Global Laryngoscopes Market By Device Type (Direct Laryngoscopes and Indirect Laryngoscopes), By Type (Video Laryngoscopes and Flexible Fiberoptic Laryngoscopes), By Usability (Reusable and Disposable), By Blade Design (Macintosh Blade, Miller Blade and Others), By Application (Airway Management, Diagnostic Procedures, Therapeutic Interventions, Training and Education), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172421

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Device Type Analysis

- Type Analysis

- Usability Analysis

- Blade Design Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

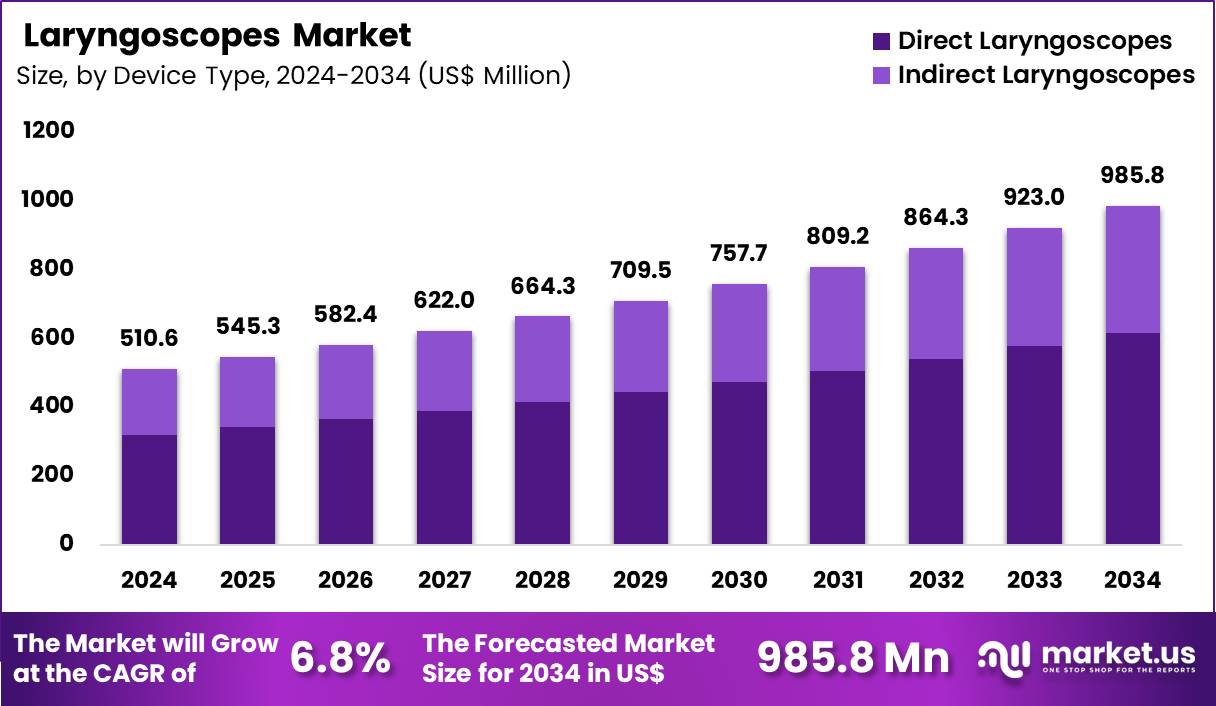

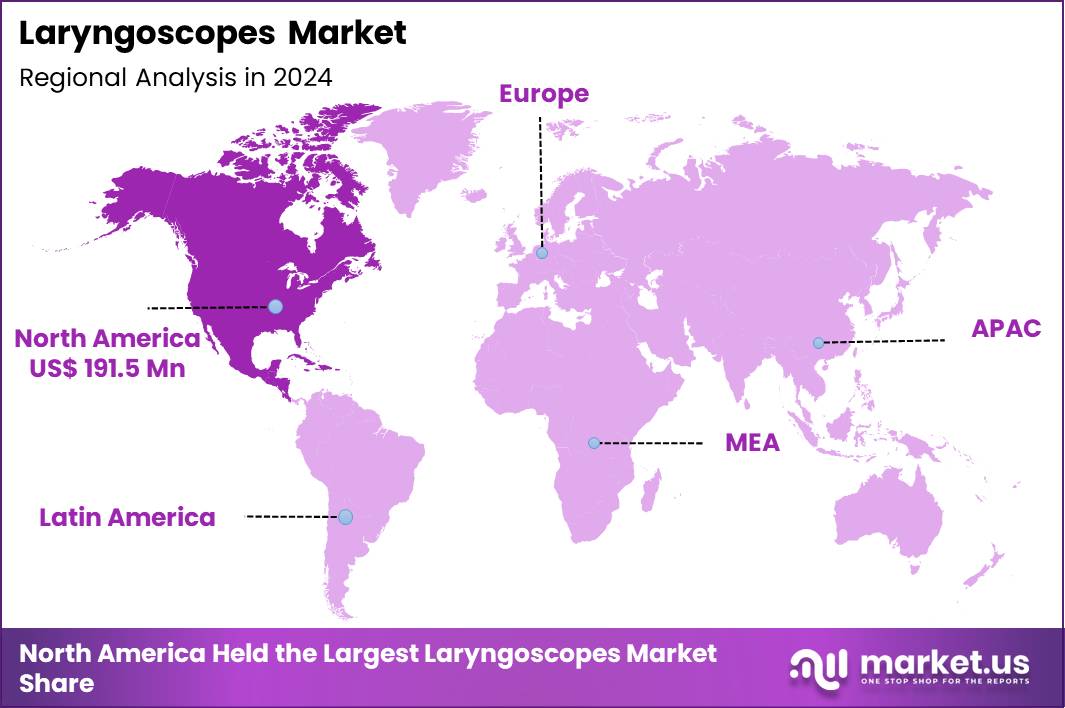

The Global Laryngoscopes Market size is expected to be worth around US$ 985.8 Million by 2034 from US$ 510.6 Million in 2024, growing at a CAGR of 6.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.5% share with a revenue of US$ 191.5 Billion.

Growing demand for advanced airway management tools propels the laryngoscopes market as clinicians prioritize devices that ensure rapid and reliable intubation in critical scenarios. Anesthesiologists routinely employ video laryngoscopes to visualize the glottis indirectly, facilitating successful tracheal tube placement in patients with anticipated difficult airways.

Emergency physicians utilize these instruments for rapid sequence intubation during resuscitation efforts, managing obstructed airways in trauma and cardiac arrest cases. Surgeons apply laryngoscopes in otolaryngology procedures to expose vocal cords for biopsy, laser treatments, and foreign body removal. Pediatric specialists select curved-blade variants to accommodate smaller anatomies during congenital anomaly corrections and tonsillectomies.

In November 2024, Verathon broadened its portfolio of single-use laryngoscopes by introducing variants designed with recyclable packaging. This shift responds to tightening environmental standards while maintaining the infection-control advantages of disposable devices. The development supports market growth by helping hospitals meet sustainability targets without reverting to reusable equipment, accelerating the transition toward single-use laryngoscopes in acute and perioperative settings.

Manufacturers seize opportunities to enhance hyperangulated blade designs that improve success rates in patients with limited neck mobility or cervical spine precautions. Developers integrate anti-fogging coatings and high-intensity LED illumination to maintain clear views during prolonged intubations in bariatric surgery. These devices expand applications in intensive care units for awake fiberoptic intubations, guiding tube placement in critically ill patients with predicted ventilation challenges.

Opportunities emerge in combining laryngoscopy with stylet systems for guided insertion in maxillofacial trauma cases requiring minimal cervical manipulation. Companies advance compact, portable models suitable for prehospital emergency services, enabling first responders to secure airways in out-of-hospital cardiac arrest scenarios. Firms pursue customizable handle grips and blade lengths to optimize ergonomics across diverse procedural requirements in neonatal intensive care.

Industry leaders incorporate wireless connectivity into video laryngoscopes, allowing real-time transmission of airway views for remote consultation during complex intubations. Developers refine disposable blade-sheath hybrids that combine single-use hygiene with reusable handle durability in high-volume operating theaters. Market participants launch augmented reality overlays that project anatomical landmarks onto live video feeds, assisting trainees in educational simulation environments.

Innovators embed artificial intelligence algorithms to predict intubation difficulty scores based on initial laryngeal views in emergency departments. Companies prioritize battery-free designs utilizing ambient light amplification for resource-constrained procedural settings. Ongoing advancements emphasize multichannel recording capabilities that capture audio-visual data for quality assurance and debriefing in airway management training programs.

Key Takeaways

- In 2024, the market generated a revenue of US$ 510.6 Million, with a CAGR of 6.8%, and is expected to reach US$ 985.8 Million by the year 2034.

- The device type segment is divided into direct laryngoscopes and indirect laryngoscopes, with direct laryngoscopes taking the lead in 2024 with a market share of 62.6%.

- Considering type, the market is divided into video laryngoscopes and flexible fiberoptic laryngoscopes. Among these, video laryngoscopes held a significant share of 71.4%.

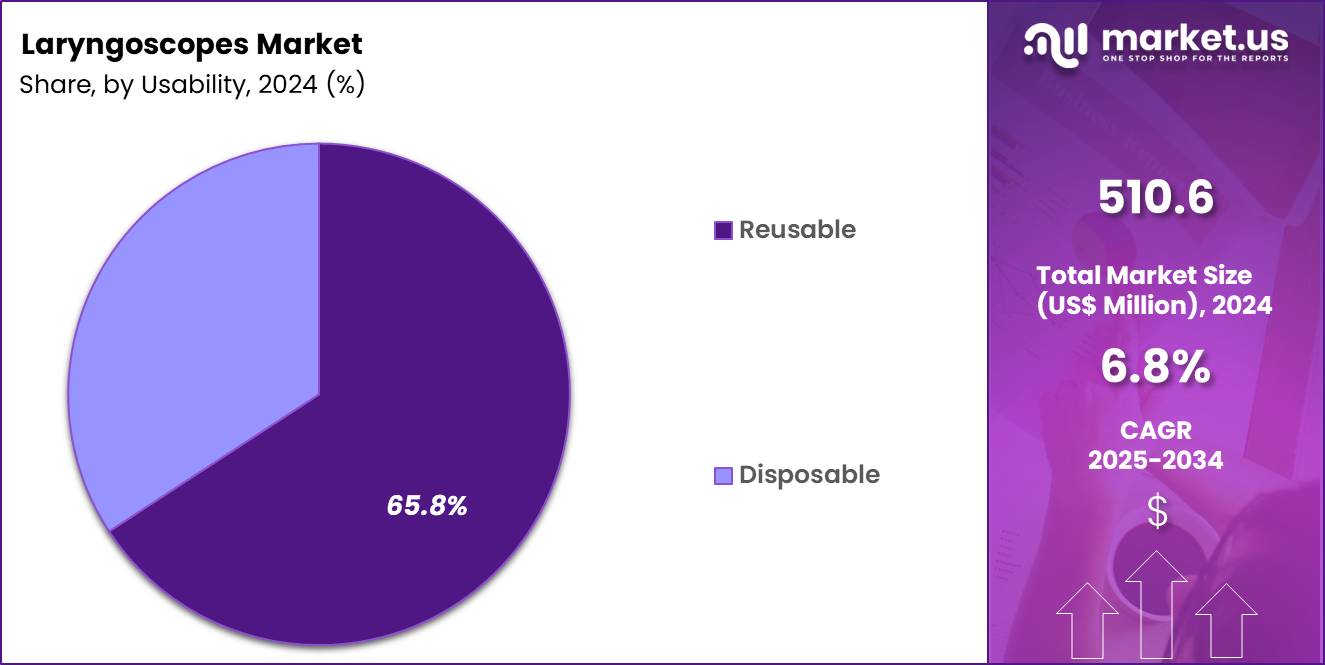

- Furthermore, concerning the usability segment, the market is segregated into reusable and disposable. The reusable sector stands out as the dominant player, holding the largest revenue share of 65.8% in the market.

- The blade design segment is segregated into macintosh blade, miller blade and others, with the macintosh blade segment leading the market, holding a revenue share of 59.9%.

- Considering application, the market is divided into airway management, diagnostic procedures, therapeutic interventions, training and education. Among these, airway management held a significant share of 37.2%.

- The end-user segment is segregated into hospitals, ambulatory surgical centers, specialty clinics and others, with the hospitals segment leading the market, holding a revenue share of 56.5%.

- North America led the market by securing a market share of 37.5% in 2024.

Device Type Analysis

Direct laryngoscopes, accounting for 62.6%, are expected to dominate because clinicians continue to rely on their simplicity, reliability, and familiarity in routine airway procedures. Many anesthesiologists and emergency physicians receive primary training on direct visualization techniques, which supports sustained usage. These devices offer rapid deployment in emergency settings without dependence on video systems.

Lower acquisition and maintenance costs appeal to budget constrained facilities. Direct laryngoscopes integrate easily into standard airway carts. Their performance in varied clinical environments strengthens confidence among practitioners. High durability supports repeated use in busy hospitals. These factors keep direct laryngoscopes anticipated to maintain strong market presence.

Type Analysis

Video laryngoscopes, holding 71.4%, are projected to lead by type due to their superior visualization and improved first pass intubation success rates. Enhanced camera based views support better airway assessment, especially in difficult intubations. Training programs increasingly adopt video guidance to improve learning outcomes. Reduced complication risk strengthens clinician preference.

Growing adoption in critical care and emergency departments accelerates demand. Technological improvements enhance image quality and portability. Integration with recording features supports documentation and education. These drivers keep video laryngoscopes likely to remain dominant.

Usability Analysis

Reusable laryngoscopes, representing 65.8%, are expected to dominate usability because hospitals prioritize long term cost efficiency and sustainability. Reusable designs reduce recurring procurement expenses compared to disposable alternatives. Established sterilization protocols support safe reuse across procedures. High quality materials extend device lifespan in high volume settings.

Hospitals favor reusable equipment to align with environmental goals. Consistent performance across multiple procedures improves clinician trust. Capital investment strategies support reusable inventories. These dynamics keep reusable laryngoscopes anticipated to retain leadership.

Blade Design Analysis

Macintosh blades, accounting for 59.9%, are projected to remain the most used blade design due to their versatility and broad clinician familiarity. The curved blade design supports effective lifting of the epiglottis in adult patients. Training standards emphasize Macintosh blades, reinforcing routine usage. Wide availability across manufacturers ensures consistent supply.

Compatibility with both direct and video systems expands applicability. Clinicians rely on predictable performance during airway management. Longstanding clinical acceptance sustains preference. These factors keep Macintosh blades expected to dominate blade design demand.

Application Analysis

Airway management, holding 37.2%, is anticipated to lead application demand as intubation remains a core procedure across anesthesia, emergency, and intensive care settings. Rising surgical volumes increase routine airway interventions. Growth in trauma and critical care cases strengthens demand for reliable airway tools.

Rapid response requirements favor proven laryngoscopy solutions. Standard airway protocols emphasize early and secure intubation. Continuous training reinforces frequent use. Technological advances improve procedural safety. These trends keep airway management projected to remain the leading application.

End-User Analysis

Hospitals, representing 56.5%, are expected to dominate end user adoption because they handle the highest volume of surgical, emergency, and critical care procedures. Hospitals maintain comprehensive airway equipment inventories to support diverse clinical needs. Centralized procurement enables bulk purchasing and standardization.

Teaching hospitals emphasize advanced airway training, increasing device utilization. Intensive care and operating rooms drive consistent demand. Infection control infrastructure supports reusable device management. Ongoing modernization initiatives encourage equipment upgrades. These factors keep hospitals likely to remain the primary end user segment.

Key Market Segments

By Device Type

- Direct Laryngoscopes

- Indirect Laryngoscopes

By Type

- Video Laryngoscopes

- Flexible Fiberoptic Laryngoscopes

By Usability

- Reusable

- Disposable

By Blade Design

- Macintosh Blade

- Miller Blade

- Others

By Application

- Airway Management

- Diagnostic Procedures

- Therapeutic Interventions

- Training and Education

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

Drivers

Rising incidence of laryngeal cancer is driving the market

The laryngoscopes market is notably driven by the rising incidence of laryngeal cancer, which requires advanced visualization tools for diagnosis, biopsy, and surgical interventions in otolaryngology practices. Laryngoscopes, including direct and video types, enable precise examination of the vocal cords and surrounding tissues to detect malignancies early. Increased risk factors such as tobacco use, alcohol consumption, and HPV infections contribute to higher case numbers globally.

Oncologists utilize these devices for staging and treatment planning in head and neck oncology. Public health screening programs emphasize endoscopic evaluations to improve survival rates through timely detection. Hospital procurement prioritizes high-resolution laryngoscopes to support multidisciplinary cancer care teams. Epidemiological monitoring by health organizations highlights the need for reliable airway visualization equipment.

Technological enhancements in blade design and lighting improve procedural efficacy in cancer cases. According to the American Cancer Society’s cancer statistics published in 2024, an estimated 12,620 new cases of laryngeal cancer were projected in the United States. This projection underscores the ongoing clinical demand that propels innovation and adoption of laryngoscopes in diagnostic settings.

Restraints

High costs associated with advanced video laryngoscopes are restraining the market

The laryngoscopes market is restrained by the high costs associated with advanced video models, which incorporate digital imaging and ergonomic features requiring substantial investment for healthcare facilities. Procurement expenses include not only the device but also compatible monitors, software, and maintenance contracts. Smaller clinics and rural hospitals often defer upgrades due to budget constraints in capital equipment allocation.

Reimbursement policies may not fully cover premium pricing for elective or routine procedures. Manufacturers face pressure to balance innovation with affordability amid economic fluctuations. Operational training for staff on sophisticated systems adds indirect costs to implementation. Supply chain dependencies for specialized components can lead to price volatility.

Regulatory compliance for electrical and optical standards elevates development expenditures passed to end-users. Geographic disparities in healthcare funding exacerbate accessibility issues in developing regions. These financial barriers collectively limit market expansion and slow penetration into cost-sensitive segments of care delivery.

Opportunities

Growing regulatory clearances for innovative laryngoscope designs is creating growth opportunities

The laryngoscopes market presents growth opportunities through growing regulatory clearances for innovative designs that enhance safety and usability in airway management. These clearances encourage manufacturers to introduce features like improved angulation and anti-fog coatings for better clinical performance. Healthcare providers can adopt cleared devices with confidence in validated efficacy for diverse patient populations.

Expanded indications support applications in pediatrics, geriatrics, and obese individuals with challenging anatomies. Partnerships between device firms and clinical researchers accelerate submission processes for novel iterations. Post-clearance market surveillance generates data for iterative improvements and label expansions. Global regulatory efforts aim to standardize evaluation criteria, facilitating cross-border commercialization.

Investments in biocompatible materials align with clearance requirements for long-term use. The U.S. Food and Drug Administration cleared the McGrath MAC video laryngoscope updates in 2024, addressing battery safety concerns. Such actions open pathways for enhanced product portfolios and increased adoption in emergency and operative environments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends invigorate the laryngoscopes market as surging healthcare budgets and expanding elderly populations worldwide compel anesthesiology departments to adopt high-definition video and fiber-optic models for precise airway management during surgeries. Executives at prominent manufacturers strategically introduce disposable and reusable innovations, harnessing preventive care momentum to broaden penetration in fast-growing emerging healthcare systems.

Persistent inflation and global economic slowdowns, however, inflate costs for stainless steel components and electronic sensors, prompting hospitals to defer equipment upgrades and constrain procedure volumes in financially strained regions. Geopolitical frictions, particularly U.S.-China trade disputes and regional conflicts, routinely interrupt supplies of critical optics and assembly parts, creating manufacturing delays and sourcing uncertainties for producers reliant on international networks.

Current U.S. tariffs impose substantial duties on imported laryngoscopes and medical instruments from China, amplifying procurement expenses for American distributors and eroding affordability for cost-conscious providers. These measures also trigger reciprocal barriers overseas that hinder U.S. exports of advanced endoscopic technologies and slow multinational development partnerships.

Still, the tariff environment galvanizes meaningful investments in North American production facilities and diversified supply strategies, forging resilient foundations that promise enhanced innovation and sustained market leadership ahead.

Latest Trends

Integration of artificial intelligence in tracheal intubation using laryngoscopes is a recent trend

In 2025, the laryngoscopes market has demonstrated a significant trend toward the integration of artificial intelligence to support tracheal intubation procedures with enhanced precision and decision-making. AI algorithms analyze real-time video feeds to identify anatomical landmarks and predict intubation difficulties. This technology assists clinicians in critical care settings by providing overlaid guidance on screen displays. Robotic-assisted systems incorporate AI for automated blade positioning and force feedback.

Research reviews advocate for wider implementation to reduce complication rates in emergency intubations. Developers focus on machine learning models trained on diverse patient datasets for inclusive performance. Clinical trials evaluate AI efficacy in reducing time to successful airway securement. Collaborative frameworks between engineers and anesthesiologists refine algorithmic accuracy.

Ethical protocols ensure AI complements rather than replaces human judgment in procedures. This trend, highlighted in a 2025 narrative review from the National Institutes of Health, promotes broader adoption of intelligent laryngoscopy solutions.

Regional Analysis

North America is leading the Laryngoscopes Market

In 2024, North America held a 37.5% share of the global laryngoscopes market, propelled by the escalating demand for advanced airway management tools amid rising respiratory emergencies and procedural complexities in healthcare settings. Emergency physicians increasingly integrate high-definition video laryngoscopes into intubation protocols, enhancing first-pass success rates in obese patients and those with predicted difficult airways during trauma resuscitations.

Surgical suites in major hospitals adopt disposable blade variants to comply with stringent infection control mandates, reducing cross-contamination risks post-pandemic. Aging demographics contribute to higher volumes of elective ENT surgeries, such as tonsillectomies and vocal cord interventions, necessitating ergonomic, fiberoptic models for precise visualization.

Anesthesia providers leverage AI-assisted scopes for real-time anatomical guidance, optimizing outcomes in ambulatory and critical care environments. Regulatory incentives from health authorities promote training simulations with reusable handles, bridging skill gaps among residents. Supply chain diversifications ensure availability of pediatric-specific designs, addressing neonatal respiratory distress syndromes. The National Center for Health Statistics documented approximately 155 million emergency department visits in the United States in 2022, many involving airway assessments that underscore the need for reliable visualization instruments.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts anticipate notable expansion in the laryngoscopes sector across Asia Pacific throughout the forecast period, as healthcare expansions confront surging infectious respiratory burdens. Clinicians in urban hospitals procure robust video-assisted models to streamline intubations during tuberculosis exacerbations, bolstering survival in multidrug-resistant cases.

Governments invest in fiberoptic variants for rural clinics, enabling precise diagnostics of laryngeal pathologies amid pollution-driven chronic conditions. Medical innovators customize lightweight handles for high-volume ENT centers, accommodating procedural surges from demographic aging. Regional training academies deploy simulation-equipped units, upskilling practitioners to manage pediatric stridor and epiglottitis effectively.

Pharmaceutical partnerships introduce antimicrobial-coated blades, curbing nosocomial transmissions in overcrowded wards. Supply networks optimize distribution of single-use scopes, aligning with infection prevention strategies in tropical climates. The World Health Organization reports that the South-East Asia Region accounted for 4,910 thousand incident tuberculosis cases in 2023, amplifying requirements for advanced airway tools in management protocols.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the laryngoscopes market drive growth by advancing video-enabled and single-use platforms that improve airway visualization, reduce cross-contamination risk, and raise first-pass intubation success in acute settings. Companies expand demand through clinician training programs and simulation partnerships that standardize airway protocols across emergency, anesthesia, and critical-care departments.

Product strategies emphasize ergonomic blades, high-resolution imaging, and compatibility with electronic medical records to streamline workflows and documentation. Commercial teams secure scale via bundled capital-light models that combine devices, disposables, service, and fleet management to lower total cost of ownership.

Geographic expansion targets fast-growing healthcare systems with rising surgical volumes and emergency preparedness investments. Verathon exemplifies leadership with its GlideScope portfolio, focused R&D in video airway management, global manufacturing and service reach, and strong relationships with clinicians that sustain adoption across diverse care environments.

Laryngoscopes Market

- Medtronic plc

- Ambu A/S

- KARL STORZ SE & Co. KG

- Verathon Inc.

- Olympus Corporation

- Teleflex Incorporated

- Nihon Kohden Corporation

- RICHARD WOLF

- Baxter

- BESDATA

- FUJIFILM

- Intersurgical Ltd.

Recent Developments

- In February 2025, KARL STORZ finalized the acquisition of medi G, expanding its production footprint in Meßkirch, Germany. The move enhances manufacturing capacity for surgical visualization tools, including laryngoscopes used in ENT and pediatric care. By strengthening supply continuity and production scalability, this expansion supports the laryngoscopes market as hospitals increasingly rely on uninterrupted access to high-quality airway management devices. Improved manufacturing flexibility also enables quicker delivery timelines and tailored product configurations, encouraging wider adoption across operating rooms and emergency departments.

- In October 2024, Verathon launched Spectrum QC eco, a single-use video laryngoscope produced largely from bio-based materials. The device significantly lowers environmental impact while preserving clinical performance, demonstrating how sustainability and advanced airway visualization can coexist. This innovation reinforces demand for next-generation laryngoscopes by appealing to healthcare providers seeking solutions that address patient safety, workflow efficiency, and environmental responsibility simultaneously.

- In September 2024, the FDA issued a Class I recall affecting certain McGrath MAC laryngoscope models due to safety concerns. The recall prompted many US hospitals to initiate immediate equipment replacement and reassessment programs. Such regulatory actions typically accelerate market activity by driving near-term replacement demand and encouraging upgrades to newer, compliant video laryngoscope technologies, thereby increasing overall market turnover.

Report Scope

Report Features Description Market Value (2024) US$ 510.6 Million Forecast Revenue (2034) US$ 985.8 Million CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device Type (Direct Laryngoscopes and Indirect Laryngoscopes), By Type (Video Laryngoscopes and Flexible Fiberoptic Laryngoscopes), By Usability (Reusable and Disposable), By Blade Design (Macintosh Blade, Miller Blade and Others), By Application (Airway Management, Diagnostic Procedures, Therapeutic Interventions, Training and Education), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic plc, Ambu A/S, KARL STORZ SE & Co. KG, Verathon Inc., Olympus Corporation, Teleflex Incorporated, Nihon Kohden Corporation, RICHARD WOLF, Baxter, BESDATA, FUJIFILM, Intersurgical Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medtronic plc

- Ambu A/S

- KARL STORZ SE & Co. KG

- Verathon Inc.

- Olympus Corporation

- Teleflex Incorporated

- Nihon Kohden Corporation

- RICHARD WOLF

- Baxter

- BESDATA

- FUJIFILM

- Intersurgical Ltd.