanding storage applications. Its involvement reflects the transition toward solutions supporting long-term and resilient power infrastructure.

Meanwhile, Furukawa continues to contribute to market growth through involvement in lead-based energy storage applications where reliability and stable discharge patterns are essential. The company remains relevant in applications requiring dependable backup power and long service life. As energy systems expand to support renewable power and grid flexibility, Furukawa is positioned to benefit from sectors prioritising cost balance, maintenance stability, and long-term operational value.

Top Key Players in the Market

- ShuangDeng

- China Tianneng

- Furukawa

- Eastpenn

- Sacred Sun

- Huafu Energy Storage

- Axion

Recent Developments

- In April 2025, ShuangDeng launched an immersion cooling lithium-battery system, marking a technical leap in high-rate and high-density energy storage applications.

- In March 2025, Tianneng announced that it is now delivering “lead-carbon + lithium battery” dual-route technology solutions, with multiple energy-storage projects such as the Huzhou Changxing Jinling Substation Energy Storage Project.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 4.1 Billion CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pure Lead Carbon Batteries, Modified Lead Carbon Batteries), By Technologyn(Flooded Lead Carbon Batteries, Valve-Regulated Lead Carbon Batteries (VRLA)), By Application (Renewable Energy Storage, Telecommunication, Uninterruptible Power Supply (UPS), Electric Vehicles and Hybrid Vehicles, Grid Stabilization, Others), By End-User (Energy and Utilities, Transportation, IT and Telecom, Industrial and Commercial Sectors, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ShuangDeng, China Tianneng, Furukawa, Eastpenn, Sacred Sun, Huafu Energy Storage, Axion Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lead Carbon Battery MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Lead Carbon Battery MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ShuangDeng

- China Tianneng

- Furukawa

- Eastpenn

- Sacred Sun

- Huafu Energy Storage

- Axion