Global High Throughput Screening Market By Product (Instruments & Systems, Consumables, Software & Informatics and Services), By Technology (Ultra-High Throughput Screening (uHTS), Label-Free Screening Technologies, Cell-Based Screening Technologies and Lab-on-a-Chip Technology (LOC)), By Application (Early-Stage Drug Discovery, Drug Repurposing Screening, Biological Research, Toxicology and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations (CROs) and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171862

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

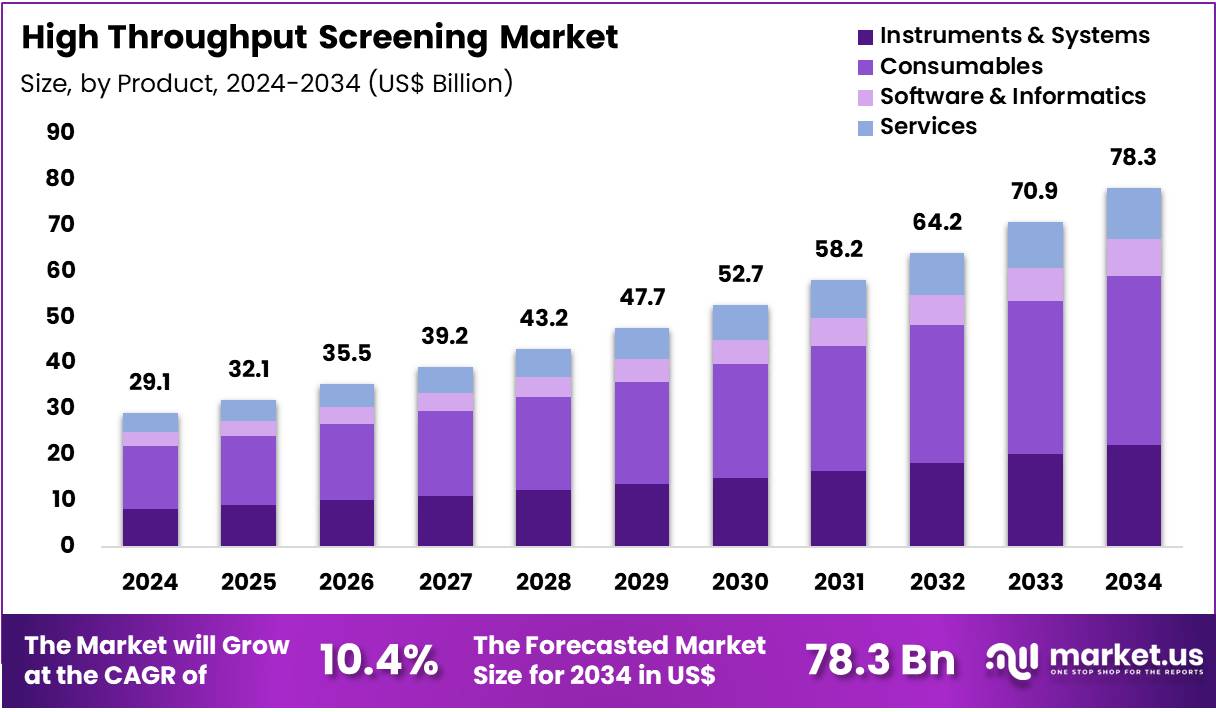

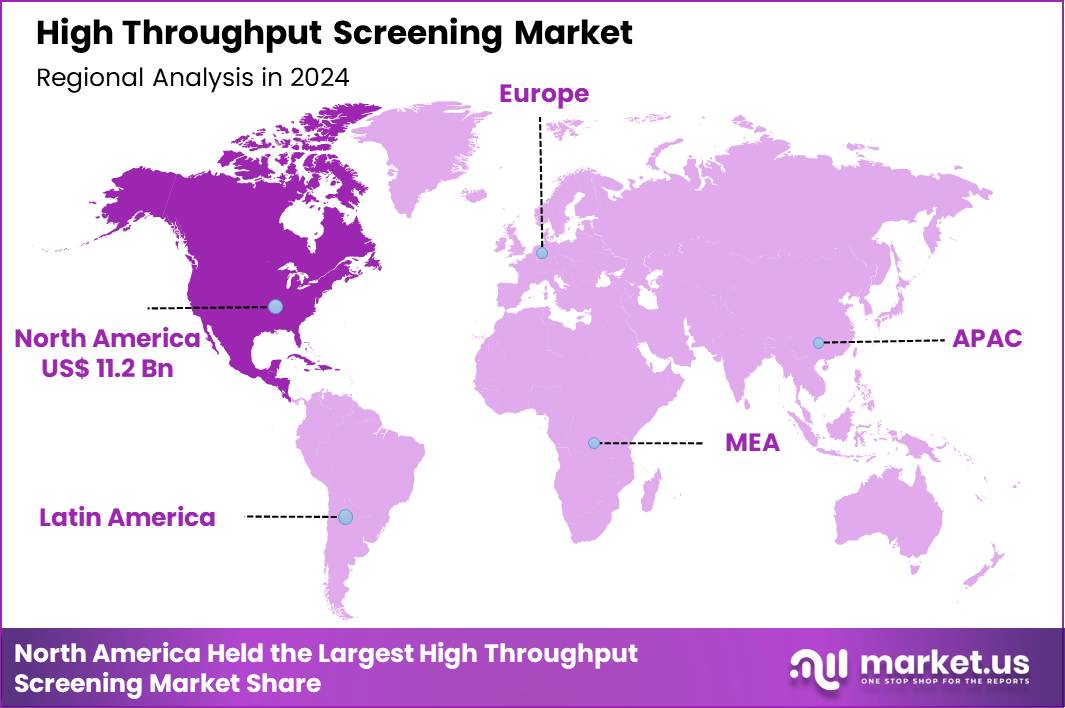

The Global High Throughput Screening Market size is expected to be worth around US$ 78.3 Billion by 2034 from US$ 29.1 Billion in 2024, growing at a CAGR of 10.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38..6% share with a revenue of US$ 11.2 Billion.

Growing adoption of high throughput screening technologies empowers pharmaceutical researchers to rapidly evaluate millions of compounds against biological targets, expediting early-stage drug discovery pipelines. Scientists extensively apply these platforms in target-based assays to identify potent inhibitors for kinase pathways implicated in oncology therapeutics. These systems facilitate phenotypic screening by monitoring cellular responses to compound libraries, uncovering novel mechanisms in neurodegenerative disease models.

Laboratories utilize high-content screening variants to capture multiparametric data from live-cell imaging, supporting toxicity assessments in cardiovascular drug development. Researchers deploy these tools for fragment-based lead discovery, detecting weak binders that evolve into high-affinity candidates for antimicrobial programs. On June 2, 2025, Thermo Fisher Scientific presented its Orbitrap Astral Zoom mass spectrometry system at the ASMS annual meeting.

The platform is engineered to support high-throughput proteomics and metabolomics by combining faster acquisition speeds with enhanced sensitivity. This capability allows researchers to process large numbers of complex biological samples more efficiently, accelerating the progression of biomarker programs from early discovery to validation phases.

Biotechnology firms seize opportunities to implement label-free high throughput screening methods that detect binding events in real time, enhancing hit validation for G-protein coupled receptor targets in metabolic disorders. Developers integrate acoustic dispensing technologies to minimize reagent consumption, enabling ultra-high throughput campaigns for rare disease orphan drug initiatives.

These approaches expand applications in RNA-targeted for small interfering RNA library evaluations, identifying sequences that silence pathogenic genes effectively. Opportunities arise in combining high throughput flow cytometry with screening to profile immune cell responses, advancing immunotherapy candidate selection.

Companies pursue multiplexed assay formats that simultaneously interrogate multiple pathways, streamlining polypharmacology studies for psychiatric conditions. Enterprises invest in organoid-based models compatible with high throughput formats, bridging in vitro and in vivo relevance in gastrointestinal therapeutic development.

Industry innovators incorporate deep learning algorithms to analyze vast screening datasets, predicting structure-activity relationships and prioritizing hits in infectious disease research. Developers advance microfluidic chip-based systems that automate complex assay setups for stem cell differentiation screening in regenerative medicine. Market participants refine fluorescence lifetime imaging to distinguish true positives from artifacts in enzyme inhibitor campaigns.

Companies enhance robotic integration with cloud computing for distributed high throughput operations in vaccine antigen discovery. Researchers prioritize CRISPR-compatible screening libraries that enable genome-wide loss-of-function studies in precision oncology. Ongoing advancements emphasize hybrid platforms merging mass spectrometry readouts with traditional fluorescence, delivering richer insights into metabolite perturbations in diabetes drug profiling.

Key Takeaways

- In 2024, the market generated a revenue of US$ 29.1 Billion, with a CAGR of 10.4%, and is expected to reach US$ 78.3 Billion by the year 2034.

- The product segment is divided into instruments & systems, consumables, software & informatics and services, with consumables taking the lead in 2024 with a market share of 47.0%.

- Considering technology, the market is divided into ultra-high throughput screening (uHTS), label-free screening technologies, cell-based screening technologies and lab-on-a-chip technology (LOC). Among these, cell-based screening technologies held a significant share of 43.7%.

- Furthermore, concerning the application segment, the market is segregated into early-stage drug discovery, drug repurposing screening, biological research, toxicology and others. The early-stage drug discovery sector stands out as the dominant player, holding the largest revenue share of 51.2% in the market.

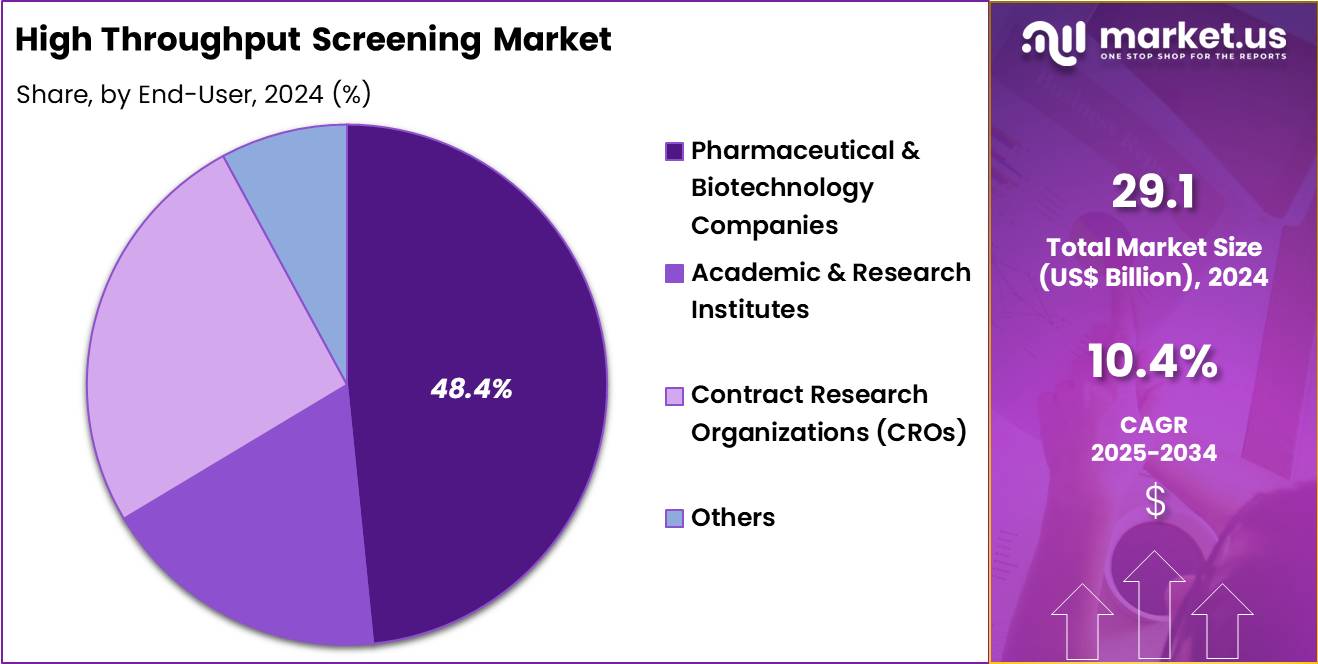

- The end-user segment is segregated into pharmaceutical & biotechnology companies, academic & research institutes, contract research organizations (CROs) and others, with the pharmaceutical & biotechnology companies segment leading the market, holding a revenue share of 48.4%.

- North America led the market by securing a market share of 38.6% in 2024.

Product Analysis

Consumables, holding 47.0%, are expected to dominate because high throughput screening workflows require continuous use of assay plates, reagents, probes, buffers, and detection kits for every screening campaign. Increasing screening volumes in pharmaceutical pipelines directly raise repeat purchasing frequency of consumables.

Standardized and validated consumables support reproducibility and data quality, which laboratories prioritize under regulatory and quality expectations. Growth in automated platforms increases compatibility demand for ready-to-use consumable formats. Cell-based and biochemical assays both rely heavily on specialized reagents, expanding breadth of use.

Rapid assay turnaround requirements favor pre-optimized consumables that reduce setup time. Vendors innovate with miniaturized and high-density formats to improve efficiency and reduce costs per data point. These factors keep consumables anticipated to remain the dominant product segment.

Technology Analysis

Cell-based screening technologies, holding 43.7%, are projected to dominate because they provide physiologically relevant insights into compound efficacy and toxicity early in discovery. Drug developers increasingly prefer cell-based models to better predict in vivo responses and reduce late-stage failures. Advances in cell engineering, reporter systems, and imaging enhance assay sensitivity and biological relevance.

Complex disease modeling in oncology, immunology, and CNS research strengthens reliance on cellular assays. Automation compatibility supports large-scale screening without sacrificing biological context. Integration with high-content analysis improves data richness and decision-making speed. Investment in 3D cultures and organoid models further expands application scope. These drivers keep cell-based screening technologies expected to lead the technology segment.

Application Analysis

Early-stage drug discovery, holding 51.2%, is expected to dominate because target identification and hit finding require rapid evaluation of large compound libraries. Pharmaceutical companies prioritize early screening to de-risk pipelines and focus resources on high-quality candidates. High throughput screening accelerates structure–activity relationship development and shortens discovery timelines.

Competitive pressure to advance multiple programs simultaneously increases screening intensity at the front end. Integration with AI-driven analytics enhances hit selection efficiency. Funding and strategic focus concentrate on discovery-stage innovation to sustain long-term pipelines. Collaborative discovery models further increase screening demand. These dynamics keep early-stage drug discovery anticipated to remain the dominant application.

End-User Analysis

Pharmaceutical and biotechnology companies, holding 48.4%, are projected to dominate because they operate the largest discovery portfolios and invest heavily in screening infrastructure. Pipeline expansion across oncology, rare diseases, and immunology drives sustained screening activity. In-house screening capabilities enable tighter control over data, timelines, and intellectual property.

Strategic outsourcing complements internal platforms, but sponsor companies retain primary demand ownership. Increased R&D budgets and technology adoption strengthen utilization intensity. Global competition incentivizes speed and scale in discovery operations. Portfolio management strategies favor high-throughput approaches to optimize resource allocation. These factors keep pharmaceutical and biotechnology companies expected to remain the leading end users.

Key Market Segments

By Product

- Instruments & Systems

- Automated liquid handling systems

- Robotic handling platforms

- Others

- Consumables

- Biochemical assay reagents

- Cell-based assay kits

- Microplates

- Others

- Software & Informatics

- Services

By Technology

- Ultra-High Throughput Screening (uHTS)

- Label-Free Screening Technologies

- Cell-Based Screening Technologies

- 3D – Cell Cultures

- 2D – Cell Cultures

- Reporter-based Assays

- Perfusion Cell Culture

- Lab-on-a-chip Technology (LOC)

By Application

- Early-stage drug discovery

- Drug repurposing screening

- Biological research

- Toxicology

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Others

Drivers

Escalating novel drug approvals is driving the market

The high throughput screening market is markedly driven by the escalating number of novel drug approvals, which underscores intensified early-stage discovery efforts reliant on efficient, large-scale compound evaluation. High throughput screening platforms enable rapid assessment of extensive chemical libraries against biological targets, facilitating hit identification in competitive pipelines. Pharmaceutical and biotechnology entities prioritize these technologies to accelerate progression from target validation to lead optimization.

The demand for scalable assays supports exploration of diverse therapeutic modalities, including small molecules and biologics. Regulatory incentives for innovative therapies further stimulate investment in advanced screening infrastructures. Collaborative academic-industry initiatives leverage HTS for translational research advancements. Instrumentation evolves to accommodate higher density formats and multimodal readouts.

Global expansion of drug development activities broadens application scopes. In 2024, the U.S. Food and Drug Administration’s Center for Drug Evaluation and Research approved 50 novel drugs. This volume reflects sustained innovation requiring robust preclinical screening capabilities.

Quality-by-design principles integrate HTS into streamlined development workflows. Emerging targets in immunology and neurology amplify screening requirements. Overall, this driver propels technological refinements and market growth in alignment with therapeutic progress.

Restraints

Complexity in data management and analysis is restraining the market

The high throughput screening market encounters restraints from the inherent complexity in managing and analyzing vast datasets generated by automated platforms, often encompassing millions of data points per campaign. Integration of heterogeneous readouts demands sophisticated informatics solutions for meaningful interpretation. False positives and assay artifacts necessitate secondary validation, extending timelines and resource allocation.

Variability in biological reagents can compromise reproducibility across runs. Scalability issues arise when transitioning from screening to hit confirmation phases. Limited interoperability between instruments and software hinders seamless workflows. Cybersecurity vulnerabilities in networked systems pose risks to proprietary data integrity. Skilled bioinformaticians remain in short supply for advanced analytical tasks. Regulatory expectations for data traceability add compliance layers in validated environments.

Economic constraints may limit upgrades to cutting-edge computational infrastructure. These challenges collectively impede operational efficiency and broader adoption in resource-limited settings. Strategic partnerships with informatics specialists become crucial for mitigation. Ongoing algorithmic developments aim to address noise reduction and pattern recognition. Such restraints require balanced approaches to harness HTS potential effectively.

Opportunities

Heightened focus on rare disease therapeutics is creating growth opportunities

The high throughput screening market presents significant growth opportunities through the heightened focus on therapeutics for rare diseases, where specialized phenotypic and target-based screens identify candidates for underserved indications. Orphan conditions often involve unique genetic mechanisms amenable to high-content screening approaches. Biotechnology firms targeting these areas utilize HTS to probe small, curated libraries with higher hit rates.

Incentives such as extended market exclusivity encourage dedicated screening programs. Patient advocacy and foundation support fund exploratory assays in niche biology. Advancements in disease modeling enhance relevance of screening outcomes. Contract screening providers expand rare disease-focused services to capture this segment. Global regulatory harmonization facilitates cross-border development efforts.

In 2024, 26 of the 50 novel drug approvals by the U.S. Food and Drug Administration were designated for rare or orphan diseases. This proportion highlights expanding pipelines amenable to HTS-driven discovery. Translational consortia incorporate screening for mechanism elucidation. Intellectual property strategies protect hits in low-competition spaces. These opportunities enable specialized differentiation and sustained market evolution.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends propel the high throughput screening market forward as robust biopharmaceutical investments and accelerating drug discovery demands push research labs to integrate automated platforms for rapid compound testing and hit identification. Executives at leading firms strategically deploy AI-enhanced robotics and multiplex assays, leveraging global R&D expansions to capture opportunities in oncology and infectious disease pipelines across thriving economies.

Persistent inflation and economic slowdowns, however, inflate costs for consumables and instrumentation, compelling biotech companies to trim screening budgets and delay high-volume campaigns amid fiscal constraints. Geopolitical frictions, notably U.S.-China trade disputes and regional instabilities, routinely sever supply chains for critical microplates and liquid handlers, generating production bottlenecks and operational uncertainties for globally reliant developers.

Current U.S. tariffs impose elevated duties on imported screening technologies and reagents, particularly from Asian sources, amplifying procurement expenses for American distributors and eroding competitive pricing in domestic healthcare channels. These tariffs also incite reciprocal barriers from trading partners that constrain U.S. exports of advanced HTS systems and impede multinational collaborative efforts.

Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Convergence of artificial intelligence with advanced cell models is a recent trend

In 2025, the high throughput screening market has evidenced a prominent trend toward the convergence of artificial intelligence with advanced three-dimensional cell models to elevate physiological relevance and predictive power. These integrated approaches utilize organoids and spheroids for more accurate representation of in vivo responses compared to traditional two-dimensional cultures. AI algorithms process complex imaging data to extract multifaceted features and predict compound efficacy.

Machine learning refines hit prioritization by correlating structural attributes with biological outcomes. Hybrid workflows combine high-content screening with deep learning for automated anomaly detection. Developers optimize culture conditions through predictive modeling to reduce variability. Real-time analytics enable adaptive screening strategies during campaigns. Collaborative platforms facilitate sharing of annotated datasets for model training.

Ethical frameworks guide responsible AI deployment in decision-making. Publications in late 2025 highlight transformative impacts on drug discovery efficiency. Instrumentation incorporates AI-assisted optics for enhanced resolution in 3D contexts. Training curricula evolve to encompass interdisciplinary skills in biology and computation. Sustainability considerations favor models reducing animal testing dependencies. This trend fundamentally advances screening fidelity and accelerates therapeutic development.

Regional Analysis

North America is leading the High Throughput Screening Market

In 2024, North America held a 38.6% share of the global high throughput screening market, energized by substantial commitments to accelerating early-stage drug discovery and integrating advanced computational tools. Biopharmaceutical entities ramp up utilization of automated robotic workstations and multiplexed assays to probe vast chemical spaces for modulators of intricate signaling cascades.

Research consortia pioneer phenotypic approaches with patient-derived cells, yielding translatable hits for immunotherapy and gene therapy targets. Venture ecosystems channel capital toward platforms combining surface plasmon resonance with mass spectrometry for fragment-based optimization. Diagnostic innovators embed microfluidic arrays to evaluate off-target liabilities concurrently with primary efficacy.

Federal funding streams catalyze development of next-generation counterscreens against resistance mechanisms in antimicrobial pipelines. Industry-academia alliances refine data management systems, harnessing big data analytics to distill actionable leads from noisy datasets. These elements enhance throughput and predictive power, fortifying competitive edges in therapeutic innovation.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders foresee marked proliferation of high-throughput assay technologies in Asia Pacific throughout the forecast period, as nations amplify indigenous research capacities to tackle prevalent health challenges. Regulators in China and South Korea streamline facility accreditations, enabling laboratories to deploy luminescence-based readers for kinase inhibitor profiling in oncology programs.

Corporations engineer droplet-based systems, facilitating single-cell resolution screens that uncover heterogeneity in tumor microenvironments. Partnerships integrate cheminformatics tools, empowering chemists to iterate structures rapidly against endemic viral proteases. Governments subsidize equipment upgrades for natural product libraries, targeting traditional medicine-derived scaffolds with modern validation.

Enterprises cultivate CRISPR-pooled libraries, dissecting genetic vulnerabilities in regionally dominant metabolic syndromes. Academic hubs foster talent pipelines skilled in assay miniaturization, optimizing costs for sustained high-volume operations. These actions converge to elevate discovery output, meeting urgent demands for novel interventions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the high throughput screening market drive growth by investing in automation, robotics, and miniaturized assay platforms that accelerate compound profiling while lowering cost per data point. Companies expand demand by integrating advanced analytics, AI-driven hit identification, and data management tools that improve decision quality across drug discovery pipelines.

Commercial strategies emphasize long-term partnerships with pharmaceutical and biotech firms, positioning screening services and platforms as embedded components of early-stage R&D. Innovation teams focus on assay diversity, including cell-based and phenotypic models, to address complex disease biology and increase platform relevance.

Geographic expansion targets emerging biotech hubs where outsourced discovery and internal screening capacity continue to rise. PerkinElmer exemplifies leadership through its broad portfolio of screening instruments, reagents, and informatics solutions, supported by global R&D infrastructure and deep relationships with life science and pharmaceutical organizations.

Top Key Players

- Thermo Fisher Scientific

- Agilent Technologies

- Danaher Corporation

- PerkinElmer

- Bio-Rad Laboratories

- Tecan Group Ltd.

- Hamilton Company

- BMG LABTECH GmbH

- HighRes Biosolutions

- Aurora Biomed Inc.

- Corning Incorporated

- Promega Corporation

- Sartorius AG

- Charles River Laboratories

- Creative Biolabs

- Eppendorf

Recent Developments

- On September 10, 2025, Beckman Coulter Diagnostics, part of Danaher, introduced a fully automated, high-capacity BD-Tau immunoassay for research use. Designed to run on the DxI 9000 platform, the assay enables consistent, large-scale measurement of brain-derived tau protein, giving neuroscience researchers a standardized solution for high-volume biomarker screening with laboratory-grade precision.

- On September 29, 2025, Revvity, Inc. launched its Living Image™ Synergy AI software during the World Molecular Imaging Congress. The platform applies artificial intelligence to streamline image analysis across multiple modalities, including optical imaging and microCT. By automating segmentation and quantification tasks, the software reduces manual workload and supports faster, more reproducible preclinical screening in high-throughput research settings.

Report Scope

Report Features Description Market Value (2024) US$ 29.1 Billion Forecast Revenue (2034) US$ 78.3 Billion CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Instruments & Systems (Automated Liquid Handling Systems, Robotic Handling Platforms and Others), Consumables (Biochemical Assay Reagents, Cell-Based Assay Kits, Microplates and Others), Software & Informatics and Services), By Technology (Ultra-High Throughput Screening (uHTS), Label-Free Screening Technologies, Cell-Based Screening Technologies (3D Cell Cultures, 2D Cell Cultures, Reporter-Based Assays and Perfusion Cell Culture) and Lab-on-a-Chip Technology (LOC)), By Application (Early-Stage Drug Discovery, Drug Repurposing Screening, Biological Research, Toxicology and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations (CROs) and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Agilent Technologies, Danaher Corporation, PerkinElmer, Bio-Rad Laboratories, Tecan Group Ltd., Hamilton Company, BMG LABTECH GmbH, HighRes Biosolutions, Aurora Biomed Inc., Corning Incorporated, Promega Corporation, Sartorius AG, Charles River Laboratories, Creative Biolabs, Eppendorf Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Throughput Screening MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

High Throughput Screening MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Agilent Technologies

- Danaher Corporation

- PerkinElmer

- Bio-Rad Laboratories

- Tecan Group Ltd.

- Hamilton Company

- BMG LABTECH GmbH

- HighRes Biosolutions

- Aurora Biomed Inc.

- Corning Incorporated

- Promega Corporation

- Sartorius AG

- Charles River Laboratories

- Creative Biolabs

- Eppendorf