Global Kaolin Mining Market Size, Share, And Enhanced Productivity By Type (Synthetic, Nature), By Grade (Calcined, Hydrous, Delaminated, Surface Treated, Others), By Application (Paper, Ceramics, Paint and Coatings, Fiberglass, Plastic, Rubber, Pharmaceuticals and Medical, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171052

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

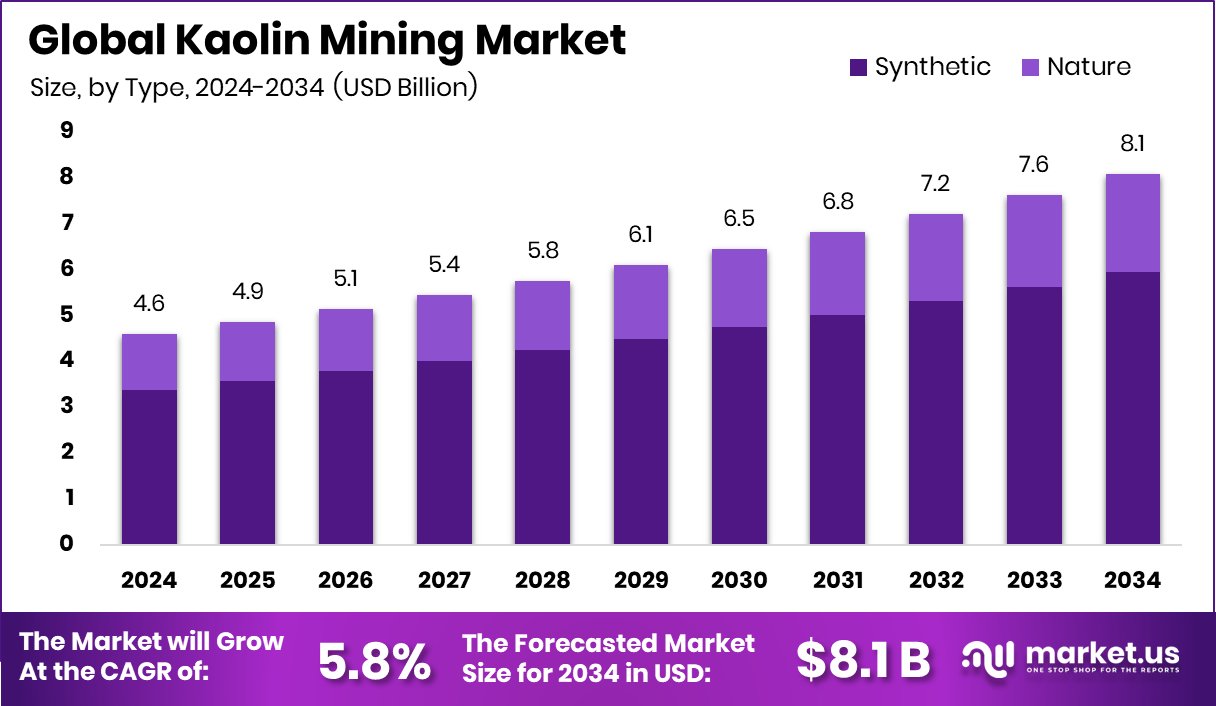

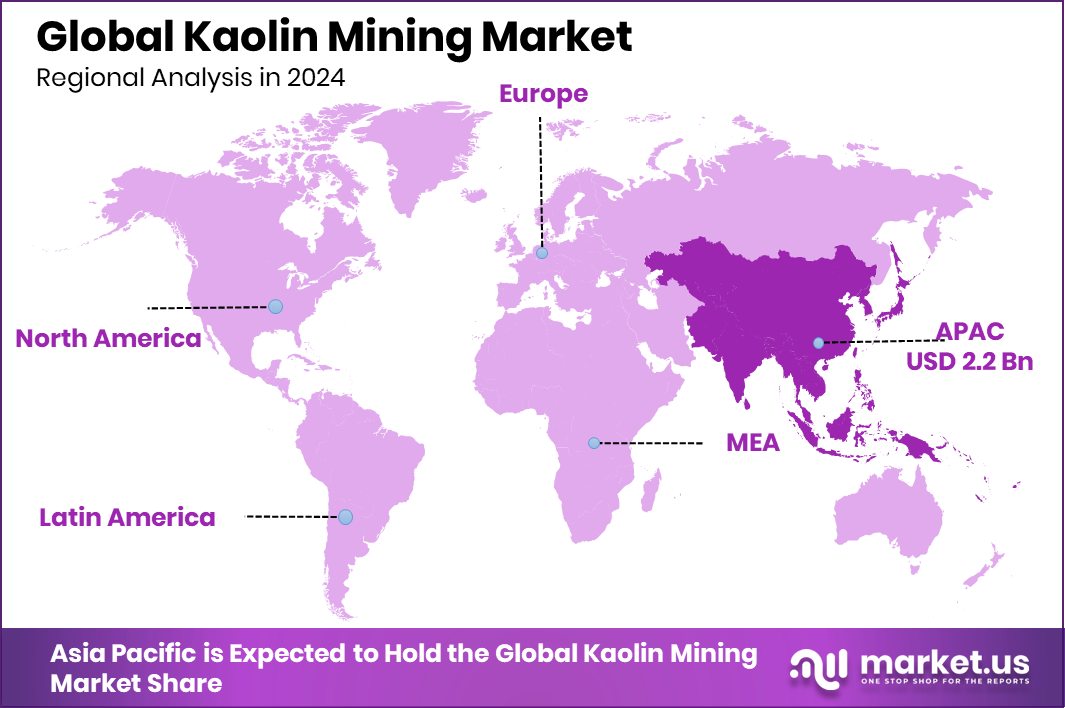

The Global Kaolin Mining Market is expected to be worth around USD 8.1 billion by 2034, up from USD 4.6 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Asia Pacific held 48.30% of the Kaolin Mining Market value, totaling USD 2.2 Bn.

Kaolin mining is the process of extracting kaolin, a naturally occurring white clay mineral, from the earth through open-pit or surface mining methods. The mined material is then washed, refined, and processed to achieve specific purity and particle properties. Kaolin is valued for its brightness, fine texture, and chemical stability, making it suitable for use in paper, paints, ceramics, construction materials, and specialty industrial products.

The kaolin mining market represents the commercial ecosystem covering kaolin extraction, processing, and supply to end-use industries. Market activity is shaped by industrial production cycles, construction output, packaging demand, and coatings consumption. Growth in value-added applications has gradually shifted focus from raw extraction toward processed kaolin grades that meet performance and quality requirements.

Market growth is supported by rising demand for surface finishing and material enhancement solutions, especially in paints and coatings. Investments in sustainable and advanced coating technologies highlight this trend, such as Ecoat securing €21 million to reinvent paint solutions. In parallel, capital movement within decorative and industrial coatings signals long-term confidence in mineral-based raw material supply chains.

Demand for kaolin remains closely linked to construction activity, packaging consumption, and decorative surface applications. Recent financing activity reflects this momentum, including RENEE Cosmetics securing $30 million and JSW Paints securing INR 3,300 crore for expansion-linked strategies, both of which indirectly strengthen demand for high-quality mineral inputs like kaolin.

Future opportunities lie in supplying refined kaolin to high-performance and regulated industries. Large financing actions underline this outlook, including JSW securing ₹9,300-crore financing tied to coatings expansion and Artbio’s $132M Series B, highlighting advanced material usage in specialized applications.

Key Takeaways

- The Global Kaolin Mining Market is expected to be worth around USD 8.1 billion by 2034, up from USD 4.6 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the Kaolin Mining Market, natural kaolin dominates by nature type, holding 73.6% share globally.

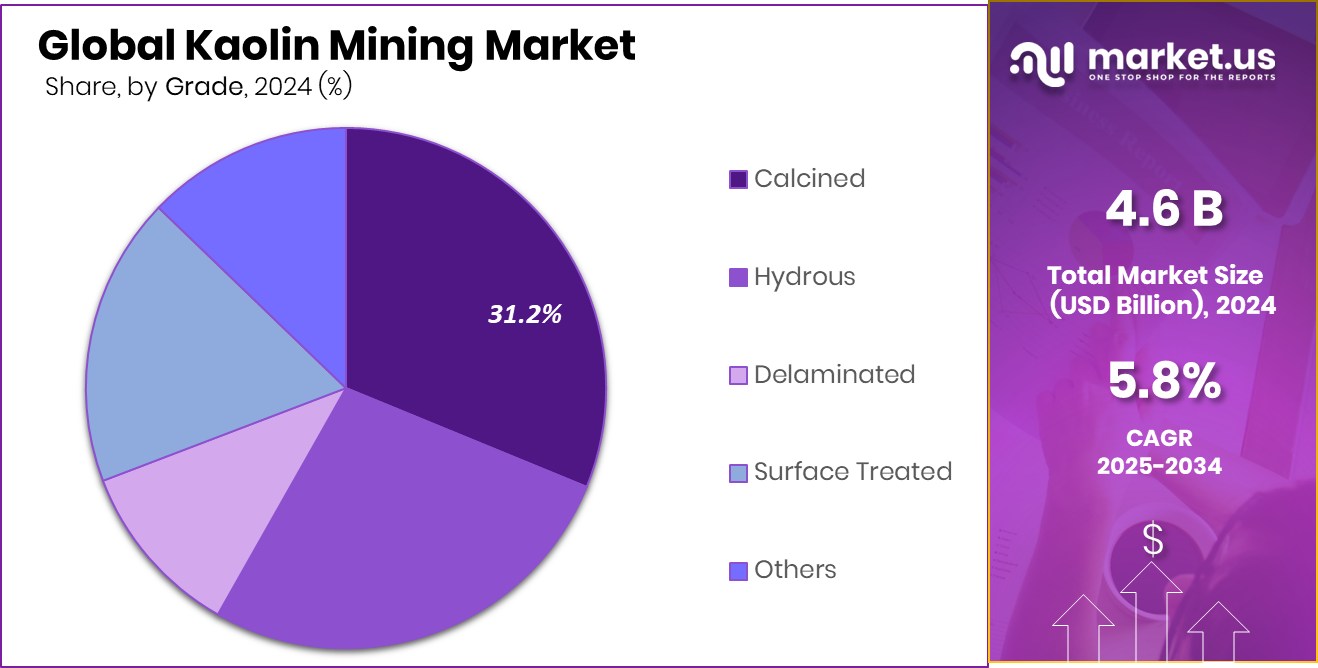

- In the Kaolin Mining Market, calcined grade leads demand, capturing 31.2% share across applications worldwide.

- In the Kaolin Mining Market, paper applications dominate usage, accounting for 32.7% market share overall.

- In the Asia Pacific, the Kaolin Mining Market generated USD 2.2 Bn, accounting 48.30% globally.

By Type Analysis

In the Kaolin Mining Market, the natural type dominates with 73.6% share globally today.

In 2024, Nature held a dominant market position in the By Type segment of the Kaolin Mining Market, with a 73.6% share. This strong position reflects the continued reliance on naturally occurring kaolin across key industrial value chains. Natural kaolin remains widely preferred due to its consistent mineral composition, established mining practices, and broad acceptance in downstream processing environments.

The 73.6% share highlights how natural kaolin mining benefits from long-standing extraction infrastructure and predictable supply patterns. Its dominance also indicates stable demand from end-use industries that value naturally sourced materials for cost efficiency and performance consistency. Overall, the leadership of Nature in 2024 underlines its central role in shaping production volumes, trade flows, and operational strategies within the global kaolin mining landscape.

By Grade Analysis

Within the Kaolin Mining Market, calcined grade leads demand, holding 31.2% market share.

In 2024, Calcined held a dominant market position in the By Grade segment of the Kaolin Mining Market, with a 31.2% share. This leadership underscores the importance of calcined kaolin as a value-enhanced grade derived through controlled thermal processing. Its market position reflects steady demand for grades that offer improved physical and functional properties.

The 31.2% share signals that calcined kaolin continues to command a significant portion of overall grade-based demand, supported by its suitability for applications requiring refined performance characteristics. This dominance also suggests stable production economics and consistent uptake across mature consumption markets. In 2024, calcined kaolin’s position reinforced its role as a key commercial grade, influencing pricing trends and capacity planning in the kaolin mining sector.

By Application Analysis

Paper application drives Kaolin Mining Market consumption, accounting for 32.7% overall usage.

In 2024, Paper held a dominant market position in the By Application segment of the Kaolin Mining Market, with a 32.7% share. This dominance reflects the long-standing use of kaolin in paper manufacturing, where it plays a critical role in enhancing surface quality and print performance. Paper-related demand continues to anchor overall application-level consumption.

The 32.7% share indicates that paper remains a core outlet for kaolin mining output, supporting stable offtake volumes. Its leading position also highlights how established paper production ecosystems continue to rely on kaolin as a functional mineral input. In 2024, the paper segment’s dominance reinforced its influence on mining output allocation and long-term demand visibility within the kaolin market.

Key Market Segments

By Type

- Synthetic

- Nature

By Grade

- Calcined

- Hydrous

- Delaminated

- Surface Treated

- Others

By Application

- Paper

- Ceramics

- Paint and Coatings

- Fiberglass

- Plastic

- Rubber

- Pharmaceuticals and Medical

- Cosmetics

- Others

Driving Factors

Rising Investment Strengthens Kaolin Mining Expansion

A key driving factor for the Kaolin Mining Market is the steady rise in investment confidence across mining and processing activities. Capital inflows signal market stability and encourage producers to scale operations, improve extraction efficiency, and secure long-term supply. This momentum is reflected in JINYAN KAOLIN (02693.HK), which closed up 2.2% at $7.46, indicating positive investor sentiment toward kaolin-focused businesses. Such stock performance often supports easier access to capital for operational upgrades and resource development.

In parallel, project-level funding is accelerating supply-side growth, as seen when Andromeda secured $48.7m funding for its Great White project in South Australia. This funding supports mine development and downstream processing readiness, reinforcing kaolin’s role as a strategic industrial mineral. Together, rising equity confidence and targeted project financing are driving sustained expansion in kaolin mining activities, ensuring consistent material availability for industrial and commercial applications worldwide.

Restraining Factors

High Capital Needs Slow Kaolin Project Progress

A major restraining factor in the Kaolin Mining Market is the high capital requirement needed to move projects from exploration to commercial production. Developing kaolin resources often demands heavy upfront spending on land acquisition, processing plants, environmental controls, and logistics. This financial pressure can delay timelines and limit entry for smaller operators. The challenge is visible in recent funding activities.

Zeotech’s $13 million raise highlights how companies must actively secure capital to support kaolin growth, manage offtake planning, and invest in sustainable material development, adding complexity to execution. At a larger scale, a Ukrainian titanium company’s plan to invest nearly $600M in three mining projects shows how mineral ventures require long-term financial commitment, which can slow decision-making during uncertain market conditions. These funding realities often restrain rapid capacity expansion across kaolin mining.

Growth Opportunity

Project Financing Unlocks Large-Scale Kaolin Expansion

A major growth opportunity in the Kaolin Mining Market lies in improved access to structured project financing, which allows producers to move faster from development to commercial output. Strong credit approvals and capital commitments help reduce execution risk and support large-scale processing capacity. This opportunity is clearly reflected in Andromeda Metals gaining credit approval for a $75m Great White debt facility, which strengthens its ability to advance kaolin mining and downstream processing activities.

In parallel, regional capacity expansion supports long-term supply growth, as seen when a firm committed £18m to invest in a china clay plant, improving production efficiency and material availability. Together, these investments show how financial backing directly supports mine development, processing upgrades, and market readiness, creating sustained growth potential for kaolin mining across industrial supply chains.

Latest Trends

Strategic Investment Drives Advanced Kaolin Resource Development

A key latest trend in the Kaolin Mining Market is the rising focus on staged investments and multi-resource exploration within existing clay assets. Companies are increasingly funding phased development to reduce risk while improving long-term asset value. This trend is evident as WA Kaolin secured $7.5 million to support stage two investment and working capital for its Wickepin Project in Western Australia, strengthening production readiness and operational stability.

At the same time, mineral producers are exploring additional value from china clay deposits, highlighted by a £1m consortium initiative searching for lithium in Cornwall’s China Clay resources. This reflects a broader shift toward maximizing resource potential from established kaolin sites. Together, these activities show how targeted funding and diversified exploration are shaping modern kaolin mining strategies.

Regional Analysis

Asia Pacific dominated the Kaolin Mining Market with 48.30% share, reaching USD 2.2 Bn.

The Kaolin Mining Market shows clear regional differentiation across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, shaped by industrial demand patterns and resource availability.

Asia Pacific dominated the market, holding a 48.30% share and reaching a value of USD 2.2 Bn, reflecting its strong mining base and extensive consumption across manufacturing-oriented economies. The region benefits from large-scale extraction activities and steady downstream usage, positioning it as the primary growth engine for global kaolin supply.

North America represents a mature market characterized by established mining operations and consistent demand from traditional industrial users, supporting stable production levels. Europe follows with steady consumption supported by regulated mining practices and long-term industrial use, maintaining a balanced supply-demand structure.

The Middle East & Africa region contributes through selective mining activity, where resource availability supports regional consumption and export-oriented flows. Latin America remains an emerging contributor, with growing mining presence and gradual integration into the global kaolin trade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to play a strategic role in the global Kaolin Mining Market through its strong focus on material science and industrial mineral integration. In 2024, the company’s approach centers on aligning kaolin-based solutions with downstream performance needs rather than volume-driven mining alone. BASF’s operational strength lies in process optimization, quality consistency, and application-specific mineral refinement. This positions the company well in serving advanced industrial users that demand reliable and standardized kaolin inputs. Its global operational footprint further supports supply continuity and long-term customer relationships.

EICL Ltd remains a significant participant in the kaolin mining landscape, backed by its long-standing expertise in mineral extraction and processing. In 2024, EICL’s strength comes from its vertically integrated operations, allowing better control over quality and cost efficiency. The company benefits from strong operational discipline and a clear focus on kaolin grades aligned with industrial consumption needs. Its steady market presence reflects consistent demand and dependable supply capabilities.

Imerys S.A. holds a strong position in the kaolin mining market through its diversified industrial minerals portfolio. In 2024, Imerys emphasizes value-added kaolin products supported by technical expertise and global reach. Its focus on application-driven mineral solutions enables it to maintain relevance across multiple end-use industries.

Top Key Players in the Market

- BASF SE

- EICL Ltd

- Imerys S.A.

- I-Minerals Inc.

- KaMin LLC

- LB Minerals Ltd.

- Quazwerke GmbH

- Sibelco

- Thiele Kaolin Company

Recent Developments

- In June 2025, Thiele Kaolin Company, a key producer of processed kaolin and mineral products, entered a distribution partnership with Calcit. Under this agreement, Calcit will represent and distribute Thiele’s kaolin products in Central Europe, aiming to better serve industries like paper, paints, plastics, and rubber. Calcit will handle sales, technical service, and supply chain functions, including a new slurry make-down facility in Stahovica, Slovenia. This development expands Thiele’s market reach in Europe and enhances customer support in the region.

- In December 2024, Quarzwerke GmbH awarded a contract to IHC Mining for the supply of a custom electric cutter suction dredger to support its mineral extraction operations. This electric dredger—based on the IHC Beaver® 65 model—was ordered specifically to improve efficiency in mining silica sands and related mineral resources. The new equipment will help the company extract deposits more effectively and sustain long-term production.

- In June 2024, Sibelco completed its acquisition of Strategic Materials, Inc. (SMI), one of North America’s largest glass recyclers. With 42 sites across the U.S., Canada, and Mexico, this deal expands Sibelco’s presence in North America and strengthens its position beyond traditional mineral supply into glass recycling, complementing its material solutions business, including clays.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Billion Forecast Revenue (2034) USD 8.1 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic, Natural), By Grade (Calcined, Hydrous, Delaminated, Surface Treated, Others), By Application (Paper, Ceramics, Paint and Coatings, Fiberglass, Plastic, Rubber, Pharmaceuticals and Medical, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, EICL Ltd, Imerys S.A., I-Minerals Inc., KaMin LLC, LB Minerals Ltd., Quazwerke GmbH, Sibelco, Thiele Kaolin Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- EICL Ltd

- Imerys S.A.

- I-Minerals Inc.

- KaMin LLC

- LB Minerals Ltd.

- Quazwerke GmbH

- Sibelco

- Thiele Kaolin Company