Global Irish Whiskey Market Size, Share Report By Type (Blended, Single Malt, Single Pot, Single Grain), By Flavor (Unflavored, Flavored Irish Whiskey), By Gender (Male, Female), By Age Group (18–30, 31–44, 45+), By Sales Channel (On-trade, Off-trade) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154422

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

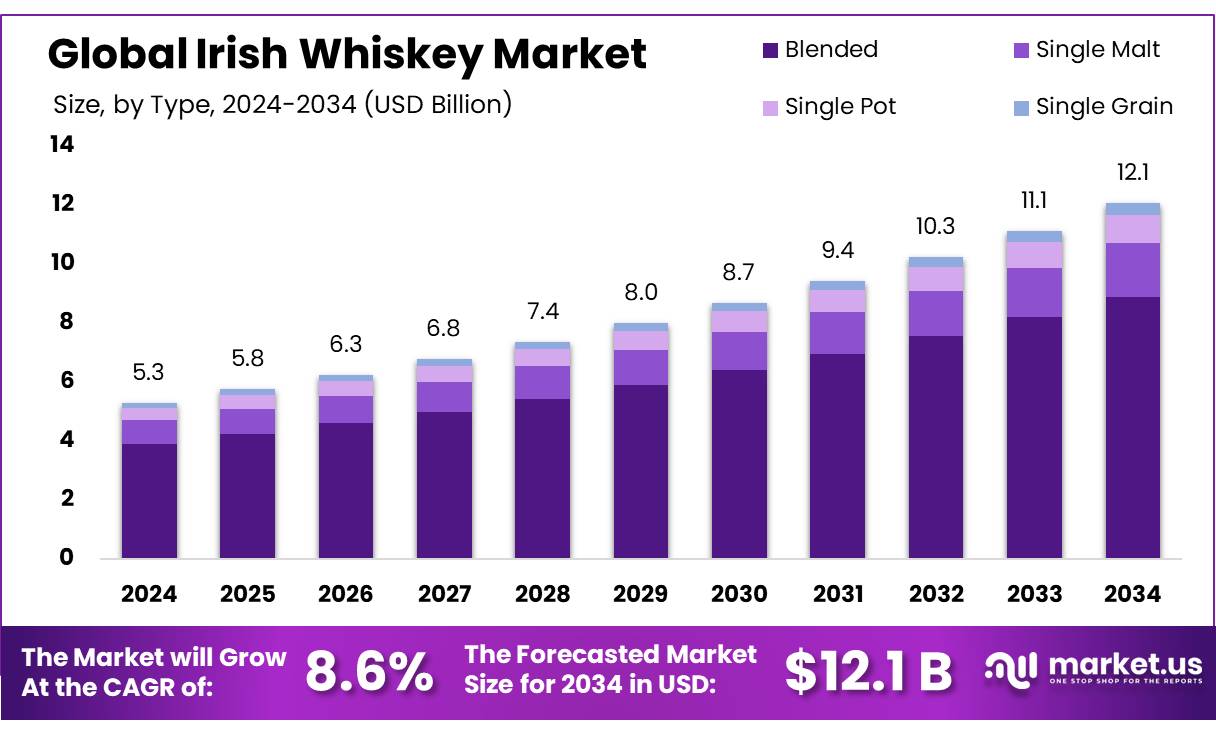

The Global Irish Whiskey Market size is expected to be worth around USD 12.1 Billion by 2034, from USD 5.3 Billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 46.2% share, holding USD 2.4 Billion in revenue.

Irish whiskey concentrate production constitutes a specialized segment within the broader Irish whiskey industry, with bulk neutral spirits and concentrated flavour extracts primarily destined for blending, bottling, and export.

The sector is supported by Ireland’s status as a protected Geographical Indication (GI) under EU Regulation No 110/2008, which mandates that all distillation and maturation occurs on the island of Ireland and that concentrates for blending must conform to the Department of Agriculture’s technical file. This regulatory framework ensures quality and traceability across concentrate usage and final whiskey products.

In the United States alone, more than 5.9 million 9‑litre cases were sold in 2021, generating about USD 1.3 billion. While these figures combine all whiskey, a significant share of production volume is destined for concentrate or bulk sales before bottling elsewhere.

Driving factors behind sector growth include sustained global demand for premium spirits, a growing cocktail and mixology culture, and rising craft‑distillery investments. From 2010 to 2019, export volumes increased 140%, from under 5 million to over 12 million nine‑litre cases, culminating in €890 million in export value in 2019 alone—well ahead of goals outlined in Food Harvest 2020 and Food Wise 2025 government strategies

Government‑led export strategies such as Ireland’s Food Harvest 2020 and Food Wise 2025 outlined whiskey export targets, contributing to export values exceeding €890 million in 2019. Supportive trade policy enabled zero tariffs on some 85 per cent of exports, stimulating global penetration and scale for distillers that supply concentrates for international blending. Strong demand from key markets—particularly the United States, which accounted for 36–40 per cent of global sales volume or export revenue in recent years—has driven bulk handling infrastructure expansion.

Key Takeaways

- Irish Whiskey Market size is expected to be worth around USD 12.1 Billion by 2034, from USD 5.3 Billion in 2024, growing at a CAGR of 8.6%.

- Blended held a dominant market position in the Irish Whiskey market by type, capturing more than a 73.6% share.

- Unflavored held a dominant market position in the Irish Whiskey market by flavor, capturing more than an 84.5% share.

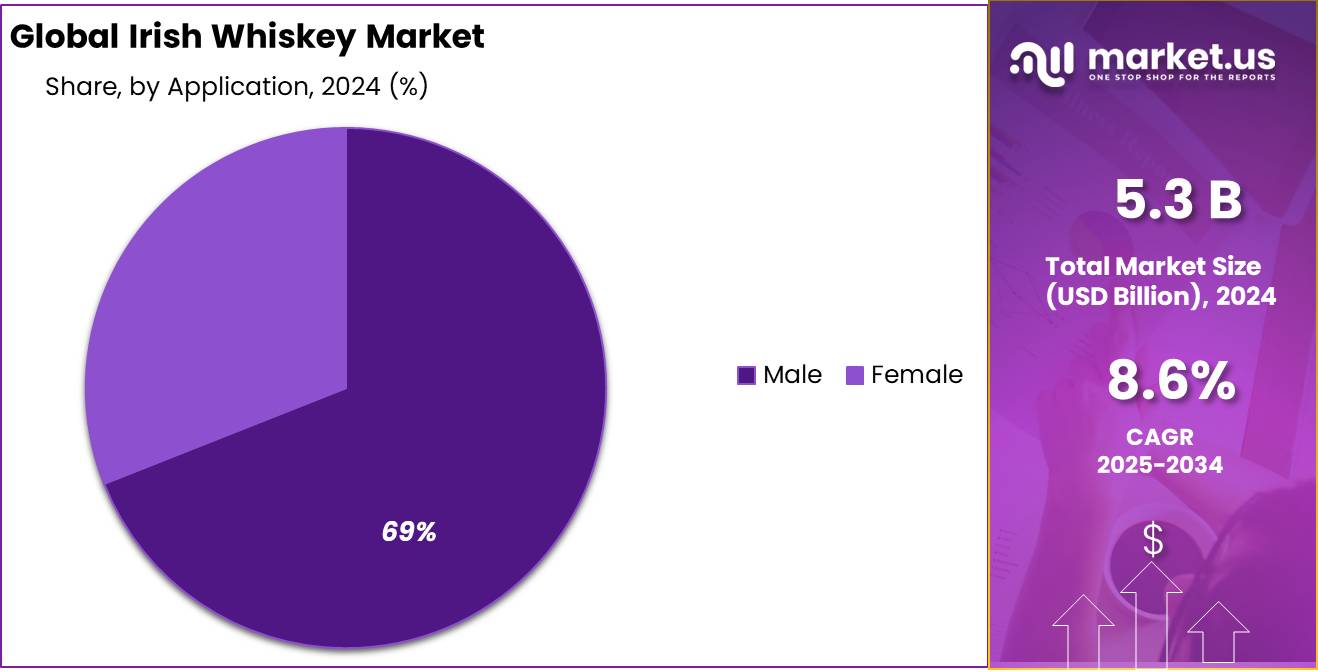

- Male held a dominant market position in the Irish Whiskey market by gender, capturing more than a 69.8% share.

- 31–44 age group held a dominant market position in the Irish Whiskey market by age, capturing more than a 46.3% share.

- Supermarkets/Hypermarkets held a dominant market position in the Irish Whiskey market by sales channel, capturing more than a 64.4% share.

- North America held a dominant position in the global Irish Whiskey market, accounting for over 46.2% of total market share and generating approximately USD 2.4 billion.

By Type Analysis

Blended Irish Whiskey leads with 73.6% share in 2024 due to its smooth taste and global demand.

In 2024, Blended held a dominant market position in the Irish Whiskey market by type, capturing more than a 73.6% share. This leadership was mainly due to the growing international preference for smoother and more approachable whiskey profiles, which blended varieties typically offer. Blended Irish whiskey combines single malt or single pot still whiskeys with grain whiskey, resulting in a balanced flavor that appeals to both new and experienced consumers. The large-scale production capabilities of major distilleries and the consistent quality of blends have helped meet increasing demand from global markets such as the United States, Canada, Germany, and Australia.

Moreover, blended types are more widely available and affordable, making them a popular choice for casual consumption, cocktail mixing, and retail distribution. In 2025, the segment is expected to maintain its leading position as exports continue to rise and more brands introduce innovative blends that attract younger and diverse consumers. The rising visibility of Irish whiskey on global shelves, along with strong marketing efforts and heritage-based branding, is also likely to support the sustained growth of the blended segment in the years ahead.

By Flavor Analysis

Unflavored Irish Whiskey dominates with 84.5% share in 2024 driven by traditional taste and global consumer trust.

In 2024, Unflavored held a dominant market position in the Irish Whiskey market by flavor, capturing more than an 84.5% share. This strong lead reflects the global consumer preference for the classic and authentic taste of traditional Irish whiskey. Unflavored variants, typically matured in oak casks and free from additional essences or infusions, are widely recognized for their purity, smoothness, and consistency. The high share also indicates that both heritage brands and new distilleries continue to focus on preserving the original character of Irish whiskey, which has earned international acclaim. Whiskey enthusiasts, collectors, and even casual drinkers often associate unflavored whiskey with higher quality and better aging potential, making it the default choice in most markets.

In 2025, this segment is expected to sustain its leadership as demand for premium and traditional spirits grows in both mature and emerging markets. The widespread use of unflavored whiskey in aged blends, single malts, and pot still categories further strengthens its dominance. As craft distilleries continue to expand, many are choosing to refine and perfect their unflavored offerings rather than experimenting with flavored versions, reinforcing the strong consumer and industry confidence in this category.

By Gender Analysis

Male consumers lead Irish Whiskey market with 69.8% share in 2024 due to strong brand loyalty and traditional preferences.

In 2024, Male held a dominant market position in the Irish Whiskey market by gender, capturing more than a 69.8% share. This dominance reflects the continued strong interest and consumption patterns among male consumers, who have traditionally formed the core customer base for whiskey. The cultural association of whiskey with masculinity, especially in key markets like the United States, the United Kingdom, and parts of Europe, has contributed to sustained demand from male demographics. Additionally, brand loyalty among male drinkers remains high, with many favoring established Irish whiskey labels known for heritage and craftsmanship. Marketing campaigns often focus on tradition, quality, and maturity—elements that resonate strongly with male audiences.

In 2025, the segment is expected to maintain its lead, although the gap may gradually narrow as whiskey brands increasingly target female and younger drinkers through diverse product offerings and inclusive messaging. Nevertheless, male consumers are expected to remain the primary drivers of Irish whiskey sales, especially in the premium and aged categories. The combination of historical consumption trends, higher per capita spending on spirits, and social drinking habits continues to reinforce male dominance in this segment.

By Age Group Analysis

Age group 31–44 dominates Irish Whiskey market with 46.3% share in 2024 due to lifestyle preferences and premium spending habits.

In 2024, the 31–44 age group held a dominant market position in the Irish Whiskey market by age, capturing more than a 46.3% share. This age segment is often marked by stable income levels, growing interest in premium and craft spirits, and a strong preference for quality over quantity. Consumers in this age range are generally more brand-conscious and are drawn to the heritage, authenticity, and craftsmanship associated with Irish whiskey. Many in this group also enjoy whiskey as part of social occasions, fine dining experiences, and personal indulgence, making them a key driver of both volume and value sales.

In 2025, this group is expected to continue leading the market as their consumption patterns remain steady and their willingness to explore new expressions—such as aged blends and single pot still variants—continues to grow. As more brands align their messaging with the lifestyle and values of this age group, including authenticity, sustainability, and experience-driven consumption, the dominance of the 31–44 segment is likely to persist in the near future.

By Sales Channel Analysis

Supermarkets/Hypermarkets lead Irish Whiskey sales with 64.4% share in 2024 due to convenience and wide brand selection.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the Irish Whiskey market by sales channel, capturing more than a 64.4% share. This strong performance is largely due to the convenience, accessibility, and competitive pricing offered by large retail chains. Consumers often prefer these outlets for their ability to compare multiple brands, explore promotions, and make spontaneous purchases while grocery shopping. The presence of well-stocked liquor sections, clear product labeling, and seasonal discounts further boosts volume sales through this channel.

In countries such as Ireland, the UK, the US, and Germany, supermarkets remain the go-to choice for purchasing Irish whiskey, especially among regular and casual buyers. The expansion of whiskey ranges in retail chains, coupled with in-store marketing and brand-led activations, has helped reinforce consumer trust and product visibility. In 2025, this segment is expected to maintain its leadership as more consumers continue to favor off-trade purchases for at-home consumption, especially during holidays and social gatherings. As e-commerce partnerships with large retailers grow, supermarkets and hypermarkets are also likely to benefit from hybrid online-offline shopping behavior, further consolidating their dominant role in the Irish whiskey sales landscape.

Key Market Segments

By Type

- Blended

- Single Malt

- Single Pot

- Single Grain

By Flavor

- Unflavored

- Flavored Irish Whiskey

By Gender

- Male

- Female

By Age Group

- 18–30

- 31–44

- 45+

By Sales Channel

- On-trade

- Off-trade

Emerging Trends

Premiumization and Craft Innovation Driving Irish Whiskey in 2025A standout trend transforming the Irish whiskey market today is premiumization, where consumers are gravitating toward aged expressions, small‑batch craft releases, and unique cask-finished variants. This isn’t just about luxury—it’s about the craft, story, and experience behind every bottle.According to official data, Irish whiskey exports in 2024 topped €1 billion, a year-on-year rise of 13% compared to 2023. Around 49% of all Ireland’s beverage export value comes from Irish whiskey alone, underscoring its dominant and growing premium role abroad. At the same time, global shipments reached approximately 15.5 million cases in 2024, with about 90% exported to overseas markets.This surge is powered by consumers, especially in North America—where nearly 40% of export volume is now sold—who value authenticity and heritage. They’re seeking single pot still, single malt, and limited-edition releases over basic blends. The rise of craft distilleries—now nearly 50 operational distilleries on the island of Ireland as of March 2025—have brought new expressions onto the market, expanding both choice and storytellingGovernment and EU bodies support this movement. Irish whiskey benefits from Protected Geographical Indication (PGI) status, ensuring that only spirits made and matured in Ireland using local methods can bear the name. This regulatory guarantee boosts confidence, allowing premium producers to justify higher prices with quality and provenance.Drivers

Government‑backed International Trade Support

One major force behind Irish whiskey’s rise is strong government‑supported trade policy, which has paved the way for export growth and protected the spirit’s quality and origin. According to the Irish Whiskey Association, about 85% of Irish whiskey sales benefit from zero‑tariff trade access in key international markets, dramatically reducing cost barriers and making export expansion feasible

This open trade framework is reinforced by geographical indication (GI) protection under EU Regulation 110/2008. That legal safeguard ensures that only spirits distilled and matured on the island of Ireland can be labelled “Irish whiskey,” preserving brand authenticity and consistency overseas

On the economic side, the Irish Government has supported the drinks sector through targeted capital and financial aid. For instance, the Ireland Strategic Investment Fund channelled at least €30 million into Irish whiskey distilleries between 2021–2022, helping fund expansion in facilities like West Cork and others

These trade-friendly policies, combined with direct investment, have produced tangible results. Exports grew from approximately €400 million in 2013 to nearly €1 billion by 2024, marking a 13% rise in a single year and making whiskey the top export category, amounting to nearly half of total alcohol exports in value

This approach is both practical and people‑centred. For distillers big and small, zero tariffs unlock new customers in places such as the U.S., Canada, and India. And GI protection reassures overseas buyers that they’re getting the real Irish deal. Meanwhile, government capital makes building new or expanding existing distilleries, and ageing stocks for higher‑value offerings, financially viable—even for smaller operators.

Restraints

Rising Export Tariffs to the U.S

One significant headwind facing Irish whiskey is the growing burden of export tariffs to the United States, its largest market. In 2023, Irish whiskey exports to the U.S. dropped by 21%, falling from US $576 million in 2022 to around US $457 million in 2023—a sharp decline tied directly to increased duties and trade uncertainty. At the same time, the overall export value of Irish spirits sank by 14%, down to approximately €875 million, even though volume remained strong at 14.9 million nine-litre cases.

Adding to the strain, in early 2025 the U.S. imposed a 10% tariff on Irish whiskey exports—on top of longstanding EU-U.S. trade frictions. Meanwhile, tensions over retaliatory tariffs remain high: proposals include punitive duties of up to 200% on European alcoholic drinks, weighing heavily on export planning and pricing strategy.

These elevated tariffs matter in deeply human terms. Distillers—especially smaller operations—find margins squeezed. Higher costs on premium bottles in U.S. stores risk dampening consumer demand. Investment funds become cautious when profits may be undercut by shifting trade rules.

Government-backed supports, like lobbying through the Irish Whiskey Association, offer some reprieve. Irish officials continue negotiating for a return to a reciprocal zero-for-zero tariff regime, which helped fuel earlier growth. Still, until trade clarity returns, many distillers are facing tough choices—scaling back production, delaying distillery expansion, or shifting focus to emerging markets beyond the U.S.

Opportunity

Spirits Tourism and Cultural Experience

Irish whiskey has a unique chance to grow further by linking its expansion with whiskey tourism. Visitors from around the world are drawn to Ireland for more than just its scenic landscapes—they seek authentic stories and experiences. Distilleries like Jameson, Bushmills, and newer operations offer tours, tastings, and retail, making whiskey part of Ireland’s cultural brand.

In 2021, global sales reached around 14 million cases, and by 2023–2024, exports surpassed 15 million nine‑litre cases, underlining the rising demand worldwide. With whiskey tourism growing, each visitor contributes both to sales and brand affinity.

The Irish alcohol sector supports approximately 92,000 jobs, with around 748 people employed directly in whiskey production and a turnover of €400 million annually in the whiskey segment alone. Whiskey tourism helps broaden this economic impact by driving retail, hospitality, and local services tied to visitor experiences at distilleries.

Supporting this, the Irish government’s Food Wise 2025 strategy set a target of 85% export growth by 2025; whiskey exports already grew 86% in the first five years of that plan. This shows strong alignment between public policy and tourism-led growth. Distillery tours and experiences add another layer—tourists buy bottles on-site, attend tastings, and share stories with friends, reinforcing Irish whiskey’s reputation abroad.

In human terms, tourism turns a bottle into a memory. Someone who tries Jameson at the Midleton Distillery or visits Tullamore Dew in Offaly feels connected—to history, place, and craft. That emotional resonance brings long-term loyalty and word-of-mouth.

Adding fuel to the opportunity, the global whiskey category grew by about 8% in 2022, even while overall spirit consumption fell by 2%. Irish whiskey, as one of the fastest-growing segments, stands to gain particularly from experiential marketing through tourism.

Regional Insights

North America dominates Irish Whiskey market with 46.2% share and USD 2.4 billion valuation in 2024

In 2024, North America held a dominant position in the global Irish Whiskey market, accounting for over 46.2% of total market share and generating approximately USD 2.4 billion in revenue. This leadership is primarily driven by high consumption levels in the United States, which stands as the single largest export destination for Irish whiskey worldwide.

- According to the Distilled Spirits Council of the United States (DISCUS), Irish whiskey imports into the U.S. reached 5.9 million 9-liter cases in 2023, reflecting consistent double-digit growth over the last decade. The widespread appreciation for Irish whiskey’s smooth, approachable flavor profile—combined with its premium image and deep-rooted Irish-American heritage—has made it a favored choice among both millennials and older consumers.

The region’s strong retail infrastructure, including large-scale supermarket chains, specialist liquor outlets, and rising online alcohol sales platforms, has further facilitated product availability and brand penetration. North American consumers also show increasing interest in premium and craft whiskey expressions, encouraging both large and independent Irish distilleries to introduce small-batch and aged variants tailored for this market. The growing popularity of whiskey-based cocktails and mixology culture has expanded usage occasions, especially among younger demographics.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Jameson, owned by Irish Distillers (a subsidiary of Pernod Ricard), is the world’s best-selling Irish whiskey brand. In 2024, it accounted for a substantial share of global Irish whiskey exports, with strong growth in the U.S., Canada, and emerging markets. Jameson’s signature smooth taste, consistent quality, and impactful global campaigns have made it a household name. The brand’s continued expansion into flavored variants and premium offerings is helping sustain its leadership in the category.

Teeling Distillery, based in Dublin, has gained global recognition for its modern approach to traditional Irish whiskey-making. Since its establishment in 2015, the distillery has focused on small-batch, innovative expressions such as single malt, single grain, and cask-finished whiskeys. Teeling has played a significant role in revitalizing Dublin’s distilling heritage and expanding Irish whiskey’s appeal to younger, experimental consumers. Its products are exported to over 60 countries, contributing to the premium segment’s growth.

The Old Bushmills Distillery, located in Northern Ireland, is one of the oldest licensed whiskey distilleries in the world, tracing its roots back to 1608. Now owned by Proximo Spirits, Bushmills produces a range of triple-distilled single malts and blended whiskeys. The brand’s strong heritage, combined with recent investments in production capacity and global marketing, has reinforced its presence in both traditional and emerging markets. Bushmills remains a symbol of craftsmanship in the Irish whiskey industry.

Top Key Players Outlook

- Beam Suntory Inc.

- Jameson Irish whiskey

- Teeling Distillery

- The Old Bushmills Distillery Co.

- Brown-Forman

- Diageo

- Pernod Ricard

- William Grant & Sons

- West Cork Distillers

- Knappogue Castle Whiskey

Recent Industry Developments

In fiscal year 2024, Beam Suntory Inc., operating under its Suntory Global Spirits division, posted consolidated alcoholic‑beverage revenue of ¥1,055.7 billion (excluding liquor tax), an increase of 1.0% year‑on‑year, and achieved operating income of ¥180.7 billion, up 2.9%

In December 2023 (reported in late 2024), The Old Bushmills Distillery Co. recorded a turnover of £56.8 million (approximately €68.2 million), with a pre‑tax profit of £11.2 million (around €13.4 million), reflecting a year‑on‑year profit increase of 9%

Report Scope

Report Features Description Market Value (2024) USD 5.3 Bn Forecast Revenue (2034) USD 12.1 Bn CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Blended, Single Malt, Single Pot, Single Grain), By Flavor (Unflavored, Flavored Irish Whiskey), By Gender (Male, Female), By Age Group (18–30, 31–44, 45+), By Sales Channel (On-trade, Off-trade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Beam Suntory Inc., Jameson Irish whiskey, Teeling Distillery, The Old Bushmills Distillery Co., Brown-Forman, Diageo, Pernod Ricard, William Grant & Sons, West Cork Distillers, Knappogue Castle Whiskey Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Beam Suntory Inc.

- Jameson Irish whiskey

- Teeling Distillery

- The Old Bushmills Distillery Co.

- Brown-Forman

- Diageo

- Pernod Ricard

- William Grant & Sons

- West Cork Distillers

- Knappogue Castle Whiskey