Global Glucose And Fructose Market Size, Share, And Enhanced Productivity By Source (Corn, Wheat, Cassava, Sugarcane / Sugar beet), By Type (Glucose, Fructose), By Form (Liquid, Powder), By Fructose Content (High Fructose Corn Syrup (HFCS), Low Fructose Corn Syrup (LFCS), Glucose), By Functional Ingredient (Sweetener, Humectant, Binder, Preservative), By End Use (Dairy and Frozen Desserts, Bakery and Confectionery, Pharmaceuticals, Beverages, Sports and Clinical Nutrition, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175948

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Source Analysis

- By Type Analysis

- By Form Analysis

- By Fructose Content Analysis

- By Functional Ingredient Analysis

- By End Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

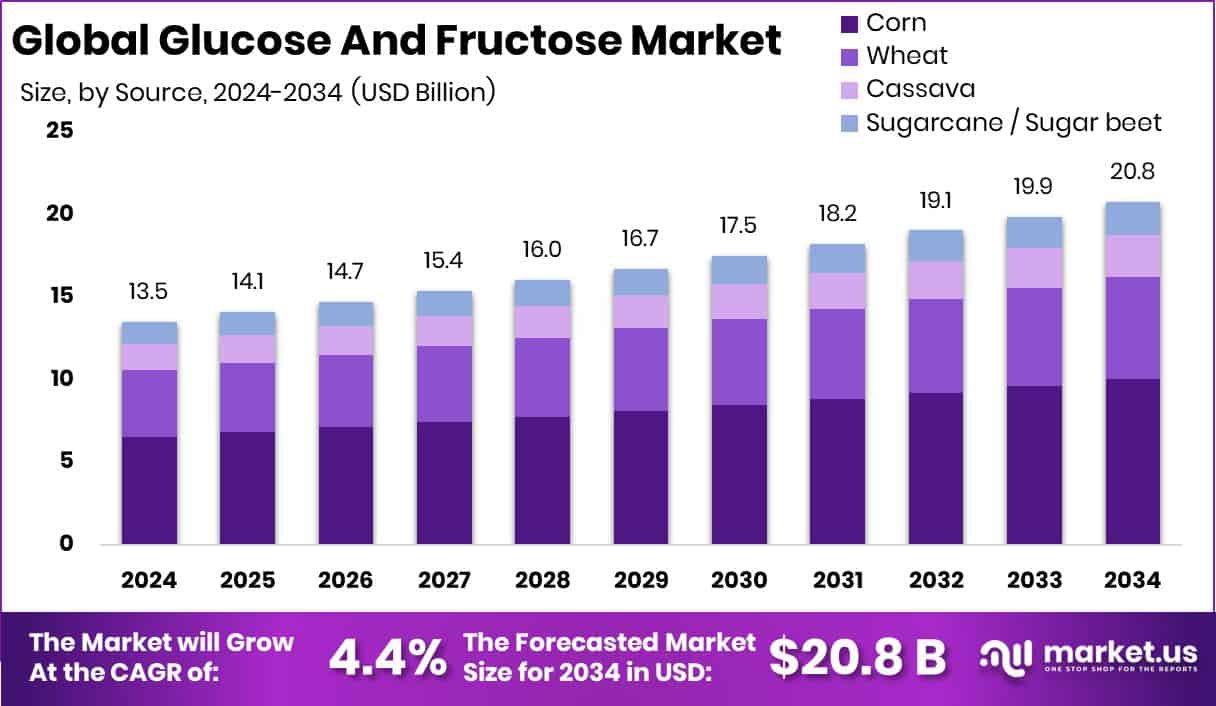

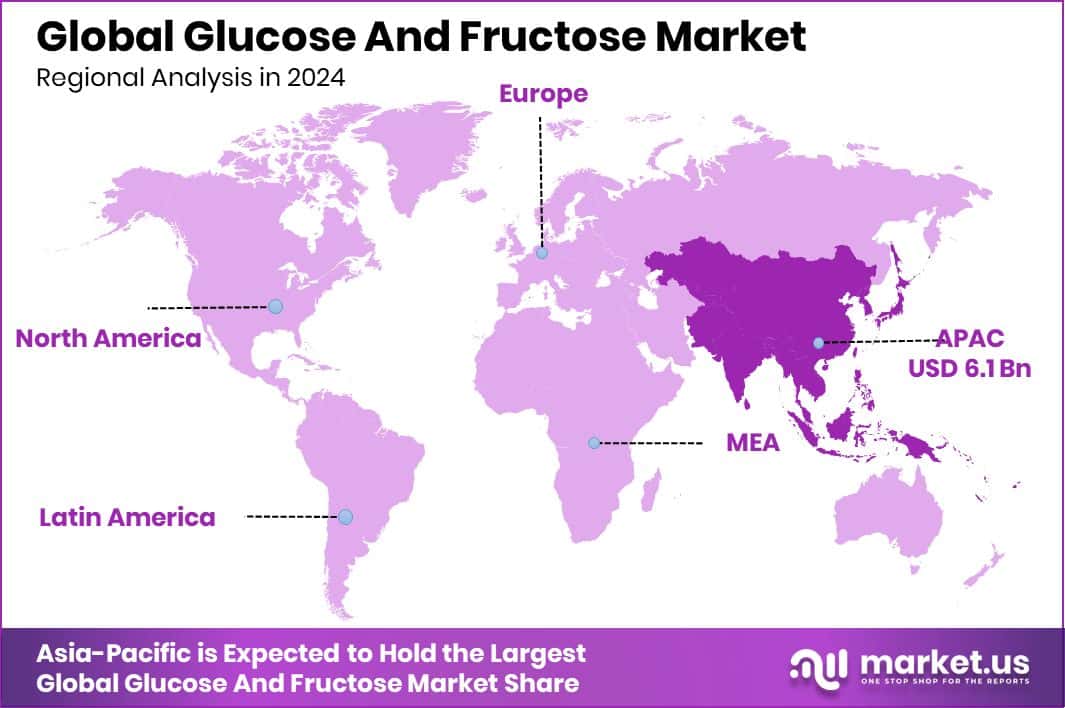

The Global Glucose And Fructose Market is expected to be worth around USD 20.8 billion by 2034, up from USD 13.5 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Region Asia Pacific recorded USD 6.1 Bn value with dominant 45.2% share.

The Global Glucose and Fructose Market is built around key sources such as corn, wheat, cassava, and sugarcane or sugar beet, which are processed into liquid or powder forms of glucose, fructose, and corn-syrup variants. Glucose and fructose are simple carbohydrates used widely as sweeteners, humectants, binders, and preservatives across dairy, bakery, beverages, pharmaceutical formulations, sports nutrition, and even animal feed. These ingredients play a central role in taste, energy delivery, moisture retention, and product stability.

Glucose and fructose themselves are essential natural sugars. Glucose is the body’s primary energy fuel, while fructose is a naturally sweet sugar present in fruits and honey. The Glucose and Fructose Market refers to the global ecosystem that manufactures these sweeteners, supplies them to food, beverage, and health sectors, and supports product development across multiple industries.

Growth in this market is supported by rising demand for ready-to-eat foods, functional drinks, and dairy innovations. Global interest in health monitoring has accelerated investments such as Biolinq’s $100M Series C, Liom’s $25M, and multiple non-invasive glucose-monitoring startups securing $4M, £1.1M, and £800,000 plus a £300,000 Innovate UK grant. These developments indirectly influence ingredient demand as consumers become more aware of sugar intake.

Opportunities continue to expand across dairy and beverages, especially with supportive programs like the U.S. Dairy Business Innovation Alliance, which recently awarded $4.6M to small and medium dairy producers. Such funding encourages new formulations and increases the use of glucose- and fructose-based ingredients in value-added dairy and frozen desserts.

Key Takeaways

- The Global Glucose And Fructose Market is expected to be worth around USD 20.8 billion by 2034, up from USD 13.5 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- The Glucose and Fructose Market shows strong leadership in corn sourcing with 48.3% dominance.

- In this market, fructose type clearly leads demand trends, capturing a 59.8% overall share.

- Liquid form dominates the Glucose and Fructose Market as it holds a 62.4% market share.

- High Fructose Corn Syrup drives major consumption patterns with a 64.5% share globally.

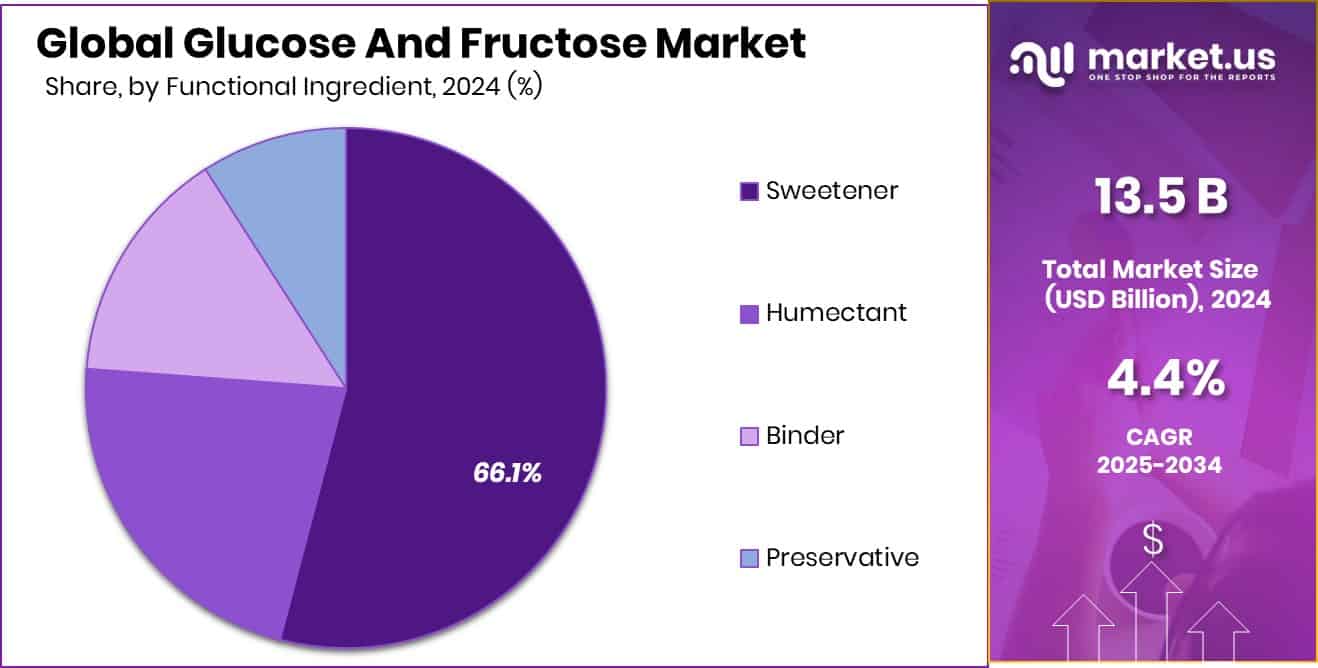

- Sweetener ingredients remain essential within the Glucose and Fructose Market, accounting for 66.1% usage today.

- Beverages continue influencing growth, with this segment representing 45.7% demand across the global market.

- Asia Pacific drives demand in Glucose and Fructose Market with 45.2% share.

By Source Analysis

The Glucose and Fructose Market sees corn dominating with 48.3% share.

In 2024, corn emerged as the most influential raw material in the Glucose and Fructose Market, holding a dominant 48.3% share. Its leadership reflects widespread availability, competitive pricing, and strong global trade networks supporting corn-based sweetener production. Food and beverage manufacturers prefer corn because it delivers consistent starch quality, enabling efficient conversion into glucose syrup and fructose derivatives. The rise of processed foods, bakery items, confectionery, and ready-to-drink beverages further fuels corn’s importance.

Additionally, major producing nations like the U.S., China, and Brazil continue expanding corn output, ensuring dependable supply for industrial sweetener applications. With growing demand for affordable sweetening agents, corn remains the backbone of glucose and fructose production worldwide.

By Type Analysis

In the Glucose and Fructose Market, fructose type leads with 59.8% adoption.

In 2024, fructose maintained a leading position in the Glucose and Fructose Market with a significant 59.8% share, driven by its superior sweetness level and lower glycemic response compared to conventional sugar. Food manufacturers increasingly rely on fructose to enhance flavor intensity while reducing overall sugar usage in beverages, dairy products, and bakery formulations. Its strong solubility and stability under acidic conditions make it ideal for packaged drinks and fruit-based products.

The consumer shift toward low-calorie and reduced-sugar diets has also strengthened fructose adoption, especially in health-conscious markets. As brands continue reformulating products to meet sugar-reduction regulations, fructose remains a preferred ingredient for achieving sweetness without compromising taste.

By Form Analysis

Liquid form holds 62.4%, driving efficiency in the Glucose and Fructose Market.

In 2024, the liquid segment dominated the Glucose and Fructose Market with a commanding 62.4% share. Liquid sweeteners such as glucose syrup and liquid fructose are favored in large-scale food manufacturing due to their ease of blending, stable viscosity, and cost-effective transport. Beverage companies, bakeries, confectionery manufacturers, and dairy processors rely heavily on liquid formats for streamlined production and consistent sweetness delivery.

The rise of ready-to-drink beverages, flavored yogurts, sauces, and energy drinks further elevates demand for liquid sweeteners. Additionally, liquid forms offer better preservation stability, reducing crystallization and improving shelf life. This operational convenience keeps liquid formats at the forefront of industrial sweetener applications.

By Fructose Content Analysis

High Fructose Corn Syrup captures 64.5%, strengthening the Glucose and Fructose Market.

In 2024, High Fructose Corn Syrup (HFCS) led the fructose content category with a strong 64.5% share in the Glucose and Fructose Market. HFCS remains a staple sweetener in carbonated beverages, processed foods, bakery products, and flavored syrups due to its affordability and sweetness efficiency. Its functional benefits—such as moisture retention, browning control, and extended shelf stability—make it especially valuable for mass-produced foods.

Despite global debates on sugar alternatives, HFCS maintains heavy demand in developing markets where cost-sensitive production dominates. The ongoing expansion of soft drink bottling plants and rising consumption of packaged foods ensure that HFCS continues to play a central role in meeting large-scale sweetener requirements.

By Functional Ingredient Analysis

Sweeteners lead functional ingredients with 66.1% in the Glucose and Fructose Market.

In 2024, sweeteners represented the largest functional ingredient category in the Glucose and Fructose Market, securing a notable 66.1% share. Their dominance is driven by consumer reliance on sweetness-enhanced processed foods, snacks, and beverages. Glucose and fructose sweeteners offer versatile applications—acting not only as flavor enhancers but also as humectants, browning agents, and fermentation substrates.

Food companies increasingly choose these sweeteners to balance taste, texture, and stability in packaged products. With rising demand for convenient foods, ready meals, and sweetened beverages, the need for sweeteners remains strong. Additionally, ongoing urbanization and lifestyle changes continue to shape consumption patterns, reinforcing the central role of glucose- and fructose-based sweeteners.

By End Use Analysis

Beverages account for 45.7%, shaping demand in the Glucose and Fructose Market.

In 2024, the beverages segment accounted for the largest end-use share in the Glucose and Fructose Market, holding 45.7%. Soft drinks, fruit juices, functional beverages, sports drinks, and flavored waters extensively rely on glucose and fructose to deliver sweetness, mouthfeel, and product stability. Beverage manufacturers favor these sweeteners because they dissolve quickly, preserve taste consistency, and support large-scale production needs.

The global shift toward packaged and on-the-go drinks further boosts demand, especially in urban and young populations. Even as sugar-reduction trends grow, many beverage brands continue to use glucose-fructose blends or HFCS in controlled quantities to maintain affordability while meeting consumer taste expectations.

Key Market Segments

By Source

- Corn

- Wheat

- Cassava

- Sugarcane / Sugar beet

By Type

- Glucose

- Fructose

By Form

- Liquid

- Powder

By Fructose Content

- High Fructose Corn Syrup (HFCS)

- Low Fructose Corn Syrup (LFCS)

- Glucose

By Functional Ingredient

- Sweetener

- Humectant

- Binder

- Preservative

By End Use

- Dairy and Frozen Desserts

- Bakery and Confectionery

- Pharmaceuticals

- Beverages

- Sports and Clinical Nutrition

- Animal Feed

- Others

Driving Factors

Rising demand for sweetened processed foods.

The Glucose and Fructose Market continues to grow as consumer demand for sweetened processed foods remains strong across bakery, confectionery, and beverage categories. At the same time, innovation in sugar-reduction technologies is influencing how manufacturers rethink sweetness profiles.

A notable example is Better Juice securing $8 million in seed funding, which encourages new processing approaches that allow producers to balance sweetness while managing overall sugar content. These developments support ongoing reformulation efforts in packaged foods, ultimately increasing the use of glucose- and fructose-based solutions where controlled sweetness, texture, and stability remain essential. The market benefits from this dual shift—rising consumer demand and technological advancement—both of which reinforce the role of glucose and fructose in modern product development.

Restraining Factors

Health concerns reducing high sugar consumption

Concerns about high sugar intake continue to shape purchasing behavior, creating pressure on manufacturers to reconsider heavy reliance on conventional sweeteners in the Glucose and Fructose Market. This challenge is further influenced by the growth of sugar-reduction technologies, such as Blue Tree Technologies securing $2.26 million to scale beverage-focused reduction systems.

Additionally, public initiatives like the Michigan Craft Beverage Council’s $450,000 in grants encourage research into healthier formulations, guiding brands toward moderated sweetness. While these movements promote better nutrition, they also restrict traditional glucose and fructose usage, prompting companies to refine ingredient strategies and align with evolving health expectations without compromising product performance.

Growth Opportunity

Growing adoption in functional nutrition products

Functional nutrition presents significant opportunity for the Glucose and Fructose Market as consumers increasingly seek energy-oriented beverages, supplements, and fortified foods. Regulatory discussions such as Oregon’s proposed wildfire funding bill, which includes a $.05 beverage container tax, may encourage brands to reformulate products strategically, increasing demand for balanced sweetening systems.

Meanwhile, BinSentry’s $68.8-million CAD Series C to expand remote animal-feed monitoring demonstrates how innovation in livestock nutrition indirectly boosts demand for carbohydrate-based ingredients. As feed systems modernize and functional foods expand, glucose and fructose remain core components due to their energy-providing properties, stability, and compatibility with diverse formulations.

Latest Trends

Rising preference for liquid sweetener formats

A noticeable trend in the Glucose and Fructose Market is the growing shift toward liquid sweetener formats, driven by their ease of blending, cost efficiency, and suitability for large-scale beverage and dairy applications. Sustainability is reinforcing this transition, highlighted by Full Circle Biotechnology securing funding for a facility designed to produce 7,000 tons of low-carbon feed ingredients annually. This emphasis on environmental performance encourages industries to adopt versatile liquid sweeteners that integrate seamlessly into cleaner production systems.

With sustainability expectations rising, manufacturers increasingly choose glucose- and fructose-based liquids to support streamlined processing, consistent sweetness, and alignment with modern environmental goals.

Regional Analysis

Glucose and Fructose Market Asia Pacific holds 45.2%, reaching USD 6.1 Bn strongly.

Asia Pacific remained the dominant region in the Glucose and Fructose Market, holding a significant 45.2% share valued at USD 6.1 Bn, supported by strong consumption of sweetened beverages, processed foods, and expanding manufacturing capacity across China, India, and Southeast Asia. The region’s large population base, rising urban lifestyles, and increasing preference for ready-to-drink beverages continue to reinforce its leadership.

North America shows steady demand driven by widespread usage of liquid sweeteners in soft drinks, bakery items, and packaged foods, supported by a mature food processing industry. Europe maintains consistent growth, influenced by high adoption of glucose-based ingredients in confectionery, dairy, and bakery segments, supported by well-established food manufacturing standards.

Latin America reflects moderate expansion due to increased sweetener use in beverages and confectionery, especially in markets like Brazil and Mexico. Middle East & Africa shows rising demand, driven by growing consumption of packaged foods and sweetened beverages in Gulf countries and emerging African cities, making it an evolving regional contributor within the global glucose and fructose landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill, Incorporated remained one of the most prominent players, leveraging its extensive global processing facilities and long-standing expertise in starch conversion technologies. The company’s integration across agriculture and food solutions helped maintain steady availability of glucose syrups and fructose ingredients for beverage and food manufacturers worldwide.

ADM continued strengthening its position through large-scale corn refining operations and a wide portfolio of carbohydrate solutions that support beverage, bakery, and confectionery applications. Its global footprint enabled consistent supply and responsiveness to large industrial buyers.

Ingredion contributed significantly through its specialty ingredient expertise, offering versatile glucose and fructose formulations used across processed foods, dairy, and beverage categories. Its focus on functionality—such as sweetness control, texture support, and stability—kept it relevant in reformulation trends.

Meanwhile, Tate & Lyle PLC maintained a solid role with decades of experience in sweetener development, catering to manufacturers that prioritize quality, performance, and consistency. Collectively, these companies supported the market’s stability and technological progress throughout 2024.

Top Key Players in the Market

- Cargill, Incorporated

- ADM

- Ingredion

- Tate & Lyle PLC

- Wilmar International Limited

- Associated British Foods plc

- Tereos Group

- Roquette Frères

- AGRANA Beteiligungs-AG

- Südzucker AG

- Gulshan Polyols Ltd.

Recent Developments

- In May 2025, Gulshan Polyols Ltd announced that its second manufacturing unit began producing sorbitol 70% solution and liquid glucose as part of its starch derivatives portfolio. This expansion reinforces the company’s capacity in glucose and related products and strengthens exports of starch-based ingredients.

- In 2024, Südzucker added a Glucose-Fructose Syrup to its product portfolio. This syrup contains glucose, fructose, maltose and oligosaccharides and is designed for use in jams, sauces, confectionery, soft drinks and other food applications. This expansion shows Südzucker expanding its liquid sweetening solutions range.

Report Scope

Report Features Description Market Value (2024) USD 13.5 Billion Forecast Revenue (2034) USD 20.8 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Corn, Wheat, Cassava, Sugarcane / Sugar beet), By Type (Glucose, Fructose), By Form (Liquid, Powder), By Fructose Content (High Fructose Corn Syrup (HFCS), Low Fructose Corn Syrup (LFCS), Glucose), By Functional Ingredient (Sweetener, Humectant, Binder, Preservative), By End Use (Dairy and Frozen Desserts, Bakery and Confectionery, Pharmaceuticals, Beverages, Sports and Clinical Nutrition, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Incorporated, ADM, Ingredion, Tate & Lyle PLC, Wilmar International Limited, Associated British Foods plc, Tereos Group, Roquette Frères, AGRANA Beteiligungs-AG, Südzucker AG, Gulshan Polyols Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glucose And Fructose MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Glucose And Fructose MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill, Incorporated

- ADM

- Ingredion

- Tate & Lyle PLC

- Wilmar International Limited

- Associated British Foods plc

- Tereos Group

- Roquette Frères

- AGRANA Beteiligungs-AG

- Südzucker AG

- Gulshan Polyols Ltd.