Global High Density Polyethylene Market Size, Share, And Business Benefits By Feedstock (Naphtha, Natural Gas, Others), By Manufacturing Process (Gas Phase Process, Slurry Process, Solution Process), By Application (Pipes and Tubes, Rigid Articles, Sheets and Films, Others), By End-user (Packaging, Transportation, Electrical and Electronics, Building and Construction, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151608

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

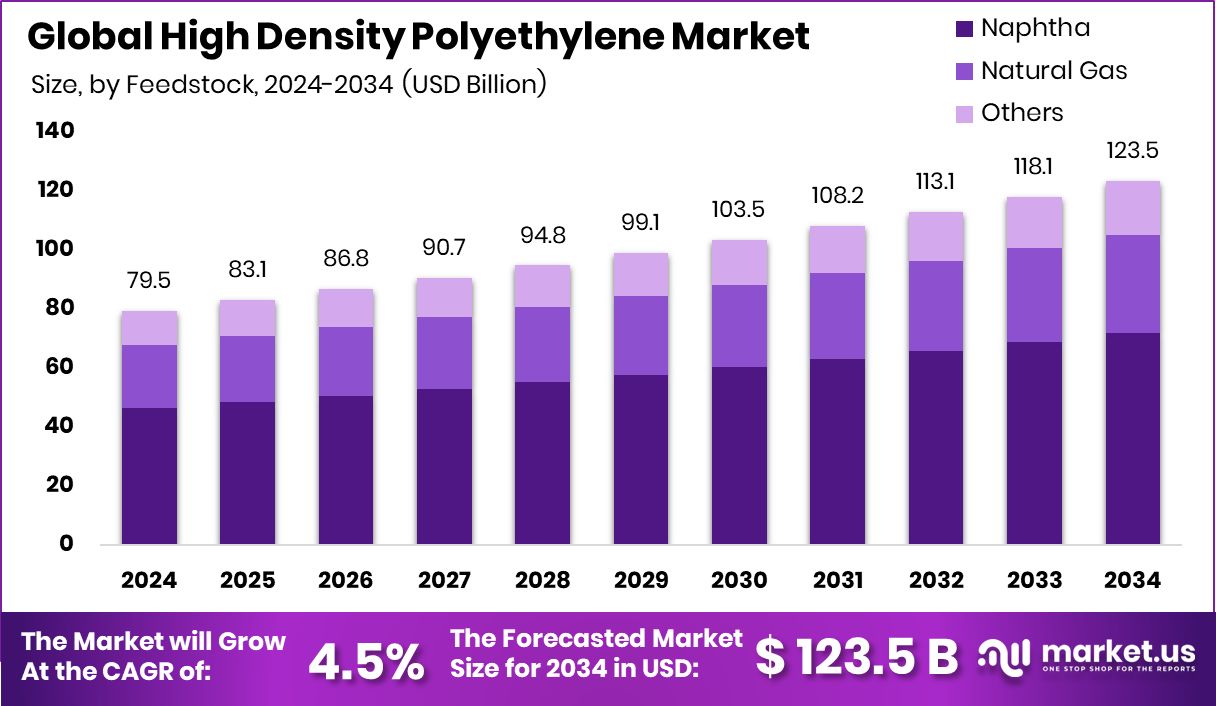

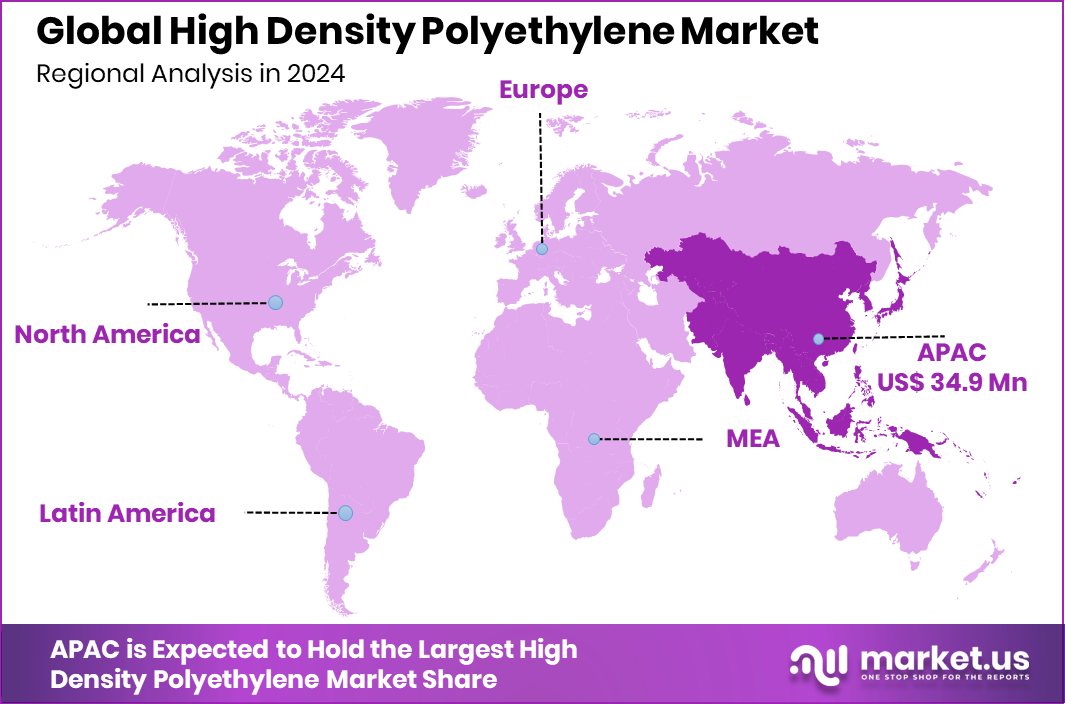

Global High Density Polyethylene Market is expected to be worth around USD 123.5 billion by 2034, up from USD 79.5 billion in 2024, and grow at a CAGR of 4.5% from 2025 to 2034. Strong demand in packaging and construction drives HDPE growth in the Asia-Pacific USD 34.9 billion region.

High Density Polyethylene (HDPE) is a thermoplastic polymer made from petroleum. It is known for its high strength-to-density ratio, durability, and chemical resistance. HDPE is commonly used in applications such as piping systems, plastic bottles, containers, geomembranes, and corrosion-resistant piping. It is lightweight yet strong, making it suitable for heavy-duty containers and industrial uses.

The growth of the HDPE market is largely driven by its widespread use in the packaging industry. As consumer demand for packaged goods increases, so does the need for durable and cost-effective plastic solutions. HDPE is favored in food and beverage packaging due to its non-toxic and moisture-resistant properties. Additionally, the growth in urban infrastructure and construction projects has led to greater use of HDPE in piping and cable insulation.

Demand for HDPE is also being boosted by the agriculture sector. The material is extensively used in irrigation pipes, greenhouse films, and water storage tanks. As global food production scales up to meet population growth, HDPE-based solutions help ensure efficient water management and crop protection, especially in regions facing water scarcity. According to an industry report, the US commits an Extra $14 million at the IUCN Forum to Fight Plastic Pollution

An important opportunity for the HDPE market lies in sustainability. With increasing pressure to reduce plastic waste, HDPE’s recyclability offers significant potential. Governments and organizations promoting circular economy practices are encouraging the use of recyclable materials like HDPE. According to an industry report, France Obtains €500 million EU Support for the Advanced Plastic Recycling Initiative

Key Takeaways

- Global High Density Polyethylene Market is expected to be worth around USD 123.5 billion by 2034, up from USD 79.5 billion in 2024, and grow at a CAGR of 4.5% from 2025 to 2034.

- In 2024, Naphtha held a dominant position in the High Density Polyethylene market with 58.3%.

- The Gas Phase Process accounted for 48.2%, making it the leading HDPE manufacturing method globally.

- Sheets and Films segment led applications, representing 41.1% of global High Density Polyethylene demand share.

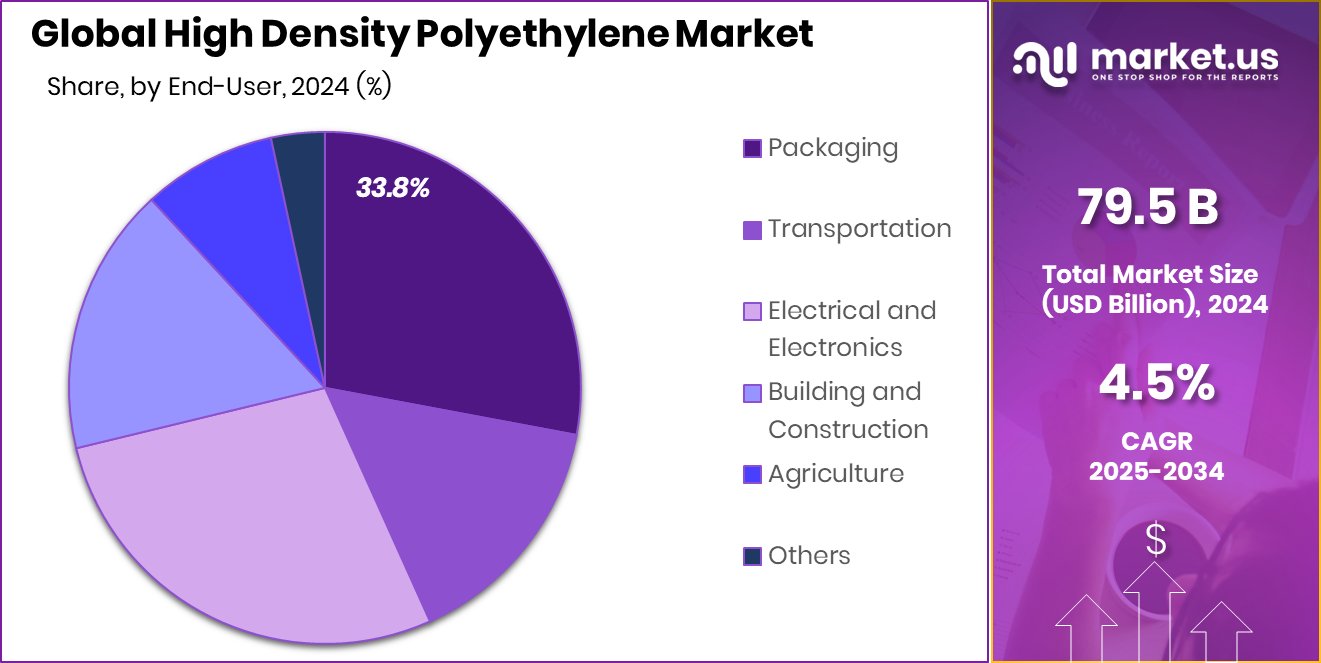

- Packaging emerged as the top end-user industry, capturing 33.8% share in the global HDPE market.

- The Asia-Pacific HDPE market reached a value of USD 34.9 billion in 2024.

By Feedstock Analysis

Naphtha dominates the High Density Polyethylene market with 58.3% share.

In 2024, Naphtha held a dominant market position in the By Feedstock segment of the High Density Polyethylene (HDPE) Market, with a 58.3% share. This leadership can be attributed to the widespread availability of naphtha across major refining regions and its established role as a key raw material in ethylene production, which is the primary precursor for HDPE.

The refining infrastructure in many countries, particularly in Asia and Europe, continues to favor naphtha cracking due to its flexibility in yielding a variety of olefins, including ethylene, required for HDPE manufacturing.

Moreover, the petrochemical industry’s long-standing dependence on naphtha feedstock ensures process compatibility and optimized output efficiencies. HDPE producers relying on naphtha benefit from stable operational frameworks, existing supply agreements, and mature logistics channels.

In emerging economies, especially across Asia-Pacific, the rapid growth of the packaging, construction, and infrastructure sectors further supports the demand for HDPE derived from naphtha. Additionally, ongoing investments in steam cracking capacities using naphtha in these regions reinforce its dominant position.

By Manufacturing Process Analysis

Gas Phase Process leads HDPE production, accounting for 48.2% market share.

In 2024, Gas Phase Process held a dominant market position in the By Manufacturing Process segment of the High Density Polyethylene (HDPE) Market, with a 48.2% share. This prominence is primarily due to the process’s operational efficiency, lower capital investment, and energy-saving advantages compared to other polymerization methods.

The gas phase process enables HDPE production at relatively low pressures and temperatures, which reduces overall energy consumption and simplifies reactor design. These factors contribute to lower operating costs and make the process highly attractive for producers focused on cost efficiency and scalability.

Furthermore, the gas phase method allows for better control over polymer properties such as molecular weight distribution and density, which are critical for applications requiring consistent material performance. It also supports flexible product changes and shorter transition times between grades, offering enhanced adaptability for manufacturers responding to dynamic end-user requirements.

The process’s minimal solvent usage and simplified downstream operations further add to its appeal, especially in regions emphasizing cleaner and more sustainable industrial practices. These advantages have supported the widespread adoption of the gas phase process in HDPE manufacturing, thereby securing its dominant share in the segment in 2024 and reinforcing its position as a preferred production method across key HDPE-producing regions.

By Application Analysis

Sheets and Films hold 41.1%, showing widespread industrial and consumer use.

In 2024, Sheets and Films held a dominant market position in the By Application segment of the High Density Polyethylene (HDPE) Market, with a 41.1% share. This segment’s leadership can be attributed to the widespread use of HDPE sheets and films across the packaging, agriculture, and construction sectors.

Their lightweight, high tensile strength, moisture resistance, and excellent chemical stability make them suitable for a broad range of functional applications. In particular, HDPE films are commonly utilized for protective packaging, carrier bags, and liners, while sheets find extensive use in industrial containment, geomembranes, and barrier systems.

The demand for HDPE-based sheets and films has also been reinforced by their cost-effectiveness and recyclability, aligning well with sustainability goals across manufacturing industries. Their ability to withstand extreme weather conditions, corrosion, and wear makes them ideal for long-term outdoor applications, particularly in agricultural mulching and construction surface barriers.

Additionally, technological advancements in film processing techniques and sheet extrusion have improved product quality and manufacturing efficiency, further driving their adoption. As a result, the Sheets and Films segment captured the largest market share in 2024, benefiting from consistent demand, versatility in application, and material advantages that support high-performance, large-scale usage across industrial and commercial environments.

By End-user Analysis

The packaging sector drives demand, capturing 33.8% of the HDPE market globally.

In 2024, Packaging held a dominant market position in the end-user segment of the Density Polyethylene (HDPE) Market, with a 33.8% share. This leadership is primarily driven by the high demand for HDPE in flexible and rigid packaging applications across food, beverage, pharmaceutical, and household product sectors.

HDPE’s resistance to moisture, chemicals, and impact makes it particularly suitable for manufacturing bottles, containers, caps, and films used in consumer packaging. Its lightweight nature also reduces transportation costs and enhances shelf efficiency, which are critical advantages for packaging companies.

Moreover, the rise in e-commerce and retail activity has led to increased consumption of secondary and protective packaging materials, further supporting HDPE usage. With growing awareness around product safety, extended shelf life, and hygiene, HDPE packaging offers a reliable solution that meets regulatory and functional needs.

Its recyclability is another key factor contributing to its preference, as industries and consumers shift toward sustainable packaging materials. These strengths have ensured the Packaging segment maintained its leading share in 2024, reflecting the material’s broad applicability, regulatory compliance, and enduring role in high-volume, fast-moving consumer goods markets where durability and safety remain top priorities.

Key Market Segments

By Feedstock

- Naphtha

- Natural Gas

- Others

By Manufacturing Process

- Gas Phase Process

- Slurry Process

- Solution Process

By Application

- Pipes and Tubes

- Rigid Articles

- Sheets and Films

- Others

By End-user

- Packaging

- Transportation

- Electrical and Electronics

- Building and Construction

- Agriculture

- Others

Driving Factors

Growing Use in Packaging Boosts HDPE Demand

One of the main driving factors for the High Density Polyethylene (HDPE) market is its increasing use in packaging. HDPE is widely used to make bottles, containers, films, and bags due to its strength, lightweight nature, and resistance to moisture and chemicals. These properties make it ideal for food packaging, personal care products, and cleaning goods.

As consumer demand for packaged goods continues to rise—especially through supermarkets and online shopping—the need for reliable, cost-effective plastic materials like HDPE is growing. In addition, HDPE can be recycled, which supports its use in sustainable packaging.

Restraining Factors

Environmental Concerns Limit HDPE Market Expansion

One major restraining factor for the High Density Polyethylene (HDPE) market is the growing concern over plastic pollution and its environmental impact. Although HDPE is recyclable, a large amount still ends up in landfills or oceans due to poor waste management and low recycling rates in many regions. Governments and environmental groups are pushing for stricter regulations on plastic use, including bans on single-use plastics and higher taxes on non-biodegradable materials.

These actions are making some manufacturers and consumers shift away from traditional plastics, including HDPE. As a result, companies using HDPE may face additional costs, regulatory challenges, and pressure to switch to biodegradable or compostable alternatives, which can slow down the overall market growth.

Growth Opportunity

Rising Demand for Recycled HDPE Drives Opportunity

One major growth opportunity for the High Density Polyethylene (HDPE) market lies in the growing demand for recycled HDPE (rHDPE). With increased consumer awareness and government initiatives promoting circular economies, industries are shifting toward using recycled plastics. HDPE’s recyclability enables it to be remelted and reused for products like bottles, pipes, and packaging materials.

Additionally, investments in improved recycling infrastructure—such as advanced sorting technologies and collection systems—enhance the quality and availability of rHDPE. As more companies set sustainability targets and consumers favor eco-friendly products, recycled HDPE offers a clear opportunity to grow while aligning with global environmental goals.

Latest Trends

Bio-Based HDPE Gains Attention for Sustainability

A key trend shaping the High Density Polyethylene (HDPE) market is the increasing focus on bio-based HDPE. Unlike traditional HDPE made from petroleum, bio-based HDPE is produced using renewable resources such as sugarcane or corn. This shift is driven by rising concerns over carbon emissions and plastic waste. Bio-based HDPE offers the same strength and durability as conventional HDPE but with a lower environmental footprint.

Many companies are now investing in developing and scaling up bio-HDPE production as part of their climate-friendly initiatives. As governments and consumers push for greener materials, this trend is expected to grow stronger. It supports both long-term sustainability goals and the demand for high-performance, eco-friendly plastic alternatives.

Regional Analysis

In 2024, Asia-Pacific led the HDPE market with 43.9% market share.

In 2024, Asia-Pacific held a dominant position in the global High Density Polyethylene (HDPE) market, capturing a 43.9% share valued at USD 34.9 billion. This leadership is driven by strong demand from the region’s rapidly expanding packaging, construction, and industrial sectors.

Countries like China, India, and Southeast Asian nations continue to invest heavily in infrastructure and manufacturing, contributing significantly to HDPE consumption. Moreover, the growing middle-class population and rise in consumer goods production have further strengthened the need for HDPE in applications such as containers, films, and pipes.

In North America and Europe, HDPE demand remains steady, supported by established packaging and automotive sectors, along with an environmental focus on recyclable materials. The Middle East & Africa region is witnessing gradual growth, aided by investments in petrochemical capacity and infrastructure development.

Latin America is also progressing, though at a moderate pace, with HDPE demand tied to agriculture and construction activities. However, Asia-Pacific continues to lead due to its cost-competitive production base and large consumer markets. The region’s ongoing urbanization, government-led infrastructure projects, and expansion of downstream plastic processing industries firmly position it as the key contributor to global HDPE market dynamics in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Borealis AG continues to leverage its advanced polymer technologies and strong research capabilities to enhance product quality and broaden its HDPE portfolio. The company’s investment in sustainable production and enhanced recycling technologies supports its position as a preferred supplier for applications in packaging and infrastructure. Its supply chain efficiency and integrated production network across Europe and beyond have reinforced its ability to serve key markets effectively.

Braskem SA maintains a competitive stance through its vertically integrated operations in Brazil. The company leverages its significant naphtha feedstock volume and efficient steam-cracking infrastructure to sustain high production margins. Braskem’s ongoing efforts in sustainability, such as initiatives to expand recycled HDPE production capacity, further position it to meet growing circular-economy demands in Latin America and other regions.

Chevron Phillips Chemical Company LLC benefits from its strong operational scale and flexible manufacturing footprint in the United States. The company’s robust supply chain and reliable ethylene feedstock access underpin its consistent HDPE output. Chevron Phillips also stands out with its polymer-grade specialty resins, which command higher margins in segments such as piping and healthcare applications.

Daelim Co. Ltd., a key player in South Korea, bolsters its position through well-developed petrochemical infrastructure and strategic joint ventures. The company employs advanced polymerization technologies, including gas-phase and slurry processes, to distinguish its HDPE quality and performance. Daelim has also engaged in capacity expansions that align with growing domestic and regional downstream demand.

Top Key Players in the Market

- Borealis AG

- Braskem SA

- Chevron Phillips Chemical Company LLC

- Daelim Co. Ltd.

- Dow

- Dynalab Corp.

- Exxon Mobil Corporation

- Formosa Plastics Corporation, U.S.A.

- Indian Oil Corporation Ltd

- INEOS AG

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals Inc.

- PetroChina Company Ltd.

- Prime Polymer Co., Ltd.

- Reliance Industries Ltd.

Recent Developments

- In June 2024, Borealis began constructing a demonstration compounding line in Beringen, Belgium, focused on recycled HDPE and PP. The line, based on Borcycle™ M technology, is expected to be fully operational in the first half of 2025. It will process post‑consumer HDPE scrap into high‑quality recycled materials for use in mobility, appliances, energy, and consumer goods.

- In December 2024, Chevron Phillips Chemical confirmed that two major polyethylene joint ventures—a Golden Triangle Polymers complex in Texas and a PE plant in Qatar—remain on schedule for a 2026 start-up. These projects will contribute new HDPE production capacity.

Report Scope

Report Features Description Market Value (2024) USD 79.5 Billion Forecast Revenue (2034) USD 123.5 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Feedstock (Naphtha, Natural Gas, Others), By Manufacturing Process (Gas Phase Process, Slurry Process, Solution Process), By Application (Pipes and Tubes, Rigid Articles, Sheets and Films, Others), By End-user (Packaging, Transportation, Electrical and Electronics, Building and Construction, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Borealis AG, Braskem SA, Chevron Phillips Chemical Company LLC, Daelim Co. Ltd., Dow, Dynalab Corp., Exxon Mobil Corporation, Formosa Plastics Corporation, U.S.A., Indian Oil Corporation Ltd, INEOS AG, LG Chem, LyondellBasell Industries Holdings BV, Mitsui Chemicals Inc., PetroChina Company Ltd., Prime Polymer Co., Ltd., Reliance Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Density Polyethylene MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

High Density Polyethylene MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Borealis AG

- Braskem SA

- Chevron Phillips Chemical Company LLC

- Daelim Co. Ltd.

- Dow

- Dynalab Corp.

- Exxon Mobil Corporation

- Formosa Plastics Corporation, U.S.A.

- Indian Oil Corporation Ltd

- INEOS AG

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals Inc.

- PetroChina Company Ltd.

- Prime Polymer Co., Ltd.

- Reliance Industries Ltd.