Global Fruit Chips Market Size, Share, And Business Benefits By Product Type (Apple Chips, Banana Chips, Mango Chips, Mixed Fruit Chips, Others), By Source (Conventional, Organic), By Flavor (Sweet, Savory, Spicy, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others), By End-User (Household, Foodservice, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157600

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

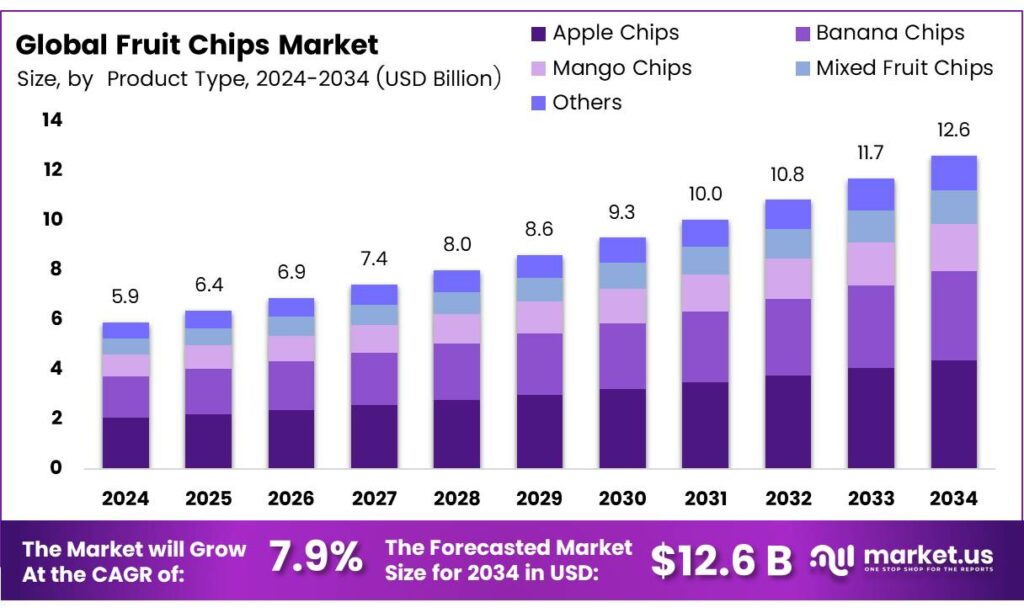

The Global Fruit Chips Market size is expected to be worth around USD 12.6 billion by 2034, from USD 5.9 billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

Dried fruits are widely recognized as healthy and popular snacks, yet detailed knowledge about their nutritional profiles and phytochemical composition remains limited. This study focused on the chemical characterization of freeze-dried fruits from four species: two established commercial products, apple and goji, and two emerging options, kaki and kiwi. The analysis included sugar and organic acid content, total phenolic compounds (TPC), and key bioactive phytochemicals, assessed through HPLC fingerprinting.

The in vitro antioxidant capacity (AOC) of the fruits showed clear differences. Total phenolic content (TPC) ranged from 210.9 mg GAE/100 g DW in kiwi to 872.6 mg GAE/100 g DW in kaki, while AOC varied from 23.09 mmol Fe²⁺/kg DW in goji to 137.5 mmol Fe²⁺/kg DW in kaki. Phenolics dominated in apple, kiwi, and kaki, 74.6–93.3%, whereas monoterpenes, 67.5% were most abundant in goji. No anthocyanins were found, likely due to conversion into phenolic acids during drying.

Baked carrot chips are often promoted as a healthier substitute for traditional potato chips. Apple Chips 34.7%, carrot chips are prepared by deep-fat frying, but vacuum frying offers a promising alternative for producing high-quality vegetable and fruit chips with reduced oil content. In the case of bananas, vacuum frying (VF) and atmospheric frying at 101.3 kPa, 170 °C yielded notable textural and structural differences.

Vacuum frying reduced the chip volume by approximately 40.7%, mainly due to the vaporization of loosely bound water, which created large pores. This process resulted in the highest breaking force of 20 N in vacuum-fried banana chips, attributed to starch network formation and crust porosity. Another study highlighted that VF produced banana chips with varied textures ranging from rubbery and soggy to hard and crisp, with a hardness measurement of 12.17 N.

Key Takeaways

- The Global Fruit Chips Market is projected to grow from USD 5.9 billion in 2024 to USD 12.6 billion by 2034, with a CAGR of 7.9%.

- Apple Chips held a 34.7% market share in 2024, driven by consumer preference for their healthy and flavorful profile.

- Conventional fruit chips captured a 63.6% market share in 2024, favored for their cost-effective, large-scale production.

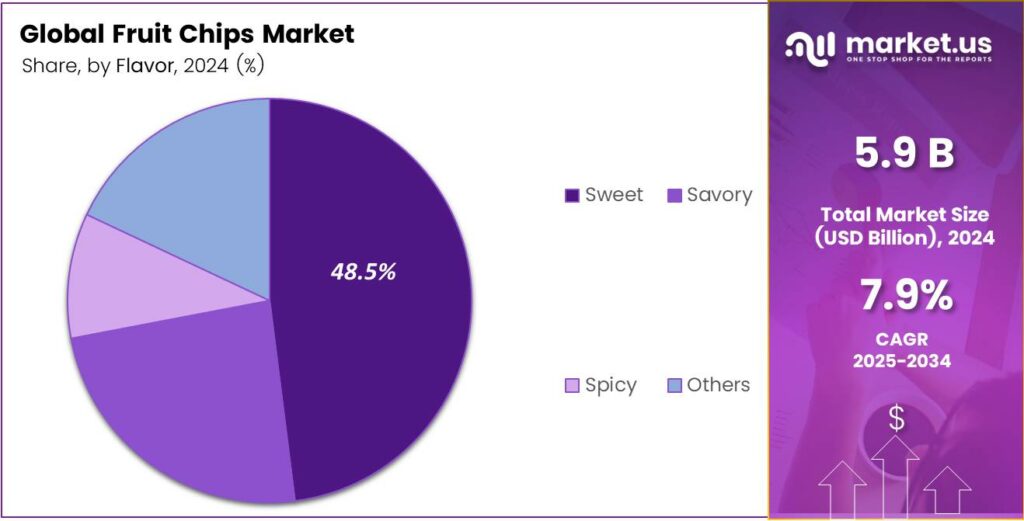

- Sweet fruit chips dominated with a 48.5% market share in 2024, appealing to consumers seeking indulgent yet healthier snacks.

- Supermarkets and Hypermarkets led distribution with a 37.8% share in 2024, offering wide product visibility and bulk purchase options.

- Household consumption held a 52.7% market share in 2024, reflecting demand for convenient, nutritious at-home snacks.

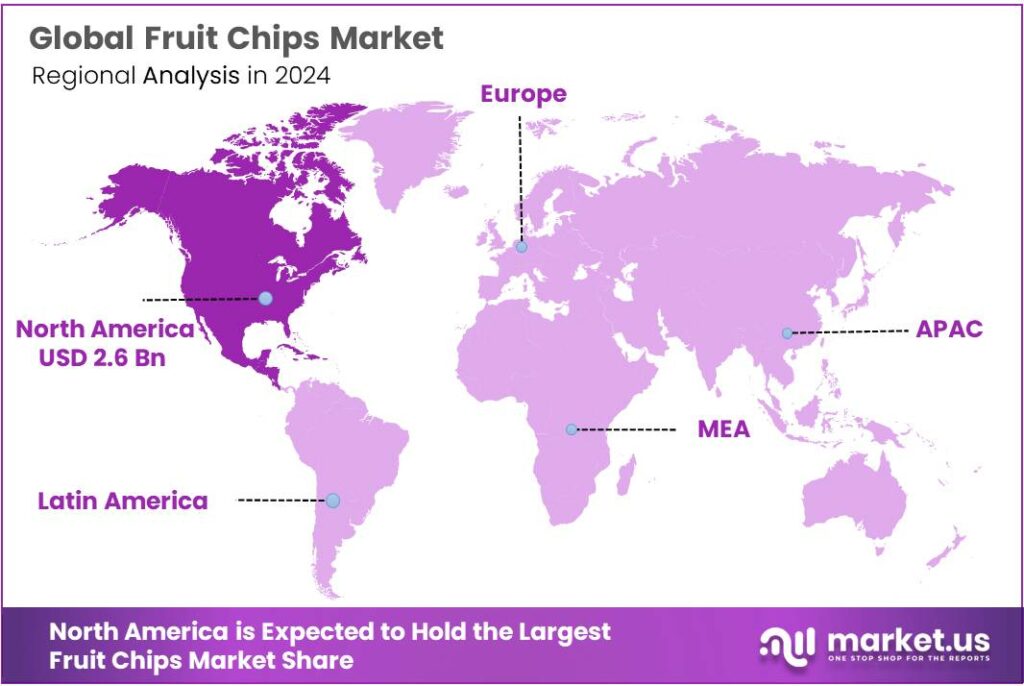

- North America led the market in 2024 with a 44.8% share, valued at USD 2.6 billion, driven by a strong snacking culture and clean-label trends.

Analyst Viewpoint

The fruit chips market is riding a wave of consumer demand for healthier, convenient snacks. With growing awareness of wellness and plant-based diets, fruit chips appeal to a broad audience, from health-conscious millennials to parents seeking nutritious options for kids. Innovations in flavors like spicy mango or mixed fruit blends and sustainable packaging are creating buzz, especially among younger buyers.

Online retail and social media platforms offer low-cost entry points for niche brands, making it an attractive space for investors to back artisanal producers or tech-focused startups. Advances in processing tech, such as freeze-drying, allow for better nutrient retention and unique textures, giving companies a chance to stand out. Higher margins on premium, clean-label products further sweeten the deal for investors.

Consumers are drawn to fruit chips for their blend of health and convenience. Health-conscious eaters, busy professionals, and parents are key demographics, valuing natural ingredients and low-calorie options. Exotic and bold flavors, like chili-lime pineapple, are gaining traction, especially among younger buyers. Sustainability matters too; eco-friendly packaging and ethical sourcing resonate strongly.

By Product Type

Apple Chips Segment – 34.7% Share

In 2024, Apple Chips held a dominant market position, capturing more than a 34.7% share in the global fruit chips market. This strong presence reflects the growing consumer preference for apple-based snacks, as they are widely regarded as both healthy and flavorful.

Apple chips benefit from their naturally sweet taste, high fiber content, and convenience, making them an attractive option for health-conscious buyers and families looking for easy snack choices. The year 2024 marked a significant shift as more manufacturers invested in baked and vacuum-fried apple chips to reduce oil content while maintaining crisp texture.

This innovation helped Apple Chips appeal to both fitness enthusiasts and general consumers who prefer guilt-free snacking. Demand is expected to continue rising, supported by the increasing popularity of plant-based diets and the steady inclusion of apple chips in retail stores, supermarkets, and even school meal programs.

By Source

Conventional Source Segment – 63.6% Share

In 2024, Conventional held a dominant market position, capturing more than a 63.6% share in the fruit chips market. This dominance highlights the strong reliance on conventional farming and sourcing methods, which remain the most accessible and cost-effective option for large-scale production.

In 2024 also shown that conventional sourcing allowed producers to meet rising demand at affordable prices, ensuring a consistent supply even in regions with limited access to premium or organic options. The conventional segment is expected to retain its strength as the majority of consumers continue to prefer budget-friendly snacks, especially in price-sensitive markets.

By Flavor

Sweet Flavor Segment – 48.5% Share

In 2024, Sweet held a dominant market position, capturing more than a 48.5% share in the fruit chips market. This reflects the natural preference of consumers for sweet-tasting snacks, which offer both indulgence and a sense of healthiness compared to traditional sugary treats.

Sweet fruit chips, often made from apples, bananas, and mangoes, are particularly popular among families and younger consumers who enjoy convenient and flavorful snacking options. In 2024 also highlighted the role of product innovation, with manufacturers introducing sweet fruit chips in varied flavor infusions such as honey, cinnamon, and caramel.

These variations helped expand the consumer base while keeping the category appealing to both children and adults. By 2025, the sweet flavor segment is expected to remain the market leader, supported by the continued demand for naturally sweet, minimally processed snacks that align with the broader healthy eating trend.

By Distribution Channel

Supermarkets and Hypermarkets Segment – 37.8% Share

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 37.8% share in the fruit chips market. This strong presence is driven by the wide product visibility, extensive shelf space, and bulk purchasing power these retail formats provide. Consumers often prefer supermarkets and hypermarkets because they can compare different brands, explore flavor options, and take advantage of promotions under one roof.

In 2024 also highlighted how in-store product placement and attractive packaging played an important role in encouraging impulse purchases of fruit chips. This segment is expected to maintain its lead, as large retail chains continue to expand their presence in both urban and semi-urban regions. The trust and convenience associated with these outlets remain key factors in driving sales volume.

By End-User

Household End-User Segment – 52.7% Share

In 2024, Household held a dominant market position, capturing more than a 52.7% share in the fruit chips market. This dominance reflects the increasing preference of families and individuals for healthier snacking options at home. Fruit chips are seen as a convenient, ready-to-eat alternative to traditional fried snacks, offering a balance of taste and nutrition that appeals to both adults and children.

The year 2024 also showed a steady rise in at-home consumption, as more people shifted towards mindful eating habits and stocked up on healthier packaged snacks. By 2025, this trend is expected to grow further, driven by busy lifestyles, remote work patterns, and the growing role of e-commerce in making fruit chips easily accessible for household consumption.

Key Market Segments

By Product Type

- Apple Chips

- Banana Chips

- Mango Chips

- Mixed Fruit Chips

- Others

By Source

- Conventional

- Organic

By Flavor

- Sweet

- Savory

- Spicy

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

By End-User

- Household

- Foodservice

- Others

Drivers

Growing Health Awareness Among Consumers

In recent years, a major factor pushing the fruit chips market forward is the rise in consumer health awareness. People are more conscious about what they eat. In India, a 2024 survey found that 73% of Indians read ingredient lists and nutritional values before buying snacks, and a remarkable 93% of those expressed a clear desire to switch to healthier options, even if they cost more.

This kind of growing awareness is powerful. It means many households are choosing snacks with natural ingredients like dried fruits over traditional fried or ultra-processed foods. When customers see fruit chips labeled clearly with fruit content and no artificial additives, they feel good about their choices. This combination of wholesome ingredients and visible transparency builds trust and boosts sales.

Government support also helps accelerate this shift. For example, the Eat Right India campaign, launched by the Food Safety and Standards Authority of India (FSSAI), encourages healthier food habits across schools, workplaces, and markets. It urges food makers to improve quality and reduce harmful ingredients, helping brands spotlight healthier products like fruit chips.

Restraints

High Sodium Content in Processed Snacks

One major restraint facing the fruit chips market is the concern over high sodium levels in packaged snacks. Even though fruit chips are perceived as healthier alternatives, they often carry added salt for flavor, which conflicts with growing health guidelines and government initiatives.

In India, the average person consumes over 12 grams of salt per day, which is more than double the WHO’s recommended limit of less than 5 grams. This high intake is linked to serious health issues hypertension, heart disease, strokes, and kidney disorders contribute to approximately 175,000 deaths annually in the country.

Globally, excessive sodium is a major health concern. The WHO promotes sodium reduction as one of the most cost-effective ways to curb non-communicable diseases, estimating a return of at least USD 12 in health savings for every USD 1 invested in such interventions. This pressure shows up in guidelines and reforms pushing food companies to reduce the salt content in processed foods fruit chips.

Opportunity

Expanding Processed Food Infrastructure in India Fuels Fruit Chip Growth

A key driver behind the surge in fruit chips is the rapid growth of India’s food processing infrastructure. In 2025, the food processing sector accounted for 32% of the overall food market in India, a sign that more fresh produce is being transformed into packaged goods like fruit chips.

As this sector expands, so do opportunities for fruit processors. An initiative by the Central Institute of Post-Harvest Engineering and Technology (CIPHET) aims to boost processing levels of fruits and vegetables from around 2% to a substantial 35%. That kind of leap would unlock massive volumes of fruit for value-added products, including fruit chips, helping manufacturers scale up while reducing post-harvest losses.

This institutional backing brings two major benefits. First, it encourages investments in cold-chain infrastructure, better cold storage, and faster logistics so that fruit doesn’t spoil before it becomes chips. Second, it supports farmer incomes when farmers have a reliable demand channel through food processing units; they’re more likely to grow quality produce and adopt best practices.

Trends

Clean-Label and Reduced Sugar Push in India

An important emerging driver for India’s fruit chips market is the rising focus on clean-label and reduced sugar snacks, strongly reinforced by government-led health initiatives. In August 2025, following Prime Minister Narendra Modi’s call to tackle obesity, the Food Safety and Standards Authority of India (FSSAI) directed all states to cut oil consumption by 10% and roll out sugar boards in schools.

These boards, designed to educate children and parents, display the sugar content in everyday foods, set daily intake guidelines, and warn of the risks of overconsumption. Such initiatives are doing more than spreading awareness; they are actively reshaping consumer preferences.

Fruit chips, when produced without added sugars and marketed with clean-label positioning, directly align with this shift. They stand out as snacks that deliver taste, while also supporting the broader clean-eating ethos promoted by FSSAI. This alignment positions fruit chips as a credible choice in India’s evolving healthy snacking landscape.

Regional Analysis

North America leads with a 44.8% share and a USD 2.6 Billion market value.

In 2024, North America emerged as the dominant region in the global fruit chips market, capturing 44.8% of the total market share, valued at approximately USD 2.6 billion. This strong position highlights the region’s established snacking culture, rising demand for healthier alternatives to traditional potato chips, and the growing adoption of clean-label and plant-based products.

The United States, in particular, has seen a surge in health-conscious consumers, with the Centers for Disease Control and Prevention (CDC) reporting that nearly 60% of U.S. adults are actively trying to reduce sugar and fat intake. This shift has created fertile ground for fruit chips that are baked, minimally processed, and free from artificial additives.

The regional growth is further supported by the rapid expansion of supermarket and hypermarket chains such as Walmart, Costco, and Kroger, which provide wide distribution and visibility for innovative fruit chip brands. Additionally, e-commerce platforms like Amazon have enabled smaller players to penetrate niche markets, reaching health-driven millennial and Gen Z consumers.

The clean-label movement, coupled with rising concerns about obesity and lifestyle-related diseases, is fueling the steady replacement of fried snacks with fruit-based alternatives. Moreover, government-backed awareness campaigns in North America about balanced diets and reduced sugar consumption are accelerating the trend toward healthier snacking.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bare Snacks is renowned for its simple, baked fruit chips made with minimal ingredients. Its core strength lies in capitalizing on the health-conscious consumer trend, offering apple, coconut, and banana chips with no added sugar or preservatives. The brand’s commitment to clean-label, non-GMO, and gluten-free products has secured its position as a popular, better-for-you snacking choice in North America and beyond, appealing to parents and health-aware adults.

Calbee Inc. is a dominant global force, primarily through its popular Harvest Snaps brand. Calbee leverages extensive R&D, massive production scale, and strong distribution networks. Its strategy focuses on combining health with taste, often using legumes and vegetables alongside fruit chips. With a significant presence across Asia and a growing footprint in Western markets, Calbee utilizes its brand recognition and product diversity to maintain a highly competitive market position.

Traina Foods is a major B2B player and private-label manufacturer specializing in dried fruit, including fruit chips. Its key strength is vertical integration: controlling the process from sun-dried fruit sourcing (notably from California) to processing and packaging. This allows for high volume, consistent quality, and cost-effective production. It primarily supplies other brands and food manufacturers, making it a foundational but less visible force in the market’s supply chain.

Top Key Players in the Market

- Bare Snacks

- Calbee Inc.

- Traina Foods

- Chaucer Foods Ltd.

- Greenday Global

- Seeberger GmbH

- Nanguo Foodstuff Co., Ltd.

- Kiwi Garden Ltd.

- LioBites

- Snackible

Recent Developments

- In 2024, Bare Snacks continues to focus on its core offerings of baked fruit and veggie chips. PepsiCo has leveraged Bare Snacks to align with consumer trends toward healthier snacking options. Bare Snacks has been integrated into PepsiCo’s broader portfolio, with emphasis on clean-label, non-GMO, and gluten-free snacks.

- In 2024, Calbee North America, which produces Harvest Snaps a vegetable-based snack, introduced new flavors like Spicy Nacho and Ranch for their crispy green pea snacks. While not strictly fruit chips, these products align with the healthy snacking trend and complement their fruit chip offerings.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Billion Forecast Revenue (2034) USD 12.6 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Apple Chips, Banana Chips, Mango Chips, Mixed Fruit Chips, Others), By Source (Conventional, Organic), By Flavor (Sweet, Savory, Spicy, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others), By End-User (Household, Foodservice, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bare Snacks, Calbee Inc., Traina Foods, Chaucer Foods Ltd., Greenday Global, Seeberger GmbH, Nanguo Foodstuff Co., Ltd., Kiwi Garden Ltd., LioBites, Snackible Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Bare Snacks

- Calbee Inc.

- Traina Foods

- Chaucer Foods Ltd.

- Greenday Global

- Seeberger GmbH

- Nanguo Foodstuff Co., Ltd.

- Kiwi Garden Ltd.

- LioBites

- Snackible