Global Gourmet Salts Market Size, Share, And Industry Analysis Report By Product Type (Sea Salt, Fleur de Sel, Sel Gris, Himalayan Pink Salt, Flake Salt, Hawaiian Salt, Smoked Salt, Black Salt), By Product Form (Crystals, Flakes, Powder), By Application (Household and Retail, Bakery and Confectionery, Meat and Poultry, Seafood, Sauces and Savories, Food Processing), By End Use (Food and Beverage, Professional Culinary, Specialty Food Manufacturing, Health and Wellness), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171656

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

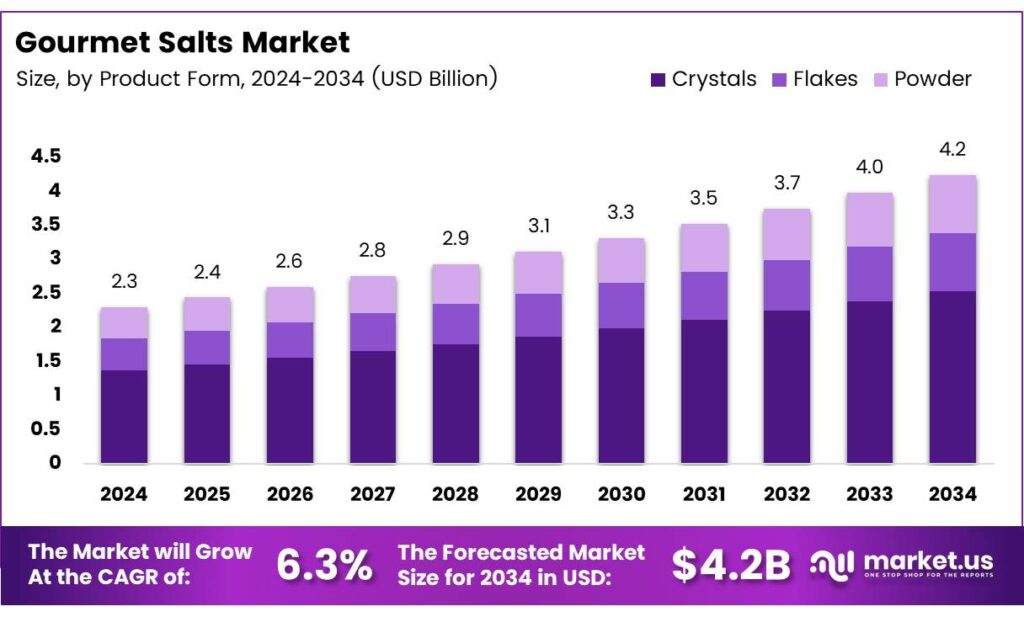

The Global Gourmet Salts Market size is expected to be worth around USD 4.2 billion by 2034, from USD 2.3 billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The Gourmet Salts Market represents a premium segment within the wider seasoning and specialty-ingredient landscape, offering differentiated textures, mineral profiles, and sensory value. It includes Himalayan pink salt, fleur de sel, flake salts, smoked salts, and infused varieties that appeal strongly to modern “clean label” and culinary-driven consumers seeking authenticity and natural sourcing.

Demand continues rising as consumers shift toward minimally processed ingredients with superior culinary performance. Premium restaurants, artisan food producers, and home cooks increasingly adopt gourmet salts to enhance flavor depth, maintain food quality, and achieve consistent finishing-salt applications. Additionally, e-commerce channels accelerate product visibility, enabling producers to promote origin-traceable and sustainability-focused salt formats.

- U.S. grocery shoppers increasingly associate premium salts with better health. Surveys show 59% believe sea salt is healthier than table salt, while 75% view it as better than sodium itself. This perception drives strong demand, with 95% showing purchase intent, and Clean Label Seekers being 49% more likely to buy products containing sea salt.

Salt remains the main dietary source of sodium, with table salt containing 97% sodium chloride and weighing 40% sodium by mass. A teaspoon of salt weighs 5.75 g, equal to 2.3 g of sodium, and Americans typically consume around 6 g daily. Since 75% of this intake is hidden in packaged foods, guidelines strongly recommend minimizing added salt in daily cooking.

Plant-based and functional-food companies integrate gourmet salts to elevate taste without artificial enhancers. Chefs highlight these salts as part of “ingredient-first” menu strategies, creating strong spillover demand in household retail. Meanwhile, sustainability-focused harvesting, solar-evaporation methods, and traceable sourcing help producers differentiate in an increasingly competitive premium-ingredient space.

Key Takeaways

- The Global Gourmet Salts Market is valued at USD 2.3 billion (2024) and is expected to reach USD 4.2 billion (2034) at a 6.3% CAGR (2025–2034).

- Sea Salt leads the By Product Type segment with a 32.6% share due to its wide availability and natural appeal.

- Crystals dominate the By-Product Form segment with a 48.2% share, supported by broad culinary versatility.

- Household and Retail applications hold the largest share at 32.8%, driven by the rising home-cooking culture.

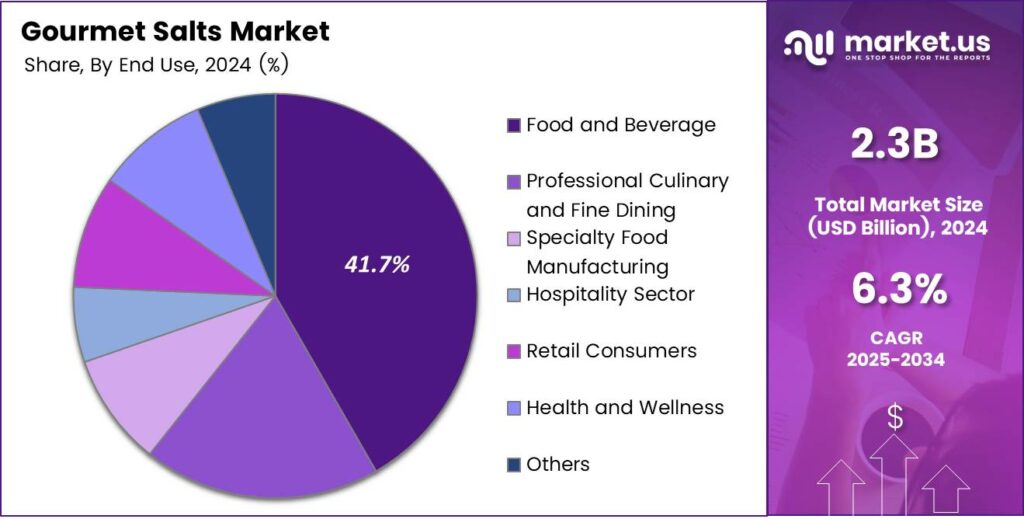

- The Food and Beverage end-use segment leads with 41.7%, reflecting strong integration into packaged foods and culinary products.

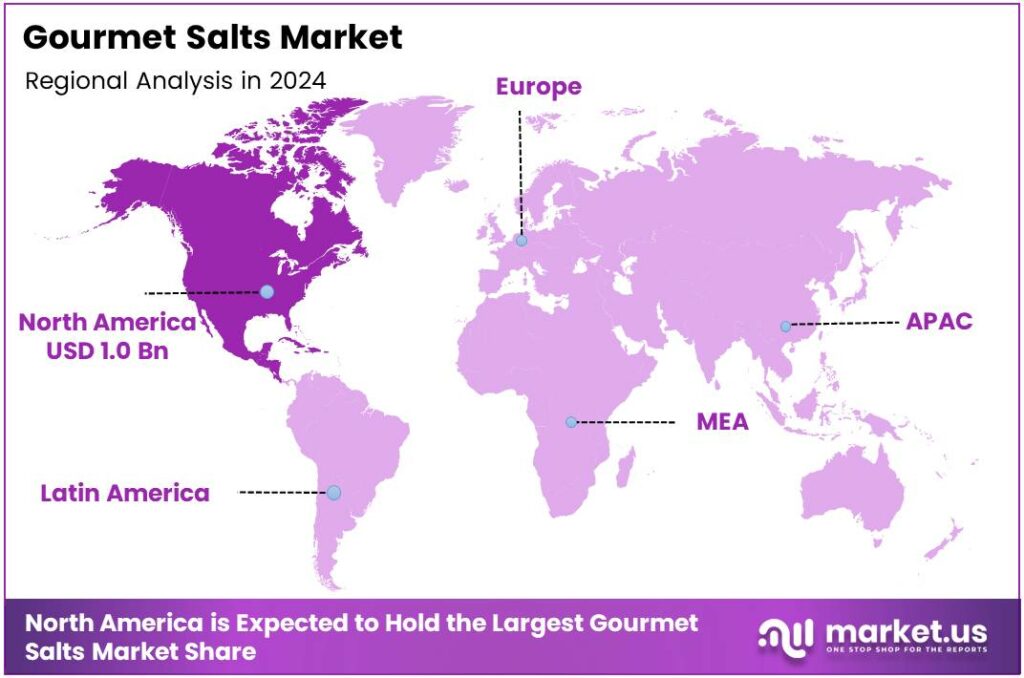

- North America is the top regional market with a 45.1% share, valued at USD 1.0 billion in 2024.

By Product Type Analysis

Sea Salt dominates with 32.6% due to its broad availability and versatile culinary use.

In 2024, Sea Salt held a dominant market position in the By Product Type segment of the Gourmet Salts Market, with a 32.6% share. It benefits from growing interest in natural, minimally processed ingredients. Consumers appreciate its mineral profile, clean flavor, and compatibility with daily cooking and premium culinary preparations.

Fleur de Sel continues gaining traction as chefs and premium food brands prefer its delicate texture. It is harvested manually, offering a unique identity linked with traditional coastal practices. Its mild salinity and refined flavor encourage adoption in gourmet desserts, confectionery toppings, and modern artisanal products.

Sel Gris (Celtic Grey Salt) attracts demand as buyers value mineral-rich, moist crystals that enhance savory dishes. Its coarse structure and ocean-derived nutrients make it popular among consumers exploring traditional European salts. It is also widely used in rubs, marinades, and slow-cooked recipes requiring deep, earthy salt profiles.

Himalayan Pink Salt, Flake Salt, Hawaiian Salt, Smoked Salt, Black Salt, and various Flavored or Infused Salts expand the market by appealing to flavor-seeking consumers. They support premium positioning and culinary experimentation, encouraging manufacturers to launch artisan blends, smoked variations, and wellness-oriented gourmet salt concepts.

By Product Form Analysis

Crystals dominate with 48.2% because of their widespread household and culinary adoption.

In 2024, Crystals held a dominant market position in the By Product Form segment of the Gourmet Salts Market, with a 48.2% share. Their versatility makes them suitable for everyday cooking, seasoning blends, and retail packaging. Their stable structure also supports easy storage, blending, and distribution across global retail formats.

Flakes show strong momentum as chefs prefer their delicate crunch and easy dissolution. They are commonly used as finishing salts, adding texture and visual appeal. Their lighter structure enhances premium plating, making them popular in bakery toppings, grilled seafood, handcrafted desserts, and artisanal culinary experiences.

Powder forms gradually expand as manufacturers use them for uniform seasoning distribution. They integrate well in snack coatings, processed foods, marinades, and rubs. The fine granularity ensures consistency in flavor delivery, supporting foodservice operators seeking efficiency, accuracy, and predictable taste across high-volume preparation settings.

By Application Analysis

Household and Retail dominate with 32.8% due to rising home-cooking interest.

In 2024, Household and Retail held a dominant market position in the By Application segment of the Gourmet Salts Market, with a 32.8% share. Growing home-cooking culture, global recipe exploration, and premium dining trends at home drive consistent demand for gourmet seasonings in consumer retail channels.

Bakery and Confectionery applications grow steadily as artisan bakers adopt delicate salts for toppings and flavor balancing. Flake salts and premium crystals enhance sweetness contrast in pastries, caramels, cookies, and gourmet chocolates, encouraging expansion of premium baked goods.

Meat and Poultry Products rely on gourmet salts for rubs, curing, and marination. These salts improve texture, moisture retention, and flavor development. Their mineral complexity supports premium positioning in processed meats, charcuterie products, and specialty butchery segments adopting artisanal curing techniques.

Seafood, Sauces and Savories, Food Processing, Foodservice, and Cosmetics and Personal Care contribute to broad diversification. Their demand reflects expanding culinary innovation, wellness-focused salt scrubs, gourmet seasonings, specialty sauces, and premium hospitality offerings.

By End Use Analysis

Food and Beverage dominate with 41.7% driven by strong culinary integration.

In 2024, Food and Beverage held a dominant market position in the By End Use segment of the Gourmet Salts Market, with a 41.7% share. Rising adoption in packaged foods, restaurant dishes, artisanal formulations, and global cuisines strengthens overall consumption across mainstream and premium culinary categories.

Professional Culinary and Fine Dining integrates gourmet salts for plating enhancement, finishing, texture control, and premium flavor delivery. Chefs rely on diverse salt profiles to elevate dishes, supporting growth in high-end restaurants, luxury dining experiences, and modern gastronomy trends.

Specialty Food Manufacturing uses gourmet salts in artisanal snacks, seasoning blends, marinades, cured meats, and small-batch premium foods. Their mineral variation helps brands differentiate products and meet consumer expectations for authenticity, clean labels, and craft-oriented food experiences.

Hospitality, Retail Consumers, Health and Wellness, and Others form a multi-sector base. These segments adopt gourmet salts for wellness-driven diets, hotel dining programs, premium gift packs, and innovative flavor blends, contributing to stable long-term market expansion.

Key Market Segments

By Product Type

- Sea Salt

- Fleur de Sel

- Sel Gris (Celtic Grey Salt)

- Himalayan Pink Salt

- Flake Salt

- Hawaiian Salt (Red and Black)

- Smoked Salt

- Black Salt

- Flavored and Infused Salts

By Product Form

- Crystals

- Flakes

- Powder

By Application

- Household and Retail

- Bakery and Confectionery

- Meat and Poultry Products

- Seafood Products

- Sauces and Savories

- Food Processing

- Foodservice

- Cosmetics and Personal Care

By End Use

- Food and Beverage

- Professional Culinary and Fine Dining

- Specialty Food Manufacturing

- Hospitality Sector

- Retail Consumers

- Health and Wellness

- Others

Emerging Trends

Growing Popularity of Premium Culinary Experiences Shapes Market Trends

One of the most notable trends is the rising interest in gourmet cooking at home. Social media, food influencers, and cooking shows have encouraged consumers to experiment with premium salts for flavor layering and presentation. This trend significantly increases household demand for artisanal varieties.

- The World Health Organization (WHO), average global adult sodium intake is 4,310 mg per day (equivalent to about 10.78 g of salt), which is more than double the recommended maximum of 2,000 mg sodium (about 5 g of salt per day). Gourmet salt from France is harvested with a moisture content of 10%, significantly higher than the <1% moisture found in industrial vacuum-evaporated salts, allowing it to retain 34 different trace minerals.

Experimentation in global cuisines is also influencing the market. As consumers try Mediterranean, Asian, and fusion dishes, demand increases for specialty salts such as Sel Gris, fleur de sel, black lava salt, and smoked salts. Sustainability is becoming a strong trend as buyers look for ethically sourced and hand-harvested salts. Producers are highlighting eco-friendly harvesting practices, artisanal craftsmanship, and traceability to attract conscious consumers.

Drivers

Rising Preference for Natural and Clean-Label Ingredients Drives Market Growth

Growing consumer interest in natural and minimally processed foods is one of the strongest drivers for gourmet salts. People are now looking for products that offer purity, trace minerals, and clean-label benefits, which makes gourmet salts more appealing than regular table salt. This shift is especially strong in households and health-focused consumers.

- Many food manufacturers are also adopting gourmet salts as premium ingredients in snacks, sauces, meat products, bakery, and ready meals. Global sodium cuts by 30% make buyers pause on extras. Schools and workplaces swap salt for herbs, shifting tastes. In many spots, daily averages top 7-8 grams, far from safe.

They see gourmet salts as a way to improve flavor profiles while maintaining a clean-label positioning. Demand rises across packaged food and foodservice channels. Premium restaurants and fine-dining chefs have also helped the market grow by using gourmet salts for texture, flavor refinement, and plating. Their influence pushes gourmet salts into mainstream awareness.

Restraints

High Product Cost Limits Wider Consumer Adoption in Many Markets

The biggest restraint in the gourmet salts market is its higher price compared to regular table salt. Many consumers still see salt as a low-cost commodity and hesitate to spend more on premium varieties, especially in developing markets. This slows down mass-market adoption.

- Limited awareness in rural regions also restricts growth. Many buyers are not familiar with the differences between gourmet salts and regular salt, making it difficult for brands to justify premium pricing. FAO notes that over 1,381 million hectares of salt-affected land need smart care for food security. India’s plans lift local production from Gujarat beds, exporting unique grains.

Supply chain limitations affect rare products such as fleur de sel and smoked salts. These varieties often rely on seasonal harvesting, manual methods, or niche production zones, which keep production volumes low. This leads to supply fluctuations and higher costs.

Growth Factors

Expanding Use of Gourmet Salts in Packaged and Convenience Foods Creates New Opportunities

The strongest opportunity lies in the rising use of gourmet salts in packaged snacks, ready-to-eat meals, artisanal bakery items, and gourmet seasonings. Food brands are using these salts to differentiate their products, improve flavor, and appeal to health-aware consumers. This trend opens new commercial avenues.

Clean-label innovation also presents a strong growth path. Consumers increasingly want products with fewer additives, and gourmet salts help brands simplify formulations while maintaining taste. Companies that position their products around purity, trace minerals, and natural origins can benefit significantly.

The rapid expansion of online retail has also improved access to premium salts. E-commerce enables niche producers to reach global customers, expanding visibility for unique varieties such as Hawaiian salts, flake salts, and smoked salts. Online specialty stores and gourmet food platforms make this category more mainstream.

Regional Analysis

North America Dominates the Gourmet Salts Market with a Market Share of 45.1%, Valued at USD 1.0 Billion

North America leads the global Gourmet Salts Market, driven by rising consumer interest in premium, artisanal, and natural seasoning products. With a dominant share of 45.1% and an estimated market value of USD 1.0 billion, the region benefits from strong retail penetration, high awareness of clean-label ingredients, and a growing trend toward gourmet cooking at home. Increasing demand for healthier salt alternatives also supports steady growth.

Europe remains a significant market due to its established culinary culture and strong acceptance of specialty salts such as sea salt flakes, fleur de sel, and smoked varieties. Consumers in Western Europe show higher adoption of gourmet ingredients in bakery, fine dining, and packaged foods. Regulatory emphasis on quality and sustainable sourcing further elevates regional demand, keeping Europe among the top contributors to global market expansion.

Asia Pacific is witnessing rapid growth supported by premiumization across foodservice chains, rising disposable incomes, and expanding interest in Western-style gourmet flavors. Countries like Japan, South Korea, and Australia showcase strong uptake of specialty salts in both household and professional culinary applications. Increasing urbanization and evolving taste preferences continue to position APAC as a high-potential emerging region.

The U.S. is the core growth engine within North America, driven by strong consumer adoption of premium salts in home cooking, packaged foods, and foodservice. Increasing interest in natural, unprocessed, and trace-mineral-rich salts fuels market expansion. The country’s robust retail infrastructure and strong gourmet food culture ensure continued leadership in the category.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Gourmet Salts Market in 2024 continues to expand steadily as consumers lean toward premium, traceable, and minimally processed salt varieties. Artisanal harvesting, clean-label positioning, and the rise of specialty cuisine have strengthened the competitive landscape. Within this environment, several niche-focused producers are shaping product quality expectations and influencing retail dynamics.

Alaska Pure Sea Salt Company maintains strong credibility in the U.S. craft salt category through its emphasis on hand-crafted flake salts derived from pristine Alaskan waters. Its strategy relies on purity-driven branding and region-specific culinary collaborations, supporting its premium positioning.

Amagansett Sea Salt Co. reinforces the appeal of small-batch, solar-evaporated sea salts, helping elevate consumer demand for slow-crafted gourmet products. Its coastal terroir-based marketing and limited-edition varieties strengthen visibility in specialty retail.

Bitterman Salt Co. continues to influence the gourmet segment through its broad culinary-oriented salt portfolio and education-led retail approach. The brand benefits from strong chef engagement and diverse flavor innovations, which help differentiate it across upscale foodservice and retail channels.

Brittany Sea Salt (Sel de Bretagne) plays a crucial role in preserving European artisanal harvesting traditions, especially hand-raked grey salts known for mineral richness. Its heritage-driven narrative and regional authenticity appeal strongly to gourmet consumers seeking origin-certified products.

Top Key Players in the Market

- Alaska Pure Sea Salt Company

- Amagansett Sea Salt Co.

- Bitterman Salt Co.

- Brittany Sea Salt

- Celtic Sea Salt

- Cargill Inc. Morton Salt

- Cheetham Salt Limited

- Halen Môn

- Infosa

- Jacobsen Salt Co.

- Le Guérandais

Recent Developments

- In 2024, Alaska Pure Sea Salt Company produces hand-crafted flake sea salt from local Pacific waters. The company collaborated with Wild Scoops, an Anchorage-based ice creamery, to offer various ice cream pints infused with their sea salt flavors, available at their retail location.

- In 2025, Amagansett Sea Salt Co. collaborated with Montauk Brewing Company (under Tilray Brands) to provide local sea salt for their limited-edition Summer Sour Ale, a tart, lightly salted brew with lime, available across Long Island and NYC. The company was highlighted in an article discussing a local salt renaissance in cheese production and tabletop use.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 4.2 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sea Salt, Fleur de Sel, Sel Gris, Himalayan Pink Salt, Flake Salt, Hawaiian Salt, Smoked Salt, Black Salt, Flavored and Infused Salts), By Product Form (Crystals, Flakes, Powder), By Application (Household and Retail, Bakery and Confectionery, Meat and Poultry, Seafood, Sauces and Savories, Food Processing, Foodservice, Cosmetics and Personal Care), By End Use (Food and Beverage, Professional Culinary, Specialty Food Manufacturing, Hospitality, Retail Consumers, Health and Wellness, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alaska Pure Sea Salt Company, Amagansett Sea Salt Co., Bitterman Salt Co., Brittany Sea Salt, Celtic Sea Salt, Cargill Inc. Morton Salt, Cheetham Salt Limited, Halen Môn, Infosa, Jacobsen Salt Co., Le Guérandais Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Alaska Pure Sea Salt Company

- Amagansett Sea Salt Co.

- Bitterman Salt Co.

- Brittany Sea Salt

- Celtic Sea Salt

- Cargill Inc. Morton Salt

- Cheetham Salt Limited

- Halen Môn

- Infosa

- Jacobsen Salt Co.

- Le Guérandais