Global Isomalto-Oligosaccharide Market Size, Share Analysis Report By Form (Liquid, Powder, Others), By Source (Corn, Wheat, Potato, Tapioca, Others), By Application (Food and Beverage, Dietary Supplements, Animal Feed Additives, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152730

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

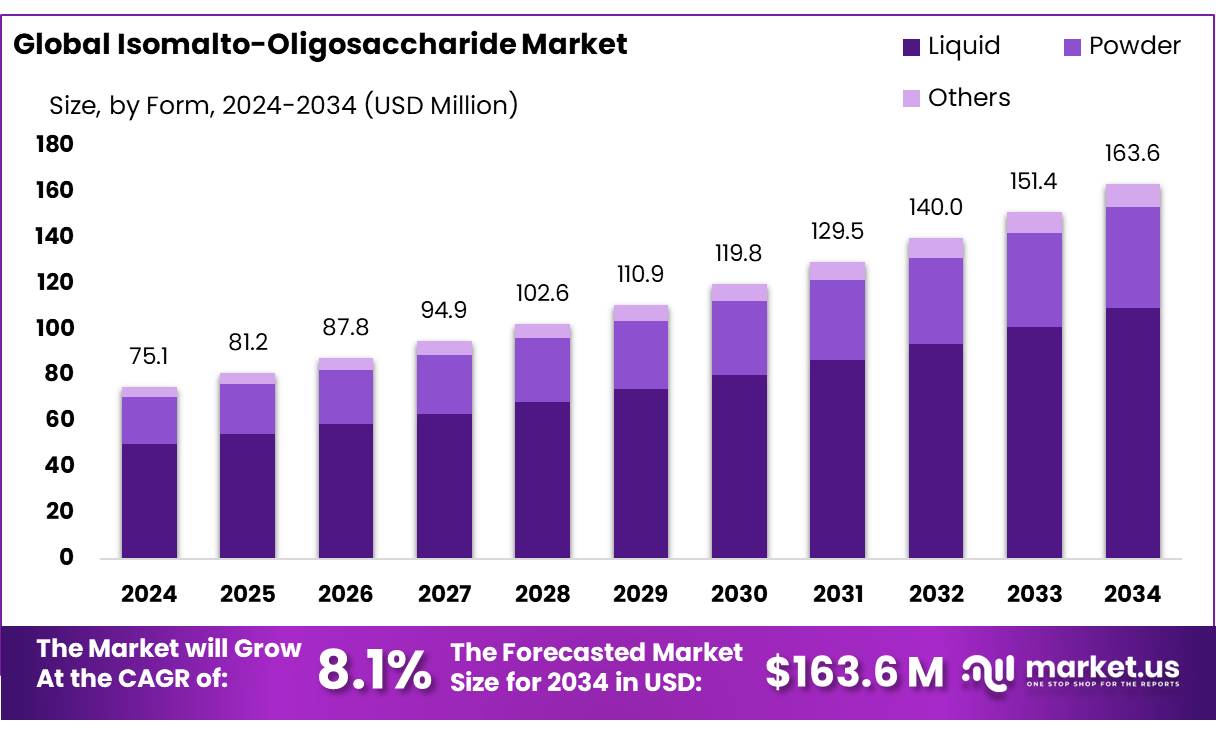

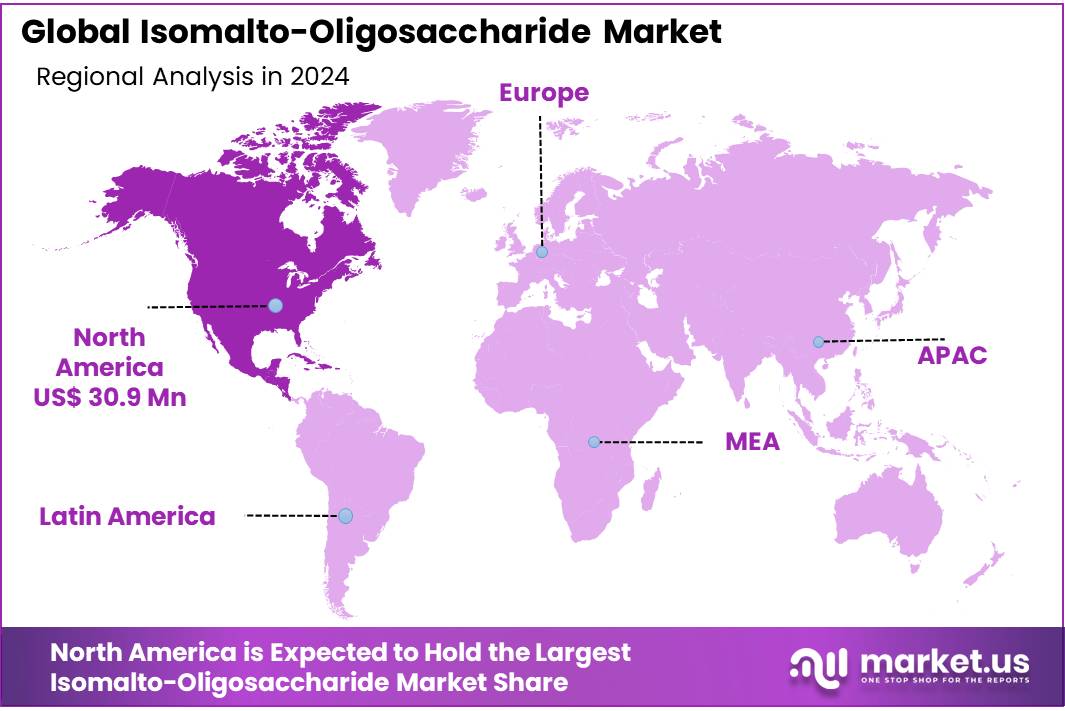

The Global Isomalto-Oligosaccharide Market size is expected to be worth around USD 163.6 Million by 2034, from USD 75.1 Million in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.2% share, holding USD 30.9 Million revenue.

Isomalto-Oligosaccharide (IMO) refers to short-chain glucose oligomers (degree of polymerization ≥3) produced enzymatically from starches (corn, wheat, potato, tapioca). They serve as prebiotic dietary fibers and low-calorie sweeteners. In the U.S., IMOs are generally recognized as safe (GRAS) for use up to ~26g/day, providing approximately 25g/day of DP3-DP9 oligosaccharides with current Good Manufacturing Practices (cGMP) compliance. The U.S. FDA initially granted GRAS status to BioNeutra’s VitaFiber™ in 2009, with Health Canada and the EU subsequently approving IMO as a novel food ingredient.

Key drivers include expanding consumer demand for digestive health solutions, driven by prebiotic awareness and concern over obesity, diabetes, and gut imbalances. IMO exhibits functional benefits—stimulating beneficial gut microbiota, reducing inflammation, improving lipid profiles, and supporting metabolic health—backed by clinical and animal studies. Comparatively low glycemic index and roughly 50% sweetness relative to sucrose make IMO attractive for sugar reduction in processed foods and beverages. Regulatory recognition in FOSHU (Japan), novel food (EU), and GRAS (U.S.) frameworks further validates IMO use.

In the U.S., FDA’s listing of IMO for GRAS at up to 26g/day establishes a safe exposure threshold. While FDA declined to include IMO on the formal dietary fiber list, EFSA has approved its use in supplements up to 30g/day. EU novel food regulation grants approval, supporting market expansion. Japan’s longstanding inclusion of IMO in FOSHU functional foods (since early 2000s) exemplifies mature regulatory support.

Government agencies have adopted frameworks that encourage IMO use as a functional fibre: In Canada, Health Canada’s 2017 policy acknowledges novel fibre sources without requiring pre market approval. In the U.S., IMO has GRAS status and FDA recommended maximum intake is 30g/day. The EU recognized IMO as a novel food under Regulation 2015/2283. In Japan, IMO has been included in the Foods for Specified Health Use (FOSHU) list since the early 2000s. These regulatory endorsements support label claims such as “low-glycaemic” or “prebiotic.”

Key Takeaways

- Isomalto-Oligosaccharide Market size is expected to be worth around USD 163.6 Million by 2034, from USD 75.1 Million in 2024, growing at a CAGR of 8.1%.

- Liquid held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by form, capturing more than a 66.8% share.

- Corn held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by source, capturing more than a 54.9% share.

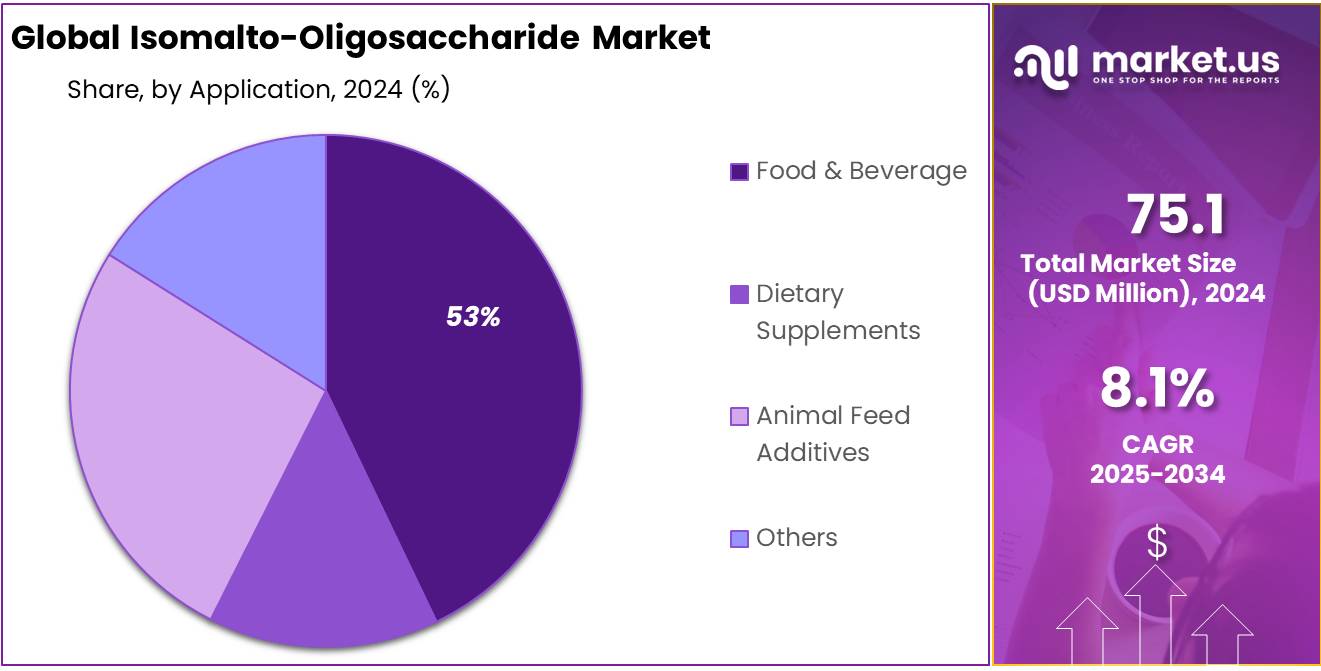

- Food & Beverage held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by application, capturing more than a 53.4% share.

- North America held the dominant position in the Isomalto-Oligosaccharide (IMO) market by region, accounting for approximately 41.2%, equal to USD 30.9 million in market revenue.

By Form Analysis

Liquid form leads the market with 66.8% share in 2024 due to its ease of use in food and beverage formulations.

In 2024, Liquid held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by form, capturing more than a 66.8% share. This strong lead is largely due to the convenience and versatility of liquid IMO in various applications, particularly in the food and beverage industry. Liquid IMO is widely used as a low-calorie sweetener and prebiotic fiber in products such as energy drinks, protein shakes, yogurt, and bakery goods.

Its high solubility, mild sweetness, and excellent blending properties make it easy for manufacturers to incorporate into their formulations without altering texture or taste. Additionally, it helps in moisture retention and extending shelf life, which are key benefits in processed food production.

By Source Analysis

Corn dominates with 54.9% share in 2024 due to its abundant supply and cost-efficiency in IMO production.

In 2024, Corn held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by source, capturing more than a 54.9% share. This leadership is mainly driven by the wide availability and affordability of corn as a raw material for IMO production. Corn-based IMO is popular among manufacturers due to its consistent quality, scalable processing, and compatibility with various end-use applications such as dietary supplements, energy bars, beverages, and baked products.

Corn starch, being a rich source of glucose, undergoes enzymatic transformation to produce IMO with excellent prebiotic properties and mild sweetness. The infrastructure for corn processing is also highly developed, especially in regions like North America and Asia, further boosting its dominance.

By Application Analysis

Food & Beverage leads with 53.4% share in 2024 due to growing demand for healthy sweeteners in everyday products.

In 2024, Food & Beverage held a dominant market position in the Isomalto-Oligosaccharide (IMO) market by application, capturing more than a 53.4% share. This strong presence is largely supported by the rising consumer shift toward healthier and functional food products. IMO is increasingly used as a low-calorie, prebiotic sweetener in items like dairy products, baked goods, energy bars, flavored drinks, and meal replacements.

Its ability to offer sweetness with added digestive health benefits makes it a preferred ingredient among manufacturers aiming to develop clean-label and reduced-sugar formulations. In addition to improving taste and texture, IMO helps enhance the fiber content in foods without compromising flavor, making it ideal for health-conscious consumers. The growing awareness of gut health, coupled with higher demand for on-the-go nutrition, has further driven its usage in ready-to-eat and drink products.

Key Market Segments

By Form

- Liquid

- Powder

- Others

By Source

- Corn

- Wheat

- Potato

- Tapioca

- Others

By Application

- Food & Beverage

- Functional Food

- Dairy Products

- Infant Formula

- Others

- Dietary Supplements

- Weight Loss

- Sports Nutrition

- General Well-Being

- Others

- Animal Feed Additives

- Poultry

- Swine

- Cattle

- Aquaculture

- Pet Food

- Equine

- Others

- Others

Emerging Trends

Rising Demand for Prebiotic-Rich Functional Foods is Driving the Market

In recent years, consumers have started shifting their focus from simply satisfying hunger to enhancing overall health through diet. One of the key driving forces behind the growing isomalto-oligosaccharide (IMO) market is the increasing demand for prebiotic-rich functional foods that support gut health. IMOs are a type of carbohydrate known for their prebiotic effect, meaning they help nourish beneficial gut bacteria. This has made them popular among health-conscious individuals, especially as awareness about digestive wellness spreads globally.

According to the Food and Agriculture Organization (FAO) and World Health Organization (WHO), functional foods, including those with prebiotics, are witnessing growing demand due to their role in promoting overall health and reducing the risk of chronic diseases. In fact, the International Probiotics Association estimates that global sales of prebiotic ingredients reached over US$ 6.9 billion in 2023, with a consistent year-on-year increase as consumers look for natural gut health solutions.

Governments are also promoting gut-friendly diets. For example, the U.S. Department of Agriculture (USDA) updated its Dietary Guidelines for Americans in 2020 to highlight the role of dietary fiber—including prebiotics like IMO—in improving digestive function. This has encouraged food manufacturers to include IMO in snack bars, beverages, yogurts, and infant formulas to align with public health recommendations.

Additionally, the clean-label movement has fueled demand for natural alternatives to artificial sweeteners. IMOs offer a sweet taste with a low glycemic index and fewer calories, making them ideal for people managing diabetes or looking to reduce sugar intake. As more consumers read ingredient labels and seek natural products, IMO becomes an attractive solution.

Drivers

Rising Demand for Low-Calorie and Prebiotic Sweeteners

One of the biggest reasons the Isomalto-Oligosaccharide (IMO) market is growing fast is because people want healthier alternatives to sugar. With rising cases of obesity and diabetes, many consumers are choosing low-calorie sweeteners that are also good for gut health. Isomalto-oligosaccharide fits this trend perfectly. It’s a natural, low-glycemic sweetener that also acts as a prebiotic—feeding the good bacteria in our intestines and supporting digestion.

According to the International Diabetes Federation (IDF), in 2021, approximately 537 million adults were living with diabetes worldwide, and this number is expected to reach 643 million by 2030. This dramatic rise has pushed health-conscious food innovations, with governments and health organizations promoting sugar-reduction strategies. The World Health Organization (WHO) has also issued guidelines recommending adults and children reduce their daily intake of free sugars to less than 10% of total energy intake, which further encourages food manufacturers to seek out alternatives like IMO.

The shift is visible in food labeling too. In many regions, including the European Union and parts of Asia, regulatory bodies are tightening sugar labeling laws. For example, China’s Healthy China 2030 plan promotes the reduction of sugar in foods as a national health goal, opening doors for alternative sweeteners like IMO to gain strong market traction.

Additionally, IMO is gaining traction in bakery, dairy, and functional beverage applications, as it doesn’t just sweeten—it adds fiber. The US FDA has recognized IMO as a dietary fiber under its new fiber labeling regulations, strengthening its position in health-focused product lines.

Restraints

Limited Consumer Awareness and Labeling Confusion

One major challenge holding back the growth of the Isomalto-Oligosaccharide (IMO) market is the lack of awareness among everyday consumers. While food scientists and nutritionists recognize IMO as a valuable prebiotic and low-glycemic sweetener, many consumers still don’t know what it is or how it benefits their health. To the average shopper, labels like “isomalto-oligosaccharide” sound unfamiliar or even artificial—especially when compared to more popular terms like “fiber” or “natural sweetener.”

This confusion gets worse with inconsistent labeling regulations across countries. In the United States, for example, the Food and Drug Administration (FDA) did not initially include IMO in its approved list of dietary fibers. It wasn’t until June 2018 that the FDA finally agreed to count certain forms of IMO toward the daily fiber intake, based on scientific evidence that they have a beneficial effect on human health.

However, the FDA also clarified that only specific types of IMO made using particular processes can be counted as fiber, which creates uncertainty for manufacturers and consumers alike. This kind of technicality in labeling makes it harder for food brands to market IMO-based products, especially when buyers are becoming increasingly skeptical of unfamiliar ingredients on nutrition labels.

Moreover, a 2023 report from the European Food Information Council (EUFIC) found that only 27% of surveyed consumers in the EU could correctly identify dietary fibers on food packaging, and fewer than 20% understood the health role of prebiotics. This low level of understanding makes it tough for IMO to gain mass-market traction.

Opportunity

Expanding Use in Infant and Pediatric Nutrition

A major growth opportunity for the Isomalto-Oligosaccharide (IMO) market lies in its increasing adoption in infant and pediatric nutrition. Parents today are more cautious about what goes into their children’s bodies. They are turning to natural, gut-friendly ingredients that support overall health, especially digestive wellness. IMO, being a prebiotic fiber, plays a critical role in supporting the growth of beneficial gut bacteria like Bifidobacteria, which is essential for infants and toddlers.

According to the World Health Organization (WHO), around 45 million children under the age of 5 suffer from wasting, and 149 million are stunted due to malnutrition and poor gut health. Improving gut microbiota through functional foods and formula is seen as a preventive approach. IMO can be used in infant formula to mimic the natural oligosaccharides found in human breast milk, enhancing immunity and digestion in infants.

Several governments are supporting initiatives that promote better child nutrition. For example, India’s POSHAN Abhiyaan (National Nutrition Mission), launched by the Ministry of Women and Child Development, is aimed at reducing undernutrition in children by promoting fortified and functional food products. Ingredients like IMO align perfectly with such initiatives as they provide nutritional benefits beyond just calories.

Also, the Codex Alimentarius, developed by the FAO and WHO, recognizes the safety of oligosaccharides like IMO in food applications, including infant food, as long as proper standards are followed. This gives manufacturers a strong regulatory basis to innovate in this space.

Regional Insights

North America leads with a 41.2% share (USD 30.9 million) in 2024

In 2024, North America held the dominant position in the Isomalto-Oligosaccharide (IMO) market by region, accounting for approximately 41.2%, equal to USD 30.9 million in market revenue. This strong standing reflects the region’s early adoption of IMO, especially within the functional food, beverage, and dietary supplement sectors. Consumers in the U.S. and Canada increasingly seek lower-calorie sweeteners and prebiotic fibers, driving manufacturers to integrate IMO into products such as yogurt, nutritional bars, beverages, and bakery items.

The region’s well-established food processing infrastructure and advanced nutritional research support have also enabled efficient commercialization. Despite growing competition from Asia-Pacific markets, North America’s confidence in IMO benefits from sustained consumer awareness and supportive regulatory frameworks that emphasize gut health and clean labeling.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Anhui Elite Industrial Co., Ltd. is a leading Chinese manufacturer specializing in functional food ingredients, including isomalto-oligosaccharides. The company emphasizes innovation in prebiotic formulations and supplies to over 30 countries globally. Their IMO products are widely used in health foods, beverages, and nutritional supplements. Anhui Elite ensures quality compliance with international standards such as ISO and HACCP, supporting its growth in North America and Europe through cost-effective production and reliable supply chain operations.

Guangzhou Shuangqiao Co., Ltd. is known for its large-scale production of starch sugars and specialty sweeteners, including IMO. The company’s IMO products are tailored for bakery, confectionery, and nutritional formulations. It maintains a solid presence in the Chinese market and continues to expand across Asia and parts of Eastern Europe. With a focus on innovation, automation, and compliance with global food safety systems, the company has earned recognition for supplying high-quality, low-calorie, gut-friendly carbohydrate ingredients.

BioNeutra North America Inc., based in Canada, focuses on the development and production of functional fiber ingredients, notably IMO and VitaFiber. It operates a state-of-the-art facility in Alberta and exports to the U.S., Europe, and Asia. The company leverages patented enzymatic technology to create clean-label, plant-based prebiotics aimed at the health food and sports nutrition sectors. Its commitment to non-GMO, gluten-free, and vegan certifications strengthens its brand among health-conscious consumers and formulators worldwide.

Top Key Players Outlook

- Anhui Elite Industrial Co. Ltd.

- BioNeutra North America

- COFCO Rongshi Biotechnology Co., Ltd.

- Guangzhou Shuangqiao Co., Ltd.

- Luzhou Bio-chem Technology Co., Ltd.

- New Francisco Biotechnology Corporation (NFBC)

- Nutra Food Ingredients

- Orison Chemicals

- Rajvi Enterprise

- Bio-Tech Co., Ltd.

- Shandong Bailong Group Co. Ltd.

- Shandong Tianjiao Bio-engineering Co., Ltd.

- Shandong Tianmei Biotech Co., Ltd.

- Shijiazhuang Huachen Starch Sugar Production Co. Ltd.

- Xi’an Healthful Biotechnology Co.,Ltd

Recent Industry Developments

In 2024, COFCO Rongshi Biotechnology Co., Ltd.—a key subsidiary of the COFCO Group—reported net profits of RMB 25.13 million, marking a strong 104% increase year over year.

In 2024, BioNeutra North America Inc.—part of the Canadian BioNeutra Global group—imported 273 IMO shipments totaling about 206,500 kg of organic IMO powder from China, serving 16 global suppliers and leveraging multiple U.S. ports like Los Angeles and Long Beach.

Report Scope

Report Features Description Market Value (2024) USD 75.1 Mn Forecast Revenue (2034) USD 163.6 Mn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder, Others), By Source (Corn, Wheat, Potato, Tapioca, Others), By Application (Food and Beverage, Dietary Supplements, Animal Feed Additives, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anhui Elite Industrial Co. Ltd., BioNeutra North America, COFCO Rongshi Biotechnology Co., Ltd., Guangzhou Shuangqiao Co., Ltd., Luzhou Bio-chem Technology Co., Ltd., New Francisco Biotechnology Corporation (NFBC), Nutra Food Ingredients, Orison Chemicals, Rajvi Enterprise, Bio-Tech Co., Ltd., Shandong Bailong Group Co. Ltd., Shandong Tianjiao Bio-engineering Co., Ltd., Shandong Tianmei Biotech Co., Ltd., Shijiazhuang Huachen Starch Sugar Production Co. Ltd., Xi’an Healthful Biotechnology Co.,Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Isomalto-Oligosaccharide MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Isomalto-Oligosaccharide MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Anhui Elite Industrial Co. Ltd.

- BioNeutra North America

- COFCO Rongshi Biotechnology Co., Ltd.

- Guangzhou Shuangqiao Co., Ltd.

- Luzhou Bio-chem Technology Co., Ltd.

- New Francisco Biotechnology Corporation (NFBC)

- Nutra Food Ingredients

- Orison Chemicals

- Rajvi Enterprise

- Bio-Tech Co., Ltd.

- Shandong Bailong Group Co. Ltd.

- Shandong Tianjiao Bio-engineering Co., Ltd.

- Shandong Tianmei Biotech Co., Ltd.

- Shijiazhuang Huachen Starch Sugar Production Co. Ltd.

- Xi'an Healthful Biotechnology Co.,Ltd