Global Heart Pump Device Market By Product (Ventricular Assist Devices (VADs) (Right Ventricular Assist Devices (RVADs), Percutaneous Ventricular Assist Devices (PVADs), Left Ventricular Assist Devices (LVADs) and BiVAD Ventricular Assist Devices (BiVADs)), Extracorporeal Membrane Oxygenation (ECMO) and Intra-Aortic Balloon Pumps (IABPs)), By Type (Implanted and Extracorporeal), By Therapy (Bridge-to-Transplant (BTT), Destination Therapy (DT), Bridge-to-Candidacy (BTC) and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174512

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

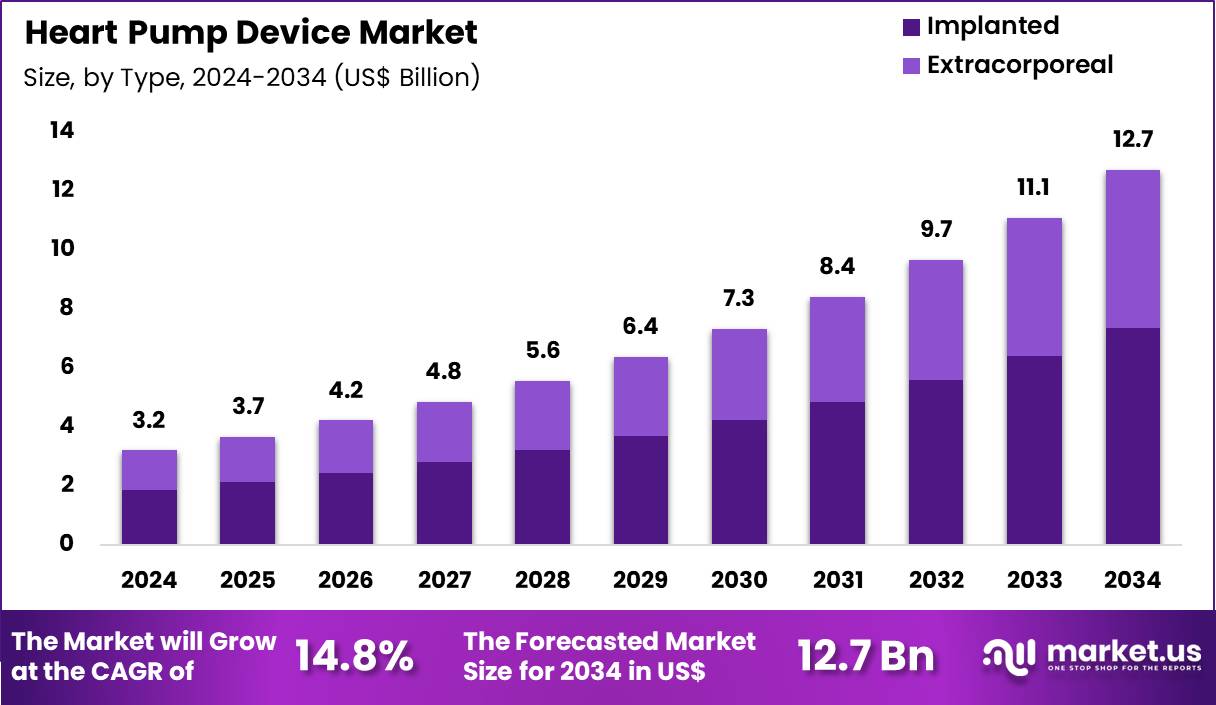

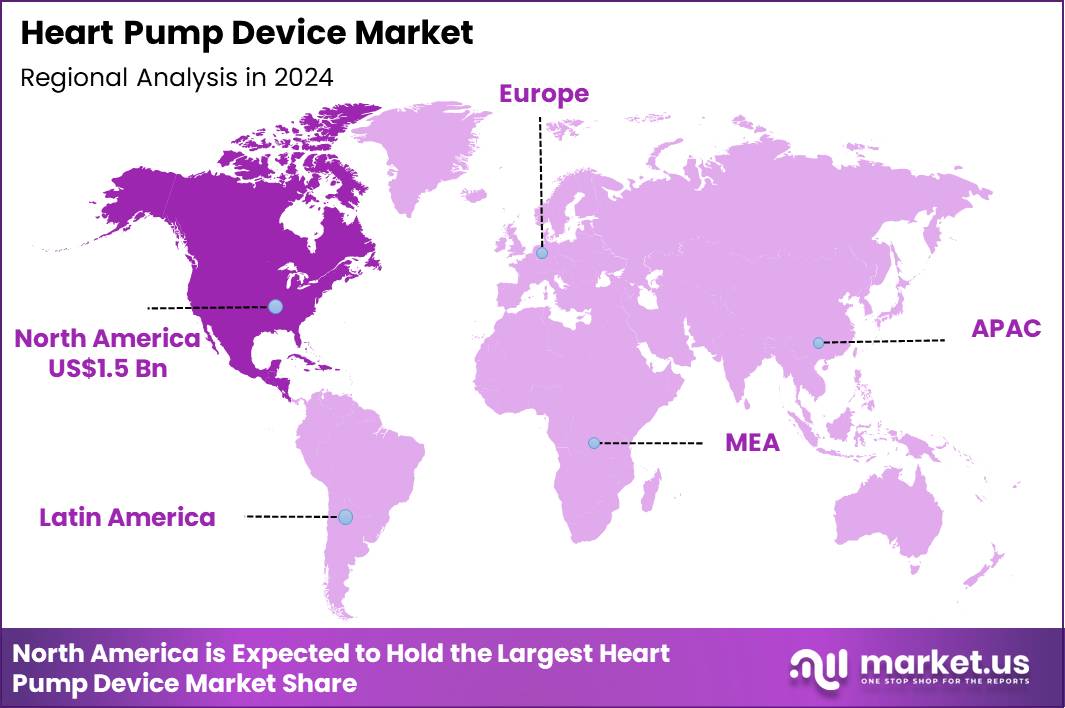

The Global Heart Pump Device Market size is expected to be worth around US$ 12.7 Billion by 2034 from US$ 3.2 Billion in 2024, growing at a CAGR of 14.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 48.3% share with a revenue of US$ 1.5 Billion.

Rising prevalence of end-stage heart failure compels cardiologists to increasingly adopt heart pump devices that provide reliable mechanical circulatory support when medical therapy fails to maintain adequate cardiac output.

Surgeons implant left ventricular assist devices as destination therapy for patients ineligible for transplantation, restoring sufficient perfusion to vital organs and enhancing exercise tolerance. These devices serve as a bridge to transplantation, stabilizing hemodynamics and preventing irreversible end-organ damage in candidates awaiting donor hearts.

Clinicians deploy biventricular assist configurations to manage combined left and right heart failure in acute cardiogenic shock following myocardial infarction or myocarditis. Short-term extracorporeal systems support postcardiotomy recovery, allowing myocardial rest and potential native heart recovery in reversible cardiac dysfunction.

In July 2025, CorWave in France reported the first human use of its advanced left ventricular assist device built around a wave membrane design that delivers pulsatile blood flow. By maintaining a rhythm closer to natural heart function, the system is intended to lower complication risks associated with continuous flow pumps. The first recipient demonstrated stable recovery beyond one month after implantation and was able to leave the hospital, indicating early clinical viability of this new LVAD concept.

Manufacturers pursue opportunities to develop fully implantable pulsatile pumps that mimic physiological flow patterns, reducing adverse events such as gastrointestinal bleeding and stroke in long-term support. Developers advance miniaturized devices with wireless energy transfer, eliminating drivelines and broadening applicability in ambulatory patients requiring prolonged mechanical assistance. These innovations facilitate bridge-to-recovery strategies in fulminant myocarditis, promoting myocardial remodeling while providing hemodynamic stability.

Opportunities emerge in hybrid systems that integrate heart pumps with transcatheter valve interventions, optimizing outcomes in heart failure with concomitant valvular pathology. Companies invest in remote monitoring platforms that track pump performance and patient parameters, enabling proactive intervention and reducing readmissions. Firms explore pediatric-specific pumps with adjustable flow capabilities, addressing unmet needs in congenital cardiomyopathy and supporting growth during extended therapy.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.2 Billion, with a CAGR of 14.8%, and is expected to reach US$ 12.7 Billion by the year 2034.

- The product segment is divided into ventricular assist devices (VADs), extracorporeal membrane oxygenation (ECMO) and intra-aortic balloon pumps (IABPs), with ventricular assist devices (VADs) taking the lead with a market share of 61.4%.

- Considering type, the market is divided into implanted and extracorporeal. Among these, implanted held a significant share of 57.8%.

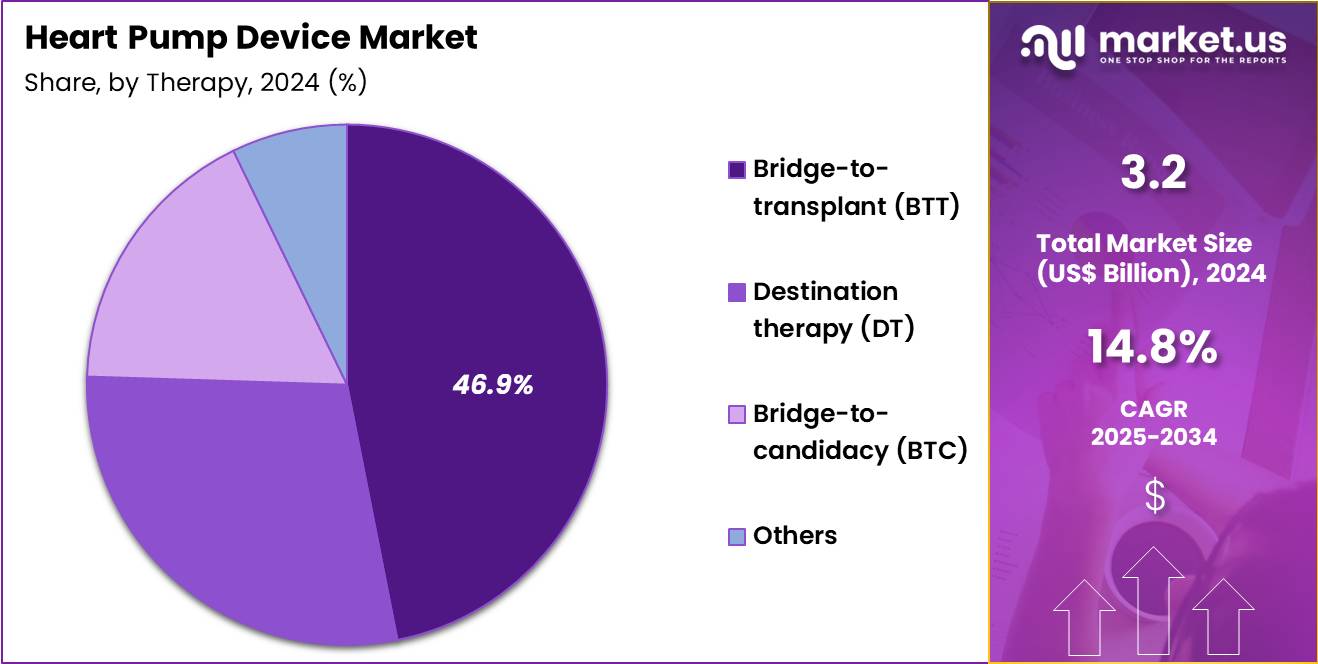

- Furthermore, concerning the therapy segment, the market is segregated into bridge-to-transplant (BTT), destination therapy (DT), bridge-to-candidacy (BTC) and others. The bridge-to-transplant (BTT) sector stands out as the dominant player, holding the largest revenue share of 46.9% in the market.

- North America led the market by securing a market share of 48.3%.

By Product Analysis

Ventricular assist devices accounted for 61.4% of growth within the product category and represent the primary technology driving the Heart Pump Device market. Rising prevalence of end-stage heart failure increases reliance on durable mechanical circulatory support. Clinicians increasingly select VADs for long-term hemodynamic stabilization in advanced patients. Improvements in pump durability extend device longevity and patient survival.

Miniaturization trends improve patient mobility and quality of life. Expanding transplant waitlists increase demand for mechanical support solutions. VADs support both left and biventricular failure management. Clinical outcomes data strengthen physician confidence in broader adoption. Improved anticoagulation protocols reduce complication risks.

Specialized heart failure centers expand VAD implantation programs. Reimbursement frameworks increasingly recognize VAD therapy value. Aging populations expand the eligible patient pool. Technological advancements reduce infection and thrombosis incidence. Training programs increase surgical proficiency and procedural success.

VADs integrate well into multidisciplinary heart failure care pathways. Patient monitoring technologies improve post-implant management. Survival benefits support use beyond temporary support scenarios. Global awareness of mechanical circulatory support increases referrals. Device innovation continues to enhance performance consistency. The segment is projected to remain dominant due to long-term support capability and clinical necessity.

By Type Analysis

Implanted devices represented 57.8% of growth within the type category and lead adoption in the Heart Pump Device market. Implanted systems support continuous circulatory assistance for chronic heart failure patients. Clinicians prefer implanted devices for long-term therapy stability. Reduced external hardware improves patient comfort and daily functioning. Advances in surgical techniques shorten implantation recovery time. Implantable designs reduce dependency on intensive care settings.

Long-term outpatient management increases treatment flexibility. Lower infection risk compared to extracorporeal systems supports preference. Implanted devices enable extended survival while awaiting transplantation. Destination therapy usage increases implanted system demand. Improved power management extends device operational reliability.

Remote monitoring enhances safety and early complication detection. Hospitals expand implant programs to meet rising demand. Patient adherence improves with fewer external constraints. Clinical guidelines increasingly reference implantable support options.

Technology refinements reduce mechanical failure rates. Implantable systems support higher quality-of-life outcomes. Care pathways emphasize early implantation for eligible patients. Health systems invest in implantable infrastructure and training. The segment is anticipated to maintain leadership due to durability and patient-centered benefits.

Therapy Analysis

Bridge-to-transplant accounted for 46.9% of growth within the therapy category and remains the leading clinical application in the Heart Pump Device market. Organ donor shortages extend transplant waiting periods. Mechanical support ensures patient survival during prolonged wait times. Transplant centers increasingly rely on BTT strategies to stabilize candidates. VAD-supported patients maintain organ perfusion and functional status. Improved pre-transplant conditioning enhances post-transplant outcomes.

Clinical protocols prioritize BTT for eligible advanced heart failure patients. Survival rates improve with timely mechanical intervention. Younger patient populations dominate BTT utilization. Transplant listing criteria align closely with BTT therapy pathways. Device reliability supports longer bridge durations. Multidisciplinary transplant teams drive therapy adoption.

Continuous monitoring optimizes transplant readiness. Regulatory and reimbursement support strengthens BTT implementation. Patient outcomes data reinforce BTT effectiveness. Expanded transplant programs increase therapy volume. Advances in immunosuppression indirectly support BTT demand.

Hospitals coordinate mechanical support and transplant workflows efficiently. Improved patient mobility enhances quality of life during waiting periods. Global transplant demand sustains long-term growth. The segment is expected to remain dominant due to persistent organ scarcity and clinical reliance on bridging strategies.

Key Market Segments

By Product

- Ventricular assist devices (VADs)

- Right ventricular assist devices (RVADs)

- Percutaneous ventricular assist devices (PVADs)

- Left ventricular assist devices (LVADs)

- BiVAD ventricular assist devices (BiVADs)

- Extracorporeal membrane oxygenation (ECMO)

- Intra-aortic balloon pumps (IABPs)

By Type

- Implanted

- Extracorporeal

By Therapy

- Bridge-to-transplant (BTT)

- Destination therapy (DT)

- Bridge-to-candidacy (BTC)

- Others

Drivers

Rising prevalence of advanced heart failure is driving the market

The heart pump device market is significantly driven by the rising prevalence of advanced heart failure, which creates urgent need for mechanical circulatory support in patients unresponsive to optimal medical therapy. Cardiologists increasingly rely on ventricular assist devices and total artificial hearts to stabilize patients awaiting transplantation or as permanent therapy.

Regulatory agencies recognize the growing burden of end-stage heart failure, supporting device approvals and reimbursement pathways. Pharmaceutical and device companies invest heavily in next-generation pumps to address limitations of earlier models, such as thrombosis and infection risks. Clinical guidelines now position mechanical support earlier in the treatment algorithm for bridge-to-transplant and destination therapy candidates.

Global heart failure registries document steady increases in advanced cases, amplifying demand for durable assist devices. Academic research validates long-term survival benefits of modern pumps in carefully selected patients. Patient quality of life improves markedly with devices that restore adequate cardiac output.

Economic analyses demonstrate cost-effectiveness through reduced hospitalizations and improved functional status. According to the American Heart Association’s 2024 Heart Disease and Stroke Statistics Update, approximately 6.7 million U.S. adults aged 20 and older had heart failure in 2022, with projections of continued growth.

Restraints

High risk of device-related adverse events is restraining the market

The heart pump device market is restrained by the high risk of device-related adverse events, including stroke, bleeding, infection, and pump thrombosis, which limit broader clinical acceptance. Surgeons and cardiologists remain cautious when selecting candidates due to significant complication rates even with contemporary devices. Regulatory agencies require extensive post-market surveillance and mandate risk mitigation strategies, increasing manufacturer compliance costs.

Clinical trial designs must account for these adverse events, prolonging development timelines and raising expenses. Healthcare systems face elevated costs associated with managing complications, including prolonged intensive care stays and reoperations. Global variations in adverse event reporting create challenges for comparative safety assessments across regions. Academic studies continue to document persistent risks despite technological improvements.

Patient selection criteria become more stringent to minimize complications, narrowing the eligible population. Economic analyses reveal substantial long-term costs from adverse events that offset initial device benefits. The Interagency Registry for Mechanically Assisted Circulatory Support (INTERMACS) reported that freedom from major adverse events at 12 months remained below 50% for many contemporary devices during the 2022-2024 period.

Opportunities

Expansion of destination therapy indications is creating growth opportunities

The heart pump device market offers growth opportunities through the expansion of destination therapy indications, allowing permanent implantation in patients ineligible for transplantation due to age or comorbidities. Device manufacturers can target a larger population of end-stage heart failure patients who previously had limited options beyond palliative care. Regulatory agencies have approved broader labeling for destination therapy based on improved long-term survival data.

Healthcare systems benefit from devices that reduce repeated hospitalizations and improve functional capacity. Clinical research explores combination strategies with medical therapy to optimize outcomes in destination therapy candidates. Global aging demographics align with increased need for permanent mechanical support. Academic collaborations refine patient selection criteria to maximize benefit in non-transplant candidates.

Patient quality of life improves substantially with devices enabling independence and symptom relief. Economic models demonstrate cost-effectiveness of destination therapy through reduced healthcare utilization. The American Heart Association’s 2024 Heart Disease and Stroke Statistics Update projects continued growth in heart failure prevalence, supporting expansion of destination therapy.

Impact of Macroeconomic / Geopolitical Factors

Global economic advancements direct resources toward cardiovascular innovations, invigorating the heart pump device market as providers prioritize durable solutions for escalating heart failure incidences in mature populations. Executives harness stable fiscal environments to collaborate on implantable technologies, which broadens therapeutic options across healthcare systems. Nevertheless, economic pressures from elevated interest rates constrain capital flows, impeding smaller firms from pursuing ambitious expansions in volatile territories.

Geopolitical rivalries in critical manufacturing zones fracture logistics networks, compelling suppliers to endure prolonged sourcing interruptions for essential components. Managers respond proactively by forging alliances in less contested areas, which fortifies procurement strategies and uncovers efficiency improvements.

Current US tariffs on imported medical devices, amid ongoing trade probes and policy shifts, amplify financial burdens for overseas entrants reliant on cost-competitive edges. Native enterprises capitalize on this landscape by scaling internal capabilities, which accelerates domestic R&D and cultivates supply autonomy. Breakthroughs in wireless monitoring integrations reliably propel the sector’s evolution, fostering enduring viability and superior clinical achievements worldwide.

Latest Trends

Increasing adoption of fully implantable systems is a recent trend

In 2024, the heart pump device market has demonstrated a prominent trend toward increasing adoption of fully implantable systems, which eliminate external drivelines and reduce infection risk compared to conventional percutaneous devices. Manufacturers are prioritizing transcutaneous energy transfer and miniaturized components to achieve complete implantation. Healthcare professionals are evaluating these systems for improved patient mobility and quality of life in long-term support.

Regulatory agencies are reviewing safety and performance data for fully implantable prototypes in clinical trials. Clinical investigations are focusing on durability and reliability in human implants. Academic publications are documenting early feasibility results and complication profiles. Global research networks are collaborating on power delivery and control systems.

Patient acceptance is rising due to elimination of external components and reduced infection concerns. Ethical considerations are guiding careful patient selection for early-stage implants. The U.S. Food and Drug Administration granted breakthrough device designation to a fully implantable left ventricular assist system in 2024 for advanced heart failure.

Regional Analysis

North America is leading the Heart Pump Device Market

In 2024, North America held a 39.9% share of the global heart pump device market, advanced by the escalating adoption of ventricular assist devices and intra-aortic balloon pumps for bridging therapy in advanced heart failure cases, where surgical volumes surged due to improved reimbursement policies and multidisciplinary heart teams optimizing patient selection for destination therapy.

Cardiologists expanded utilization of implantable pumps for long-term support in non-transplant candidates, supported by clinical evidence highlighting reduced hospital readmissions and enhanced quality of life in elderly populations with comorbidities. Innovations in wireless monitoring and smaller centrifugal flow designs minimized complications like driveline infections, aligning with regulatory priorities for post-market surveillance in high-volume transplant centers.

Demographic increases in ischemic cardiomyopathy amplified demands for temporary circulatory support in acute myocardial infarction, prompting integrated models with telemedicine for follow-up. Biotechnology firms refined biocompatible coatings for hemocompatibility, facilitating broader integrations in pediatric congenital heart defects.

Collaborative registries tracked device longevity, fostering confidence in hybrid approaches with ECMO. Supply adaptations ensured sterile, ready-to-implant kits compliant with biosafety norms in specialty units. Approximately 6.7 million Americans over 20 years of age have heart failure (HF), and the prevalence is expected to rise to 8.7 million in 2030.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders forecast substantial momentum in heart pump device technologies across Asia Pacific throughout the forecast period, as healthcare modernizations tackle surging cardiovascular burdens from dietary shifts and pollution. Specialists deploy ventricular assist systems in bridge-to-transplant protocols, tailoring configurations to manage end-stage failure in densely populated urban hospitals.

National authorities invest in intra-aortic balloon pumps for public wards, equipping them to handle acute decompensations amid humid climates. Biotech innovators customize centrifugal flow variants with enhanced durability, suiting regional anatomical variations in ischemic cohorts. Cross-national consortia evaluate device efficacy through population trials, optimizing outcomes for diabetic cardiomyopathy patients.

Pharmaceutical partnerships promote temporary support options with minimal invasiveness, addressing adherence in aging workforces. Policy initiatives incentivize training on implantation techniques, extending coverage to peripheral facilities facing resource constraints. Asia is the fastest-growing and most populous region of the world, accounting for 60% of the worldwide cardiovascular disease burden.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Heart Pump Device market drive growth by advancing miniaturized, durable mechanical circulatory support technologies that improve hemodynamic performance and patient mobility in advanced heart failure care. Companies expand adoption through structured training programs, center-of-excellence partnerships, and post-implant management tools that strengthen clinical outcomes and long-term survival.

Commercial strategies focus on expanding indications across bridge-to-transplant, destination therapy, and acute cardiogenic shock to widen eligible patient populations. Innovation priorities include enhanced biocompatibility, remote monitoring capabilities, and smarter power management systems that reduce complications and support outpatient living.

Market expansion targets regions investing in advanced cardiac care infrastructure and reimbursement frameworks for device-based heart failure treatment. Abbott operates as a leading participant through its LifeVest and ventricular assist system portfolio, global manufacturing scale, and deep cardiology relationships that enable broad adoption and sustained leadership in mechanical heart support solutions.

Top Key Players

- Abbott Laboratories

- Medtronic plc

- Boston Scientific Corporation

- Terumo Corporation

- Getinge AB

- LivaNova PLC

- Abiomed, Inc.

- CARMAT

- SynCardia Systems, LLC

- Berlin Heart GmbH

Recent Developments

- In June 2025, the US FDA awarded Breakthrough Device designation to the BiVACOR Total Artificial Heart, a fully implantable rotary pump constructed from titanium. The device is intended for patients with advanced heart failure affecting one or both ventricles, particularly in situations where conventional LVAD support is insufficient and transplantation is being pursued. The designation reflects the significant unmet need for durable total heart replacement technologies.

- In August 2024, the US FDA broadened approval for the Impella 5.5 with SmartAssist and Impella CP with SmartAssist systems to include selected pediatric patients. The expanded premarket approval allows use of Impella CP in children weighing at least 52 kilograms and Impella 5.5 in those weighing at least 30 kilograms, enabling mechanical circulatory support for pediatric cases of acute decompensated heart failure and cardiogenic shock.

Report Scope

Report Features Description Market Value (2024) US$ 3.2 Billion Forecast Revenue (2034) US$ 12.7 Billion CAGR (2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Ventricular Assist Devices (VADs) (Right Ventricular Assist Devices (RVADs), Percutaneous Ventricular Assist Devices (PVADs), Left Ventricular Assist Devices (LVADs) and BiVAD Ventricular Assist Devices (BiVADs)), Extracorporeal Membrane Oxygenation (ECMO) and Intra-Aortic Balloon Pumps (IABPs)), By Type (Implanted and Extracorporeal), By Therapy (Bridge-to-Transplant (BTT), Destination Therapy (DT), Bridge-to-Candidacy (BTC) and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Terumo Corporation, Getinge AB, LivaNova PLC, Abiomed, Inc., CARMAT, SynCardia Systems, LLC, Berlin Heart GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott Laboratories

- Medtronic plc

- Boston Scientific Corporation

- Terumo Corporation

- Getinge AB

- LivaNova PLC

- Abiomed, Inc.

- CARMAT

- SynCardia Systems, LLC

- Berlin Heart GmbH