Global High Temperature Coatings Market Size, Share, And Enhanced Productivity By Resin (Epoxy, Silicone, Polyethersulfone, Polyester, Acrylic, Alkyd, Others), By Technology (Solvent Based, Dispersion/Water Based, Powder Based), By Application (Energy and Power, Metal Processing, Cookware, Stoves and Grills, Marine, Automotive, Coil Coating, Aerospace, Building and Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173552

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

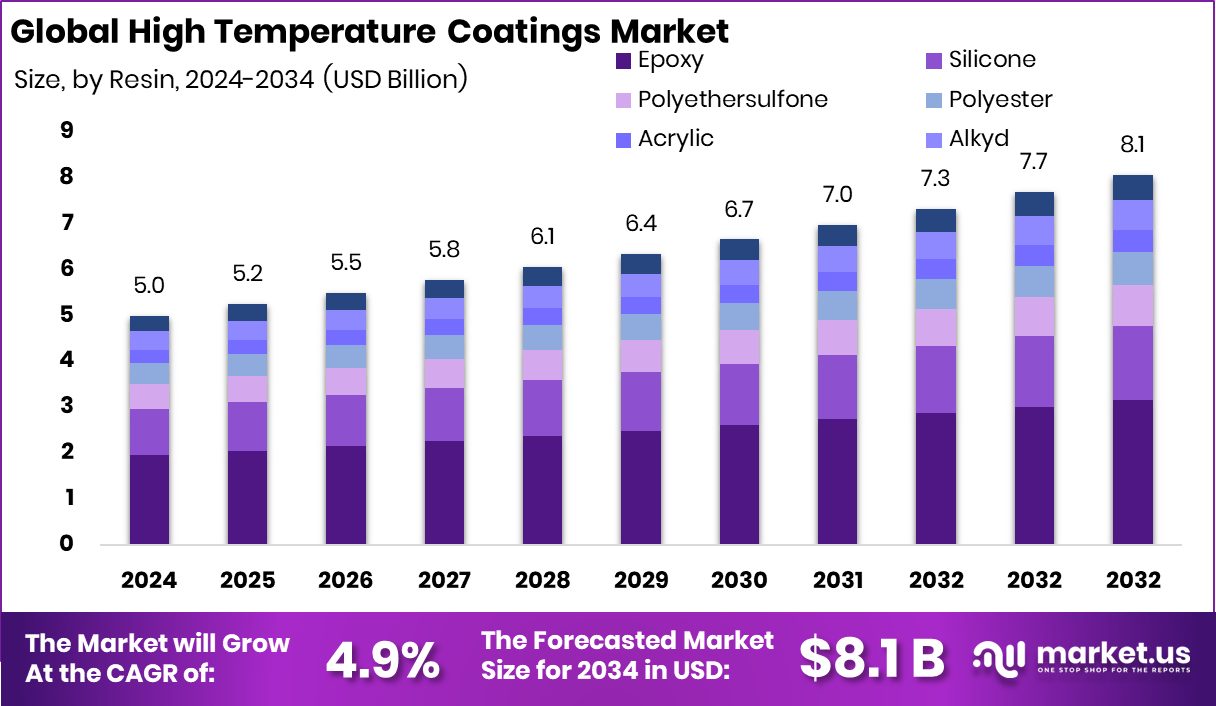

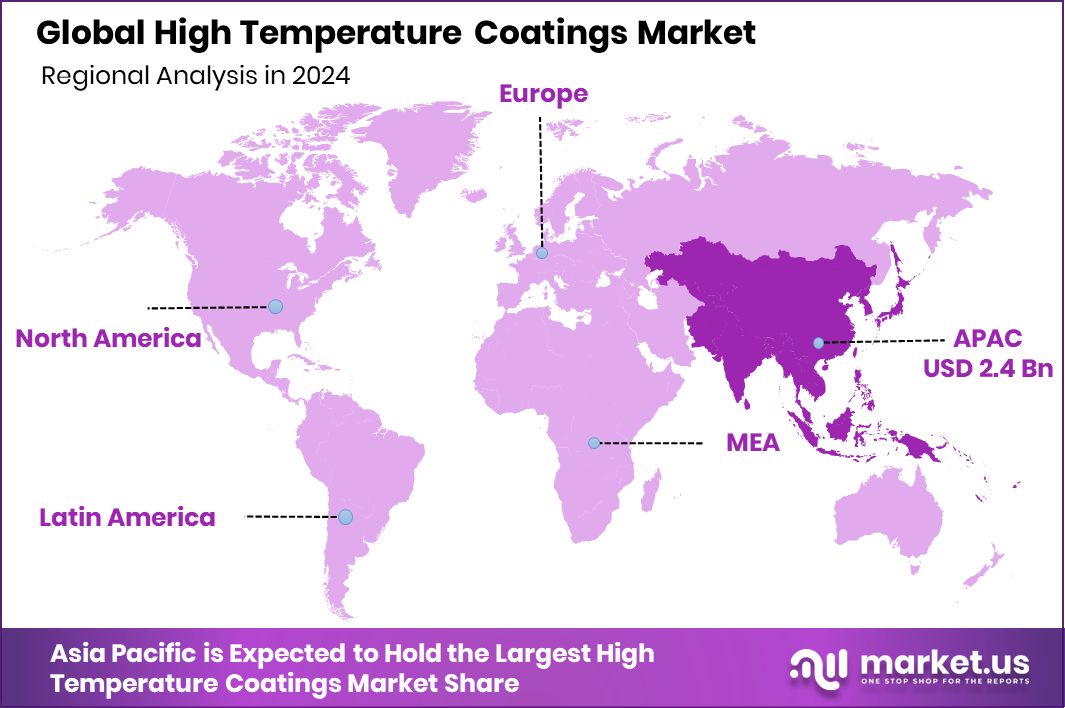

The Global High Temperature Coatings Market is expected to be worth around USD 8.1 billion by 2034, up from USD 5.0 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Asia Pacific dominates High Temperature Coatings Market with 48.10% share, USD 2.4 Bn.

High temperature coatings are protective surface layers designed to withstand extreme heat, often above normal industrial limits. They protect metal and equipment from oxidation, corrosion, thermal shock, and wear. These coatings are commonly used on furnaces, pipelines, engines, exhaust systems, and power equipment where high heat exposure is continuous.

The high temperature coatings market covers the production, application, and use of these coatings across industries such as energy, manufacturing, transportation, and infrastructure. It exists to extend equipment life, reduce downtime, and improve safety in operations exposed to intense heat. The market focuses on performance, durability, and reliability rather than decorative value.

One key growth factor is material innovation. A Renton-based company becoming a finalist in a $3 million global business competition for bio-epoxy resins highlights efforts to develop advanced heat-resistant materials. Such innovations improve coating stability while supporting long-term industrial performance.

Demand is rising due to increased manufacturing and infrastructure activity. Ontario’s $10.4 million manufacturing investment supports plant upgrades and equipment expansion, where high temperature coatings are essential for protecting machinery operating under thermal stress.

A major opportunity lies in technology-driven efficiency and new industrial use cases. A camping technology startup securing $500,000 in pre-seed funding reflects broader interest in durable, heat-resistant materials for portable and outdoor equipment, opening niche applications beyond heavy industry.

Key Takeaways

- The Global High Temperature Coatings Market is expected to be worth around USD 8.1 billion by 2034, up from USD 5.0 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In the High Temperature Coatings Market, epoxy resins hold 39.2% share due to durability, adhesion, and thermal resistance.

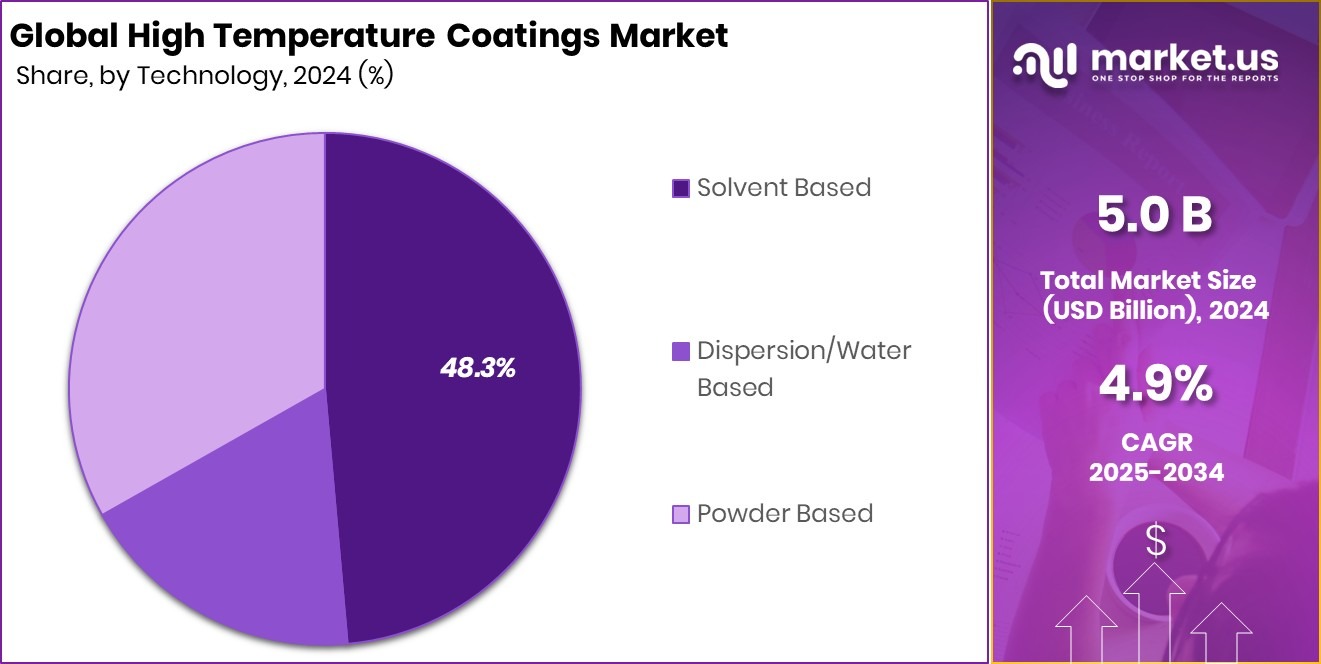

- Solvent-based technology dominates with 48.3% share, offering reliable performance under extreme heat and harsh environments.

- Energy and power applications account for 24.9% share, driven by turbines, boilers, and high-temperature industrial equipment.

- Asia Pacific High Temperature Coatings Market reaches 48.10% share, totaling USD 2.4 Bn.

By Resin Analysis

Epoxy resins dominate High Temperature Coatings Market with 39.2% share globally today.

In 2024, the Epoxy resin segment held a leading 39.2% share in the High Temperature Coatings Market, supported by its strong adhesion, chemical resistance, and thermal stability. Epoxy-based formulations are widely used to protect metal substrates exposed to extreme heat, corrosion, and mechanical stress. These coatings perform well in industrial furnaces, exhaust systems, pipelines, and heavy machinery, where long service life reduces maintenance shutdowns. Their compatibility with primers and topcoats also improves coating integrity under cyclic temperature loads.

In addition, epoxy resins offer formulation flexibility, allowing manufacturers to tailor coatings for specific operating temperatures and environments. As industries prioritize durability and asset protection, epoxy resins remain a preferred choice for high-temperature protection solutions across demanding applications.

By Technology Analysis

Solvent based technology leads High Temperature Coatings Market with 48.3% adoption rate.

In 2024, solvent-based technology dominated the High Temperature Coatings Market with a 48.3% share, reflecting its reliability and performance in harsh conditions. Solvent-based coatings provide excellent film formation, strong adhesion, and consistent curing, even in challenging application environments. These advantages make them suitable for field-applied coatings in oil & gas facilities, power plants, and industrial processing units.

The technology supports high solids loading, which enhances heat resistance and protective performance at elevated temperatures. Moreover, solvent-based systems are compatible with a wide range of resins and pigments used for thermal stability. Despite increasing interest in water-based alternatives, solvent-based coatings continue to be favored where performance requirements outweigh regulatory and environmental constraints.

By Application Analysis

Energy and power applications hold 24.9% share in High Temperature Coatings Market.

In 2024, the Energy and Power application segment accounted for a 24.9% share of the High Temperature Coatings Market, driven by expanding energy infrastructure and rising thermal efficiency demands. Power generation assets such as boilers, turbines, heat exchangers, and exhaust stacks operate under extreme heat and pressure, requiring advanced protective coatings. High temperature coatings help prevent oxidation, corrosion, and thermal degradation, extending equipment life and improving operational reliability.

The growing focus on grid stability, renewable integration, and plant efficiency has increased maintenance and refurbishment activities, further supporting demand. As energy systems become more complex and operate at higher temperatures, the need for durable, heat-resistant coatings in the energy and power sector remains strong.

Key Market Segments

By Resin

- Epoxy

- Silicone

- Polyethersulfone

- Polyester

- Acrylic

- Alkyd

- Others

By Technology

- Solvent Based

- Dispersion/Water Based

- Powder Based

By Application

- Energy and Power

- Metal Processing

- Cookware

- Stoves and Grills

- Marine

- Automotive

- Coil Coating

- Aerospace

- Building and Construction

- Others

Driving Factors

Strong Investment Flow Accelerates Coating Technology Innovation

In the High Temperature Coatings Market, strong capital flow is a major driving factor supporting faster technology development. When VC funding in start-ups rises to $6.53 bn and private equity investments reach $4.69 bn between January and November, it creates a healthy environment for innovation. Start-ups and scale-ups use this funding to improve coating durability, heat resistance, and application efficiency.

In addition, Syre raising $100 million in funding shows growing investor confidence in advanced material technologies linked to industrial performance. Such funding helps companies expand pilot plants, improve formulations, and speed up commercialization. As more money flows into materials and process innovation, manufacturers gain access to better-performing high temperature coatings, driving adoption across energy, industrial, and infrastructure applications.

Restraining Factors

Capital Shift Toward Recycling Slows Coating Investments

A key restraining factor for the High Temperature Coatings Market is the diversion of investment toward alternative industrial priorities. Although VC funding in start-ups reaches $6.53 bn and PEs invest $4.69 bn, not all capital flows into coatings-related development. Some funding shifts toward large-scale sustainability projects, such as when Binh Dinh grants an investment licence to SYRE’s $1 billion polyester recycling project. These large commitments can limit near-term funding availability for specialized coating upgrades.

As investors focus on recycling and circular materials, coating producers may face slower expansion, delayed capacity upgrades, or limited research budgets. This imbalance can slow innovation cycles and restrict faster adoption of advanced high temperature coatings in industrial markets.

Growth Opportunity

Expansion Funding Opens New Industrial Coating Demand

A major growth opportunity for the High Temperature Coatings Market comes from expansion-led industrial activity. When Sapphire Foods raises Rs 1,150 crore from private equity firms to fund expansion, it signals wider construction, equipment installation, and infrastructure development. These activities require protective coatings for high-heat kitchens, processing equipment, and energy systems.

At the same time, MacroCycle closing a $6.5 million financing round reflects growing interest in advanced material solutions supporting long-life industrial assets. Such funding enables new facilities, upgraded machinery, and expanded operations where high temperature coatings are essential. As companies scale operations, the need to protect equipment from heat, corrosion, and wear creates steady opportunities for coating suppliers.

Latest Trends

Rising Focus on Circular Materials Influences Coating Formulations

One of the latest trends in the High Temperature Coatings Market is the growing influence of circular material funding on coating development. When DePoly secures a total of $30 million in funding, it highlights strong interest in recycling-based material technologies.

Similarly, textile recycler Eeden raising €18 million shows investor focus on sustainable processing systems. These trends push coating developers to rethink formulations, improve thermal performance on recycled substrates, and ensure coatings withstand repeated heat cycles.

As industries adopt recycled metals and materials, coatings must adapt to new surface behaviors and heat responses. This shift is shaping next-generation high temperature coatings with better compatibility and longer service life.

Regional Analysis

Asia Pacific leads High Temperature Coatings Market at 48.10% share, USD 2.4 Bn.

The High Temperature Coatings Market shows varied regional performance shaped by industrial activity, energy infrastructure, and manufacturing intensity. Asia Pacific dominates the global market, holding a 48.10% share valued at USD 2.4 Bn, driven by large-scale power generation assets, rapid industrialization, and extensive metal processing across major economies. Strong demand from energy, petrochemical, and heavy manufacturing sectors supports consistent coating consumption in this region.

North America follows with steady demand supported by mature power plants, oil & gas facilities, and strict equipment protection requirements, where high-temperature coatings are essential for asset longevity. Europe maintains stable growth due to refurbishment of aging industrial infrastructure and efficiency upgrades in energy systems, particularly in thermal and renewable-linked facilities.

The Middle East & Africa region benefits from ongoing investments in oil refining, gas processing, and power generation, where coatings protect equipment exposed to extreme heat. Latin America shows moderate adoption, supported by expanding energy projects and industrial maintenance needs, contributing steadily to overall market development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF SE continues to play a strategic role in the High Temperature Coatings Market through its deep materials science expertise and integrated chemical portfolio. The company’s strength lies in resin chemistry, additives, and performance coatings that withstand extreme thermal and chemical stress. BASF’s focus on durability, corrosion resistance, and long service life aligns well with demanding applications in energy, industrial processing, and heavy manufacturing. Its global production footprint also supports consistent supply to customers operating high-temperature assets across multiple regions.

Akzo Nobel N.V. maintains a strong market presence by combining advanced coating formulations with application-specific solutions. The company emphasizes protective performance in high-heat environments such as power plants, refineries, and industrial equipment. Akzo Nobel’s long-standing experience in industrial coatings enables it to address customer needs related to thermal stability, surface protection, and operational efficiency. Its broad customer base and technical service capabilities support repeat demand in maintenance and refurbishment cycles.

The Sherwin-Williams Company remains a key player due to its extensive industrial coatings portfolio and strong customer relationships. The company focuses on practical, high-performance solutions designed for real-world operating conditions. Its strength in field-applied coatings, combined with technical support and product reliability, positions Sherwin-Williams as a preferred supplier for high-temperature protection in energy, infrastructure, and industrial environments.

Top Key Players in the Market

- BASF SE

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Valspar

- Carboline Company

- Axalta Coating Systems, LLC

- Jotun

- Aremco

- Belzona International Ltd.

Recent Developments

- In September 2025, PPG announced that it would feature core coating technologies at The Battery Show North America, including specialized thermal management and protection coatings such as PPG CORATHERM® TCA-4000, which are designed for heat-related performance in electrified systems.

- In May 2025, Valspar introduced four new interior and exterior paint and stain products designed for both DIYers and construction professionals. These new offerings expand Valspar’s existing portfolio and give customers more options for durable surface finishes. While these are broader coating products, their launch reflects ongoing product development under the Valspar brand.

Report Scope

Report Features Description Market Value (2024) USD 5.0 Billion Forecast Revenue (2034) USD 8.1 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin (Epoxy, Silicone, Polyethersulfone, Polyester, Acrylic, Alkyd, Others), By Technology (Solvent Based, Dispersion/Water Based, Powder Based), By Application (Energy and Power, Metal Processing, Cookware, Stoves and Grills, Marine, Automotive, Coil Coating, Aerospace, Building and Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., Valspar, Carboline Company, Axalta Coating Systems, LLC, Jotun, Aremco, Belzona International Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Temperature Coatings MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

High Temperature Coatings MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Valspar

- Carboline Company

- Axalta Coating Systems, LLC

- Jotun

- Aremco

- Belzona International Ltd.