Global High Performance Pigments Market Size, Share, And Business Benefits By Type (Inorganic, Organic, Hybrid), By Form (Powder, Liquid, Granules), By Application (Coatings, Plastics, Inks, Cosmetics, Others), By End-use (Automotive and Transportation, Construction and Infrastructure, Printing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151191

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

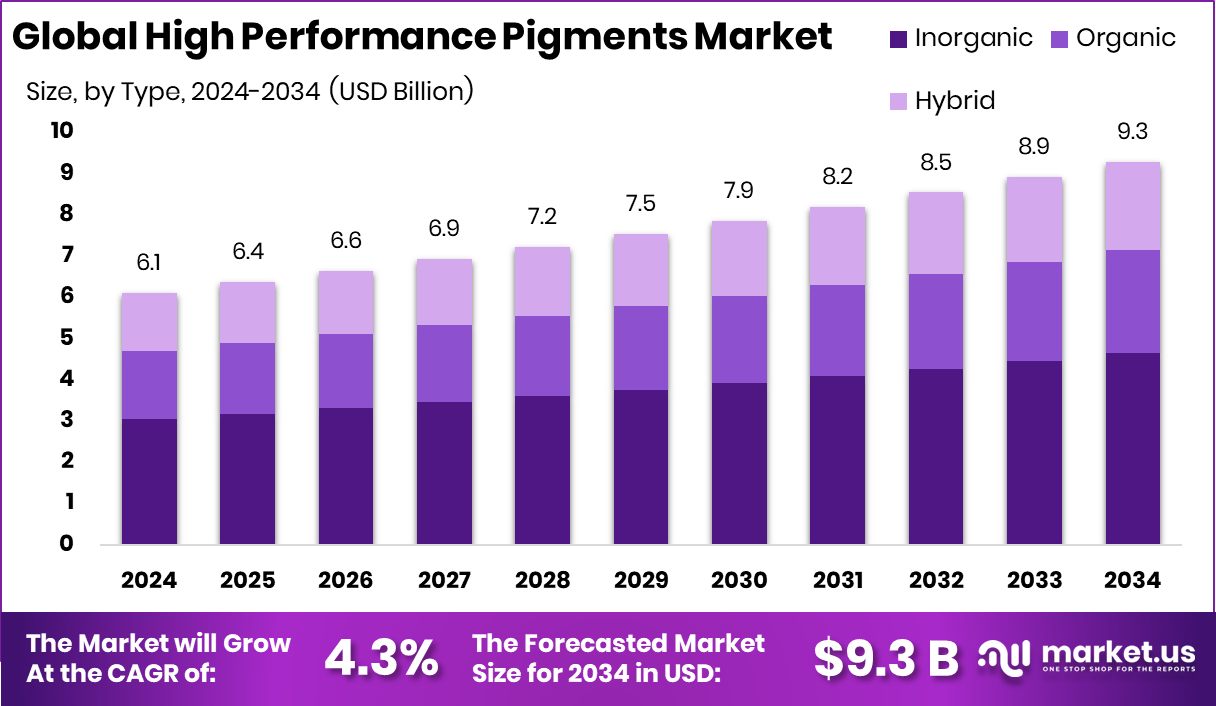

Global High Performance Pigments Market is expected to be worth around USD 9.3 billion by 2034, up from USD 6.1 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. Strong demand from the automotive and construction sectors boosted Europe’s USD 2.3 billion market.

High Performance Pigments (HPPs) are a class of pigments known for their exceptional durability, color strength, and resistance to heat, light, and chemicals. These pigments are often based on complex organic and inorganic compounds, and they are used in applications where standard pigments would degrade or fail. Their vibrant colors and long-lasting properties make them ideal for automotive coatings, industrial paints, plastics, and high-end decorative materials.

The High-Performance Pigments market has been witnessing steady growth due to the increasing demand for long-lasting and aesthetically appealing colorants in end-use industries. Automotive and construction sectors, in particular, are driving consumption, as manufacturers seek durable finishes that withstand harsh environmental exposure. With rising awareness around material quality and lifespan, industries are turning to HPPs for solutions that go beyond basic coloring needs.

Growth factors include increasing urbanization, infrastructure development, and the rising trend of product customization in consumer goods. As consumers seek high-quality, visually appealing products, the demand for advanced pigmentation solutions continues to grow. The shift towards sustainable and energy-efficient coatings also supports the use of HPPs, which offer better coverage and durability, reducing the need for frequent repainting or replacement.

Opportunities lie in the development of eco-friendly and non-toxic HPPs that meet evolving environmental regulations. There’s also rising interest in specialized applications like electronics, aerospace, and 3D printing, where precision and durability are key. As these industries expand, they create new pathways for innovation and growth in the pigment sector, especially for materials that combine function and aesthetics.

Key Takeaways

- Global High Performance Pigments Market is expected to be worth around USD 9.3 billion by 2034, up from USD 6.1 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- Inorganic pigments dominate the High Performance Pigments Market, holding a 49.9% share for durability.

- Powder form leads in the High Performance Pigments Market, preferred for its versatility, 59.1%, and easy application.

- Coatings represent 44.2% of the High Performance Pigments Market, driven by demand in industrial finishes.

- The automotive and transportation sector fuels 34.8% of the High Performance Pigments Market through high-end applications.

- The regional market value in Europe reached USD 2.3 billion in 2024.

By Type Analysis

Inorganic pigments dominate the High Performance Pigments Market with a 49.9% share.

In 2024, Inorganic held a dominant market position in the By Type segment of the High Performance Pigments Market, with a 49.9% share. This strong foothold is primarily attributed to the superior durability, thermal stability, and chemical resistance that inorganic pigments offer, making them the preferred choice for demanding industrial applications. Their ability to maintain color integrity and performance under harsh environmental conditions has led to increased adoption in sectors such as automotive coatings, industrial paints, and construction materials.

The high share also reflects a consistent demand from manufacturers seeking pigments that ensure long-term product performance and compliance with regulatory standards. Inorganic pigments are particularly valued for their opacity and lightfastness, which are critical in exterior applications exposed to UV radiation and moisture. Their compatibility with a wide range of substrates further supports their use across multiple industries.

This market leadership underscores the continued reliance on inorganic pigment technologies for applications where performance cannot be compromised. As industries push for higher quality and longer-lasting materials, inorganic pigments remain a key enabler, reinforcing their strong market presence.

By Form Analysis

Powder form holds the largest High Performance Pigments Market share at 59.1%.

In 2024, Powder held a dominant market position in the By Form segment of the High Performance Pigments Market, with a 59.1% share. This significant market share reflects the wide acceptance and preference for powder-form pigments across various end-use applications due to their ease of handling, high color strength, and extended shelf life. Powder pigments are especially valued for their stability and performance in manufacturing processes that demand consistent quality and precise color matching.

The popularity of powder form is also driven by its compatibility with a broad range of formulations, including paints, plastics, and coatings. Manufacturers often favor powder pigments for their ease of dispersion and ability to provide uniform coverage without compromising on performance. Additionally, the ability to blend powders to achieve custom shades and properties adds to their versatility and demand.

With a clear lead in market share, powder pigments continue to be the go-to choice for applications requiring high durability, color retention, and processing flexibility. Their dominant position highlights their critical role in ensuring high performance across industries that rely on reliable and long-lasting pigment solutions. The strong preference for powder form underlines its contribution to consistent product quality and manufacturing efficiency.

By Application Analysis

Coatings lead application segment in the High Performance Pigments Market with 44.2%.

In 2024, Coatings held a dominant market position in the By Application segment of the High Performance Pigments Market, with a 44.2% share. This leading position reflects the strong and consistent demand for high-performance pigments in coating applications where durability, weather resistance, and long-term aesthetic appeal are critical. Industries such as automotive, architecture, and industrial manufacturing continue to prioritize coatings that can withstand harsh environmental conditions, which in turn drives the need for pigments that maintain color integrity over time.

High-performance pigments used in coatings are known for their superior resistance to UV light, chemicals, and temperature extremes, making them the preferred choice for exterior and high-stress environments. Their ability to deliver vibrant, long-lasting colors without fading or degradation ensures that coated surfaces retain their appearance and performance, even under demanding use.

The dominance of coatings in this segment underscores the essential role that pigments play in not only visual enhancement but also in the functional protection of surfaces. The 44.2% market share highlights how critical coatings are as an application area for high-performance pigments, supporting their continued relevance and strong market presence in 2024.

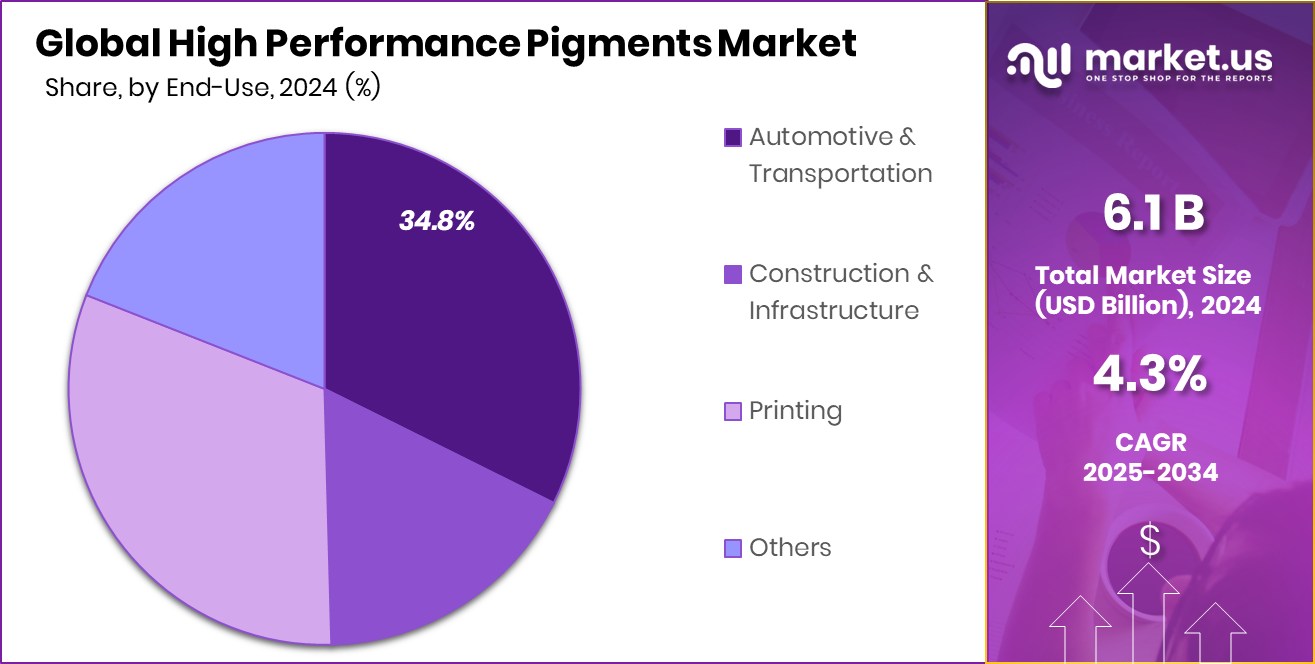

By End-use Analysis

Automotive sector drives High Performance Pigments Market, capturing 34.8% of the end-use share.

In 2024, Automotive and Transportation held a dominant market position in the By End-use segment of the High Performance Pigments Market, with a 34.8% share. This leadership is largely driven by the critical need for advanced pigmentation solutions in automotive finishes and components that demand superior durability, resistance to extreme weather, and lasting visual appeal.

The automotive industry places strong emphasis on aesthetic differentiation, surface longevity, and environmental resilience, making high performance pigments an indispensable material in vehicle manufacturing and refinishing. Their ability to withstand UV radiation, road chemicals, and temperature fluctuations without fading or deteriorating supports their extensive use in this sector. Whether for exterior body paints or interior detailing, these pigments ensure both visual quality and material performance.

Holding a 34.8% share in 2024, the Automotive and Transportation segment demonstrates a clear reliance on these pigments to meet industry standards for appearance and endurance. This dominant market position reflects the sector’s continued focus on innovation, consumer appeal, and product life cycle, all of which rely heavily on the advanced capabilities offered by high performance pigments.

Key Market Segments

By Type

- Inorganic

- Organic

- Hybrid

By Form

- Powder

- Liquid

- Granules

By Application

- Coatings

- Plastics

- Inks

- Cosmetics

- Others

By End-use

- Automotive and Transportation

- Construction and Infrastructure

- Printing

- Others

Driving Factors

Growing Demand for Durable and Long-Lasting Colors

One of the top driving factors for the High Performance Pigments (HPP) Market is the increasing demand for pigments that offer durability and long-lasting color. Industries like automotive, construction, and industrial coatings need pigments that can handle tough weather, heat, sunlight, and chemicals without fading or breaking down.

High-performance pigments are designed to meet these needs by providing strong color that lasts much longer than regular pigments. As more manufacturers and consumers look for quality and products that last, the use of HPPs continues to grow. Whether it’s a car, a building, or a plastic product, lasting color and appearance matter—and HPPs are the solution that helps deliver those results reliably.

Restraining Factors

High Production Costs Limit Wider Market Adoption

A major restraining factor for the High Performance Pigments (HPP) Market is the high cost of production. These pigments require complex raw materials and advanced manufacturing processes, which make them much more expensive than standard pigments. This higher cost can be a barrier, especially for small manufacturers or cost-sensitive industries that may not be able to afford premium pigments.

In many cases, companies choose less durable alternatives to save money, even if it means more frequent maintenance or replacement. The price factor makes it difficult for HPPs to penetrate markets where cost is a major deciding factor. Unless production becomes more affordable, this price challenge may slow down the overall growth of the HPP market.

Growth Opportunity

Rising Demand for Eco-Friendly Pigment Solutions

A key growth opportunity in the High Performance Pigments (HPP) Market lies in the rising demand for eco-friendly and non-toxic pigment options. As environmental regulations become stricter and awareness about sustainability increases, industries are actively looking for safer alternatives that don’t harm people or the planet. High performance pigments can be developed using cleaner, safer materials that meet these new standards.

This creates a strong opportunity for companies to innovate and offer green pigment solutions that deliver both performance and environmental safety. The push for sustainable construction, eco-conscious automotive coatings, and safer consumer goods is opening up new doors for growth in the market, especially for businesses that can align their products with this global sustainability trend.

Latest Trends

Use of High-Performance Pigments in Plastics

One of the latest trends in the High Performance Pigments (HPP) Market is their growing use in plastic products. With the rise in demand for high-quality, colorful, and long-lasting plastic goods—like packaging, electronics, furniture, and appliances—manufacturers are turning to HPPs for better results. These pigments offer excellent heat stability, color consistency, and resistance to fading, which are essential when plastics are used outdoors or exposed to sunlight and chemicals.

Consumers also want products that keep their appearance over time, and HPPs help achieve that. This trend reflects how industries are shifting toward more reliable materials in plastic applications, making HPPs a preferred choice for combining strong looks with high performance in everyday plastic items.

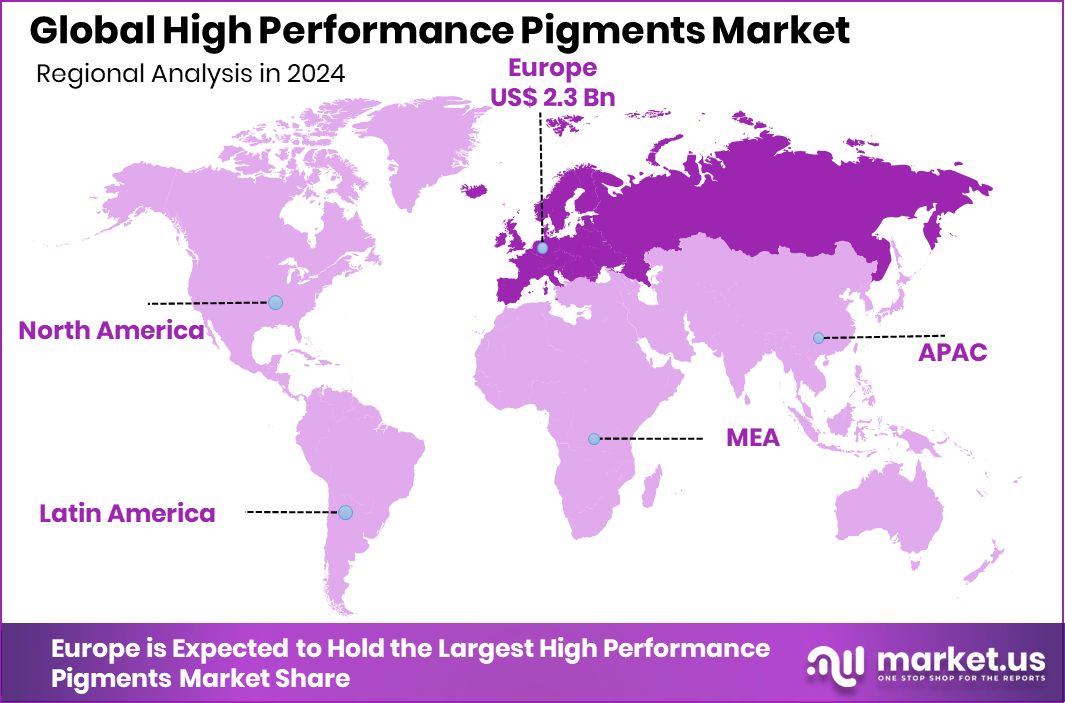

Regional Analysis

In 2024, Europe led the High Performance Pigments Market with a 38.7% share.

In 2024, Europe emerged as the dominant region in the High Performance Pigments Market, accounting for a significant 38.7% share with a market value of USD 2.3 billion. The region’s leadership is supported by strong demand across key industries such as automotive, industrial coatings, and construction, where high standards for durability, aesthetics, and environmental compliance drive the adoption of advanced pigments.

Europe’s mature manufacturing base and emphasis on sustainable, long-lasting materials further contribute to its commanding position in the market. Other regions, including North America, Asia Pacific, the Middle East & Africa, and Latin America, continue to contribute to the global growth of the High Performance Pigments Market, though their individual market shares and values remain lower compared to Europe.

North America shows steady uptake driven by industrial and infrastructure needs, while Asia Pacific is gradually expanding with increasing industrialization. However, neither has matched Europe’s scale or market value in 2024. Latin America and the Middle East & Africa reflect emerging interest but remain in early stages of growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global High Performance Pigments (HPP) Market witnessed strong activity and innovation from leading players such as Clariant, DIC Corporation, and Ferro Corporation. These companies played a key role in shaping market dynamics through strategic product offerings, technological enhancements, and a focus on high-performance, application-specific pigment solutions.

Clariant maintained a strong presence with its focus on specialty chemicals and sustainable pigment solutions. The company emphasized environmentally friendly formulations and advanced pigment technologies tailored for coatings, plastics, and printing applications. Clariant’s ability to balance performance and regulatory compliance positioned it as a preferred choice for high-end customers seeking durable, long-lasting colorants.

DIC Corporation demonstrated steady growth through its diversified pigment portfolio and investment in research and development. With experience across various pigment chemistries, DIC’s efforts in enhancing pigment performance, stability, and color range contributed significantly to market competitiveness. The company’s broad application reach across automotive, packaging, and electronics strengthened its global footprint.

Ferro Corporation continued to assert its role in the HPP space with an emphasis on inorganic pigment technologies. Known for their color consistency and thermal stability, Ferro’s pigments remained in demand for industrial and construction-related coatings. The company’s focus on quality and performance in high-temperature and exterior applications reinforced its reputation as a reliable supplier.

Top Key Players in the Market

- ALTANA

- BASF SE

- Atul Ltd.

- CINIC

- Clariant

- DIC Corporation

- Ferro Corporation

- GHARDA CHEMICALS

- Heubach GmbH

- LANSCO COLORS

- Lanxess

- Meghmani Organics Ltd.

- Sudarshan Chemical Industries Limited

- Sun Chemical

- Synthesia A.S.

- Venator Materials PLC

- Vijay Chemical Industries

- VOXCO India

Recent Developments

- In March 2025, ALTANA reported a 16 % sales increase in fiscal year 2024, reaching €3.17 billion, fueled by strong pigment demand and prior acquisitions. They also raised R&D spending by 8 % and invested heavily in sites, digitalization, and sustainability.

- In October 2024, BASF introduced EFFLORESCENCE, a single-layer automotive monocoat that creates a pearlescent white effect without conventional effect pigments. It simplifies production and reflects over 65% of light, reducing heat absorption and winning a Red Dot design award.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Billion Forecast Revenue (2034) USD 9.3 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Inorganic, Organic, Hybrid), By Form (Powder, Liquid, Granules), By Application (Coatings, Plastics, Inks, Cosmetics, Others), By End-use (Automotive and Transportation, Construction and Infrastructure, Printing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ALTANA, BASF SE, Atul Ltd., CINIC, Clariant, DIC Corporation, Ferro Corporation, GHARDA CHEMICALS, Heubach GmbH, LANSCO COLORS, Lanxess, Meghmani Organics Ltd., Sudarshan Chemical Industries Limited, Sun Chemical, Synthesia A.S., Venator Materials PLC, Vijay Chemical Industries, VOXCO India Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Performance Pigments MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

High Performance Pigments MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ALTANA

- BASF SE

- Atul Ltd.

- CINIC

- Clariant

- DIC Corporation

- Ferro Corporation

- GHARDA CHEMICALS

- Heubach GmbH

- LANSCO COLORS

- Lanxess

- Meghmani Organics Ltd.

- Sudarshan Chemical Industries Limited

- Sun Chemical

- Synthesia A.S.

- Venator Materials PLC

- Vijay Chemical Industries

- VOXCO India