Global HVDC Power Supply Market Size, Share Analysis Report By Voltage (Upto 1000V, 1000-4000V, Above 4000V), By Application (Telecommunication, Medical, Oil And Gas, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170214

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

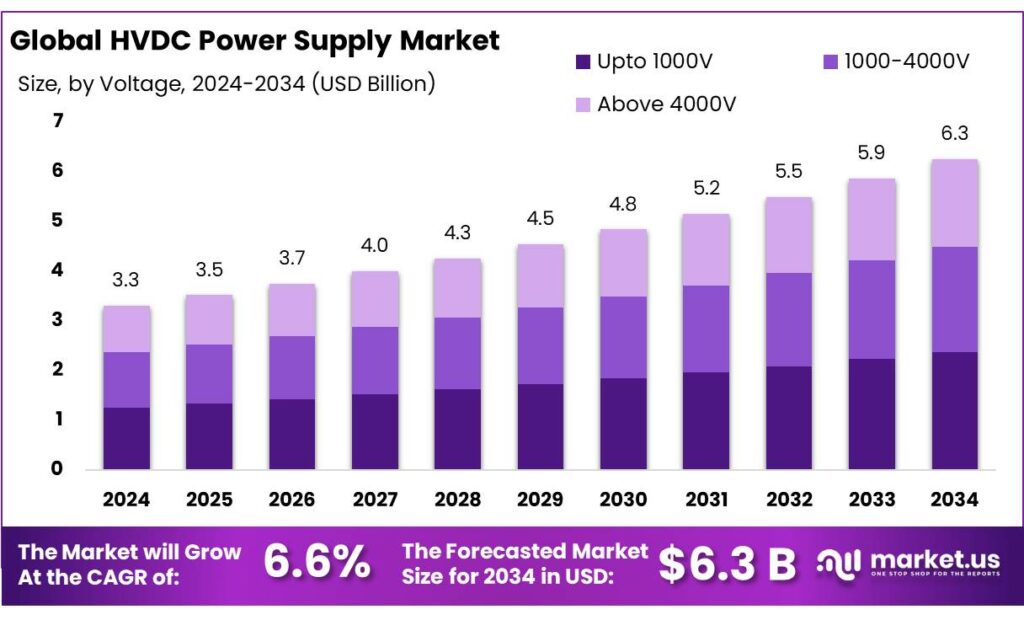

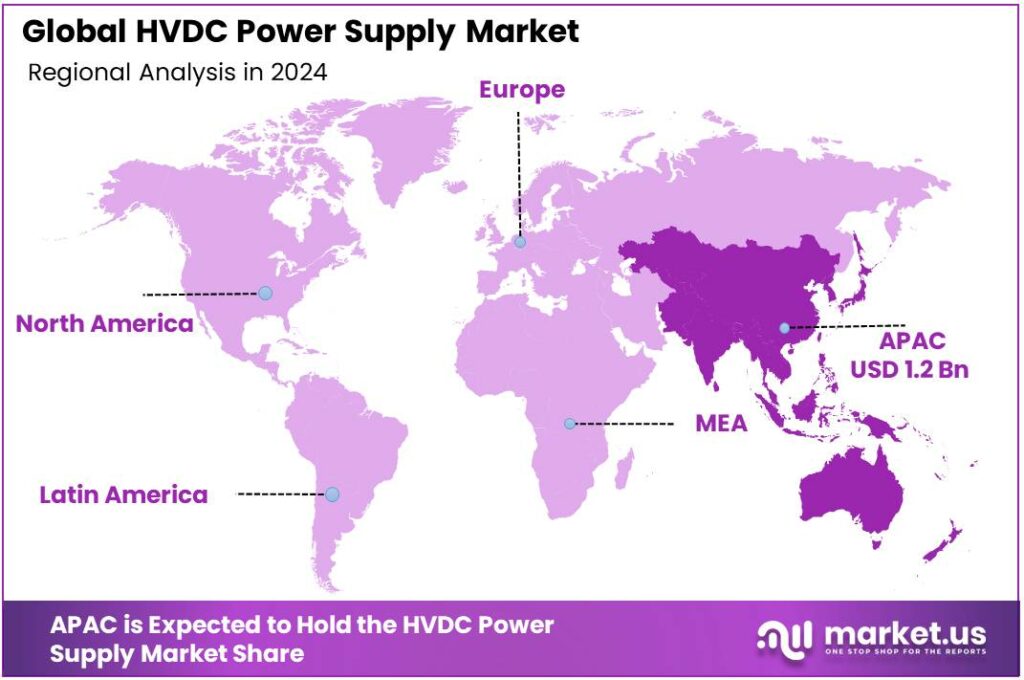

The Global HVDC Power Supply Market size is expected to be worth around USD 6.3 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 39.20% share, holding USD 1.2 Billion revenue.

HVDC power supply refers to the dedicated electrical “backbone” that keeps an HVDC link stable and controllable—converter stations, station auxiliary power, control & protection systems, cooling, and fast DC protection hardware such as HVDC breakers. Industrially, demand is shifting from single point-to-point projects toward multi-purpose grid infrastructure that can move bulk power over long distances with lower losses, interconnect asynchronous grids, and stabilize networks with high renewable penetration.

- Governments are actively accelerating this build-out: the U.S. Department of Energy launched the IDEAL HVDC initiative at about USD 11 million (with USD 8.1 million from DOE’s Office of Electricity and USD 3 million from EERE/Wind) and set a target to cut HVDC transmission system costs by 35% by 2035.

The industrial scenario is also being shaped by large-scale transmission corridors and cross-border interconnectors, which pull through demand for robust station service power supplies, redundant UPS/battery systems, and grid-code compliant protection schemes. India’s Ministry of Power, for example, details Green Energy Corridor works including 1,268 ckm of transmission lines and two HVDC terminals of 5,000 MW each, with a project cost of ₹20,773.70 crore and a central grant of 40% (about ₹8,309.48 crore), targeted for completion by FY 2029–30.

- In parallel, a Government of India release on the Ladakh renewable evacuation scheme highlights an HVDC build featuring 5 GW terminal capacity at each end (Pang and Kaithal) and a line package including 480 km of HVDC line. In Europe, grid investment is being reinforced by the Connecting Europe Facility, which allocated nearly €1.25 billion to 41 cross-border energy infrastructure projects—supportive of new HVDC links and associated converter-station power architectures.

Food and cold-chain growth is a practical demand-side amplifier for HVDC-enabled grid strength. The food sector uses around 30% of total global primary energy consumption, and cold-chain activities already account for about 5% of food-system emissions—numbers that underline why reliable, efficient electricity delivery matters for processing, storage, and distribution. Academic work focused on food cold supply chains also notes cooling and freezing can represent about 30% of the electricity consumption in the food sector, making power quality and uptime economically critical.

Key Takeaways

- HVDC Power Supply Market size is expected to be worth around USD 6.3 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 6.6%.

- Upto 1000V held a dominant market position, capturing more than a 37.8% share.

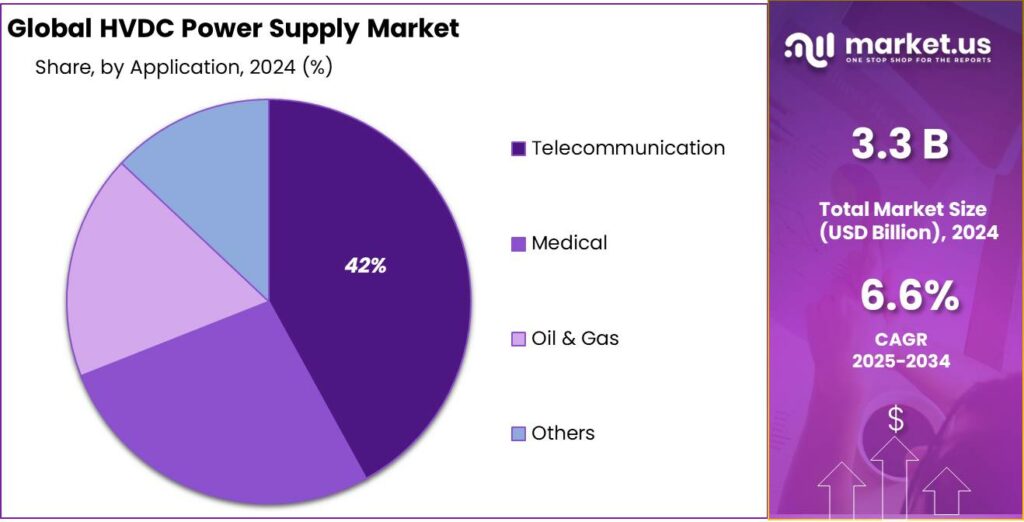

- Telecommunication held a dominant market position, capturing more than a 42.1% share.

- Asia Pacific region accounted for 39.20% of the HVDC power supply market, representing approximately USD 1.2 billion.

By Voltage Analysis

Upto 1000V dominates with 37.8% due to its fit for compact, low-voltage HVDC systems.

In 2024, Upto 1000V held a dominant market position, capturing more than a 37.8% share. This segment’s leadership can be attributed to its suitability for short-distance and on-site DC power applications where safety, ease of installation and lower insulation requirements are prioritized. Adoption was driven by increased use in industrial drives, data-centre intra-racks, telecom power systems and certain renewable-tie applications that benefit from compact converters and simpler protection schemes.

Procurement in 2024 tended to favour units that reduced footprint and enabled straightforward integration with existing low-voltage infrastructure, while lifecycle costs were managed through reduced balance-of-system complexity. Technical suppliers responded with modular, serviceable platforms that simplified maintenance and accelerated time to commissioning. Into 2025, the upto-1000V segment was expected to remain prominent as demand for localized DC distribution and efficient point-to-point links continued, with emphasis on product reliability, safety standards compliance and compatibility with battery storage and power-electronics ecosystems.

By Application Analysis

Telecommunication dominates with 42.1% as network reliability and backup power needs drive HVDC uptake.

In 2024, Telecommunication held a dominant market position, capturing more than a 42.1% share. This leadership can be attributed to the widespread deployment of remote base stations, edge sites and central office power systems where HVDC solutions are preferred for efficient battery integration, reduced conversion losses and simplified backup power architecture. The segment was supported by the need for high availability, compact power footprints at tower and shelter sites, and easier integration with on-site storage that improves uptime during grid disturbances.

Procurement decisions in 2024 favoured HVDC platforms that offered modularity, ease of maintenance and clear lifecycle cost benefits for telecom operators. Continued roll-outs of advanced mobile networks and the drive to improve energy resilience mean the telecommunication segment is expected to maintain its prominence into 2025 as network operators prioritise reliable, low-loss DC power solutions.

Key Market Segments

By Voltage

- Upto 1000V

- 1000-4000V

- Above 4000V

By Application

- Telecommunication

- Medical

- Oil & Gas

- Others

Emerging Trends

Multi-Terminal VSC-HVDC and “Smarter” Converter Stations

One major latest trend in HVDC power supply is the shift from traditional point-to-point links toward more flexible, multi-terminal HVDC networks, enabled by VSC-HVDC converter technology and increasingly digital control systems. The reason is practical: grids are being asked to move power from more places to more load centers, and they need controllability—not just capacity. The IEA reports global electricity demand rose by 4.3% in 2024 and is expected to keep growing at close to 4% through 2027, which raises the value of transmission assets that can be dispatched and stabilized like “grid tools,” not passive wires.

- In MTDC designs, modular multilevel converters (MMCs) have become a workhorse architecture, and studies note typical operating levels around 320 kV or 525 kV for offshore MTDC applications—showing how the market is scaling up voltage classes to carry more power per corridor while keeping losses manageable.

A second piece of this trend is standardization and cost-down, which is pulling HVDC power supply toward more repeatable “platform” designs. The U.S. Department of Energy’s HVDC COst REduction (CORE) Initiative is explicitly aimed at reducing HVDC technology and long-distance transmission costs by 35%. In parallel, U.S. funding language linked to CORE targets reducing the annual levelized cost for HVDC converter stations by 35% by 2035 to $210 per MW per kV.

This trend connects closely to the food economy, because food systems increasingly depend on reliable electricity for cooling, storage, and processing. FAO has highlighted that the lack of effective refrigeration directly results in the loss of 526 million tons of food production—about 12% of the global total—showing how power reliability and cold-chain access are not “nice to have,” but tied to real waste and livelihoods. SEforALL also cites the same 526 million tons estimate and adds that weak cold chains contribute to a 15% reduction in smallholder farmers’ income, reinforcing how grid performance can affect household economics, not only industrial output.

Drivers

Rising Industrial Electrification and Cold-Chain Reliability Needs

A major driving factor for HVDC power supply is the simple reality that grids must move much larger blocks of electricity—and move them more reliably—than they did a decade ago. Heavy industry is electrifying processes to cut fuel risk and emissions, while new loads are appearing faster than many AC networks can reinforce.

- The International Energy Agency (IEA) reports that the industry sector made up nearly 40% of total electricity-demand growth in 2024, and electricity use in industry grew by nearly 4% in 2024. When industrial demand rises in concentrated corridors, transmission becomes the bottleneck—and that’s where HVDC power supply becomes critical, because it can move power long distances with controllability that supports grid stability.

The U.S. Department of Energy’s HVDC COst REduction (CORE) Initiative sets a clear target to reduce HVDC technology and long-distance transmission costs by 35%. For suppliers, that target isn’t abstract—it influences the R&D direction for converter stations, valve halls, insulation systems, and digital control platforms, and it encourages domestic manufacturing capacity to shorten lead times. In practical terms, federal opportunity notices tied to CORE also describe an end-state benchmark for converter stations: a 35% reduction in annual levelized cost by 2035, reaching $210 per MW per kV.

The food system is an under-appreciated part of this demand story, and it brings a very human reason for upgrading transmission: keeping food safe and reducing avoidable loss. FAO highlights that lack of effective refrigeration leads to the loss of 526 million tons of food production—about 12% of the global total. FAO also notes that around 14% of the world’s food is lost in the supply chain after harvest and before retail.

Cold chains and food processing depend on steady power quality; outages and voltage instability don’t just disrupt factories—they can spoil temperature-sensitive inventories and undermine farmer incomes. As countries expand cold storage, reefer logistics, and electrified processing, they also need stronger “backbone” transmission to deliver dependable power into growing load centers—especially where generation is remote and demand is urban or industrial.

Restraints

High Upfront Cost and Long Project Timelines

One major restraining factor for HVDC power supply is the high upfront cost of converter stations and the long timeline needed to permit, procure, and commission these systems. HVDC is not just a “wire upgrade.” The power supply side includes converter transformers, valve halls, cooling systems, controls, protection, harmonic filtering, and civil works—often delivered as a tightly engineered package where small design changes can ripple into months of rework. Even when the long-distance efficiency case is strong, many grid owners still struggle to justify the initial capital outlay within typical budget cycles, especially when there are competing needs like substation hardening, distribution upgrades, or urgent reliability repairs.

- Government programs make this challenge very visible because they are literally built around cost reduction. The U.S. Department of Energy’s HVDC COst REduction (CORE) Initiative sets an explicit goal to reduce HVDC technology and long-distance transmission costs by 35% by 2035—a strong signal that current cost levels are a barrier to wider adoption. The same initiative also spells out a benchmark for converter stations: reducing the annual levelized cost by 35% by 2035 to reach $210 per MW per kV. When a national program has to set targets that specific, it’s effectively acknowledging that today’s price, engineering complexity, and delivery risk slow down purchasing decisions.

That connection to food is more direct than it sounds. FAO highlights that the lack of effective refrigeration directly results in the loss of 526 million tons of food production, about 12% of the global total. FAO also notes that around 14% of the world’s food—valued at about $400 billion per year—is lost in the supply chain after harvest and before retail. Cold chains depend on steady electricity, and when grid reinforcement projects are delayed, food businesses often have to rely more on local diesel backup or accept higher spoilage risk.

Opportunity

Modular HVDC Converter Stations to Support Cold-Chain Expansion

A major growth opportunity for HVDC power supply is the shift toward more modular, repeatable converter-station designs that can be deployed faster to strengthen grids serving large industrial loads—especially the fast-growing “cold chain” that keeps food safe from farm gate to retail. HVDC projects have traditionally been custom-built, with long engineering cycles and limited opportunities to reuse designs.

The opportunity now is to standardize major blocks—valves, controls, transformers, cooling, and protection—so utilities can order converter capacity in a more predictable way, similar to how other grid equipment is procured. When converter stations become easier to replicate and commission, HVDC is no longer reserved only for megaprojects; it becomes a practical option for more corridors and interconnections.

- The food system makes this opportunity feel real, not theoretical. The FAO has highlighted that the lack of effective refrigeration directly results in the loss of 526 million tons of food production—about 12% of the global total. FAO also notes that around 14% of the world’s food—valued at about $400 billion per year—continues to be lost in the supply chain after harvest and before retail.

Regional Insights

Asia Pacific dominates with 39.20% (~USD 1.2 billion) as renewable expansion and interconnection projects accelerate

In 2024, the Asia Pacific region accounted for 39.20% of the HVDC power supply market, representing approximately USD 1.2 billion in revenues; this leadership was driven by rapid additions of large-scale renewable capacity, cross-border transmission initiatives, and targeted grid-modernisation programmes across China, India, Australia and Southeast Asia. The region’s utilities and system operators prioritised HVDC solutions for long-distance bulk transfer and efficient integration of offshore wind and remote solar farms, which increased demand for converters, valves, and station-level power supplies.

Procurement in 2024 favoured VSC-based platforms for flexibility and multi-terminal expansion, while LCC projects continued where high power density and established transmission corridors justified line-commutated approaches. Strong manufacturing and project engineering capabilities in the region reduced lead times and supported competitive system pricing, enabling faster project execution and higher installed capacity.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

General Electric (GE Vernova) — GE Vernova reported USD 34.9 billion in revenue and USD 44.1 billion in orders for 2024, reflecting major scale in power and electrification. GE’s grid and power-conversion businesses provide converters, valves and station engineering that are directly applicable to HVDC projects and converter-station deliveries.

Excelitas Technologies Corp. — Excelitas is a technology supplier to defence, aerospace and industrial markets; in late 2024 parts of its business were the subject of a USD 710 million transaction reported by industry press. The company supplies high-voltage optics, sensors and power-electronics components that can be applied in HVDC power-electronics and station subsystems.

AHV (American High Voltage) — Founded in the late 1970s, AHV is a specialist in high-voltage, harsh-environment power supplies with 40+ years of field experience. The firm supplies custom HV power modules for industrial, oil & gas and defence applications where rugged, high-reliability DC supplies are required; public financials are limited for this private specialist.

Top Key Players Outlook

- ABB Ltd.

- AHV

- Excelitas Technologies Corp.

- General Electric

- American Power Design

- Glassman Europe Ltd.

- Hamamatsu

- Siemens AG

- Toshiba Corp.

- XP Power

Recent Industry Developments

In 2024, Glassman Europe Ltd (Company No. 02379302) remained a small, specialist supplier and distributor of high-voltage DC power supplies and test equipment; public filings show a registered office at 16 Horseshoe Park, Pangbourne and annual accounts made up to 31 Dec 2023 (filed May 2024), while detailed group financials are not publicly disclosed.

In 2024, American Power Design (APD), headquartered in Windham, New Hampshire, continued to serve niche industrial and HVDC-related power needs with a broad range of 0.5 W to 200 W high-voltage DC/DC converters and power modules, offering output voltages up to ~8000 Vdc in compact, regulated designs. These converters are used in demanding applications from laboratory systems to industrial equipment where reliable high-voltage DC sources are required.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Bn Forecast Revenue (2034) USD 6.3 Bn CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Voltage (Upto 1000V, 1000-4000V, Above 4000V), By Application (Telecommunication, Medical, Oil And Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., AHV, Excelitas Technologies Corp., General Electric, American Power Design, Glassman Europe Ltd., Hamamatsu, Siemens AG, Toshiba Corp., XP Power Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- AHV

- Excelitas Technologies Corp.

- General Electric

- American Power Design

- Glassman Europe Ltd.

- Hamamatsu

- Siemens AG

- Toshiba Corp.

- XP Power