Global Food Fillings Market Size, Share Report By Type (Bakeable, Non Bakeable), By Application (Commercial, Home) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154350

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

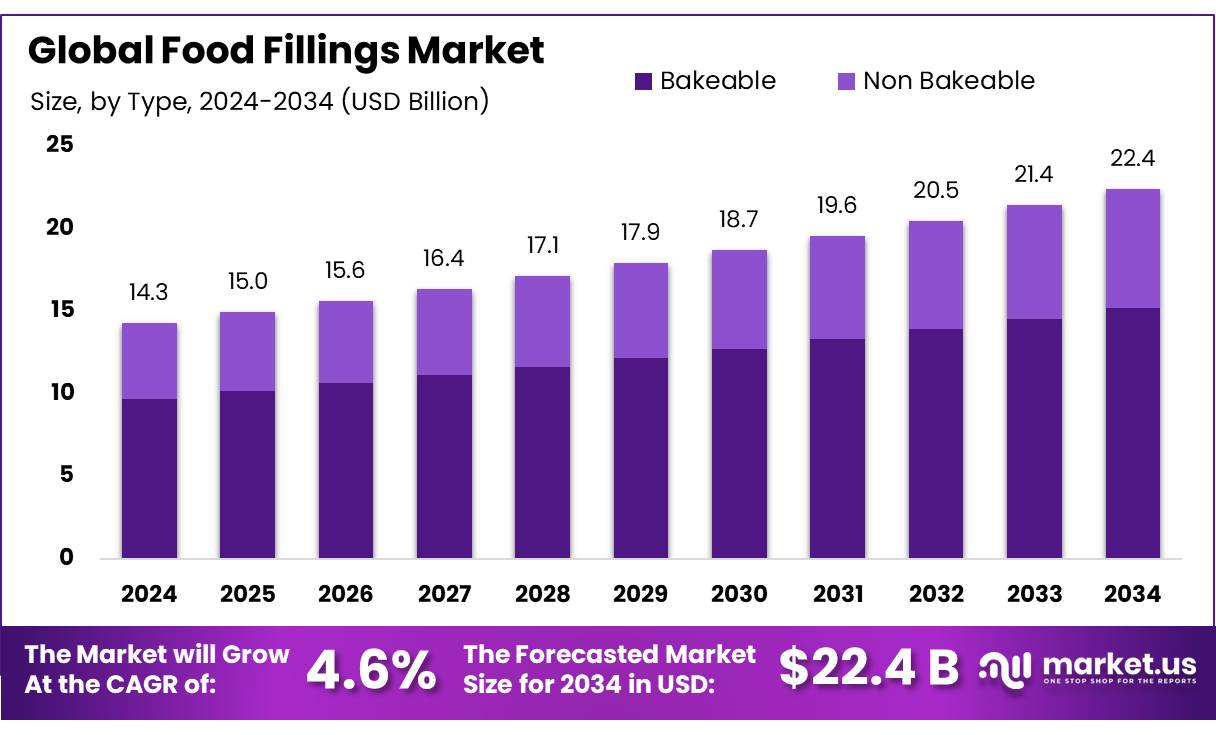

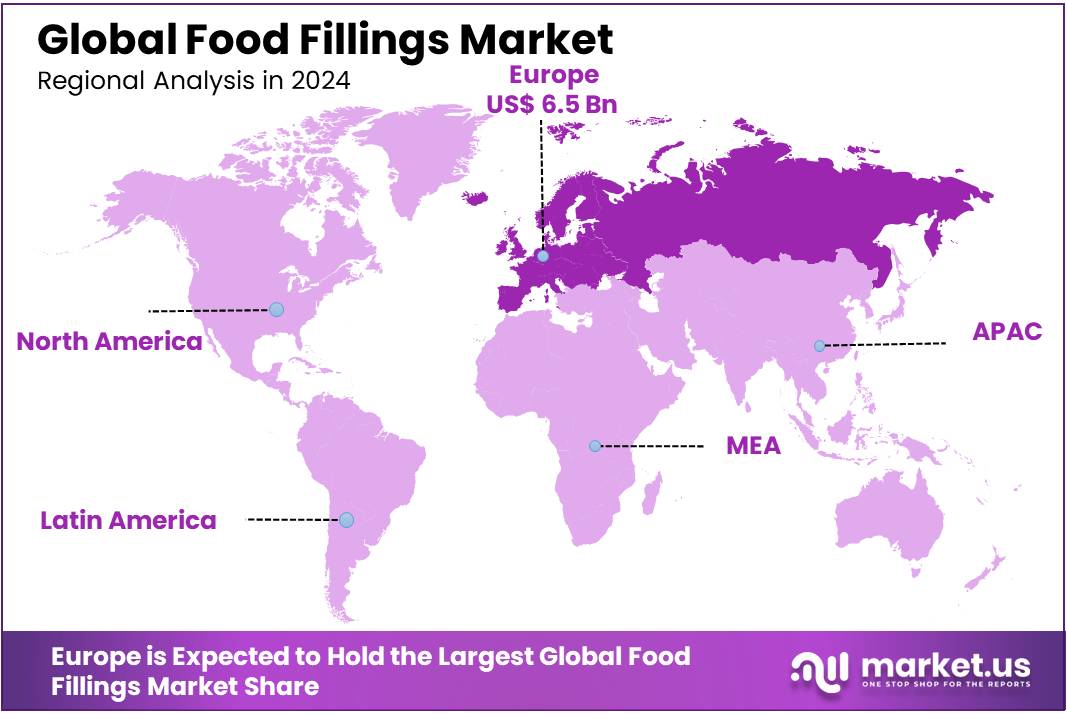

The Global Food Fillings Market size is expected to be worth around USD 22.4 Billion by 2034, from USD 14.3 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 46.1% share, holding USD 6.5 Billion in revenue.

The food fillings concentrates industry in India is an integral segment of the broader food processing sector, which has experienced significant growth due to favorable government policies and an expanding domestic market. This industry encompasses the production of concentrated fillings used in various food products, including bakery items, confectioneries, dairy products, and ready-to-eat meals. The demand for these concentrates is driven by the increasing consumer preference for convenience foods, the rise of the organized retail sector, and the growing trend of urbanization.

India’s food processing industry has witnessed substantial growth, with the Gross Value Added (GVA) increasing from ₹1.34 lakh crore in 2014-15 to ₹1.92 lakh crore in 2022-23. The sector has also attracted significant foreign direct investment (FDI), amounting to USD 6.793 billion between April 2014 and March 2024. Processed food exports have seen a notable rise, from 13.7% of agri-food exports in 2014-15 to 23.4% in 2023-24. These developments underscore the growing importance of the food processing industry in India’s economy.

The government’s initiatives have played a pivotal role in this growth trajectory. Programs like the Production Linked Incentive Scheme for Food Processing Industries (PLISFPI) and the Pradhan Mantri Kisan Sampada Yojana (PMKSY) aim to boost investment and infrastructure. As of October 2024, 1,079 projects under PMKSY have been completed, and 171 applications approved under PLISFPI, with beneficiaries investing USD 1.07 billion and receiving USD 130.6 million in incentives.

These schemes are designed to enhance the competitiveness of Indian food products in the global market and support the creation of global food manufacturing champions. Under this initiative, the Union Cabinet approved an allocation of ₹6,520 crore for the expansion of PMKSY during the 15th Finance Commission cycle (2021–26), including the establishment of 50 irradiation units and 100 food testing laboratories to enhance food safety and quality standards .

Another significant program is the Production Linked Incentive Scheme for Food Processing Industries (PLISFPI), which provides financial incentives to promote Indian food brands abroad and supports the creation of global food manufacturing champions. The scheme is being implemented over a six-year period from 2021-22 to 2026-27 with an outlay of ₹10,900 crore.

Key Takeaways

- Food Fillings Market size is expected to be worth around USD 22.4 Billion by 2034, from USD 14.3 Billion in 2024, growing at a CAGR of 4.6%.

- Bakeable Fillings held a dominant market position in the Food Fillings Market, capturing more than a 67.9% share.

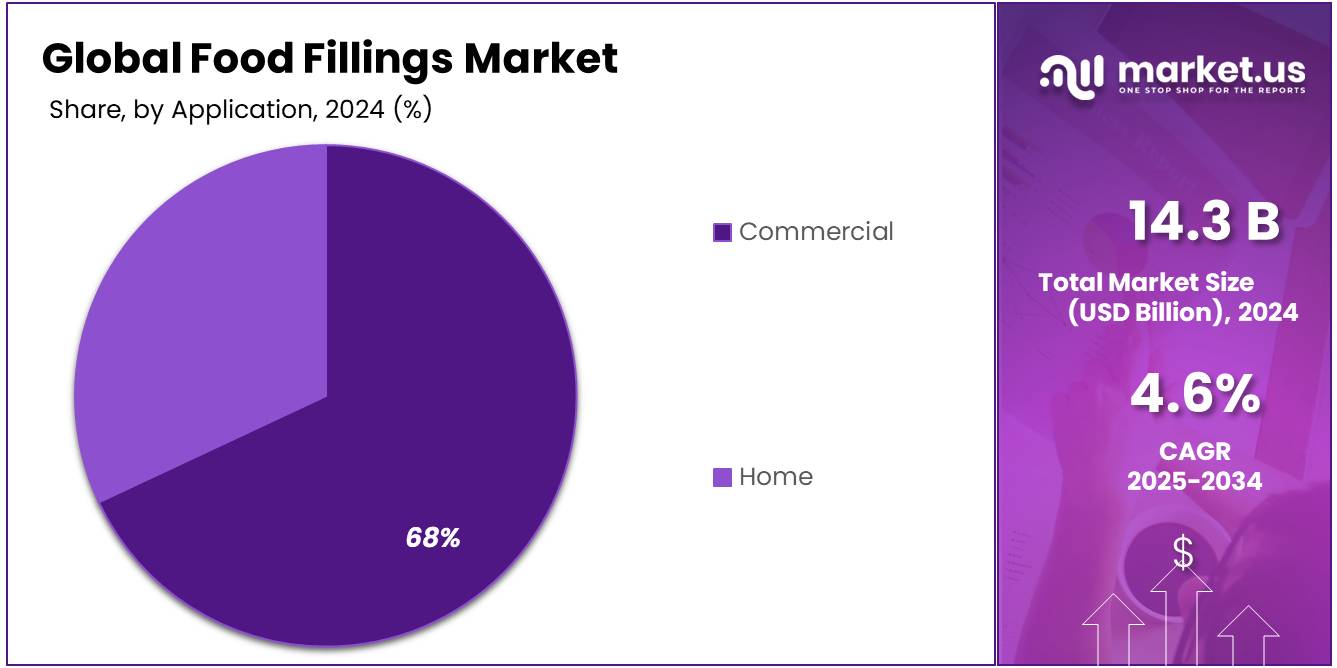

- Commercial Application held a dominant market position in the Food Fillings Market, capturing more than a 68.1% share.

- Europe held a dominant position in the global Food Fillings Market, accounting for more than 46.1% of the total market share, with an estimated market value of USD 6.5 billion.

By Type Analysis

Bakeable Fillings dominate with 67.9% due to their high stability and demand in bakery applications

In 2024, Bakeable Fillings held a dominant market position in the Food Fillings Market, capturing more than a 67.9% share. This strong performance was largely driven by their heat stability and versatility, which make them ideal for a wide range of bakery products such as pies, pastries, and filled cookies. Bakeable fillings are designed to withstand high oven temperatures without breaking down or losing flavor, making them a preferred choice in commercial and artisanal baking. Their ease of use and consistent performance in high-volume production lines have made them particularly popular across industrial and retail bakeries.

By Application Analysis

Commercial Application dominates with 68.1% due to rising demand from food service and industrial bakeries

In 2024, Commercial Application held a dominant market position in the Food Fillings Market, capturing more than a 68.1% share. This strong dominance was fueled by increasing demand from large-scale food service chains, industrial bakeries, and ready-to-eat food manufacturers. Commercial users prefer food fillings that are consistent in quality, shelf-stable, and easy to handle in bulk operations—qualities that align with the needs of quick-service restaurants, convenience food producers, and institutional kitchens. The rising consumption of bakery items like doughnuts, croissants, and snack bars in cafes and on-the-go channels has also boosted demand for fillings in commercial formats.

Key Market Segments

By Type

- Bakeable

- Non Bakeable

By Application

- Commercial

- Home

Emerging Trends

The Rise of Plant-Based Ingredients in Food Fillings

A significant trend shaping the future of food fillings concentrates in India is the growing consumer preference for plant-based ingredients. This shift is driven by increasing health consciousness, environmental concerns, and a desire for clean-label products. Consumers are becoming more aware of the benefits of plant-based diets, leading to a surge in demand for natural, minimally processed food products. This trend is evident in the rising popularity of plant-based snacks, beverages, and ready-to-eat meals, which often incorporate fruit and vegetable-based fillings.

The Indian government has recognized this shift and is actively promoting the use of plant-based ingredients through various initiatives. For instance, the Ministry of Food Processing Industries (MoFPI) is encouraging the incorporation of millets into Ready to Eat (RTE) and Ready to Cook (RTC) products. Under the Production Linked Incentive Scheme for Millet-based Products (PLISMBP), the government is providing incentives to increase the usage of millets in food products, thereby promoting value addition and sales.

This initiative not only supports the plant-based trend but also aligns with India’s objective to enhance millet production and consumption, as highlighted in the Economic Survey of 2024–25. The survey notes that the share of processed food exports within agri-food exports has risen from 14.9% in FY18 to 23.4% in FY24, reflecting the growing global demand for processed plant-based foods.

Furthermore, the government’s focus on sustainability is evident in its support for biodegradable packaging solutions. Institutions like IIT Madras have developed biodegradable packaging materials using agricultural waste, offering a sustainable alternative to plastic foams. Such innovations are crucial for the food processing industry, as they align with global sustainability goals and cater to the environmentally conscious consumer.

Drivers

Government Initiatives Driving Growth in Food Fillings Concentrates

A significant catalyst for the growth of the food fillings concentrates industry in India is the government’s strategic support through various initiatives aimed at enhancing infrastructure, reducing wastage, and promoting value addition in the food processing sector.

The Pradhan Mantri Kisan Sampada Yojana (PMKSY) is a flagship scheme designed to create modern infrastructure and efficient supply chains in the food processing industry. In the 15th Finance Commission cycle (2021–26), the Union Cabinet approved an allocation of ₹6,520 crore for the expansion of PMKSY. This includes the establishment of 50 irradiation units and 100 food testing laboratories to improve food safety and quality standards.

Additionally, the Production Linked Incentive Scheme for Food Processing Industries (PLISFPI) was introduced to support the creation of global food manufacturing champions and promote Indian food brands in international markets. The scheme is being implemented over a six-year period from 2021–22 to 2026–27 with an outlay of ₹10,900 crore.

These initiatives are expected to bolster the food processing sector by enhancing infrastructure, reducing post-harvest losses, increasing processing levels, and boosting exports of processed foods. The government’s focus on value addition and infrastructure development is creating new opportunities for innovation and investment in the sector, thereby driving the growth of the food fillings concentrates industry in India.

Restraints

Infrastructure Gaps Hindering Growth in Food Fillings Concentrates

A significant challenge facing the food fillings concentrates industry in India is the inadequate infrastructure, particularly in cold storage and transportation. Despite being one of the largest producers of agricultural products globally, India grapples with high post-harvest losses due to these infrastructural deficiencies. It’s estimated that approximately 30% of fruits and vegetables are wasted annually, leading to losses of about ₹92,651 crore, primarily due to the lack of proper cold chain facilities and efficient logistics.

The absence of a robust cold storage network results in the spoilage of perishable items, affecting the quality and availability of raw materials essential for producing food fillings concentrates. This not only hampers the industry’s growth but also impacts the income of farmers and the overall food supply chain.

Recognizing these challenges, the Indian government has initiated several measures to bolster infrastructure in the food processing sector. For instance, the Pradhan Mantri Kisan Sampada Yojana (PMKSY) has been allocated ₹6,520 crore for the 15th Finance Commission cycle (2021–26), focusing on creating modern infrastructure and reducing post-harvest losses . Additionally, the establishment of Mega Food Parks aims to provide integrated infrastructure for storing and processing requirements of the food processing industry.

Opportunity

A Gateway to Growth for Food Fillings Concentrates

The Indian government’s proactive approach to enhancing the food processing sector presents significant growth opportunities for the food fillings concentrates industry. Through strategic initiatives and substantial investments, the government aims to bolster infrastructure, reduce wastage, and promote value addition, thereby fostering a conducive environment for industry expansion.

Additionally, the Production Linked Incentive Scheme for Food Processing Industries (PLISFPI) has been allocated ₹10,900 crore for the period 2021–2027. This scheme provides financial incentives to support the creation of global food manufacturing champions and promote Indian food brands in international markets. The focus on enhancing competitiveness and export potential aligns with the objectives of the food fillings concentrates industry, offering avenues for growth and market expansion.

Furthermore, the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme has facilitated the establishment and modernization of micro food processing units across the country. In states like Gujarat and Bihar, the scheme has enabled numerous entrepreneurs to scale up operations and access new markets. The support provided under PMFME, including capital subsidies and financial assistance, contributes to the development of a robust food processing ecosystem, benefiting the food fillings concentrates sector.

Regional Insights

Europe leads the global Food Fillings Market with 46.1% share, valued at USD 6.5 billion in 2024

In 2024, Europe held a dominant position in the global Food Fillings Market, accounting for more than 46.1% of the total market share, with an estimated market value of USD 6.5 billion. This leadership is attributed to the region’s highly developed bakery and confectionery industry, long-standing culinary traditions, and strong consumer preference for filled pastries, cakes, and ready-to-eat desserts. Countries such as Germany, France, the United Kingdom, and Italy are major contributors, where both artisanal and industrial-scale production of baked goods consistently drives demand for various types of fillings including fruit-based, chocolate, and cream variants.

The European food industry benefits from advanced processing infrastructure and stringent quality standards, ensuring high product consistency and safety, which further supports the widespread use of fillings in commercial production. Additionally, rising interest in premium, organic, and clean-label products across Western Europe has created new opportunities for natural and bake-stable filling solutions. The convenience food trend has also been gaining traction, especially in Northern and Western Europe, where busy urban lifestyles are fueling the consumption of packaged bakery products and filled snacks.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Baldwin Richardson Foods Co. is a leading manufacturer of food fillings and toppings, renowned for its innovation in producing a wide variety of fruit fillings, syrups, and frostings. Based in the United States, the company serves a broad range of customers in the foodservice and retail sectors. Known for its commitment to quality, Baldwin Richardson focuses on meeting consumer demand for clean-label and natural ingredients, aligning with the increasing trend toward healthier food options.

Schulze and Burch Biscuit Co., located in the United States, is a private-label manufacturer that produces snack bars, toaster pastries, and baked goods with integrated filling solutions. The company uses both fruit and dairy-based fillings in its product lines, catering primarily to major retailers and co-manufacturing partners. Its vertically integrated operations and long-standing industry experience allow for consistent quality, cost efficiency, and scalability in food fillings production for on-the-go snack categories.

Fruit Crown Products Corporation is a U.S.-based company specializing in the development and production of fruit fillings and toppings for the food industry. The company provides customized filling solutions for bakeries, dairy processors, and dessert brands. Known for its premium fruit content and bake stability, Fruit Crown’s offerings include conventional and clean-label options tailored to client specifications. Its flexible manufacturing systems and commitment to quality control have helped the company build strong partnerships across the commercial food sector.

Top Key Players Outlook

- Baldwin Richardson Foods Co.

- Zentis GmbH & Co. KG

- Fruit Crown Products Corporation

- Schulze and Burch Biscuit Co.

- Lyons Magnus

- Fruit Fillings Inc.

- Wawona Frozen Foods

- AGRANA International

- Dawn Foods Global

- GRUPO ALTEX

Recent Industry Developments

Zentis GmbH & Co. KG, headquartered in Aachen, Germany, specializing in fruit preparations, jams, and sweet spreads. In 2024, the company reported an annual revenue of €711 million, with a workforce of approximately 1,960 employees across its six production sites in Germany, Poland, Hungary, and the USA.

In 2024 Schulze & Burch Biscuit Co., reported an estimated annual revenue of $64.7 million and employed approximately 218 individuals, reflecting a 7% growth in its workforce compared to the previous year.

Report Scope

Report Features Description Market Value (2024) USD 14.3 Bn Forecast Revenue (2034) USD 22.4 Bn CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bakeable, Non Bakeable), By Application(Commercial, Home) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Baldwin Richardson Foods Co., Zentis GmbH & Co. KG, Fruit Crown Products Corporation, Schulze and Burch Biscuit Co., Lyons Magnus, Fruit Fillings Inc., Wawona Frozen Foods, AGRANA International, Dawn Foods Global, GRUPO ALTEX Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Baldwin Richardson Foods Co.

- Zentis GmbH & Co. KG

- Fruit Crown Products Corporation

- Schulze and Burch Biscuit Co.

- Lyons Magnus

- Fruit Fillings Inc.

- Wawona Frozen Foods

- AGRANA International

- Dawn Foods Global

- GRUPO ALTEX