Global High Purity Alumina Market By Product Type (4N, 5N, and 6N), By Production Process (Hydrolysis and Hydrochloric Acid Leaching), By Application (LED, Electronics & Semiconductors, Phosphor, Sapphire, Lithium-Ion Battery Separators, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175706

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

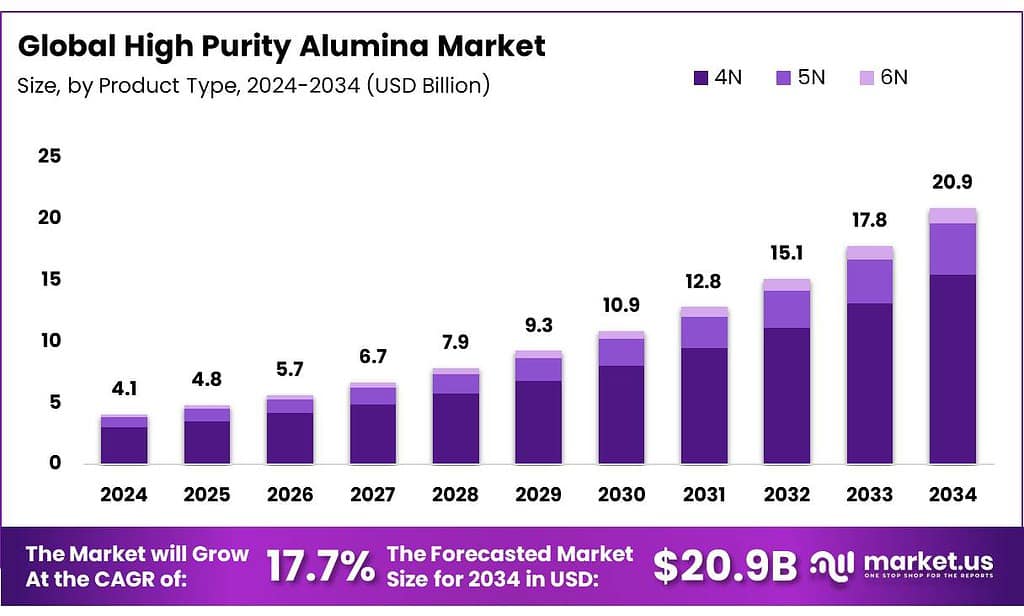

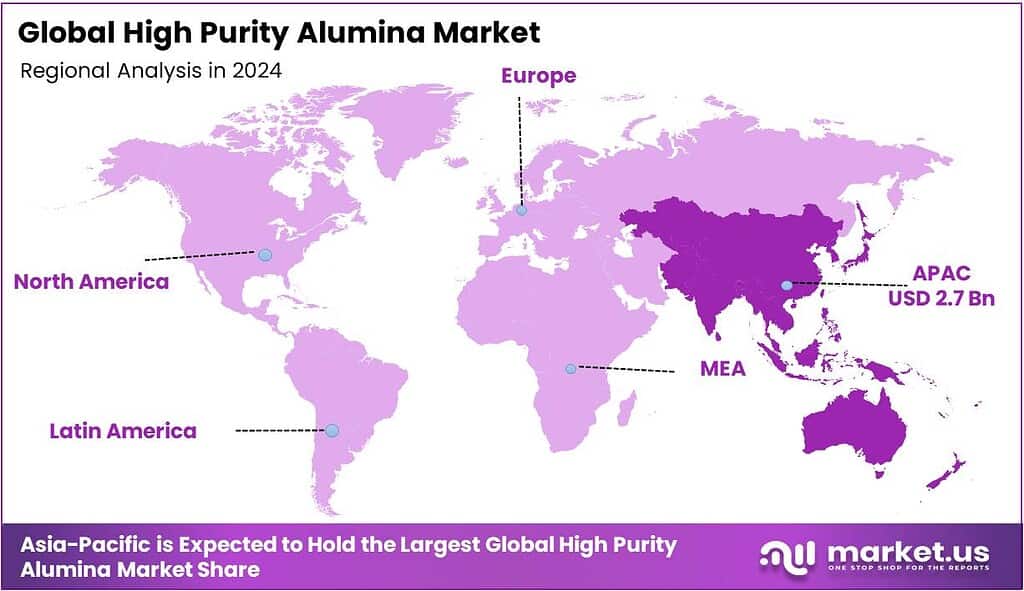

Global High Purity Alumina Market size is expected to be worth around USD 20.9 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 17.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 38.4% share, holding USD 0.7 Billion in revenue.

High Purity Alumina (HPA) is an extremely refined form of aluminum oxide, typically 99.99% (4N) pure or higher, valued for its superior chemical stability, hardness, electrical insulation, and thermal properties, making it essential for high-tech applications. The HPA market is driven by its critical role in advanced materials across electronics, LEDs, ceramics, and specialty glass applications.

- According to the SEMI, the industry association serving the global semiconductor and electronics design and manufacturing supply chain, in 2025, global advanced process capacity reached 982,000 wafers per month (wpm), with 2026 projected to be the first year to surpass 1 million wpm, with capacity reaching 1.16 million wpm.

Asia Pacific is at the forefront, led by China, Japan, and South Korea, due to their massive semiconductor, LED, and battery manufacturing ecosystems, where HPA is used in sapphire substrates, dielectric layers, and insulating components. LEDs held a major share, as HPA’s thermal stability and optical clarity make it essential for high‑brightness, energy‑efficient lighting.

Producers rely on strategic activities such as capacity expansion, process innovation, vertical integration, and partnerships to enhance quality, secure supply chains, and maintain competitiveness in the market. Hydrolysis remains the dominant production route due to its ability to deliver ultra‑pure, uniform alumina efficiently, while 4N HPA is widely used for its balance of performance and cost.

Key Takeaways

- The global high purity alumina market was valued at USD 4.1 billion in 2024.

- The global high purity alumina market is projected to grow at a CAGR of 17.7% and is estimated to reach USD 20.9 billion by 2034.

- On the basis of product type, 4N high purity alumina dominated the market, constituting 73.8% of the total market share.

- Based on the production process, the largest amount of high purity alumina is produced by hydrolysis, with a substantial market share of around 68.7%.

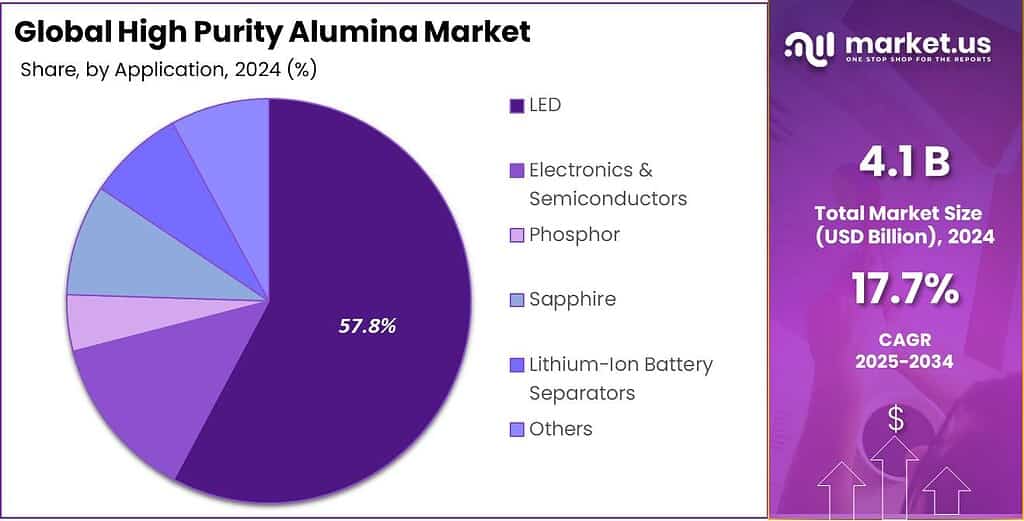

- Among the applications, the LEDs held a major share in the high purity alumina market, 57.8% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the high purity alumina market, accounting for 65.8% of the total global consumption.

Product Type Analysis

4N High Purity Alumina is a Prominent Segment in the Market.

The high purity alumina market is segmented based on product type into 4N, 5N, and 6N. The 4N high purity alumina led the market, comprising 73.8% of the market share, as it offers a practical balance between performance and cost, making it suitable for many mainstream industrial applications. The shift from 4N to 5N or 6N requires significantly more rigorous purification, tighter control of trace impurities, down to parts per million, and more complex processing steps, which substantially increase production cost and energy requirements.

In contrast, 4N is sufficiently pure for high-volume uses such as LED substrate production, battery separator coatings, and many advanced ceramics where ultra-trace impurities have minimal impact on performance. This balance of adequate purity with lower input and processing intensity drives broader adoption in large-scale manufacturing, while 5N and 6N remain niche for highly sensitive semiconductor and specialized optical applications where extreme purity is essential.

Production Process Analysis

Hydrolysis Held a Major Share of the High Purity Alumina the Market.

On the basis of the production process, the high purity alumina market is segmented into hydrolysis and hydrochloric acid leaching. The hydrolysis process held a major share in the high purity alumina market, comprising 68.7% of the market share. Most high purity alumina is produced via hydrolysis of aluminum alkoxides rather than hydrochloric acid leaching, as the hydrolysis route delivers very low impurity levels with tight control over particle size and morphology, which is essential for electronics and LED applications where consistency remains an important constraint.

Hydrolysis often involves reacting aluminum metal with alcohol to form an alkoxide, which is then hydrolyzed and calcined to yield HPA with purity often above 99.99% and uniform properties tailored for high-end uses, without introducing large quantities of corrosive acids that require complex handling.

In contrast, HCl leaching can be more capital-intensive, environmentally challenging, and harder to scale cost-effectively, since handling and disposing of strong acids adds regulatory and operational burdens. Consequently, hydrolysis remains the dominant commercial method due to its scalability, consistent quality, and fewer impurity risks.

Application Analysis

High Purity Alumina is Mostly Utilized for the Manufacturing of LEDs.

Based on the applications, the high purity alumina market is segmented into LED, electronics & semiconductors, phosphor, sapphire, lithium-ion battery separators, and others. Among the applications of the high purity alumina, 57.8% of the material consumed globally is for the manufacturing of LEDs, as HPA is essential for producing sapphire substrates used in LED chips, and this segment alone accounts for a majority share of global HPA usage due to the widespread adoption of energy-efficient lighting across consumer, commercial, and industrial sectors.

Sapphire, grown from HPA, provides the thermal stability and optical clarity required for high-brightness and long-term LEDs, leading manufacturers to prioritize it over alternatives in many lighting products. In contrast, electronics & semiconductors, phosphor, and lithium-ion battery separator coatings represent smaller portions of total demand as their HPA requirements are more niche, tied to newer technologies still scaling up, or limited to specific purity grades, so they contribute less to the market despite growing interest.

Key Market Segments

By Product Type

- 4N

- 5N

- 6N

By Production Process

- Hydrolysis

- Hydrochloric Acid Leaching

By Application

- LED

- Electronics & Semiconductors

- Phosphor

- Sapphire

- Lithium-Ion Battery Separators

- Others

Drivers

Booming Electronics and Semiconductors Sectors Drive the High Purity Alumina Market.

High-purity alumina has increasingly become a critical input material in electronics and semiconductor manufacturing due to its unique thermal, mechanical, and chemical properties. For instance, the ultrahigh-purity grades are engineered for CMP polishing and thermal interface applications in semiconductor fabs, enhancing surface planarity and heat management essential for high-yield wafer fabrication processes.

- In 2025, computer-aided engineering (CAE) revenue increased 9.1%, IC physical design and verification revenue increased 1.3%, printed circuit board and multi-chip module (PCB and MCM) revenue increased by 3.4%, and semiconductor intellectual property (SIP) by 13.6%. As wafer fabrication increases, there is a consistent demand for high-purity

High-performance processors used in data centers underpin artificial intelligence applications and are deployed by companies such as NVIDIA, Intel, and Amazon. However, the increasing computational intensity of these systems generates substantial heat, posing a significant constraint on continued technological expansion.

To manage this thermal load, contemporary large-scale data centers rely on advanced air-conditioning infrastructure and substantial water resources. In some cases, individual facilities consume up to 19 million liters of water per day, an amount comparable to the daily water usage of a town with a population of between 10,000 and 50,000 residents.

High-purity alumina is incorporated into modern semiconductor manufacturing to enhance thermal conductivity and facilitate the dissipation of heat from critical electronic components. The global electronics manufacturing, bolstered by semiconductor fab expansions and LED adoption, has driven HPA demand.

Restraints

Availability of Effective Alternatives for Specific Applications Might Hinder the Growth of the High Purity Alumina Market.

Availability of effective alternative materials for specific functions can constrain the adoption of high purity alumina in specific high-tech applications. The materials, such as aluminum nitride (AlN), silicon carbide (SiC), silicon nitride, mullite, and glass-ceramics, are included in the offerings for electronics, insulation, and high-temperature applications, indicating that these alternatives are industrially viable options across overlapping use-cases.

For instance, aluminum nitride is a notable substitute in electronics and semiconductor packaging where higher thermal conductivity, 160–200 W/m·K, than alumina and comparable electrical insulation are required, particularly in power modules and heat-dissipating substrates. This positions AlN as a material of choice for high-power LED drivers, RF modules, and inverter substrates where heat management is prioritized.

Similarly, silicon carbide and AlSiC composites appear as heat spreaders and substrate frameworks due to their adjustable thermal expansion and elevated thermal conductivities, 190–200 W/m·K, enabling mechanical and thermal compatibility with silicon and GaN devices. Furthermore, ceramics such as transparent aluminum oxynitride (ALON) offer optical and mechanical performance characteristics relevant to optoelectronic windows and advanced packaging.

Moreover, for structural ceramics, materials such as mullite (Al₂O₃–SiO₂) provide alternatives to pure alumina in thermal shock and insulation applications. The presence of these materials illustrates functional substitution pathways that may reduce reliance on HPA for certain applications, depending on performance requirements and manufacturing constraints.

Opportunity

Demand from the Ceramics and Glass Industry Creates Opportunities in the High Purity Alumina Market.

High purity alumina presents incremental opportunities within the ceramics and glass sectors, where its physicochemical attributes directly address technical performance requirements. In advanced technical ceramics, HPA grades are used to manufacture precision components exhibiting enhanced mechanical strength, chemical resistance, and thermal stability, supporting applications such as insulating parts, high-temperature crucibles, and substrate materials for electronics and integrated circuits. These applications leverage the material’s high Al₂O₃ content and resultant property enhancements over lower-purity ceramics.

Similarly, in the glass industry, alumina is recognized as a key additive in glass formulations, particularly in soda-lime and specialty aluminosilicate glasses, where Al₂O₃ improves chemical durability, mechanical integrity, and thermal properties. Alumina contributes to structural reinforcement when added as an intermediate oxide in glass batches, aiding in network modification during smelting and refining processes, and is incorporated into certain high-performance glass-ceramics.

Trends

High Purity Alumina for Manufacturing of Synthetic Sapphire.

High purity alumina is increasingly adopted as the primary precursor for synthetic sapphire production, reflecting a material-specific trend grounded in its purity and crystallization performance. The ultra-low impurity alumina is specified to reduce defects and opacification during crystal growth, particularly for LED and optical applications. Several crystal growth methods require starting alumina with sodium and other metal contaminants controlled below single-digit ppm levels, iron below 6 ppm, and silicon below 5 ppm, to achieve high optical quality in sapphire boules.

The impurity levels significantly influence yield and defect density in single-crystal growth processes, evidencing that material purity metrics directly correlate with product quality in synthetic sapphire manufacturing. These substrates serve as foundational materials for LED chips and high-performance optical components, where sapphire’s hardness, thermal stability, and transmission across UV-IR wavelengths are critical.

In addition, the rise of Gallium-Nitride (GaN)-on-sapphire platforms for high-power and high-frequency devices is driving demand for wider format (8-inch) C-plane sapphire wafers, specifically optimized for growth from high-purity alumina. The adoption of HPA for synthetic sapphire reflects a specification-driven trend in high-precision substrate production.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Disruption in the Production of High Purity Alumina.

The geopolitical tensions are materially affecting raw material supply chains linked to high purity alumina production, with documented trade-policy actions and sourcing-security initiatives shaping upstream dynamics. For instance, as of early 2026, the U.S. maintained a 50% tariff on aluminum imports, including derivative products, to incentivize local production, which market 40% price increase for US customers.

Similarly, in January 2026, the European Commission introduced measures against Chinese fused alumina imports to mitigate dependency, affecting a market import of approximately 200,000 tons. Such trade restrictions alter cost and access parameters for materials proximate to HPA production pathways, forcing downstream users to adjust sourcing and supply chain configurations. Similarly, in January 2026, the U.S. Department of Defense took a US$150 million equity stake in a domestic alumina refinery to secure feedstock.

Government actions in allied jurisdictions further signal elevated institutional emphasis on secure and diversified supplies of critical materials, which include alumina derivatives used in high-purity applications. While these measures aim to strengthen domestic resilience, they introduce quantifiable supply-chain complexity and trade cost variability that bear on HPA feedstock availability and logistics in globally integrated value chains.

Regional Analysis

Asia Pacific Held the Largest Share of the Global High Purity Alumina Market.

In 2024, the Asia Pacific dominated the global High Purity Alumina market, holding about 44.5% of the total global consumption, reflecting the region’s leading role in electronics and clean-energy manufacturing ecosystems. China, Japan, South Korea, and Australia are principal contributors, underpinned by significant industrial capacity in LEDs, semiconductors, and lithium-ion battery components.

- According to the Ministry of Trade, Industry and Resources of South Korea, semiconductor exports in the region rose 38.6% to US$17.3 billion from January to November 2025, an all-time monthly high, driven by strong data-center demand for high-value memory and rising memory prices.

- According to the SEMI, in Q3 2025, Asia Pacific (APAC) procured US$2.2 billion in electronic system design products and services, up 20.5%, with a four-quarter moving average growth of 12.8%.

According to the International Energy Agency (IEA), China accounted for around 70% of total global EV production in 2024, supporting downstream battery-grade applications where alumina coatings enhance separator performance. Additionally, China built more than 7,000 advanced smart factories by 2025 and had become the world’s largest intelligent manufacturing application base.

Similarly, the government initiatives in the Asia Pacific illustrate institutional backing for regional supply chain development in HPA processing. These data collectively reinforce that Asia Pacific’s industrial structure and targeted public support underlie its status as the largest HPA market globally.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of high purity alumina concentrate on technology development, supply-chain integration, and strategic partnerships to enhance competitiveness and market share. These firms focus on advancing proprietary production processes and capacity to meet stringent purity and performance specifications, including the expansion of high-purity alumina output.

Additionally, strategic activities include securing long-term supply and distribution agreements with downstream partners, widening their product reach. Similarly, manufacturers prioritize capacity expansion and project financing supported by government and institutional backing to build new HPA facilities and bring advanced technologies into effect.

The Major Players in The Industry

- Almatis, Inc.

- Sumitomo Chemical Co., Ltd.

- Nippon Light Metal Group / Nikkeikin

- Taimei Chemicals Co., Ltd.

- Saint-Gobain

- Alpha HPA

- Altech

- FYI Resources

- Honghe Chemical

- Zibo Xinfumeng Chemicals Co., Ltd.

- Hebei Pengda Advanced Materials Technology

- Shandong Keheng Crystal Materials Technology Co., Ltd.

- Xuancheng Jingrui New Materials Co., Ltd.

- AdValue Technology

- Baikowski SA.

- Other Key Players

Key Development

- In November 2025, Alpha HPA secured AU$30 million from the Queensland Government’s Critical Minerals and Battery Technology Fund (QCMBTF) for the Gladstone project, aimed at becoming the world’s largest single-site production facility.

- In October 2025, Almatis inaugurated a calcined alumina plant in Huangdao, Qingdao Free Trade Zone, to increase its manufacturing capacity and to consolidate advanced calcination and grinding technology in one location.

Report Scope

Report Features Description Market Value (2024) US$4.1 Bn Forecast Revenue (2034) US$20.9 Bn CAGR (2025-2034) 17.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (4N, 5N, and 6N), By Production Process (Hydrolysis and Hydrochloric Acid Leaching), By Application (LED, Electronics & Semiconductors, Phosphor, Sapphire, Lithium-Ion Battery Separators, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Almatis, Inc., Sumitomo Chemical Co., Ltd., Nippon Light Metal Group / Nikkeikin, Taimei Chemicals Co., Ltd., Saint-Gobain, Alpha HPA, Altech, FYI Resources, Honghe Chemical, Zibo Xinfumeng Chemicals Co., Ltd., Hebei Pengda Advanced Materials Technology, Shandong Keheng Crystal Materials Technology Co., Ltd., Xuancheng Jingrui New Materials Co., Ltd., AdValue Technology, Baikowski SA, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Almatis, Inc.

- Sumitomo Chemical Co., Ltd.

- Nippon Light Metal Group / Nikkeikin

- Taimei Chemicals Co., Ltd.

- Saint-Gobain

- Alpha HPA

- Altech

- FYI Resources

- Honghe Chemical

- Zibo Xinfumeng Chemicals Co., Ltd.

- Hebei Pengda Advanced Materials Technology

- Shandong Keheng Crystal Materials Technology Co., Ltd.

- Xuancheng Jingrui New Materials Co., Ltd.

- AdValue Technology

- Baikowski SA.

- Other Key Players