Global Humic and Fulvic Acids Market Size, Share, And Enhanced Productivity By Product Type (Humic Acid Products, Fulvic Acid Products, Combined Humic and Fulvic Products, Specialty and Functional Products), By Source Material (Leonardite and Coal-Derived, Composted Organic Matter, Peat and Organic Soil Sources), By Application (Field Crop Applications, Fruit and Vegetable Production, Specialty and High-Value Crops, Turf and Ornamental Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174631

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

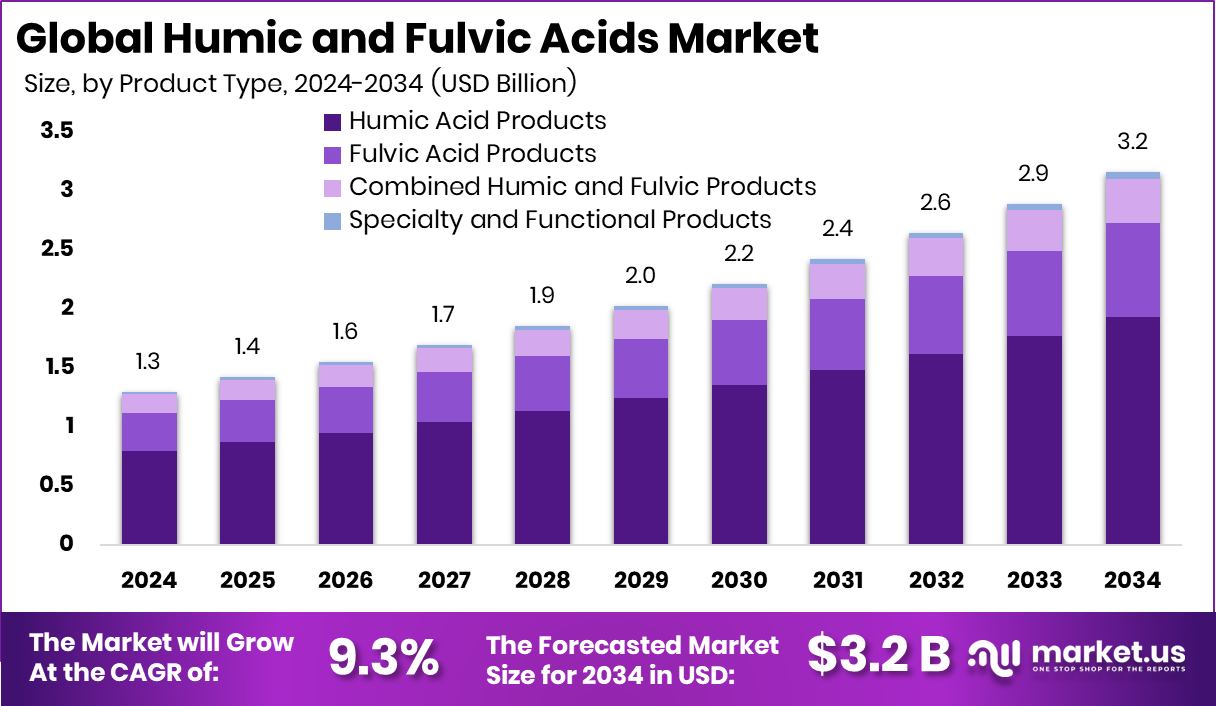

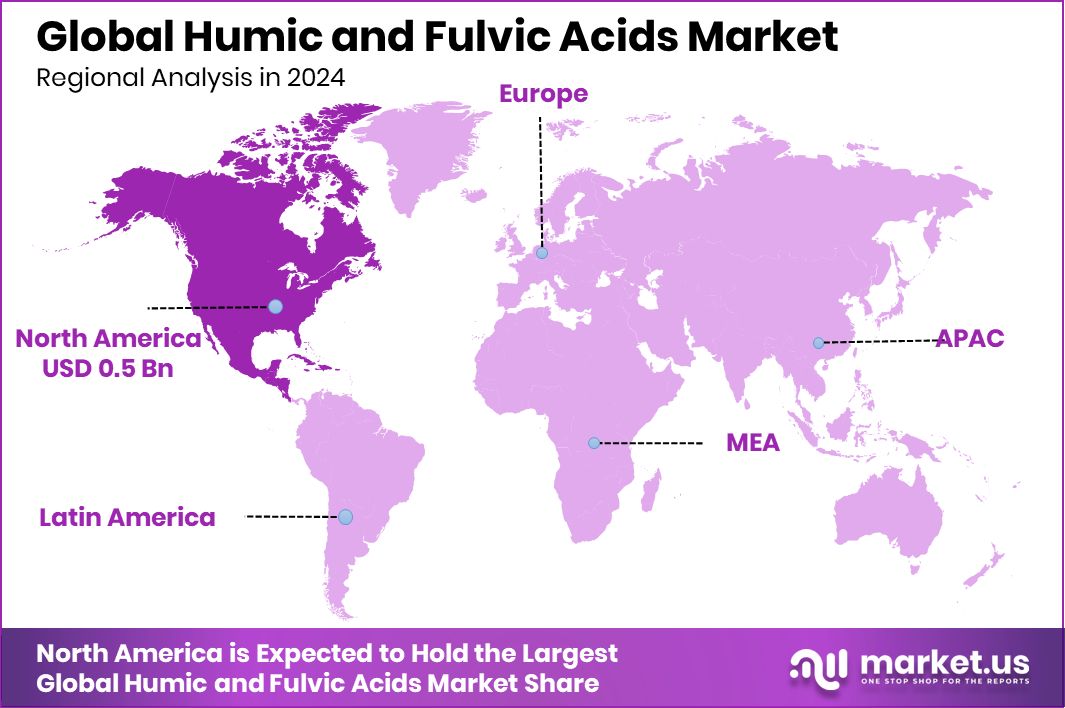

The Global Humic and Fulvic Acids Market is expected to be worth around USD 3.2 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 9.3% from 2025 to 2034. North America maintained dominance at 39.9%, generating a solid USD 0.5 Bn value.

Humic and fulvic acids are natural organic compounds formed during the breakdown of plant and microbial matter in soil. They improve soil structure, increase nutrient absorption, and enhance water-holding capacity, making them essential for healthier crops. Their importance continues to grow as farmers adopt biological inputs that enrich soil rather than relying only on chemical fertilizers, especially in regions where organic matter is rapidly declining.

The Humic and Fulvic Acids Market includes products made from natural sources such as peat, leonardite, and composted materials. These products are used in farming, gardening, and soil restoration because they strengthen root development and help plants cope with stress. The market is growing as agriculture shifts toward sustainable soil practices and natural nutrient enhancers.

One key growth factor is the rising global interest in regenerative farming. For example, the insight “Earn Rs 30,000 from 1 kg of cow dung,” shared by nano-scientist Dr. Satya Prakash Verma, highlights how organic materials continue gaining value, encouraging farmers to explore humic-rich inputs that come from natural waste sources.

Demand is also rising due to expanding peat-rich regions being mapped more accurately. The discovery that peat soils cover 13% more area than previously recorded supports higher availability of humic substances, which naturally benefits producers and users of soil-improvement products.

Opportunity grows further as large natural landscapes—such as the 6+ million acres of Minnesota’s wilderness areas—highlight the importance of soil conservation. These regions inspire broader adoption of humic and fulvic acids to protect ecosystems, restore degraded lands, and maintain long-term soil fertility.

Key Takeaways

- The Global Humic and Fulvic Acids Market is expected to be worth around USD 3.2 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 9.3% from 2025 to 2034.

- In the Humic and Fulvic Acids Market, humic acid products dominate the product type with a 61.2% share globally.

- Within the Humic and Fulvic Acids Market, leonardite and coal-derived sources lead the supply with 59.4% share globally.

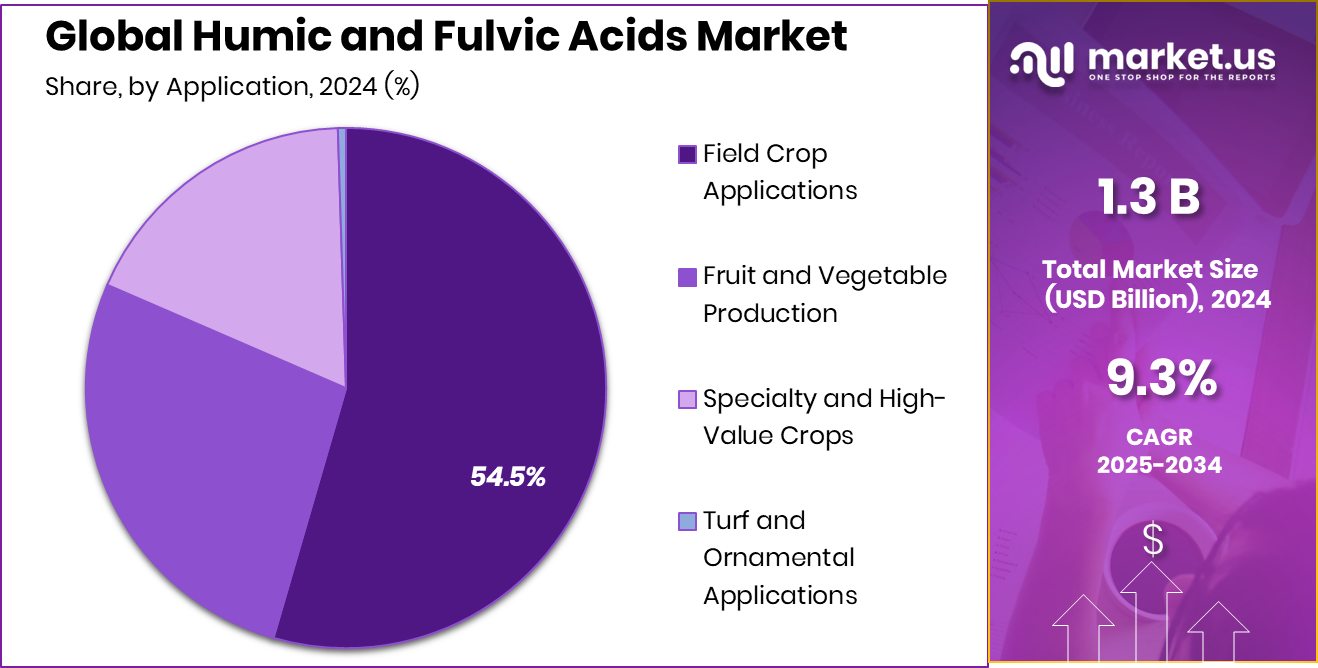

- In the Humic and Fulvic Acids Market, field crop applications remain the dominant application segment, holding 54.5% share.

- In North America, the market achieved USD 0.5 Bn with a strong 39.9% share.

By Product Type Analysis

Humic Acid Products dominate the Humic and Fulvic Acids Market, holding 61.2% share.

In 2024, the Humic and Fulvic Acids Market saw Humic Acid Products secure a dominant 61.2% share, reflecting strong adoption across soil improvement, nutrient enhancement, and plant resilience applications as farmers increasingly shifted toward organic soil conditioners, precision-based nutrient programs, and sustainable cultivation methods that offer better moisture retention, reduced fertilizer loss, and improved root development, leading agricultural producers, especially in large-scale field operations, to widely choose humic-based formulations due to their proven economic value, compatibility with modern fertigation systems, and measurable impact on yield performance, thereby solidifying humic acid’s leadership position within the global bio-stimulant landscape.

By Source Material Analysis

Leonardite and Coal-Derived sources lead the Humic and Fulvic Acids Market with 59.4%.

In 2024, the Humic and Fulvic Acids Market was strongly led by Leonardite and Coal-Derived materials, contributing 59.4% of total consumption as manufacturers prioritized these sources for their high humic concentration, consistent extraction quality, and cost-effective processing benefits, enabling wider commercialization of liquid and granular humic products used across diverse agricultural zones, while the increasing need for carbon-rich soil enhancers, regenerative farming inputs, and biologically active compounds encouraged producers to rely on Leonardite due to its stable supply chain, superior purity, and ability to generate formulations that significantly boost soil fertility and nutrient uptake, thereby making it the backbone material of the market’s production ecosystem.

By Application Analysis

Field Crop Applications drive the Humic and Fulvic Acids Market, accounting for 54.5%.

In 2024, Field Crop Applications dominated the Humic and Fulvic Acids Market with 54.5% share, driven by expanding use of humic-based amendments in cereals, oilseeds, pulses, and forage crops where growers focused heavily on improving soil structure, nutrient-use efficiency, and abiotic stress resistance, particularly in regions affected by declining soil health and rising input costs, prompting agricultural producers to incorporate humic and fulvic compounds into their baseline fertility programs, seed treatments, and foliar nutrition plans to ensure stronger root systems, enhanced microbial activity, and optimal plant performance, ultimately positioning field crops as the primary revenue generator for the global market.

Key Market Segments

By Product Type

- Humic Acid Products

- Fulvic Acid Products

- Combined Humic and Fulvic Products

- Specialty and Functional Products

By Source Material

- Leonardite and Coal-Derived

- Composted Organic Matter

- Peat and Organic Soil Sources

By Application

- Field Crop Applications

- Fruit and Vegetable Production

- Specialty and High-Value Crops

- Turf and Ornamental Applications

Driving Factors

Government Crop Support Accelerates Natural Soil Inputs

Strong public funding for specialty crops is a key driving factor for the Humic and Fulvic Acids Market. Programs that support fruits, vegetables, and high-value crops encourage farmers to adopt soil-improving inputs that raise quality and yield. For example, Michigan awarded USD 2.08 million for 22 specialty crop projects statewide, helping growers improve soil health, nutrient efficiency, and sustainability practices where humic and fulvic acids play a direct role.

Similarly, Spain requested EUR 350.7 million from the EU fruit and vegetable aid scheme for 2024, reflecting continued financial backing for crop systems that benefit from biological soil enhancers. These funds lower adoption risks for farmers, promote better soil management, and indirectly accelerate demand for humic and fulvic acids across supported crop categories.

Restraining Factors

Funding Complexity Limits Small Grower Adoption

A major restraining factor for the Humic and Fulvic Acids Market is the uneven access to large agricultural funding programs. While Spain asked the European Commission for EUR 391 million for fruit and vegetable producers, such large-scale support often favors organized producer groups, leaving smaller farmers slower to adopt advanced soil inputs.

In parallel, although USD 72.9 million is available under the Specialty Crop Block Grant Program, navigating applications, compliance rules, and reporting requirements can delay on-ground implementation. This gap limits how quickly humic and fulvic products reach fragmented farming communities. As a result, adoption remains inconsistent across regions, even when financial support exists, slowing broader market expansion.

Growth Opportunity

Agri-Startups Drive Soil Nutrition Innovation Adoption

One major growth opportunity comes from agri-startups reshaping how fresh produce is grown and sourced. Fresh From Farm raised over INR 3.2 crore in a seed funding round led by Inflection Point Ventures, showing rising investor interest in sustainable, farm-linked supply models.

Such startups focus on quality produce, traceability, and soil health, creating new demand for humic and fulvic acids to improve crop performance naturally. As these platforms work closely with farmers, they promote better soil inputs at the grassroots level. This funding supports scalable adoption, knowledge sharing, and long-term use of soil conditioners that enhance productivity without heavy chemical dependence.

Latest Trends

Export-Led Farming Boosts Biological Soil Solutions

A key latest trend in the Humic and Fulvic Acids Market is the strong link between export growth and soil quality improvement. Fresh From Farm raised Rs 3.2 crore in seed funding led by Inflection Point Ventures, reinforcing the role of organized farm-to-market systems. At the same time, India’s fruit and vegetable exports surged 47.3% with APEDA’s financial assistance, highlighting how export-focused farming prioritizes crop quality and consistency. To meet international standards, growers increasingly rely on humic and fulvic acids to improve soil structure, nutrient uptake, and plant health. This trend positions biological soil inputs as essential tools for export-driven agriculture.

Regional Analysis

North America led the Humic and Fulvic Acids Market with 39.9%, reaching USD 0.5 Bn.

North America dominated the Humic and Fulvic Acids Market with a 39.9% share, reaching USD 0.5 Bn, supported by strong adoption of soil-enhancing bio-stimulants across large-scale farming systems and rising demand for sustainable crop inputs.

Europe continued to show stable market participation, driven by expanding organic farming practices and heightened regulatory focus on soil regeneration, which encouraged wider use of humic and fulvic formulations.

Asia Pacific reflected steady growth as agricultural producers increased reliance on natural soil conditioners to improve nutrient efficiency and support high-intensity cultivation across diverse climatic zones.

The Middle East & Africa exhibited gradual adoption, mainly influenced by the region’s need to enhance soil structure in arid environments and optimize crop resilience. Latin America sustained a consistent presence as growers in key agricultural economies integrated humic-based solutions to support soil fertility and long-term productivity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Bio Huma Netics, Inc. stands out for its long-standing focus on humic and fulvic technologies tailored to soil health and plant nutrition. The company’s strength lies in formulation depth and application-specific solutions used across agriculture, turf, and specialty crops. Its emphasis on consistent product performance and agronomic compatibility positions it as a trusted supplier for growers seeking reliable biological soil inputs rather than experimental additives.

Black Earth Humic LP is viewed as a vertically integrated player with strong control over raw material sourcing and processing. In 2024, this integration supports product consistency and scalable supply for agricultural customers. Analysts note that its operational model allows steady delivery of humic-based products suited for soil conditioning and nutrient efficiency, helping the company maintain relevance among distributors and growers focused on practical, field-proven soil improvement solutions.

From a market behavior perspective, Grow More, Inc. differentiates itself through its broader plant nutrition portfolio that includes humic and fulvic components. The company’s positioning appeals to growers seeking integrated nutrient programs rather than standalone soil amendments. Its practical, application-driven product design supports adoption across diverse cropping systems, reinforcing its role as a complementary supplier within the humic and fulvic acids landscape in 2024.

Top Key Players in the Market

- Bio Huma Netics, Inc.

- Black Earth Humic LP

- Grow More, Inc.

- Horizon Ag-Products, LLC

- Humatech, Inc.

- Humic Growth Solutions, Inc.

- Humintech GmbH

- Inner Mongolia Yili Humic Acid Ecological Technology Co., Ltd.

- Jiloca Industrial, S.A.

- Omnia Specialities Australia Pty Ltd.

- The Andersons, Inc.

Recent Developments

- In August 2025, Tikehau Capital, a French alternative asset manager focused on regenerative agriculture, acquired a majority stake in Horizon Ag-Products, expanding the company’s access to global investment and strategic growth support for its organic acids and humic technologies.

- In July 2025, The Andersons completed the acquisition of full ownership interest in The Andersons Marathon Holdings LLC (TAMH), a move expanding its agribusiness and renewables footprint; while not directly a humic product launch, this strategic ownership strengthens its overall agricultural product ecosystem.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 3.2 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Humic Acid Products, Fulvic Acid Products, Combined Humic and Fulvic Products, Specialty and Functional Products), By Source Material (Leonardite and Coal-Derived, Composted Organic Matter, Peat and Organic Soil Sources), By Application (Field Crop Applications, Fruit and Vegetable Production, Specialty and High-Value Crops, Turf and Ornamental Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bio Huma Netics, Inc., Black Earth Humic LP, Grow More, Inc., Horizon Ag-Products, LLC, Humatech, Inc., Humic Growth Solutions, Inc., Humintech GmbH, Inner Mongolia Yili Humic Acid Ecological Technology Co., Ltd., Jiloca Industrial, S.A., Omnia Specialities Australia Pty Ltd., The Andersons, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Humic and Fulvic Acids MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Humic and Fulvic Acids MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bio Huma Netics, Inc.

- Black Earth Humic LP

- Grow More, Inc.

- Horizon Ag-Products, LLC

- Humatech, Inc.

- Humic Growth Solutions, Inc.

- Humintech GmbH

- Inner Mongolia Yili Humic Acid Ecological Technology Co., Ltd.

- Jiloca Industrial, S.A.

- Omnia Specialities Australia Pty Ltd.

- The Andersons, Inc.