Global Human Coagulation Factor VII Market By Product Type (Plasma-Derived Factor VII and Recombinant Factor VII), By Application (Hemophilia and Surgery), By End-User (Hospitals, Specialty Clinics, and Ambulatory Surgery Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152453

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

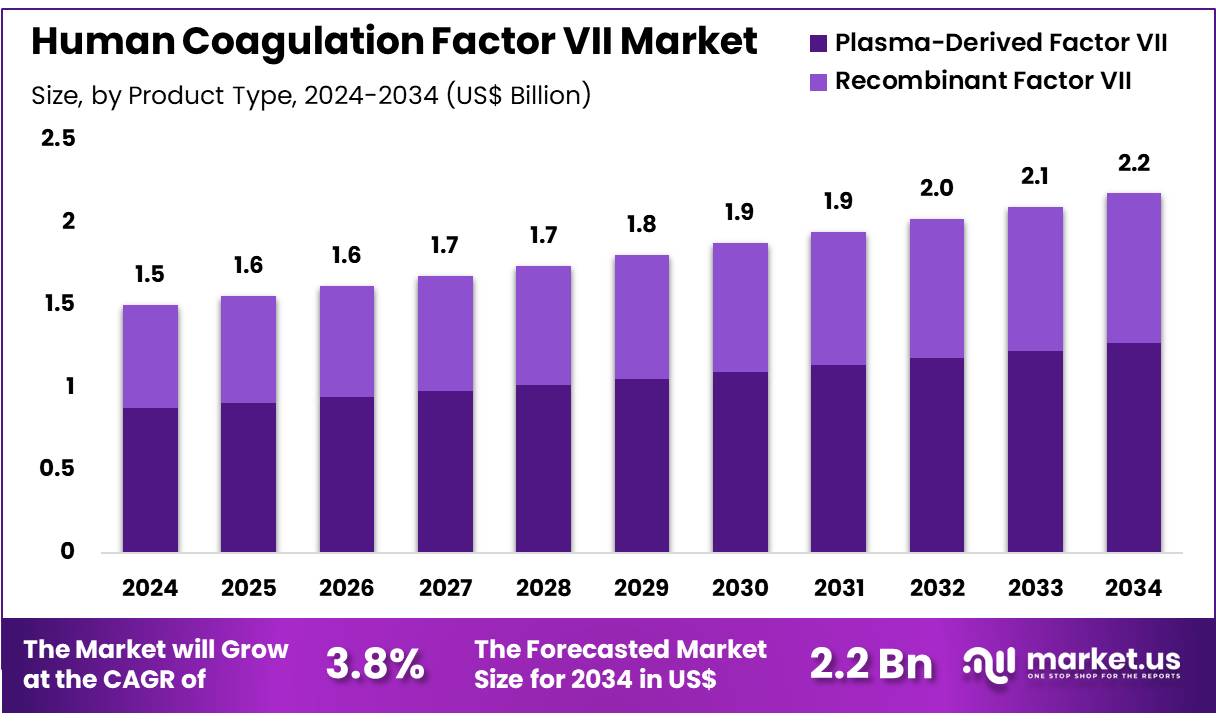

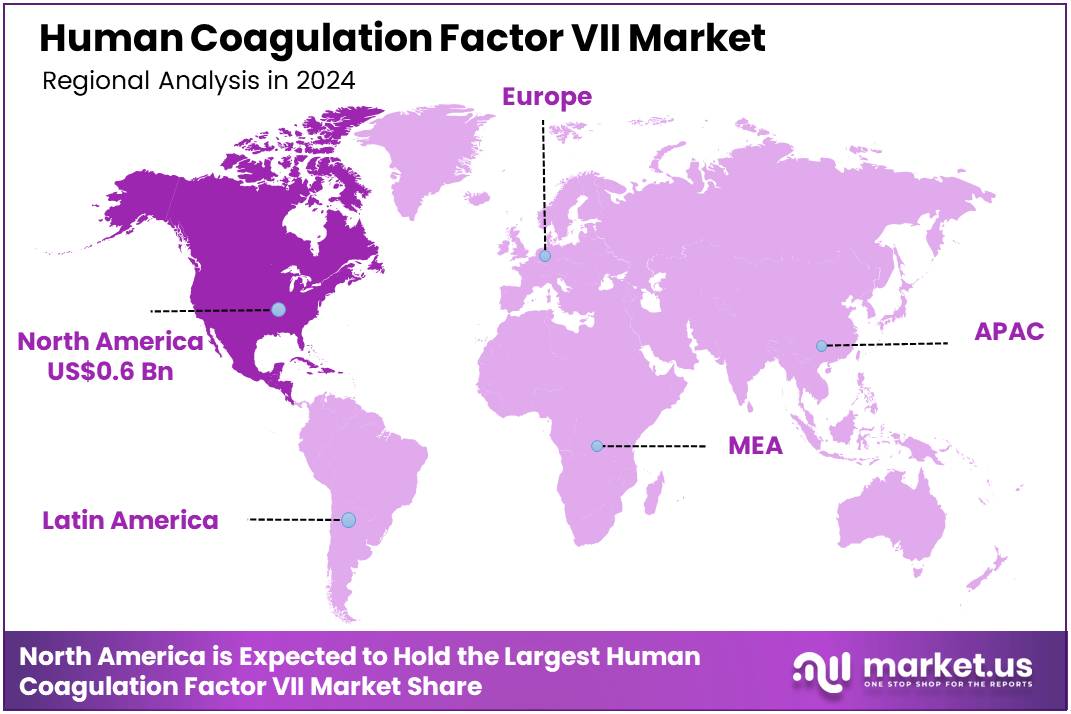

Global Human Coagulation Factor VII Market size is expected to be worth around US$ 2.2 Billion by 2034 from US$ 1.5 Billion in 2024, growing at a CAGR of 3.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.2% share with a revenue of US$ 0.6 Billion.

Growing recognition of the importance of clotting factor therapies and the rising prevalence of bleeding disorders are driving the expansion of the human coagulation factor VII market. Coagulation factor VII plays a crucial role in the blood clotting cascade, and its deficiencies can lead to conditions like hemophilia and other coagulation disorders. The demand for human coagulation factor VII is increasing due to the rising incidence of such bleeding disorders and the growing awareness of advanced therapies that can significantly improve patient quality of life.

Advancements in biotechnology and plasma fractionation processes have led to the development of more effective and safer treatments, addressing the limitations of traditional therapies. These treatments are especially essential in the management of congenital factor VII deficiencies and are being increasingly used in surgery and trauma care to control bleeding. In May 2023, PlasmaGen Biosciences launched a manufacturing plant in Kolar, Bengaluru, with a capacity to process 500,000 liters of plasma annually. This facility enhances the supply of coagulation factors, particularly in emerging markets where the demand for these life-saving therapies is on the rise.

The market is also benefiting from the increasing focus on recombinant technology, which enables the production of coagulation factors without the need for human blood donations, ensuring a more sustainable and scalable supply. As the understanding of bleeding disorders evolves and new clinical applications emerge, the market for human coagulation factor VII continues to grow, offering significant opportunities for pharmaceutical companies to meet the expanding need for these critical therapies.

Key Takeaways

- In 2024, the market for human coagulation factor VII generated a revenue of US$ 1.5 Billion, with a CAGR of 3.8%, and is expected to reach US$ 2.2 Billion by the year 2034.

- The product type segment is divided into plasma-derived factor VII and recombinant factor VII, with plasma-derived factor VII taking the lead in 2023 with a market share of 58.3%.

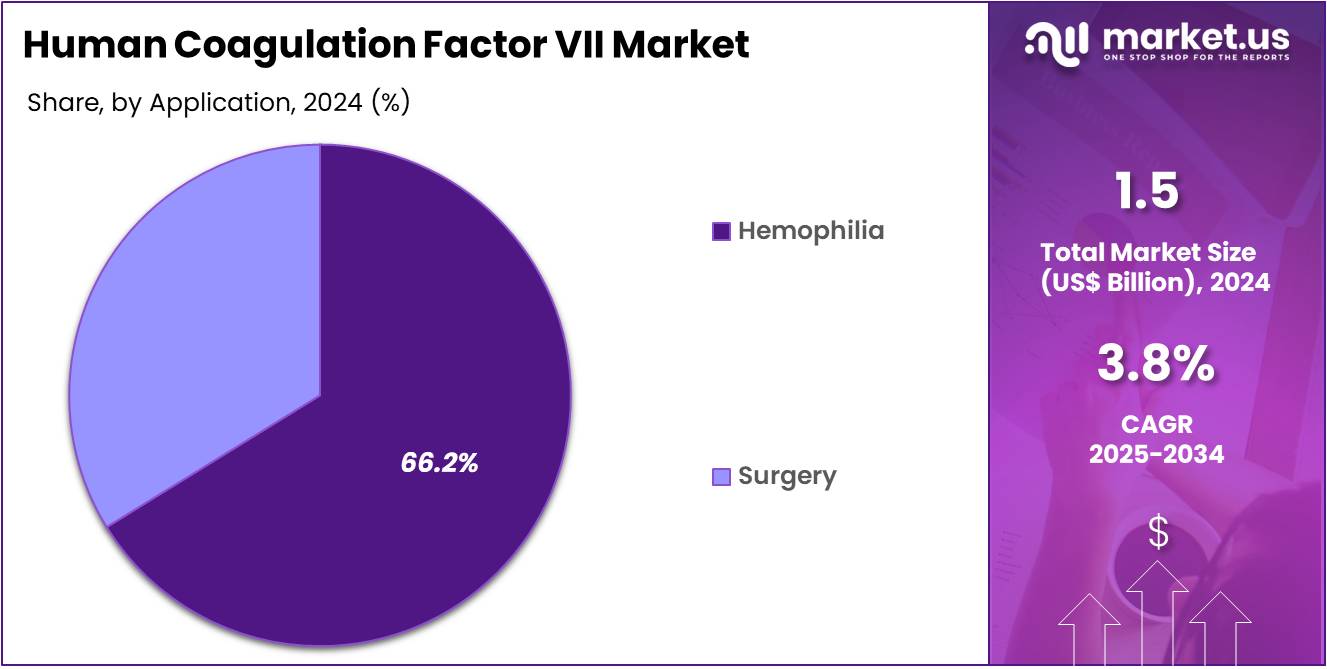

- Considering application, the market is divided into hemophilia and surgery. Among these, hemophilia held a significant share of 66.2%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics, and ambulatory surgery centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 69.5% in the human coagulation factor VII market.

- North America led the market by securing a market share of 38.2% in 2023.

Product Type Analysis

Plasma-derived factor VII holds a dominant share of 58.3% in the human coagulation factor VII market. This segment’s growth is expected to continue as plasma-derived products remain the gold standard for treating bleeding disorders, particularly in patients with hemophilia. The increasing global demand for plasma-derived therapies, driven by the growing prevalence of clotting factor deficiencies, is anticipated to contribute to the segment’s expansion.

Plasma-derived factor VII is also projected to see sustained growth due to its high clinical efficacy and established safety profile. The ability to harvest this factor from human plasma and its effective use in emergency and prophylactic treatments for hemophilia patients will likely drive its demand further. Additionally, as more patients are diagnosed with coagulation factor deficiencies, the reliance on plasma-derived therapies is estimated to increase.

Regulatory bodies continue to approve these products for broader use, which is expected to contribute to the market’s overall growth. Furthermore, plasma-derived factor VII is often used in conjunction with other coagulation factors, creating synergies that further promote growth in this segment.

Application Analysis

Hemophilia is the dominant application, holding a share of 66.2% in the market. This segment’s growth is expected to be fueled by the increasing number of hemophilia cases globally, especially in developing countries where healthcare access is improving. Hemophilia treatment is a critical area of healthcare, and the increasing number of diagnosed cases is anticipated to drive demand for coagulation factor VII products.

Additionally, advancements in hemophilia care, including gene therapies and longer-acting factor VII products, are projected to enhance treatment options and improve patient outcomes, contributing to the growth of this segment. The rising awareness of bleeding disorders and improved diagnostic techniques are also likely to lead to early intervention, increasing the demand for coagulation factors.

Hemophilia A and B patients, especially those with severe forms of the disease, are anticipated to continue to rely heavily on factor VII therapies. With ongoing innovation in treatment protocols and the development of more efficient and cost-effective solutions, this application is projected to maintain its dominant position in the market.

End-User Analysis

Hospitals hold the largest share of 69.5% in the human coagulation factor VII market. The growth in this segment is primarily driven by hospitals being the primary healthcare setting for the administration of coagulation factors, including factor VII. Hospitals are likely to continue to be the major source of factor VII treatments due to the complexity of these therapies and the need for specialized healthcare professionals.

The increasing prevalence of clotting disorders, particularly in emergency and surgical settings, is anticipated to drive demand for factor VII in hospitals. As healthcare systems in both developed and emerging markets continue to evolve, hospitals are expected to see an increase in patient numbers, leading to a higher requirement for coagulation factor products.

Additionally, hospitals offer the infrastructure needed for the safe and effective administration of plasma-derived and recombinant factor VII products. The growing number of specialized hematology and surgery departments within hospitals is projected to further contribute to the demand for coagulation factor VII. With the advancement of clinical applications and the integration of new therapies, hospitals will continue to play a critical role in the use and distribution of these life-saving products.

Key Market Segments

By Product Type

- Plasma-Derived Factor VII

- Recombinant Factor VII

By Application

- Hemophilia

- Surgery

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgery Centers

Drivers

Increasing Prevalence of Hemophilia and Bleeding Disorders is Driving the Market

The increasing global prevalence of hemophilia and other inherited bleeding disorders is a significant driver propelling the human coagulation factor VII market. Human coagulation factor VII, particularly recombinant activated Factor VII (rFVIIa), serves as a crucial bypassing agent for patients with hemophilia A or B who have developed inhibitors (antibodies) to traditional factor VIII or IX replacement therapies, making their condition difficult to treat.

It is also vital for individuals with congenital factor VII deficiency and Glanzmann’s thrombasthenia. The rising number of diagnosed patients with these severe conditions necessitates a consistent and growing supply of effective hemostatic agents like Factor VII. Early diagnosis and improved access to treatment in developing regions also contribute to this expanding patient pool.

The Centers for Disease Control and Prevention (CDC) continuously monitors hemophilia prevalence in the United States. While precise, real-time national counts for 2022-2024 are part of ongoing surveillance, the CDC generally states that hemophilia A occurs in about 1 in 5,000 live male births and hemophilia B in about 1 in 30,000 live male births. These figures highlight the consistent birth incidence of these conditions, ensuring a steady influx of patients requiring lifelong treatment.

As of 2022, data from the CDC’s Community Counts Registry, which collects data from U.S. Hemophilia Treatment Centers, indicated thousands of individuals with hemophilia receiving care, many of whom may require bypassing agents at some point in their lives due to inhibitor development or specific bleeding episodes. This consistent and critical medical need drives the demand for Factor VII products.

Restraints

High Cost of Treatment and Manufacturing Complexities are Restraining the Market

The inherently high cost associated with human coagulation factor VII products, coupled with the complex manufacturing processes, significantly restrains the market’s broader expansion. Factor VII therapies, especially recombinant activated forms, are expensive to produce due to the sophisticated biotechnological processes involved in their manufacturing, which include cell culture, purification, and quality control.

These high production costs translate into very high treatment prices for patients and healthcare systems. Such high costs can lead to challenges in reimbursement from insurance providers and government health programs, potentially limiting patient access, particularly in regions with constrained healthcare budgets. For example, while not specific to Factor VII, a general review of pharmaceutical pricing by the U.S. Department of Health and Human Services (HHS) frequently highlights the high cost of specialty drugs, a category that includes many biologic therapies for rare diseases.

Additionally, the development and regulatory approval pathways for these complex biologic drugs are lengthy and expensive, requiring significant research and clinical trial investments. The manufacturing process itself demands specialized facilities, highly skilled personnel, and stringent quality assurance protocols to ensure product safety and efficacy. These complexities contribute to limited production capacities and high barriers to entry for new manufacturers, thereby restricting the overall supply and keeping prices elevated.

Opportunities

Increasing Research and Development into Gene Therapies and Novel Formulations is Creating Growth Opportunities

Increasing research and development into gene therapies and novel formulations for bleeding disorders is creating significant growth opportunities in the human coagulation factor VII market. While gene therapies aim to provide a long-term cure for hemophilia by enabling the patient’s body to produce the missing clotting factor, their development and adoption still face considerable challenges, creating a window for optimized conventional therapies. This intense research environment also drives innovation in existing treatment modalities for factor VII.

Companies are exploring enhanced recombinant Factor VIIa formulations with improved pharmacokinetics, allowing for less frequent dosing and potentially better bleed control. Furthermore, the focus on developing more personalized treatment approaches for patients with inhibitors, where Factor VII is often crucial, continues to drive innovation.

The U.S. Food and Drug Administration (FDA) has actively approved and continues to review several gene therapies for hemophilia, such as Roctavian (valoctocogene roxaparvovec) for hemophilia A, approved in June 2023, and Hemgenix (etranacogene dezaparvovec) for hemophilia B, approved in November 2022.

While these gene therapies are for Factor VIII and IX deficiencies, their presence pushes the entire bleeding disorder treatment landscape forward. The ongoing pursuit of gene therapies and the insights gained from this research ultimately foster advancements in bypassing agents like Factor VII, as companies refine existing products and develop new strategies to manage complex bleeding episodes, even in the context of emerging curative options.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the human coagulation factor VII market, shaping both its challenges and its trajectory. Economic conditions, such as global inflation rates and fluctuations in national healthcare budgets, directly impact the affordability and reimbursement of these often high-cost, life-saving therapies. During periods of high inflation, the cost of specialized raw materials, advanced manufacturing processes, and highly skilled labor required for producing coagulation factor VII can increase significantly.

For example, the U.S. Bureau of Labor Statistics reported that the Producer Price Index for Pharmaceutical Preparation and Medicament Manufacturing increased by 2.6% from May 2023 to May 2024, indicating persistent inflationary pressures on drug production. This pressure can strain healthcare budgets, especially in publicly funded systems, potentially leading to greater scrutiny of pricing or delayed adoption of new therapies. Simultaneously, geopolitical events, including trade disputes, international conflicts, or shifts in diplomatic relations, can disrupt the global supply chain of critical components or restrict the movement of finished products.

Such disruptions can lead to manufacturing delays, product shortages, or increased costs, particularly for a specialized biologic like Factor VII that relies on complex global networks. Despite these challenges, such global events can also compel countries to prioritize national self-sufficiency in critical medicines, potentially spurring domestic investment in advanced biopharmaceutical manufacturing capabilities. This can lead to more diversified and resilient global supply networks in the long run.

Current US tariffs have both direct and indirect effects on the human coagulation factor VII market. Tariffs on imported specialized raw materials, advanced manufacturing equipment, and certain finished pharmaceutical products directly raise costs for companies in the Factor VII supply chain. These increased input costs force manufacturers to either absorb the additional expenses, which negatively impacts their profit margins and reduces investment in research and development (R&D), or pass these costs on to healthcare providers, ultimately leading to higher prices for crucial Factor VII products.

A June 2025 analysis by the Johns Hopkins Bloomberg School of Public Health showed that US pharmaceutical imports more than doubled in value, from US$73 billion in 2014 to over US$215 billion in 2024, highlighting the significant dependence of the US market on global supply chains that tariffs can disrupt. The analysis also noted that high tariffs on Chinese APIs—up to 245%—were expected to substantially raise the cost of these APIs.

While Factor VII is a complex biologic and not a simple API, disruptions to the broader pharmaceutical supply chain due to tariffs can still cause ripple effects, raising manufacturing costs and impacting logistics. Indirectly, these tariffs may create trade uncertainties that could discourage foreign investment in US-based biopharmaceutical manufacturing facilities.

However, such tariff policies could also act as an incentive for domestic manufacturing and innovation, prompting pharmaceutical companies to invest more in US-based production facilities and R&D for Factor VII therapies. This shift to domestic manufacturing could foster job creation, enhance supply chain security, and ultimately strengthen the resilience of the US market for essential coagulation factors.

Latest Trends

Focus on Personalized Dosing and Real-World Evidence is a Recent Trend

A prominent recent trend significantly impacting the human coagulation factor VII market in 2024 and continuing into 2025 is the increased focus on personalized dosing strategies and the extensive use of real-world evidence (RWE) to optimize treatment outcomes. Healthcare providers and manufacturers are moving away from one-size-fits-all dosing regimens towards approaches tailored to individual patient needs, considering factors like bleeding patterns, inhibitor status, pharmacokinetics, and lifestyle. This personalization aims to enhance treatment efficacy, reduce thrombotic risks, and optimize resource utilization.

Real-world evidence, derived from electronic health records, patient registries, and claims data, is becoming increasingly critical in understanding how Factor VII products perform in routine clinical practice, complementing traditional clinical trial data. This trend supports more informed clinical decisions and helps refine treatment guidelines. The U.S. National Institutes of Health (NIH) consistently funds research into personalized medicine for rare diseases, including bleeding disorders, which drives this focus on individualized care.

Additionally, the Centers for Disease Control and Prevention (CDC) collects real-world data through programs like Community Counts to better understand the epidemiology and management of bleeding disorders in the U.S. This emphasis on tailoring treatment and leveraging comprehensive real-world data helps ensure that Factor VII therapies are used most effectively, improving patient quality of life and informing future product development.

Regional Analysis

North America is leading the Human Coagulation Factor VII Market

North America dominated the market with the highest revenue share of 38.2% owing to the persistent need for effective hemostatic agents in patients with bleeding disorders, particularly those with inhibitors to traditional factor replacement therapies, and in specific surgical or trauma settings. This crucial market segment serves individuals with hemophilia A or B with inhibitors, congenital Factor VII deficiency, and those experiencing severe bleeding.

The prevalence of hemophilia in the United States remains a significant driver, with an estimated 30,000 to 33,000 males living with the disorder in the United States during the period of 2012–2018, based on a CDC study that used data from federally funded hemophilia treatment centers, indicating a substantial and consistent patient base. The availability of recombinant human coagulation Factor VIIa (rFVIIa) products has been pivotal, offering a bypass agent for inhibitor patients, thereby improving treatment outcomes and patient quality of life.

The U.S. Food and Drug Administration (FDA) continues to assess and approve therapies for these conditions; for instance, SEVENFACT (eptacog beta), another recombinant Factor VIIa, received FDA approval in November 2022 to decrease the incidence of infection in patients with non-myeloid malignancies receiving myelosuppressive anti-cancer drugs associated with clinically significant incidence of febrile neutropenia. Novo Nordisk, a key player with its product NovoSeven, reported strong performance for its Rare Disease segment in 2024.

Although specific regional revenue for NovoSeven is often consolidated within broader rare disease reporting, Novo Nordisk’s overall net sales increased significantly by 31% in Danish kroner and 36% at constant exchange rates in 2023, reflecting a robust underlying demand for specialized treatments, including those for bleeding disorders.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing efforts to diagnose bleeding disorders, improving access to specialized healthcare services, and a rising awareness among medical practitioners regarding advanced hemostatic treatments. Despite being largely underdiagnosed in many parts of the region, the World Federation of Hemophilia’s Annual Global Survey 2023 indicated that a significant number of individuals with hemophilia remain unidentified, implying substantial unmet needs for effective therapies, including Factor VII.

Governments across Asia Pacific are likely to enhance their rare disease policies and funding to improve patient outcomes. For example, China’s National Health Commission updated its guidelines for the diagnosis and management of hemophilia with inhibitors in 2023, emphasizing comprehensive care that includes access to bypass agents. Japan’s Ministry of Health, Labour and Welfare also consistently supports the provision of treatments for rare diseases through its national health insurance system.

Pharmaceutical companies are anticipated to intensify their focus on expanding the reach of human coagulation factor VII products in the region. Novo Nordisk, with its global presence, is likely to further strengthen its distribution networks and educational initiatives to improve diagnosis and treatment rates for bleeding disorders, including those requiring Factor VII. This concerted effort by public health bodies and industry leaders is projected to significantly drive the market for human coagulation factor VII across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the human coagulation factor VII market employ various strategies to drive growth and market expansion. They focus on improving product efficacy by developing enhanced formulations and delivery methods for patients with bleeding disorders. Collaborations with research institutions and healthcare providers help in advancing clinical trials and obtaining regulatory approvals for new treatments.

Companies also invest in broadening their geographic reach, targeting regions with growing healthcare needs. They strengthen their market presence through strategic acquisitions, expanding product portfolios to include adjunct therapies. Additionally, companies are improving patient access programs to support treatment adherence and addressing unmet medical needs through innovation.

One key player, Novo Nordisk, is a global leader in diabetes care and hemophilia treatment. The company produces a range of therapies, including recombinant clotting factor products. Novo Nordisk focuses on the development of next-generation therapies for bleeding disorders, investing heavily in research and clinical trials. With its extensive global distribution network and commitment to advancing treatment options, the company maintains a strong position in the coagulation factor market.

Top Key Players

- RAAS

- Pfizer Bayer

- Octapharma USA

- Novo Nordisk

- Kedrion

- Hualan Bio

- CSL Behring

- Biogen

Recent Developments

- In September 2024, Octapharma USA, Inc. received extended U.S. FDA approval for Fibryga, a Fibrinogen (Human) Lyophilized Powder. This approval supports the broader coagulation factor market by ensuring a stable supply of plasma-derived coagulation factors.

- In March 2023, CSL Behring opened a new plasma fractionation facility in Marburg, Germany, boosting its capacity to produce plasma-derived therapies, including coagulation factors. This expansion supports the increasing global demand for these essential products.

Report Scope

Report Features Description Market Value (2024) US$ 1.5 Billion Forecast Revenue (2034) US$ 2.2 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Plasma-Derived Factor VII and Recombinant Factor VII), By Application (Hemophilia and Surgery), By End-User (Hospitals, Specialty Clinics, and Ambulatory Surgery Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape RAAS, Pfizer Bayer, Octapharma USA, Novo Nordisk, Kedrion, Hualan Bio, CSL Behring, Biogen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Human Coagulation Factor VII MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Human Coagulation Factor VII MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- RAAS

- Pfizer Bayer

- Octapharma USA

- Novo Nordisk

- Kedrion

- Hualan Bio

- CSL Behring

- Biogen