Global Knowledge Process Outsourcing (KPO) Market Size, Share, Industry Analysis Report By Service (Analytics & Market Research, Operations & Supply Chain Analytics, Engineering & Design, Financial Process Outsourcing, Publishing Outsourcing, Research & Development Outsourcing, Others), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Application (BFSI, Healthcare, IT & Telecom, Manufacturing, Pharmaceutical, Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 156745

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- Role of Generative AI

- Emerging Trends in KPO

- U.S. KPO Market Size

- Service Analysis

- Organization Size Analysis

- Application Analysis

- Growth Factors in KPO

- Top Use Cases in KPO

- Key Market Segments

- Driver Factor

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

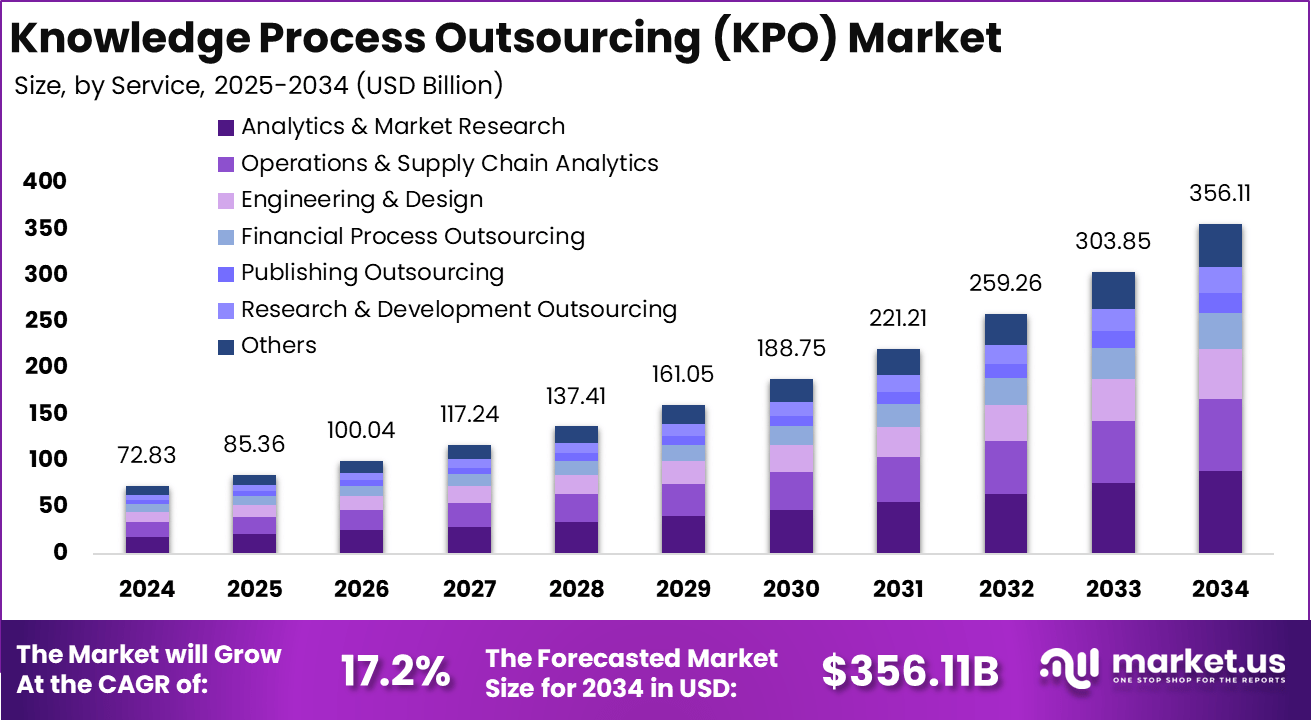

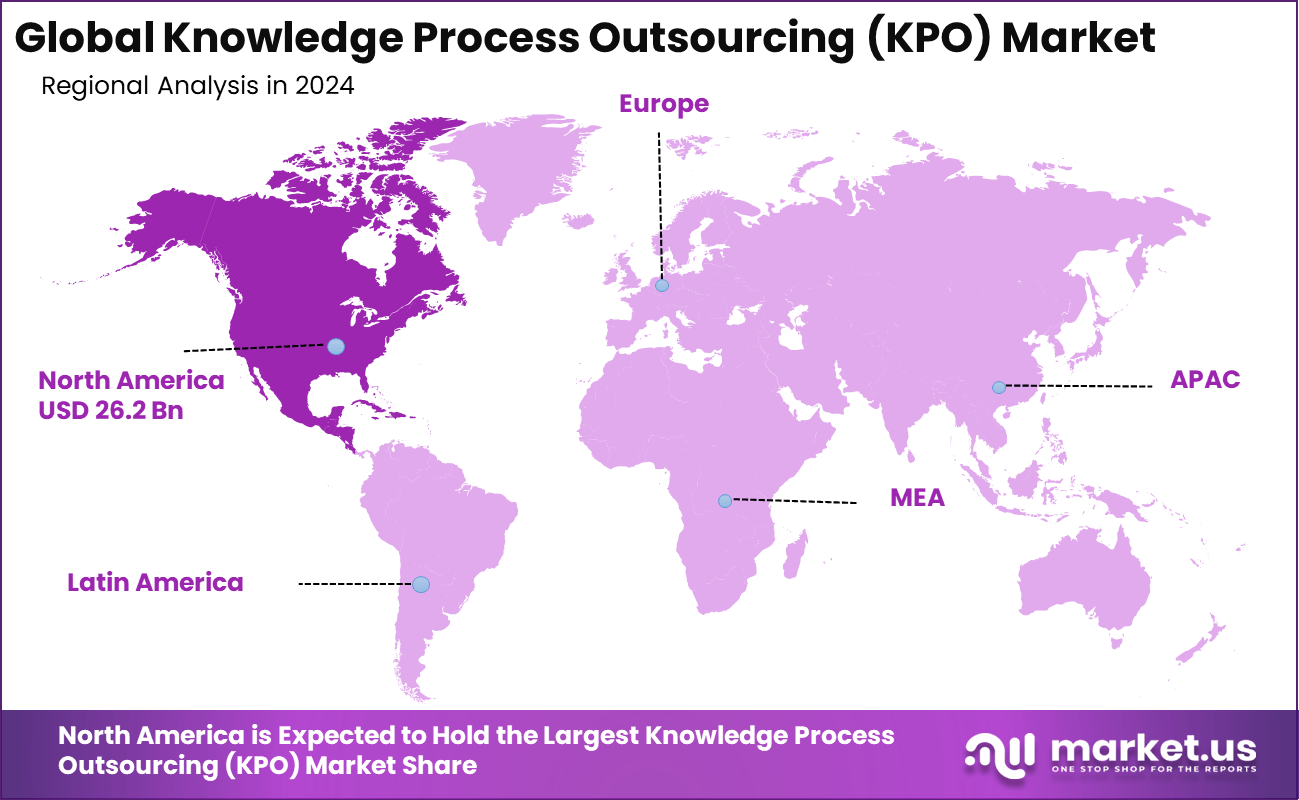

The Global Knowledge Process Outsourcing (KPO) Market size is expected to be worth around USD 356.11 billion by 2034, from USD 72.83 billion in 2024, growing at a CAGR of 17.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 26.2 billion in revenue.

The Knowledge Process Outsourcing (KPO) market refers to the contracting of advanced, specialist business tasks – such as research, analytics, legal services, investment analysis, and strategic studies – to external experts. This practice is distinguished by its reliance on deep technical and domain knowledge, critical thinking, and tailored research, placing it on a higher value tier than standard process outsourcing

One of the top driving factors in the KPO market is the increasing complexity of business operations, which necessitates a higher degree of specialized knowledge than typical outsourcing solutions. Companies are drawn to KPO’s ability to optimize costs while simultaneously gaining access to highly educated talent pools in regions where labor costs remain competitive.

The increasing adoption of technologies such as artificial intelligence, machine learning, robotic process automation, and big-data analytics is redefining how KPO services are delivered. These innovations allow KPO firms to automate routine knowledge tasks, speed up data processing, and generate more valuable insights. Technologies also improve the accuracy and reliability of outsourced tasks, making knowledge outsourcing more attractive and transformative for diverse business functions.

Key Takeaway

- The Analytics & Market Research segment held a strong lead, capturing 25% share, reflecting the demand for data-driven business insights.

- By enterprise size, Large Enterprises dominated the market with a 66% share, showing reliance on outsourced high-value knowledge services.

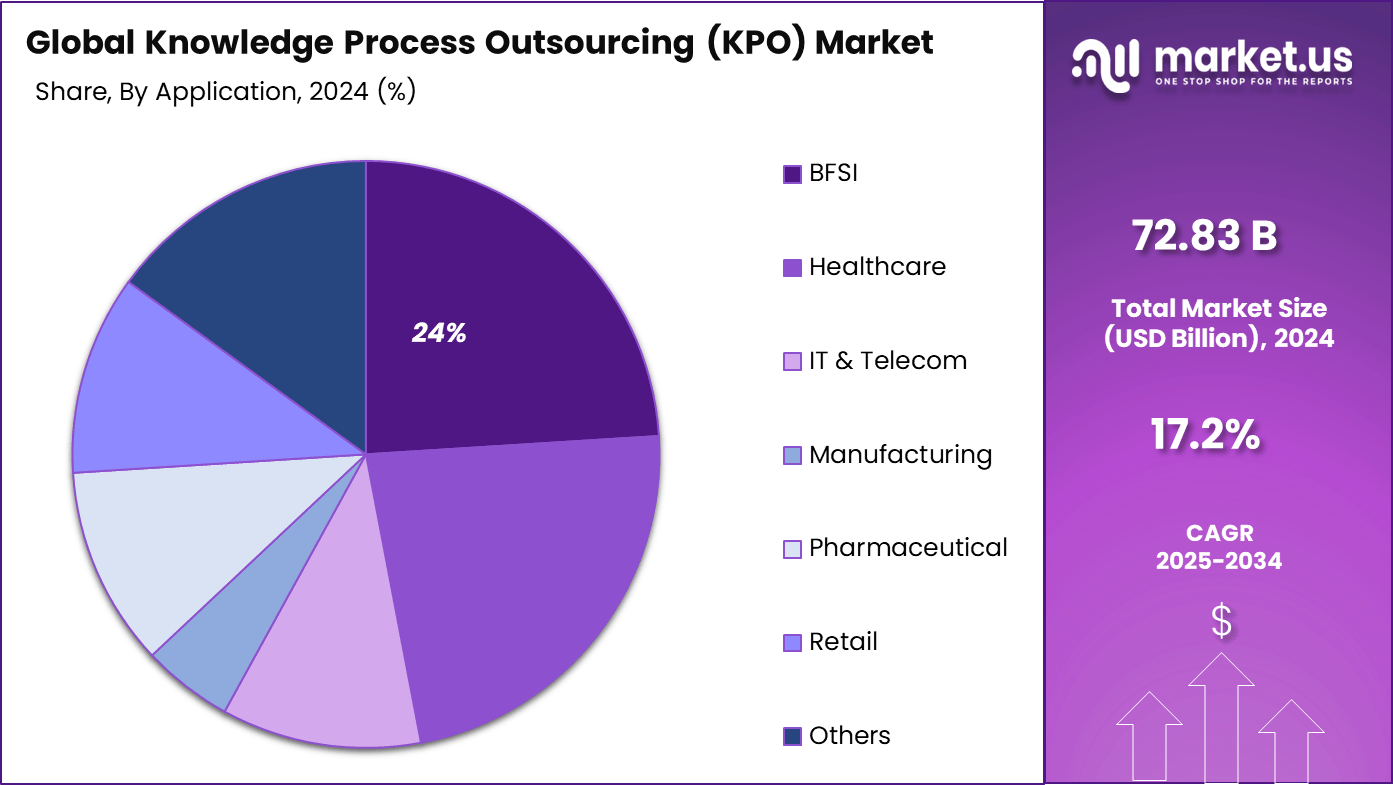

- By industry vertical, BFSI accounted for 24% share, driven by rising needs for risk analysis, compliance management, and financial data processing.

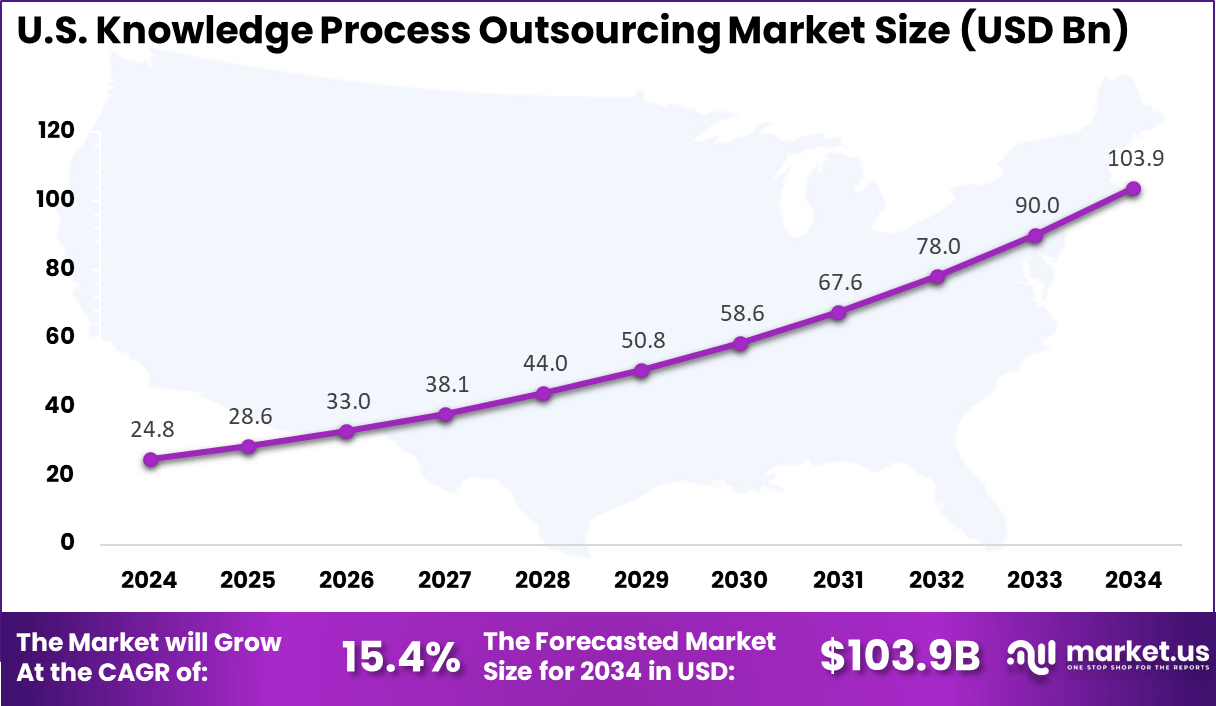

- The U.S. KPO Market reached a valuation of USD 24.8 Billion in 2024, with a robust CAGR of 15.4%, supported by technology adoption and growing enterprise outsourcing.

- North America led globally, capturing more than a 36% share, highlighting the region’s maturity in outsourcing advanced research and knowledge-driven services.

Analysts’ Viewpoint

Investment opportunities in the KPO market arise primarily from the growing demand for niche expertise in areas such as analytics, intellectual property, compliance, and strategic business consulting. As organizations increasingly seek out knowledge-centered partnerships for deeper insights and long-term strategic advice, investors are finding value in firms able to deliver not only cost savings but also innovation and tailored business intelligence.

KPO’s business benefits include the ability to scale knowledge capabilities rapidly, improve operational agility, and support global expansion initiatives. Outsourcing specialized functions lets organizations adapt faster to market shifts, enhance decision-making processes, and improve resource allocation without significantly increasing internal headcount or infrastructure costs.

The regulatory environment in KPO is shaped by rigorous standards around data privacy, security, and compliance. Effective KPO firms prioritize measures such as encryption, secure data transmission, and compliance frameworks that align with regulations like GDPR and HIPAA. The focus on data protection and process transparency is increasing, as regulators worldwide tighten oversight of outsourced knowledge activities.

Role of Generative AI

Key Points Description Enhance Knowledge Continuity Generative AI ensures business knowledge continuity by actively documenting, summarizing, and updating information repositories as workforce dynamics shift. Automate Knowledge Base Maintenance AI solutions automatically monitor industry trends and revise outdated documentation for relevant, up-to-date resource accuracy. Instant Knowledge Access AI chatbots and automated tools deliver context-aware responses, minimizing manual search and support workload. Personalized Content Creation AI delivers tailored articles and support materials, refining content quality and aligning employee/customer experiences to specific needs. Advanced Decision Support Generative AI synthesizes data patterns and insights, rapidly generating solutions and recommendations for complex problem-solving. Emerging Trends in KPO

Key Points Description Shift to Strategic Enablement KPOs transition from passive data support to active business decision facilitation, emphasizing actionable insights. Domain-Specific Expertise KPO providers increasingly focus on specialized sectors like healthcare, fintech, and legal research to deliver deeper value. Seamless AI–Human Collaboration Automation augments human expertise, speeding up analysis while keeping domain knowledge at the core of decision-making. Predictive Modeling & Analytics Clients demand predictive intelligence and forecasting to anticipate shifts and guide executive strategy. Modular, Agile Team Structures Providers reconfigure teams for flexibility, enabling rapid adaptation to changing client requirements and market conditions. U.S. KPO Market Size

The market for Knowledge Process Outsourcing (KPO) within the U.S. is growing tremendously and is currently valued at USD 24.8 billion, the market has a projected CAGR of 15.4%. The Knowledge Process Outsourcing (KPO) sector in the U.S. is expanding swiftly as a result of a rising need for specialized services such as data analytics, financial research, and legal process outsourcing.

The demand for advanced knowledge is driving businesses to seek low-cost sources, while advancements in AI and automation enable faster and more precise decision-making. This movement enables businesses to prioritize innovation while cutting down on operational expenses.

For instance, in December 2020, eClerx, a leading player in the Knowledge Process Outsourcing (KPO) industry, announced its acquisition of U.S.-based Personiv for $34 million. This strategic move aimed to expand eClerx’s capabilities in customer experience management and back-office operations, allowing the company to enhance its service offerings in the BFSI, retail, and healthcare sectors.

In 2024, North America held a dominant market position in the Global Knowledge Process Outsourcing (KPO) Market, capturing more than a 36% share, holding USD 26.2 billion in revenue. The market held a dominant position due to a significant demand for specialized services, advancements in technology, and a vibrant business landscape, especially in the United States.

The sector encounters a growing demand for advanced analytics, strong IT outsourcing, and heightened emphasis on innovation in areas such as software and data analytics. The demand for KPO providers is increasing as companies seek to acquire expertise, reduce costs, and improve efficiency, solidifying the region’s position in the global KMO arena.

For instance, in January 2024, Premier BPO announced its expansion into the North American market with a focus on “Right-Shoring” to optimize business processes across multiple industries. The company emphasized leveraging a hybrid model that combines both offshore and onshore operations, ensuring high-quality service delivery while minimizing costs.

Service Analysis

In 2024, the Analytics and Market Research segment accounts for a significant portion of the Knowledge Process Outsourcing market, representing 25% of the service share. This segment plays a crucial role by providing data-driven insights that help businesses make informed decisions. Analytics services include data analysis, market intelligence, consumer behavior studies, and competitive landscape assessments.

The increasing demand for specialized market research and advanced analytics is driving growth in this segment as companies rely on external expertise to gain deeper knowledge and maintain a competitive edge. With the advancement of digital technologies such as artificial intelligence and machine learning, analytics services in the KPO industry are evolving rapidly.

Providers are incorporating AI techniques to enhance data processing, speed insight generation, and offer predictive analytics capabilities. This advancement allows businesses to move beyond traditional reporting and engage in strategic decision-making supported by detailed data analysis. The Analytics and Market Research segment’s growth is set to continue as organizations increasingly outsource these knowledge-intensive functions to leverage specialized skills and technologies effectively.

For instance, in March 2023, Acuity Knowledge Partners announced that it had surpassed 5,500 employees, driven by increasing demand for bespoke research and analytics services. The company’s growth reflects a broader industry trend, as businesses across sectors such as finance, healthcare, and technology continue to outsource specialized research and data analytics functions.

Organization Size Analysis

In 2024, Large enterprises dominate the Knowledge Process Outsourcing market, accounting for 66% of the market share by organization size. These companies prefer outsourcing high-value knowledge processes to optimize efficiency, reduce costs, and focus on core business activities.

Large enterprises benefit from KPO services that provide specialized expertise in areas such as financial analysis, research and development, legal services, and market intelligence. Their substantial scale allows them to engage in complex, knowledge-driven outsourcing relationships that enhance productivity and innovation. The preference for KPO among large enterprises is driven by their ability to leverage advanced technologies and global talent pools.

These organizations often require comprehensive analytics, regulatory compliance support, and risk management services that external providers can deliver. Additionally, the high demand for data security and confidentiality makes large enterprises selective about their KPO partners, favoring providers with strong data protection capabilities and industry certifications.

For instance, in May 2025, two former Big 4 executives launched a new Knowledge Process Outsourcing (KPO) firm aimed at redefining offshoring services for large enterprises. The new firm focuses on providing high-quality, cost-effective solutions tailored to the complex needs of large organizations, particularly in sectors like accounting, finance, and compliance.

Application Analysis

In 2024, the BFSI (Banking, Financial Services, and Insurance) sector is a key application area for Knowledge Process Outsourcing, constituting 24% of the market. This sector relies heavily on KPO services for risk analytics, regulatory compliance, financial modeling, and fraud detection. Due to the sensitive and complex nature of financial data, BFSI organizations seek specialized outsourcing partners who can provide accuracy, security, and regulatory adherence in knowledge-based services.

KPO in BFSI enables financial institutions to improve operational efficiency and manage costs while accessing advanced analytics and market intelligence. The sector’s increasing focus on compliance with evolving regulations and the growing volumes of transaction data have heightened demand for outsourced services. These services support core activities such as credit risk assessment, investment research, and claims management.

For Instance, in September 2022, Acuity Knowledge Partners, backed by Equistone, acquired Cians Analytics, a move that strengthened its presence in the BFSI (Banking, Financial Services, and Insurance) sector. The acquisition reflects the growing demand for advanced data analytics and research services in the financial industry.

Growth Factors in KPO

Points Description Specialized Expertise Demand Organizations outsource knowledge-intensive, complex tasks requiring sector-specific skills. Adoption of Advanced Technologies AI, machine learning, and analytics drive greater efficiency, expanding KPO capabilities. Cost Optimization Goals The need to manage operational expenses pushes firms to leverage outsourcing for high-value services. Globalization & Talent Access Global KPO adoption expands as businesses seek skilled expertise beyond domestic markets. Digital Transformation & Analytics The rise of digitalization and big data analytics amplifies demand for outsourced research and modeling. Top Use Cases in KPO

Points Description Financial & Risk Analytics Outsourced risk modeling, investment analysis, and predictive financial forecasting. Market & Competitive Intelligence Providers deliver research and business intelligence for strategic planning. Legal & Compliance Research Specialized legal and regulatory analysis for compliance and risk management. Engineering & Technical Services Skilled teams manage engineering design, technical support, and process optimization. Customer Service Knowledge Bases AI-led support articles, chatbots, and tailored information delivery for customer and internal teams. Key Market Segments

By Service

- Analytics & Market Research

- Operations & Supply Chain Analytics

- Engineering & Design

- Financial Process Outsourcing

- Publishing Outsourcing

- Research & Development Outsourcing

- Others

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- BFSI

- Healthcare

- IT & Telecom

- Manufacturing

- Pharmaceutical

- Retail

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Factor

Complexity Demands Expertise

The primary engine driving KPO forward is the rising complexity of business operations in a fast-changing global landscape. As organizations deal with more demanding data environments, regulatory frameworks, and competitive pressures, internal resources often fall short on specialized capabilities.

Businesses increasingly rely on KPO providers because they offer focused expertise that supports smart decision-making and allows companies to stay agile in diverse markets. The ability to tackle intricate analysis, handle compliance, and deliver actionable intelligence is why KPO is chosen for tasks where standard outsourcing cannot deliver enough value.

When organizations offshore knowledge-intensive duties like market research or financial analysis, they enjoy sharper insights and better resource allocation. Qualified analysts and domain experts become external partners, helping leaders navigate new markets, adjust strategies, and respond to emerging risks more confidently. This deeper specialization strengthens the company’s hand in competitive sectors.

For instance, in 2024, IBN Technologies expanded its outsourced bookkeeping services to help California firms reduce costs and enhance accuracy. The increasing demand for specialized expertise in bookkeeping and financial management has fueled the growth of Knowledge Process Outsourcing (KPO) in regions like California.

Restraint

Data Security Concerns

One clear restraint slowing KPO adoption is the persistent concern over data security and confidentiality. When companies outsource core knowledge tasks, they must share sensitive information – from legal files to proprietary business intelligence – with third-party vendors.

This creates anxieties around potential breaches, unauthorized access, and regulatory penalties if strict compliance standards aren’t followed. The cost and complexity of implementing robust cybersecurity frameworks also act as deterrents for smaller firms or sectors with limited budgets.

Navigating diverse regulatory environments further complicates compliance, especially when outsourcing crosses international borders. Many companies thus weigh the benefits of KPO against possible risks and sometimes choose to keep critical processes in-house if doubts about vendor security persist.

For instance, in January 2024, a significant national public data breach was reported, affecting millions of individuals in both the United States and Canada. The breach exposed sensitive personal and financial information, raising serious concerns about data security and privacy. The incident underscored the vulnerability of public and private sectors to cyberattacks, especially with the growing sophistication of threat actors.

Opportunities

Digital Transformation Upsides

Rapid advances in technology present promising opportunities for KPO providers and their clients. The embrace of automation, artificial intelligence, and advanced analytics tools is revolutionizing knowledge outsourcing. These digital changes make it easier for companies to gather, process, and interpret large data volumes efficiently, translating into smarter business strategies and faster results.

KPO partners that adopt such technologies can offer more precise answers, streamline workflows, and deliver high-impact insights at scale. This technical leap also opens doors to new service lines, such as real-time data monitoring and predictive analytics, which were previously out of reach for mid-size firms.

For instance, In June 2025, Ghana and the UAE signed a $1B deal to launch Africa’s largest innovation and AI hub, which is expected to significantly impact the Knowledge Process Outsourcing (KPO) sector. The hub will serve as a key center for AI-driven services, such as data analytics, financial research, and market intelligence, helping businesses in Africa and globally to access specialized KPO expertise.

Challenges

Intense Competition and Price Pressures

The worldwide KPO market is becoming saturated, with numerous providers delivering comparable services. This commoditization exerts downward pricing pressure and necessitates continuous innovation to retain competitive advantage. It is essential to distinguish oneself through quality, industry knowledge, and technology integration, particularly as clients look for collaborators who can promote both efficiency and innovation.

For instance, In April 2025, WNS (Holdings) Limited announced its fiscal year-end results, reflecting the competitive nature of the global KPO market. With over 63,000 professionals across 66 delivery centers worldwide, including India, the Philippines, and Poland, the company continues to expand its global presence by leveraging AI, advanced technology, and domain expertise to strengthen its market position.

Key Players Analysis

WNS Global Services, Genpact Limited, and IBM Corporation are recognized as leading companies in the Knowledge Process Outsourcing market. These firms provide advanced analytics, financial services, and research-based solutions to global clients. Their strong presence is built on domain expertise, technology integration, and a diverse service portfolio.

Wipro Limited, Infosys Limited, and Aptara, Inc. are also significant players contributing to the growth of the market. These companies leverage established IT infrastructure and consulting expertise to enhance outsourcing solutions. Their capabilities extend to legal process outsourcing, content management, and data analytics.

Magellan Solutions, Corpshore Solutions, Conectys, Accenture, Invedus, Eminenture, and other emerging providers add competitive depth to the market. These firms focus on niche services, flexible outsourcing models, and specialized domain knowledge to attract clients. Their strategies often include multilingual support, geographic expansion, and industry-specific expertise.

Top Key Players in the Market

- WNS Global Services

- Genpact Limited

- IBM Corporation

- Wipro Limited

- Infosys Limited

- Aptara, Inc.

- Magellan Solutions

- Corpshore Solutions

- Conectys

- Accenture

- Invedus

- Eminenture

- Other Key Players

Recent Developments

- In May 2025, WNS Holdings announced a strategic collaboration with Snowflake to accelerate AI and data modernization, a move that will have a significant impact on the KPO industry. By leveraging Snowflake’s cloud-based data platform, WNS aims to enhance its ability to deliver advanced analytics, AI-driven insights, and real-time data solutions to its clients across various sectors.

- In July 2024, Infosys Foundation and ICT Academy announced a partnership to skill 48,000 students in India, with a focus on preparing them for the evolving KPO sector. The collaboration aims to equip students with advanced technical and analytical skills, aligning with the growing demand for specialized expertise in industries such as data analytics, financial research, and market intelligence.

Report Scope

Report Features Description Market Value (2024) USD 72.83 Bn Forecast Revenue (2034) USD 356.11 Bn CAGR(2025-2034) 17.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service (Analytics & Market Research, Operations & Supply Chain Analytics, Engineering & Design, Financial Process Outsourcing, Publishing Outsourcing, Research & Development Outsourcing, Others), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Application (BFSI, Healthcare, IT & Telecom, Manufacturing, Pharmaceutical, Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WNS Global Services, Genpact Limited, IBM Corporation, Wipro Limited, Infosys Limited, Aptara, Inc., Magellan Solutions, Corpshore Solutions, Conectys, Accenture, Invedus, Eminenture, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Knowledge Process Outsourcing (KPO) MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Knowledge Process Outsourcing (KPO) MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WNS Global Services

- Genpact Limited

- IBM Corporation

- Wipro Limited

- Infosys Limited

- Aptara, Inc.

- Magellan Solutions

- Corpshore Solutions

- Conectys

- Accenture

- Invedus

- Eminenture

- Other Key Players